Data Analysis

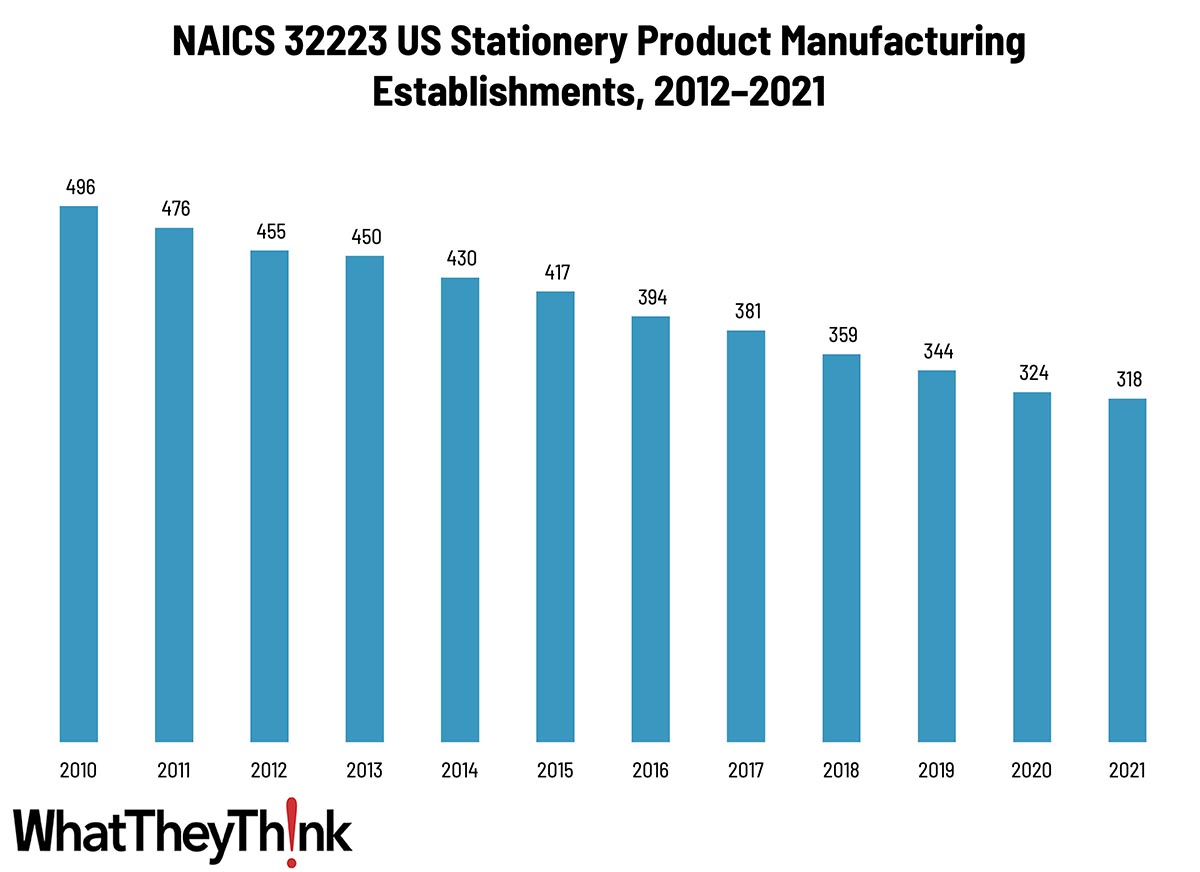

Stationery Product Manufacturing—2010–2021

Published: July 26, 2024

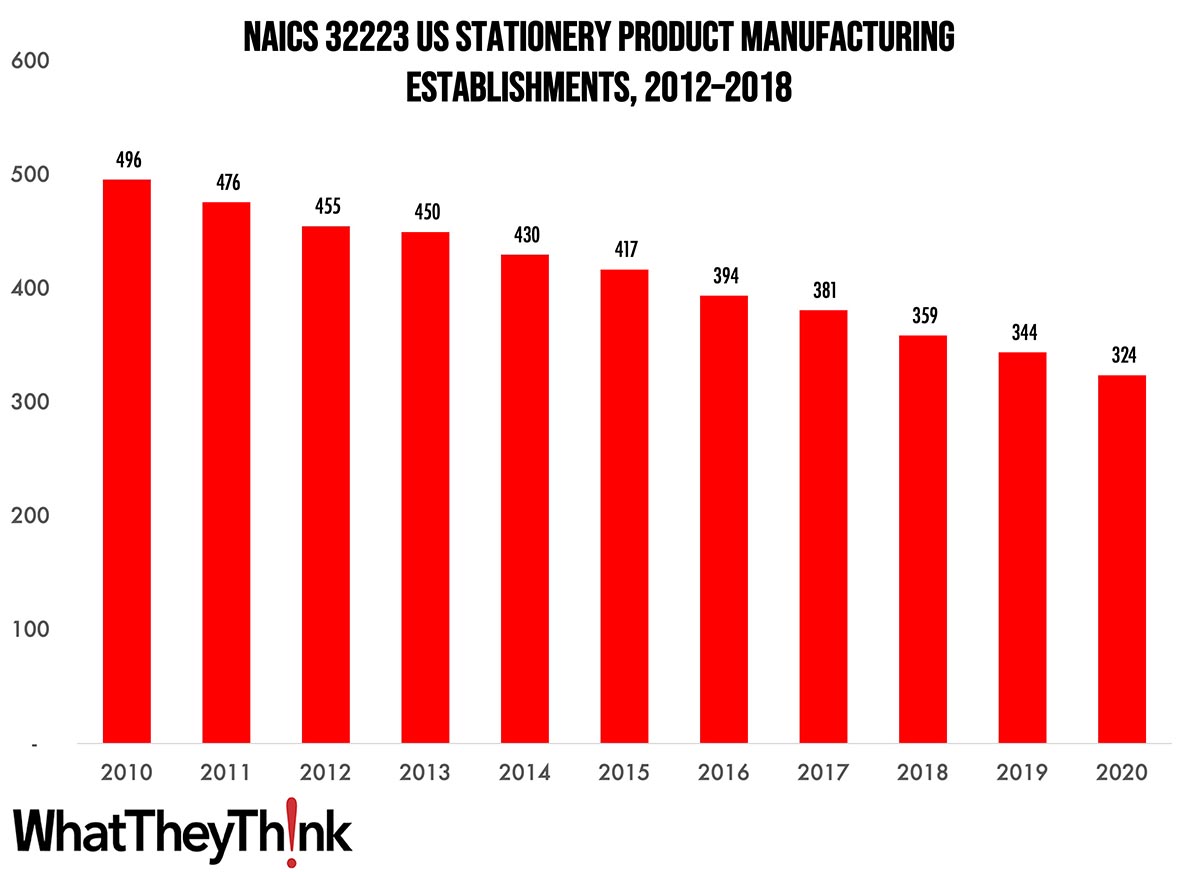

According to County Business Patterns, in 2021 there were 318 establishments in NAICS 32223 (Stationery Product Manufacturing). This category saw a net decrease in establishments of -36% since 2010. In macro news, June inflation was practically 0. Full Analysis

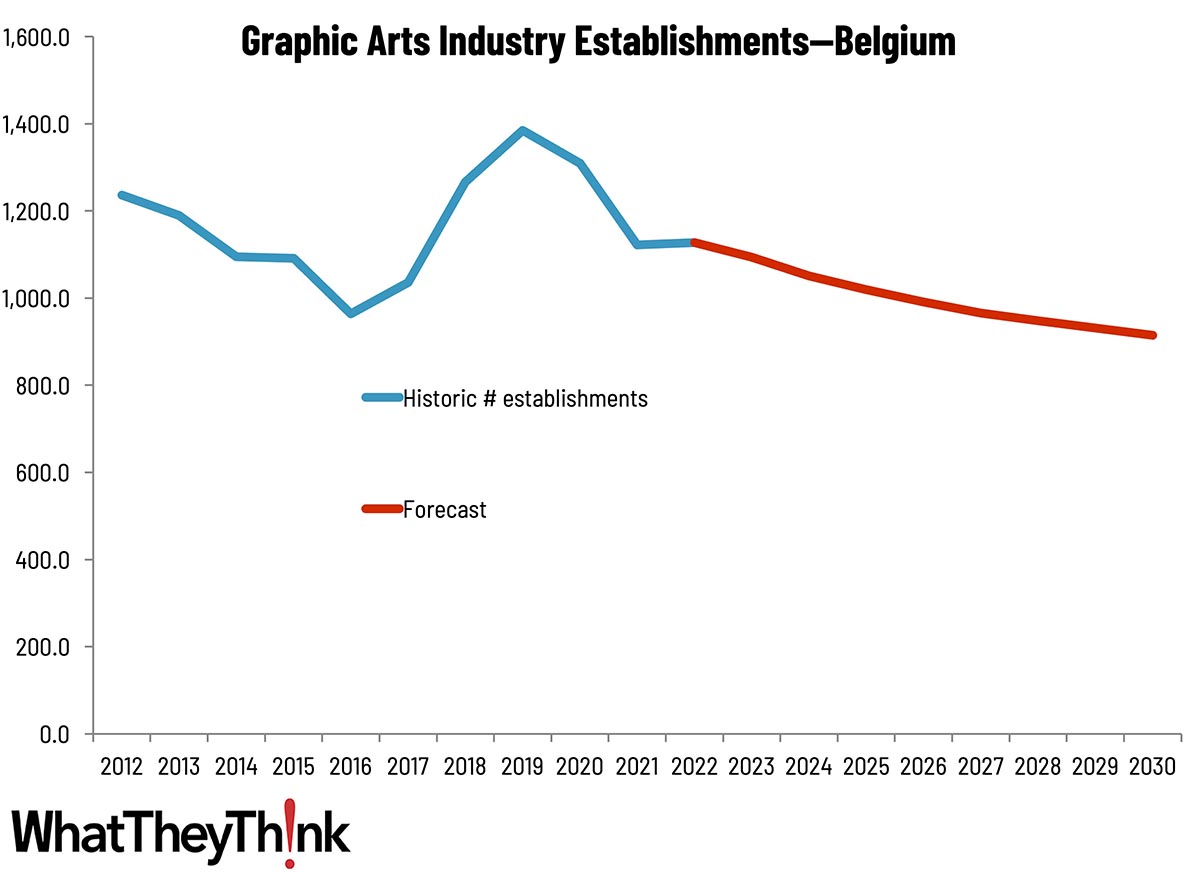

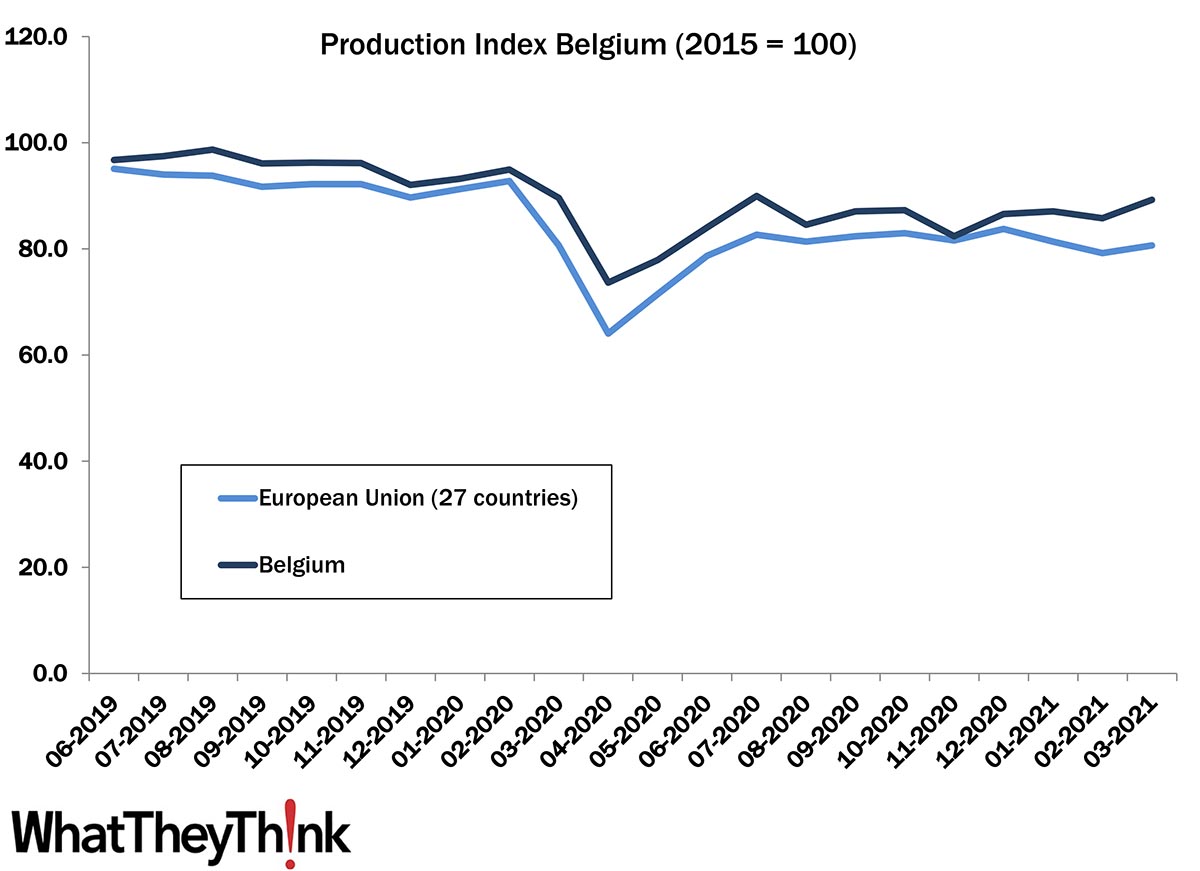

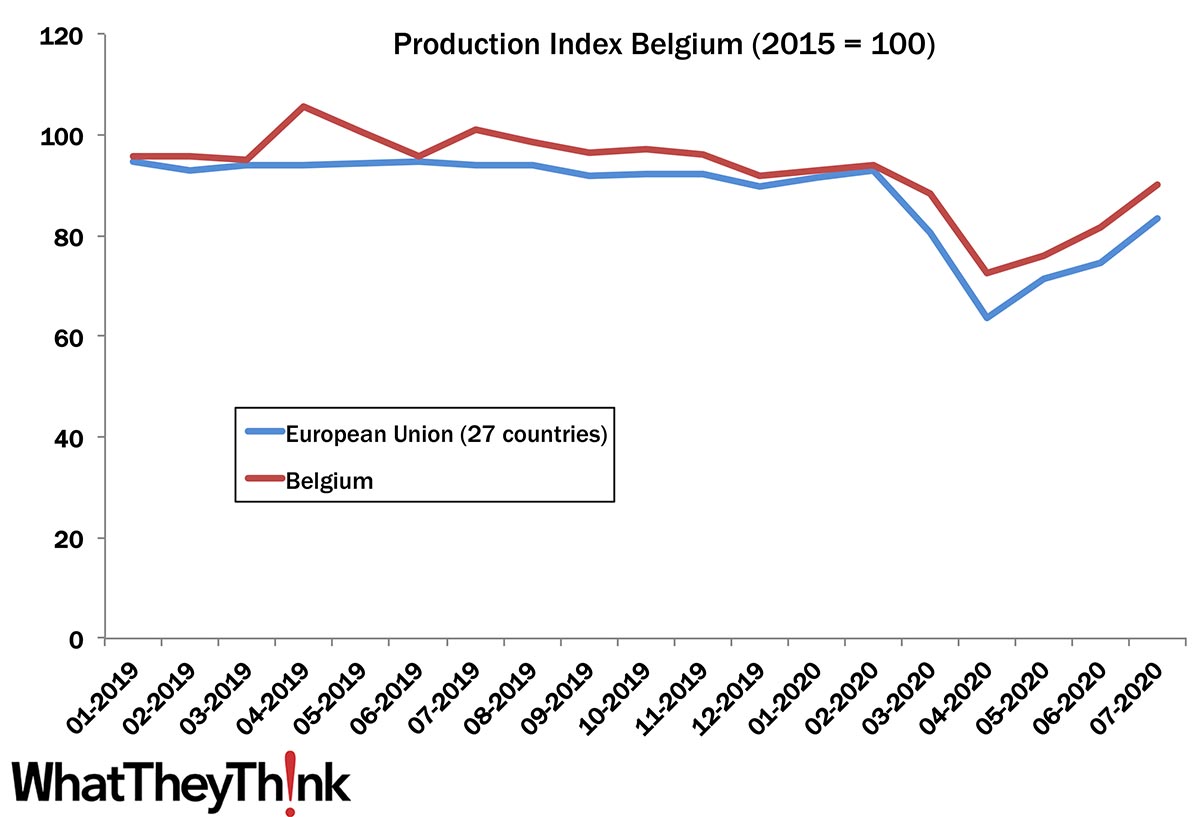

Sizing the Printing Industry in Europe—Belgium

Published: July 23, 2024

This bi-weekly series of short articles provides some country details on the size of the printing industry in Europe per country, especially tracking the number of printing establishments. This time we look at Belgium. Full Analysis

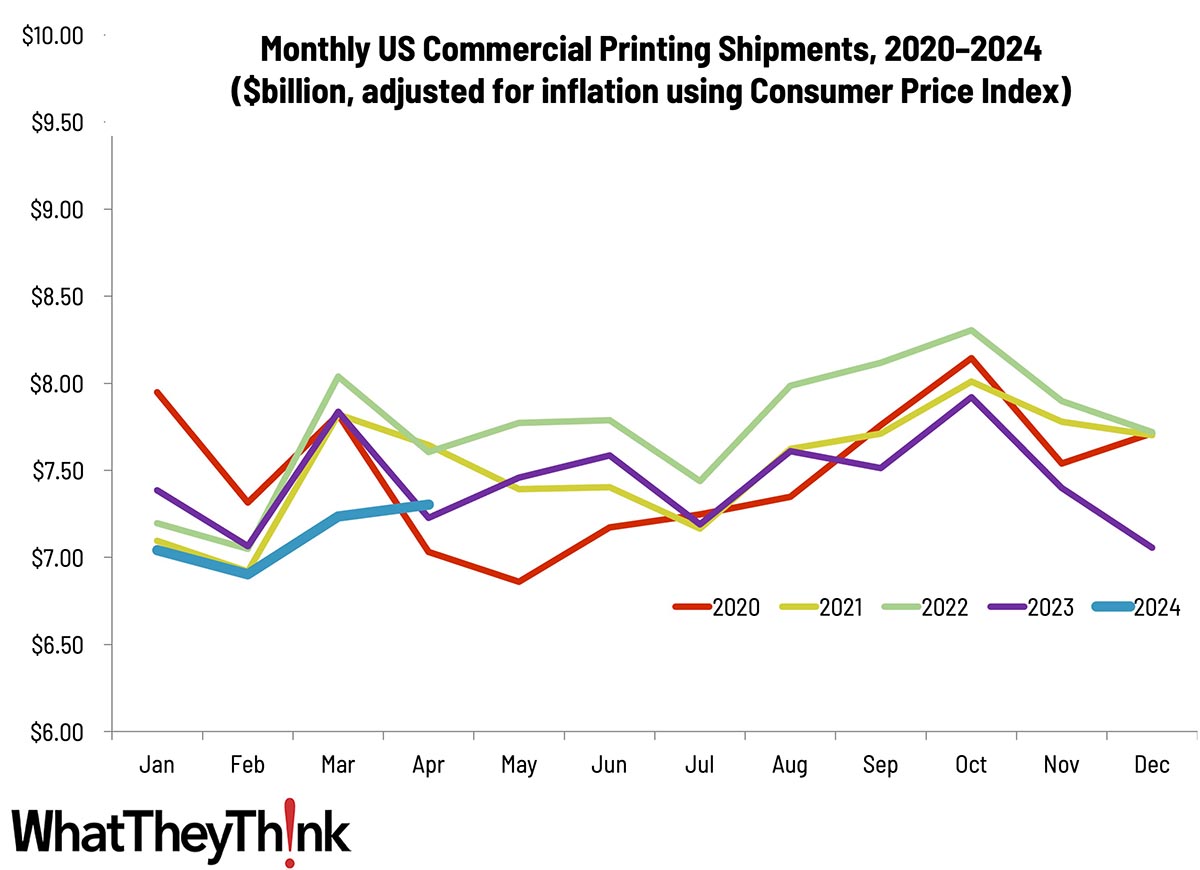

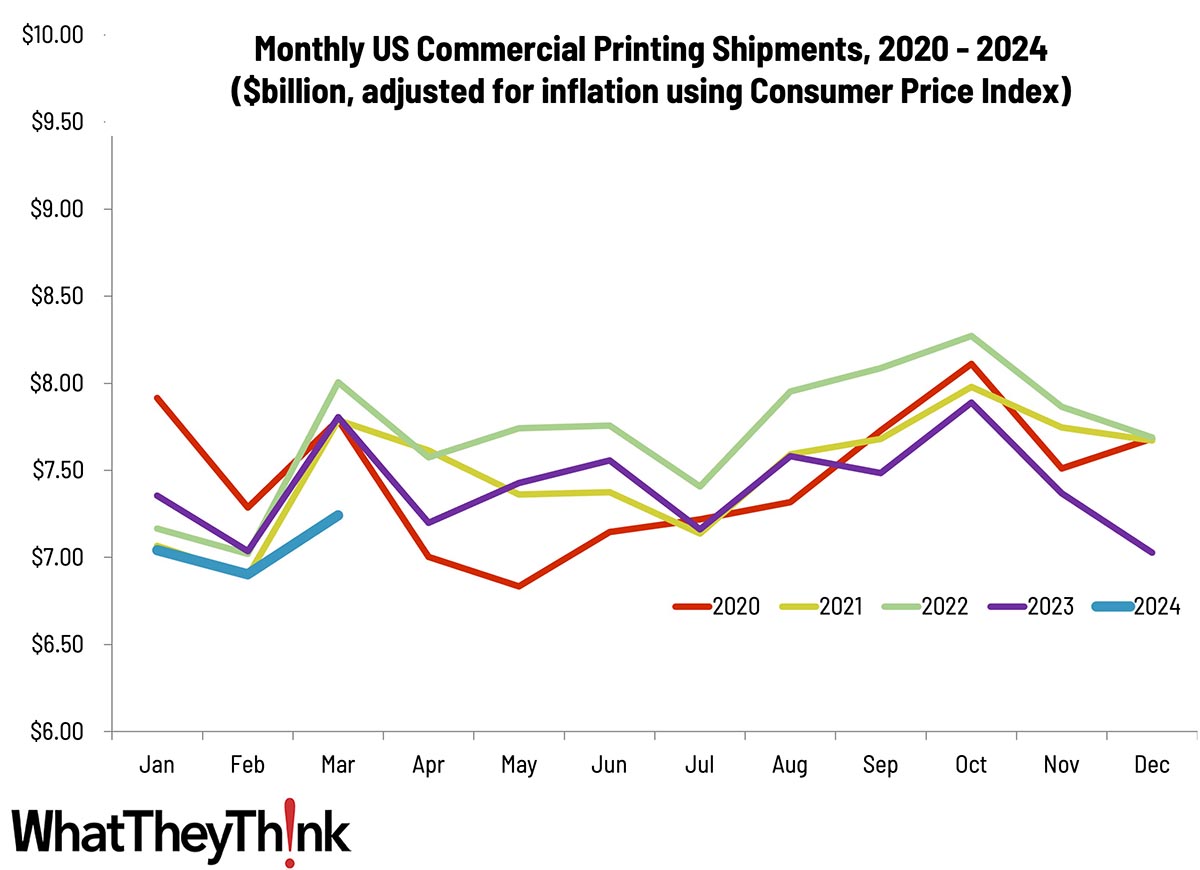

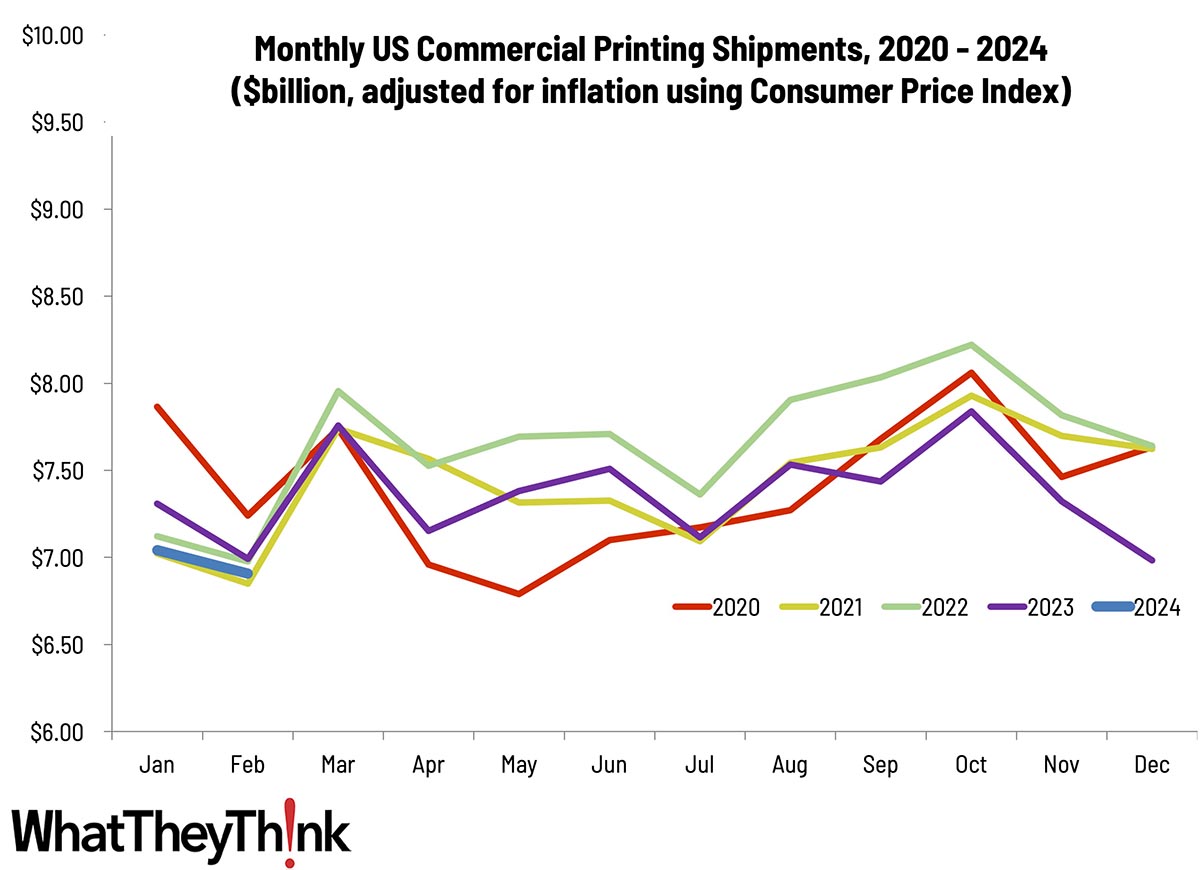

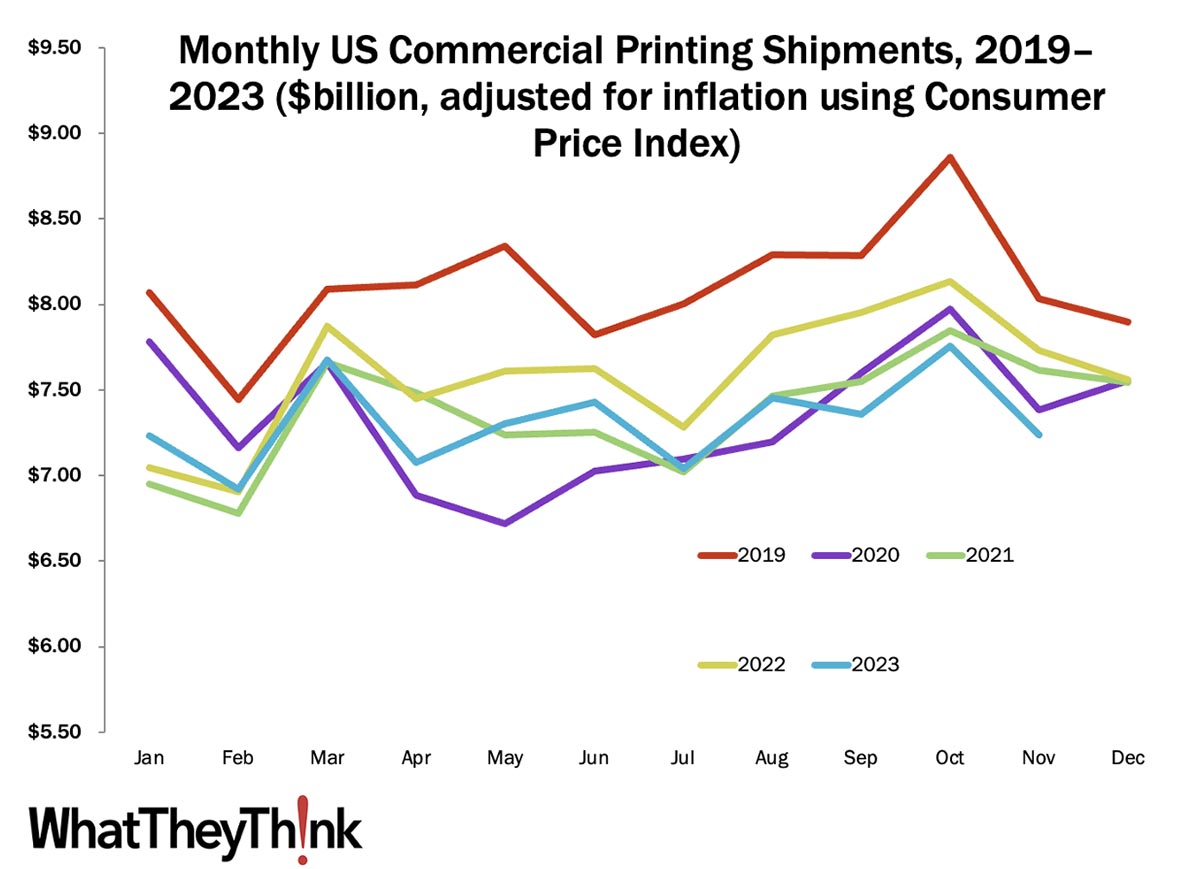

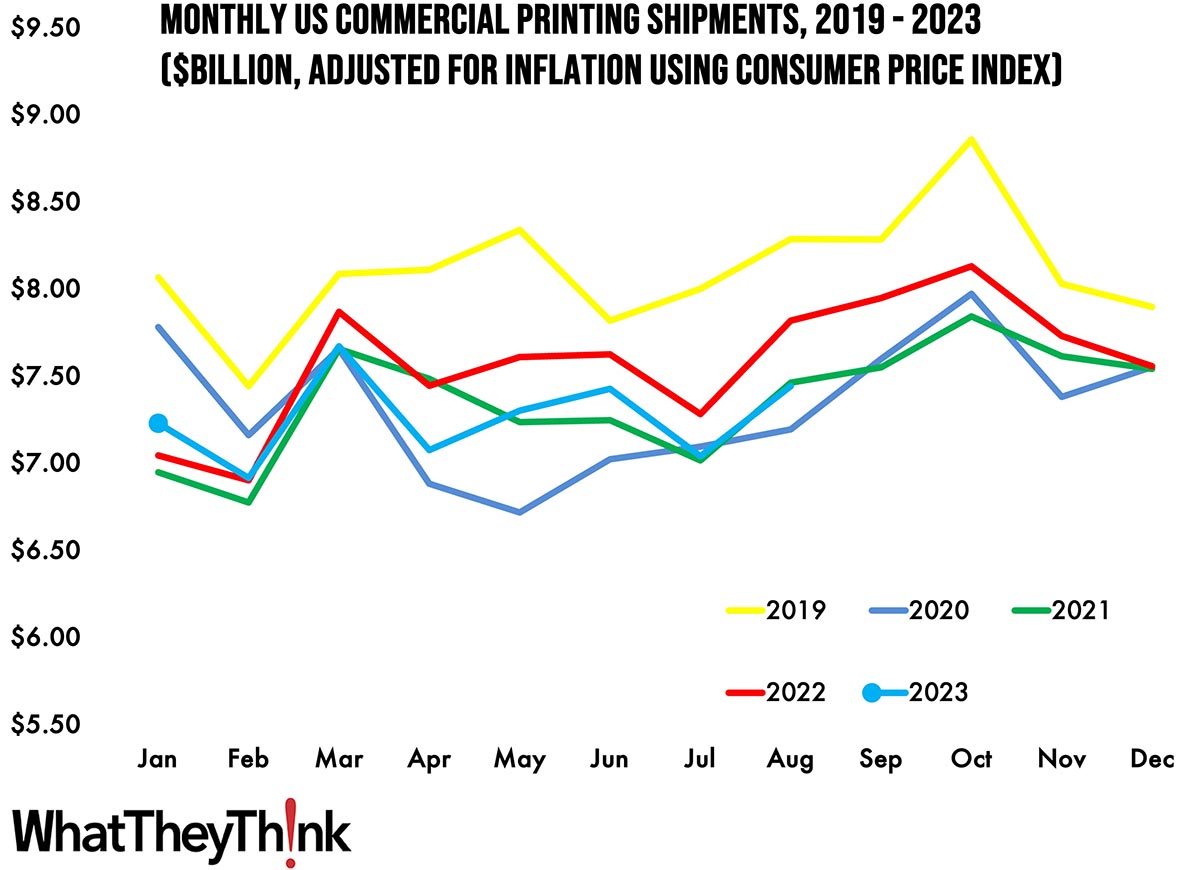

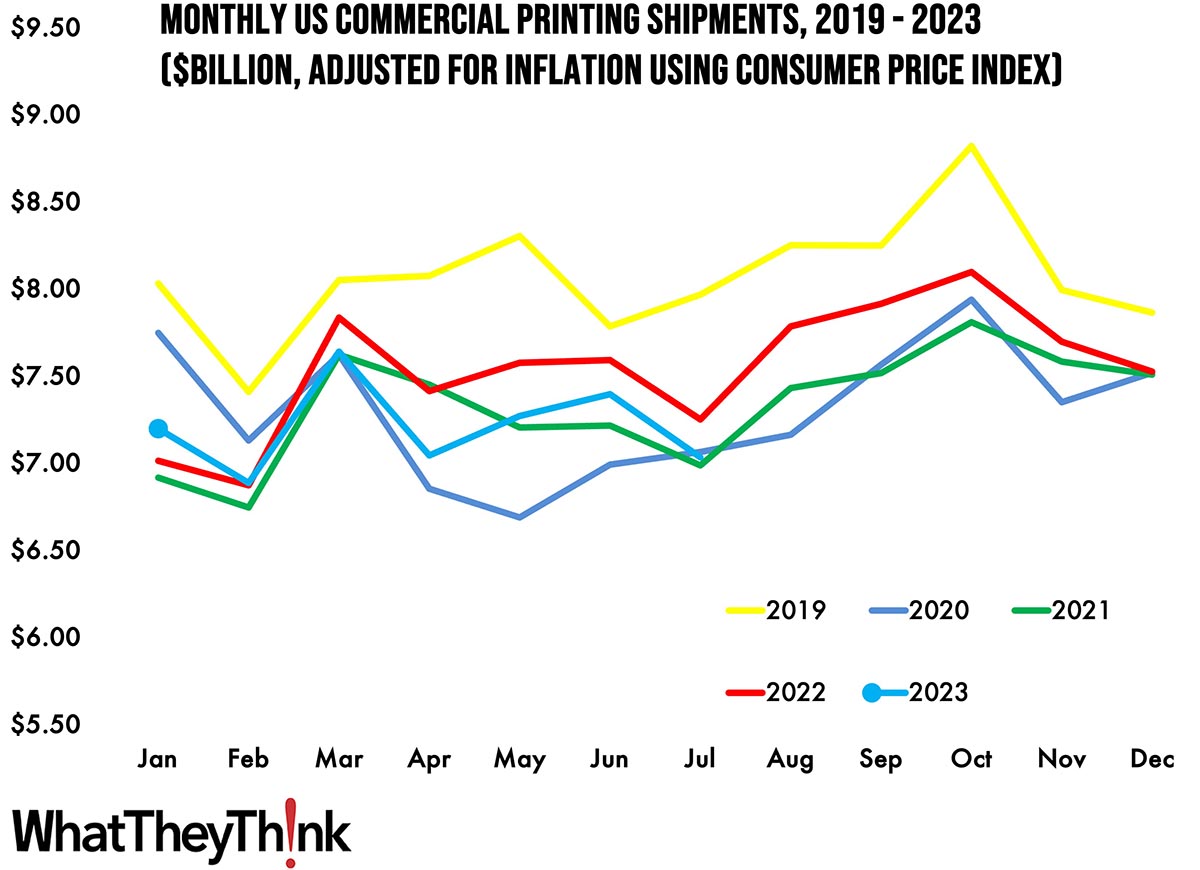

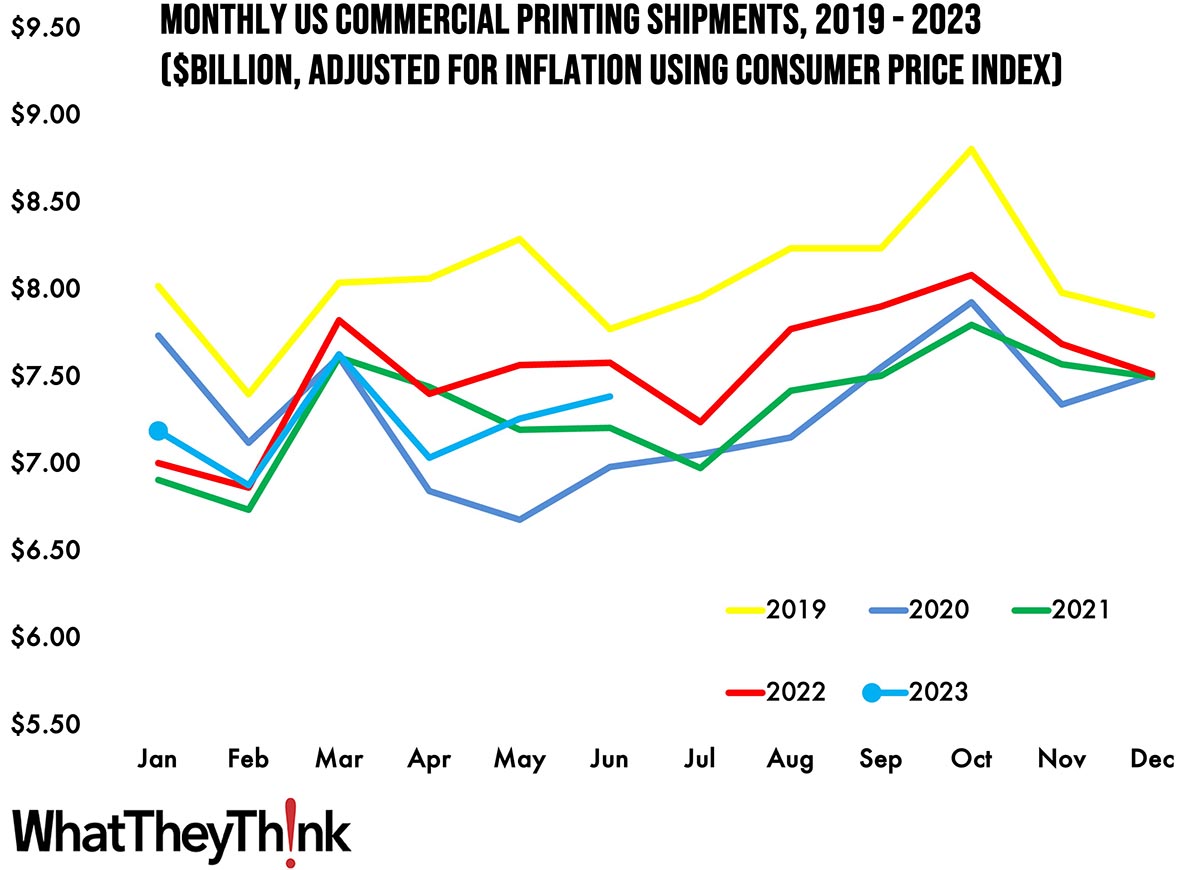

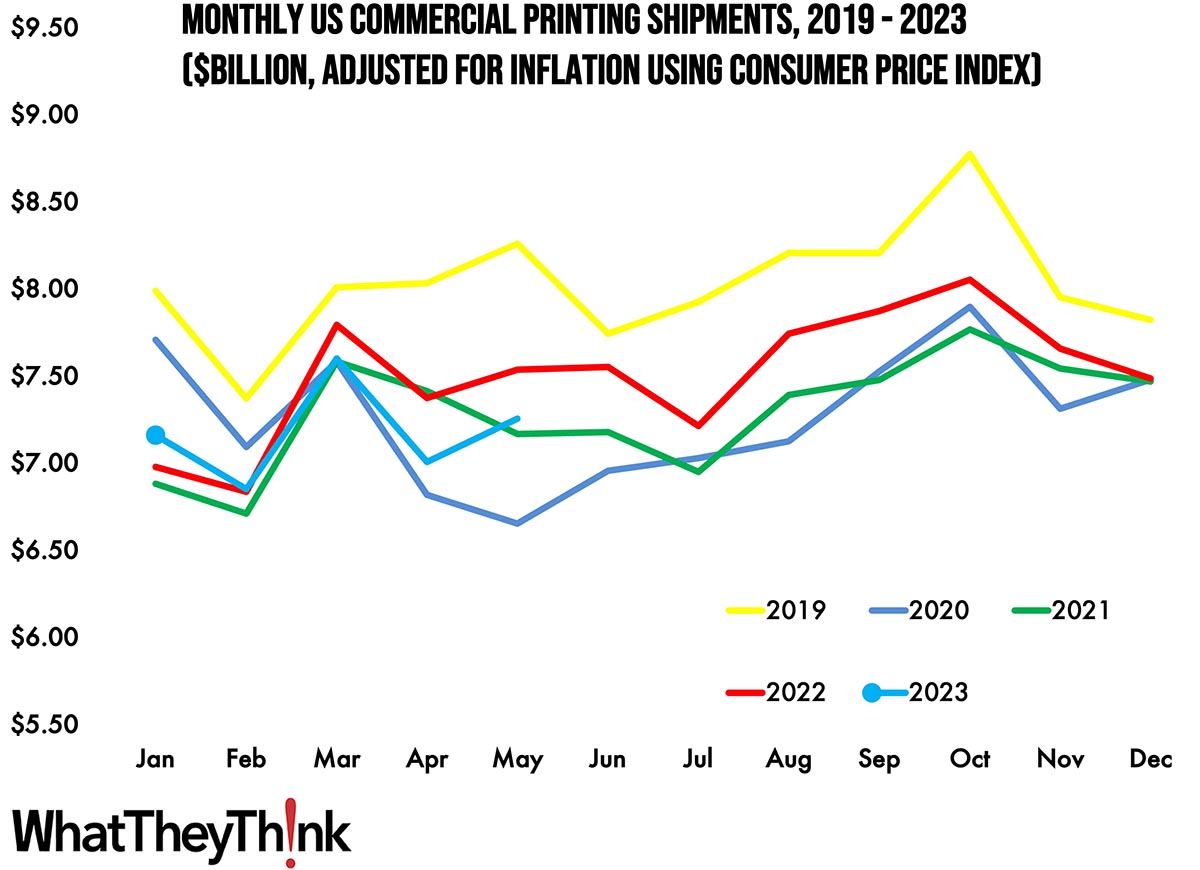

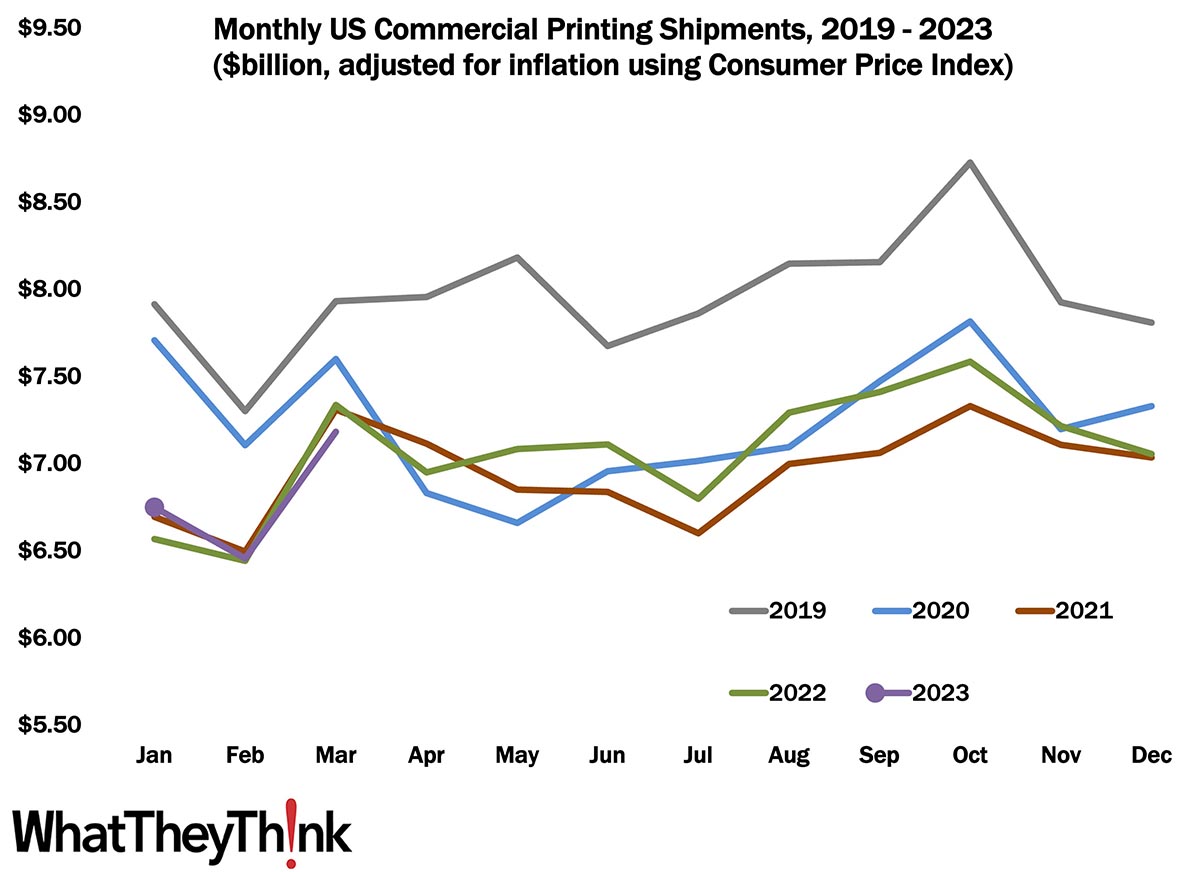

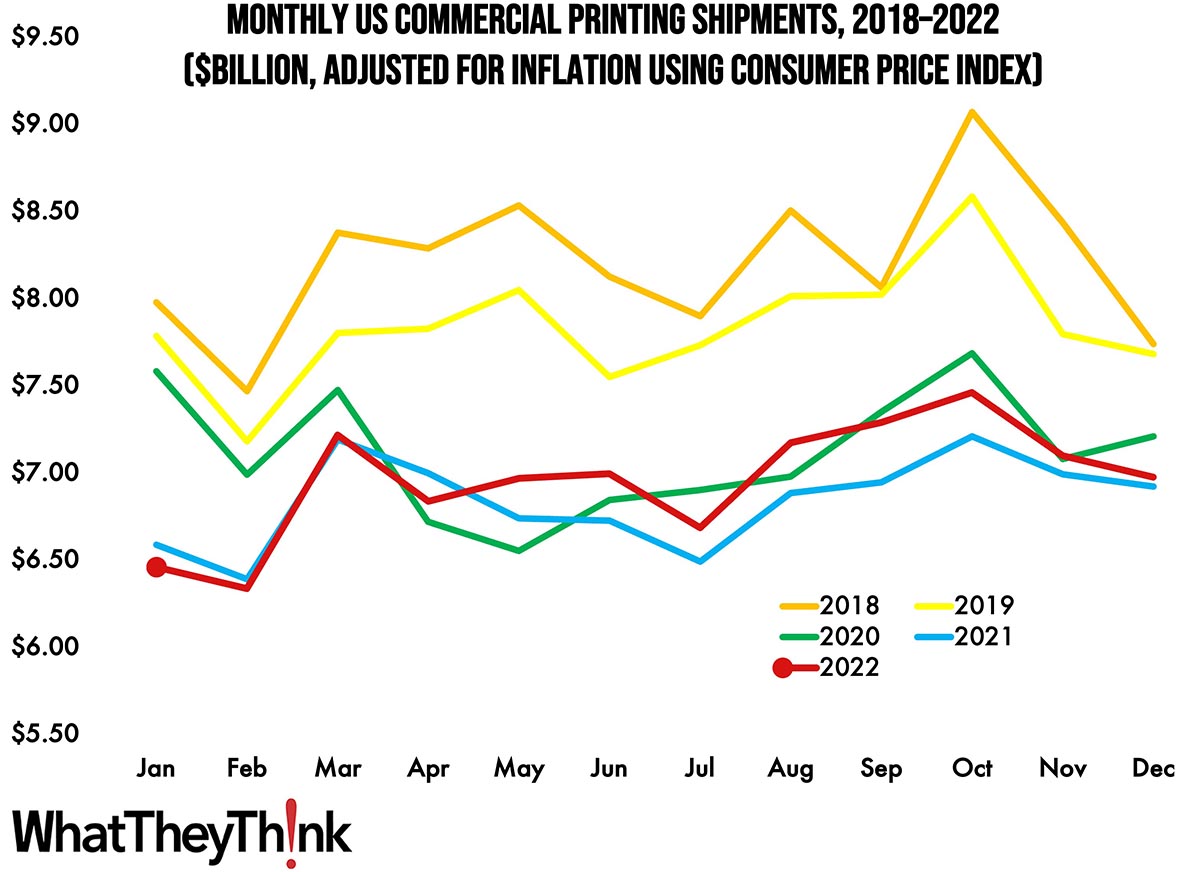

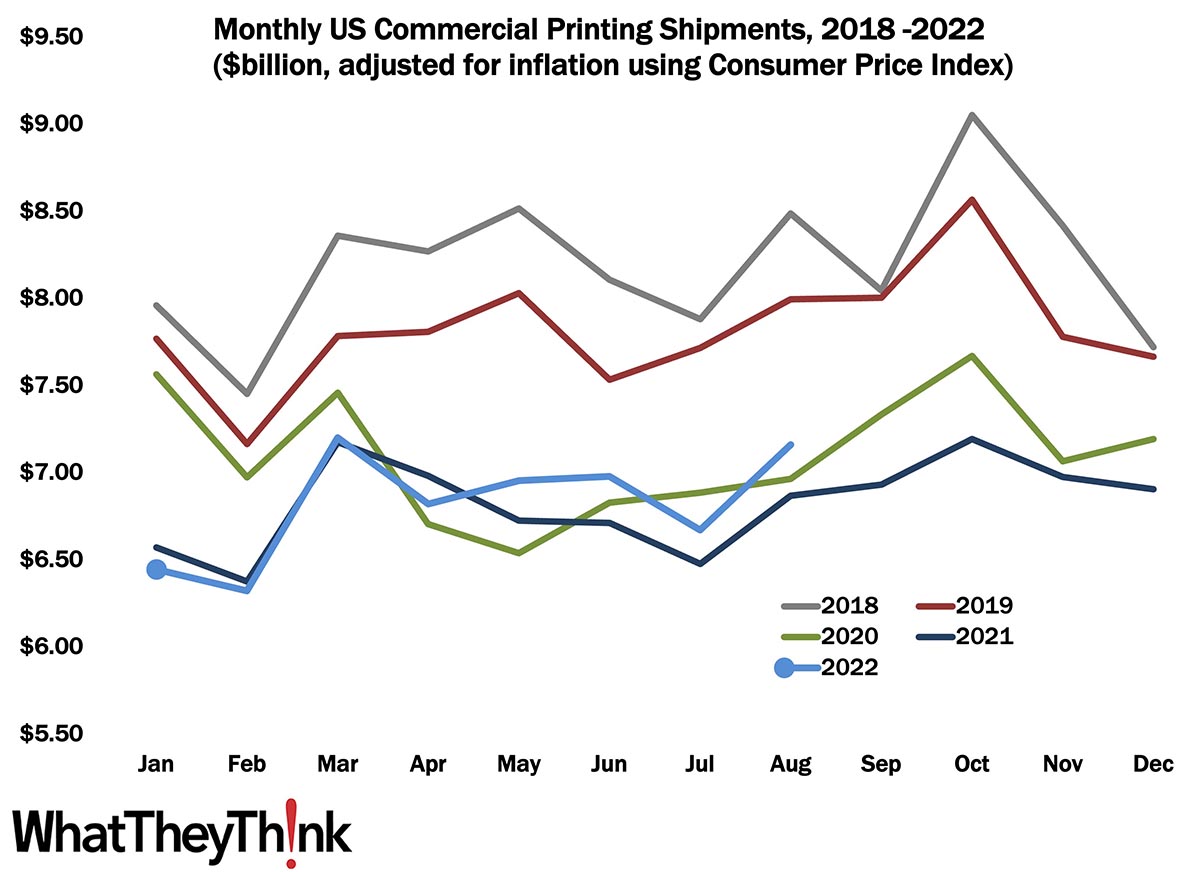

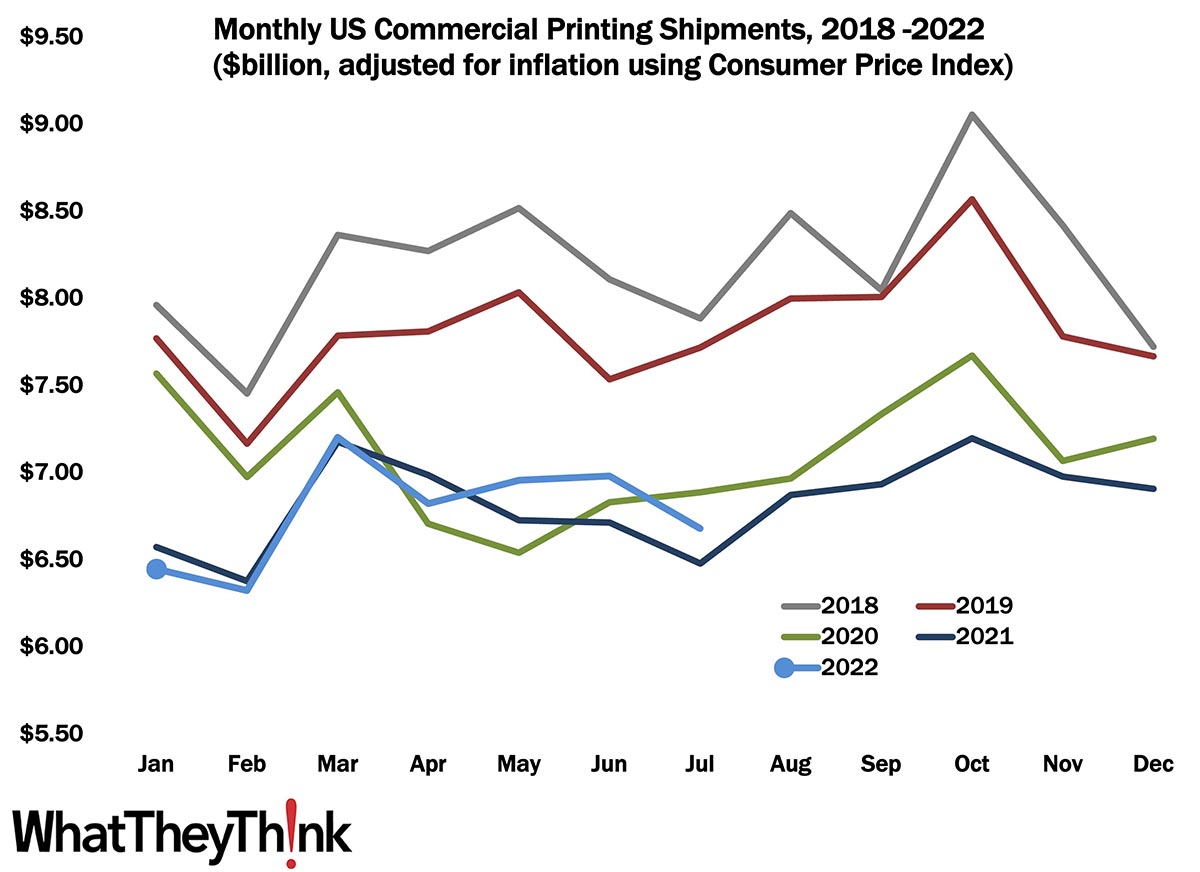

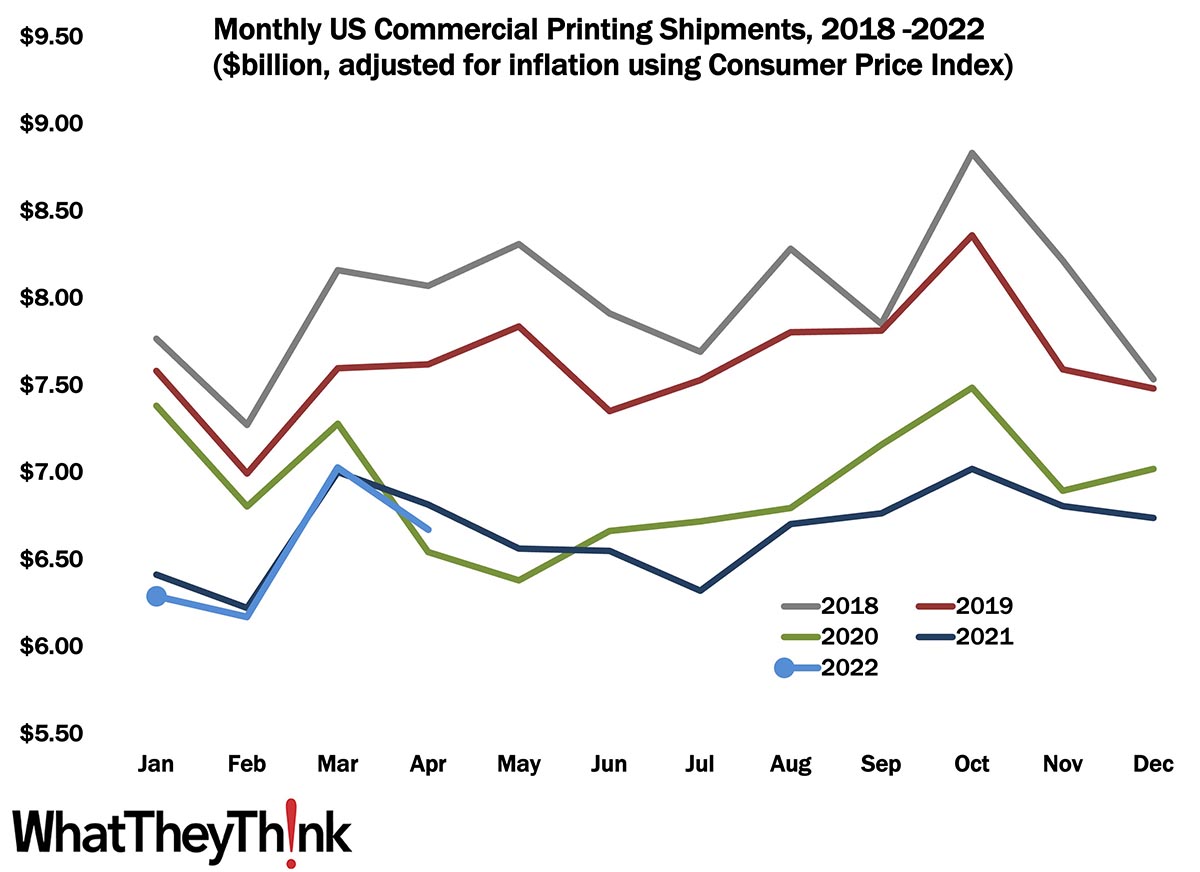

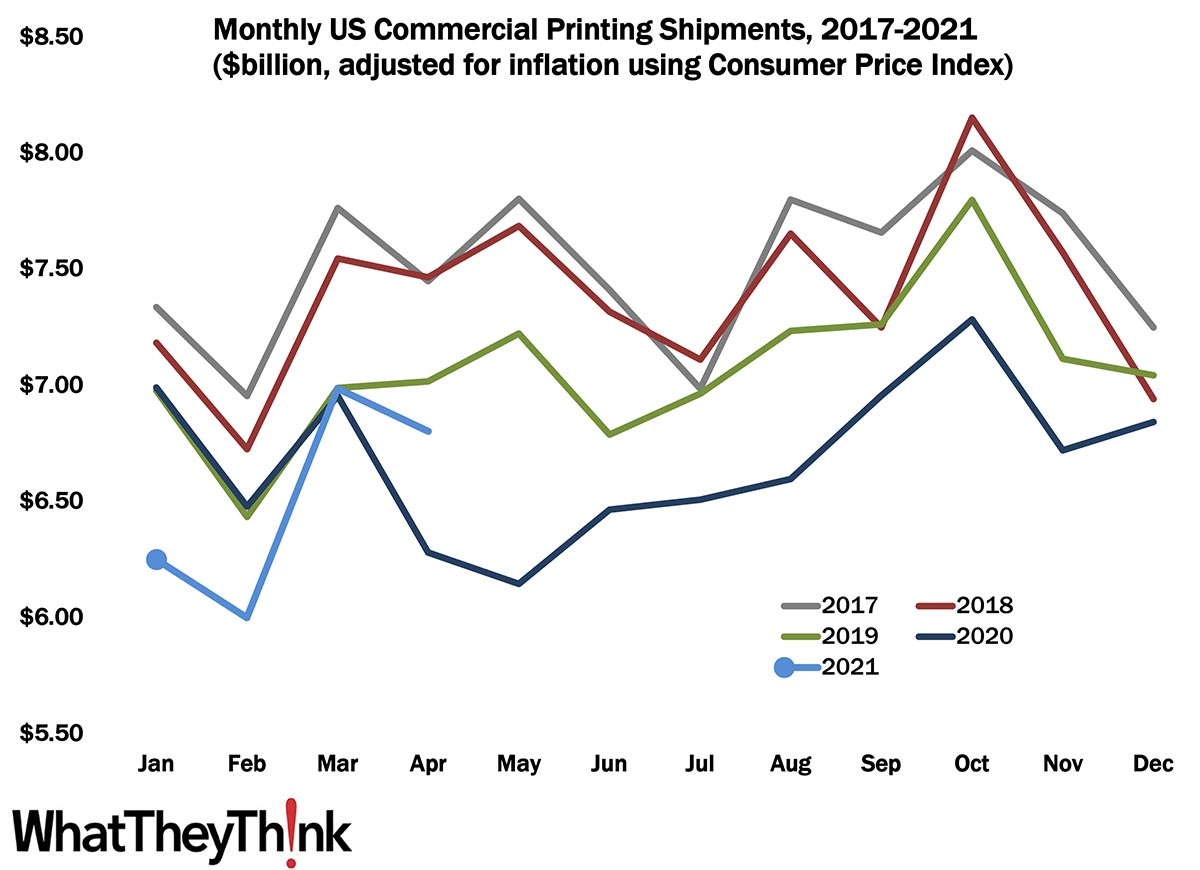

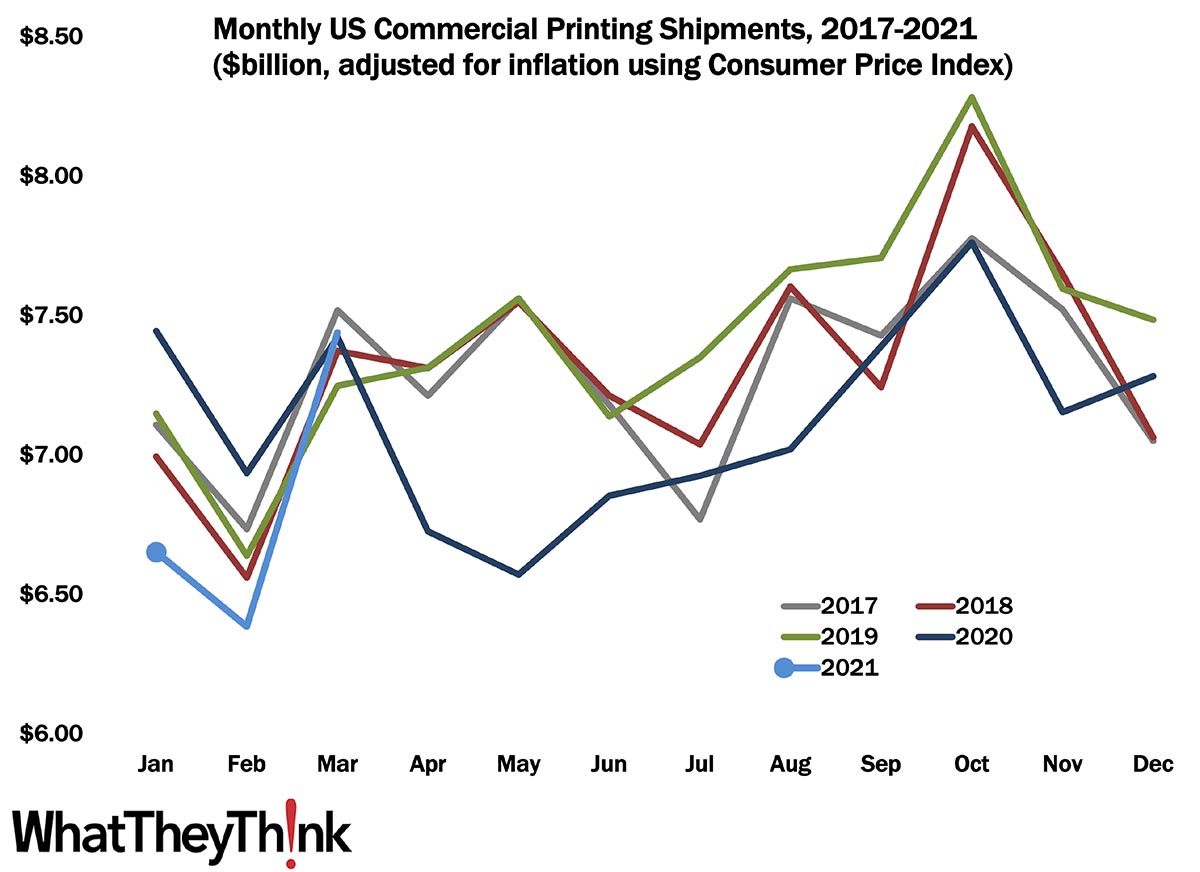

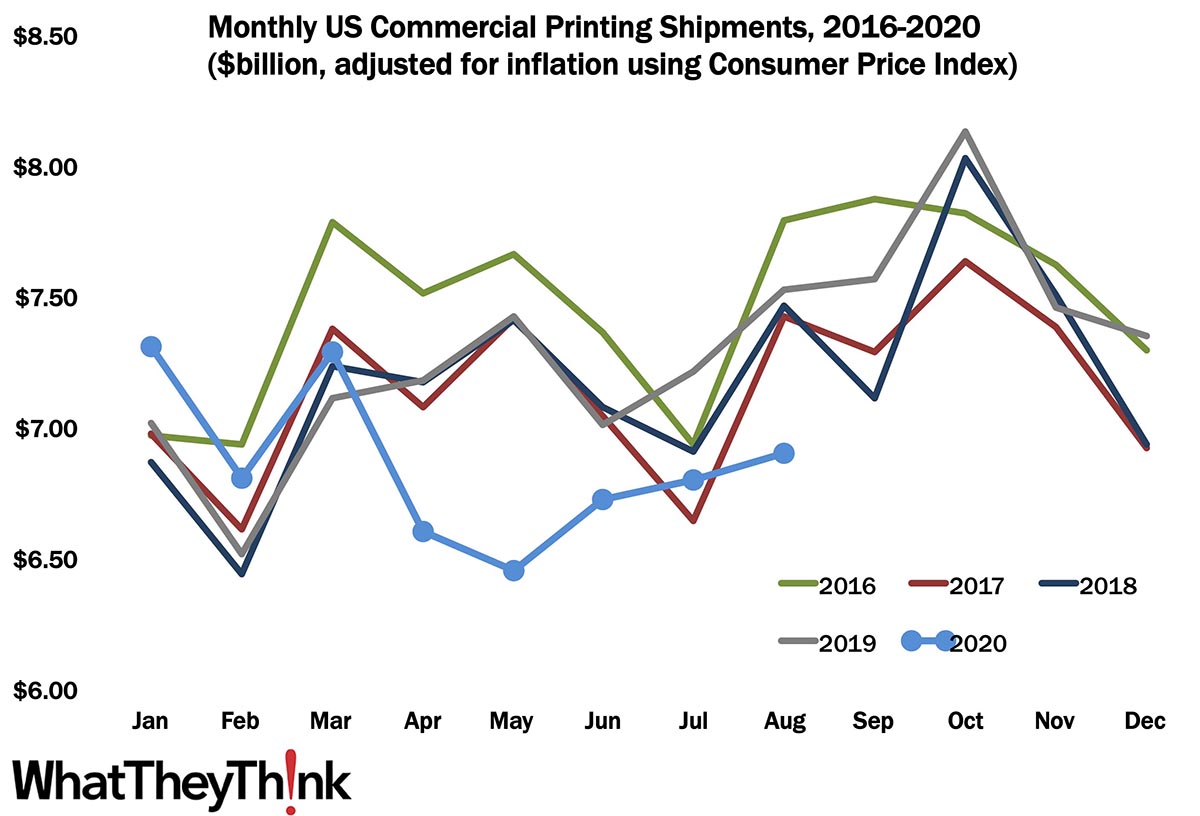

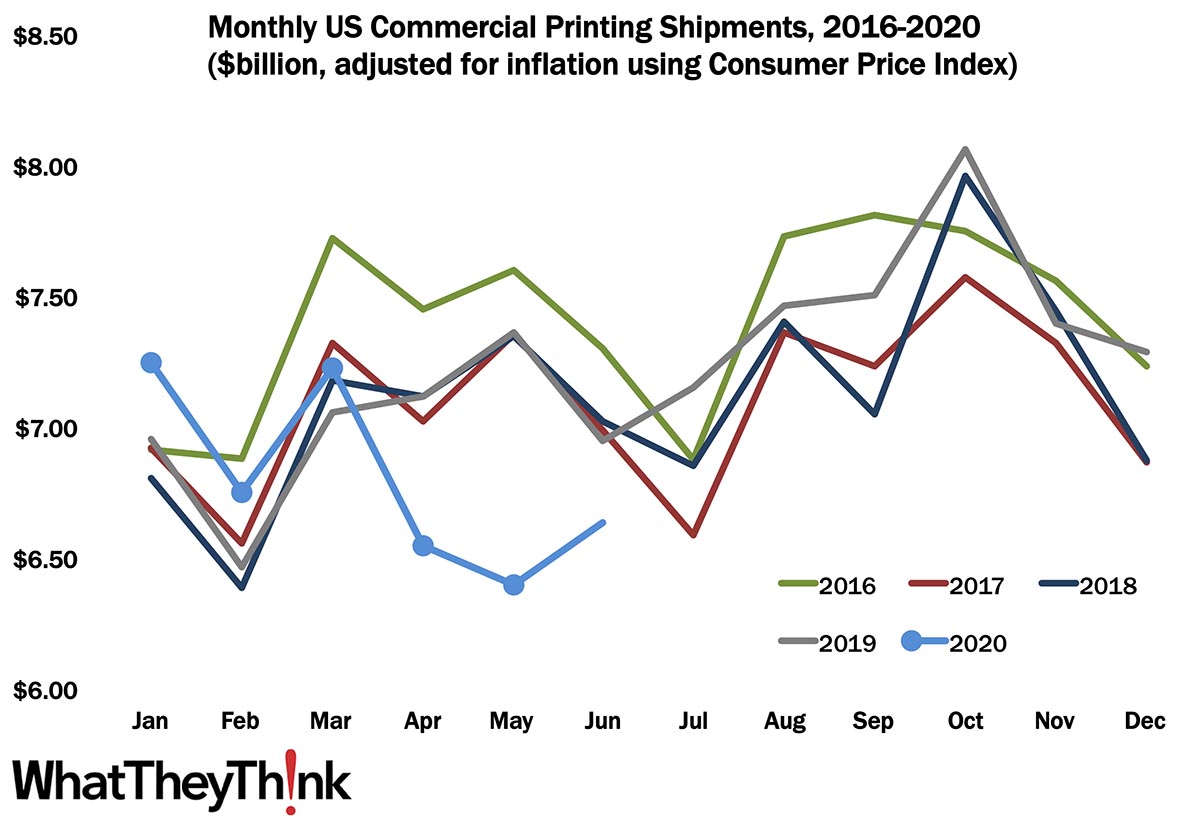

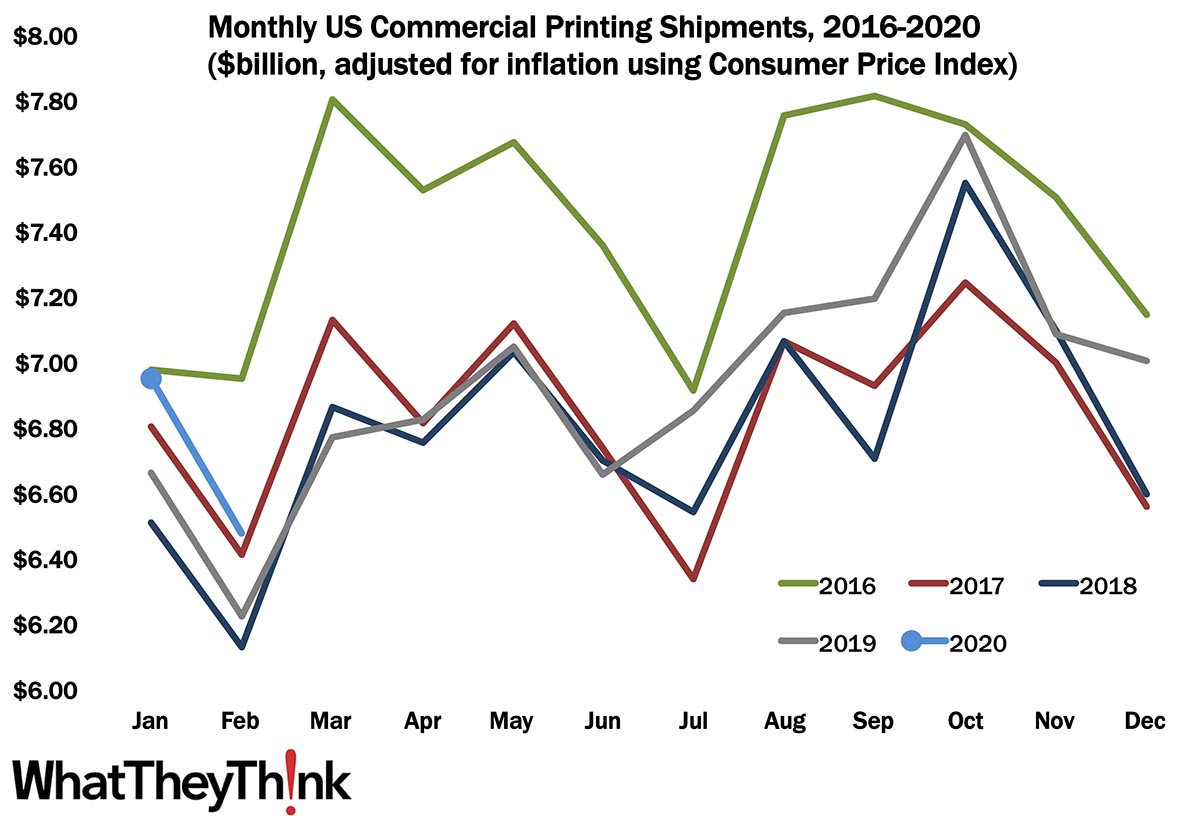

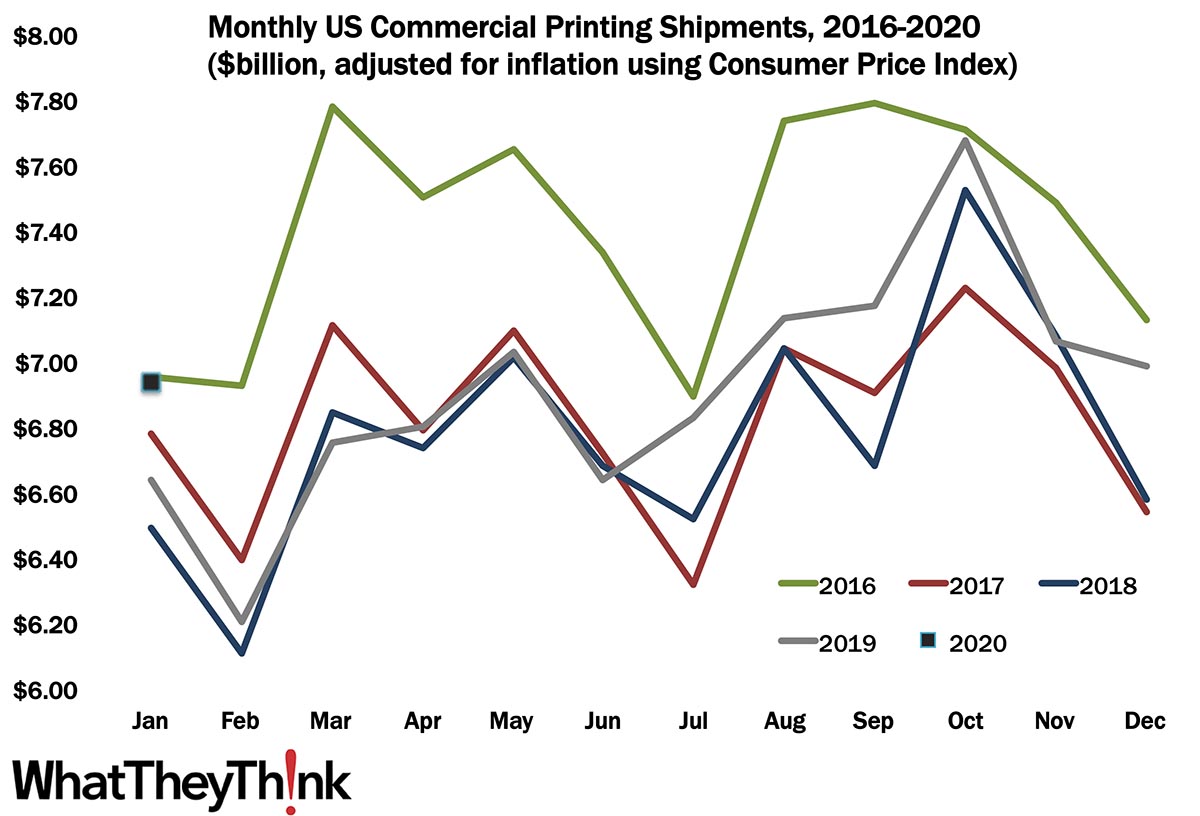

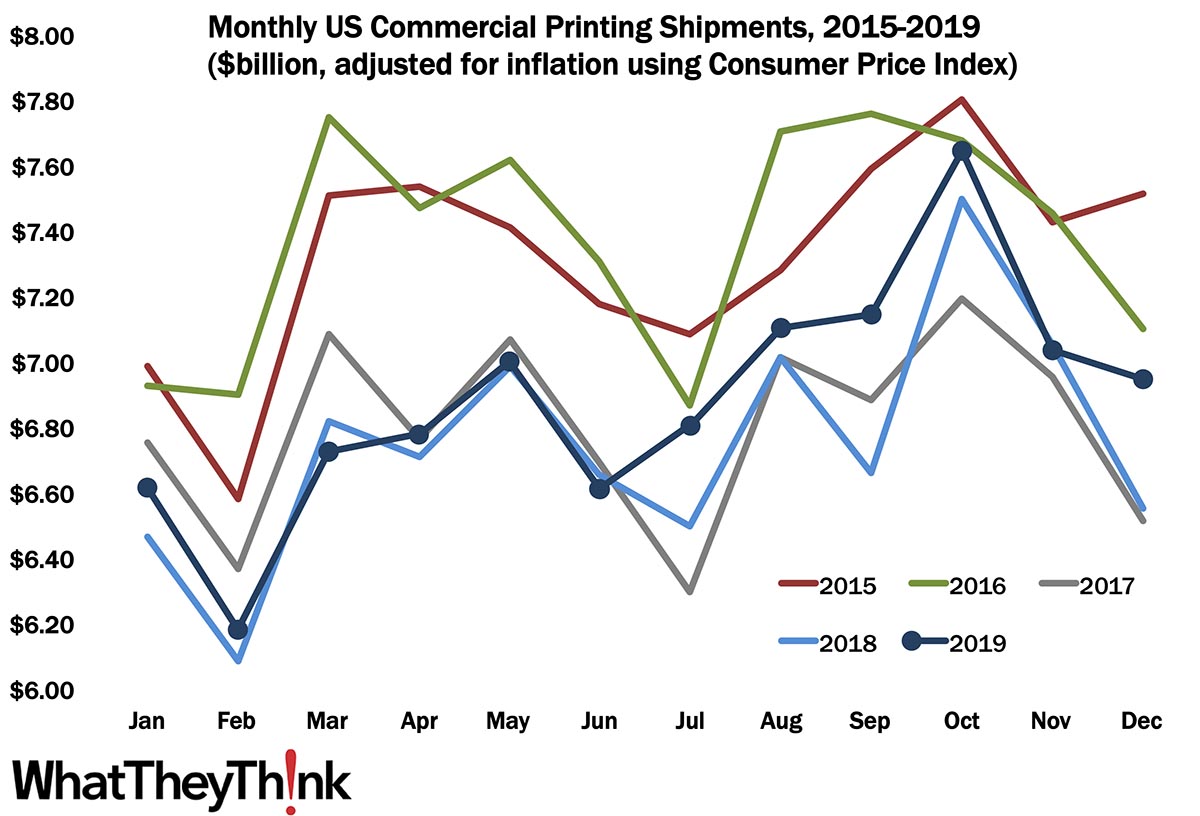

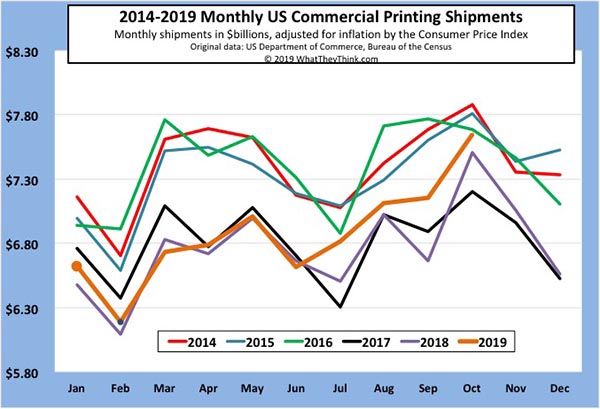

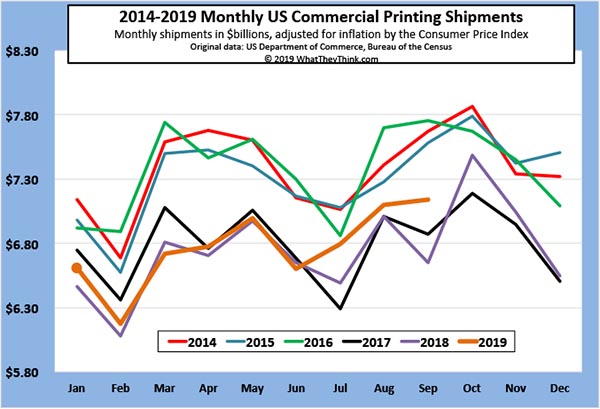

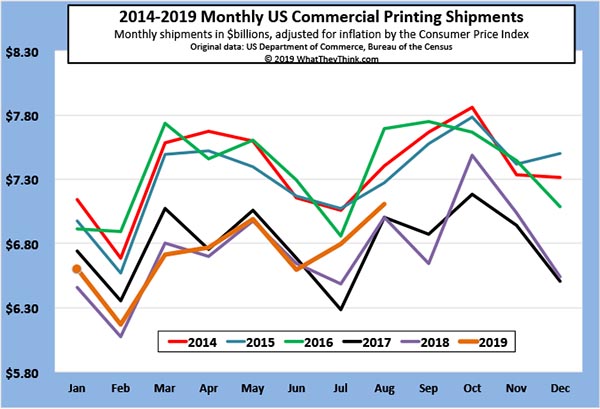

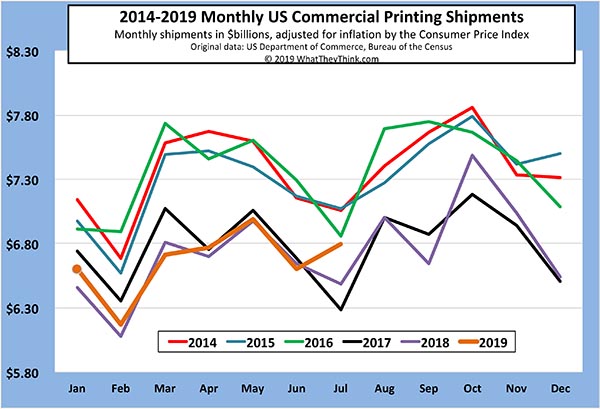

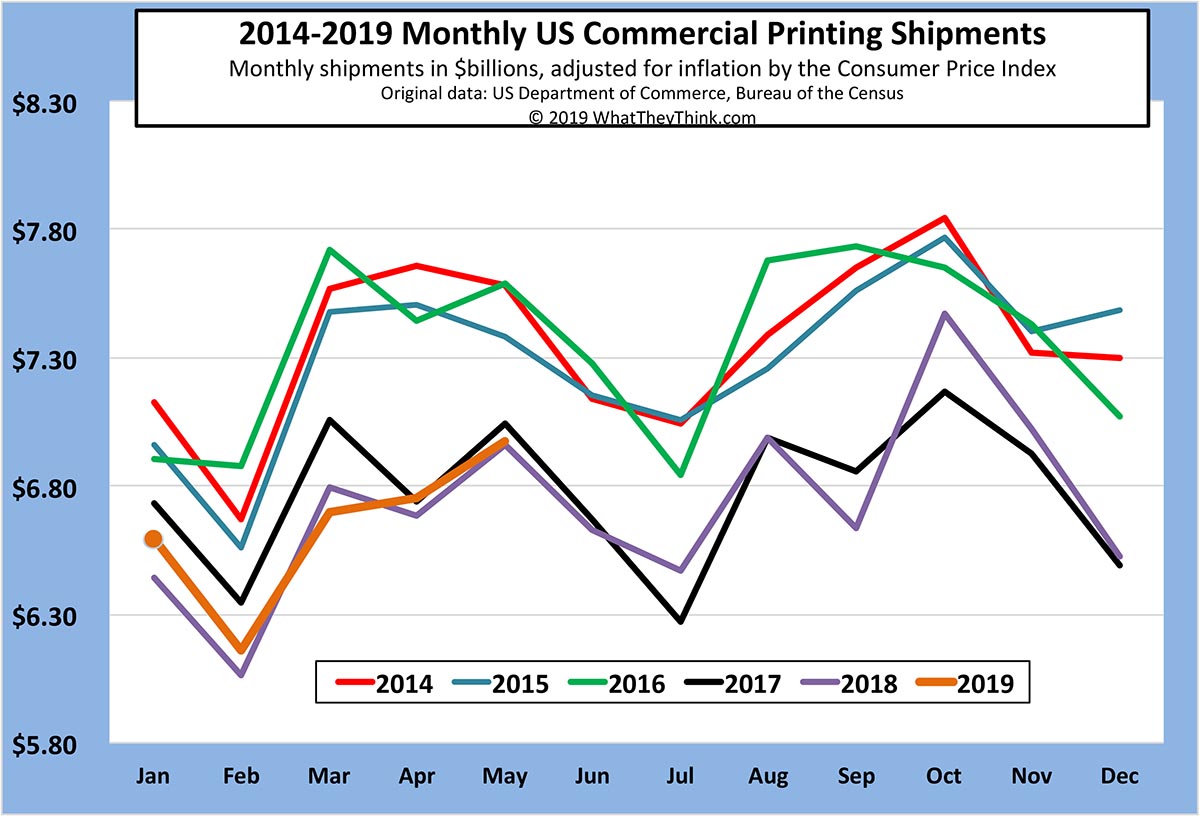

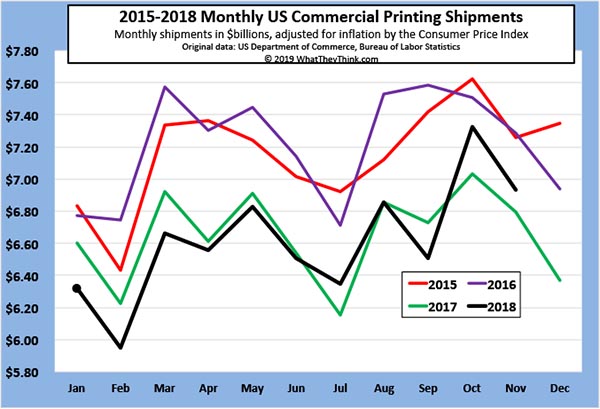

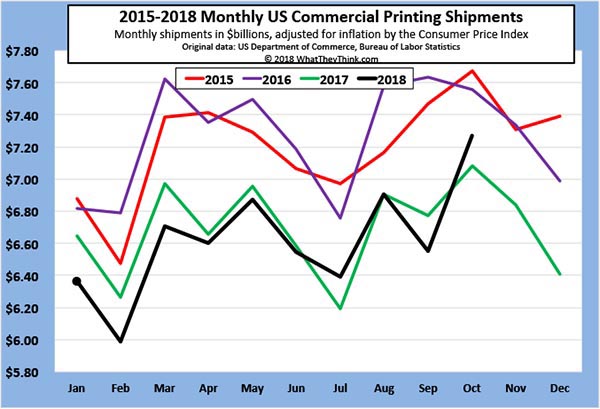

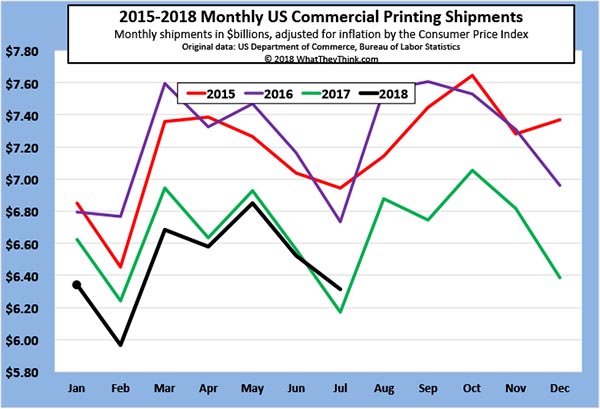

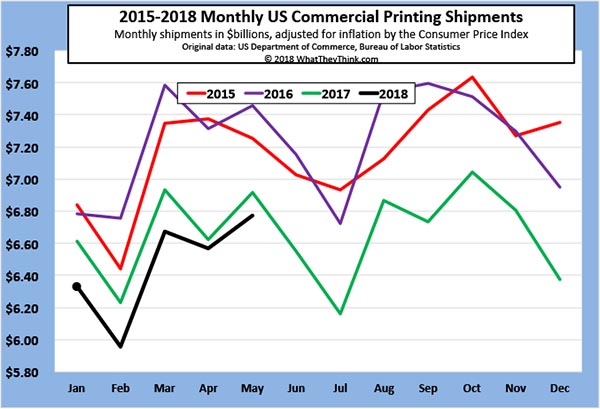

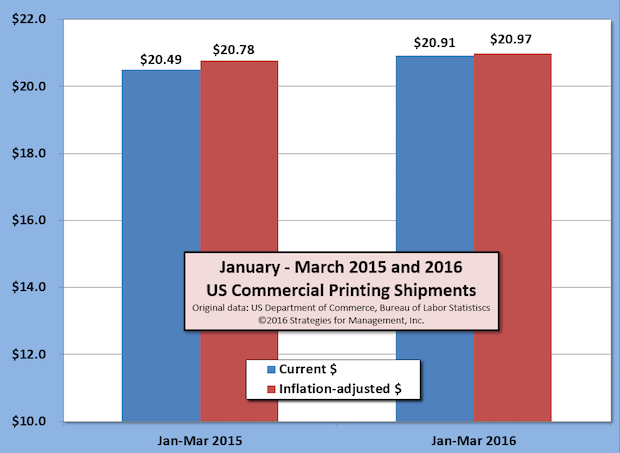

April Shipments: A Pleasant Surprise

Published: July 19, 2024

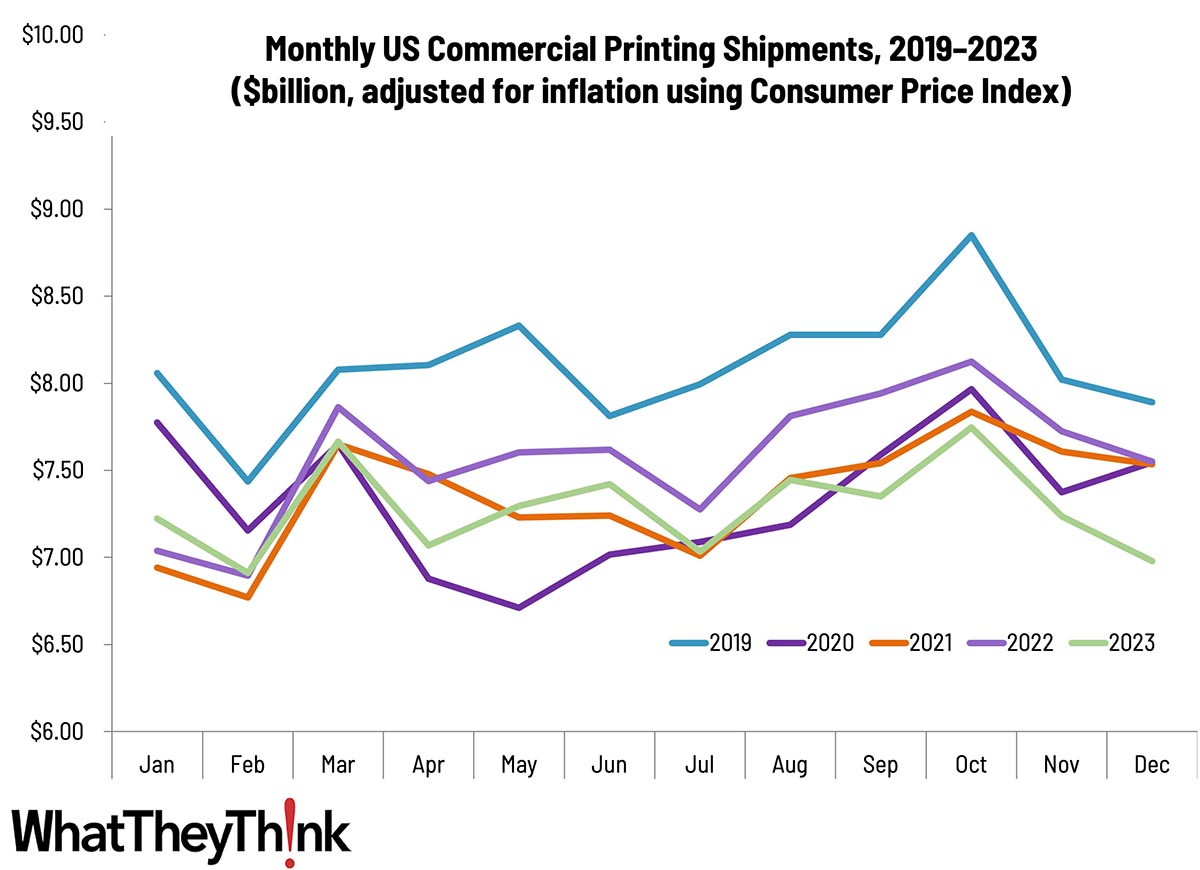

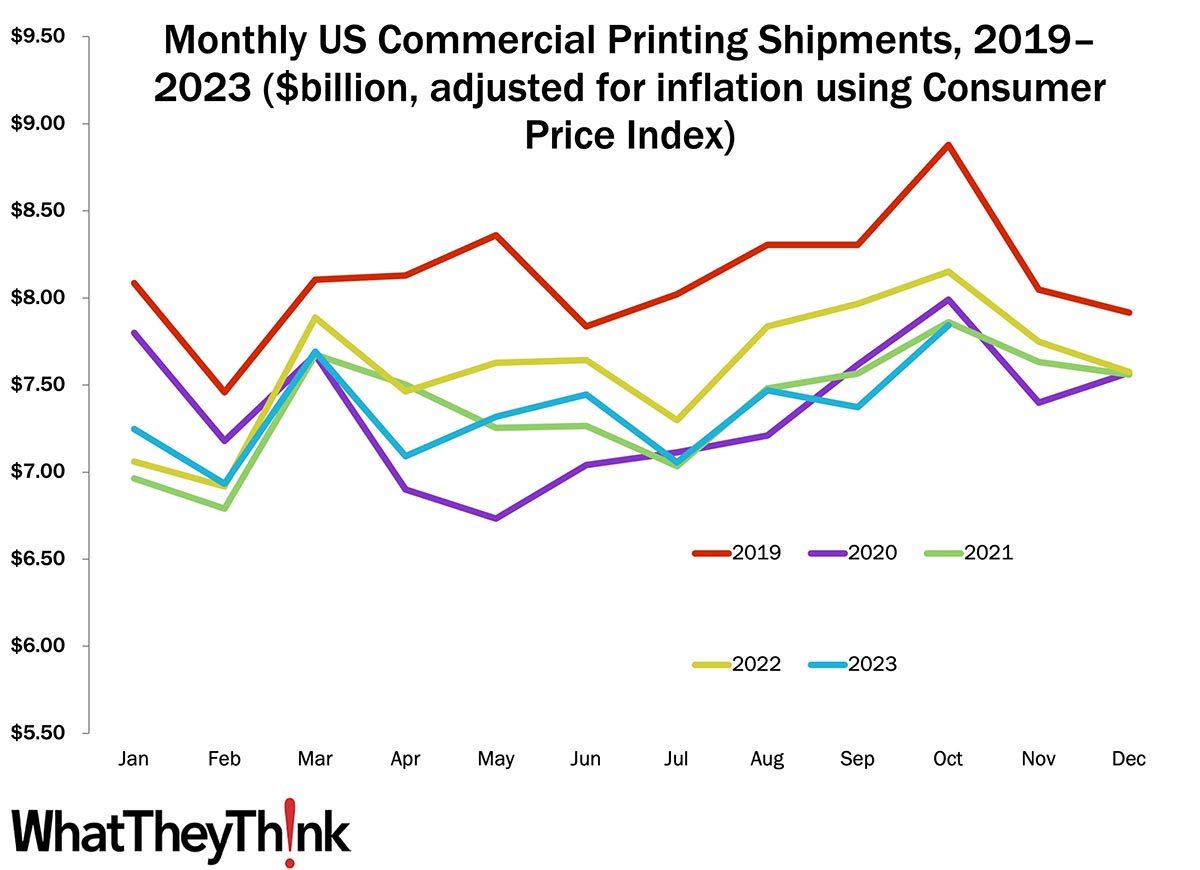

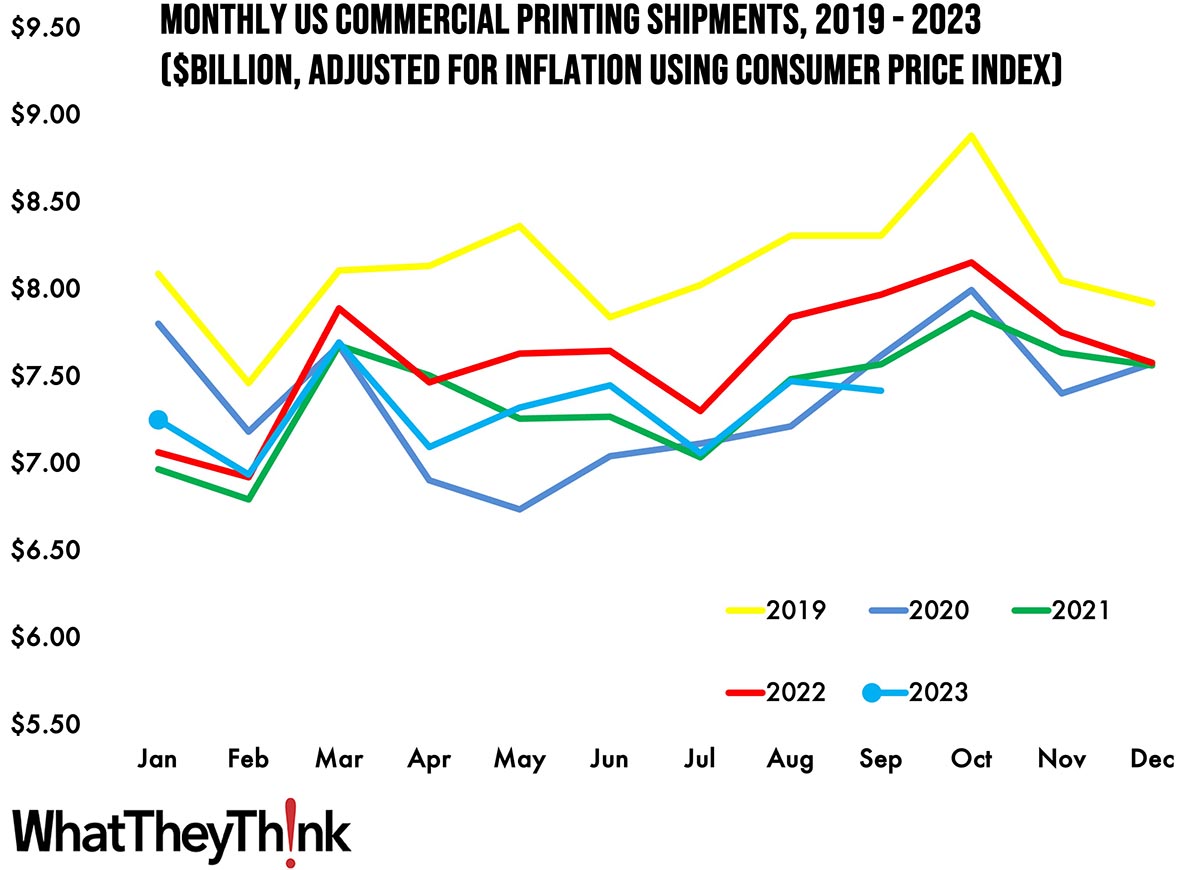

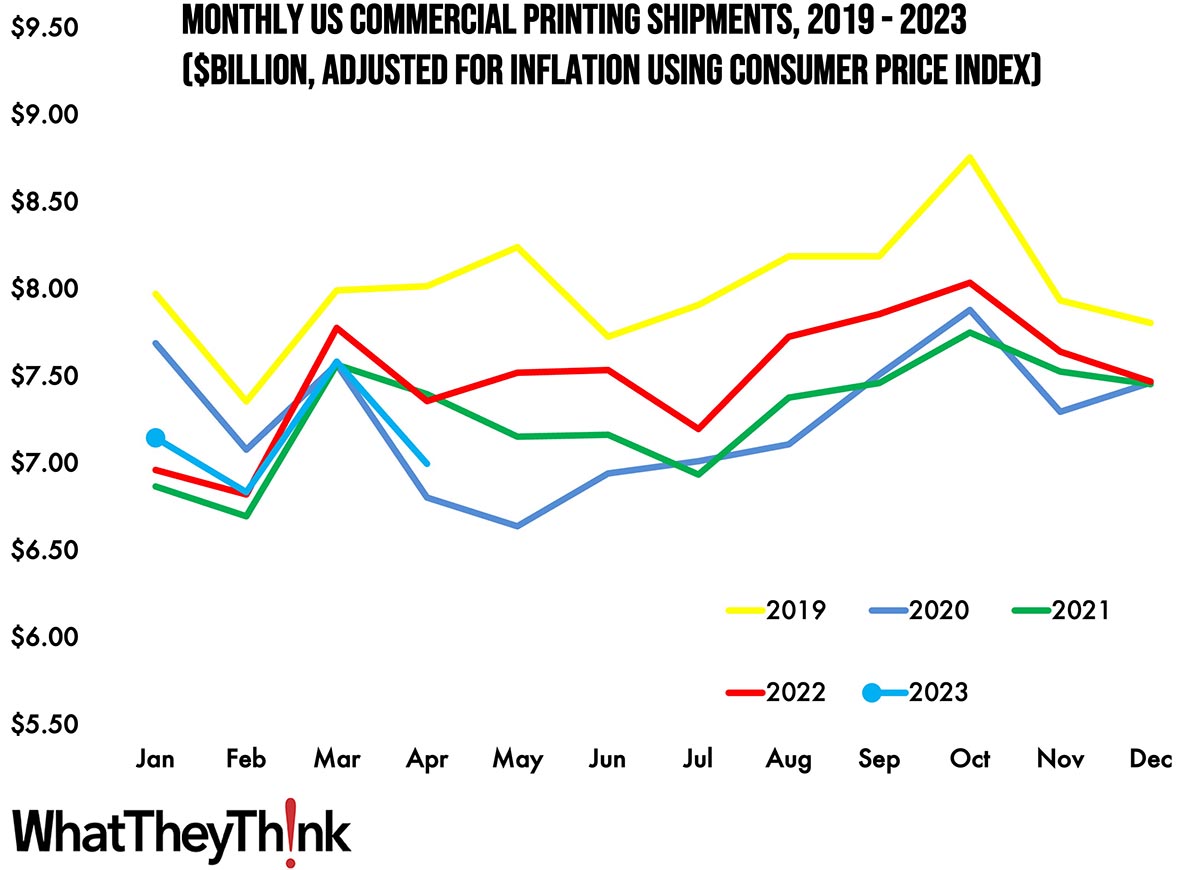

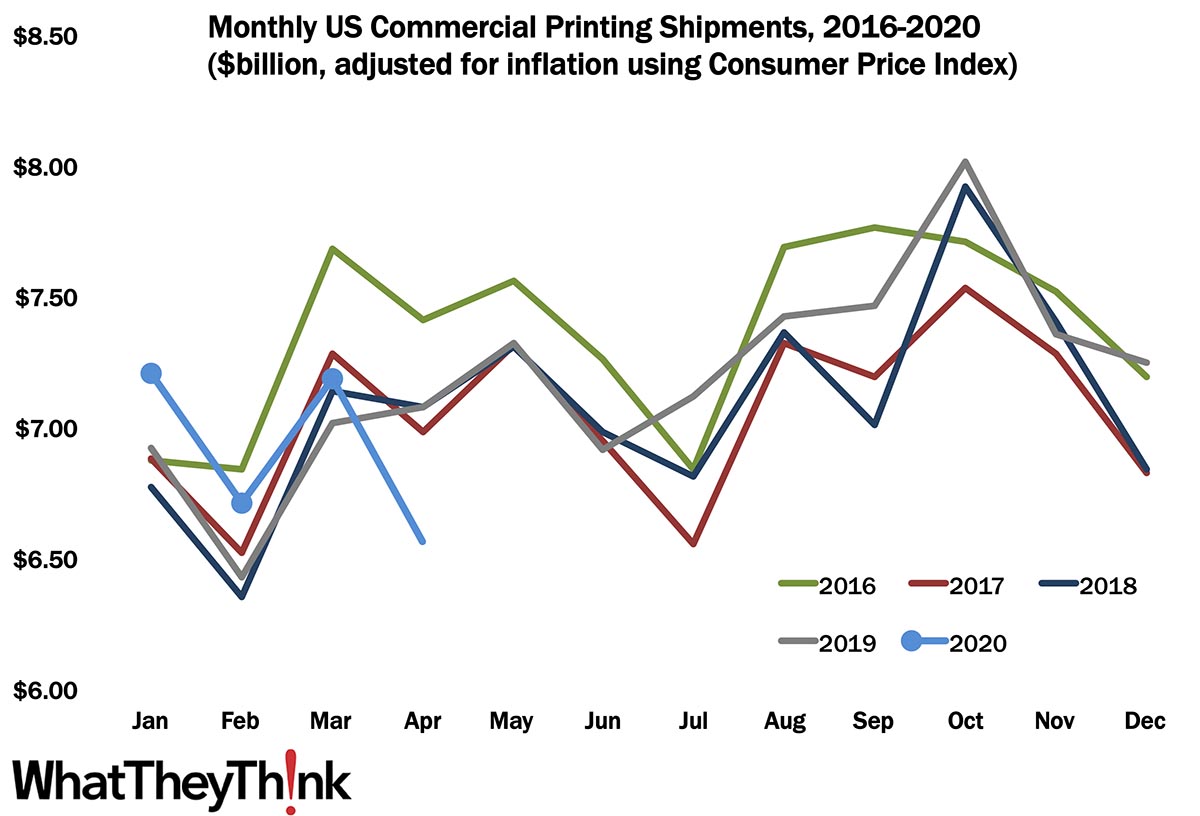

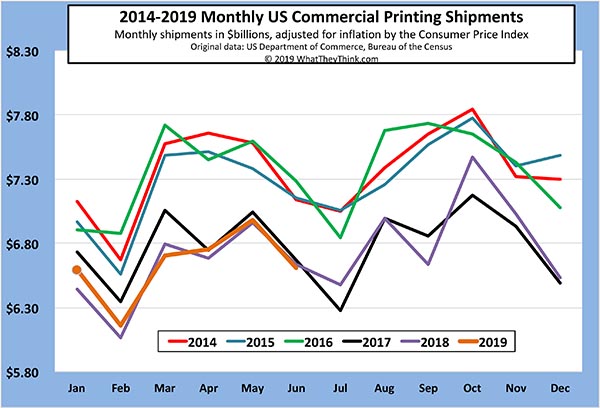

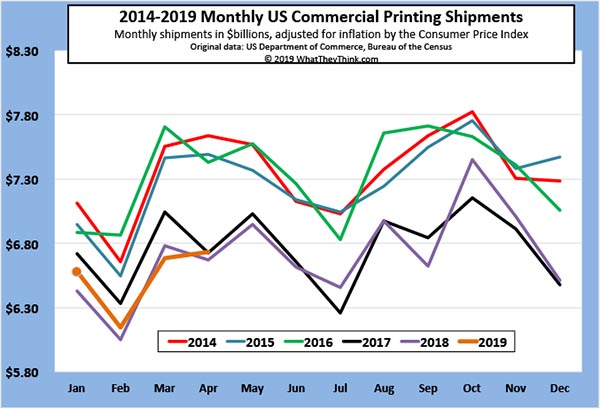

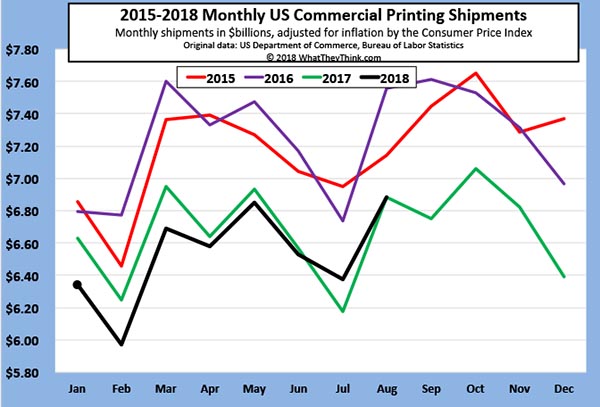

April 2024 shipments came in at $7.30 billion, up from March’s $7.24 billion—an unexpected but welcome rebound. Full Analysis

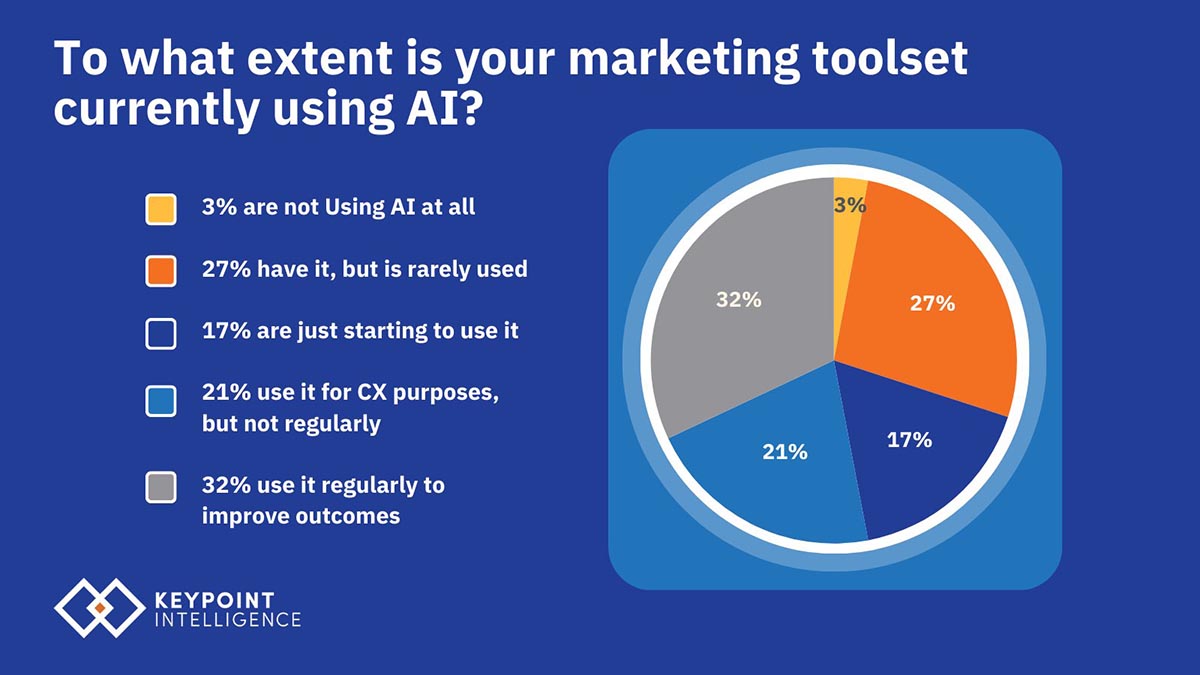

Artificial Intelligence and What It Means for Marketers

Published: July 12, 2024

Artificial intelligence (AI) significantly impacts marketing by improving customer experience and campaign effectiveness. This article explores AI's current influence and potential future impact on marketers. Discover how AI applications like static image recognition, tagging, and cyberattack prevention are transforming the marketing landscape. Arm yourself with the best data available and learn how to successfully leverage AI. Full Analysis

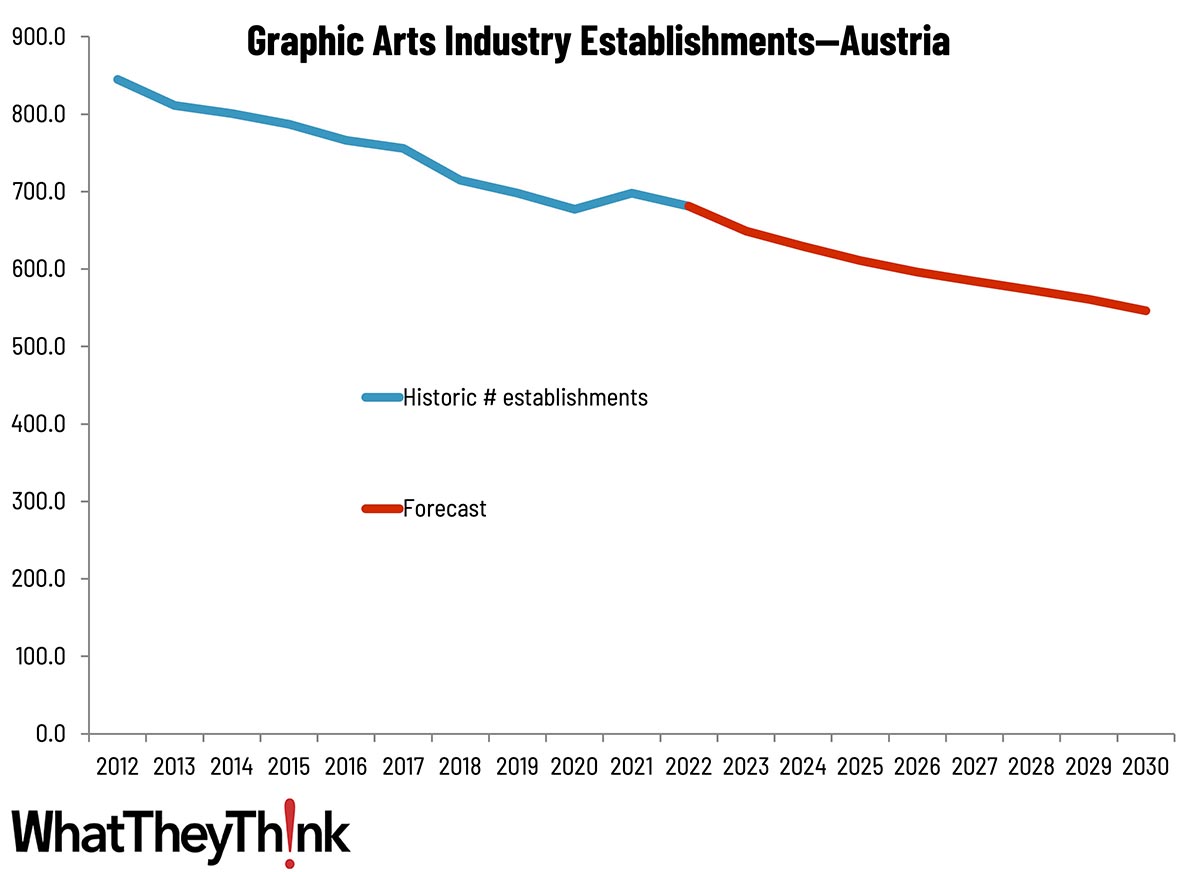

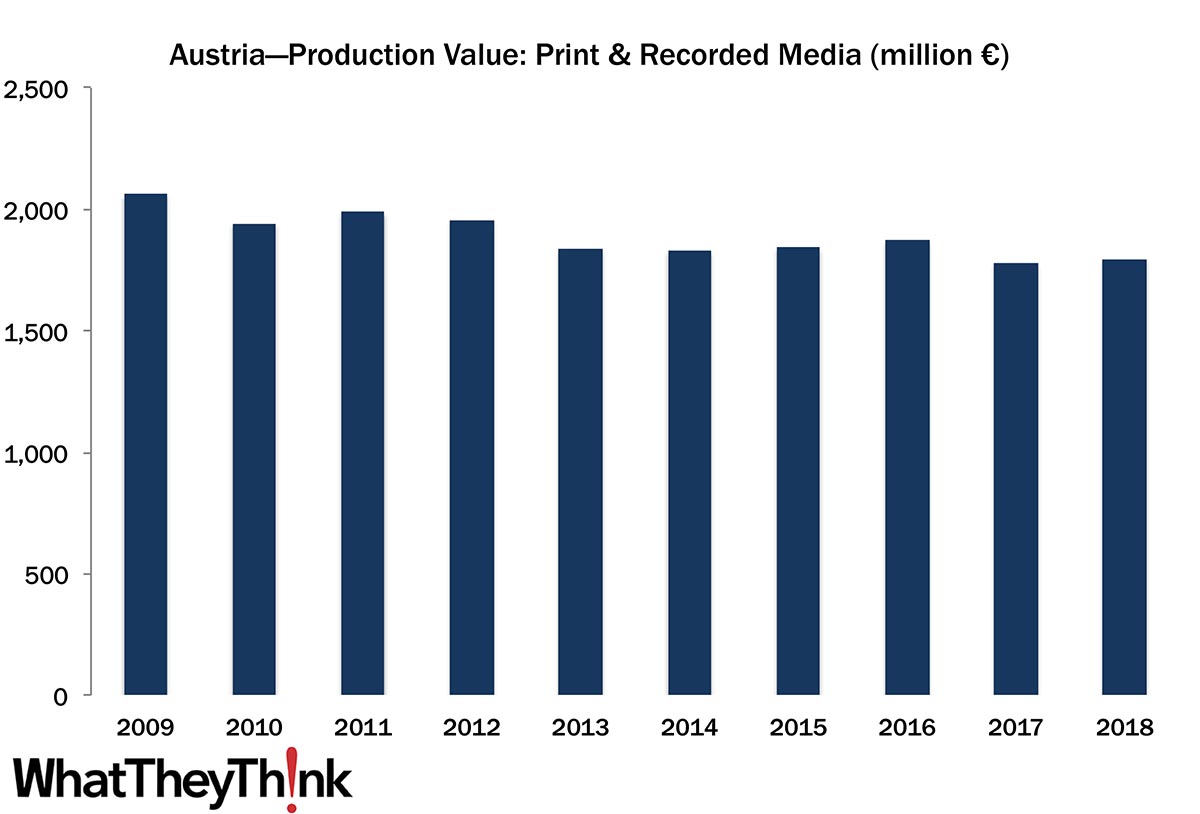

Sizing the Printing Industry in Europe—Austria

Published: July 8, 2024

This bi-weekly series of short articles provides some country details on the size of the printing industry in Europe per country, especially tracking the number of printing establishments. This time we look at Austria. Full Analysis

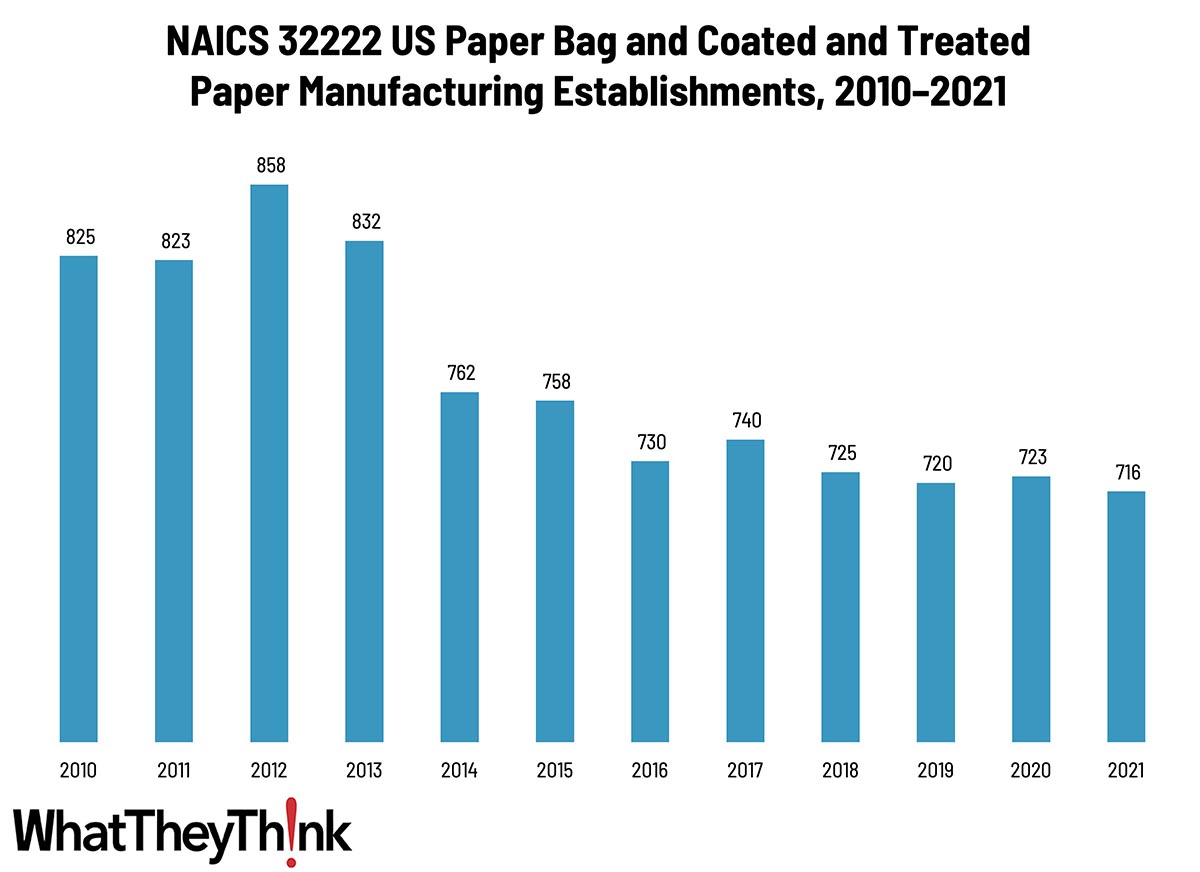

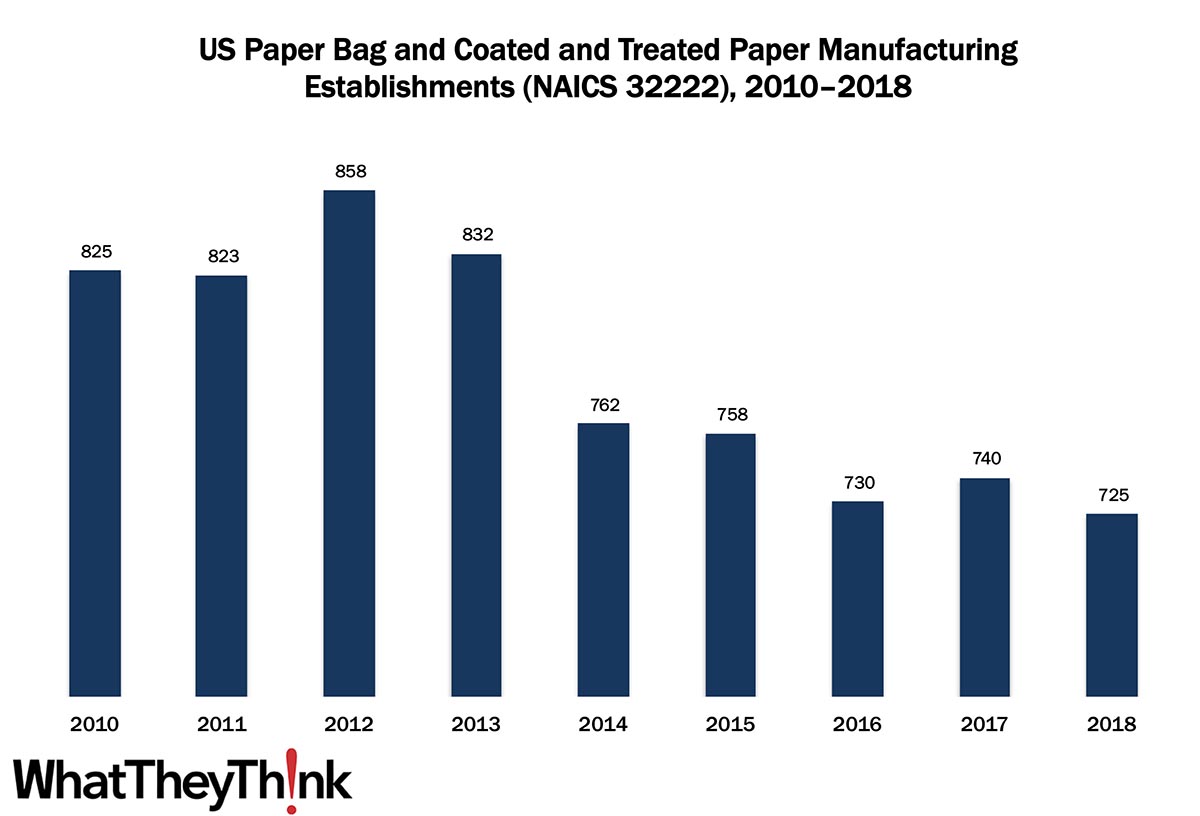

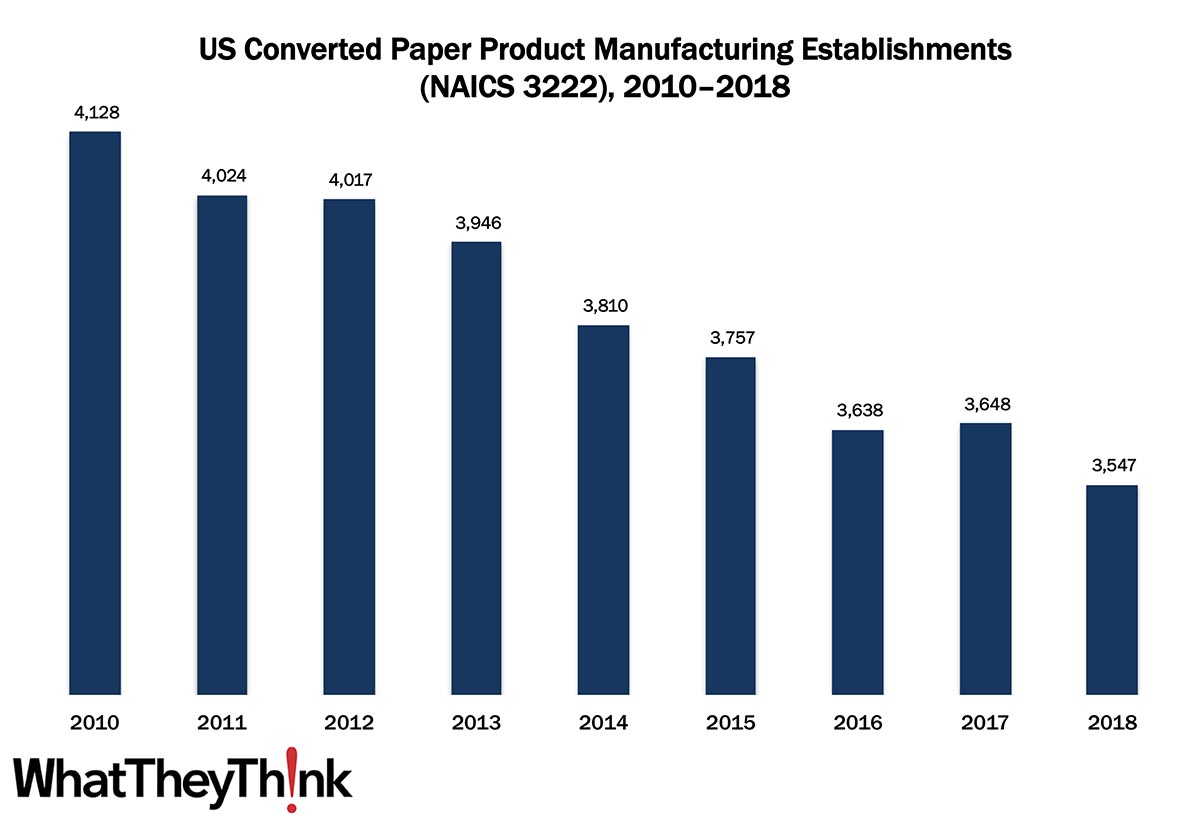

Paper Bag and Coated and Treated Paper Manufacturing—2010–2021

Published: June 28, 2024

According to County Business Patterns, in 2021 there were 276 establishments in NAICS 32222 (Paper Bag and Coated and Treated Paper Manufacturing). This category saw a net decrease in establishments of -13% since 2010. In macro news, Q1 GDP revised up to 1.4%. Full Analysis

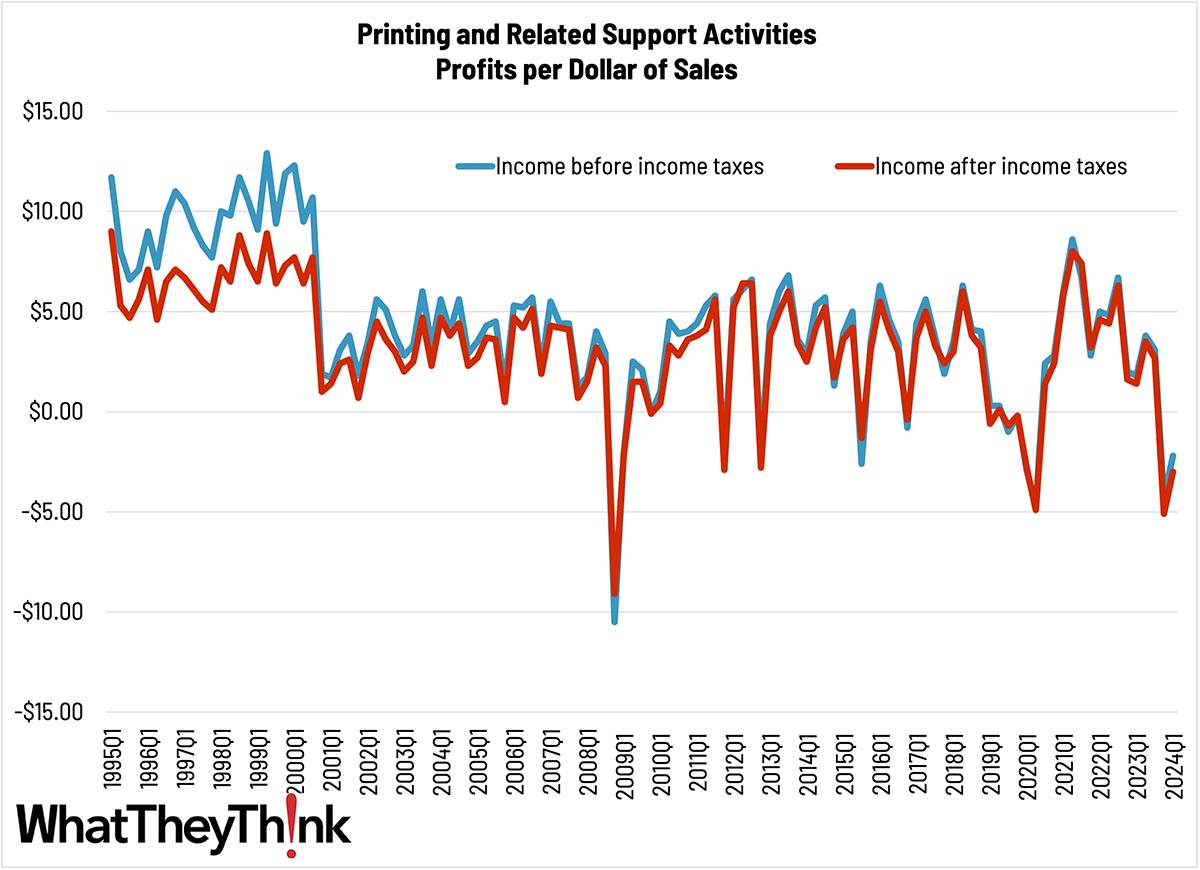

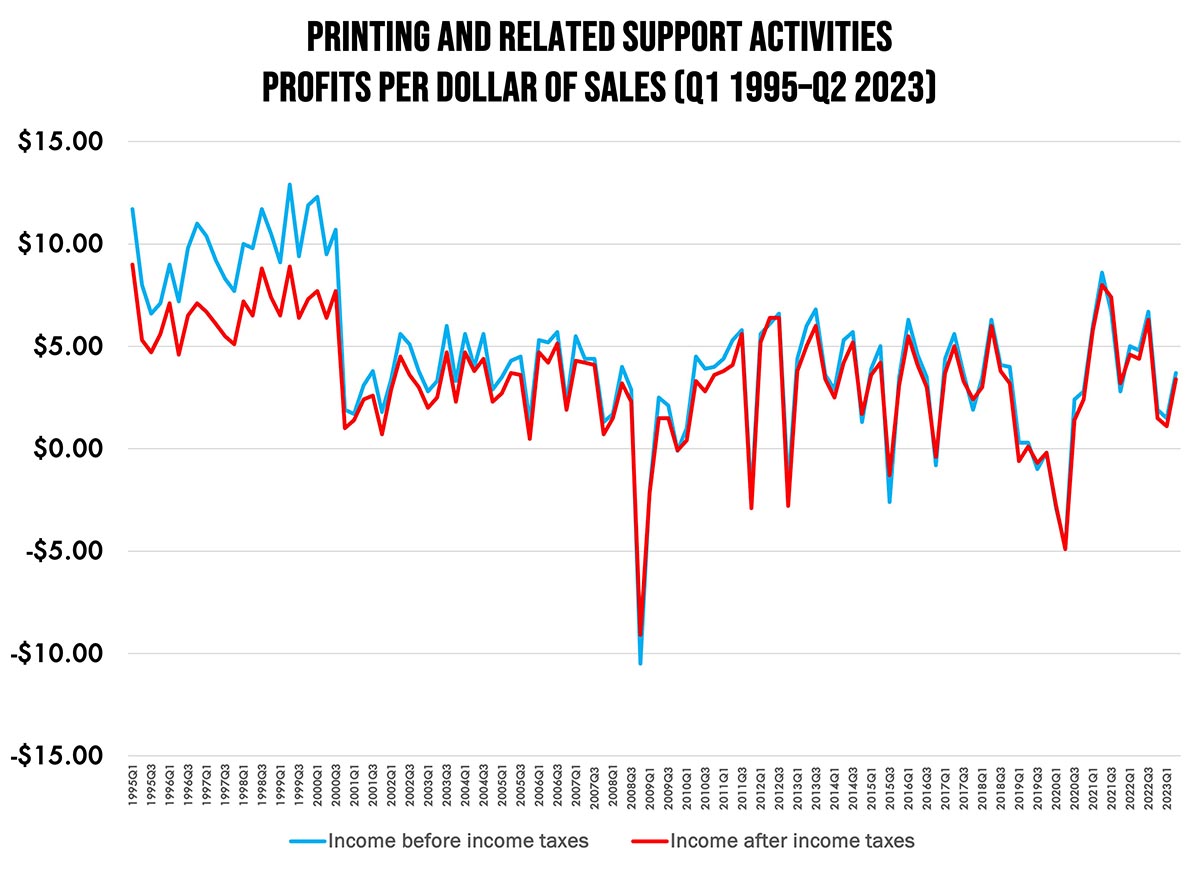

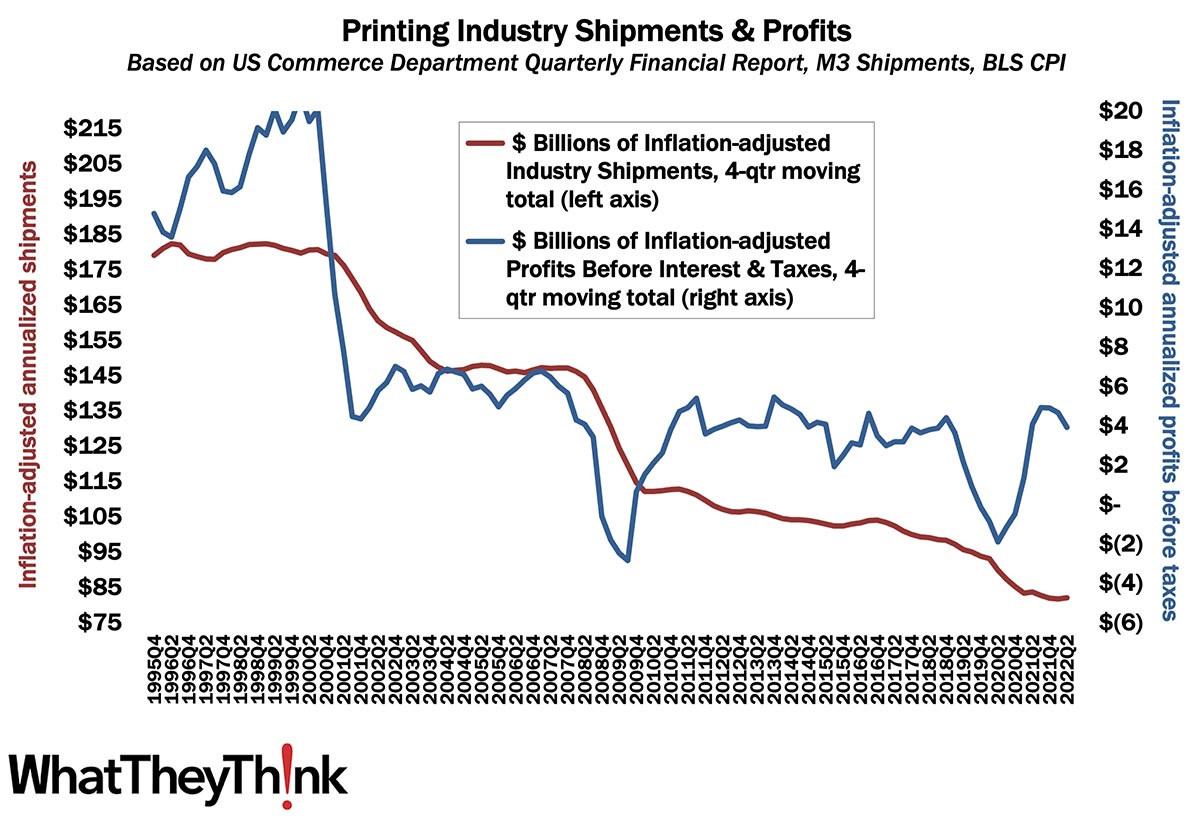

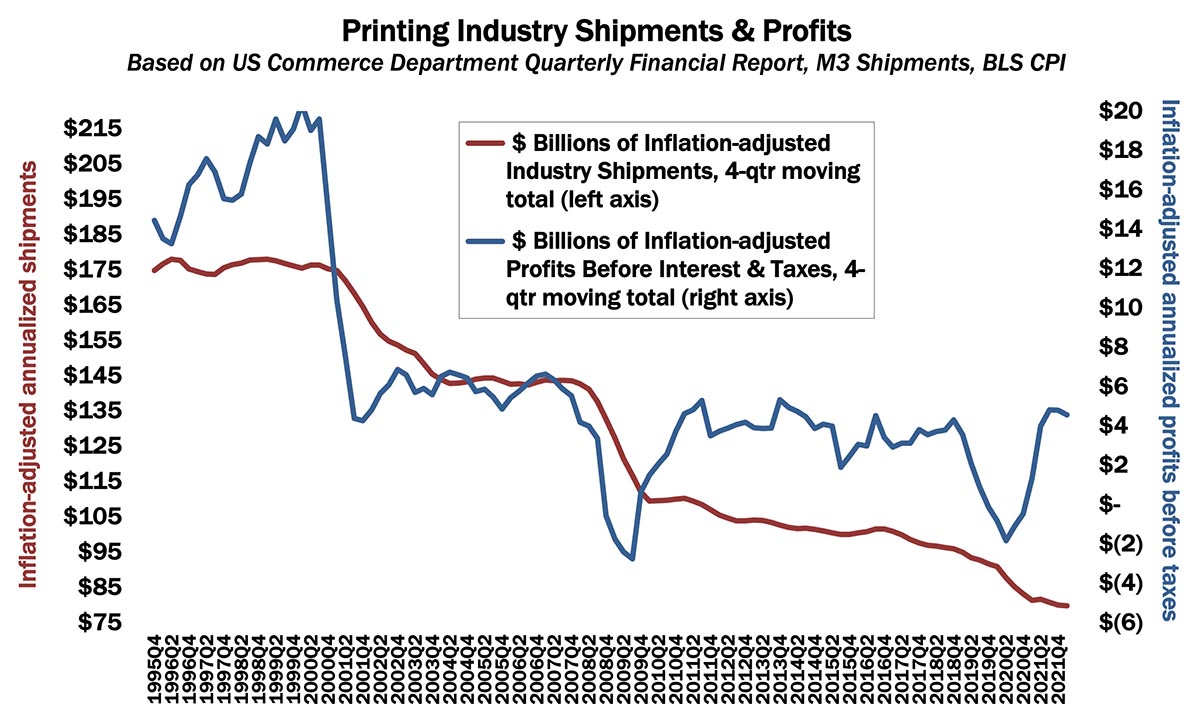

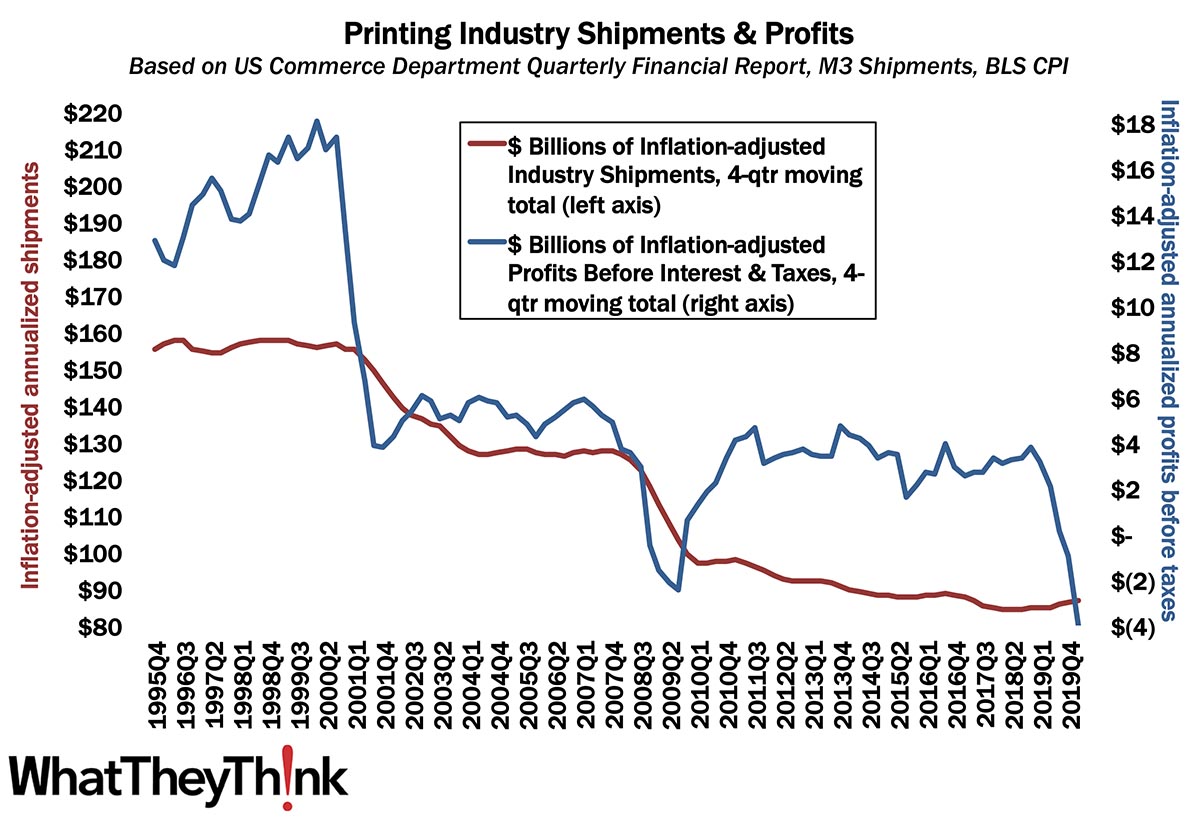

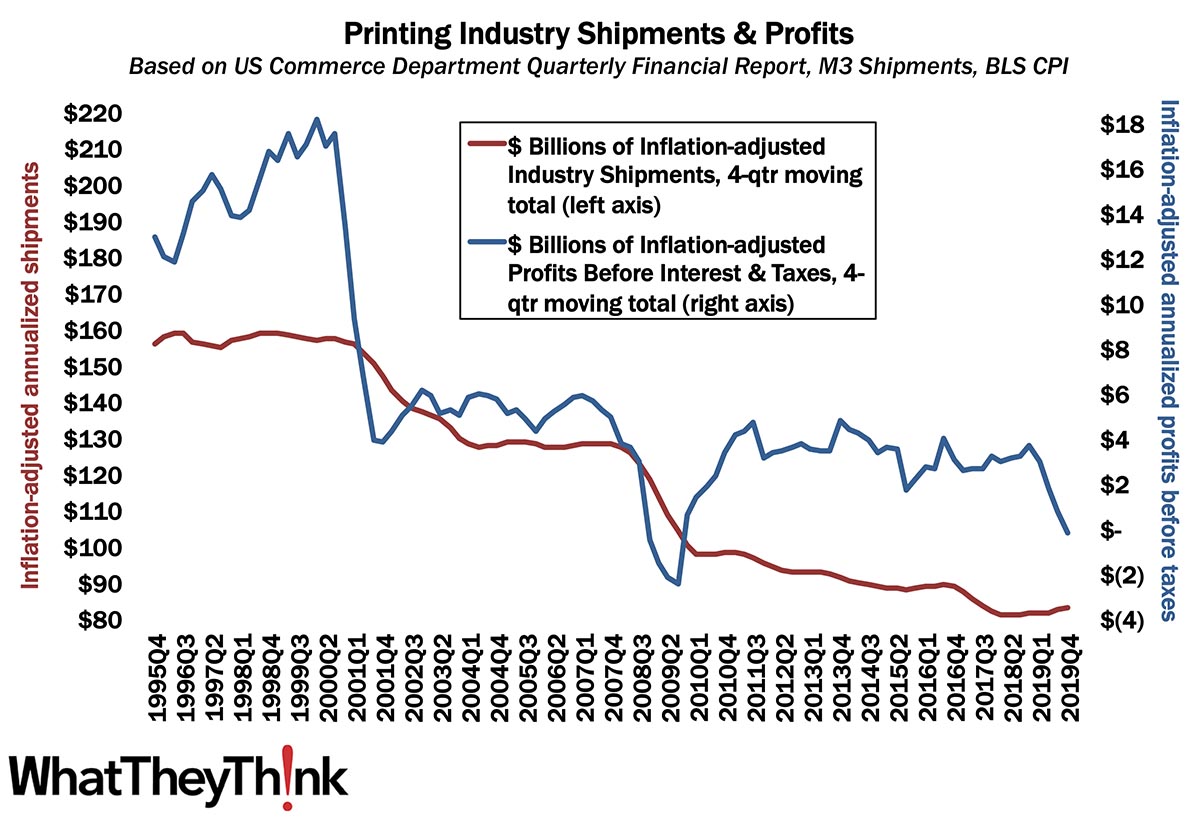

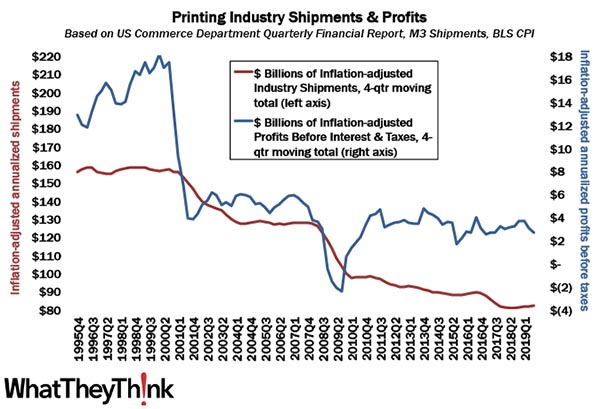

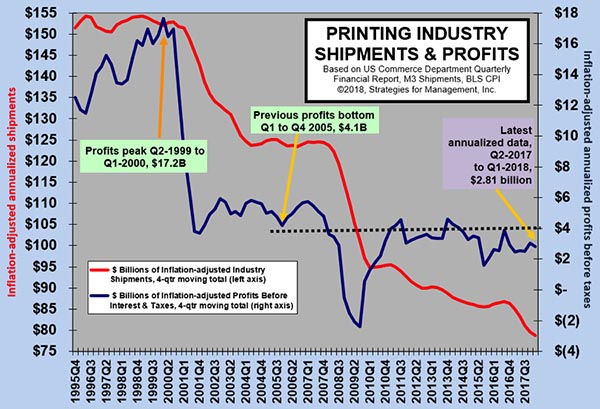

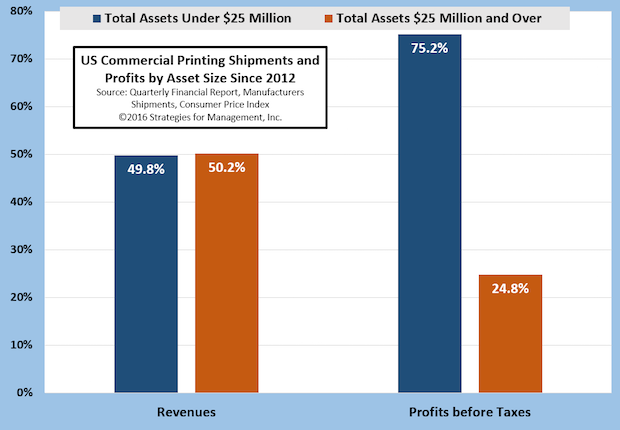

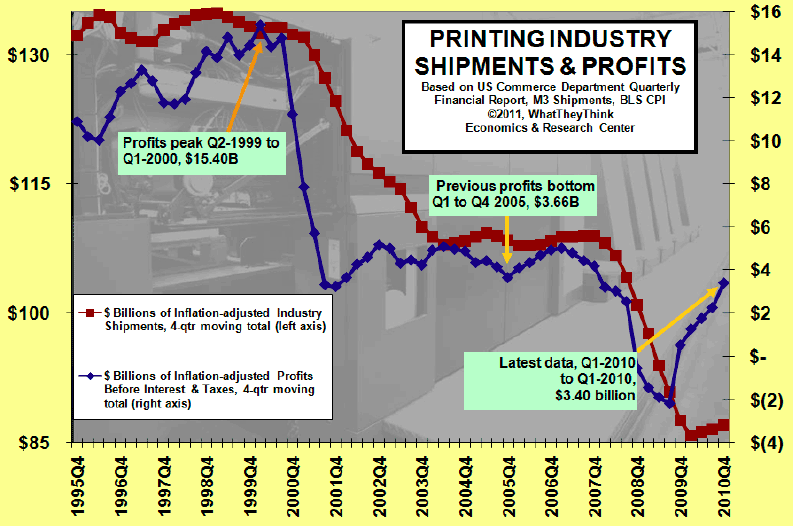

Q1 Industry Profits: The Two Cities Become One (and Not a Good One)

Published: June 21, 2024

Quarter-over-quarter profit margin data can be fairly noisy but had been on a general upward trend since the trough of the pandemic—although we had another crash in Q4 2023, which is proving difficult to climb out of. Full Analysis

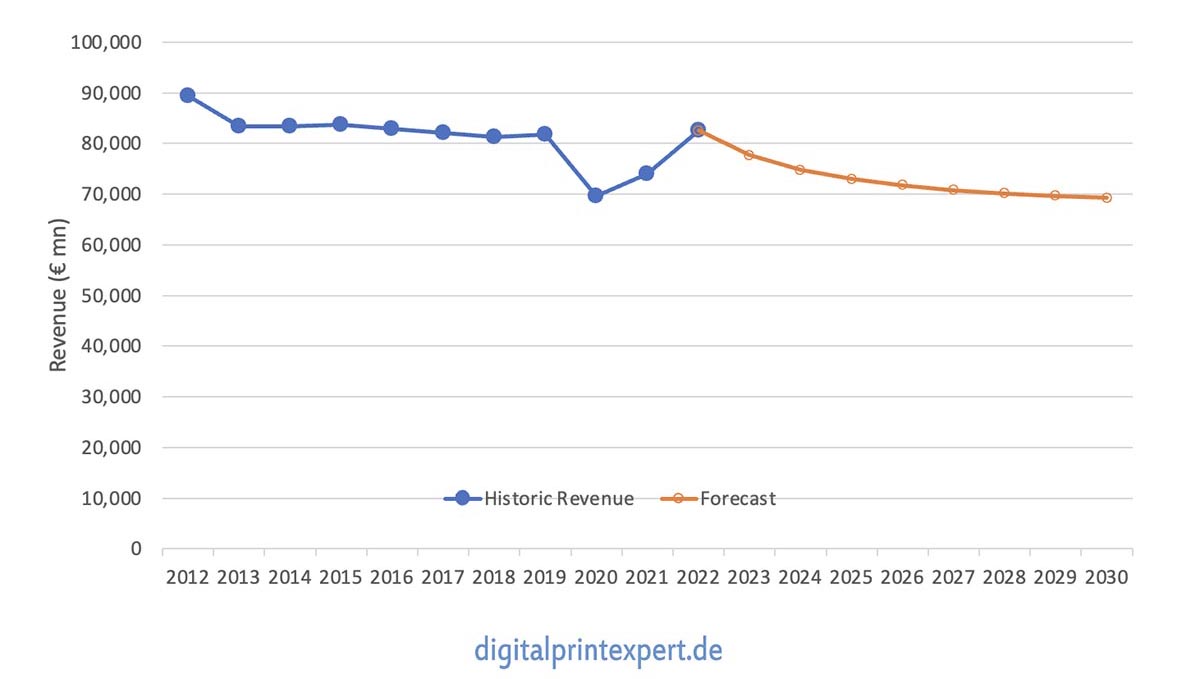

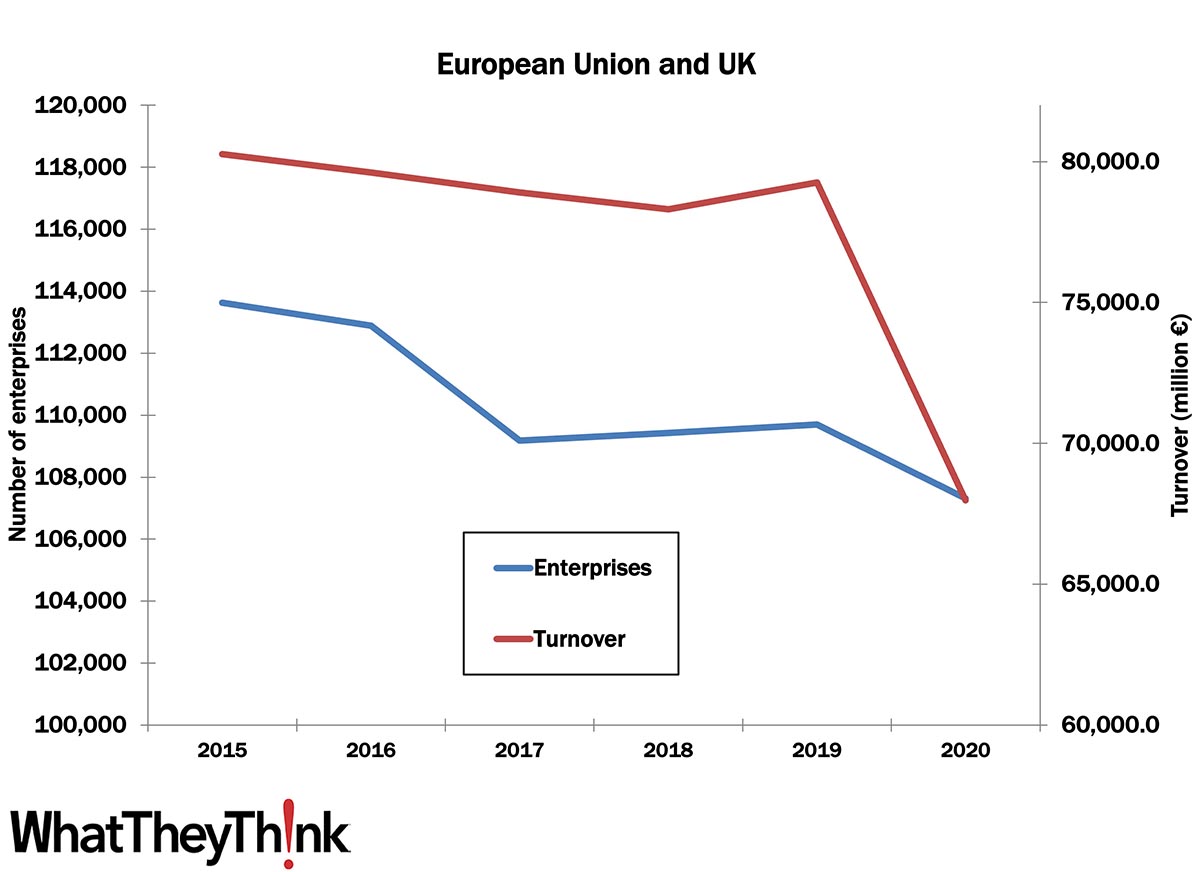

Sizing the European Print Industry

Published: June 18, 2024

Kicking off a regular series of country-by-country analyses, European section editor Ralf Schlözer looks at the demographics of the printing industry in Europe as a whole—identifying revenue, employment, and the number of establishments. Full Analysis

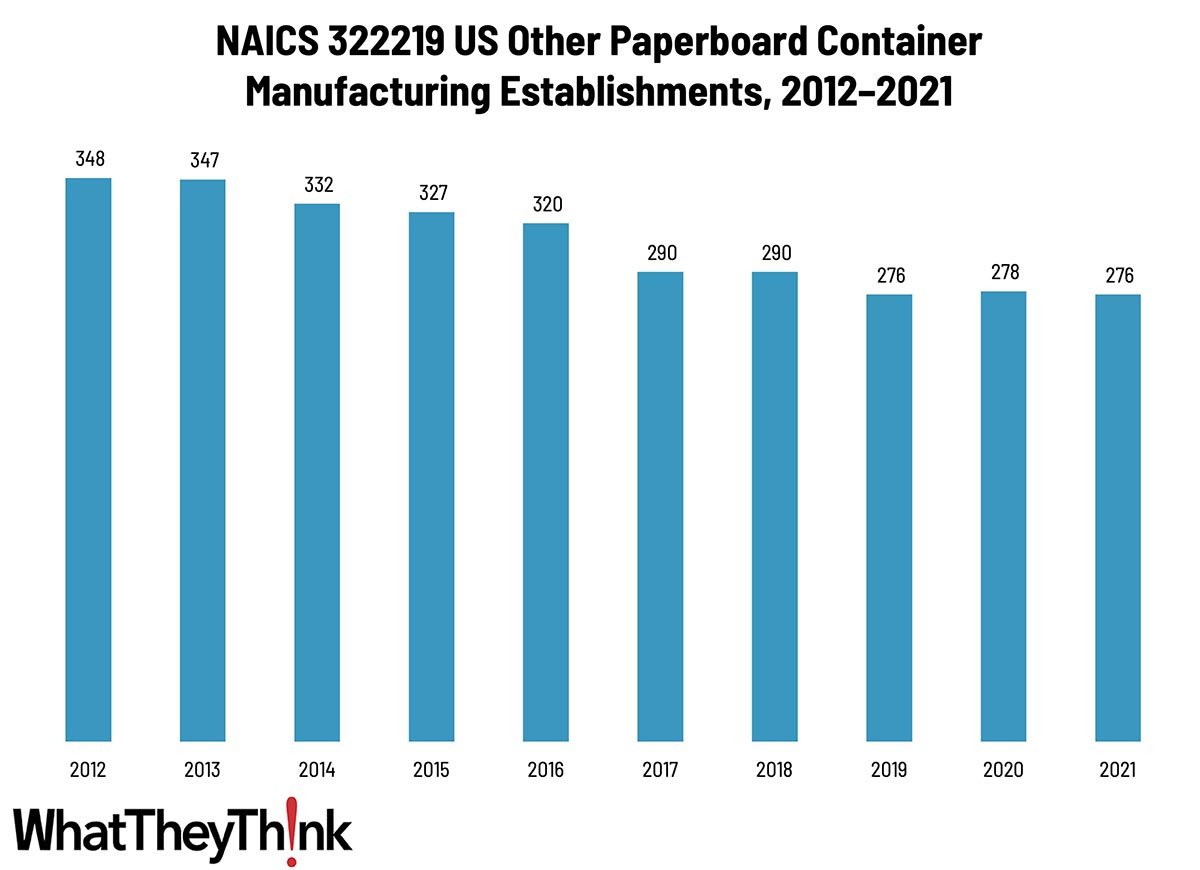

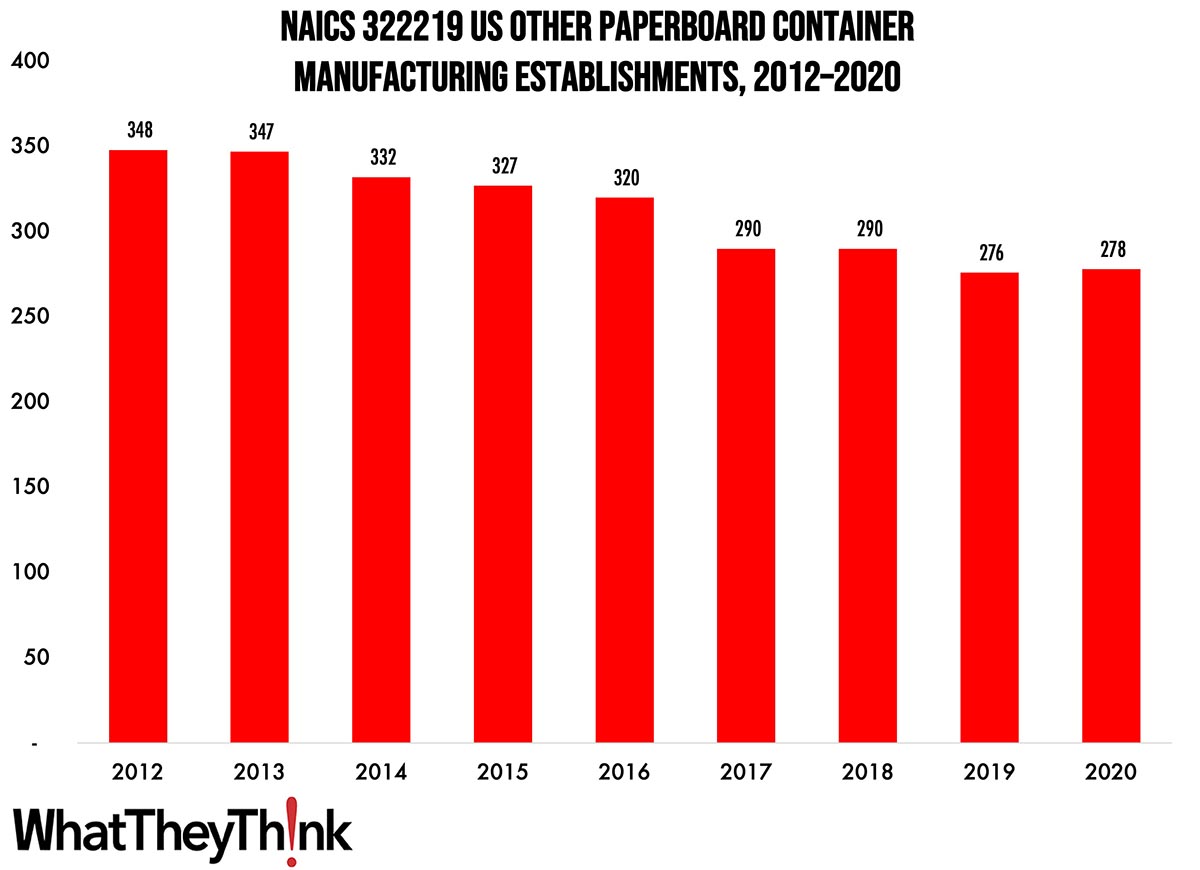

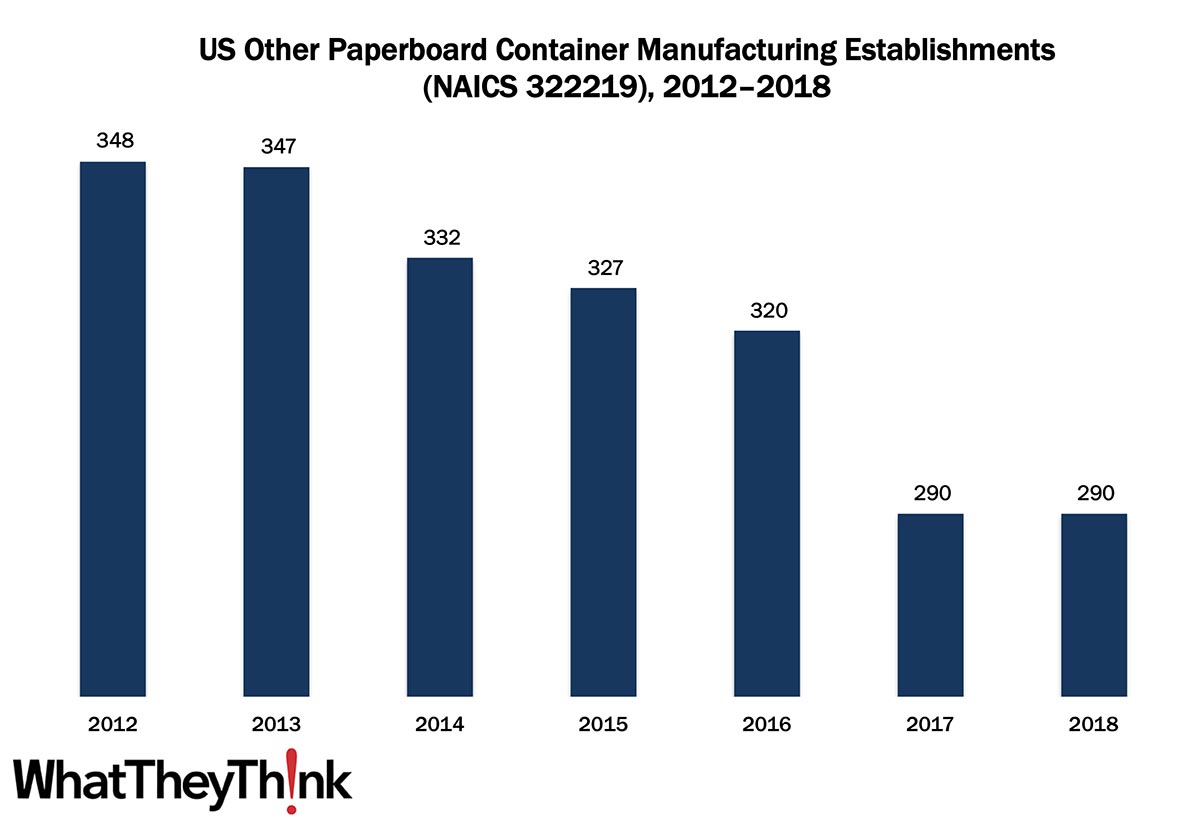

Other Paperboard Container Manufacturing Establishments—2010–2021

Published: June 14, 2024

According to County Business Patterns, in 2021 there were 276 establishments in NAICS 322219 (Other Paperboard Container Manufacturing). This category saw a net decrease in establishments of -21% since 2010. In macro news, inflation was virtually unchanged in May. Full Analysis

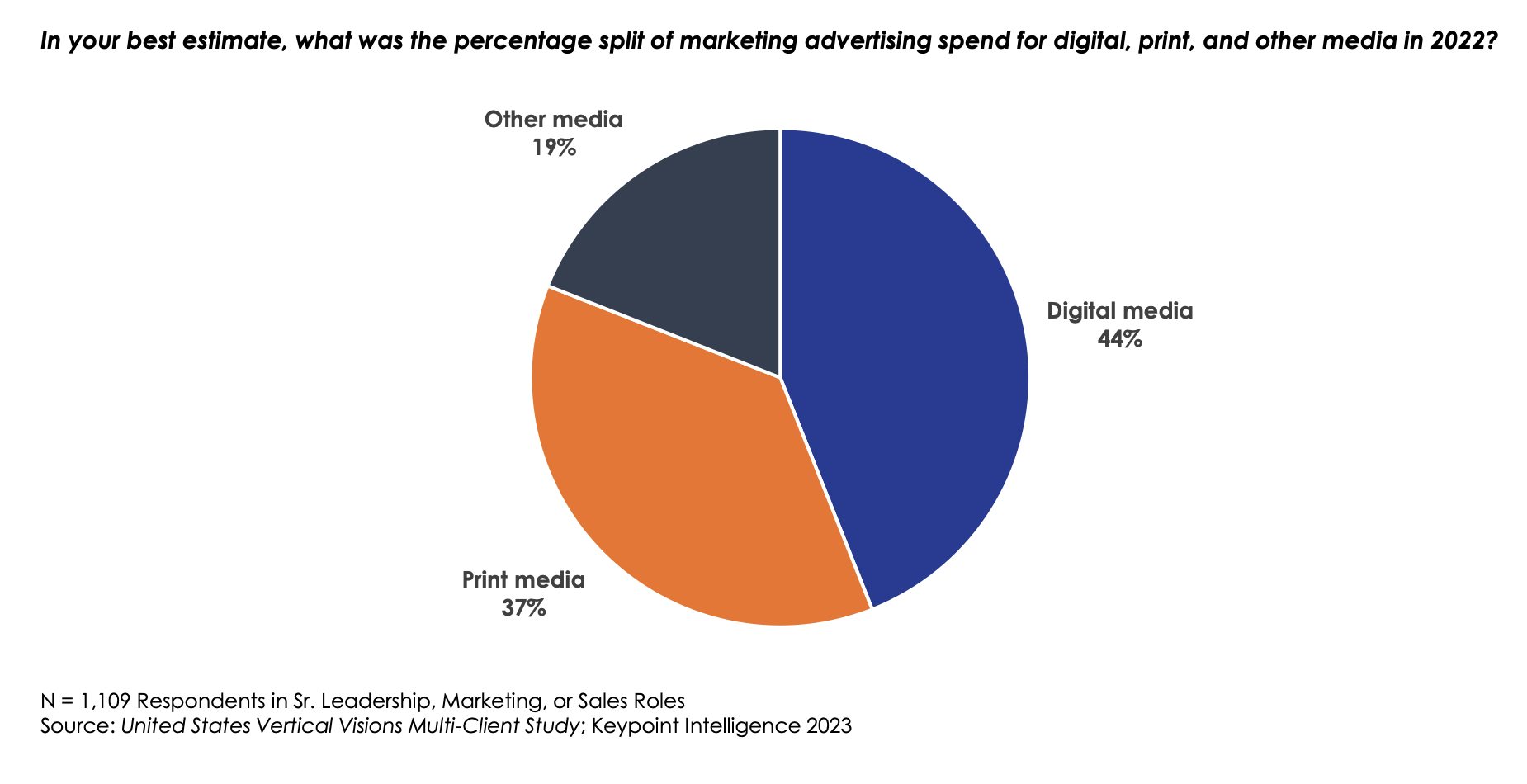

Vertical Market Research from Keypoint Intelligence Uncovers Key Industry Trends

Published: June 10, 2024

In late 2023, Keypoint Intelligence completed a comprehensive multi-client study to gain a better understanding of how print demand is changing in key vertical industries. The vertical industries that were covered in depth include education, finance/banking, healthcare, hospitality, insurance, manufacturing, retail, and publishing. Full Analysis

Tales from the Database: Finishing Up

Published: June 7, 2024

Drawing on six years’ worth of Print Business Outlook surveys, our “Tales from the Database” series looks at historical data to see if we can spot any particular hardware, software or business trends. This issue, we turn our attention to various aspects of finishing, including mailing and embellishments. Full Analysis

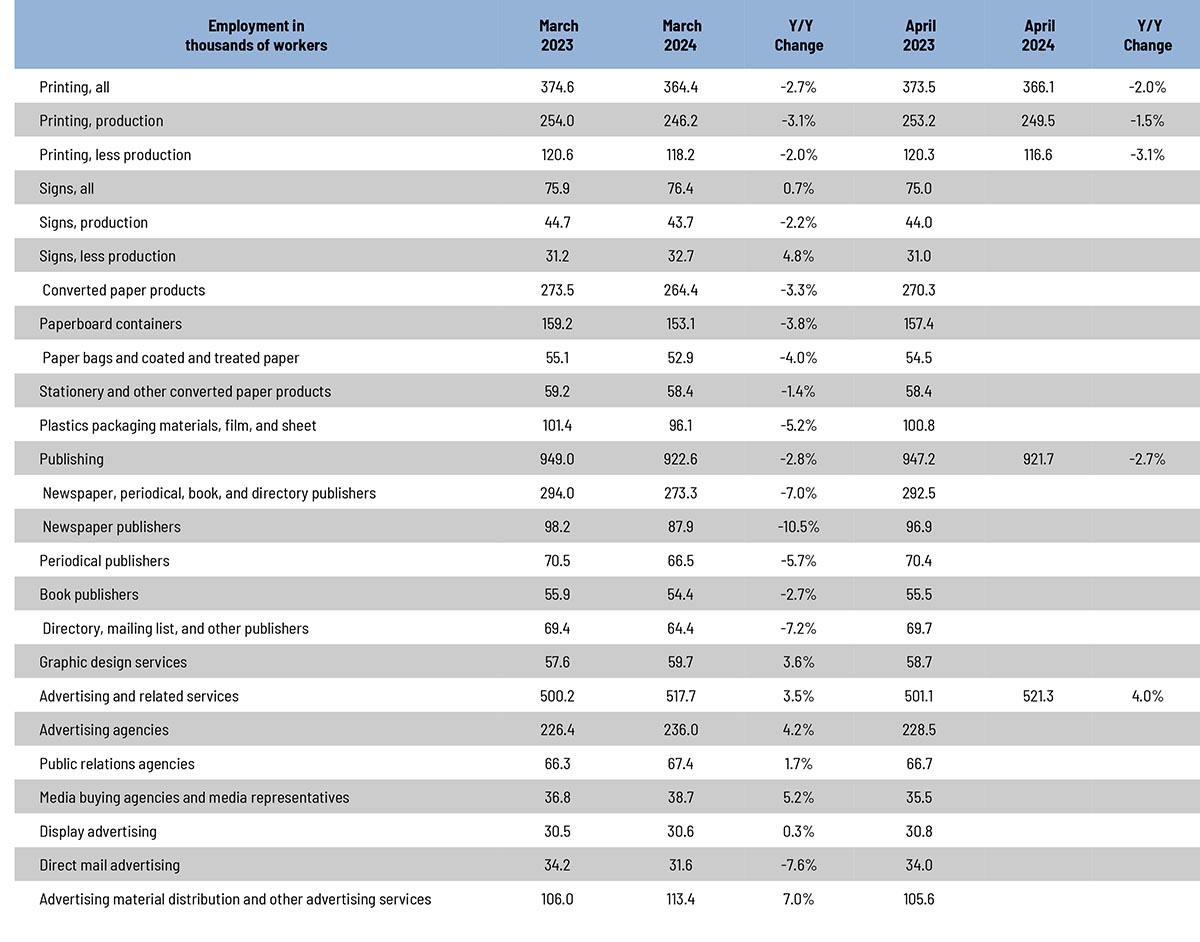

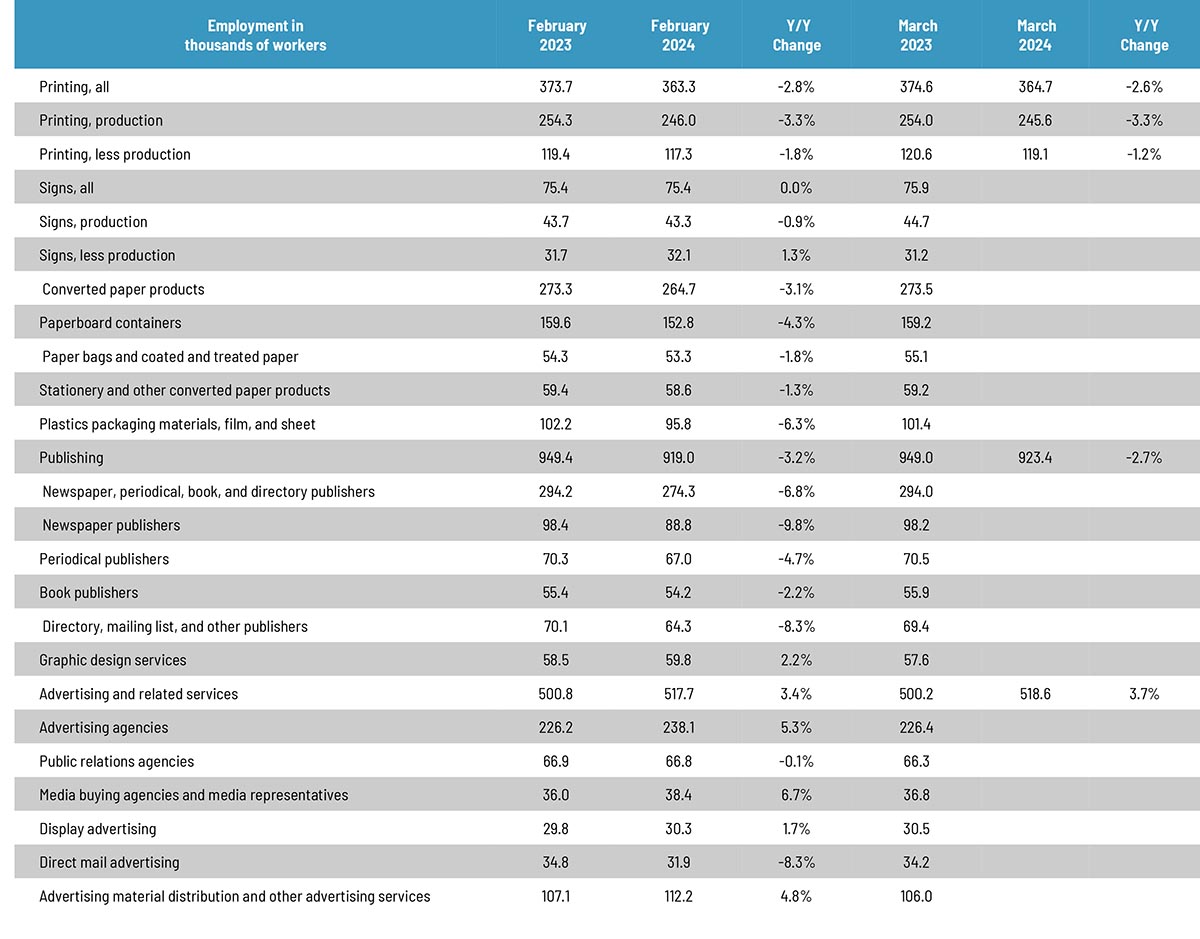

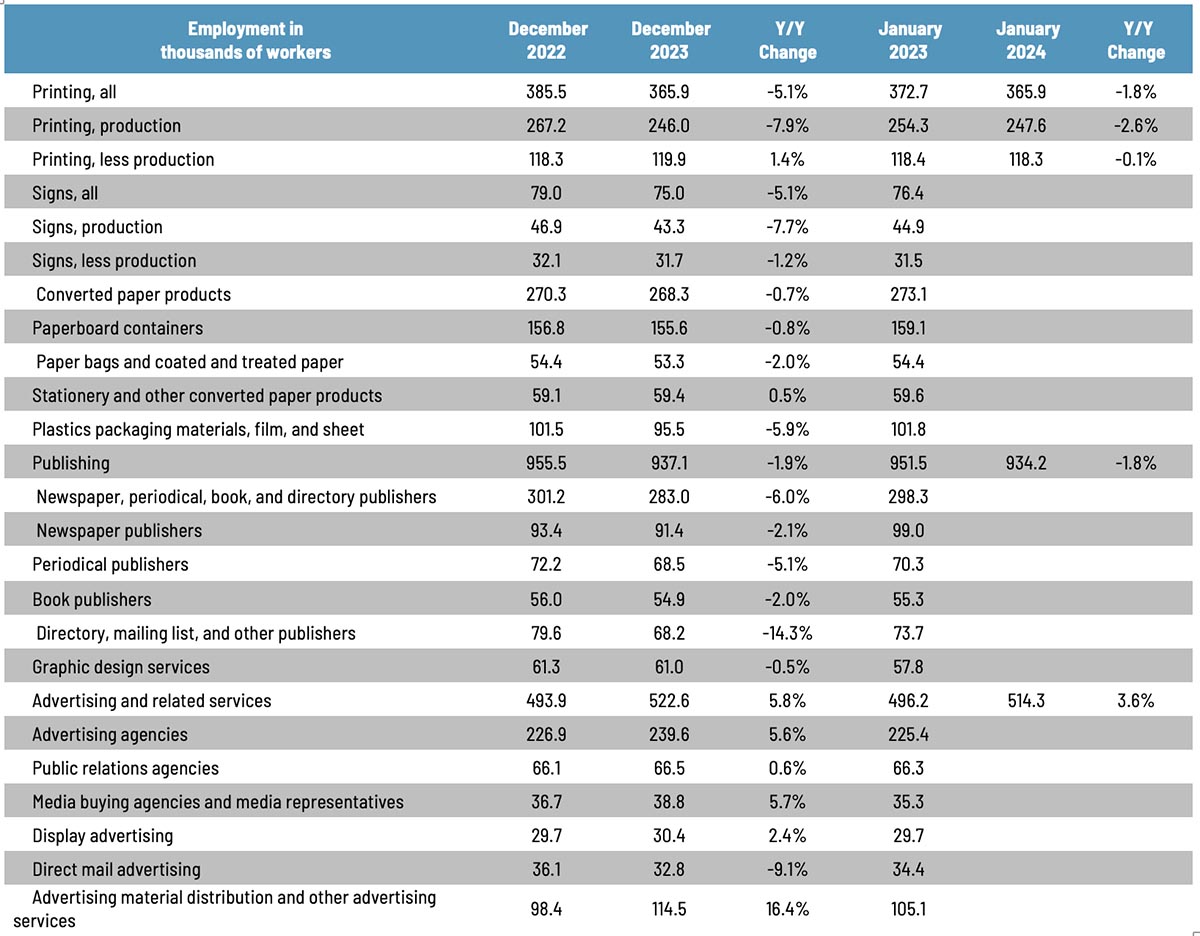

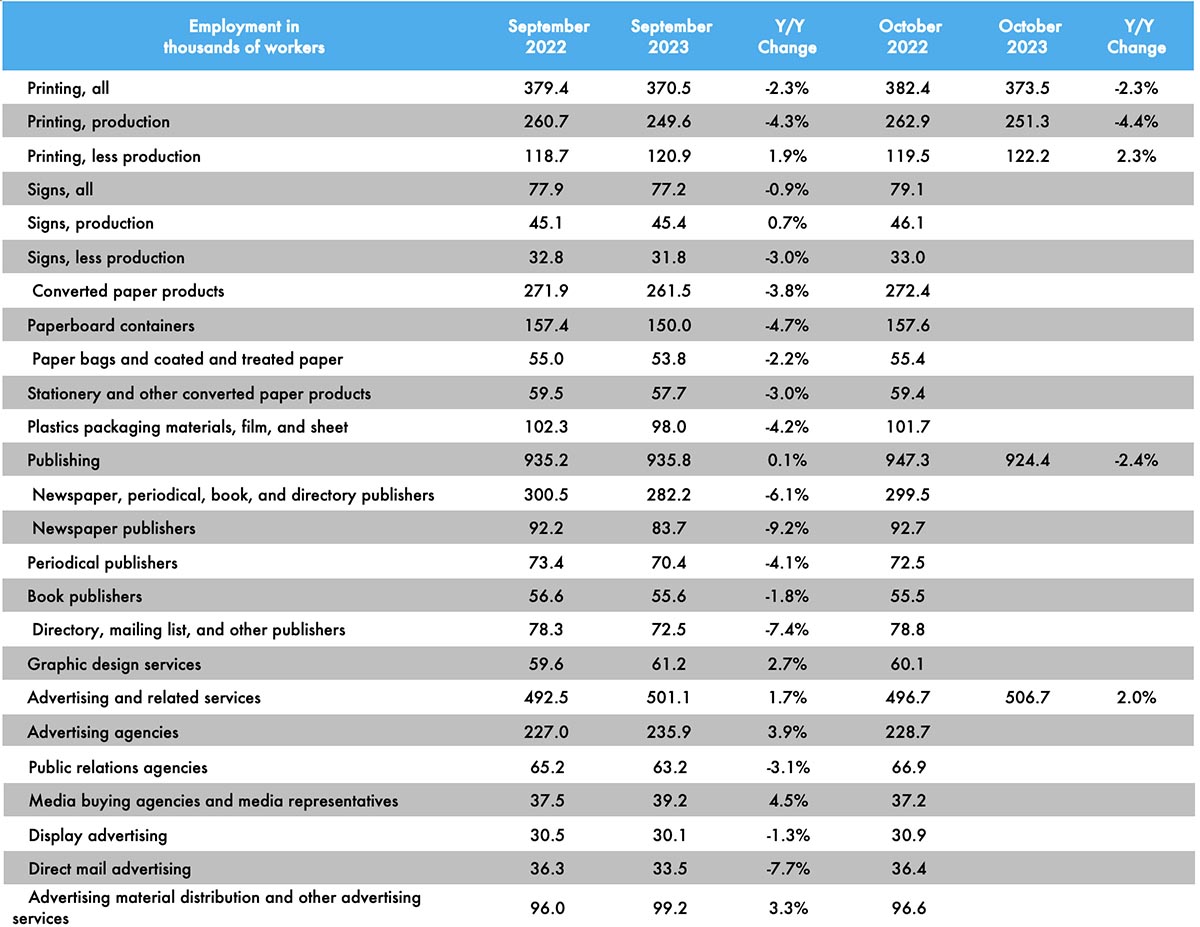

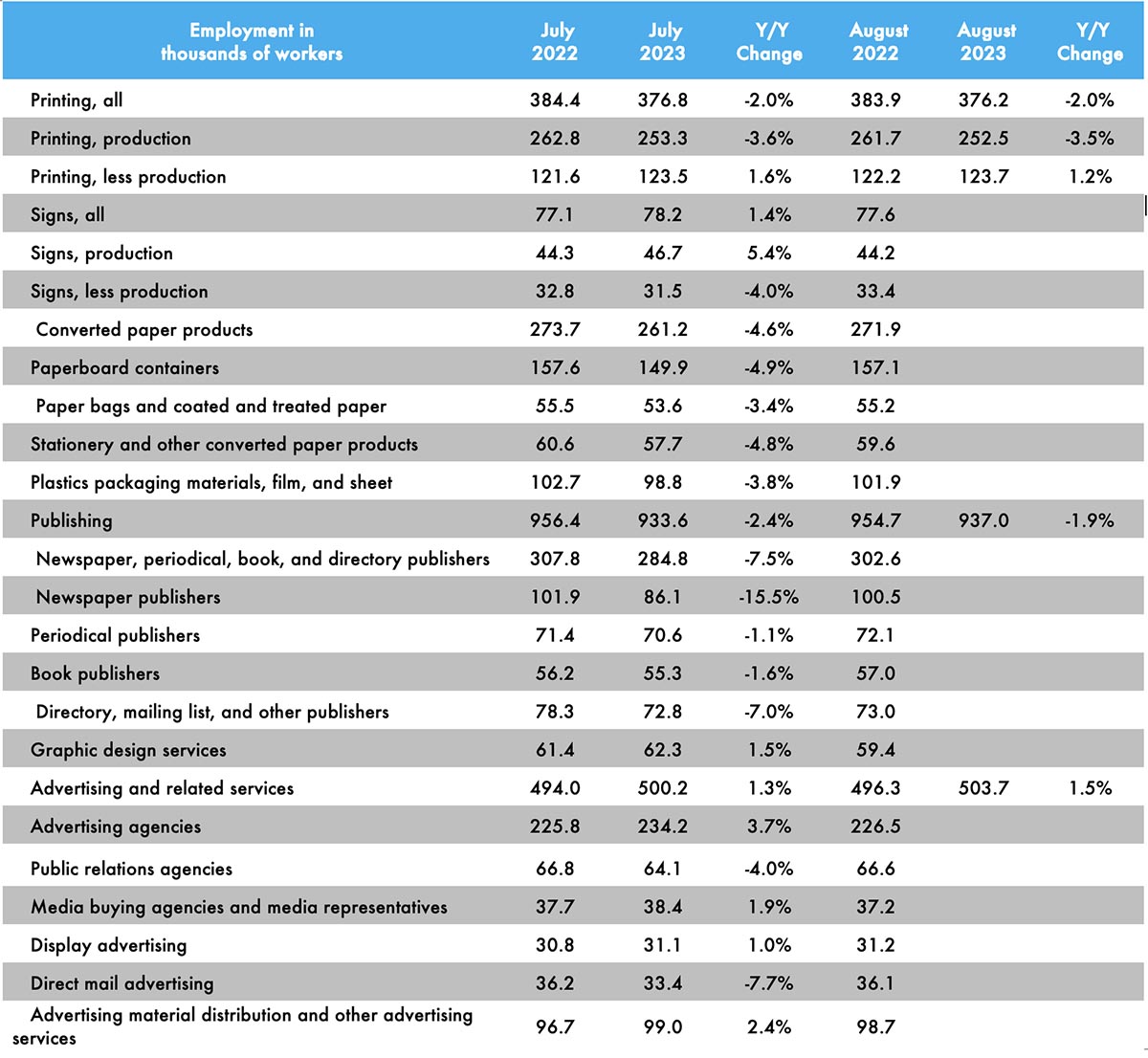

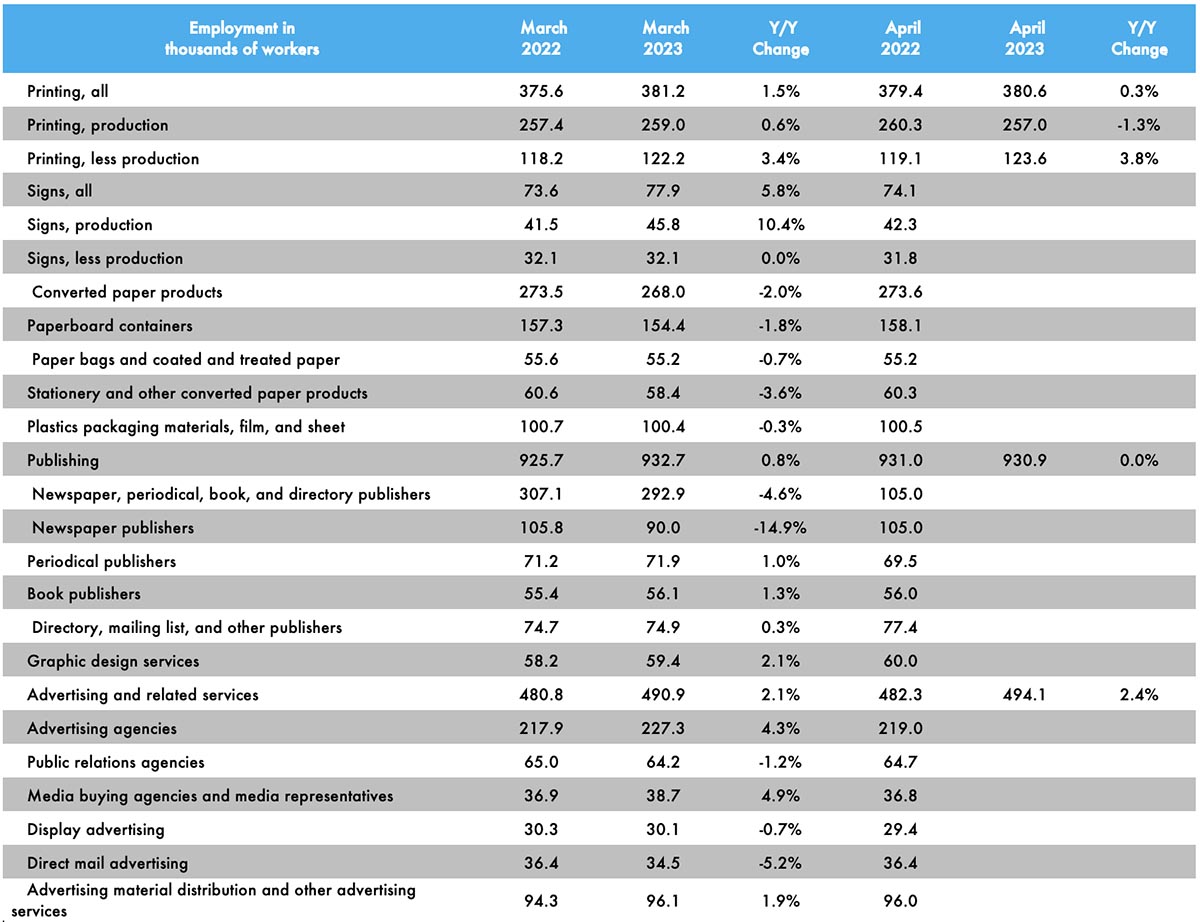

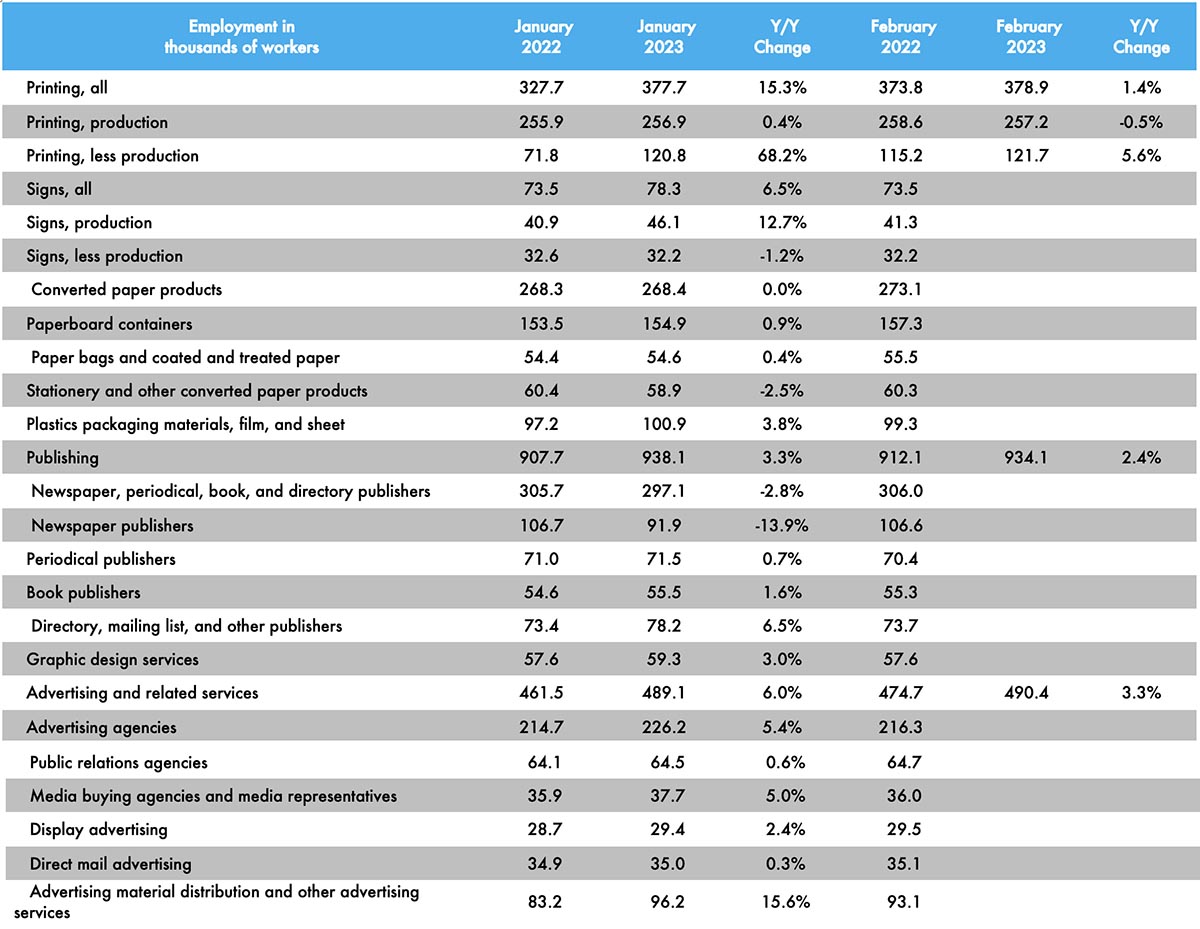

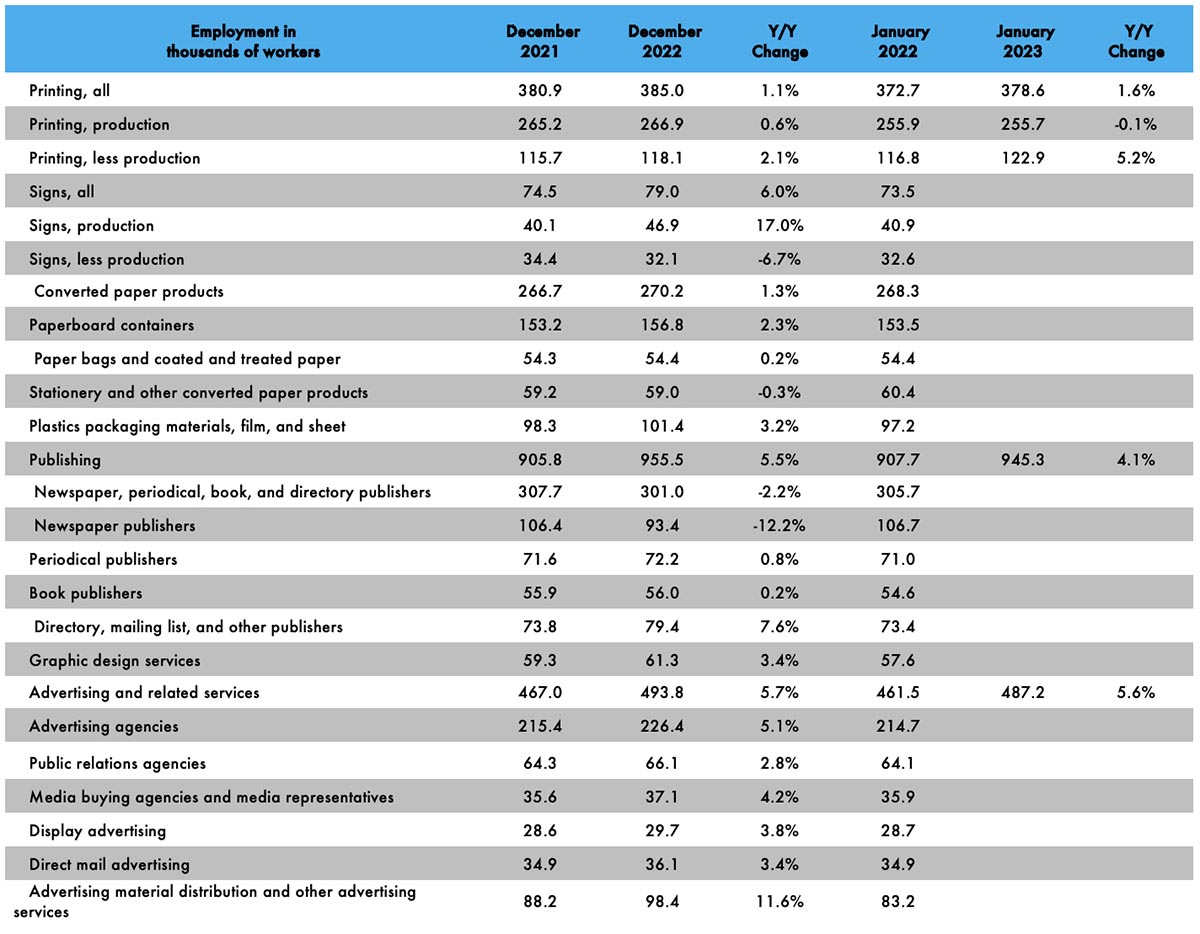

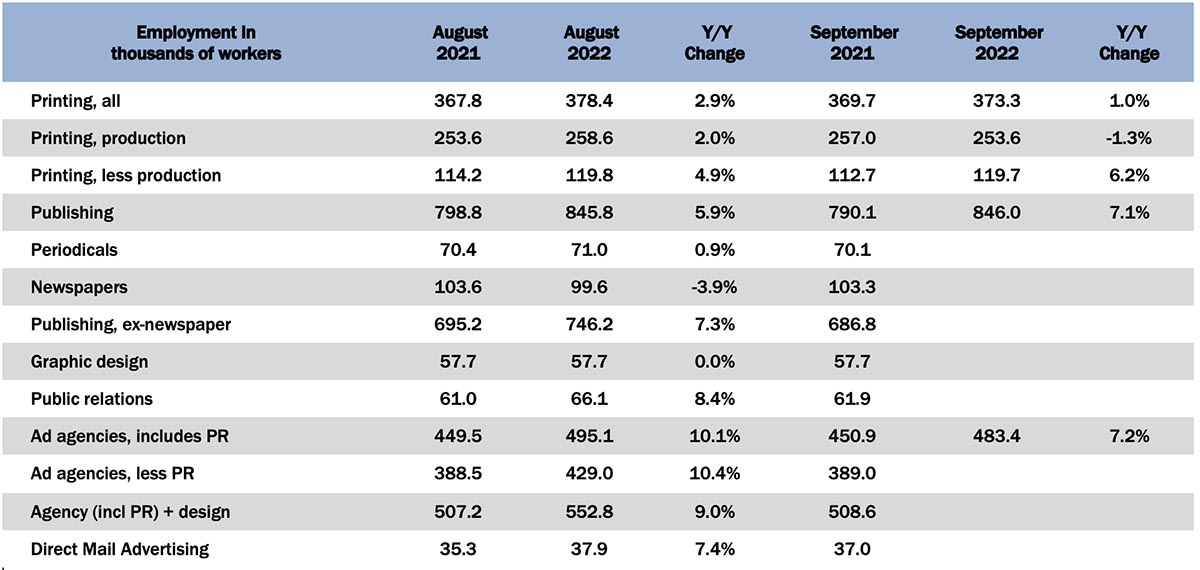

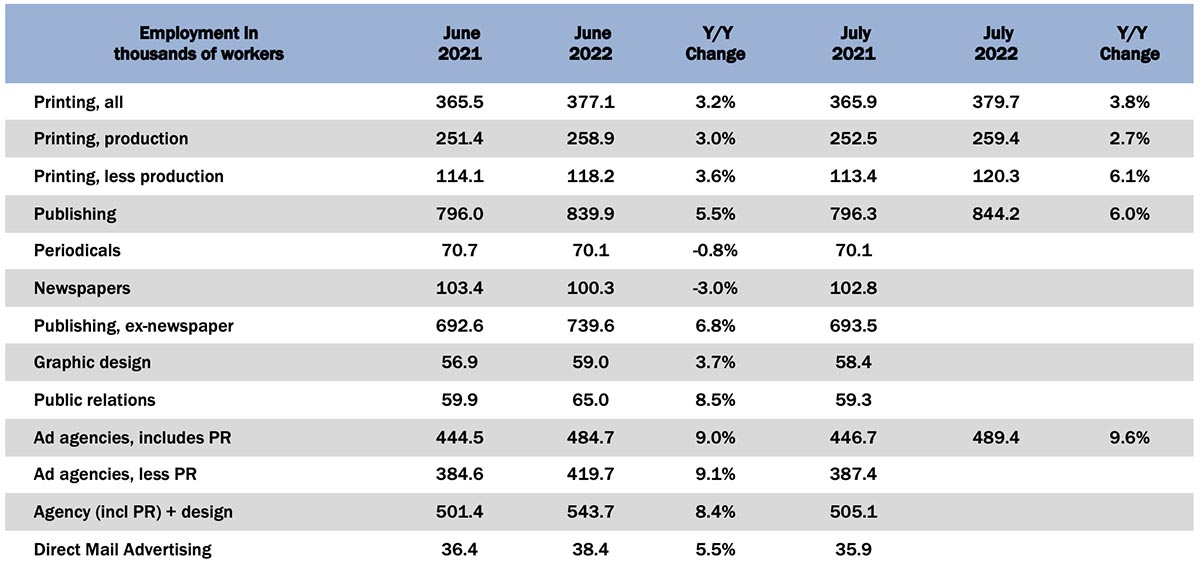

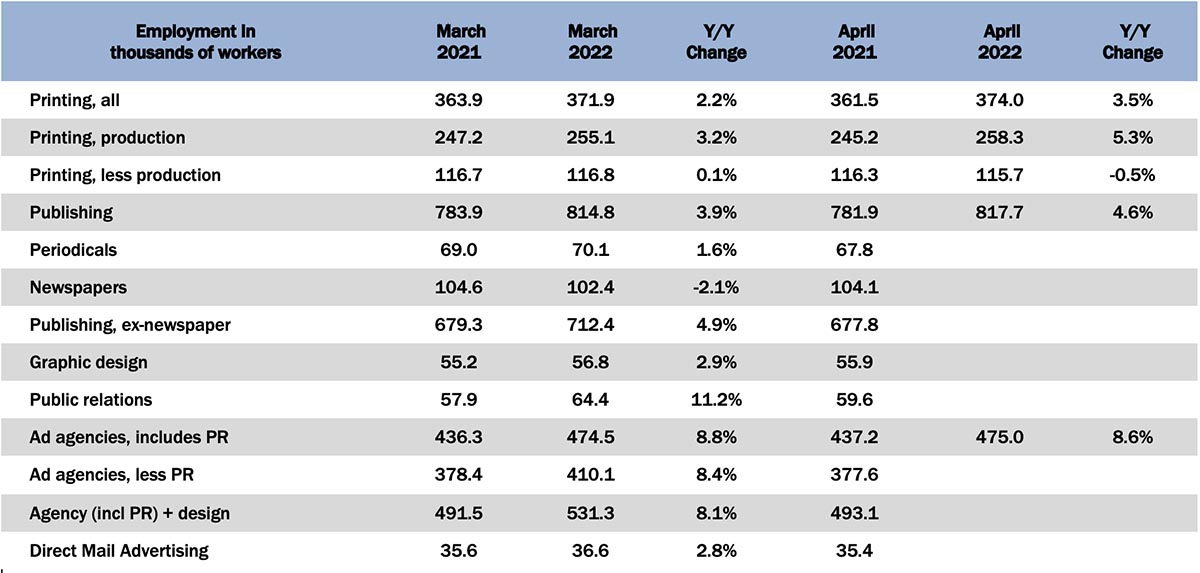

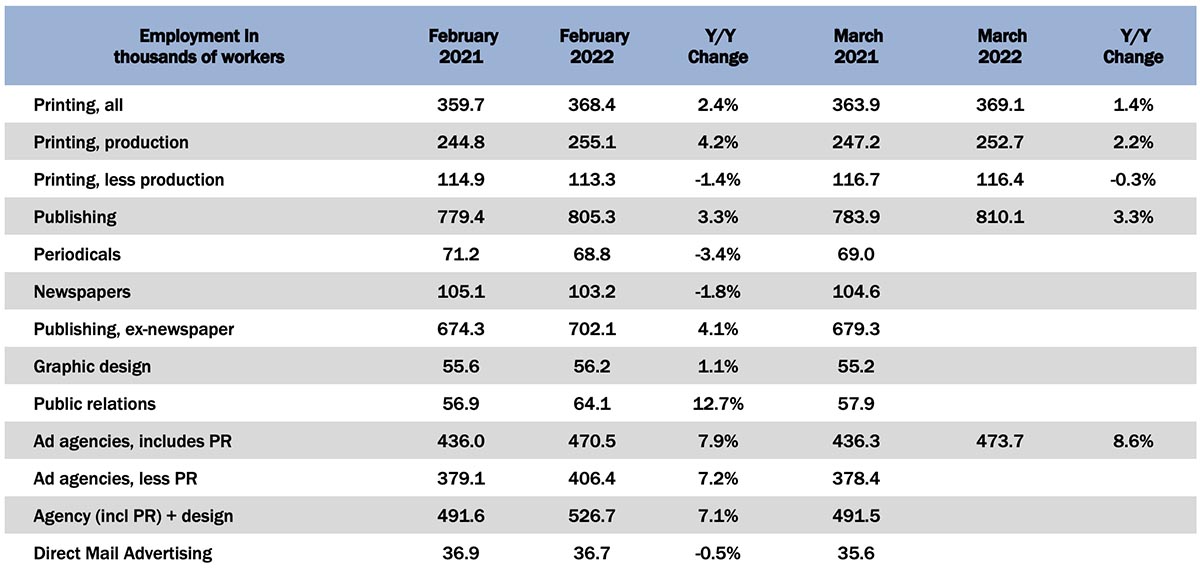

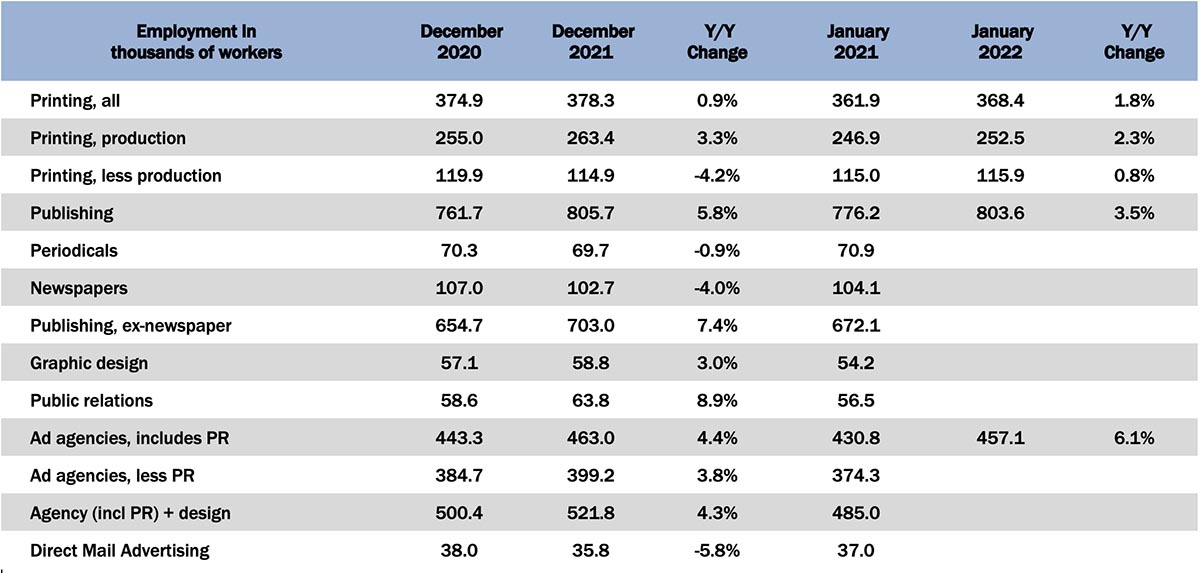

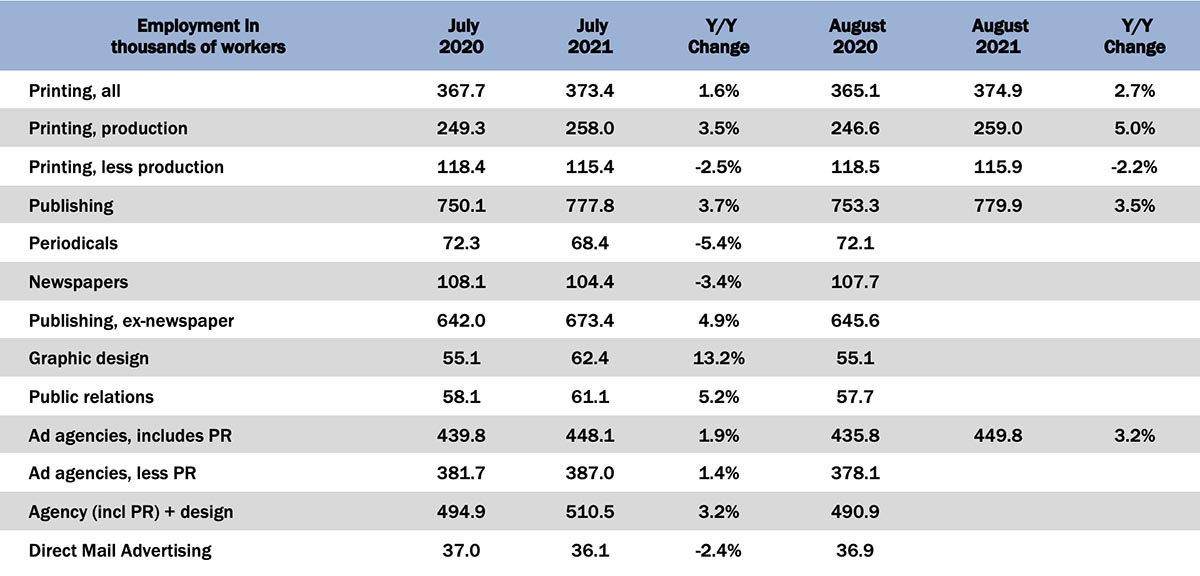

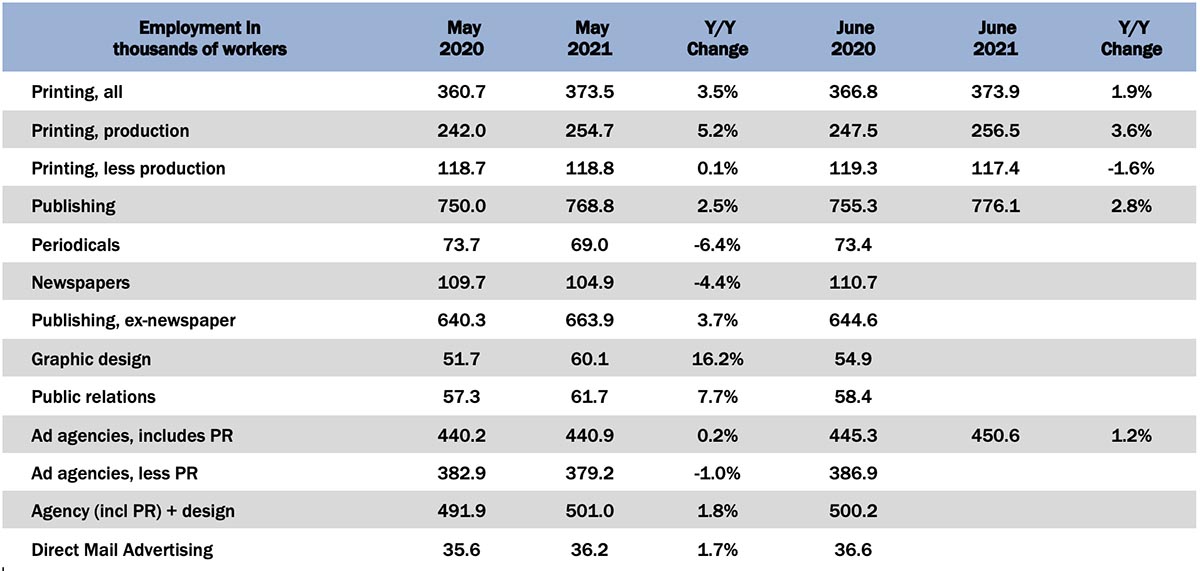

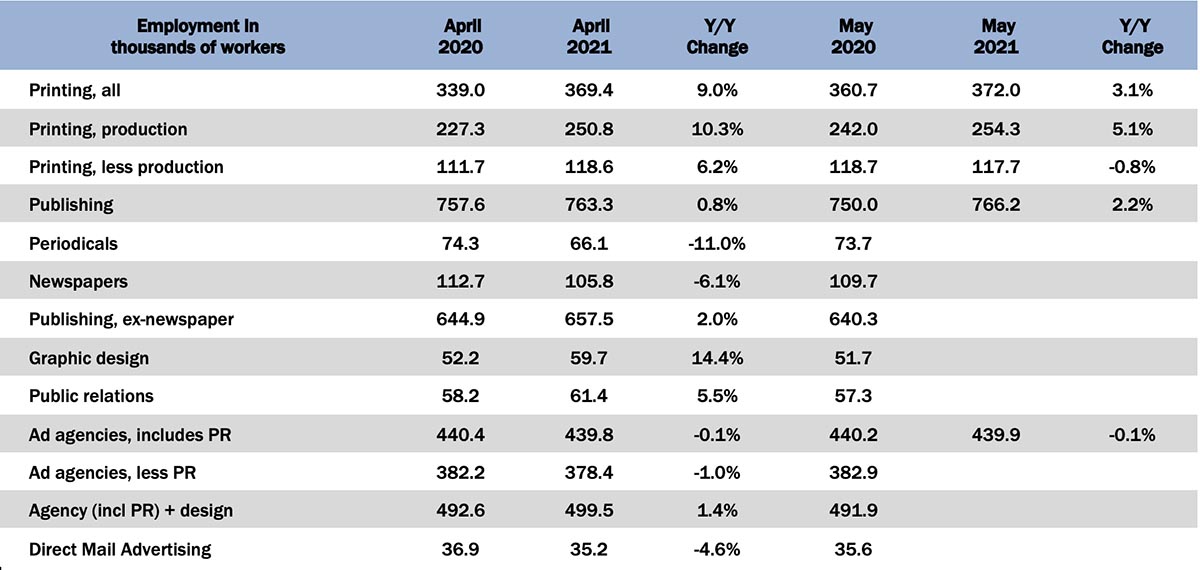

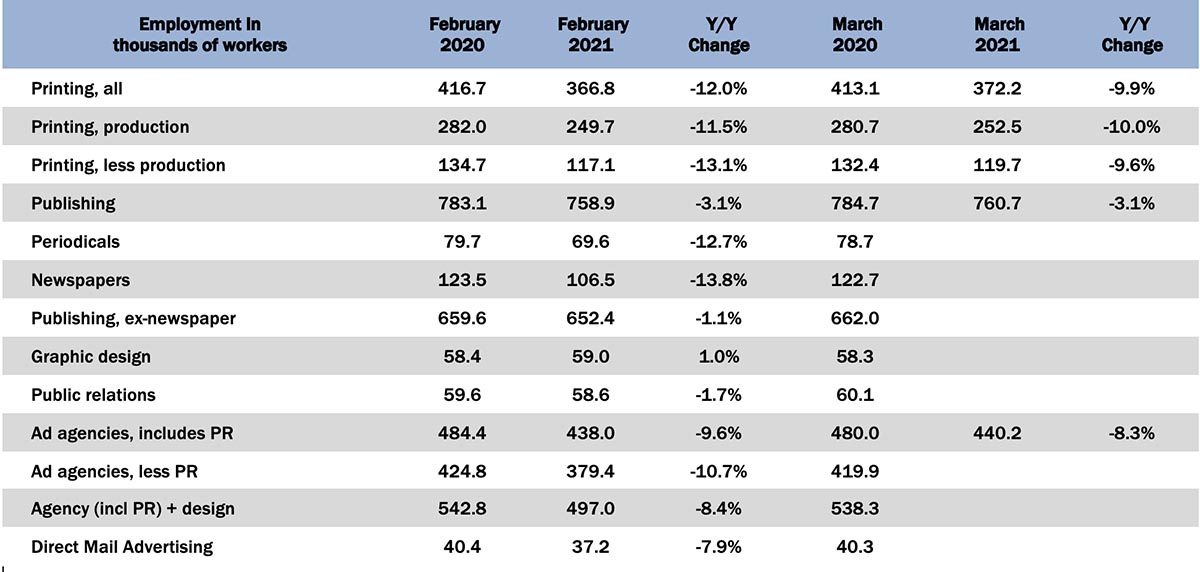

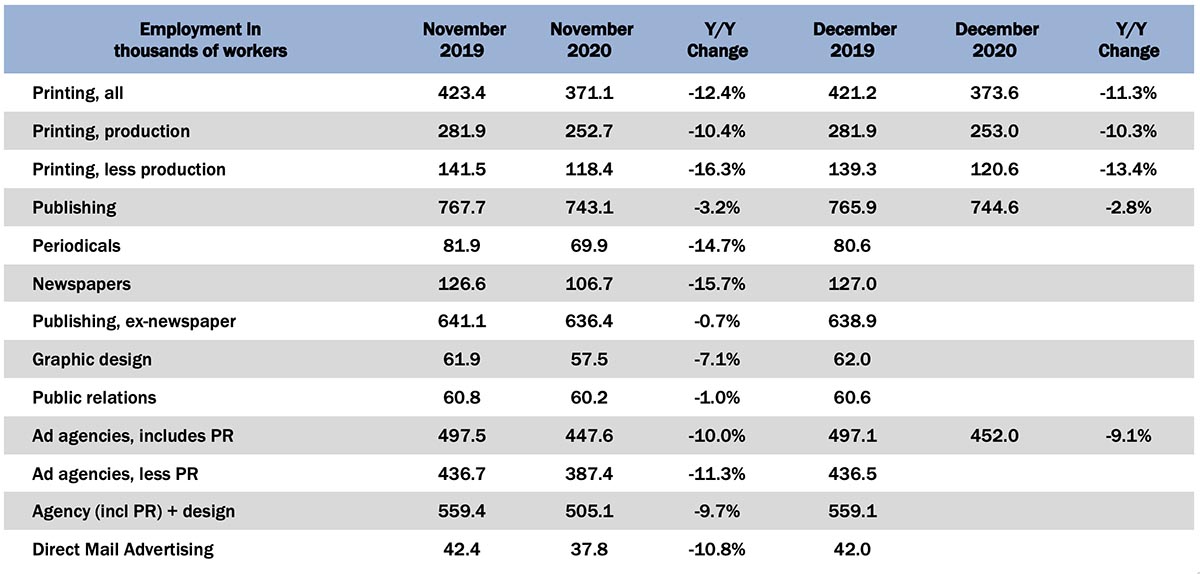

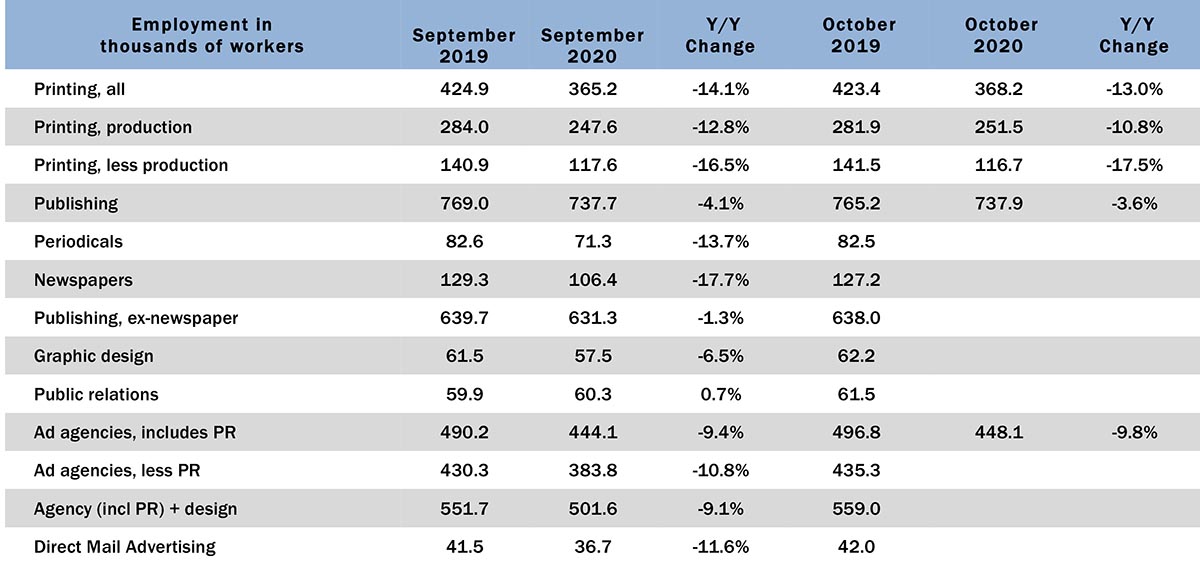

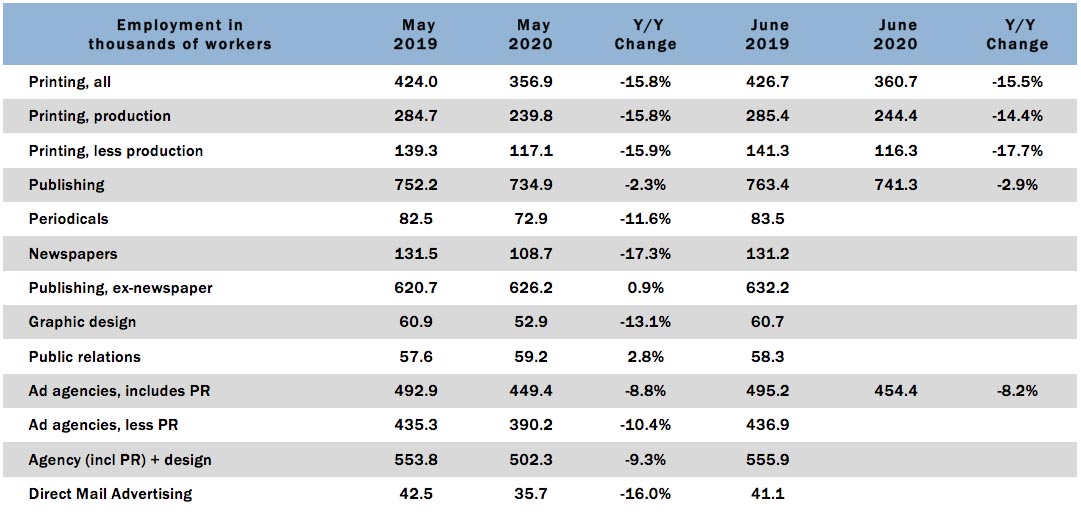

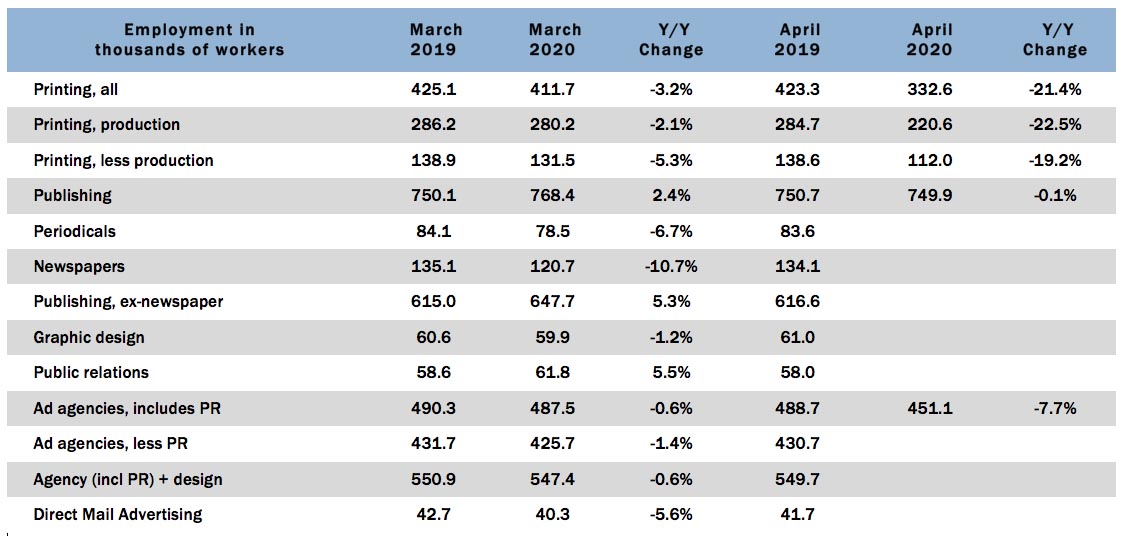

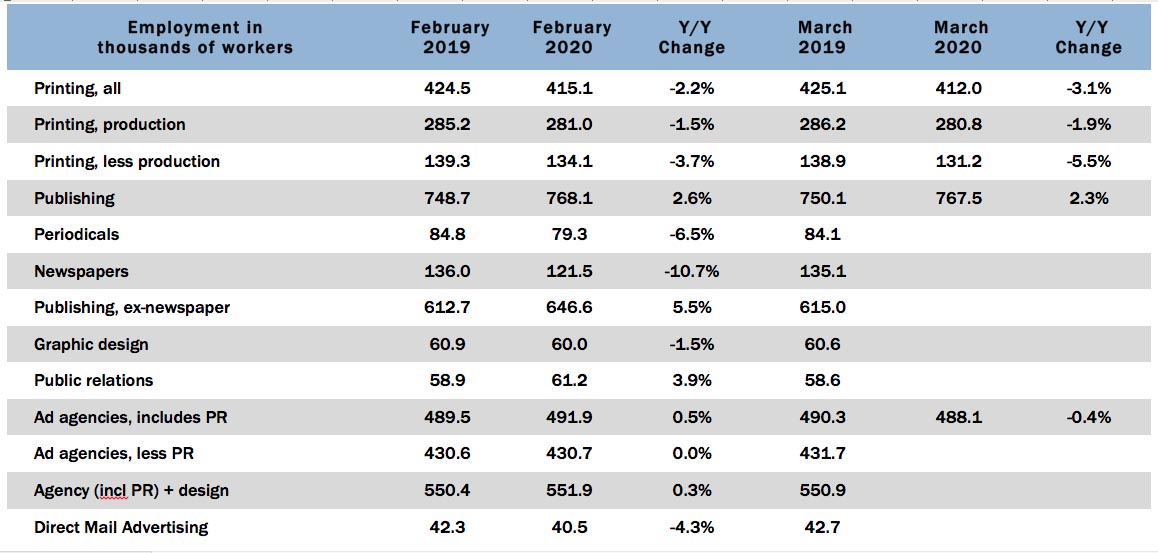

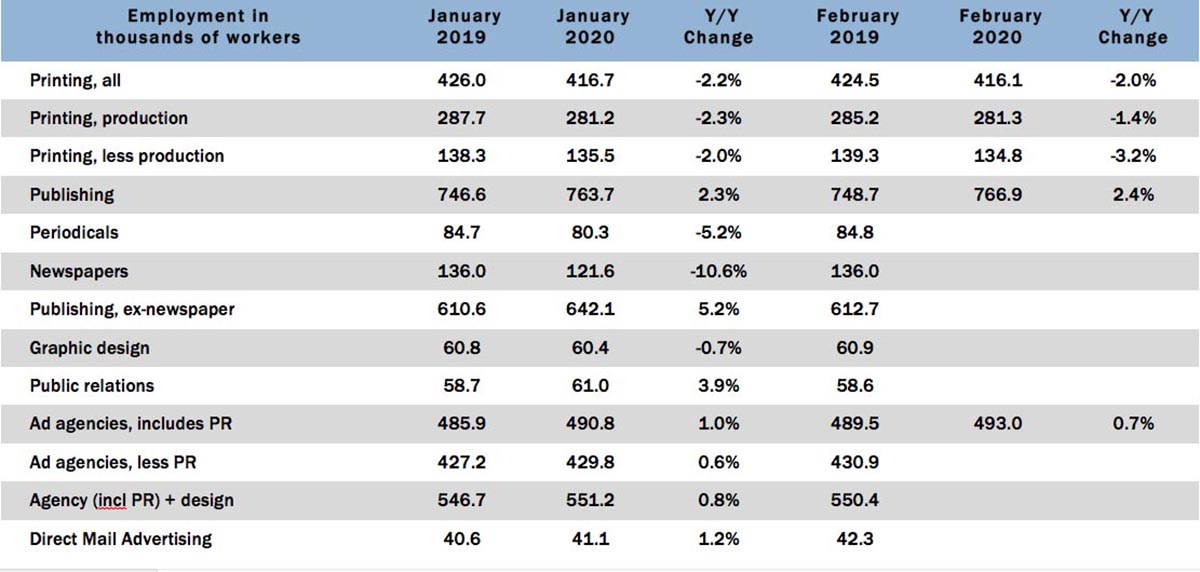

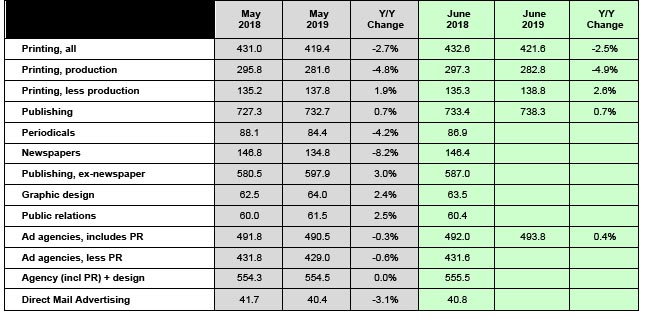

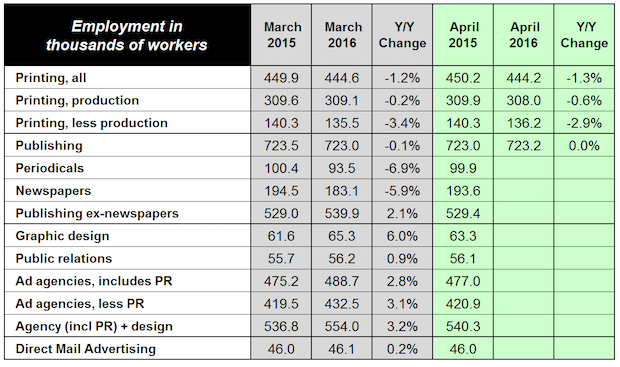

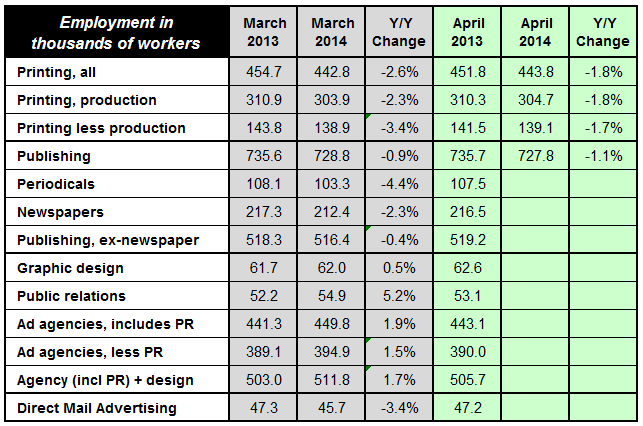

April Graphic Arts Employment A Mixed Bag

Published: May 31, 2024

Overall printing employment in April 2024 was generally up—+0.5% from March—with production employment up +1.3% and non-production employment down +1.4%. Full Analysis

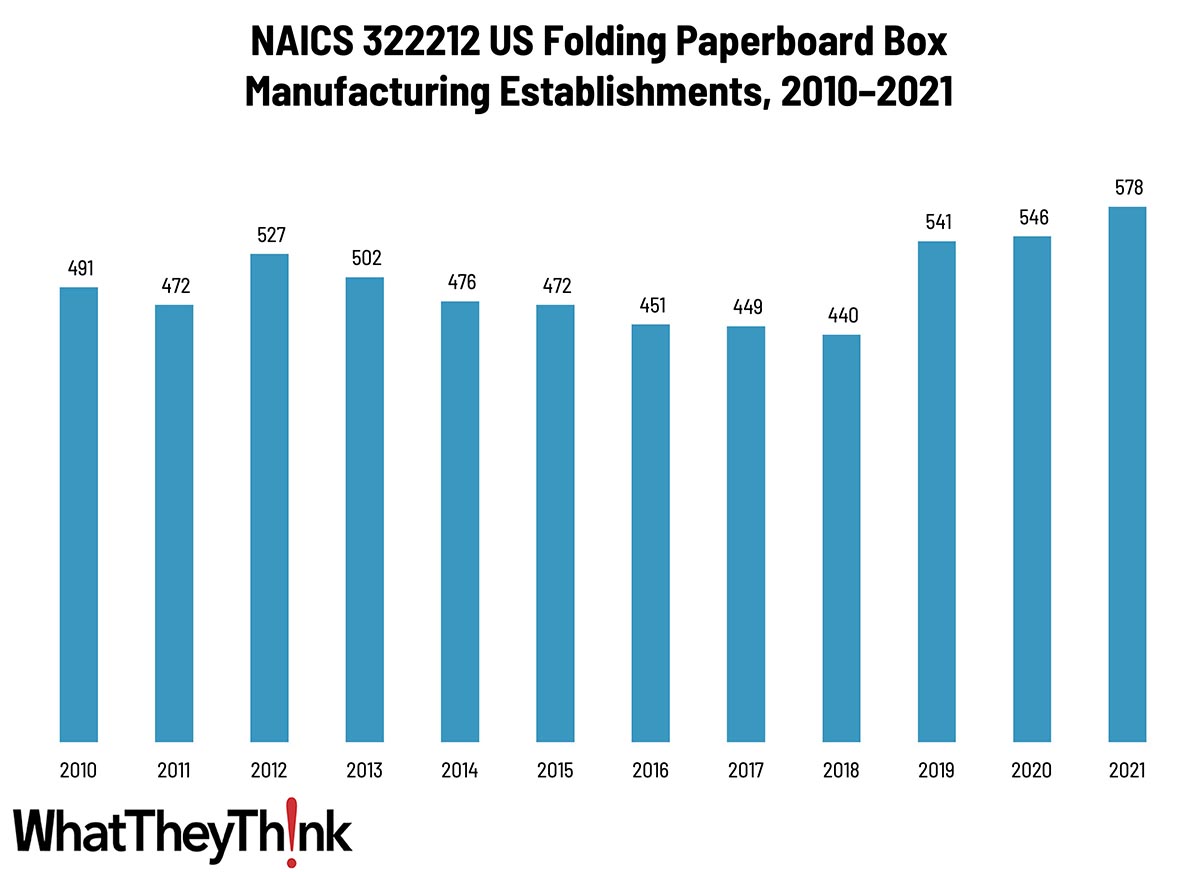

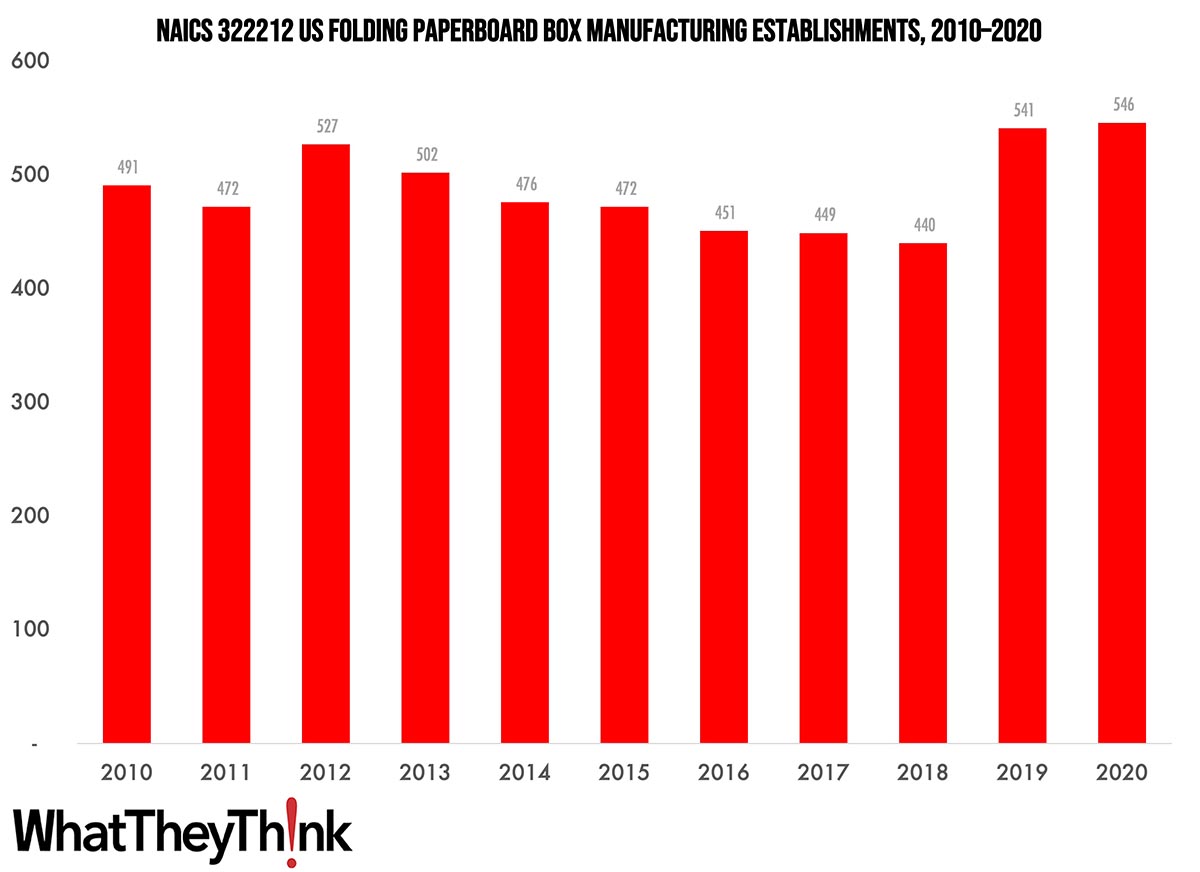

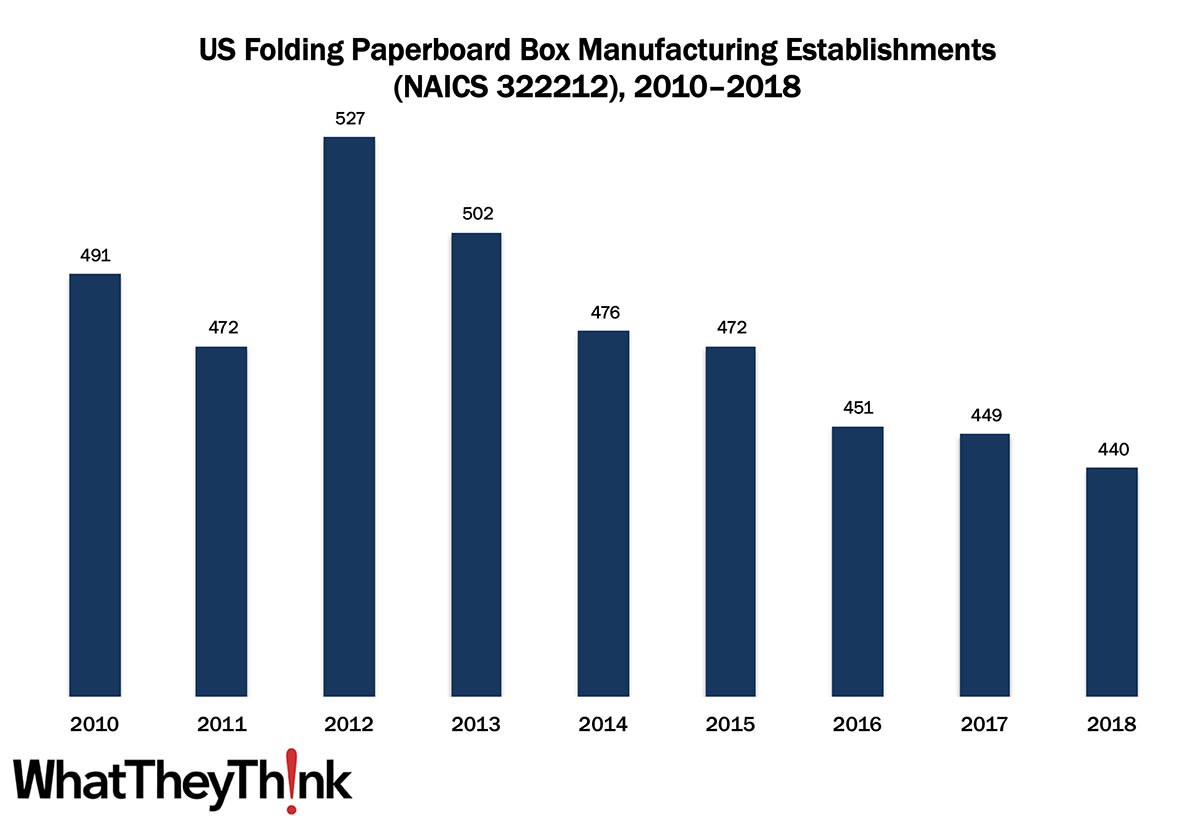

Folding Paperboard Box Manufacturing—2010–2021

Published: May 24, 2024

According to County Business Patterns, in 2021 there were 578 establishments in NAICS 322212 (Folding Paperboard Box Manufacturing). This category saw a net decrease of 18% since 2010. In macro news,inflation in April eased a bit. Full Analysis

March Shipments: We Got Good News and Bad News

Published: May 17, 2024

March 2024 shipments came in at $7.24 billion, up from February’s $7.04 billion—and yet the worst March the industry has had. Full Analysis

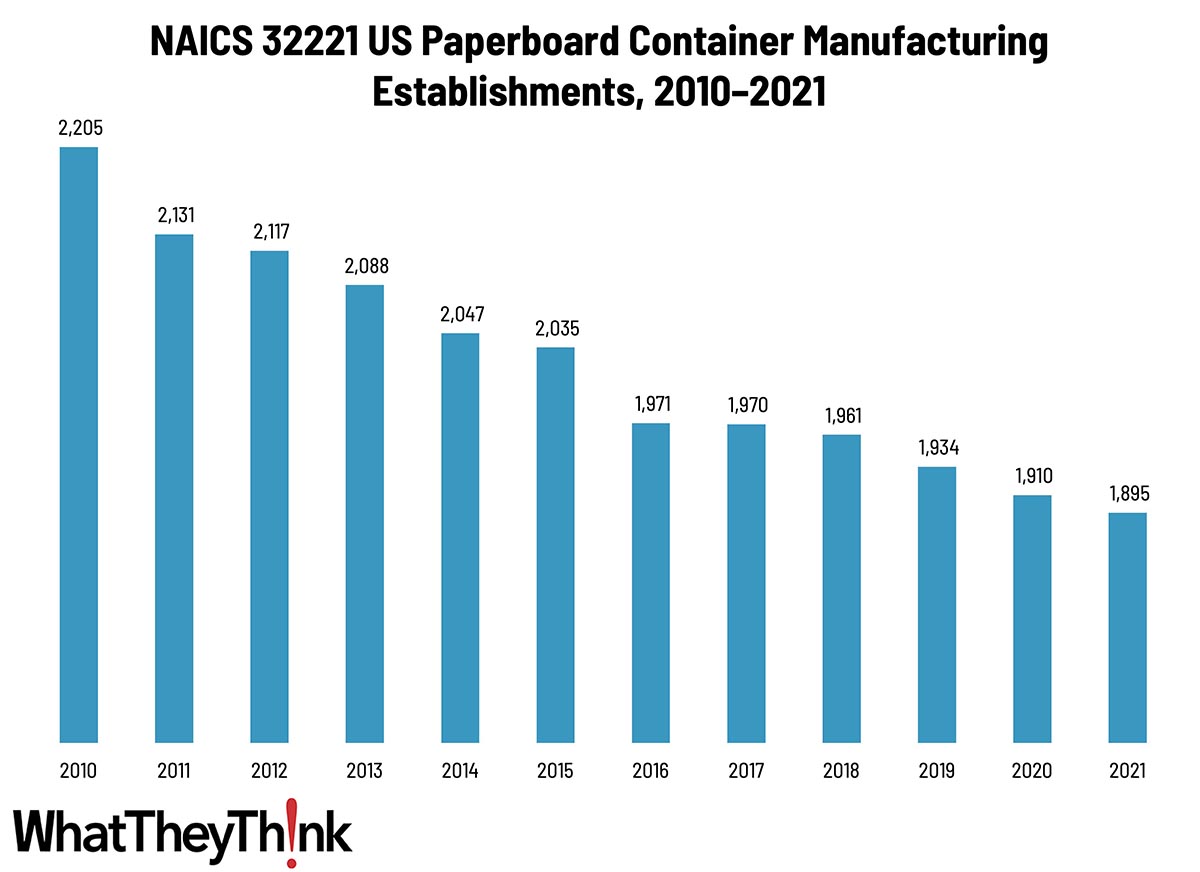

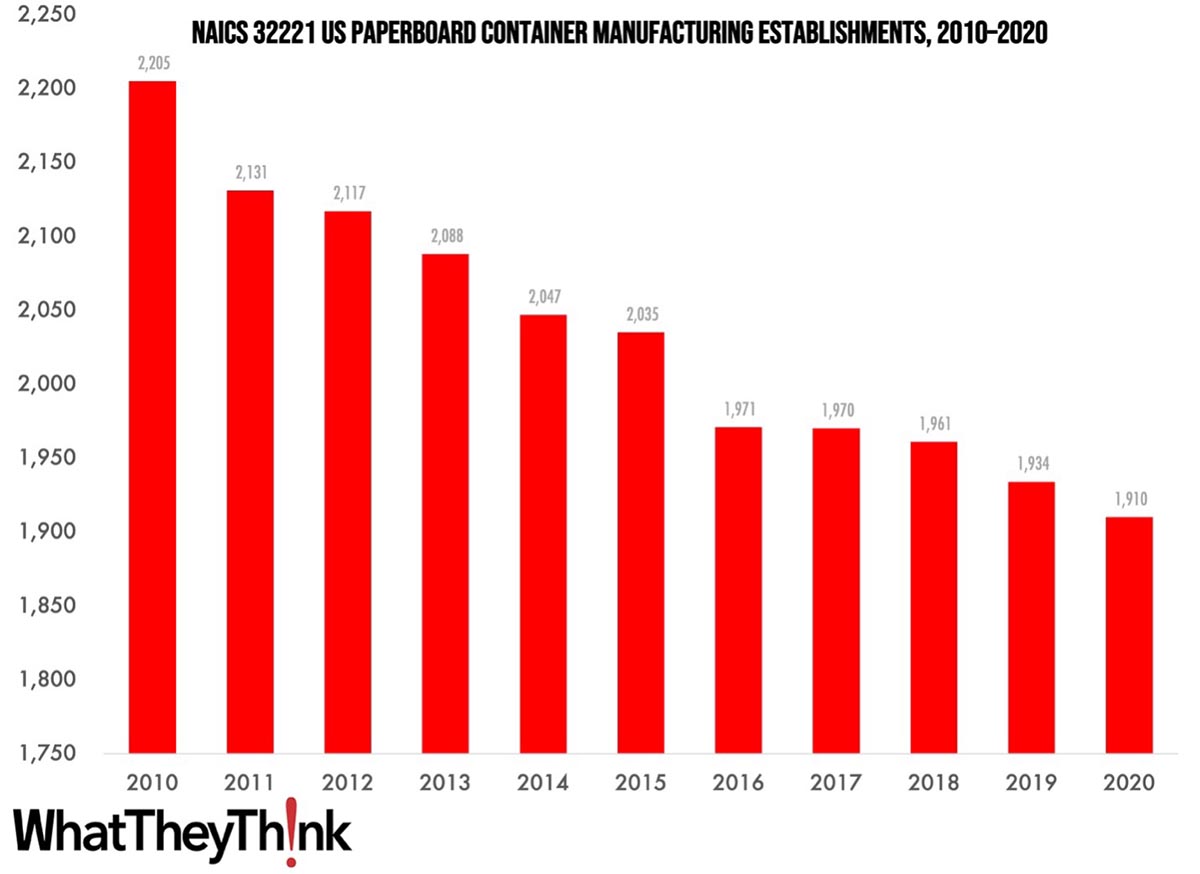

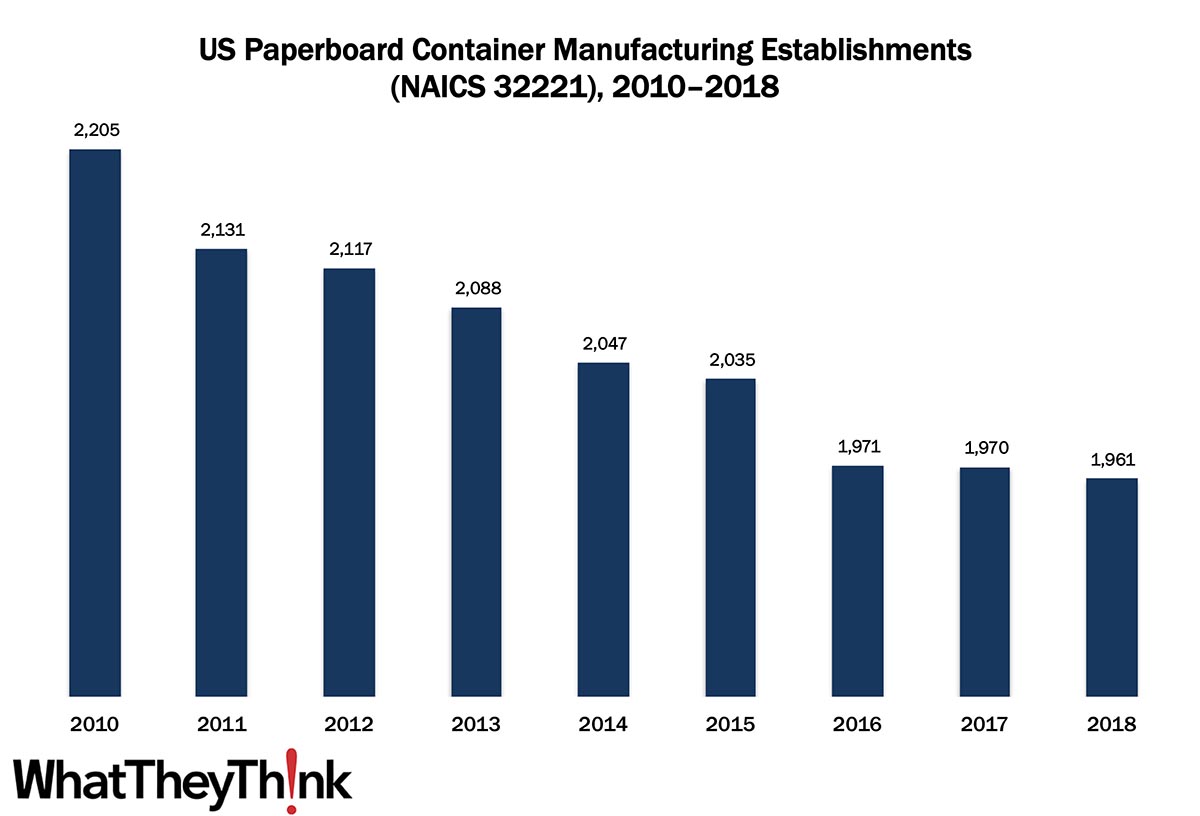

Paperboard Container Manufacturing Establishments—2010–2021

Published: May 10, 2024

According to County Business Patterns, in 2021 there were 1,895 establishments in NAICS 32221 (Paperboard Container Manufacturing). This category saw a net decrease of 15% since 2010. In macro news, early Q2 GDP predictions are bullish. Full Analysis

March Graphic Arts Employment A Mixed Bag

Published: May 3, 2024

Overall printing employment in March 2024 was generally up—+0.4% from February—with production employment down -0.2% and non-production employment up +1.5%. Full Analysis

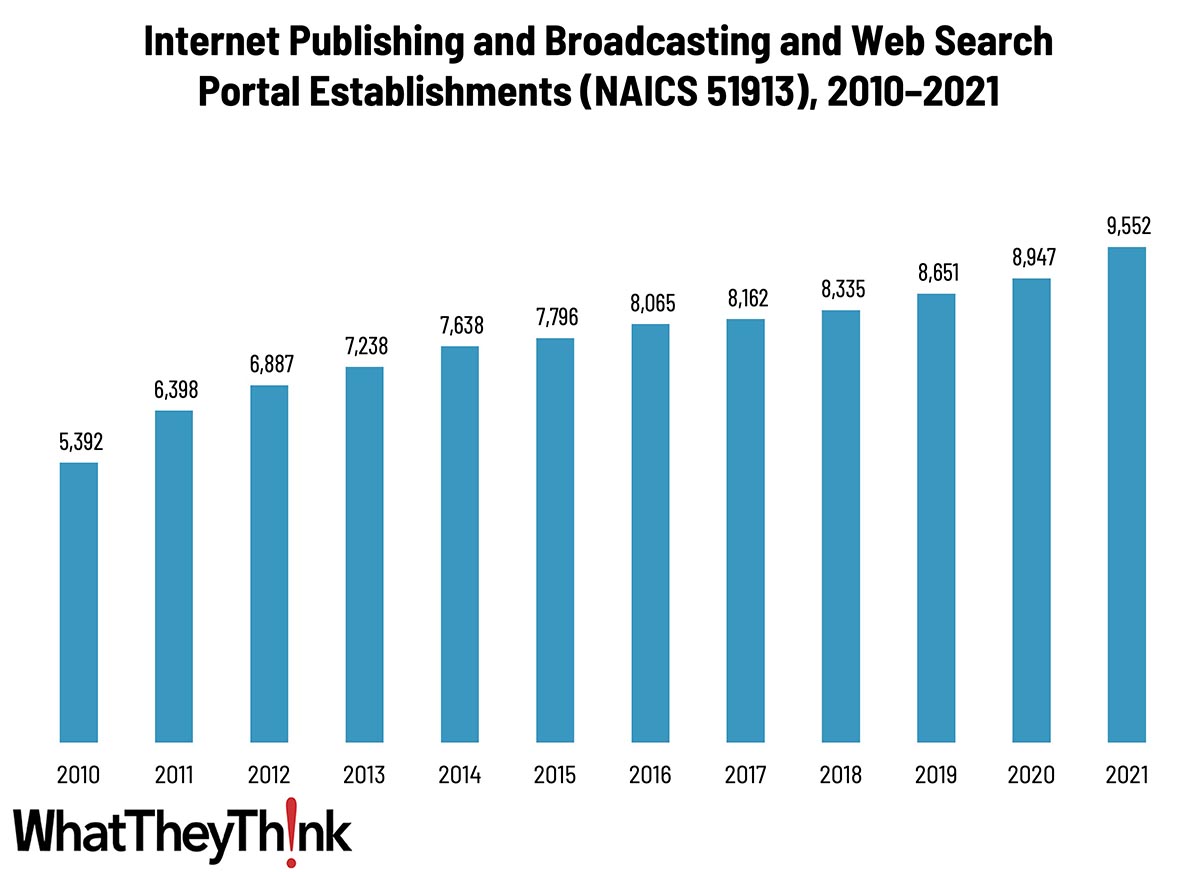

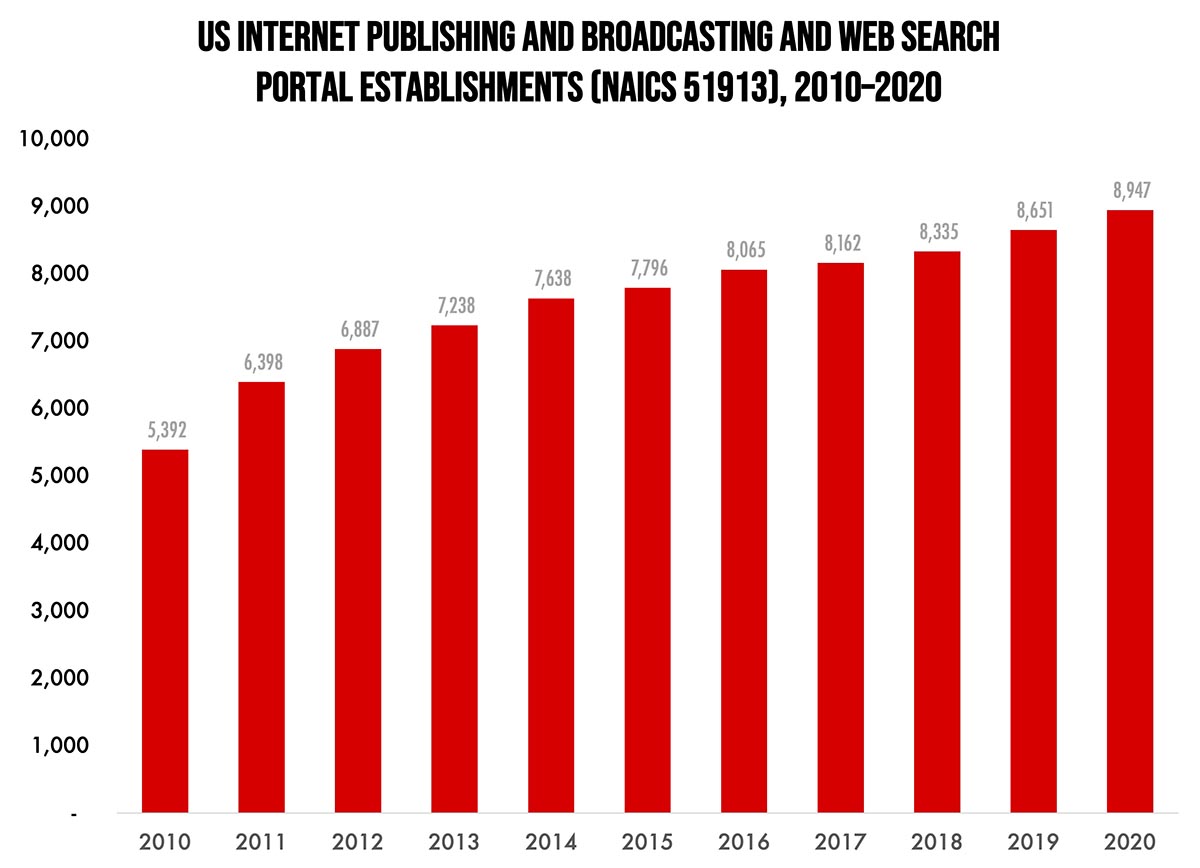

Internet Publishing and Broadcasting and Web Search Portal Establishments—2010–2021

Published: April 26, 2024

According to County Business Patterns, in 2020 there were 8,947 establishments in NAICS 51913 (Internet Publishing and Broadcasting and Web Search Portals). This category saw a net increase of 66% since 2010. In macro news, Q1 GDP is much lower than expected. Full Analysis

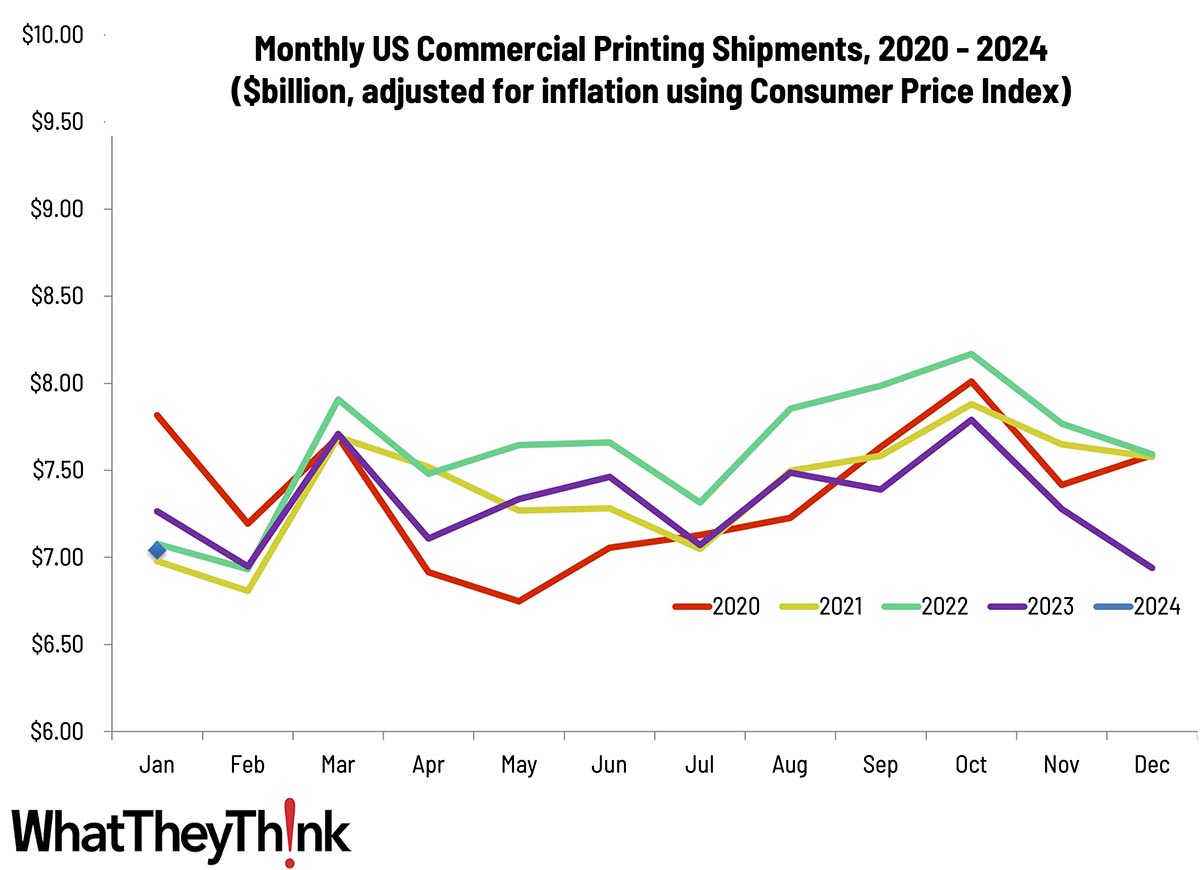

February Shipments: Well, At Least It’s Seasonal

Published: April 19, 2024

February 2024 shipments came in at $6.01 billion, down from January’s $7.04 billion—and right between February 2021 and 2022. Full Analysis

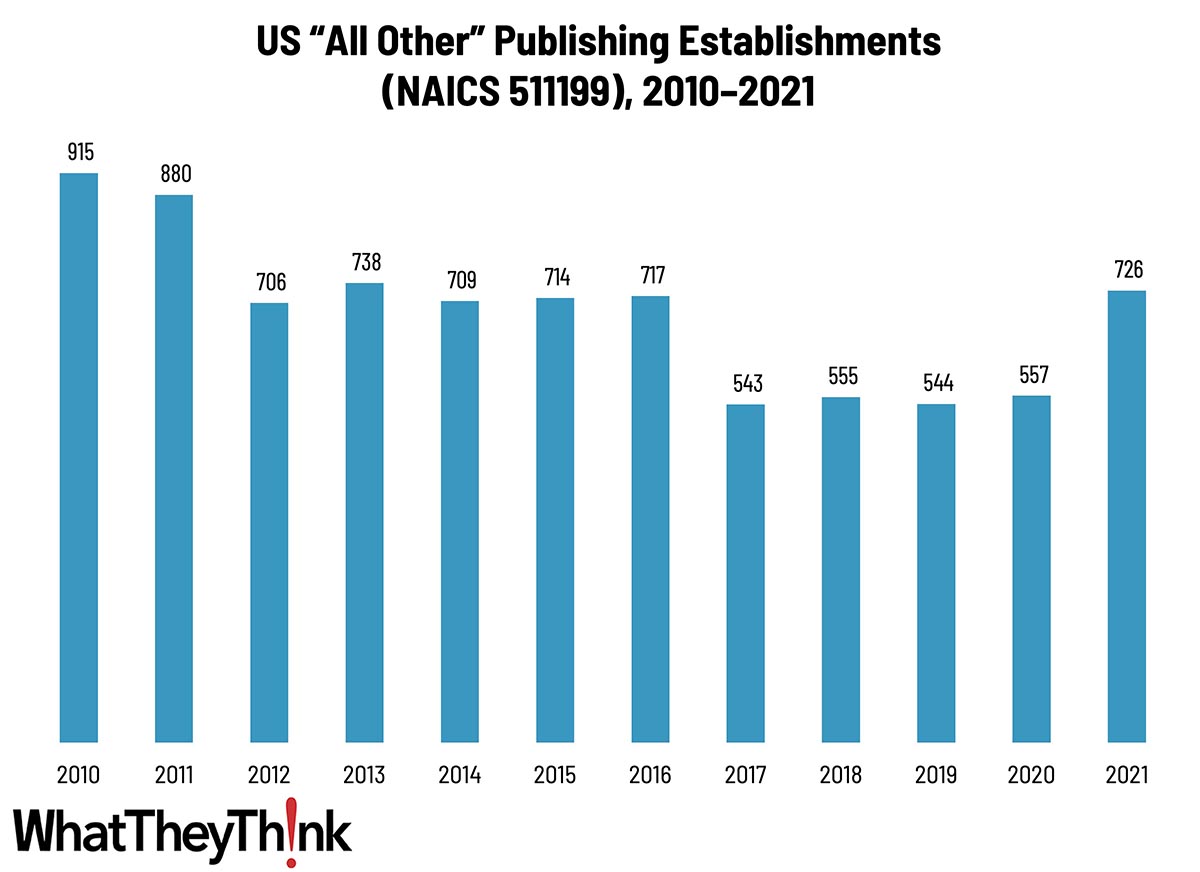

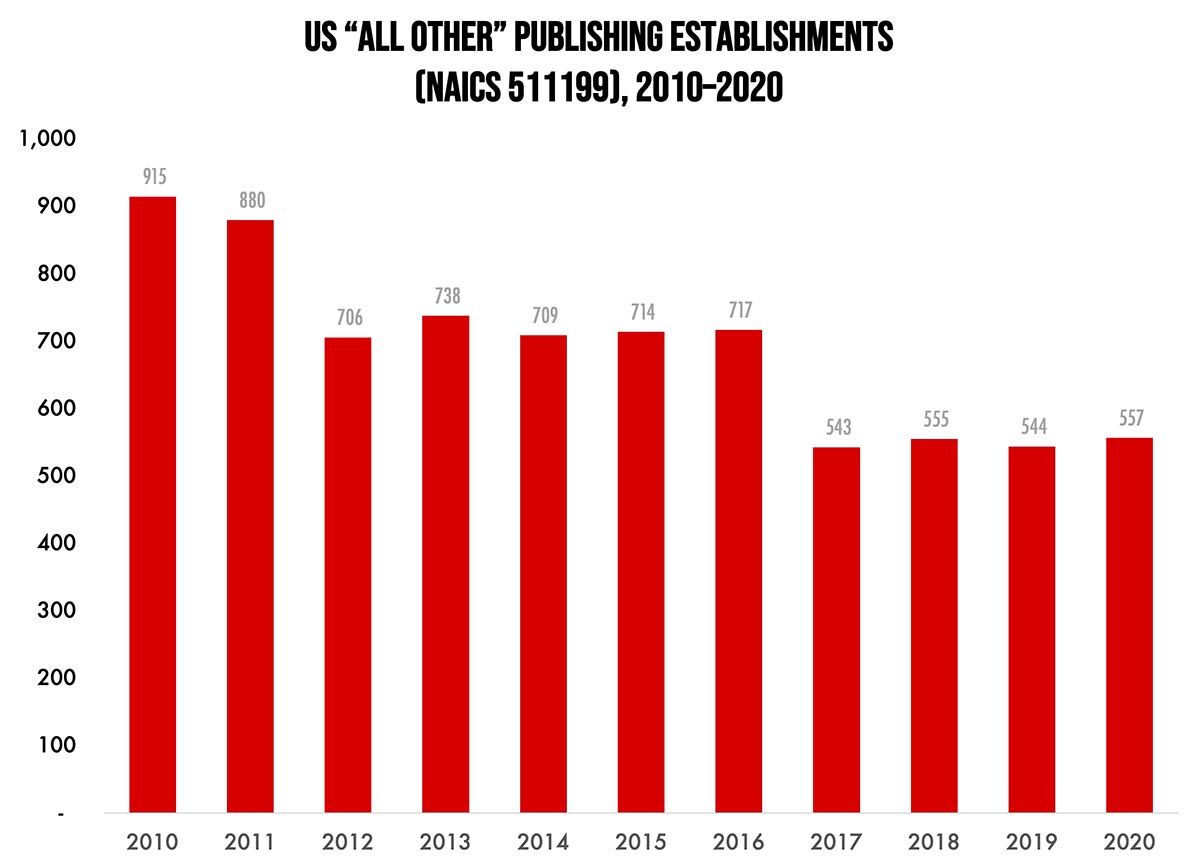

Assorted Publishing Establishments—2010–2021

Published: April 12, 2024

According to County Business Patterns, in 2021 there were 726 establishments in NAICS 511199 (All Other Publishing). This category saw a net decrease of 39% since 2010, although establishments spiked from 2020 to 2021. In macro news, estimates of Q1 GDP are running around +2%. Full Analysis

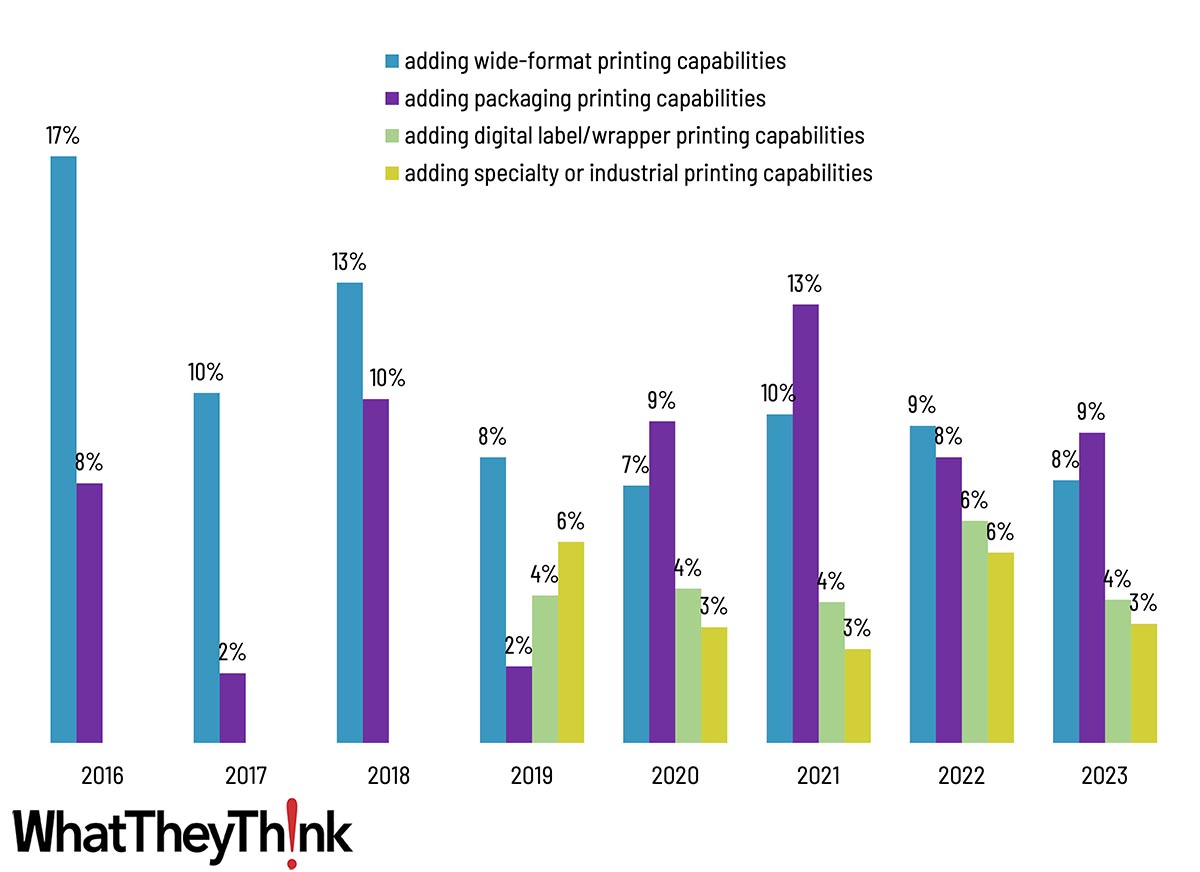

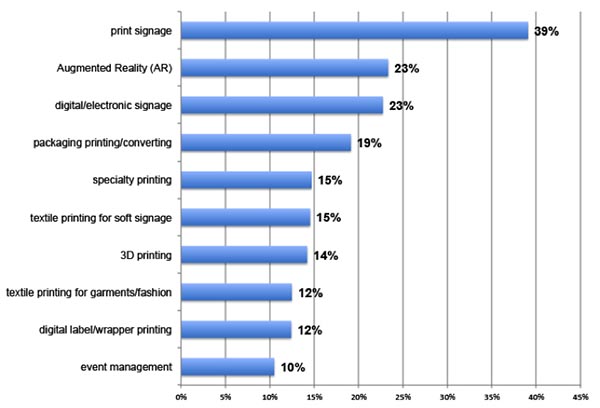

Tales from the Database: These Are Not the Applications You’re Looking For

Published: April 5, 2024

Drawing on six years’ worth of Print Business Outlook surveys, our “Tales from the Database” series looks at historical data to see if we can spot any particular hardware, software, or business trends. This issue, we turn our attention to specialty printing—or any printing beyond traditional offset or digital commercial work. Full Analysis

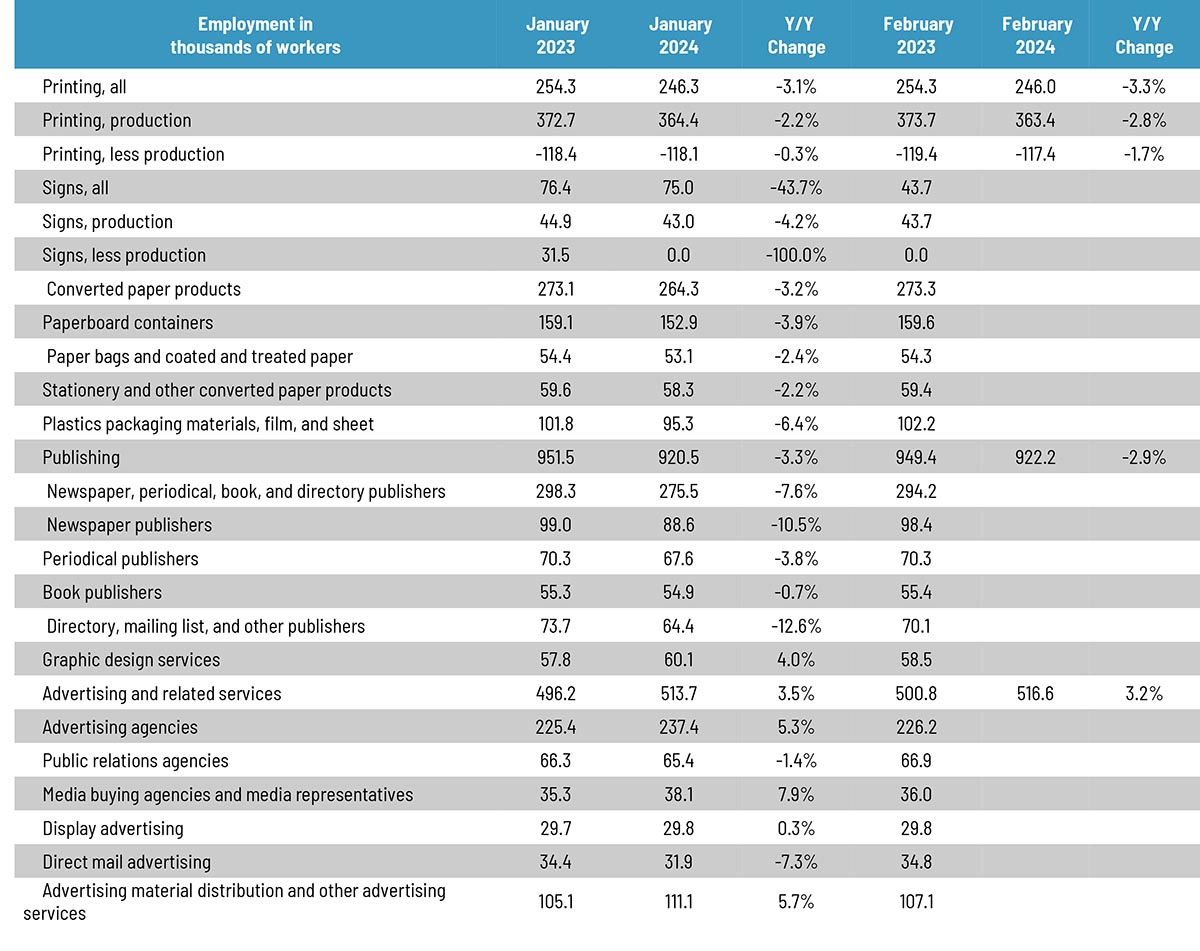

February Graphic Arts Employment Remains Generally Flat

Published: March 29, 2024

Overall printing employment in February 2024 was little changed from January, with production employment down -1.0%, while non-production employment was down -0.6%, with net employment down -0.1%. Full Analysis

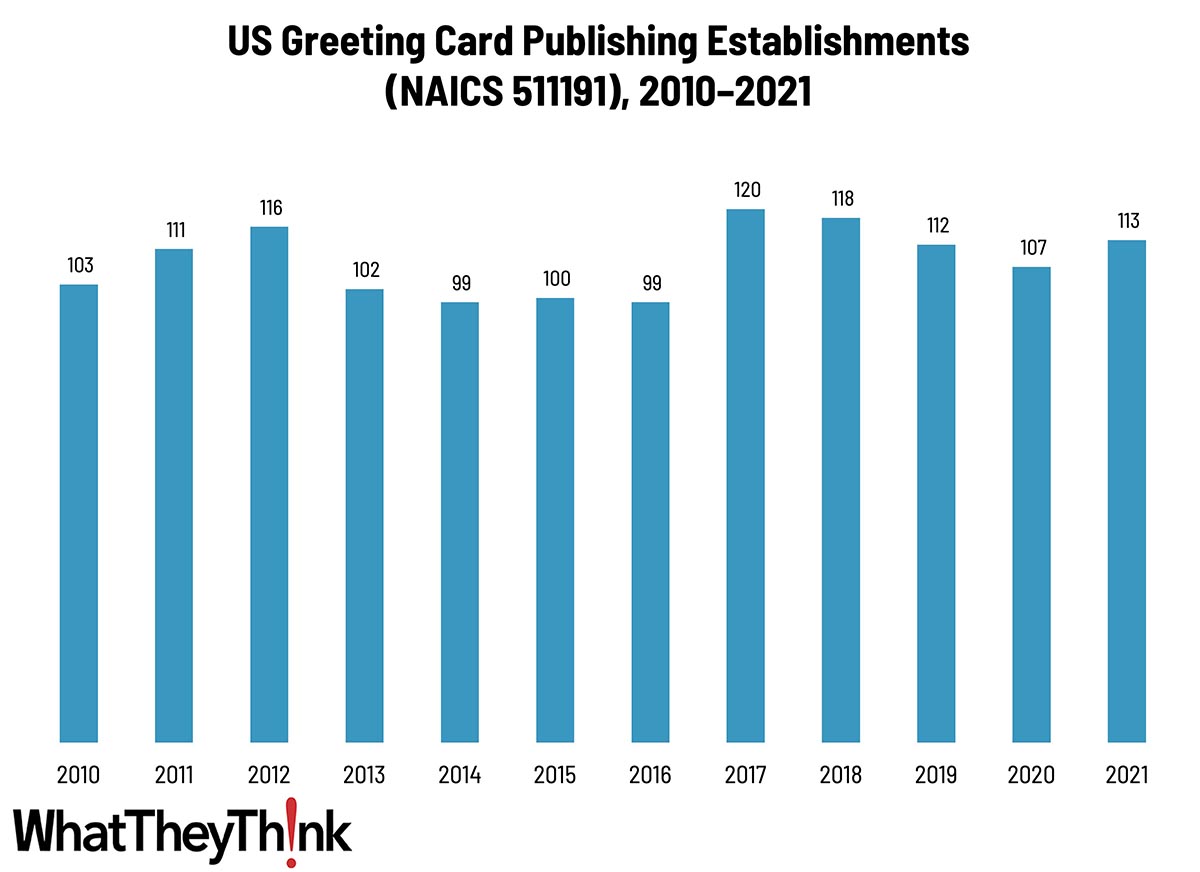

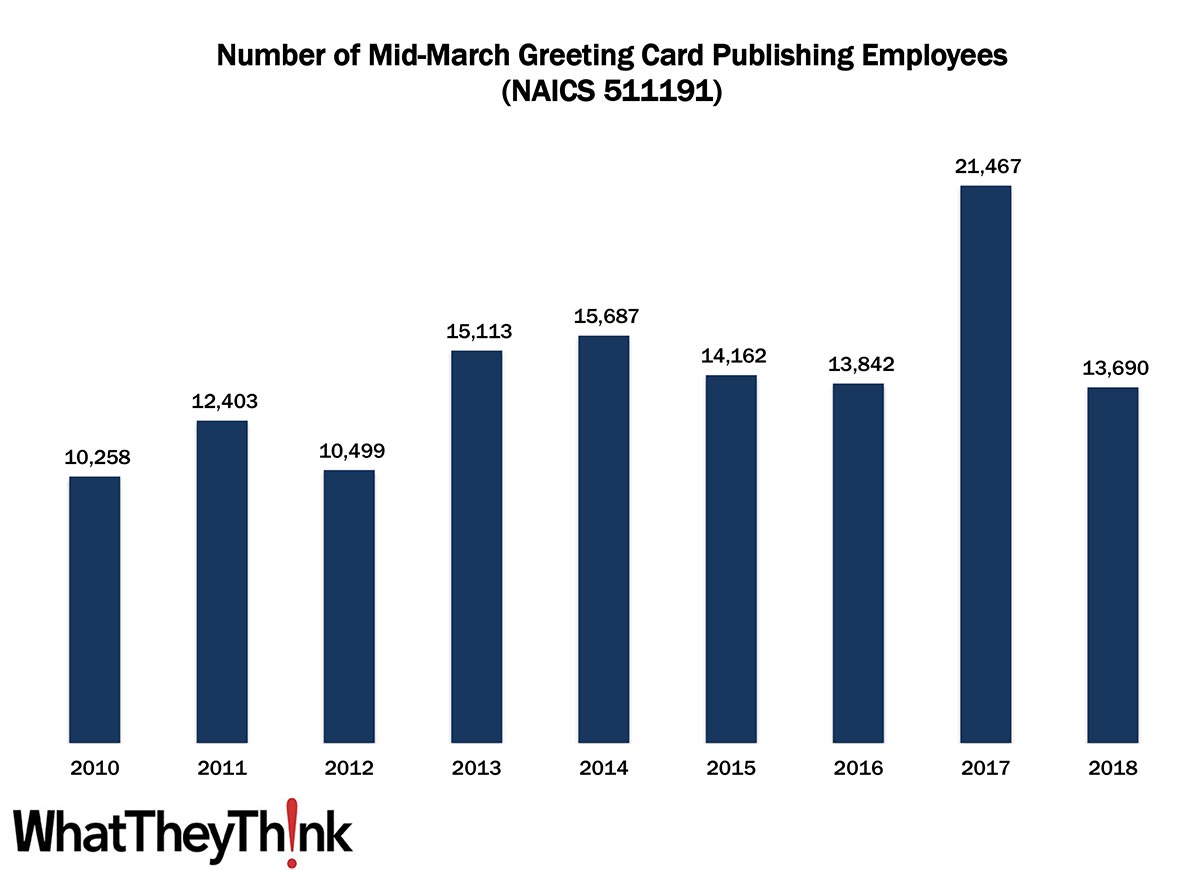

Greeting Card Publishing Establishments—2010–2021

Published: March 22, 2024

According to the latest edition of County Business Patterns, in 2021 there were 113 establishments in NAICS 511191 (Greeting Card Publishers). Although this represents a net increase of 10% since 2010, it has been a category that has ebbed and flowed over the course of the decade, although we’re not talking about a tremendous number of establishments. In macro news, inflation increased in February. Full Analysis

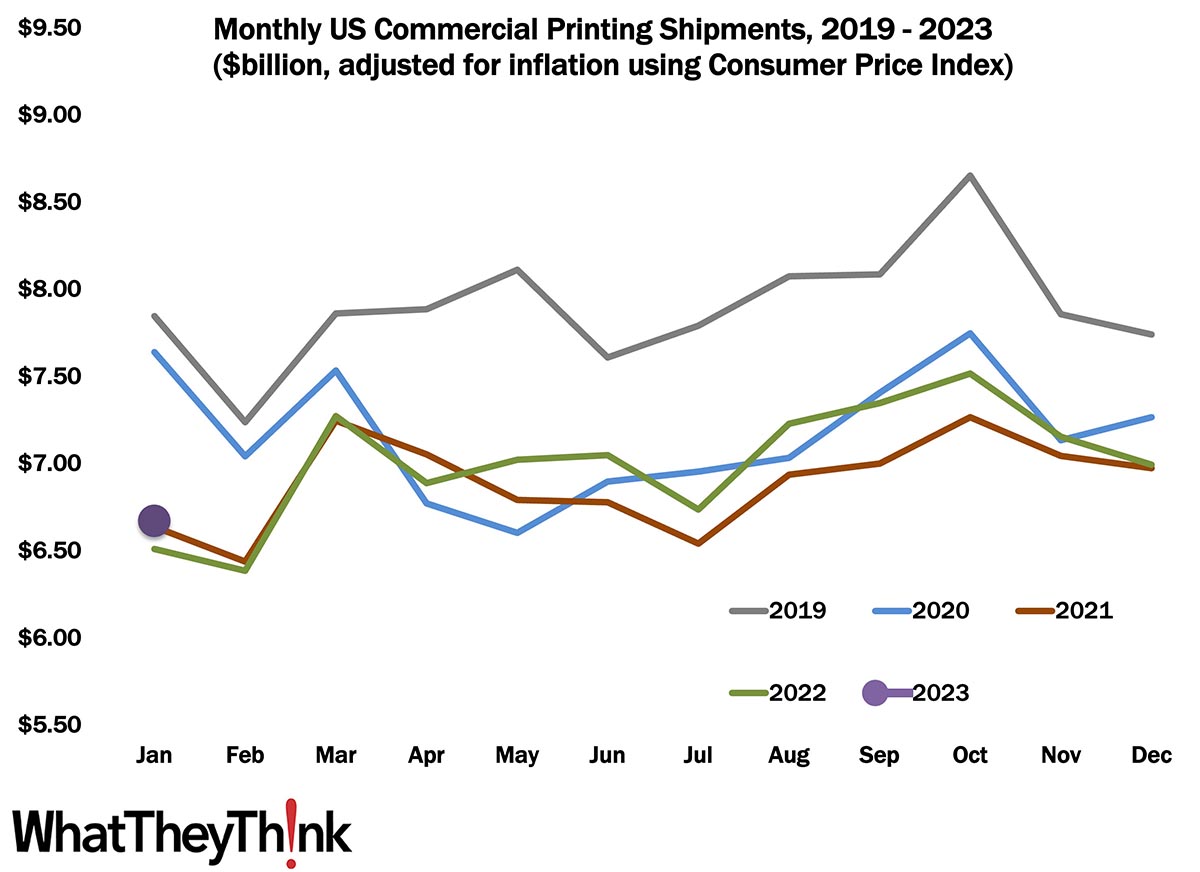

January Shipments: Back to Normal?

Published: March 15, 2024

January 2024 shipments came in at $7.04 billion, up from December’s $6.94 billion—and right between January 2021 and 2022. Full Analysis

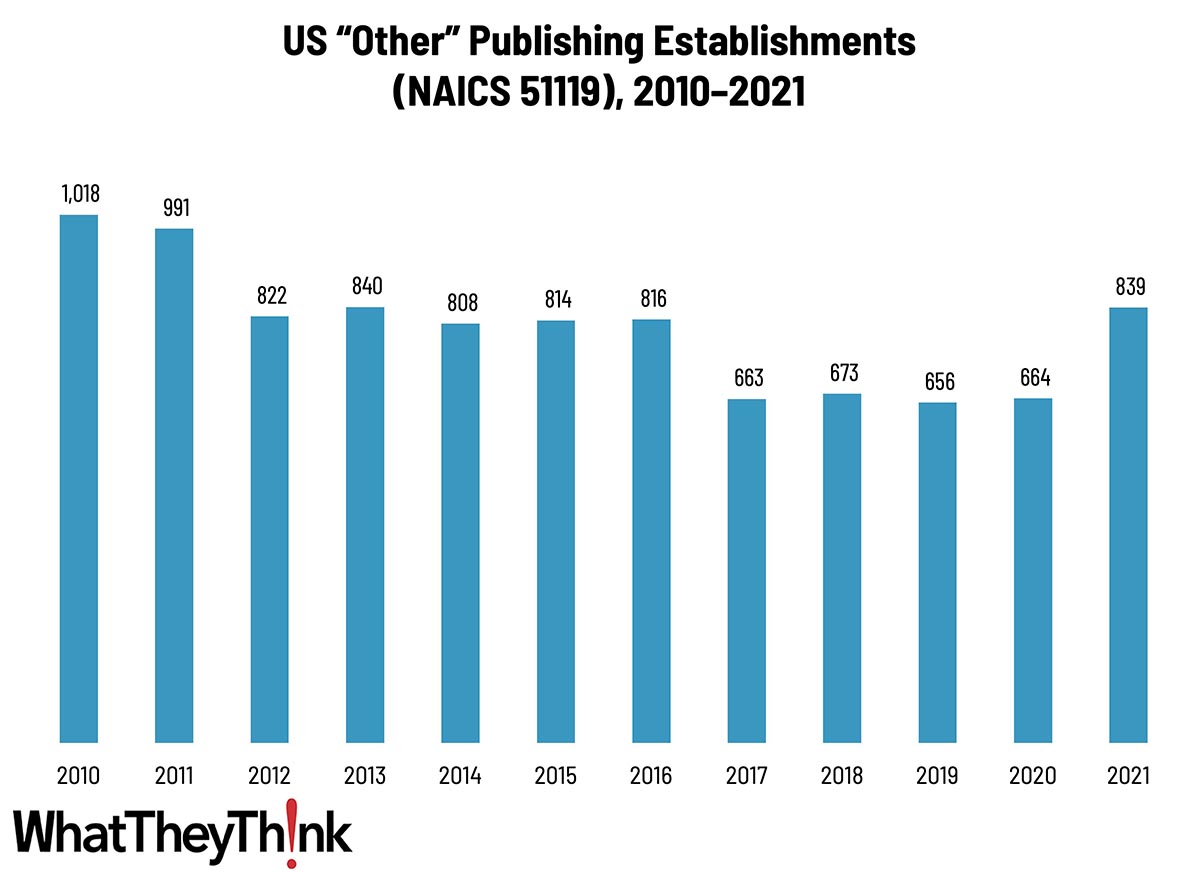

“Other” Publishing Establishments—2010–2021

Published: March 8, 2024

According to the latest edition of County Business Patterns, in 2021 there were 839 establishments in NAICS 51119 (Other Publishers). This represents a net decrease of 18% since 2010, but a 26% increase in the past year. In macro news, Q4 GDP was revised down slightly. Full Analysis

December Shipments: Ending the Year on a Low Note

Published: March 1, 2024

December 2023 shipments came in at $6.98 billion, down from November’s $7.24 billion—and, alas, the lowest of the year. Full Analysis

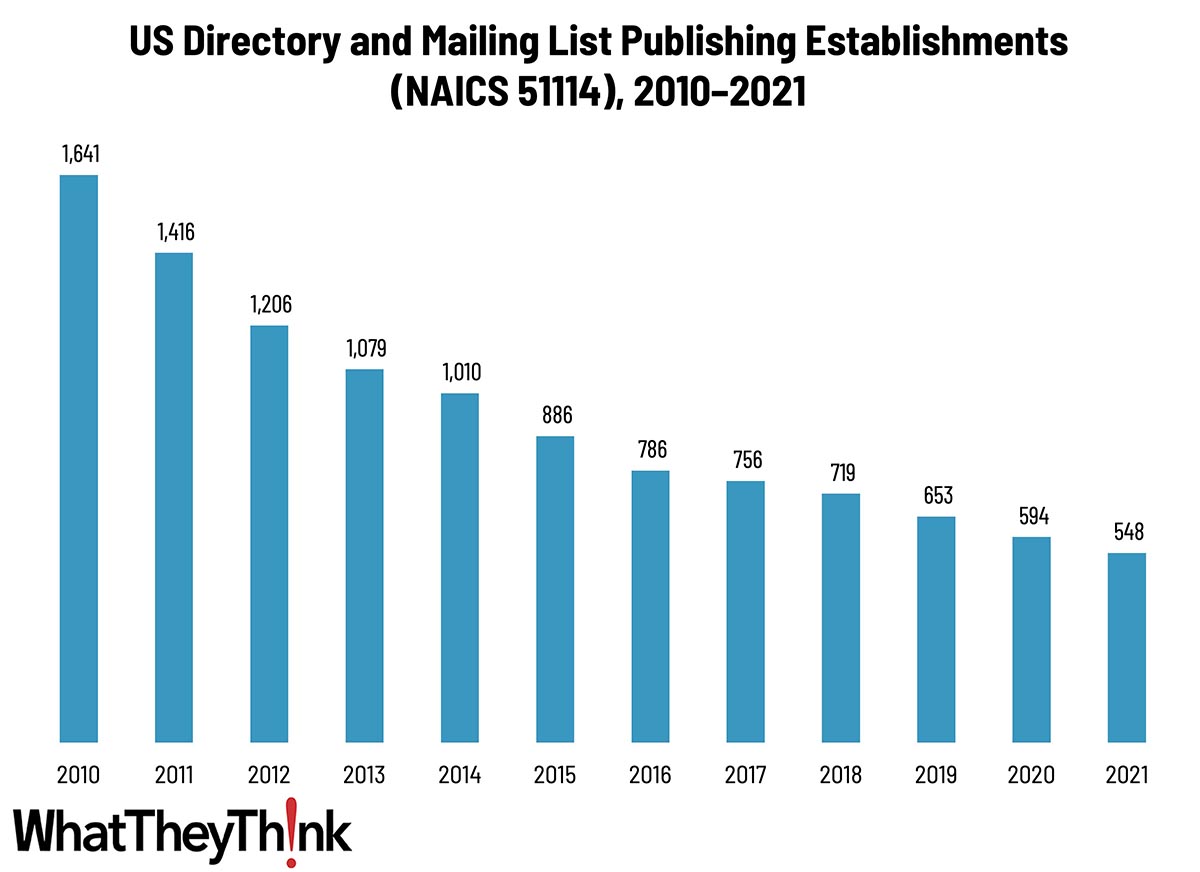

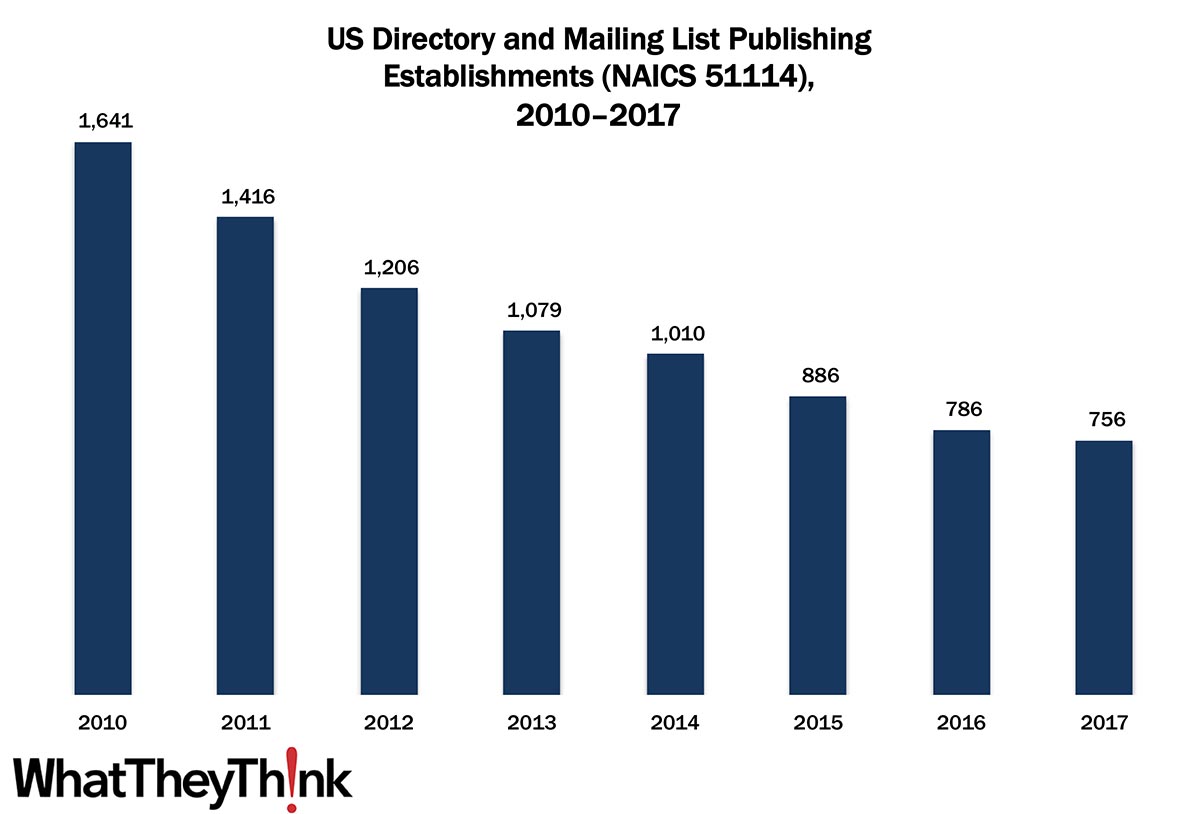

Directory and Mailing List Publishing Establishments—2010–2021

Published: February 23, 2024

According to the latest edition of County Business Patterns, in 2021 there were 548 establishments in NAICS 51114 (Directory and Mailing List Publishers). This represents a decrease of 67% since 2010. In macro news, retail sales dipped slightly in January. Full Analysis

January Graphic Arts Employment Generally Flat

Published: February 16, 2024

Overall printing employment in January 2024 was unchanged from December, with production employment up 0.7%, while non-production employment was down -1.3%. Full Analysis

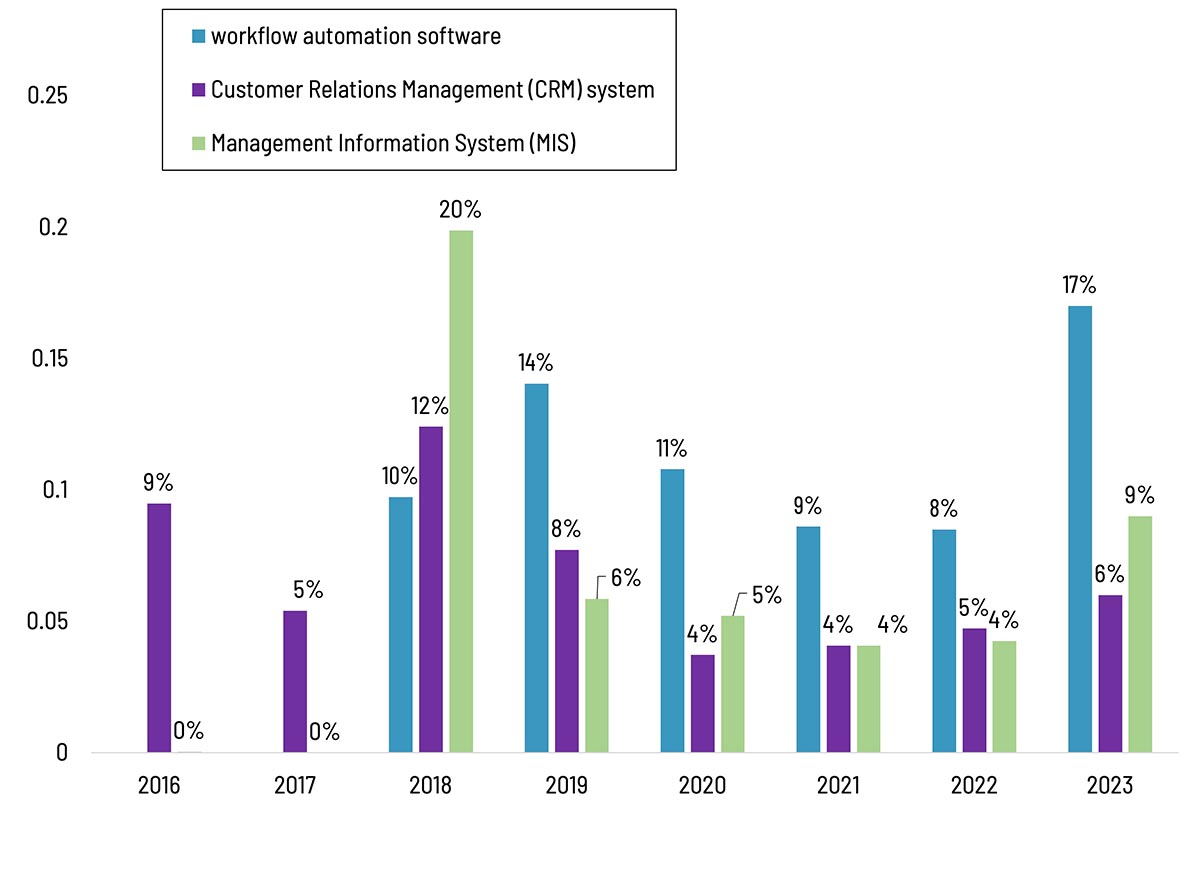

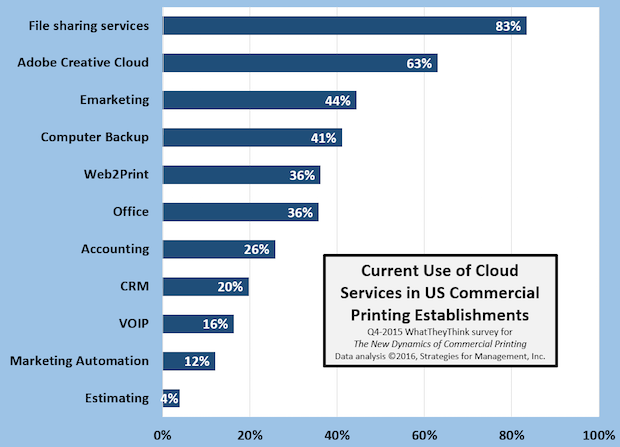

Tales from the Database: Looking at the Cloud from Both Sides

Published: February 9, 2024

Drawing on eight years’ worth of Print Business Outlook surveys, our “Tales from the Database” series looks at historical data to see if we can glean any particular hardware, software, or business trends. This issue, we turn our attention to software—specifically, migration to the cloud. Full Analysis

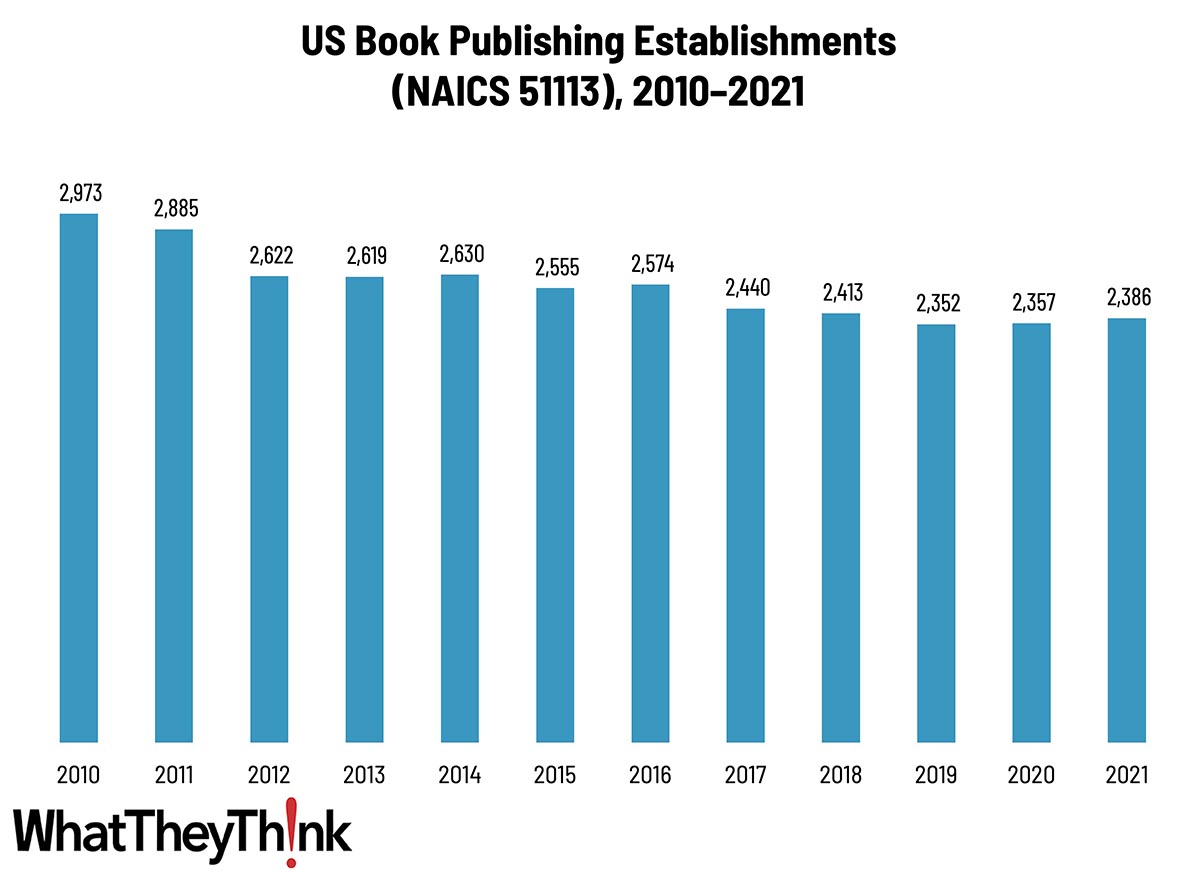

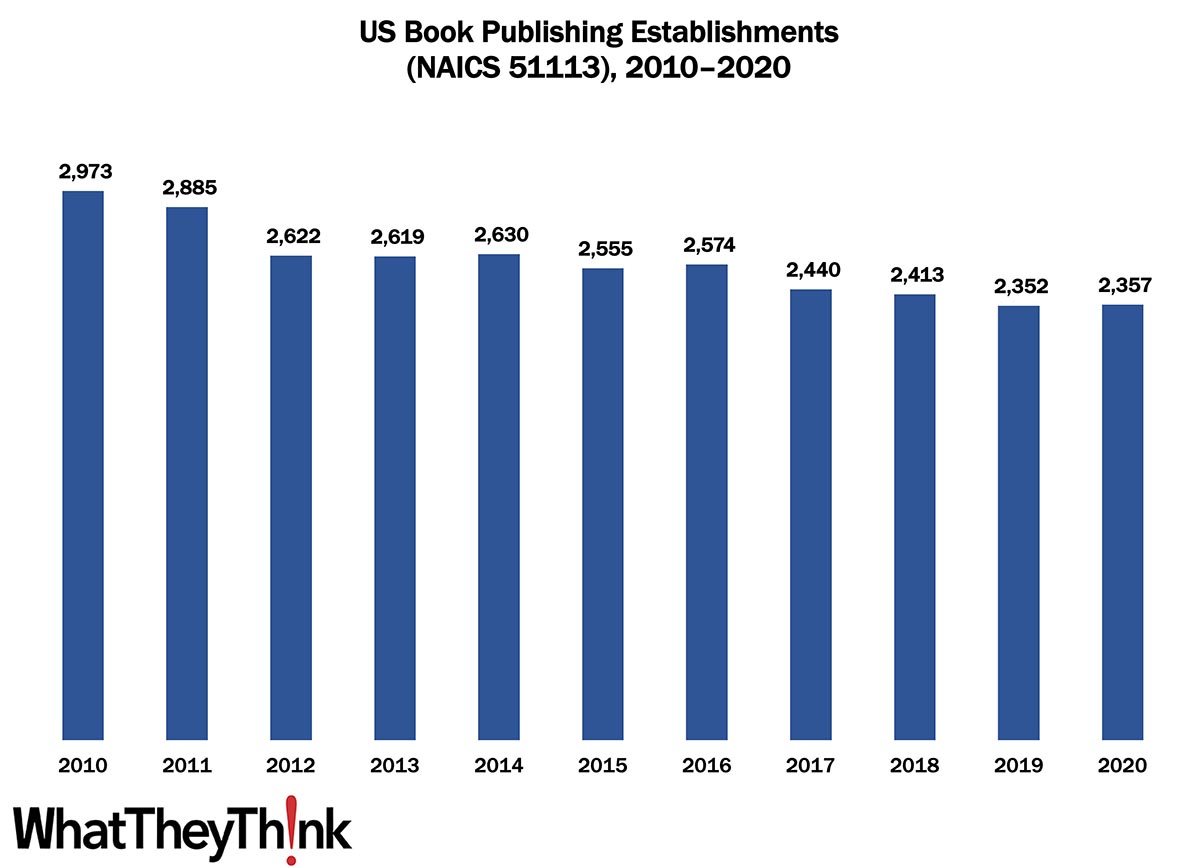

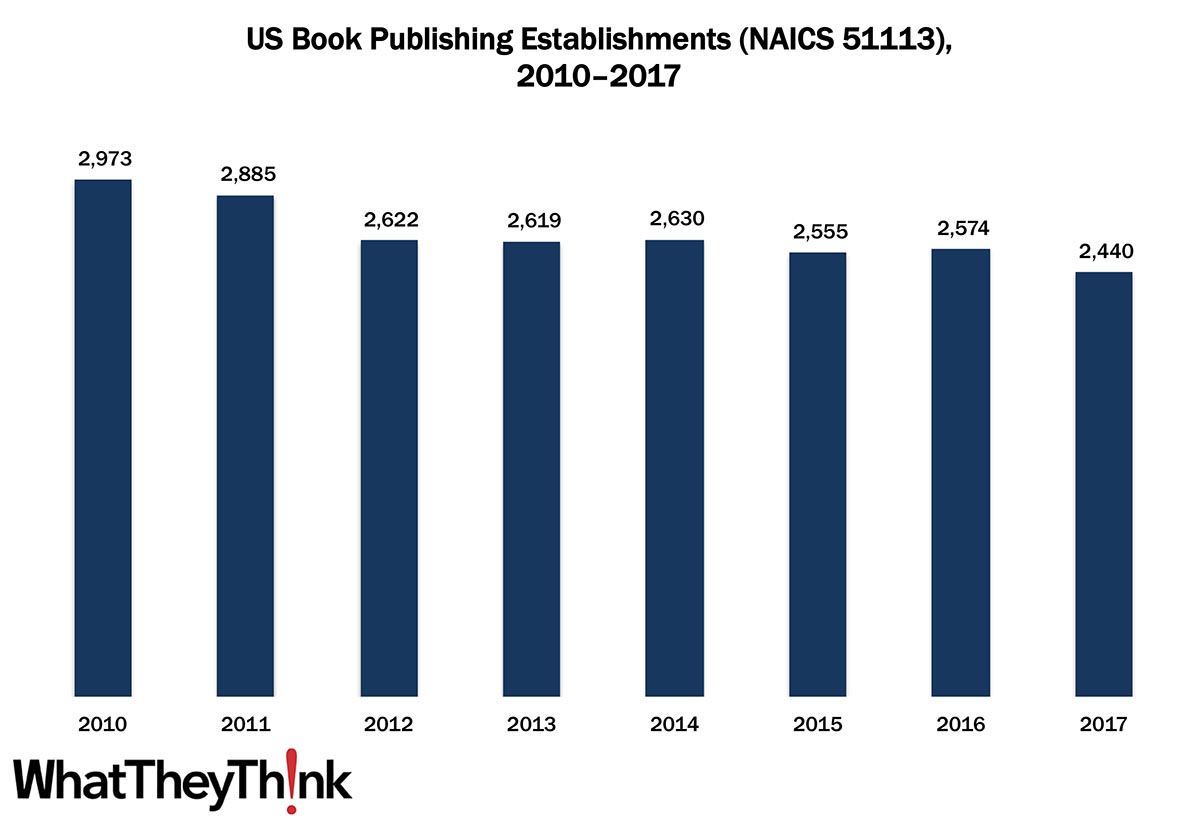

Book Publishing Establishments—2010–2021

Published: February 2, 2024

According to the latest edition of County Business Patterns, in 2021 there were 2,386 establishments in NAICS 51113 (Book Publishing). Although this represents a decrease of 20% since 2010, establishments ticked up by 29 establishments in 2021. In macro news, Q4 GDP grew 3.3%. Full Analysis

November Shipments: Tis the Season…

Published: January 26, 2024

November 2023 shipments came in at $7.24 billion, down from the year’s high of $7.76 billion a month earlier. Full Analysis

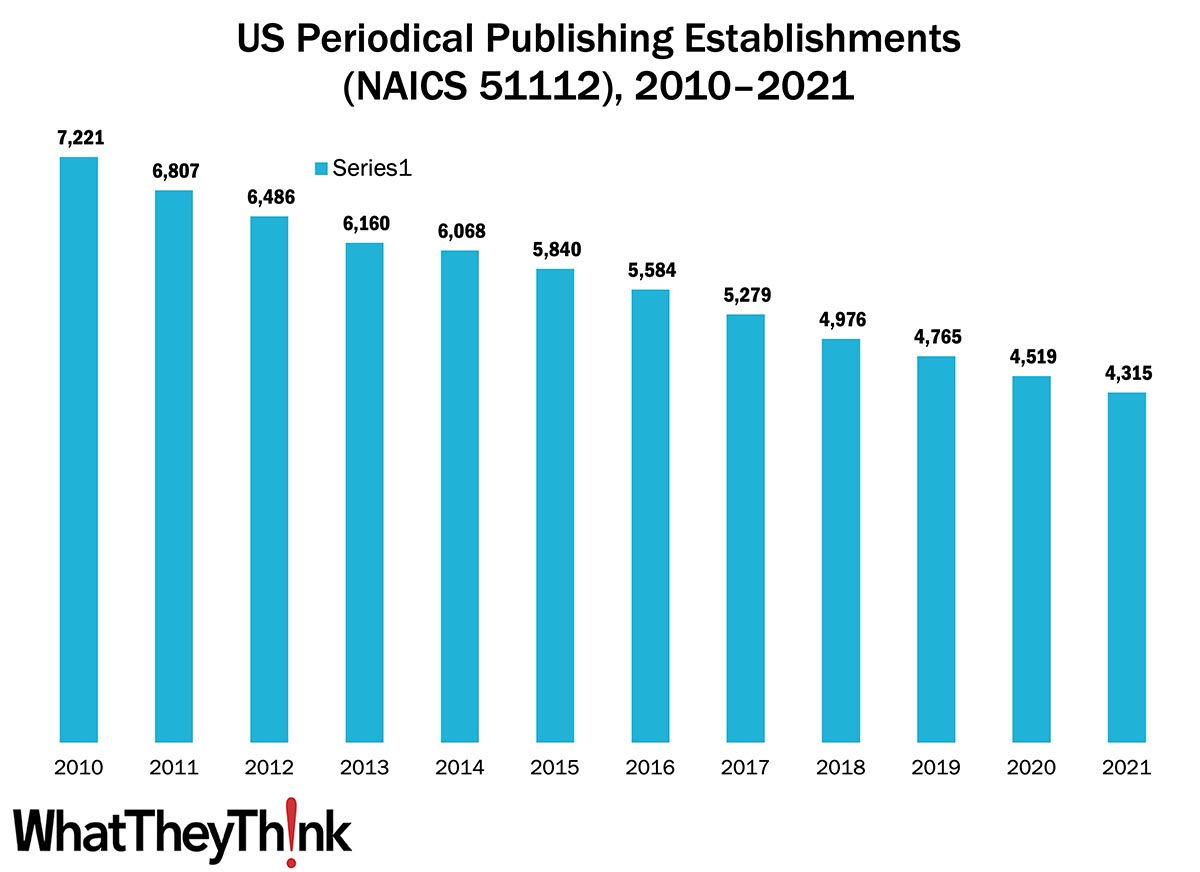

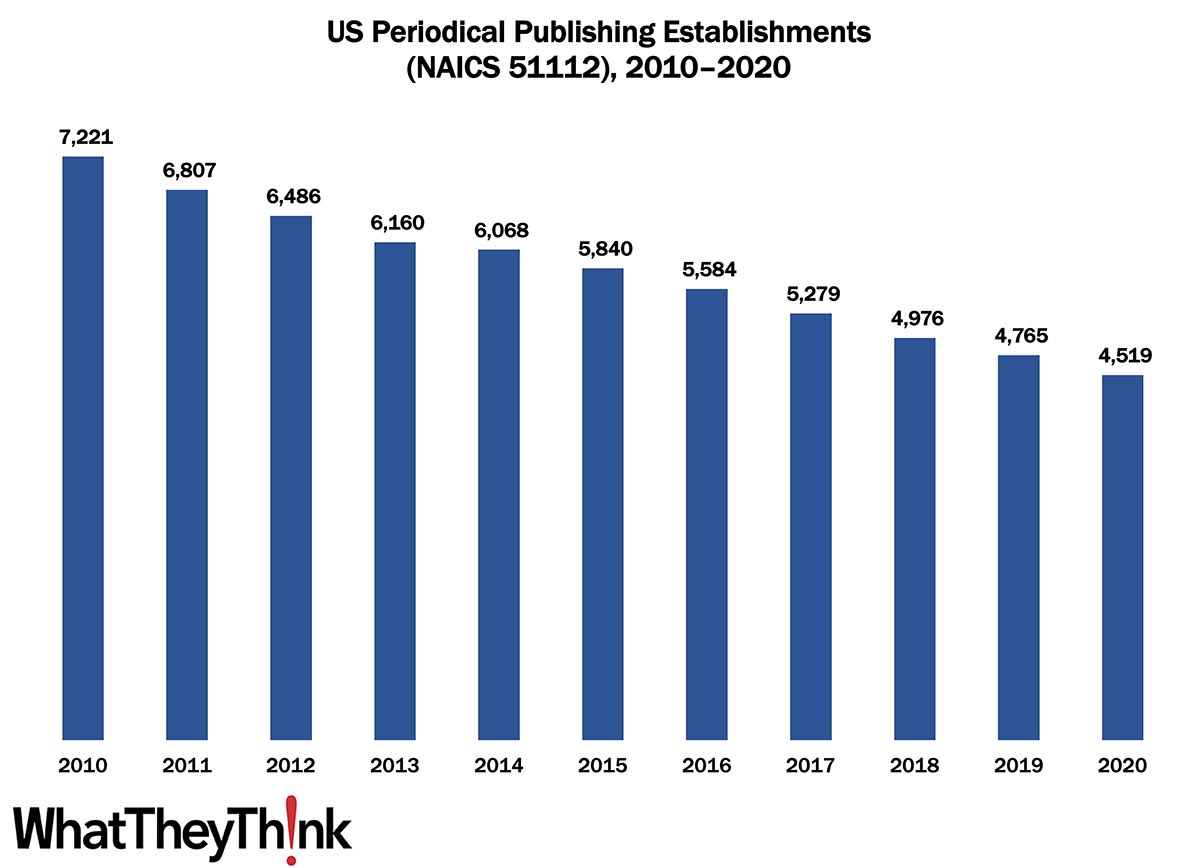

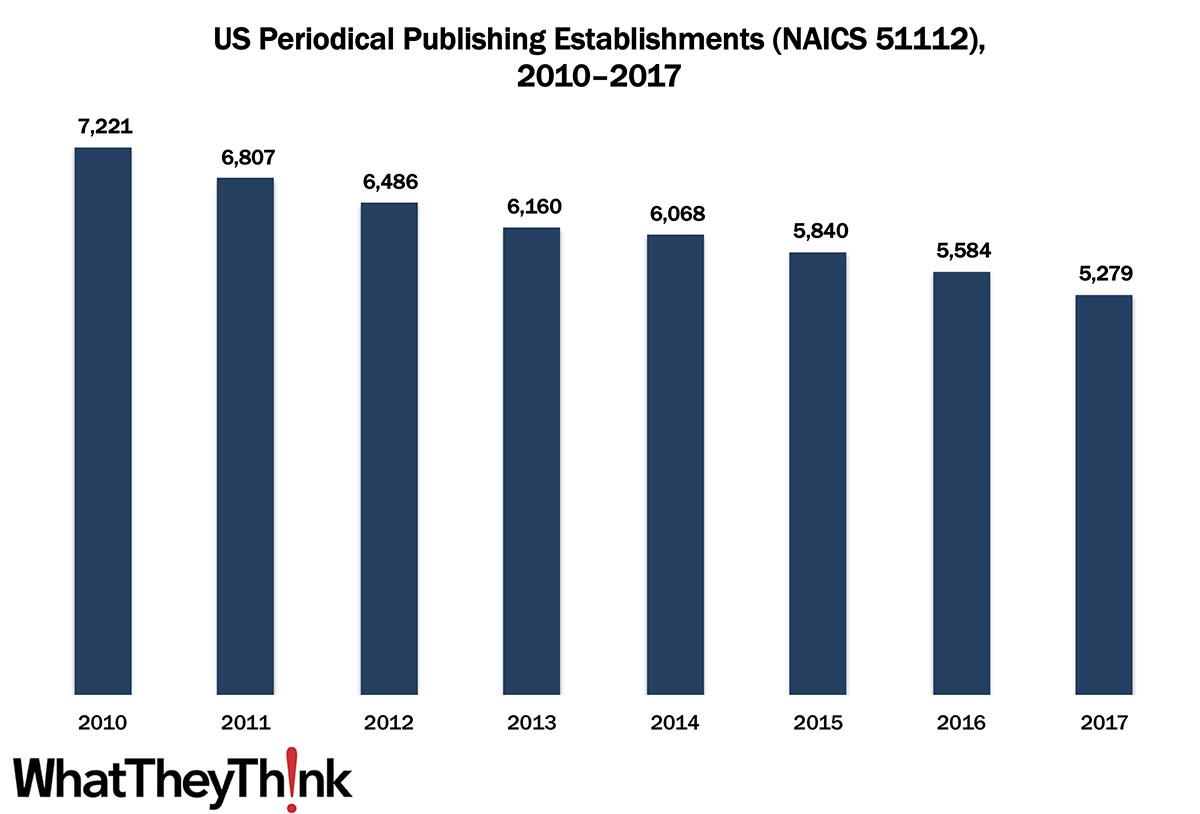

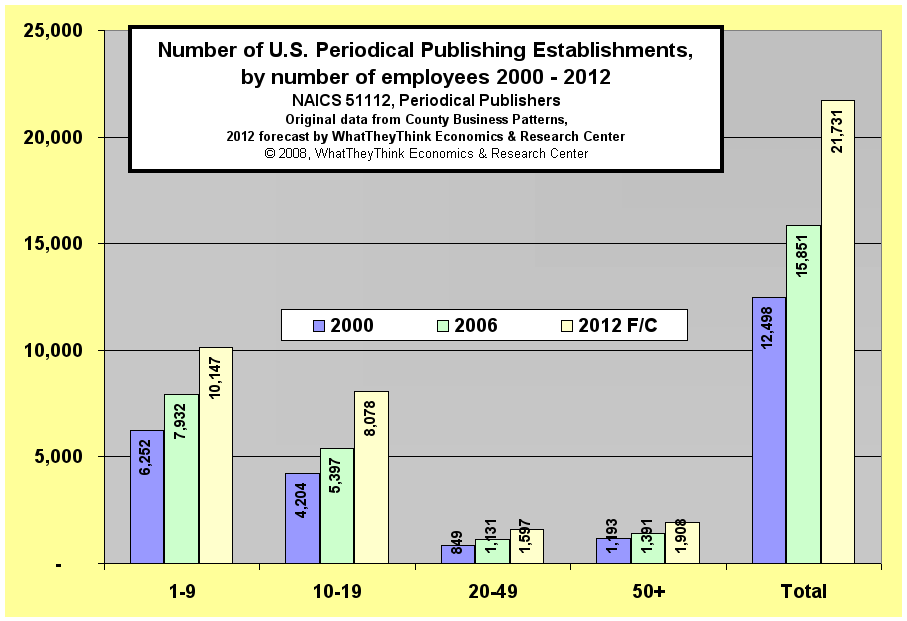

Periodical Publishing Establishments—2010–2021

Published: January 19, 2024

According to the latest edition of County Business Patterns, in 2021 there were 4,315 establishments in NAICS 51112 (Periodical Publishing). This represents a decrease of 40% since 2010. In macro news, December retail sales were up from November. Full Analysis

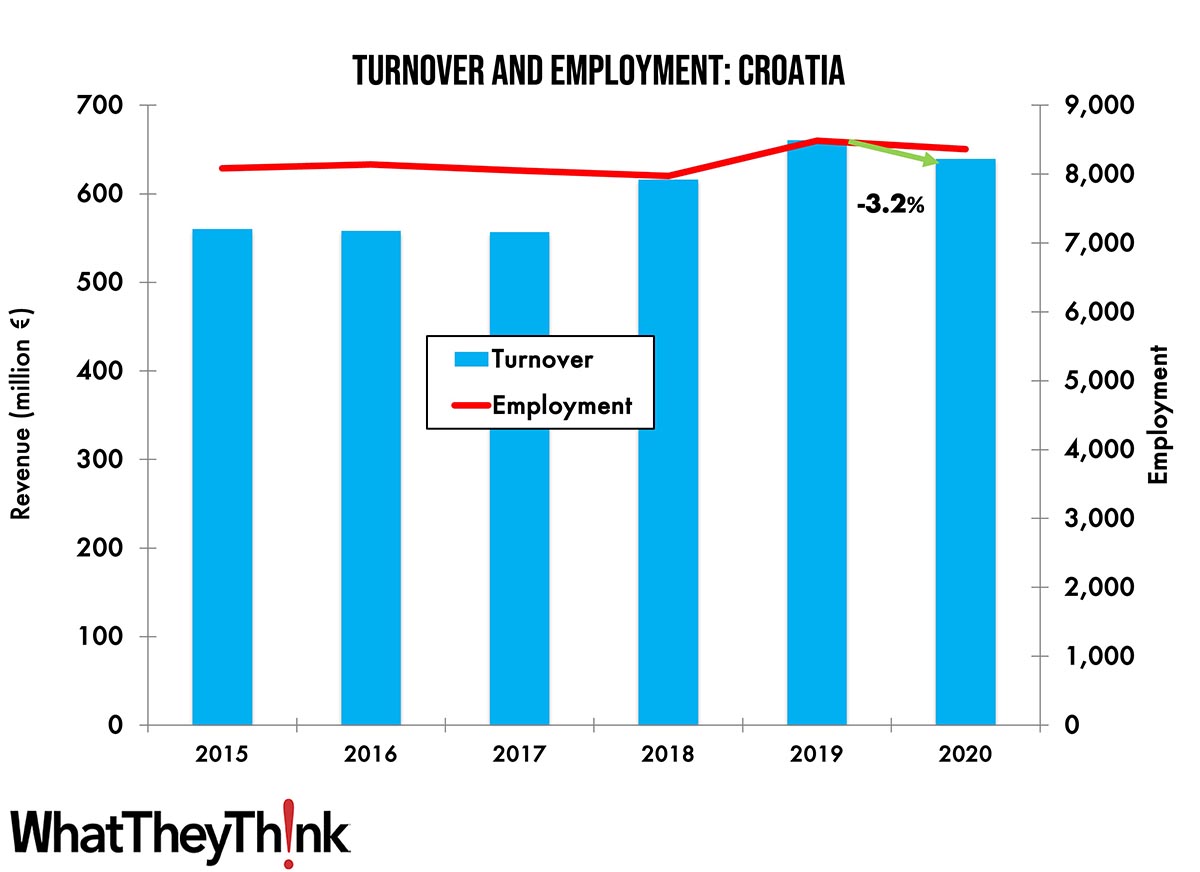

Turnover and Employment in Print in Europe—Croatia

Published: January 16, 2024

This bi-weekly series of short articles aims to shed a spotlight on the size of the printing industry in Europe per country and how revenues and employment developed in 2020, when the pandemic impacted businesses. In this final installment, we look at Croatia, which ranks at number 19 among the printing industries by turnover in Europe. Full Analysis

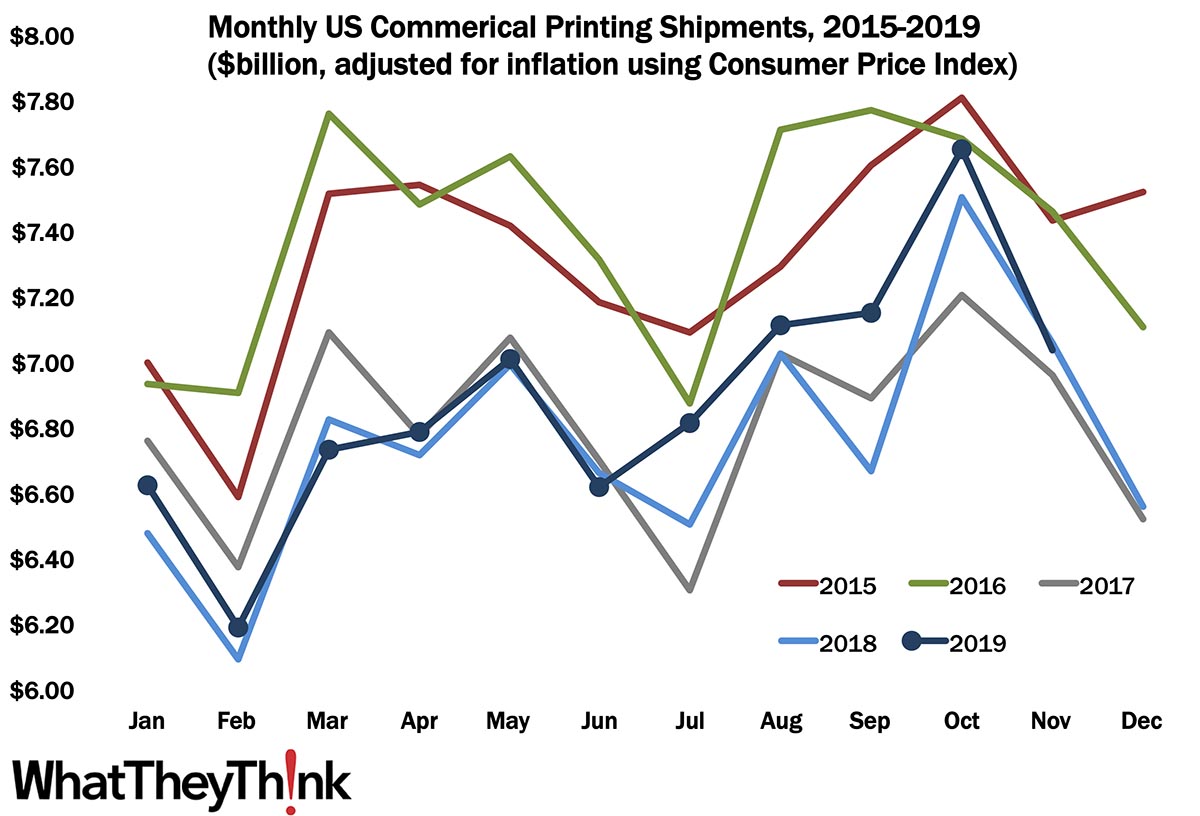

October Shipments: Peak Performance

Published: January 12, 2024

October 2023 printing shipments came in at $7.84 billion, up from September’s $7.37 billion. Full Analysis

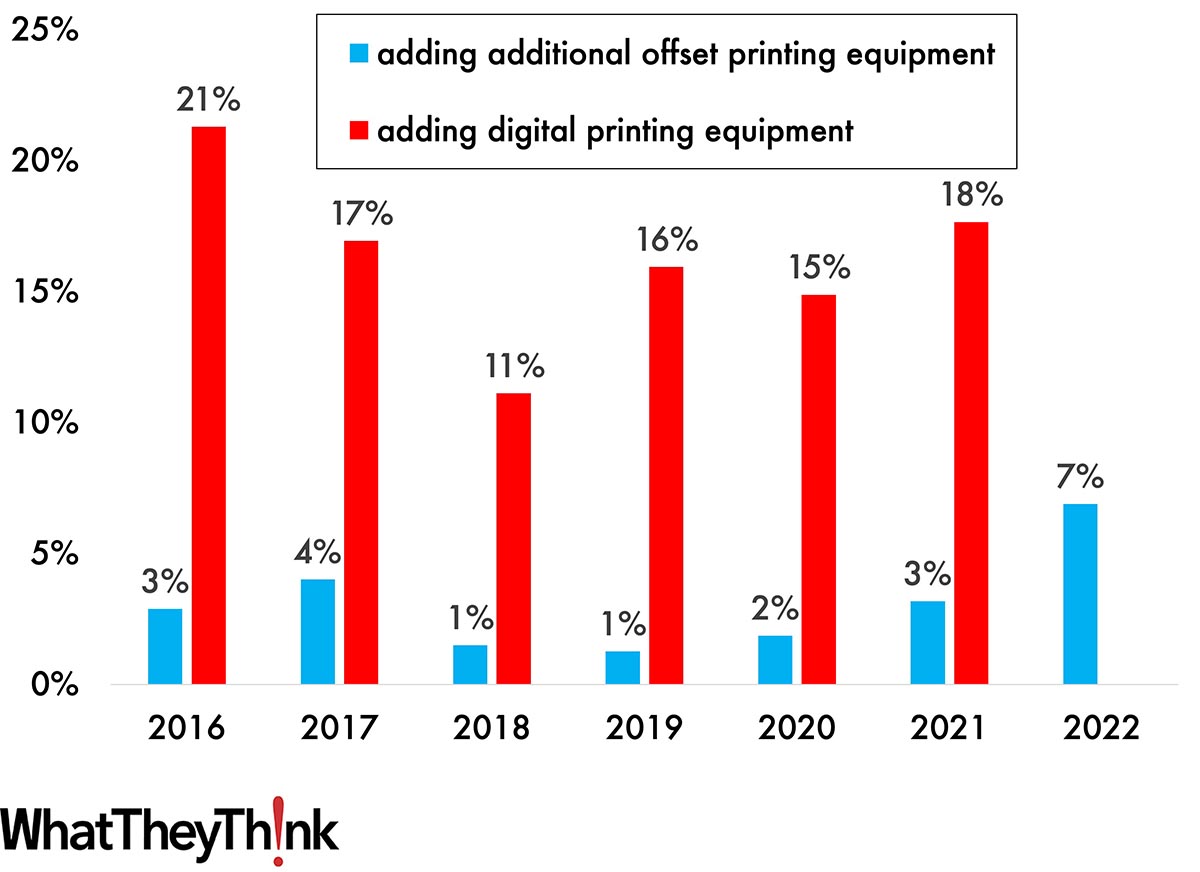

Tales from the Database: Prints Charming

Published: December 15, 2023

Drawing on six years’ worth of Print Business Outlook surveys, our “Tales from the Database” series looks at historical data to see if we can spot any particular hardware, software or business trends. In this installment, we turn our attention to printing technologies. Full Analysis

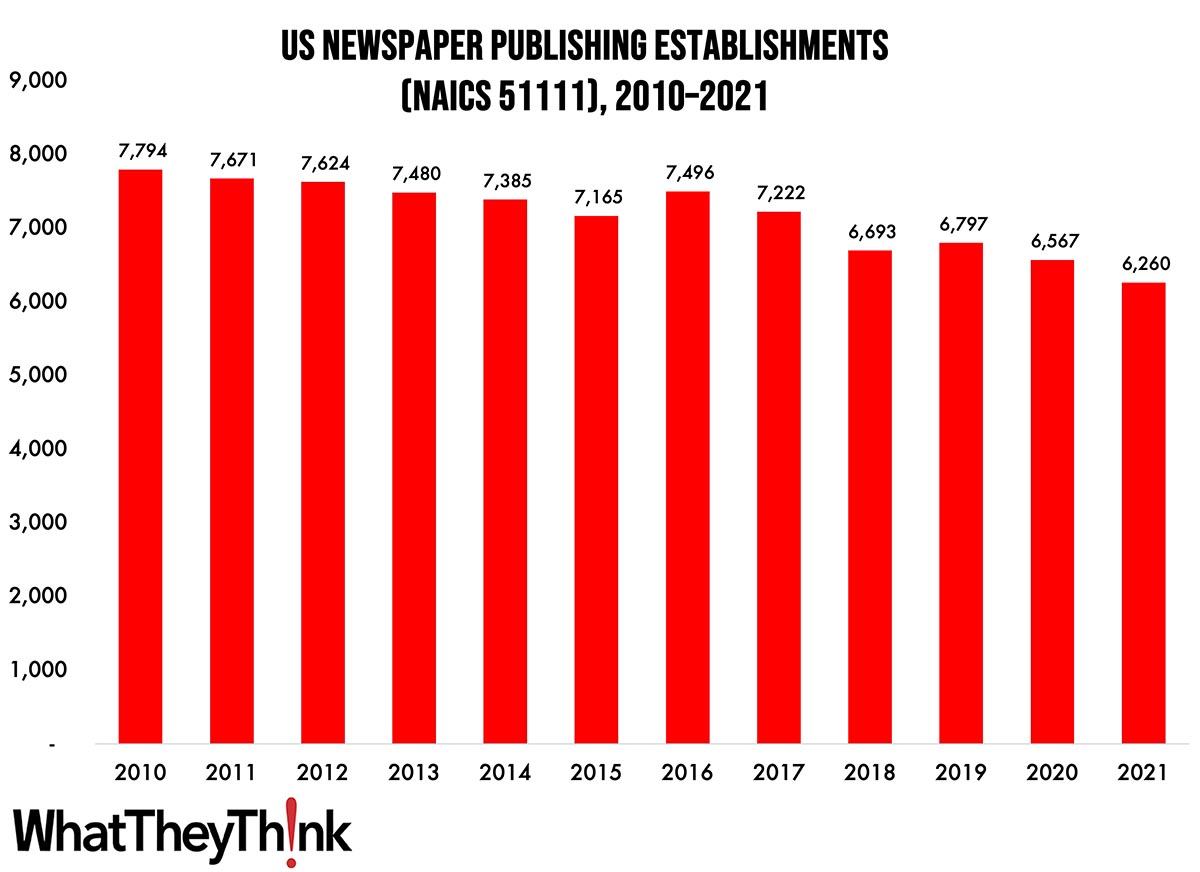

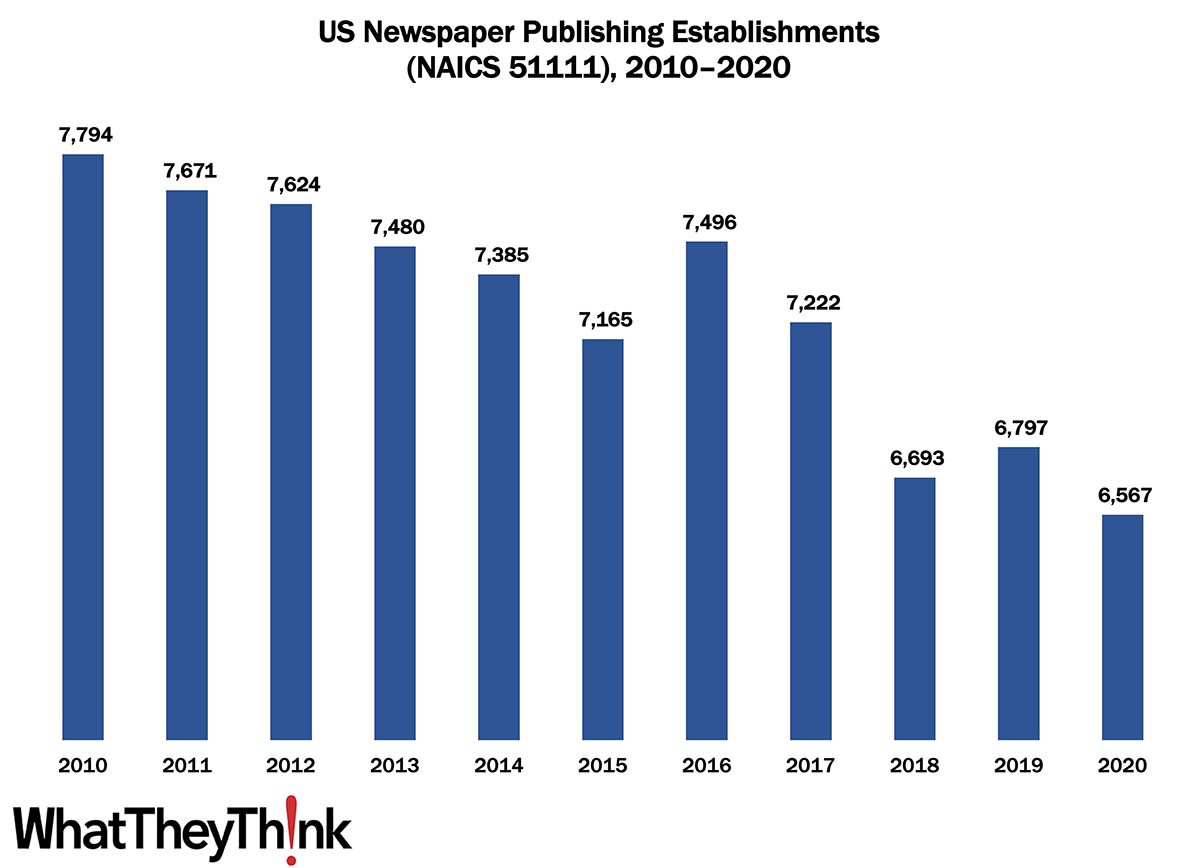

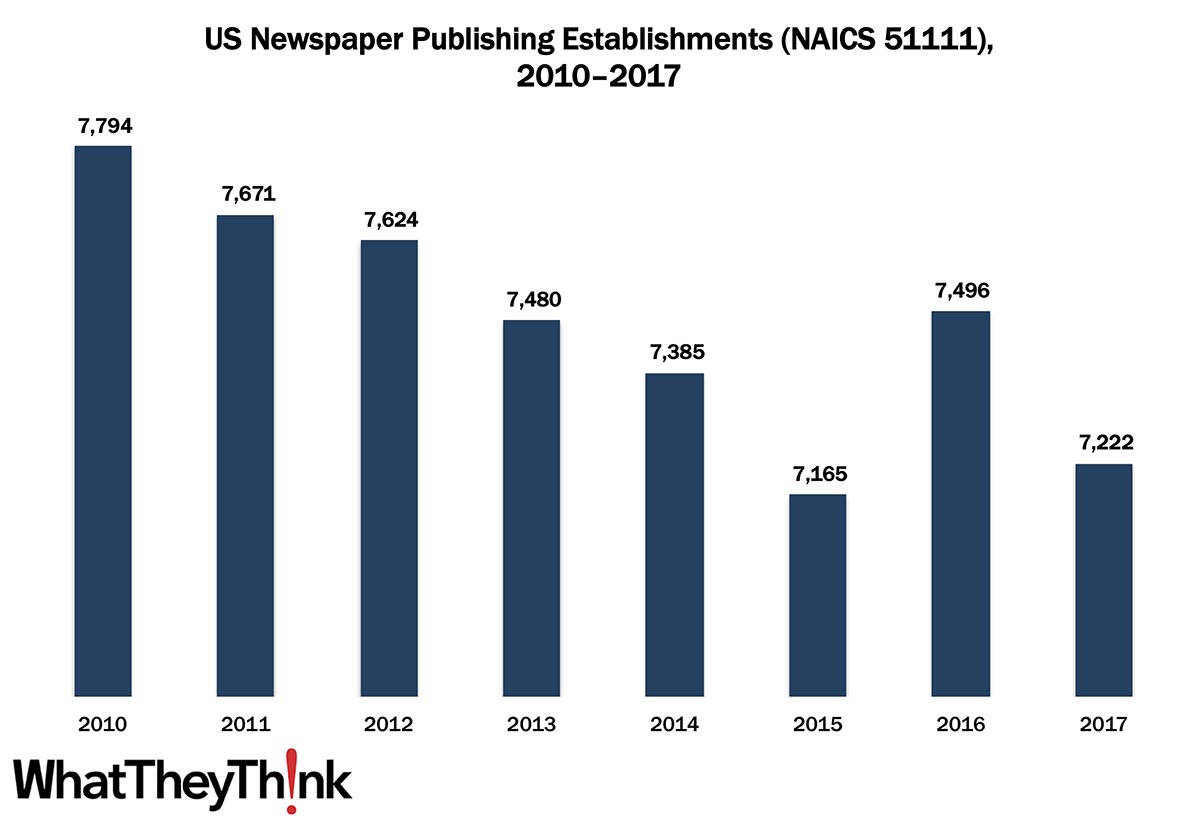

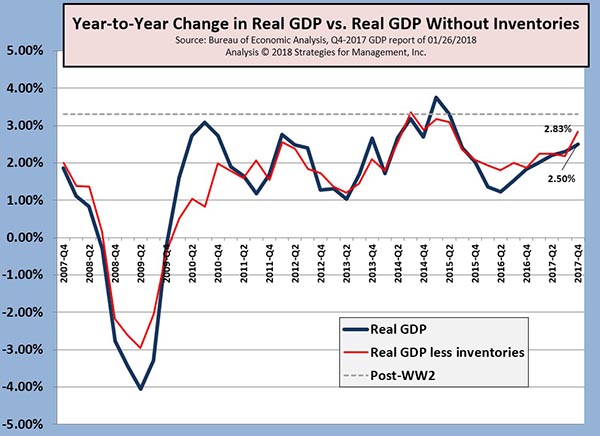

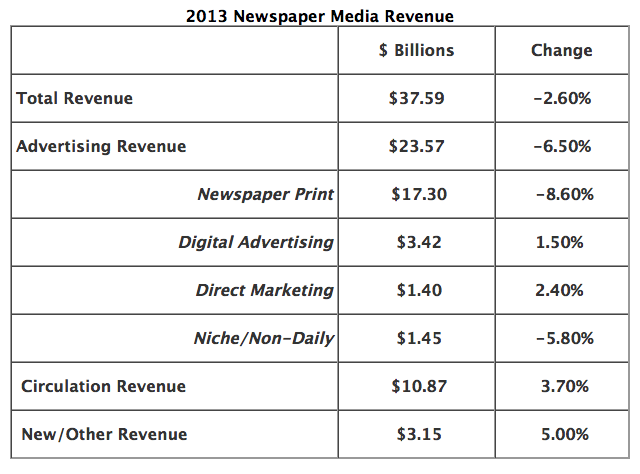

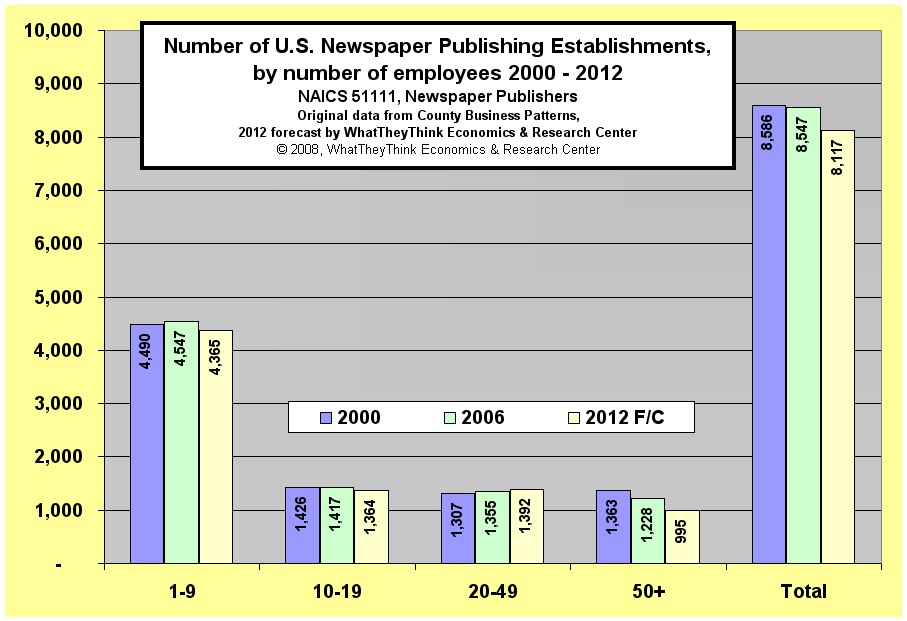

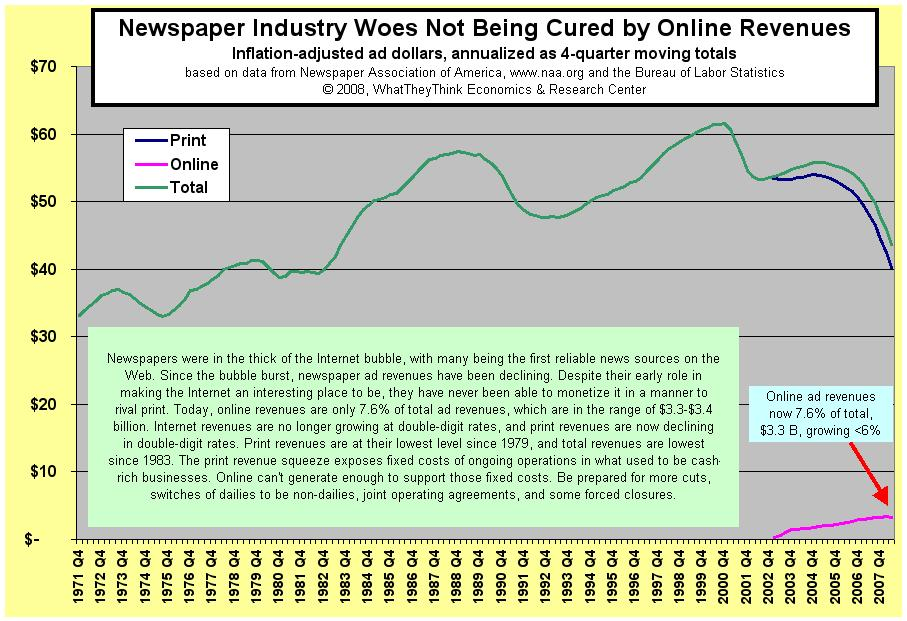

Newspaper Publishing Establishments—2010–2021

Published: December 8, 2023

According to the latest, recently released edition of County Business Patterns, in 2021 there were 6,260 establishments in NAICS 51111 (Newspaper Publishing). This represents a decrease of 20% since 2010. In macro news, what is going on with GDP? Full Analysis

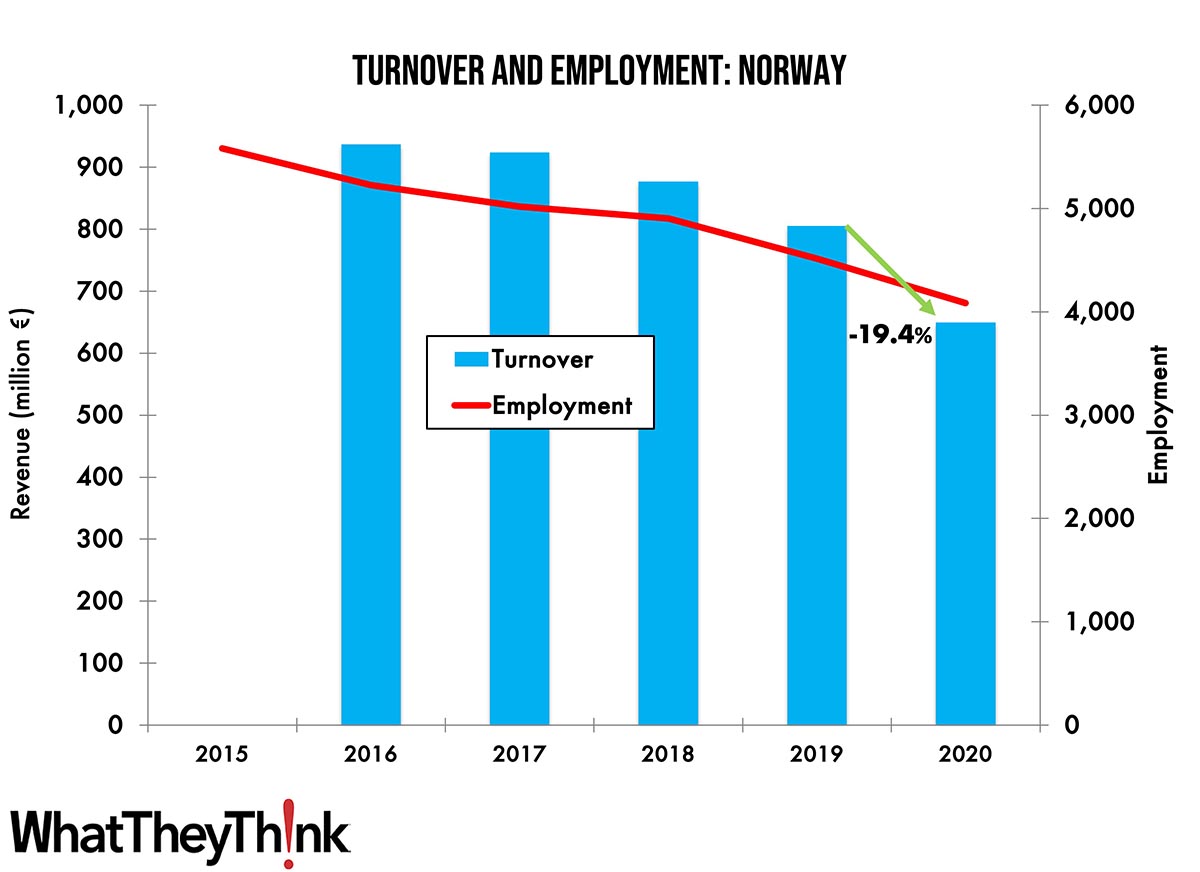

Turnover and Employment in Print in Europe—Norway

Published: December 5, 2023

This bi-weekly series of short articles aims to shed a spotlight on the size of the printing industry in Europe per country and how revenues and employment developed in 2020, when the pandemic impacted businesses. This time we look at Norway, which ranks at number 18 among the printing industries by turnover in Europe. Full Analysis

September Shipments: Heading into the Fall

Published: December 1, 2023

September 2023 printing shipments came in at $7.42 billion, down from August’s $7.47 billion. Full Analysis

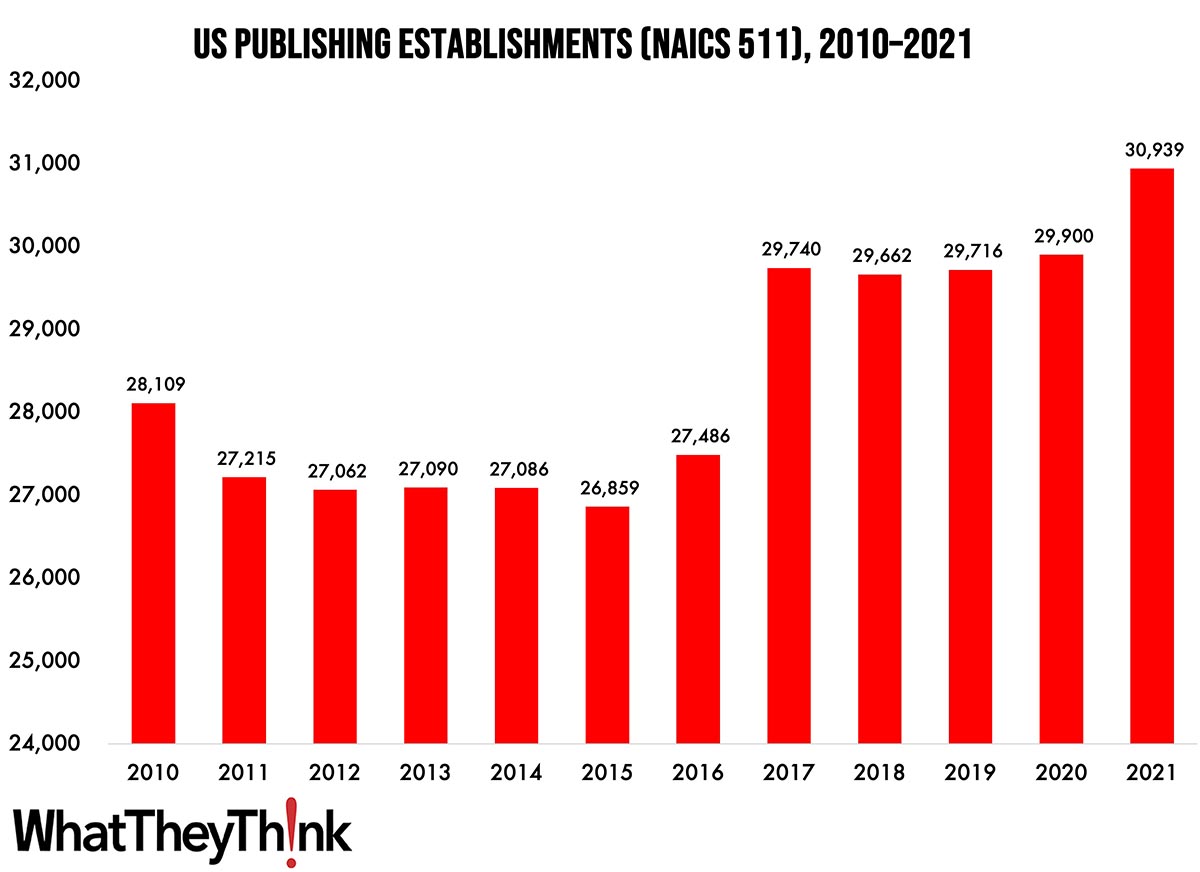

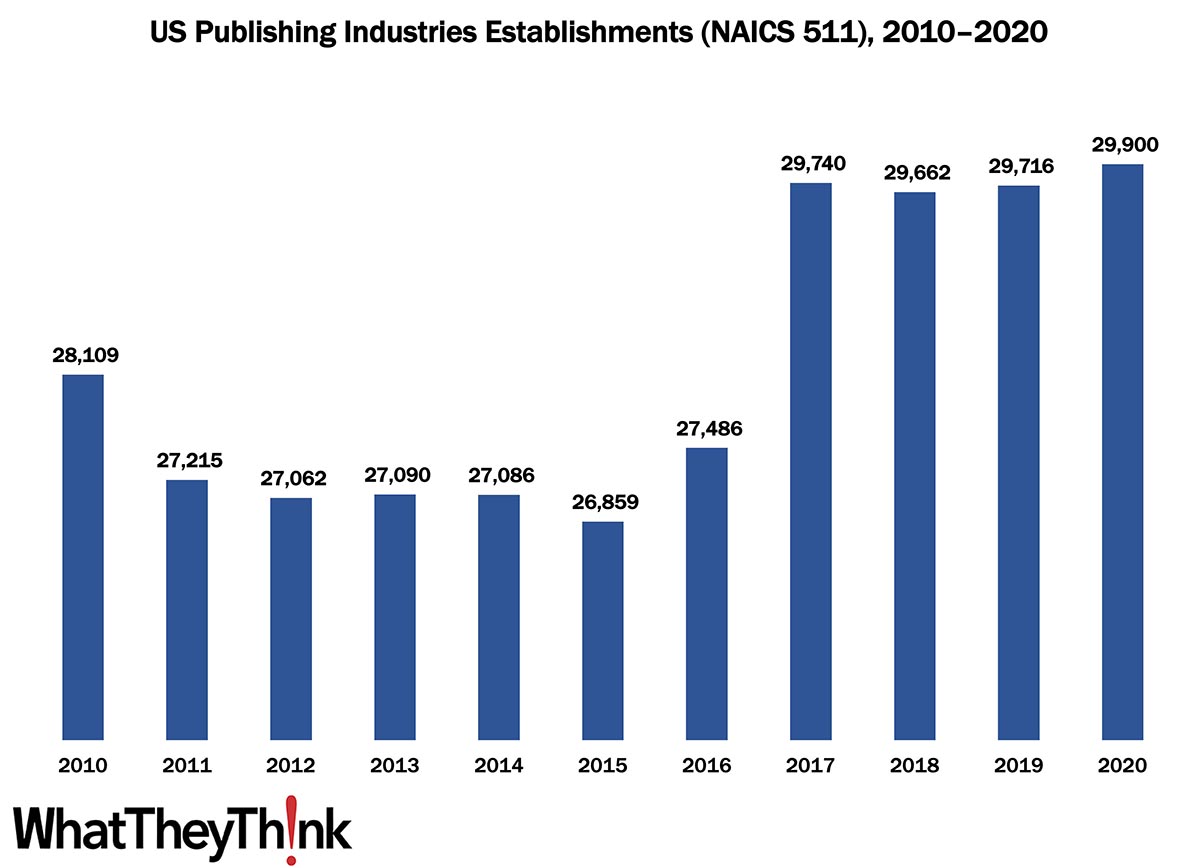

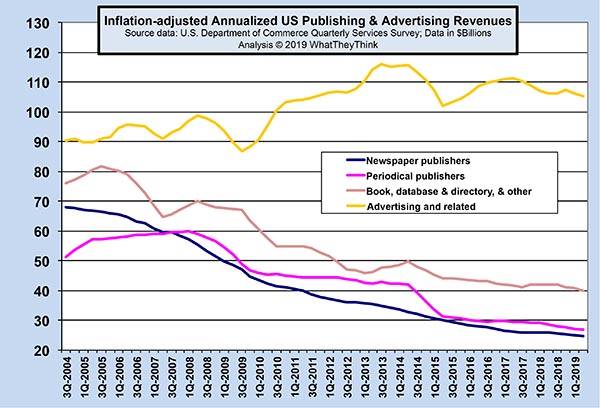

Publishing Establishments—2010–2021

Published: November 17, 2023

According to the latest, recently released edition of County Business Patterns, in 2020 there were 30,939 establishments in NAICS 511 (Publishing Industries [except Internet]). This represents an increase of 10% since 2010 and increase of 13% since 2016. In macro news, October inflation was unchanged from September. Full Analysis

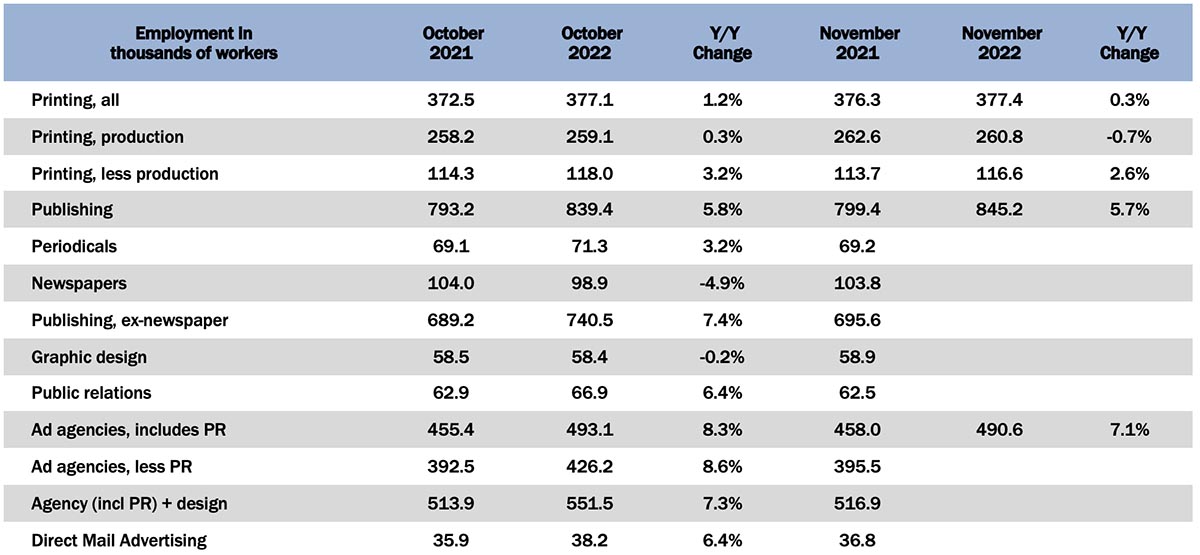

October Graphic Arts Employment Up Slightly

Published: November 10, 2023

Overall printing employment in October 2023 was up 0.8% from September. Production employment was up 0.7% while non-production employment was up 1.1%. Full Analysis

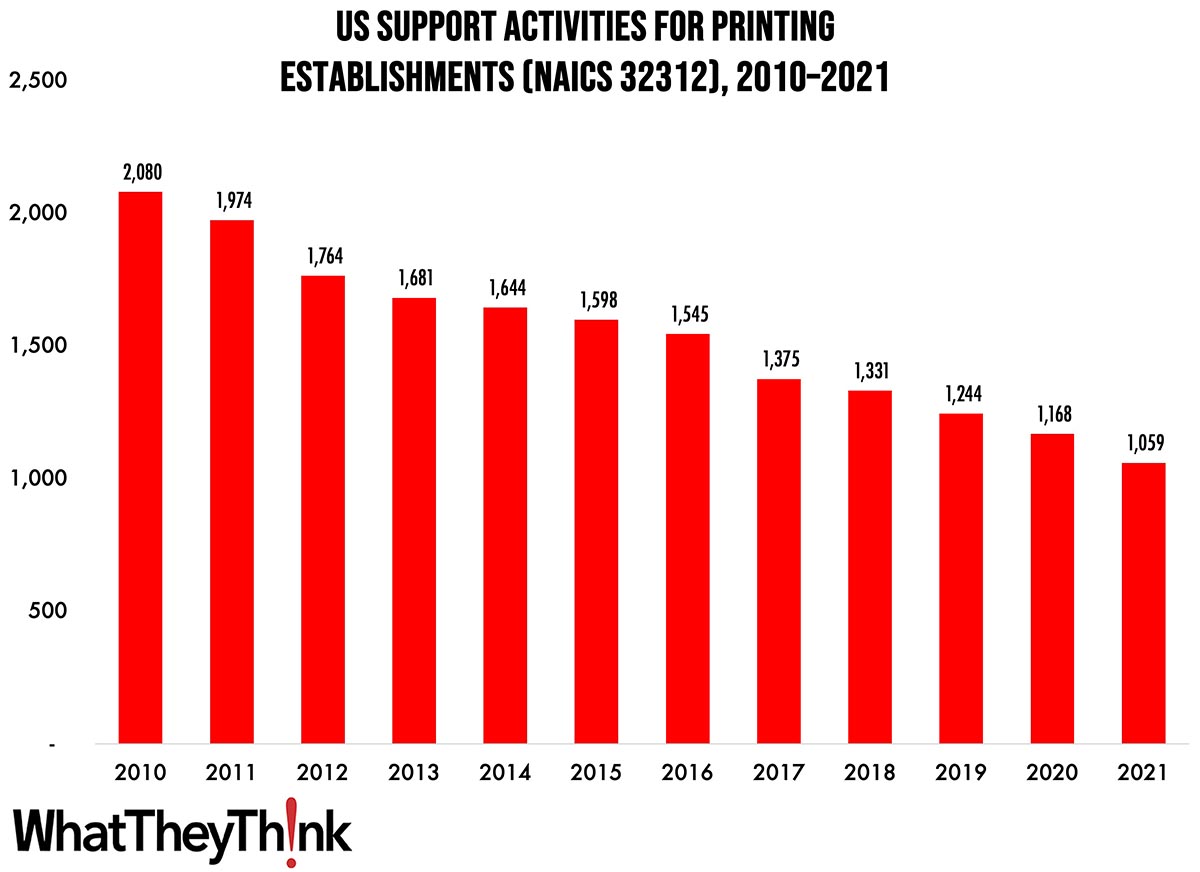

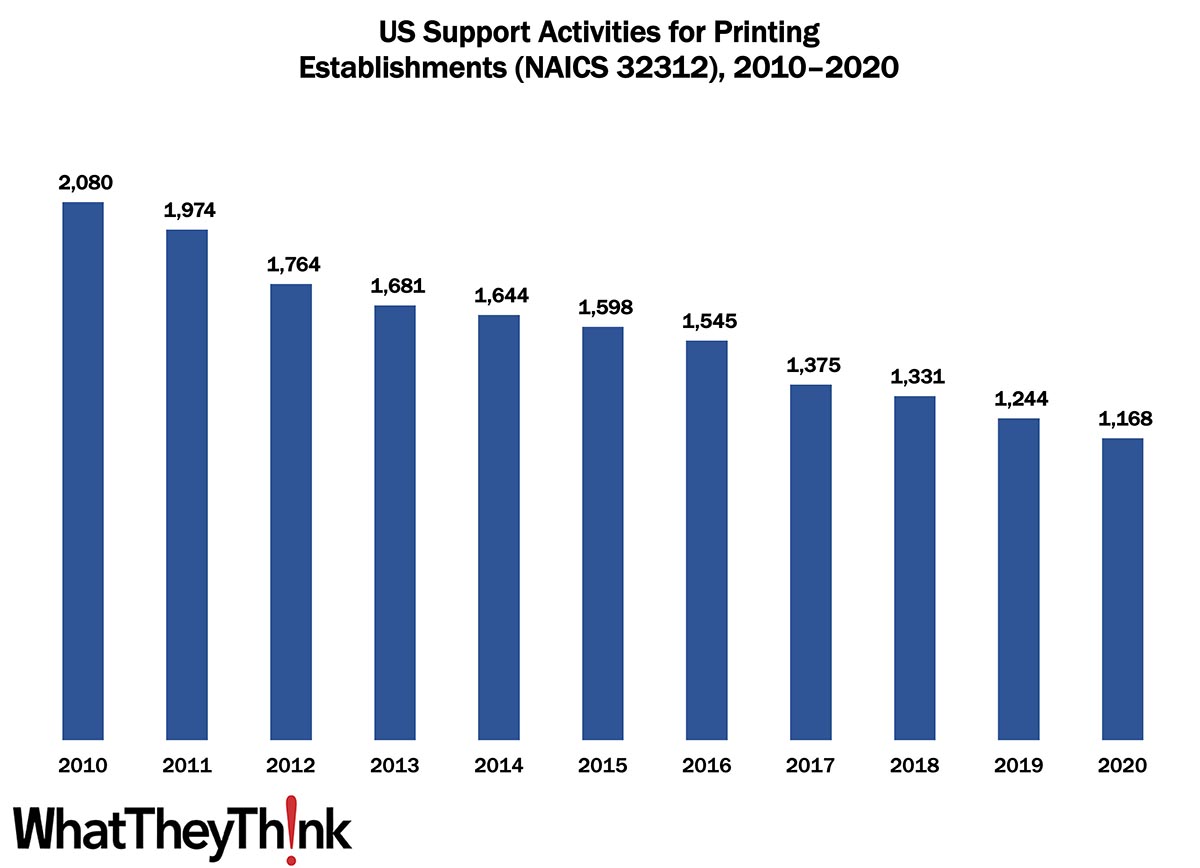

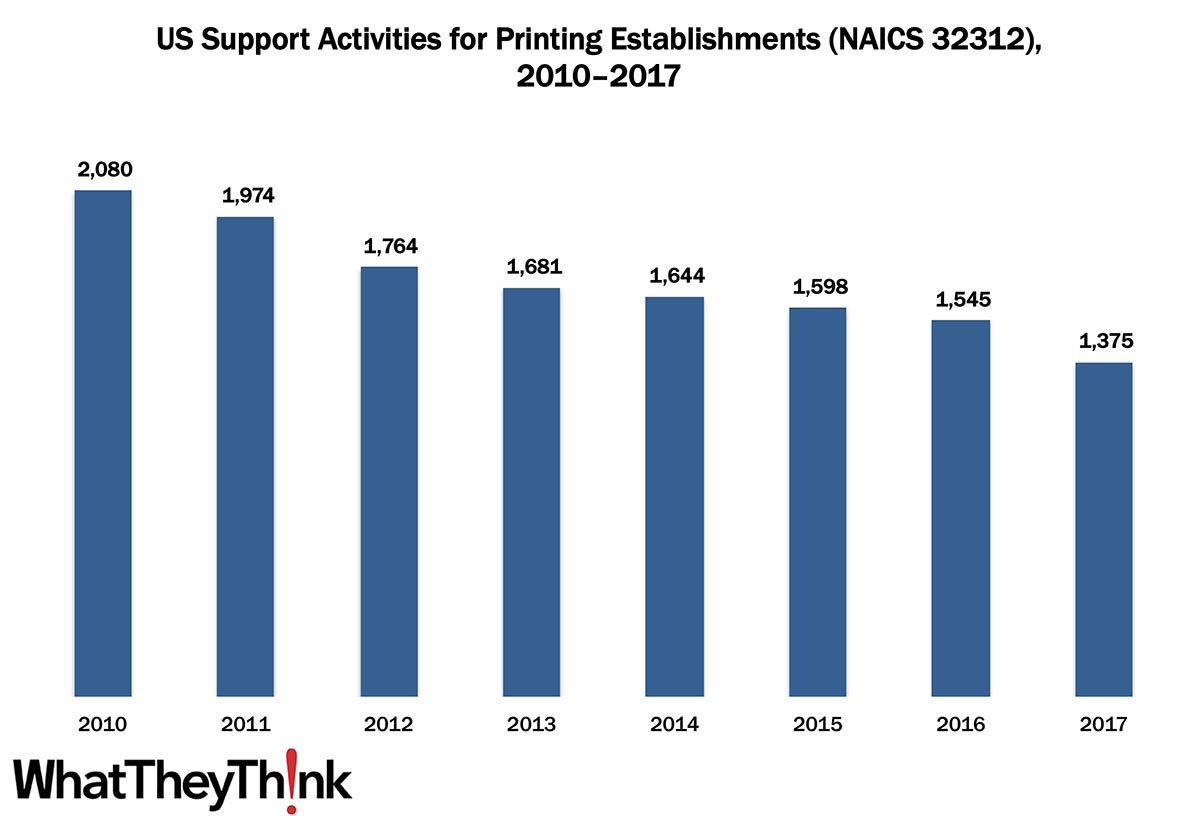

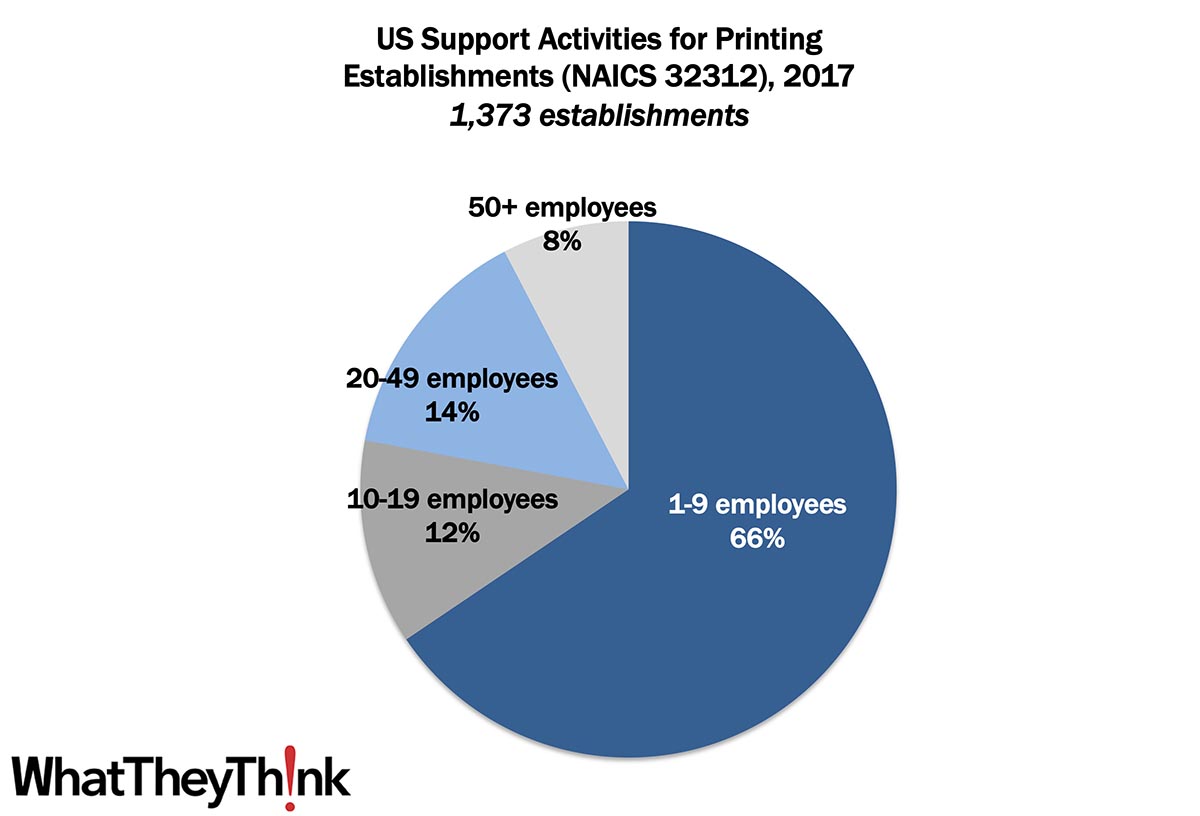

Pre- and Postpress Establishments—2010–2021

Published: November 3, 2023

According to the latest, recently released edition of County Business Patterns, in 2021 there were 1,059 establishments in NAICS 32312 (Support Activities for Printing). This represents a decrease of 49% since 2010. In macro news, Q3 GDP was up 4.9%. Full Analysis

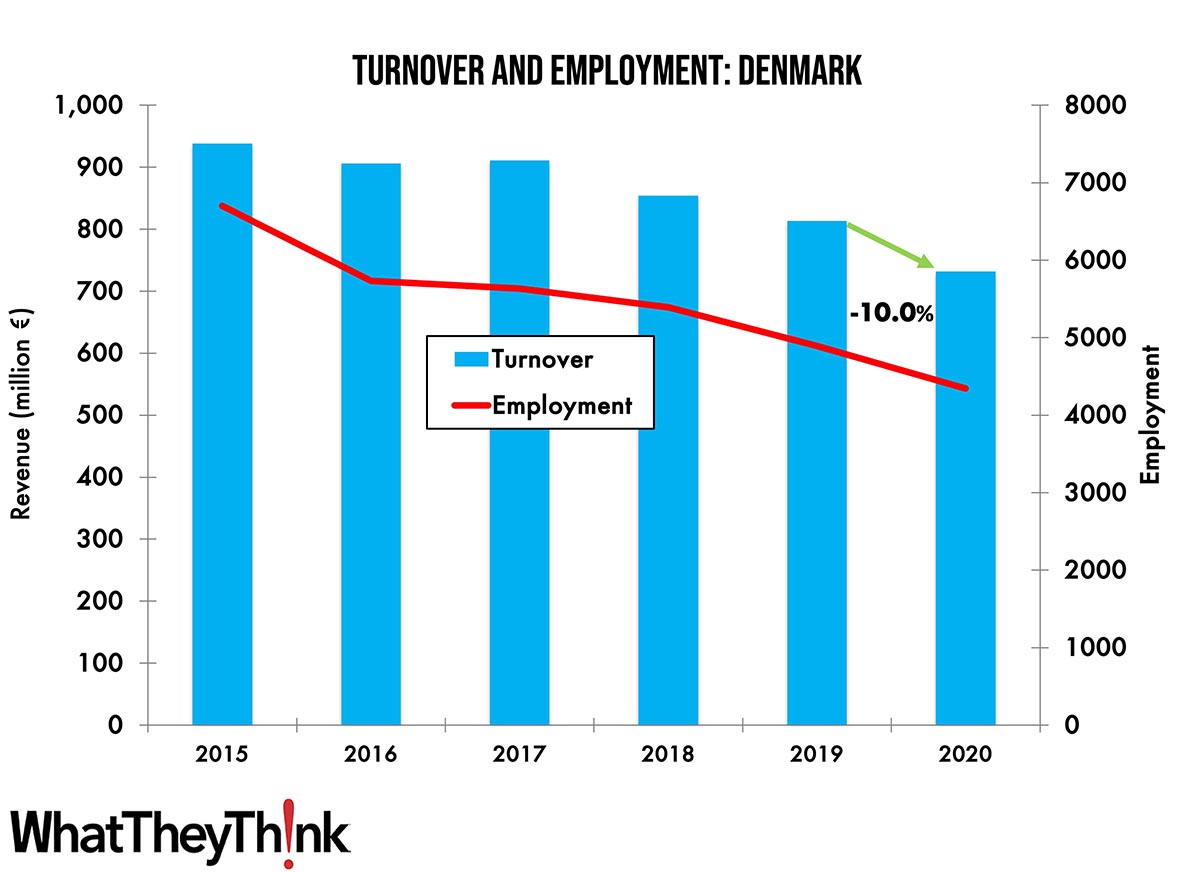

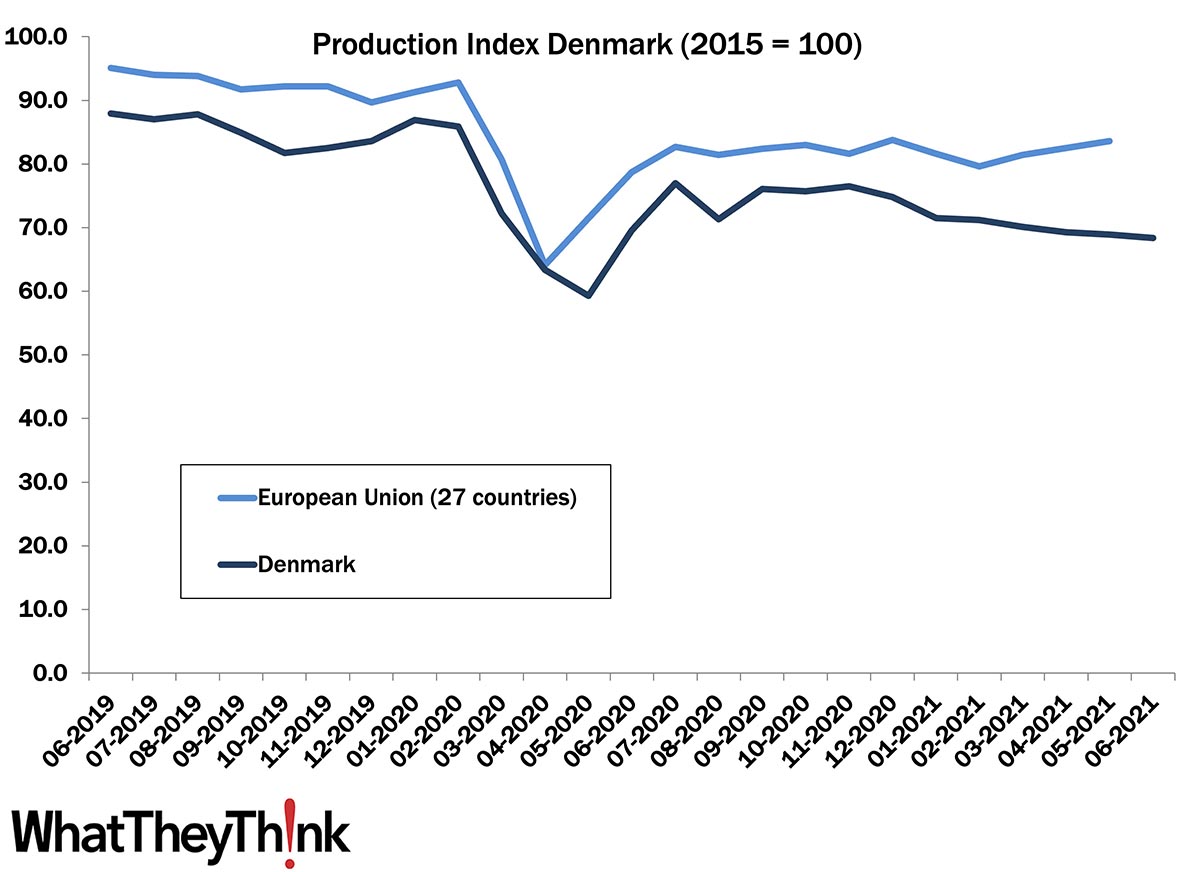

Turnover and Employment in Print in Europe—Denmark

Published: October 31, 2023

This bi-weekly series of short articles aims to shed a spotlight on the size of the printing industry in Europe per country and how revenues and employment developed in 2020, when the pandemic impacted businesses. This time we look at Denmark, the 17th largest printing industry by turnover in Europe and the third largest in the Nordic region. Full Analysis

August Shipments: …And We’re Up Again

Published: October 27, 2023

August 2023 printing shipments came in at $7.44 billion, up from July’s $7.04 billion. Full Analysis

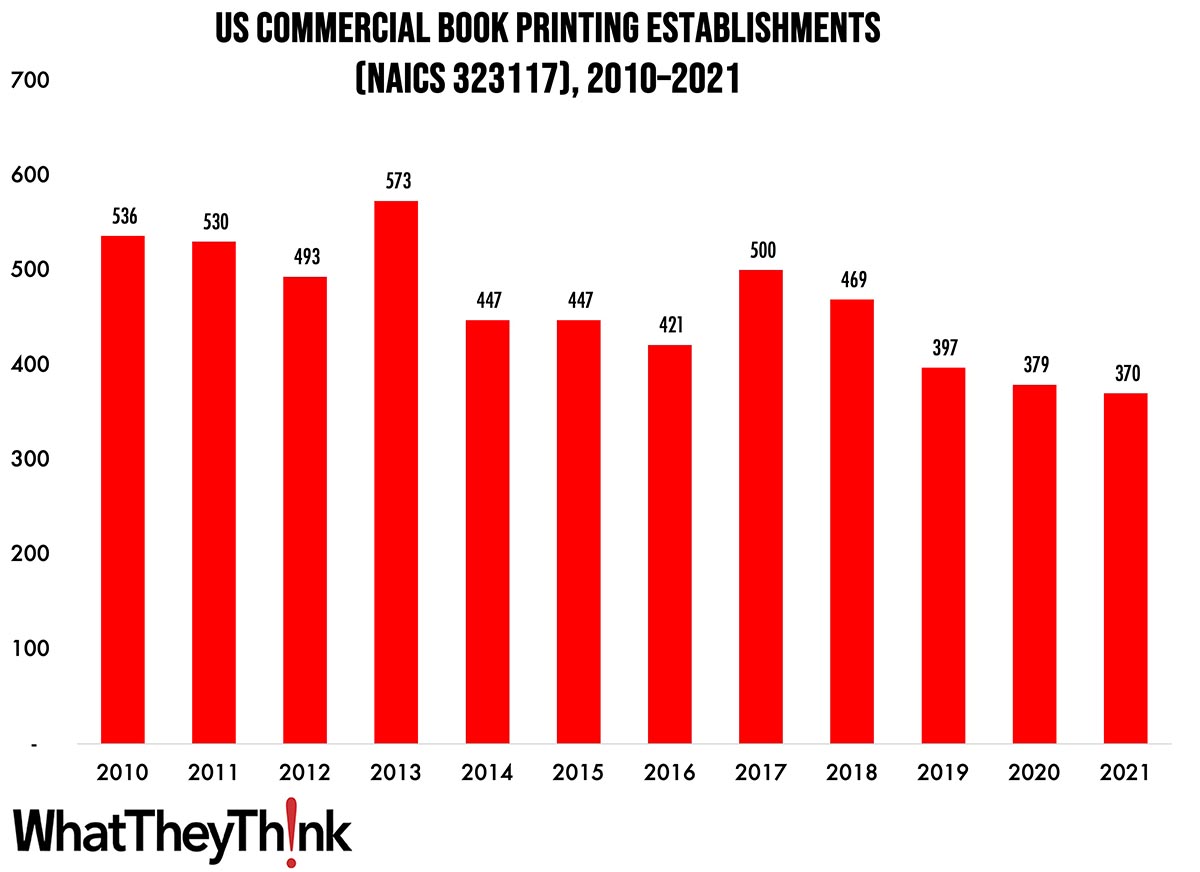

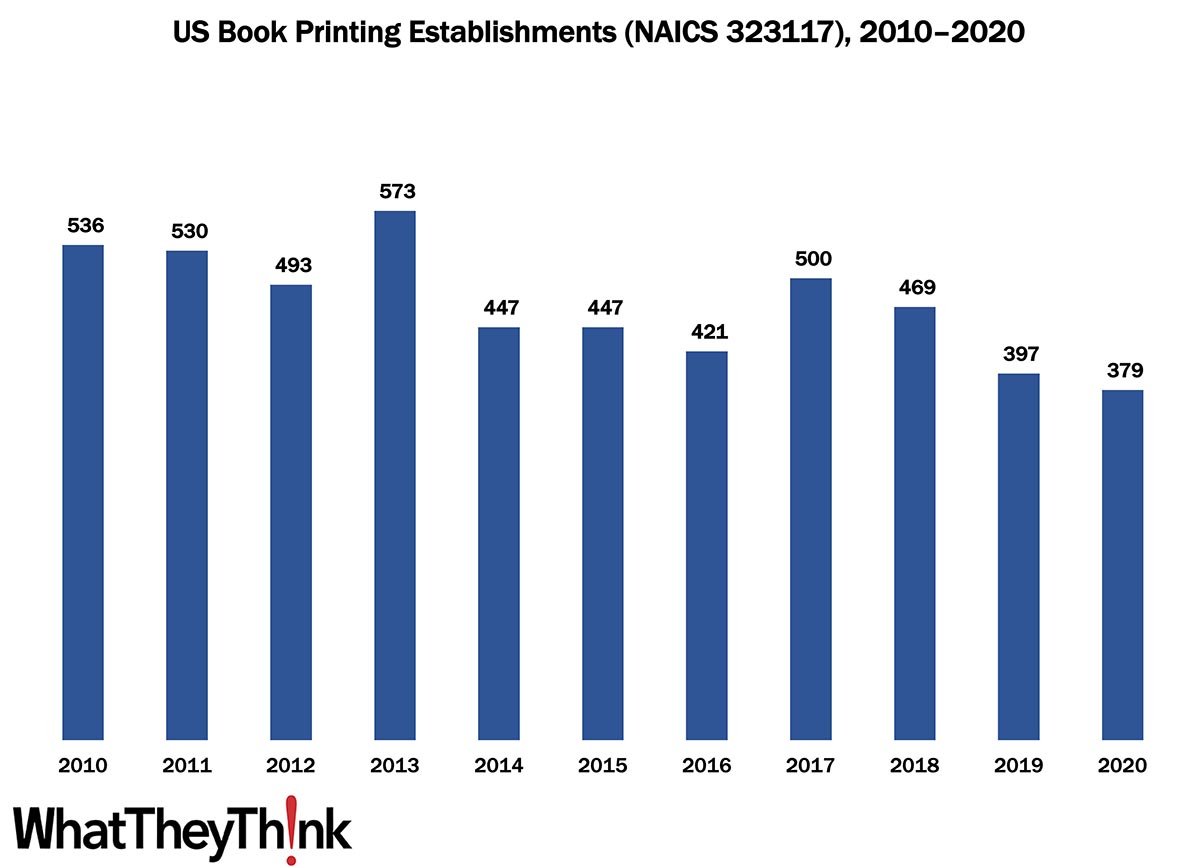

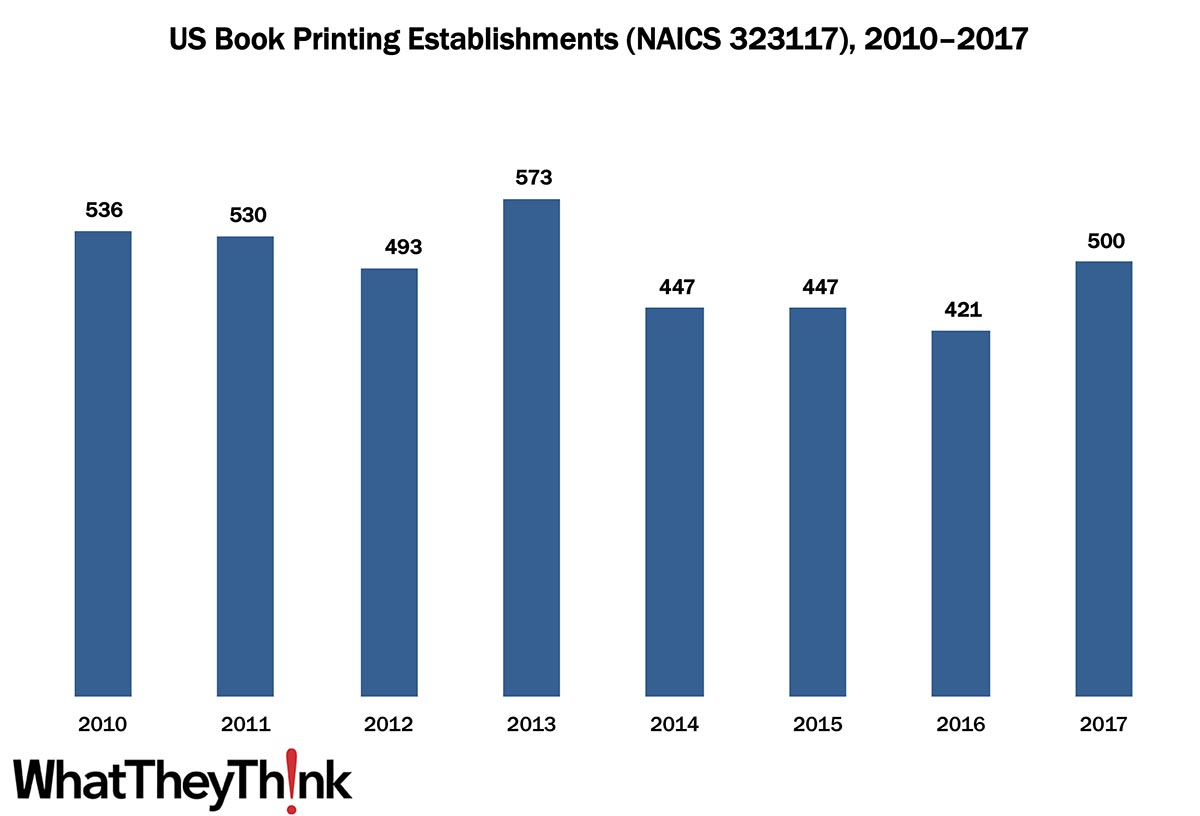

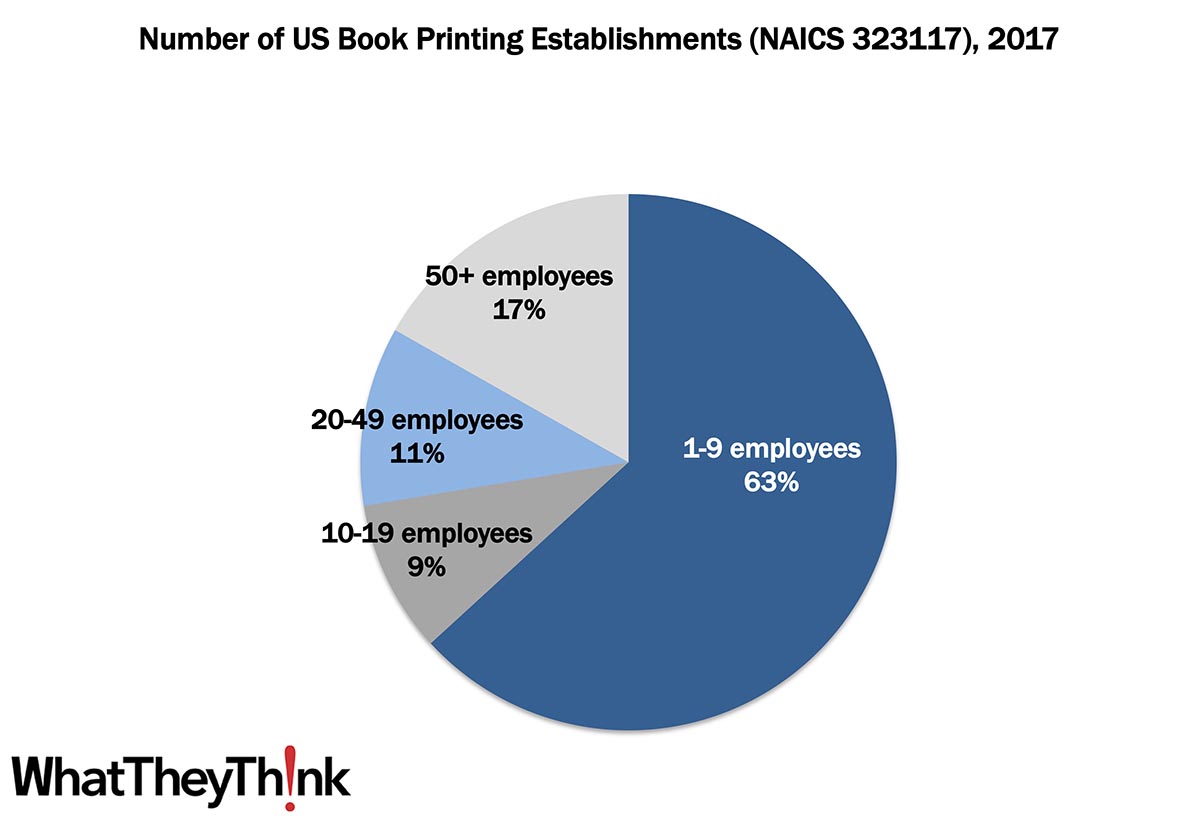

Book Printing Establishments—2010–2021

Published: October 20, 2023

According to the latest, recently released edition of County Business Patterns, in 2021 there were 370 establishments in NAICS 323117 (Commercial Book Printing). This represents a decrease of 31% since 2010—but a decrease of -2.4% from 2020. In macro news, AIA’s Architecture Billings Index (ABI) indicates that demand for design services decelerated in September, boding ill for commercial real estate construction and thus signage projects. Full Analysis

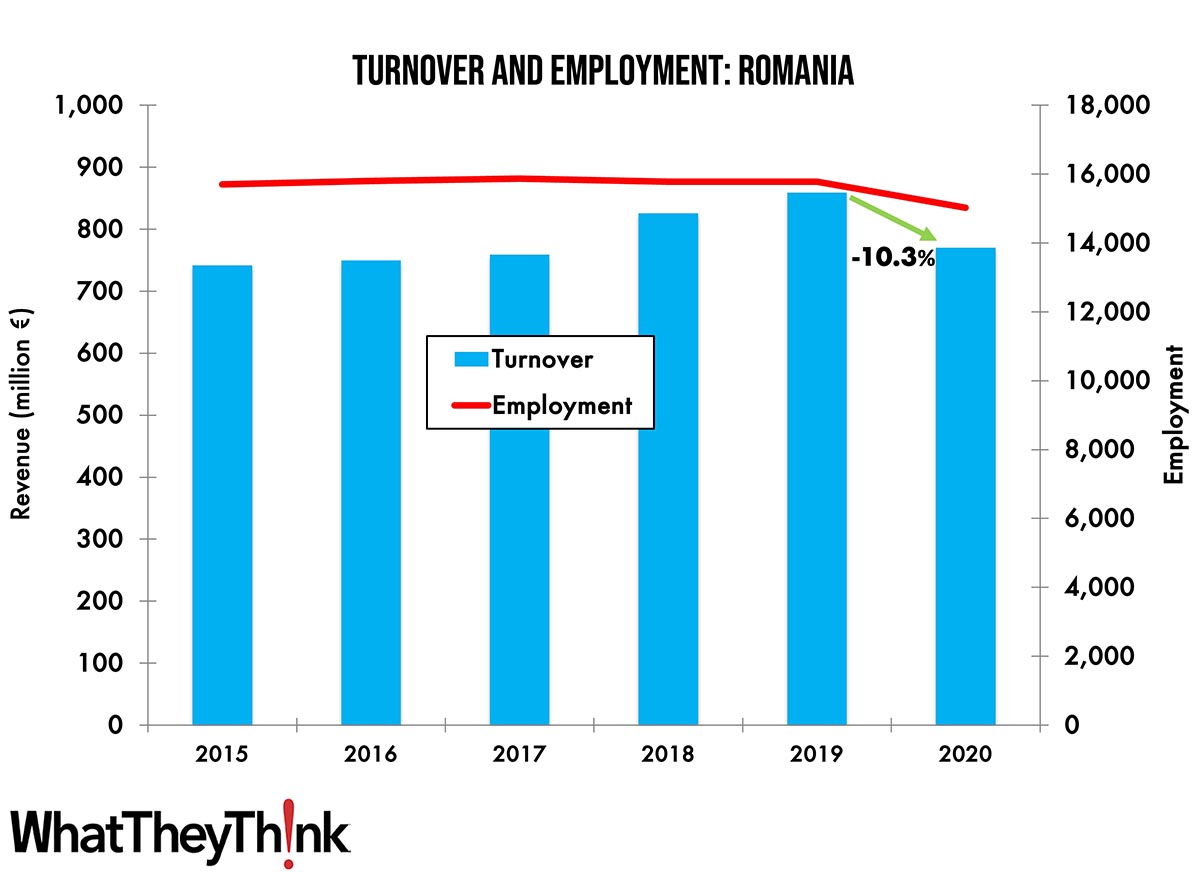

Turnover and Employment in Print in Europe—Romania

Published: October 17, 2023

This bi-weekly series of short articles aims to shed a spotlight on the size of the printing industry in Europe per country and how revenues and employment developed in 2020, when the pandemic impacted businesses. This time we look at Romania, the fourth-largest printing industry by turnover in Central and Eastern Europe. Full Analysis

Q2 Industry Profits: The Latest From the Two Cities

Published: October 13, 2023

Quarter-over-quarter profit margin data can be fairly noisy but we’re on a general upward trend since the trough of the pandemic. Full Analysis

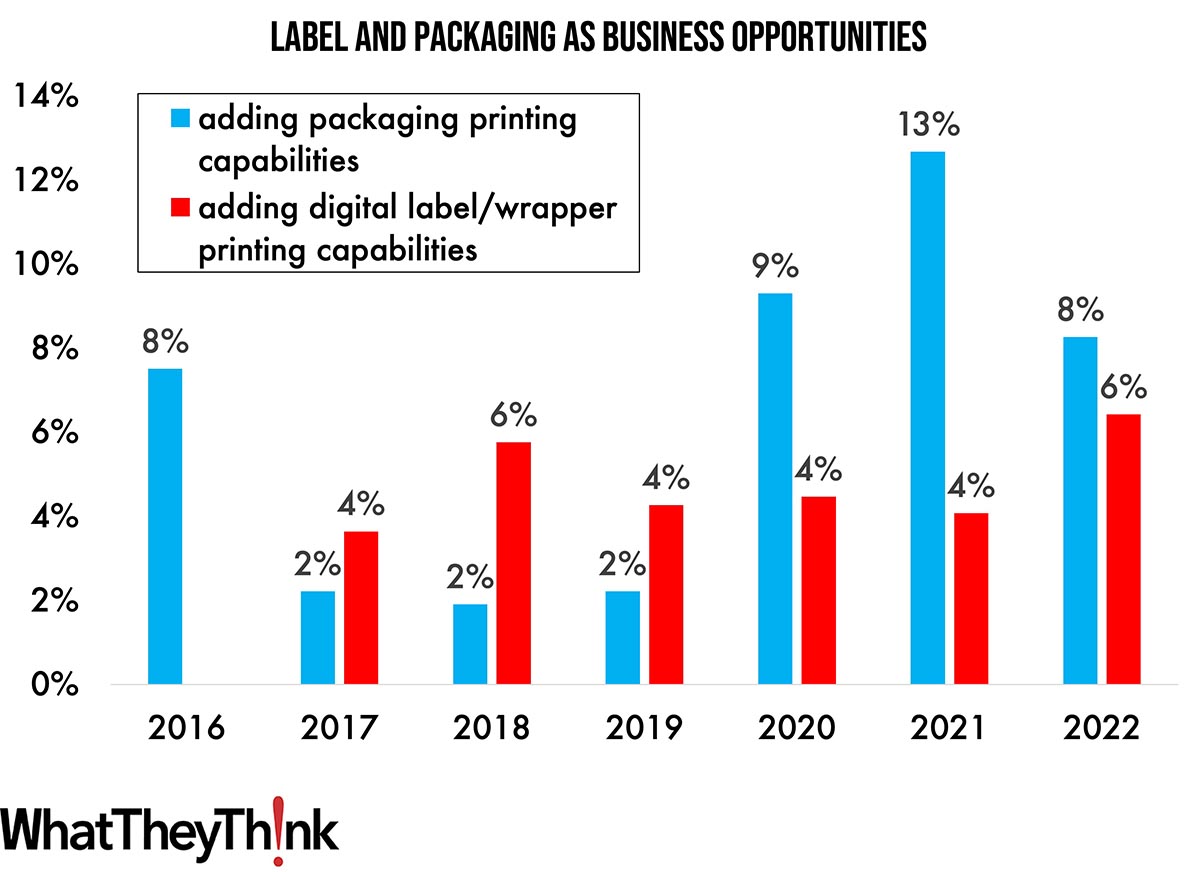

Tales from the Database: A Complete Package?

Published: October 6, 2023

Drawing on six years’ worth of Print Business Outlook surveys, our “Tales from the Database” series looks at historical data to see if we can spot any particular hardware, software or business trends. In this installment, we turn our attention to labels and packaging. Full Analysis

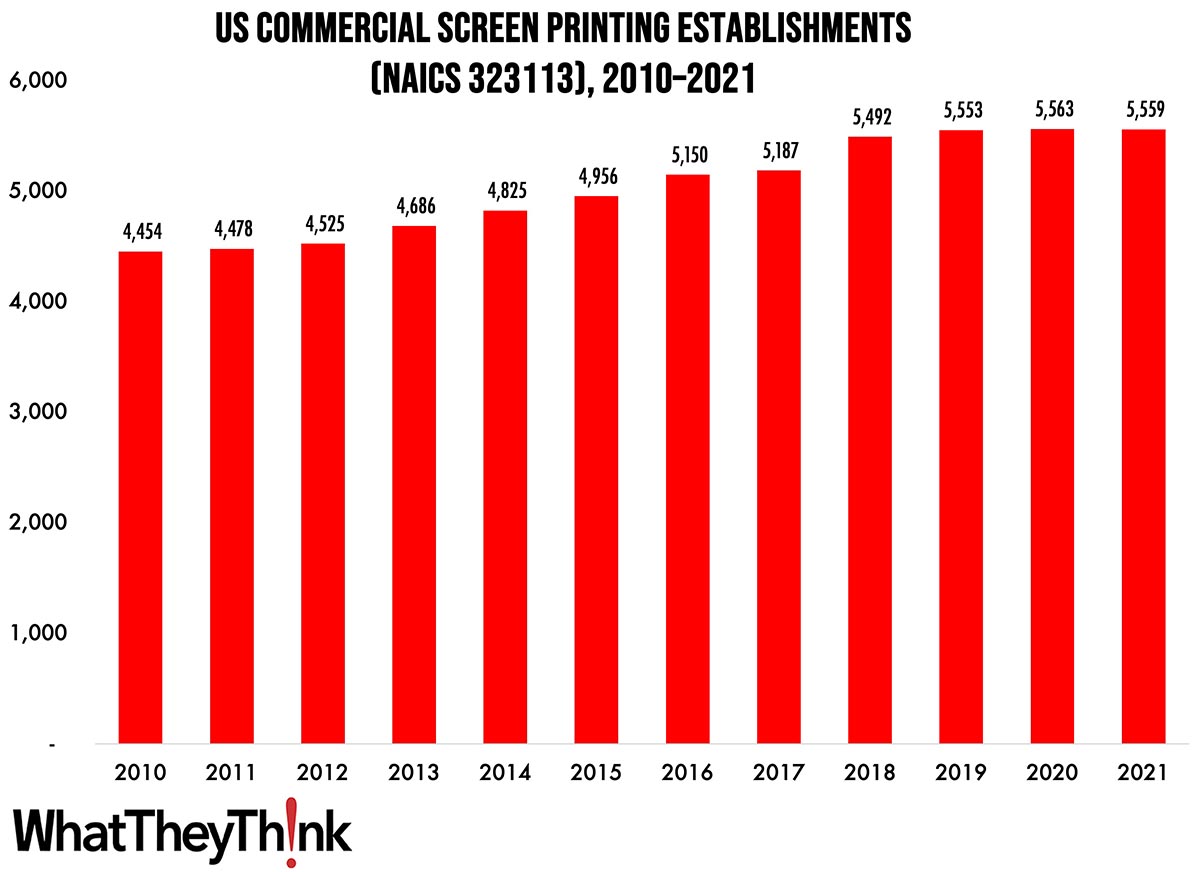

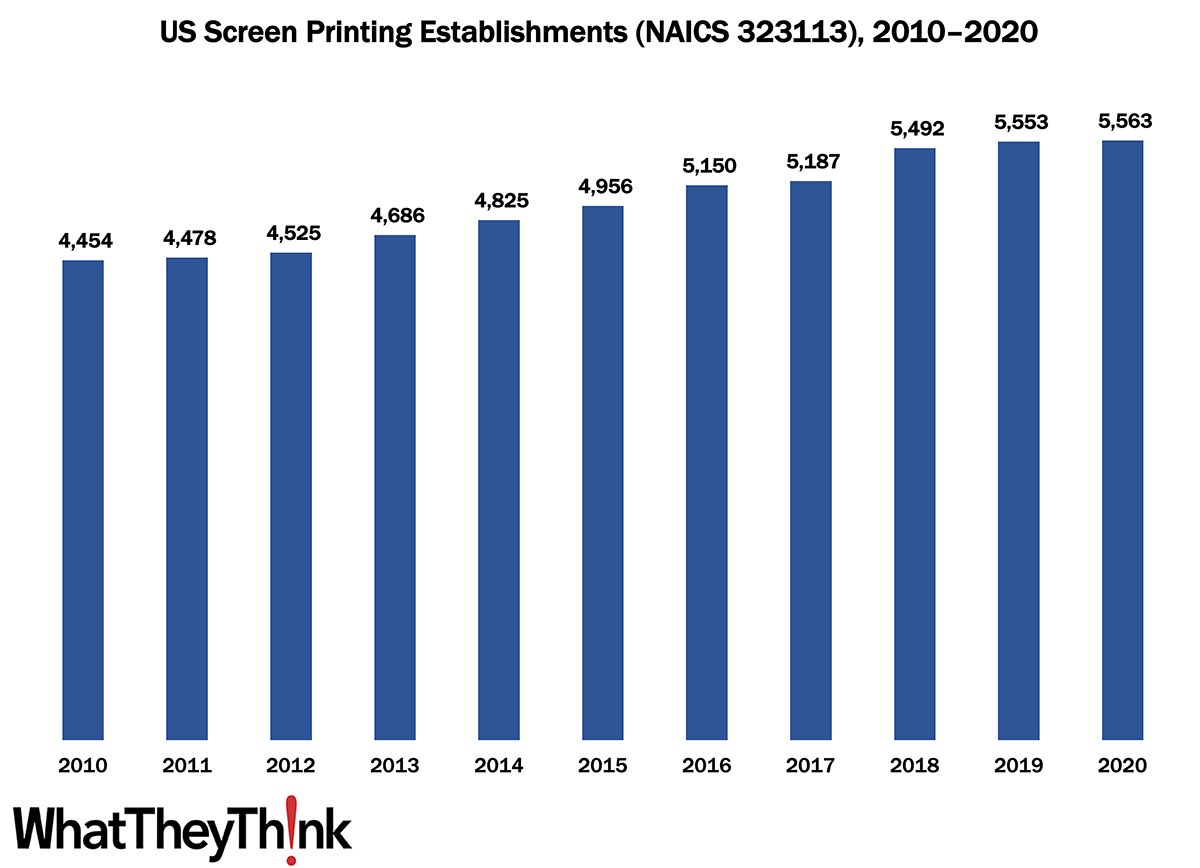

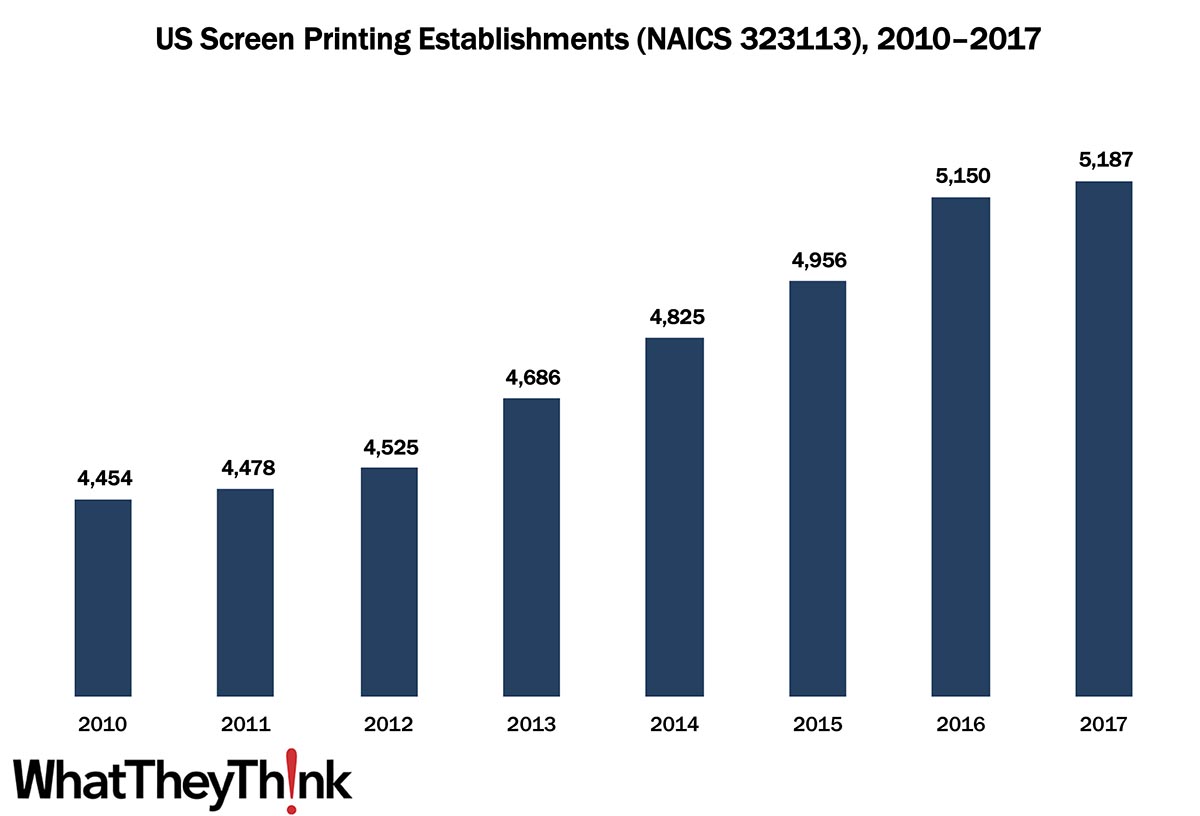

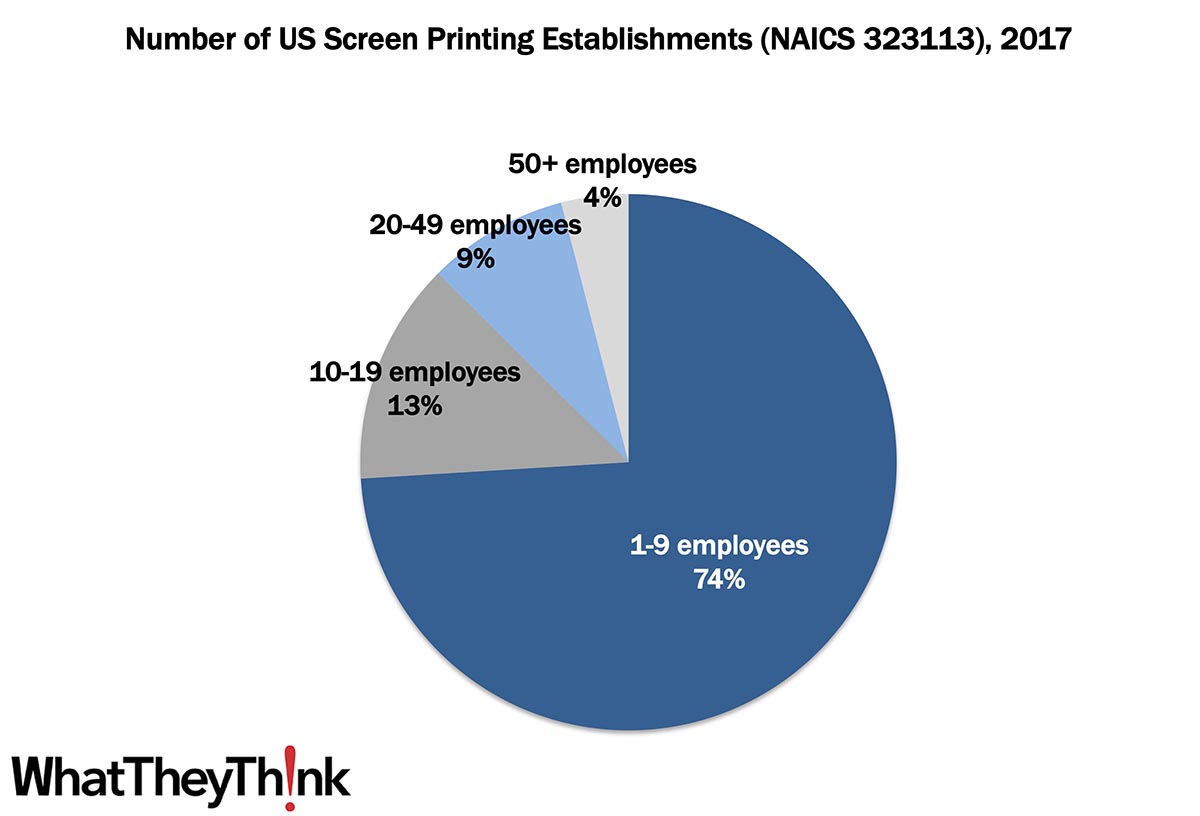

Screen Printing Establishments—2010–2020

Published: September 29, 2023

According to the latest, recently released edition of County Business Patterns, in 2021 there were 5,559 establishments in NAICS 323113 (Commercial Screen Printing). This represents an increase of 25% since 2010—but a decrease of -0.1% from 2020. In macro news, the third estimate of Q2 GDP is unchanged, but with some subtle changes “under the hood.” Full Analysis

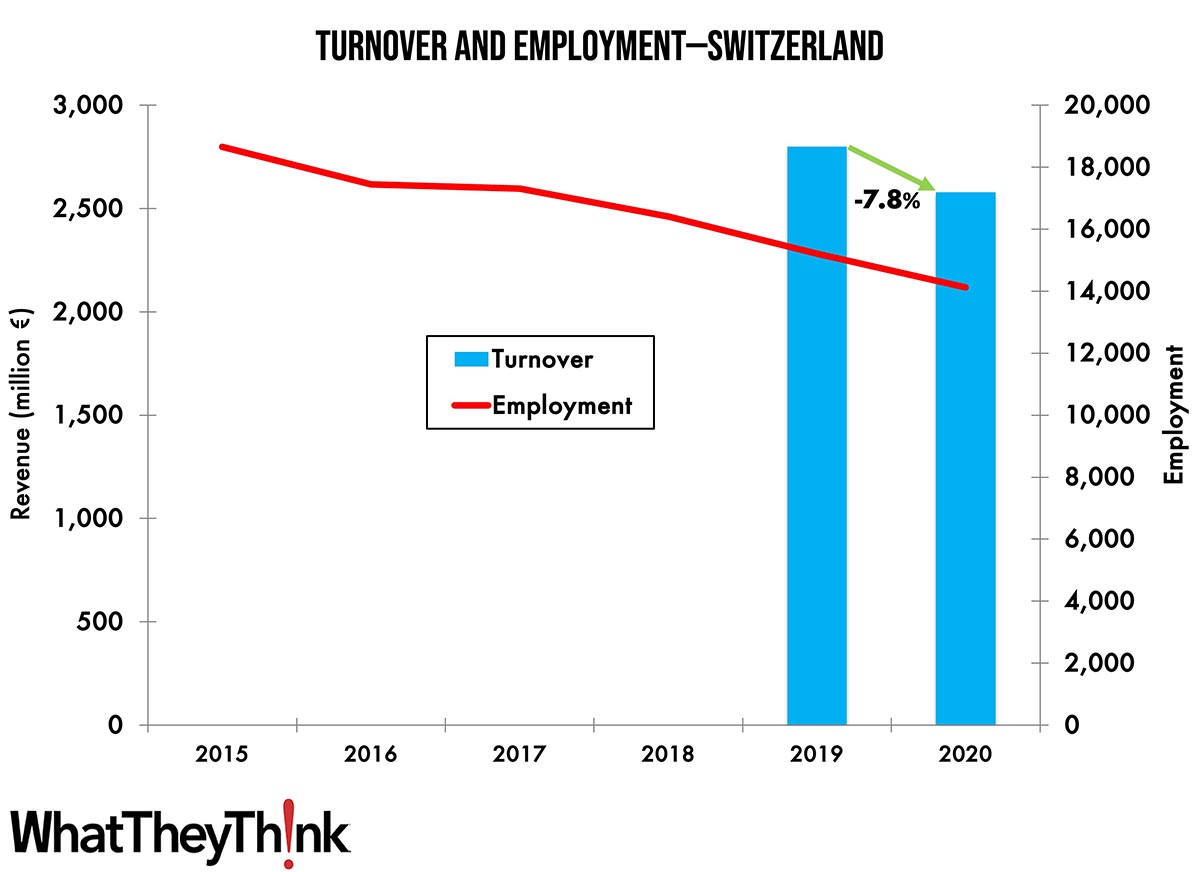

Turnover and Employment in Print in Europe—Switzerland

Published: September 27, 2023

This bi-weekly series of short articles aims to shed a spotlight on the size of the printing industry in Europe per country and how revenues and employment developed in 2020, when the pandemic impacted businesses. This time we look at Switzerland, the eighth-largest printing industry by turnover in Europe. Full Analysis

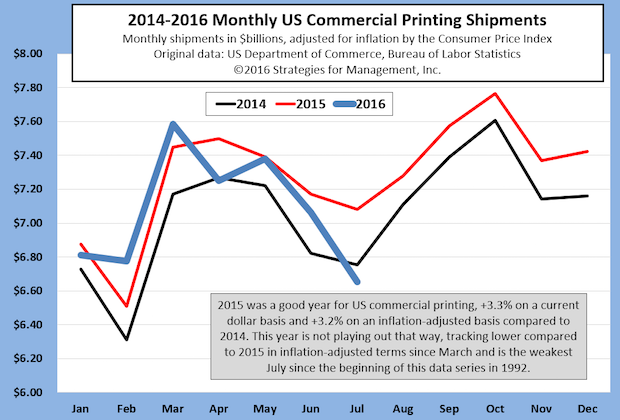

July Shipments: Down, Down We Go

Published: September 22, 2023

In a year that continues to surprise, July 2023 printing shipments came in at $7.04 billion, down from June’s $7.40 billion. Full Analysis

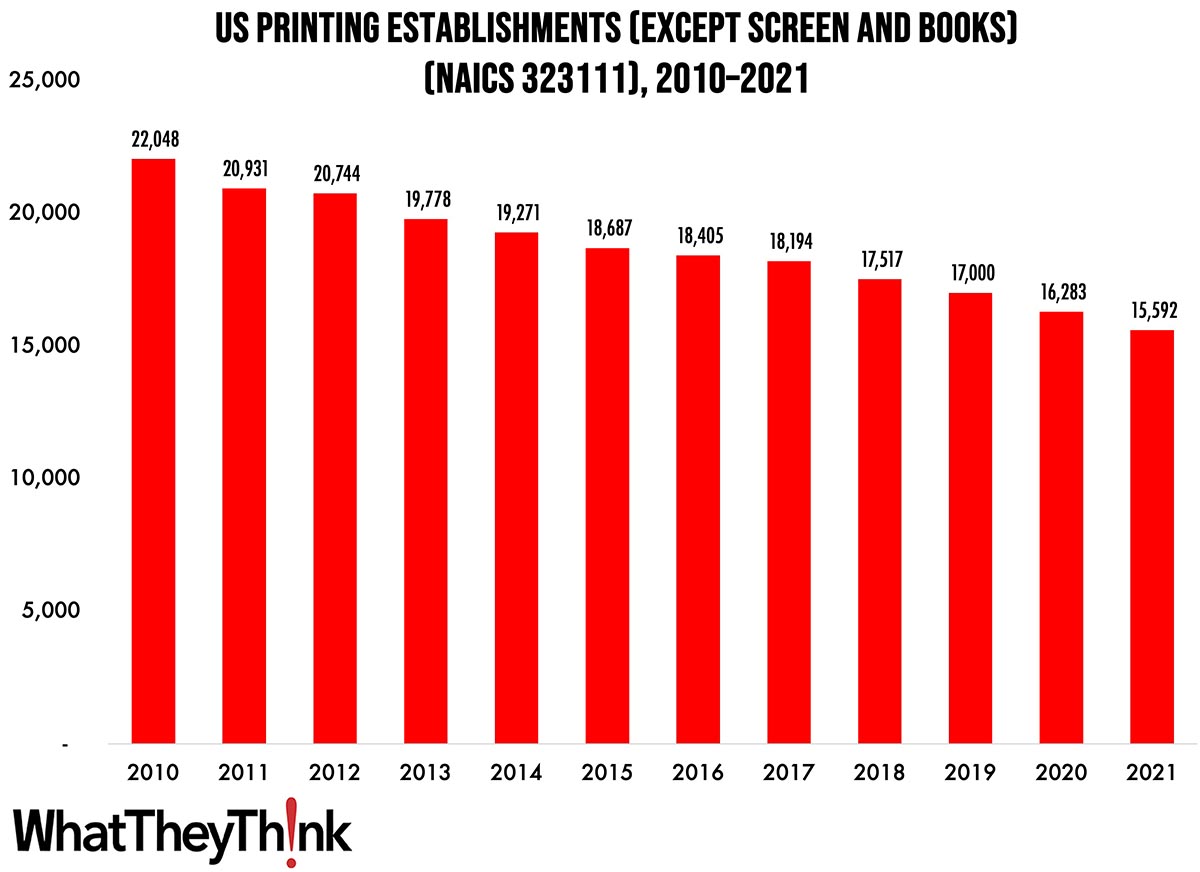

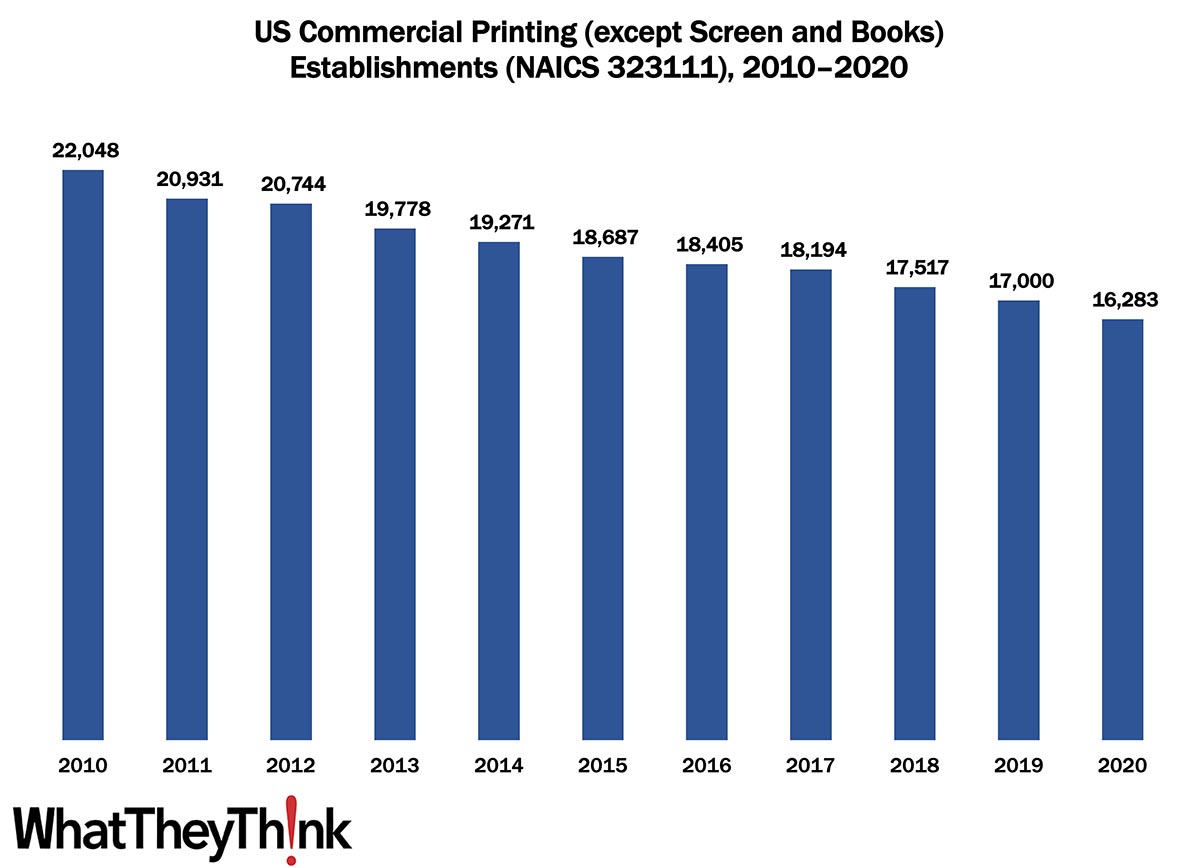

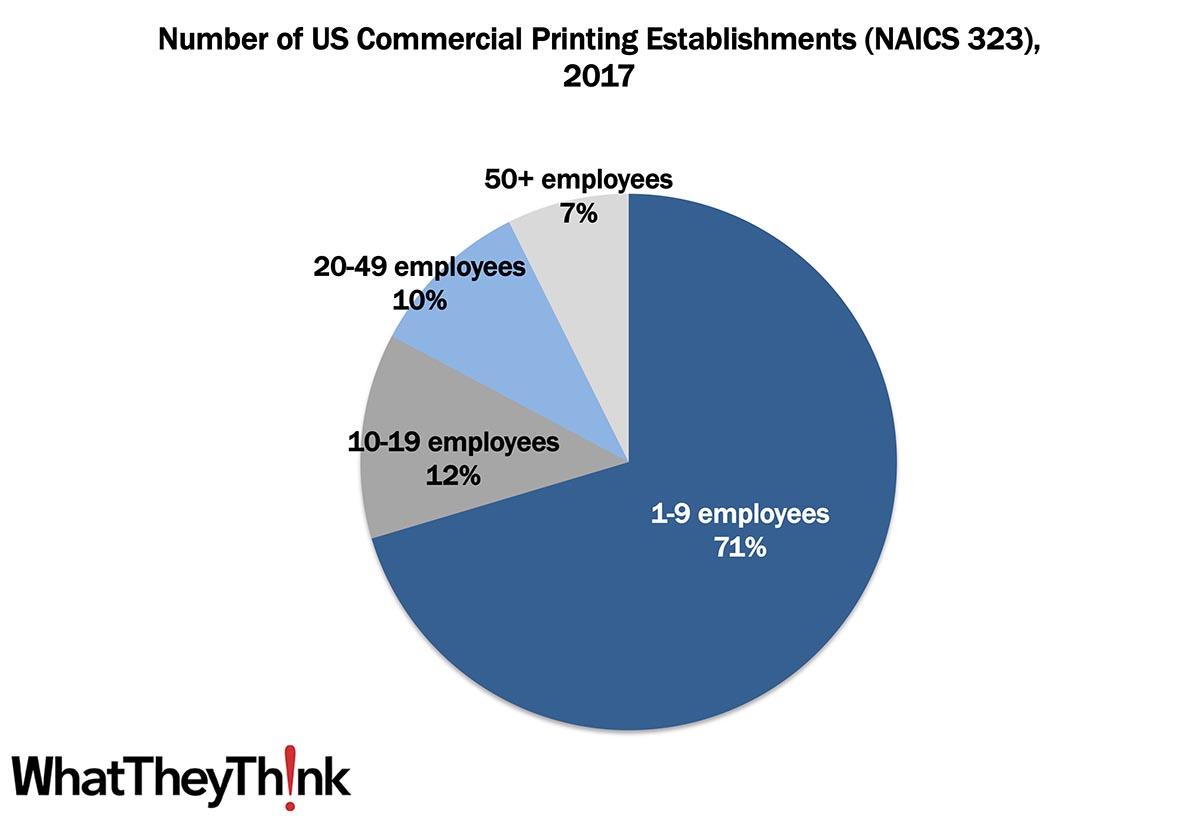

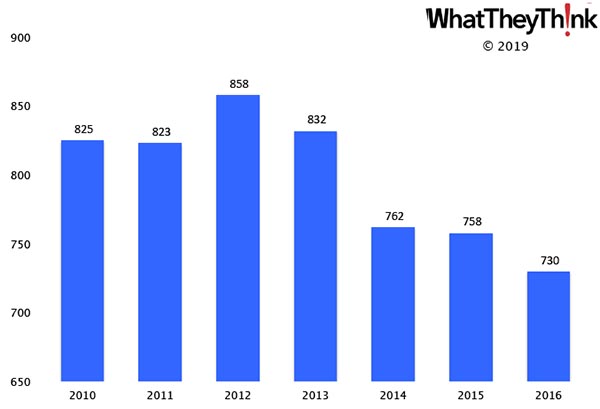

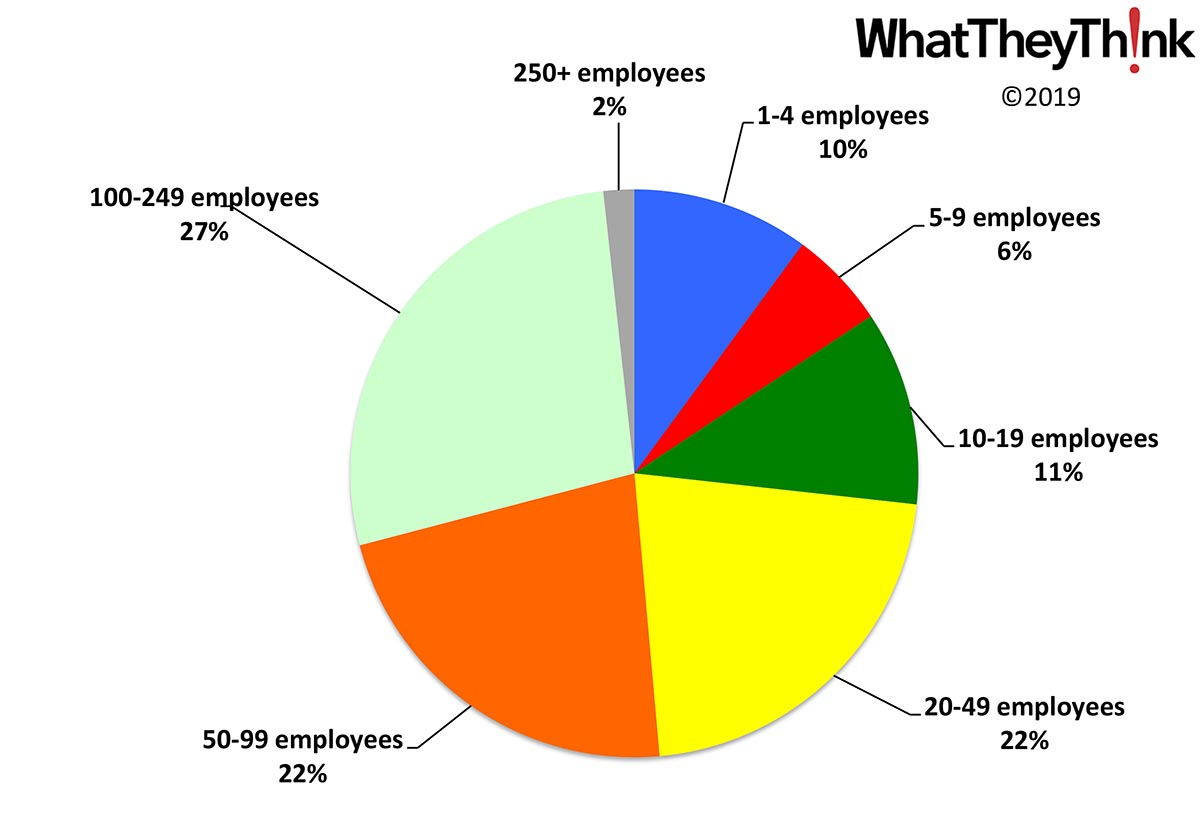

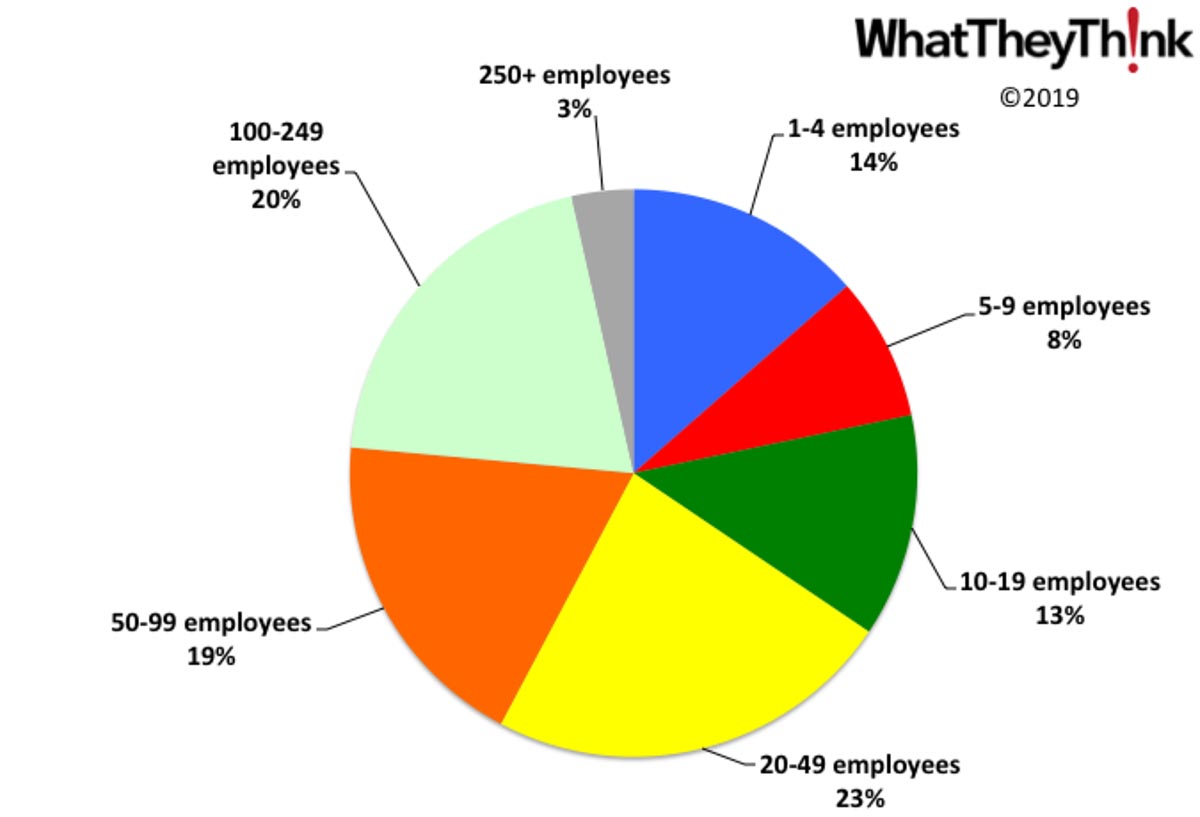

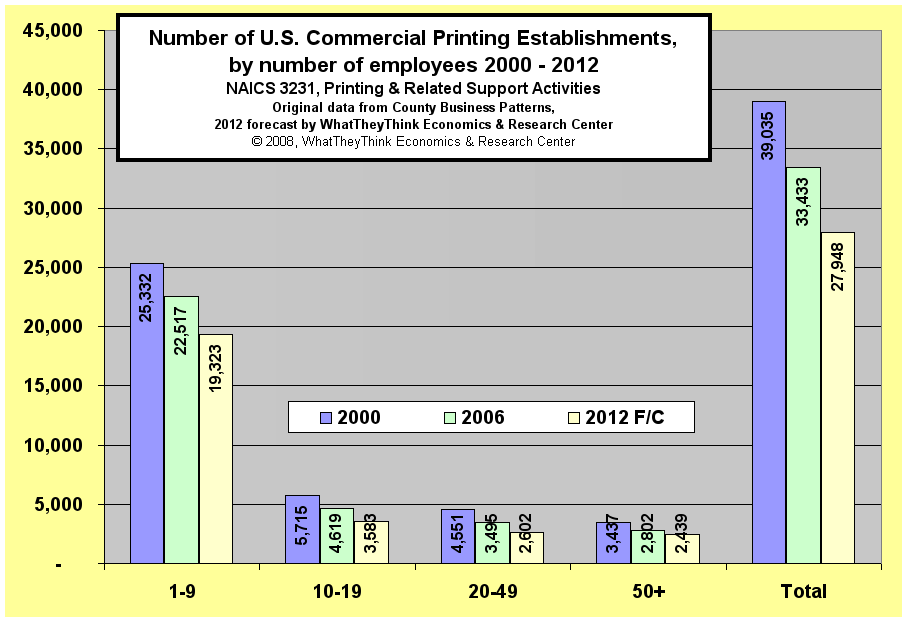

Commercial Printing Establishments—2010–2021

Published: September 15, 2023

According to the latest, recently released edition of County Business Patterns, in 2021 there were 15,592 establishments in NAICS 323111 (Commercial Printing except Screen and Books). This represents a decline of 26% since 2010. In macro news, inflation is alas up. Full Analysis

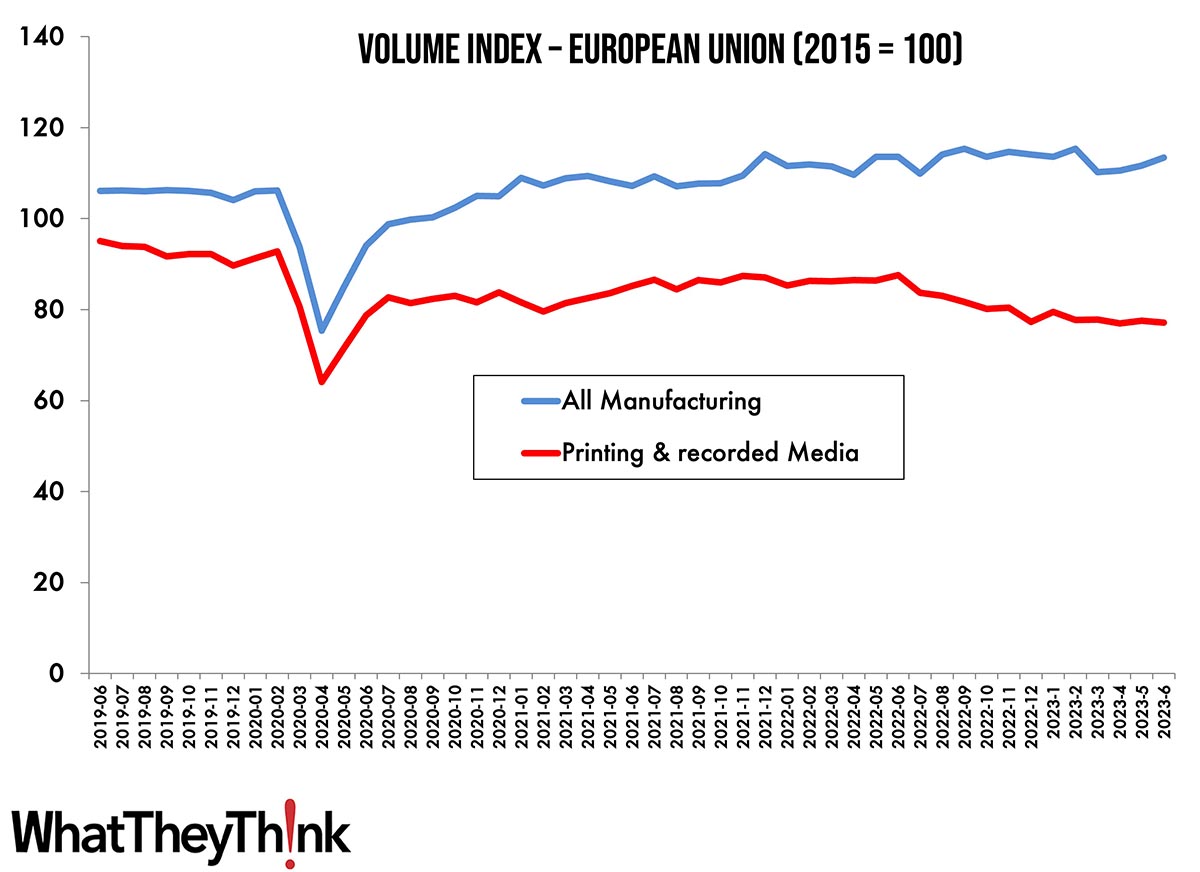

European Print Volume Trends

Published: September 12, 2023

European section editor Ralf Schlözer takes a break from the Europen country-by-country look at turnover and employment to provide a bigger-picture look at print volumes in Europe pre- and post-pandemic. Full Analysis

August Printing Production Employment Basically Flat

Published: September 8, 2023

Overall printing employment in August 2023 was down 0.2% from July. Production employment was down 0.3% while non-production employment was up 0.2%. Full Analysis

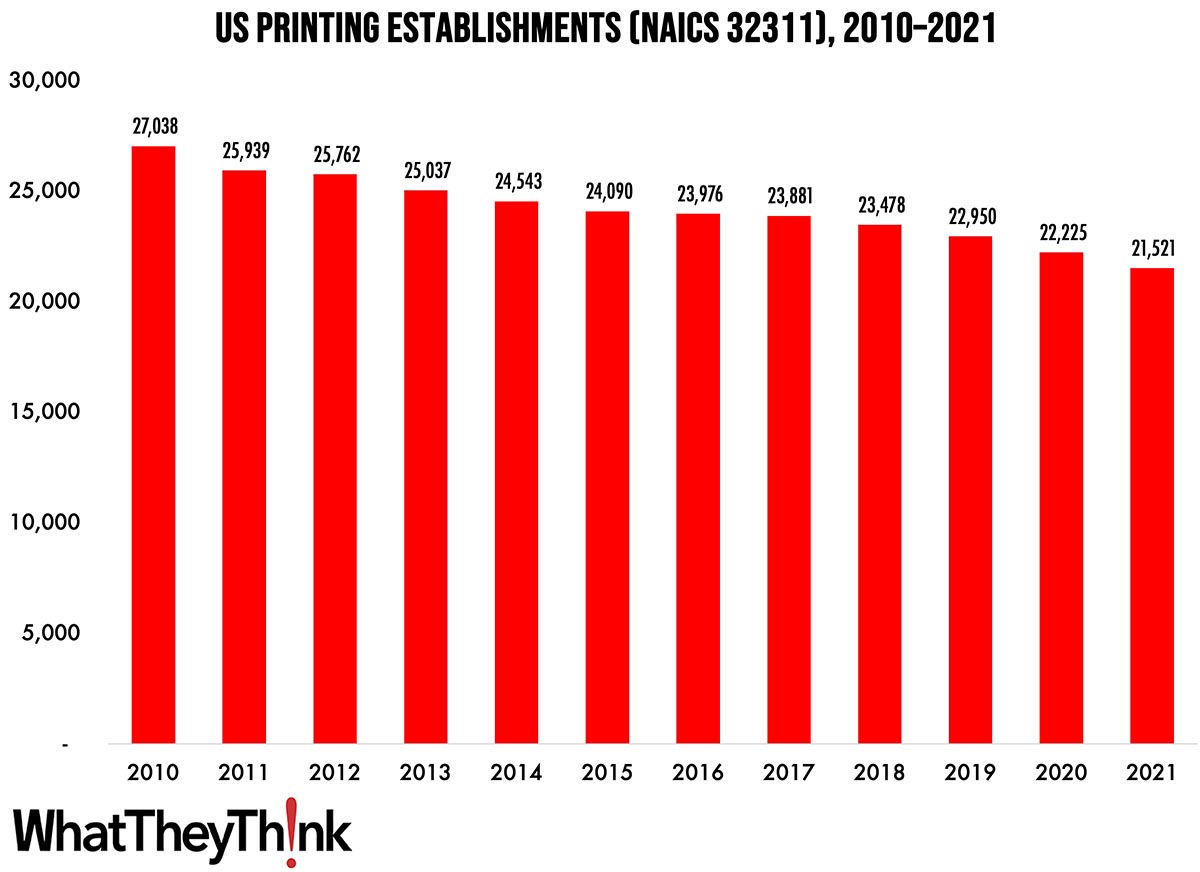

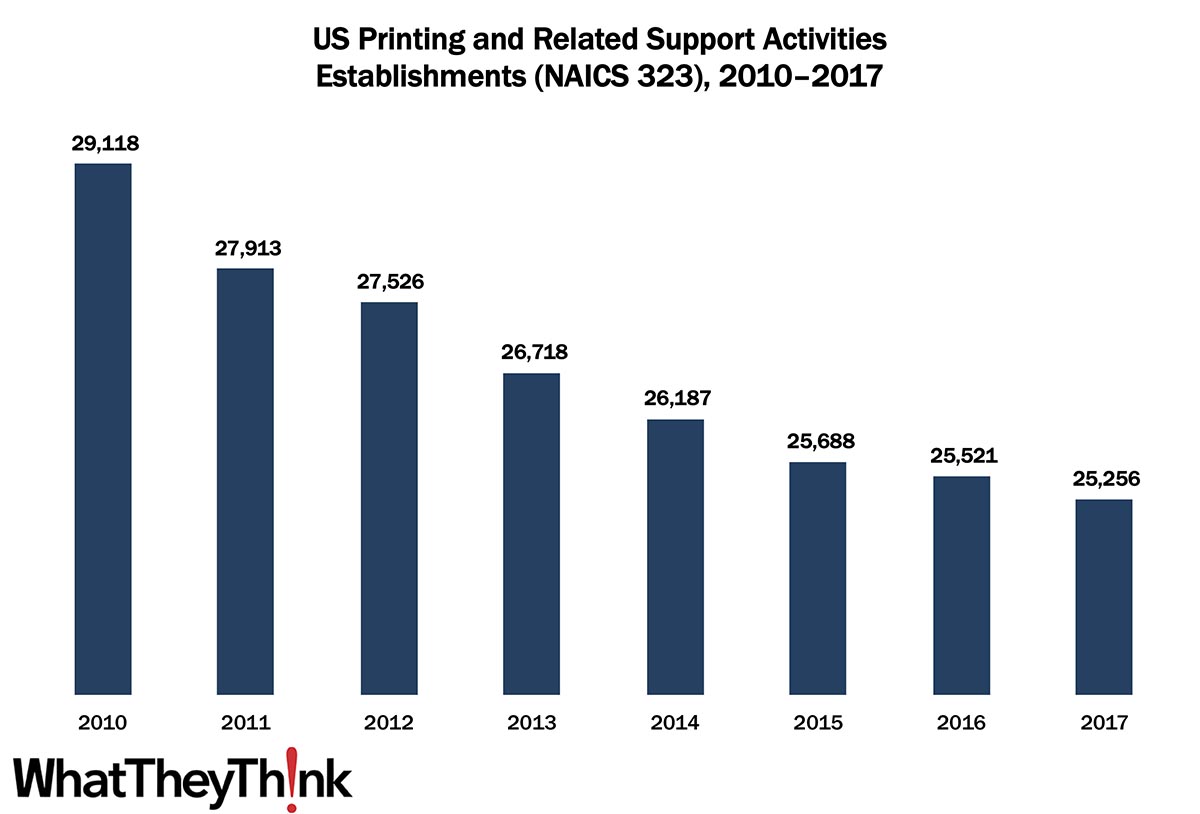

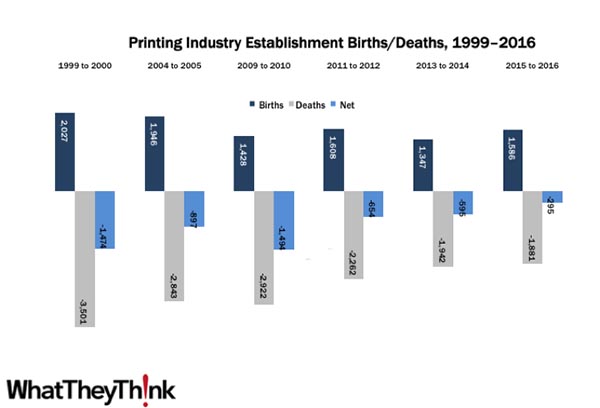

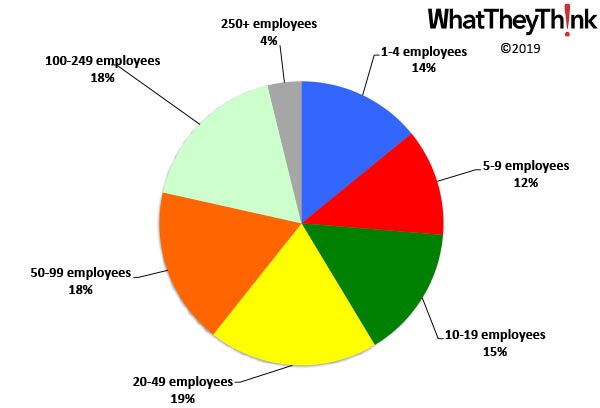

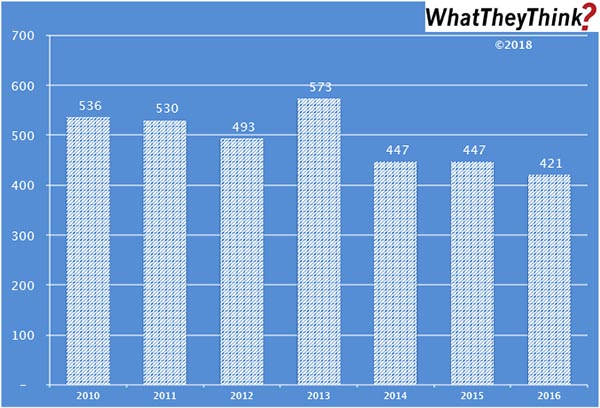

Printing Establishments—2010–2021

Published: September 1, 2023

According to the latest, just-released edition of County Business Patterns, in 2021 there were 21,521 establishments in NAICS 32311 (Printing). This represents a decline of 20% since 2010. In macro news, Q2 GDP revised downward. Full Analysis

June Shipments: Up, Up, and Away

Published: August 25, 2023

In a year that continues to surprise, June 2023 printing shipments came in at $7.38 billion, up from May’s $7.26 billion. Full Analysis

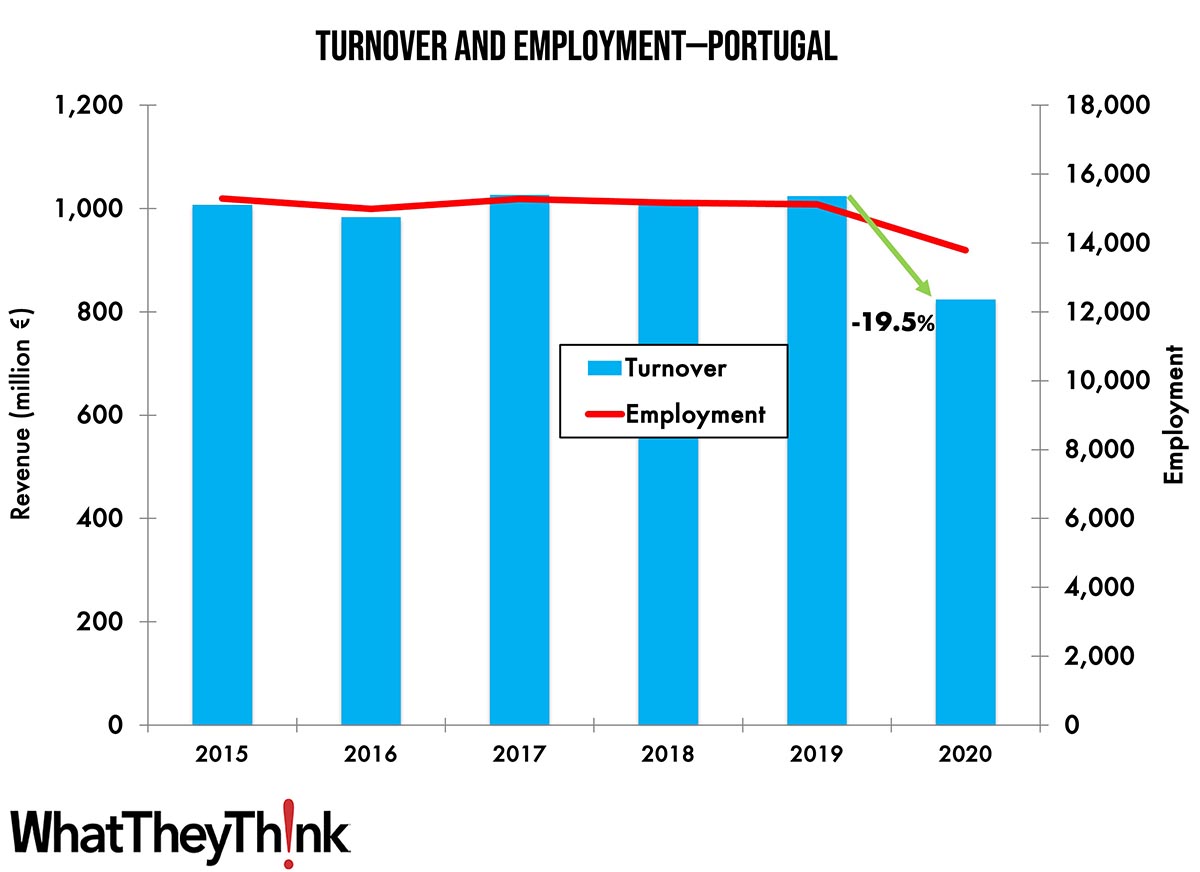

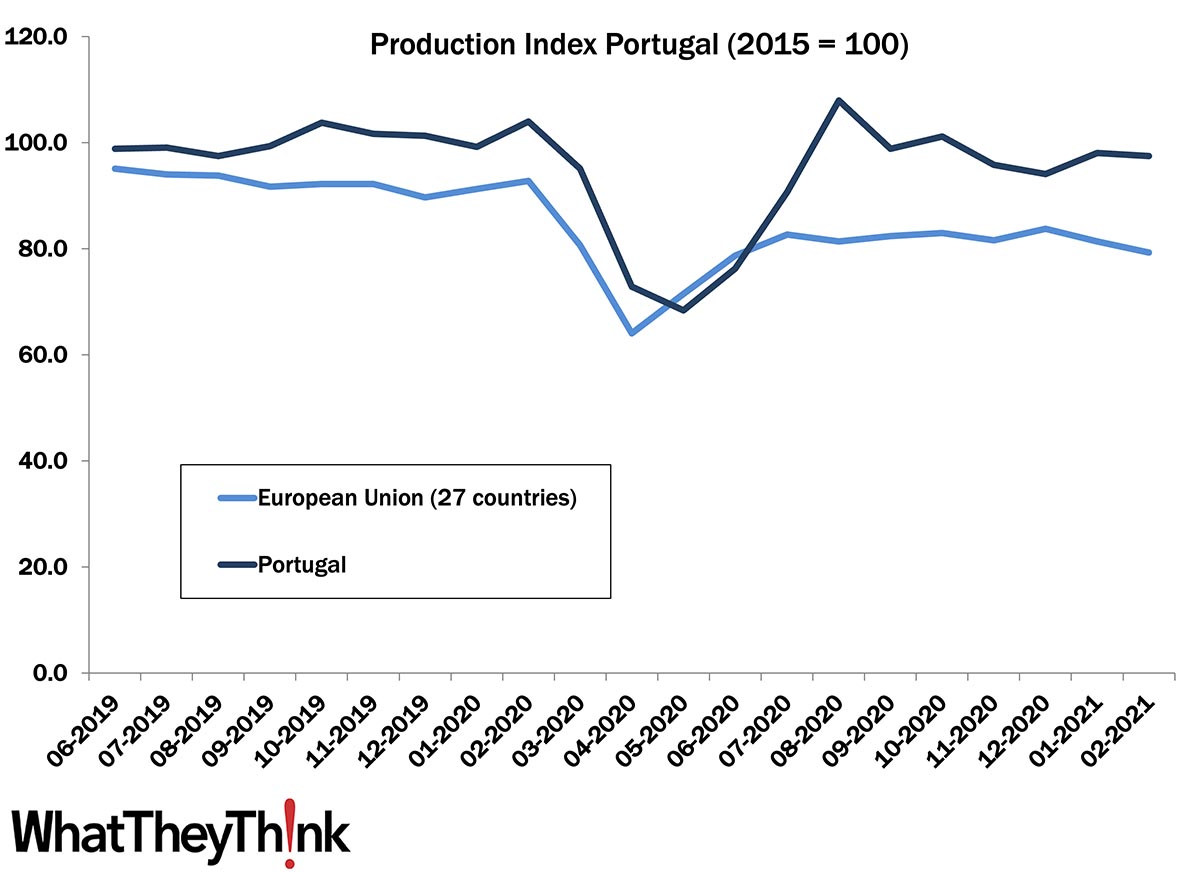

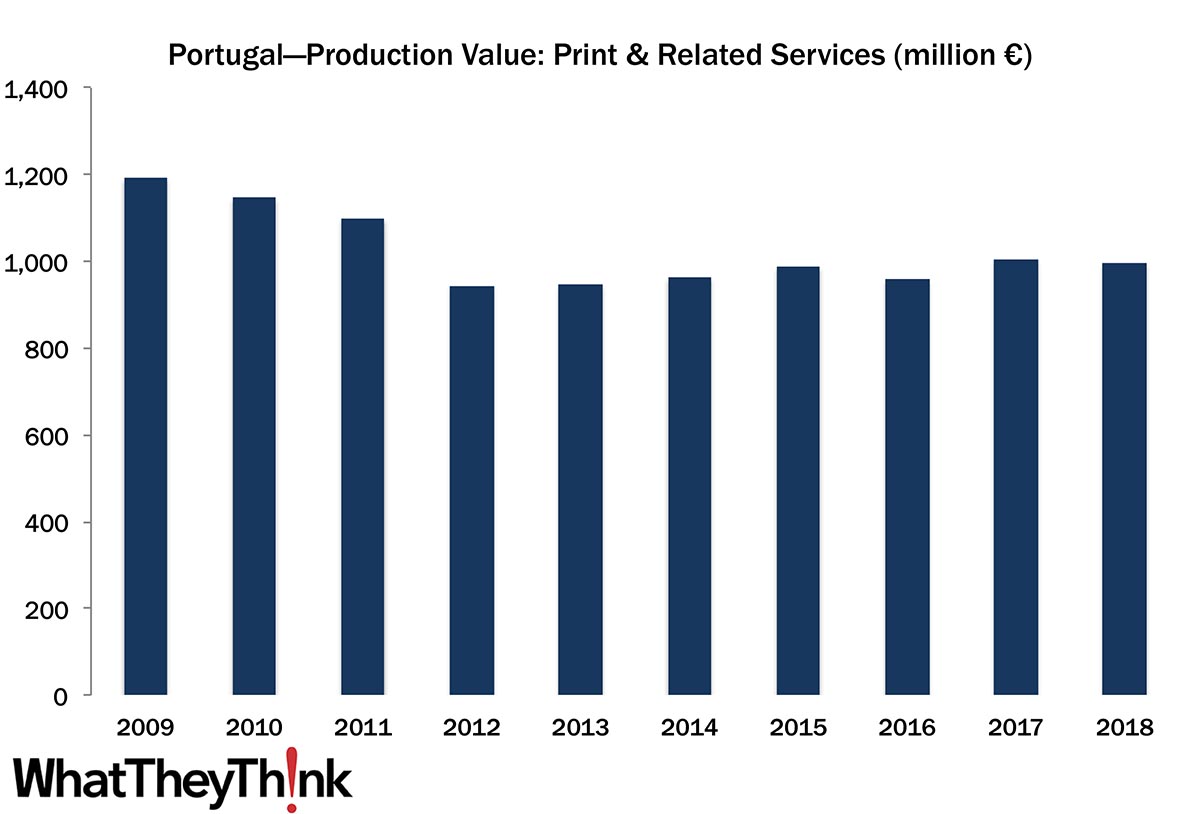

Turnover and Employment in Print in Europe—Portugal

Published: August 21, 2023

This bi-weekly series of articles aims at shedding a spotlight on the size of the printing industry in Europe per country and how revenues and employment developed in 2020, when the pandemic impacted businesses. This time we look at Portugal, the 15th-largest printing industry by turnover in Europe. Full Analysis

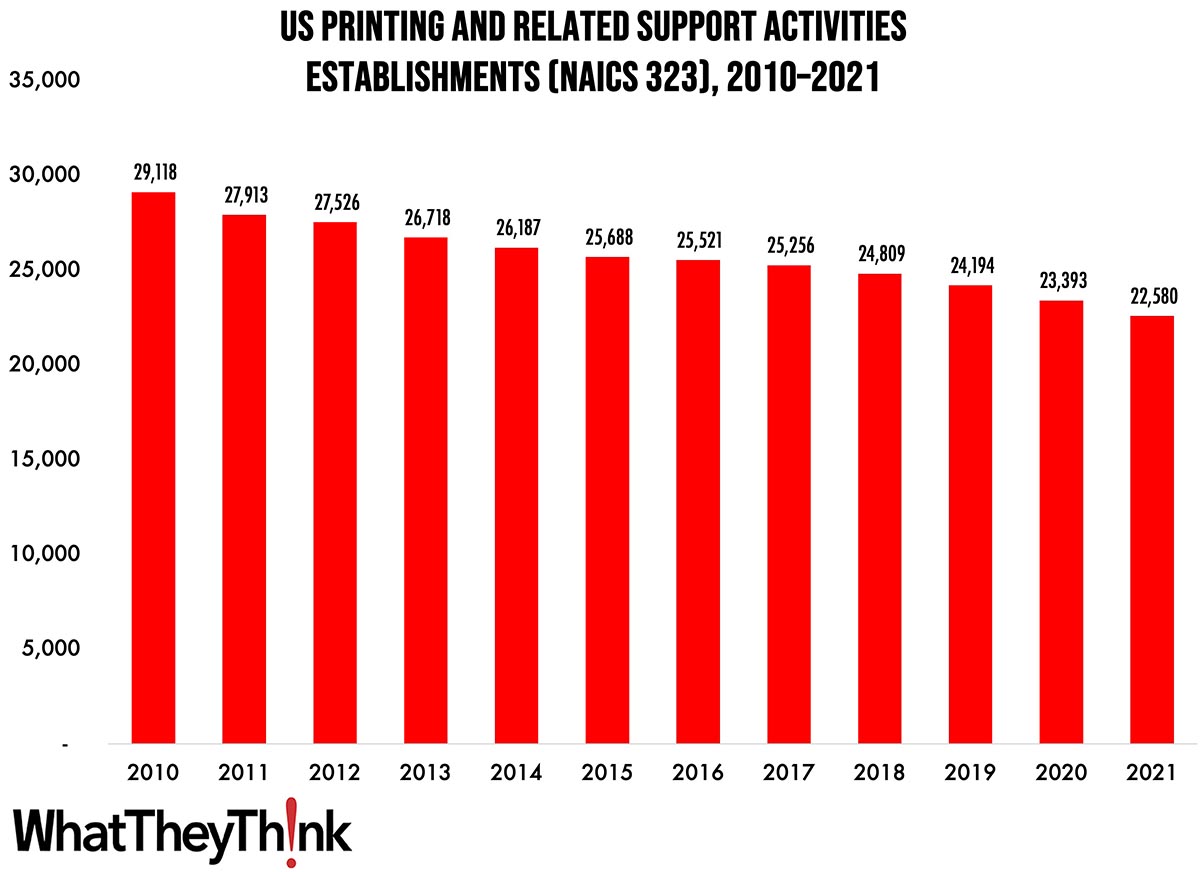

Printing Establishments—2010–2021

Published: August 18, 2023

According to the latest, just-released edition of County Business Patterns, in 2021 there were 22,580 establishments in NAICS 323 (Printing and Related Support Activities). This represents a decline of 22% since 2010. In macro news, July retail sales came in above expectations. Full Analysis

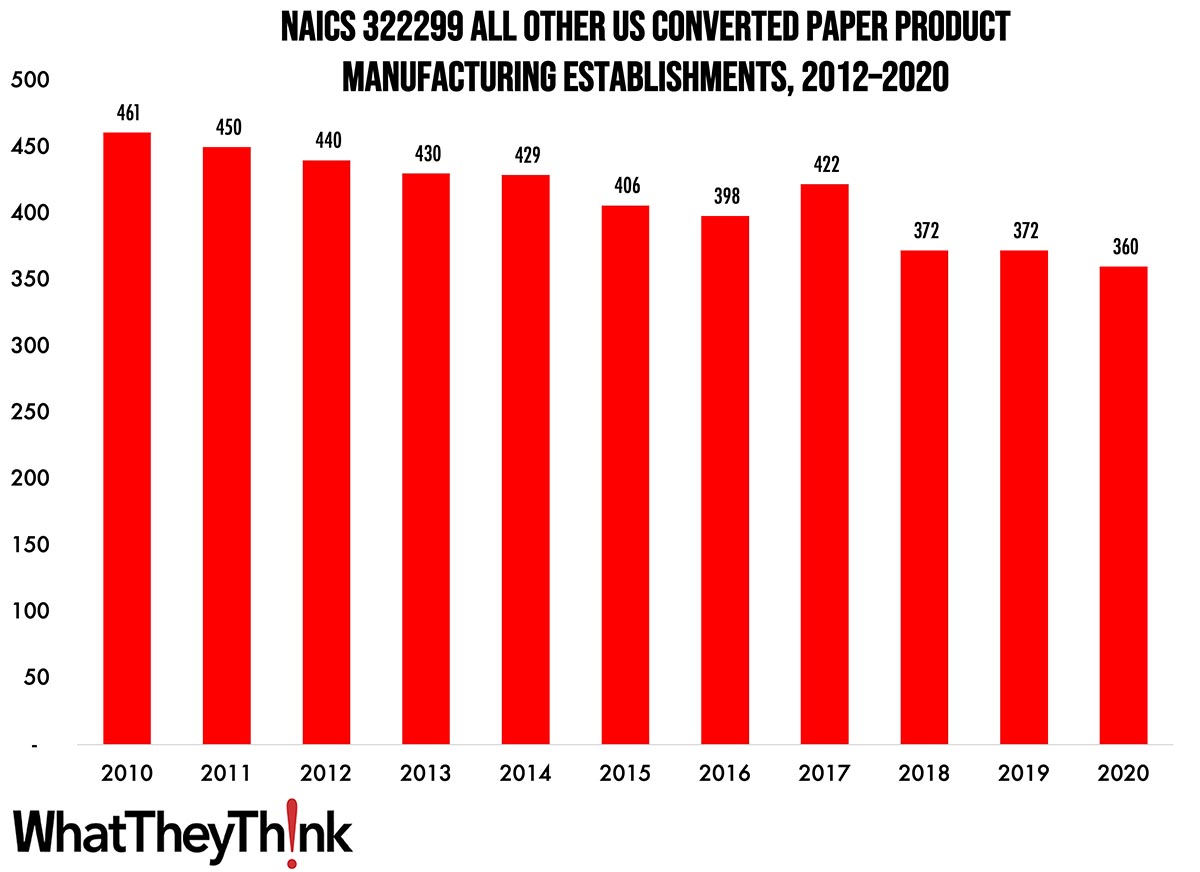

All Other Converted Paper Product Manufacturing Establishments—2010–2020

Published: August 4, 2023

According to County Business Patterns, in 2020 there were 360 establishments in NAICS 322299 (All Other Converted Paper Product Manufacturing). This category saw a net decrease in establishments of -22% since 2010. In macro news, Q2 GDP is up. Full Analysis

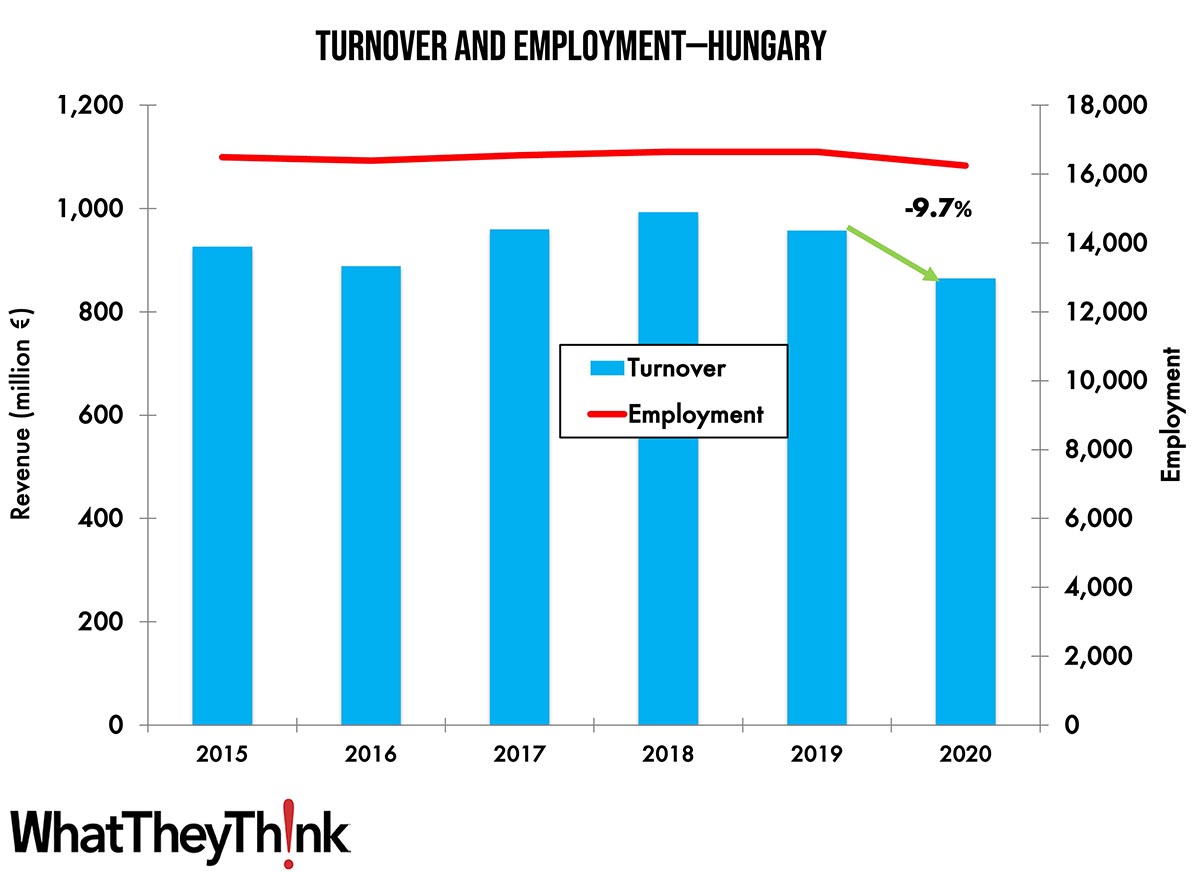

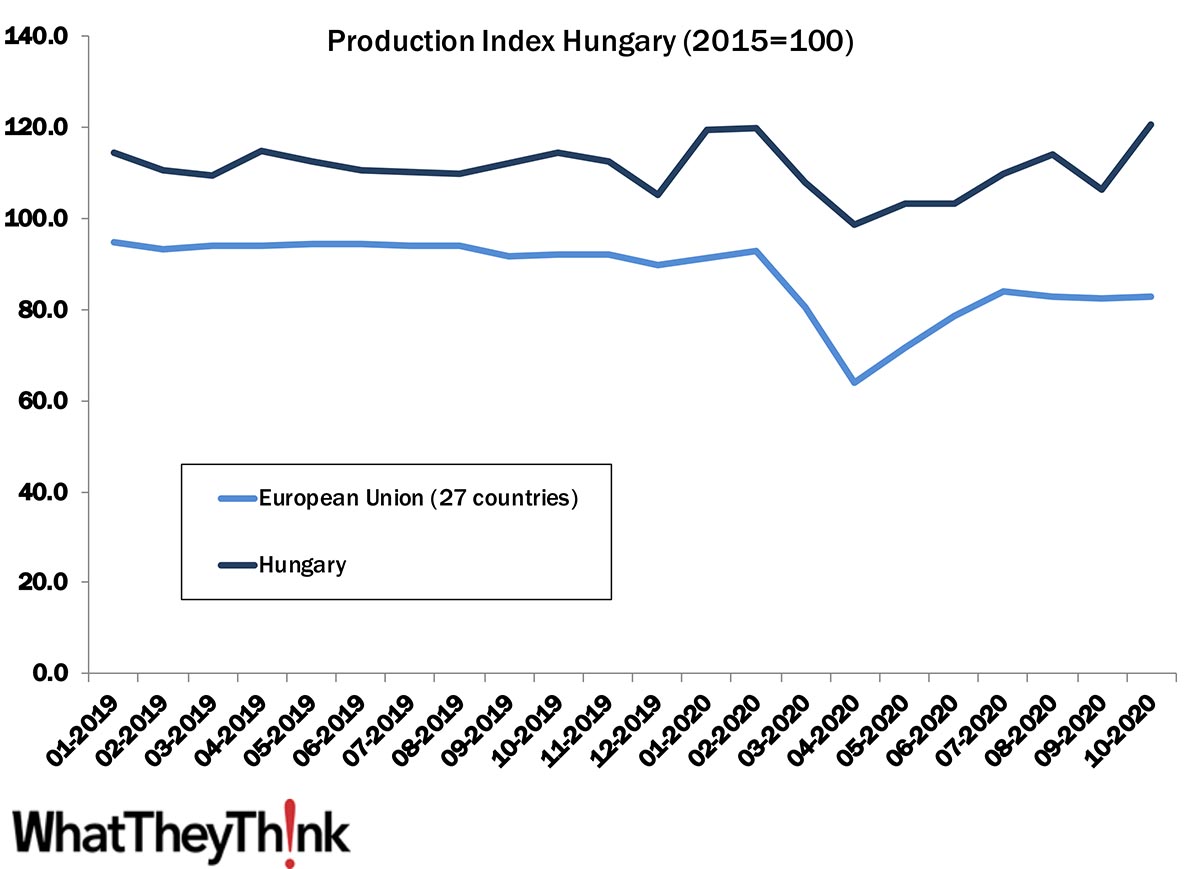

Turnover and Employment in Print in Europe—Hungary

Published: August 1, 2023

This series of short articles aims at shedding a spotlight on the size of the printing industry in Europe per country and how revenues and employment developed in 2020, when the pandemic impacted businesses. This time we look at Hungary, the 13th-largest printing industry by turnover in Europe and third largest in Central and Eastern Europe. Full Analysis

May Shipments Take an Unexpected—But Welcome—Turn

Published: July 28, 2023

May 2023 printing shipments came in at $7.26 billion, unexpectedly up from April’s $7.01 billion. Full Analysis

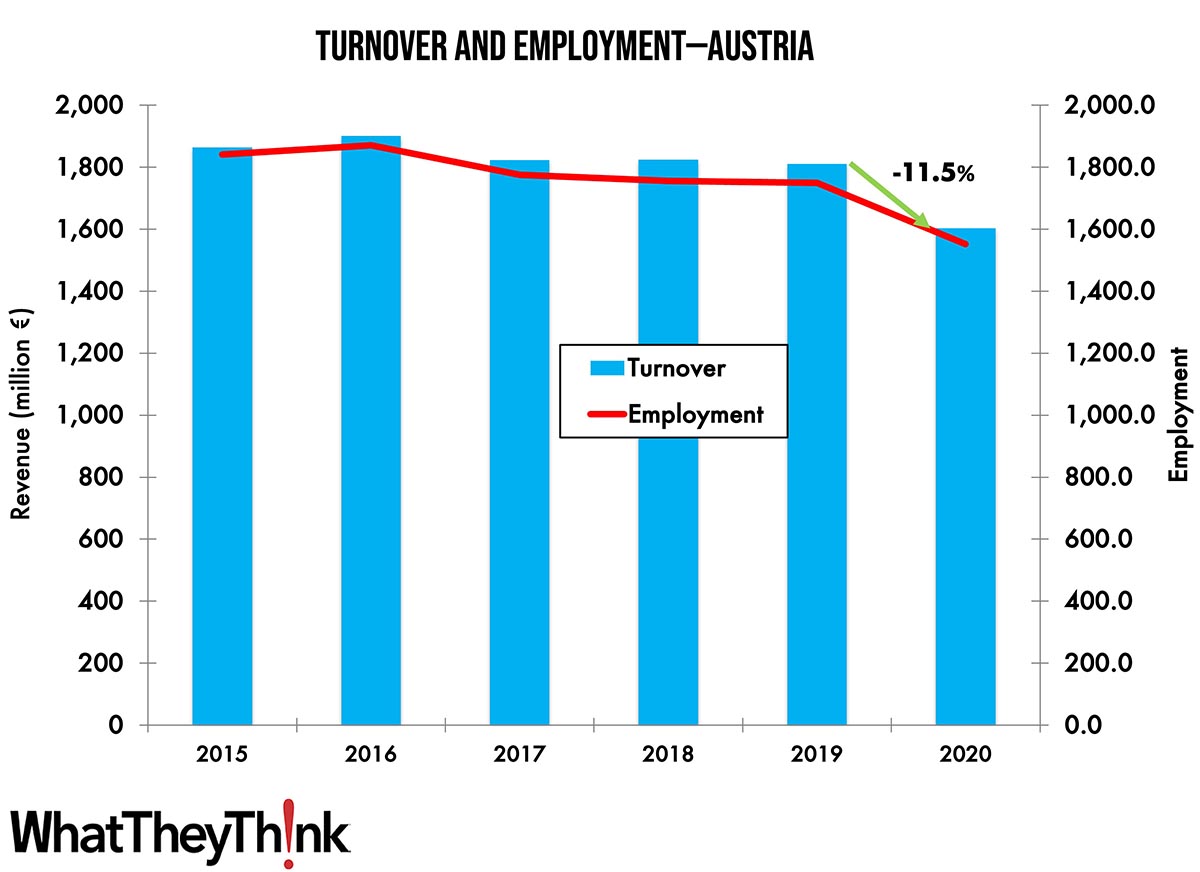

Turnover and Employment in Print in Europe—Austria

Published: July 25, 2023

This bi-weekly series of short articles aims at shedding a spotlight on the size of the printing industry in Europe per country and how revenues and employment developed in 2020, when the pandemic impacted businesses. This time we look at Austria, the tenth-largest printing industry by turnover in Europe. Full Analysis

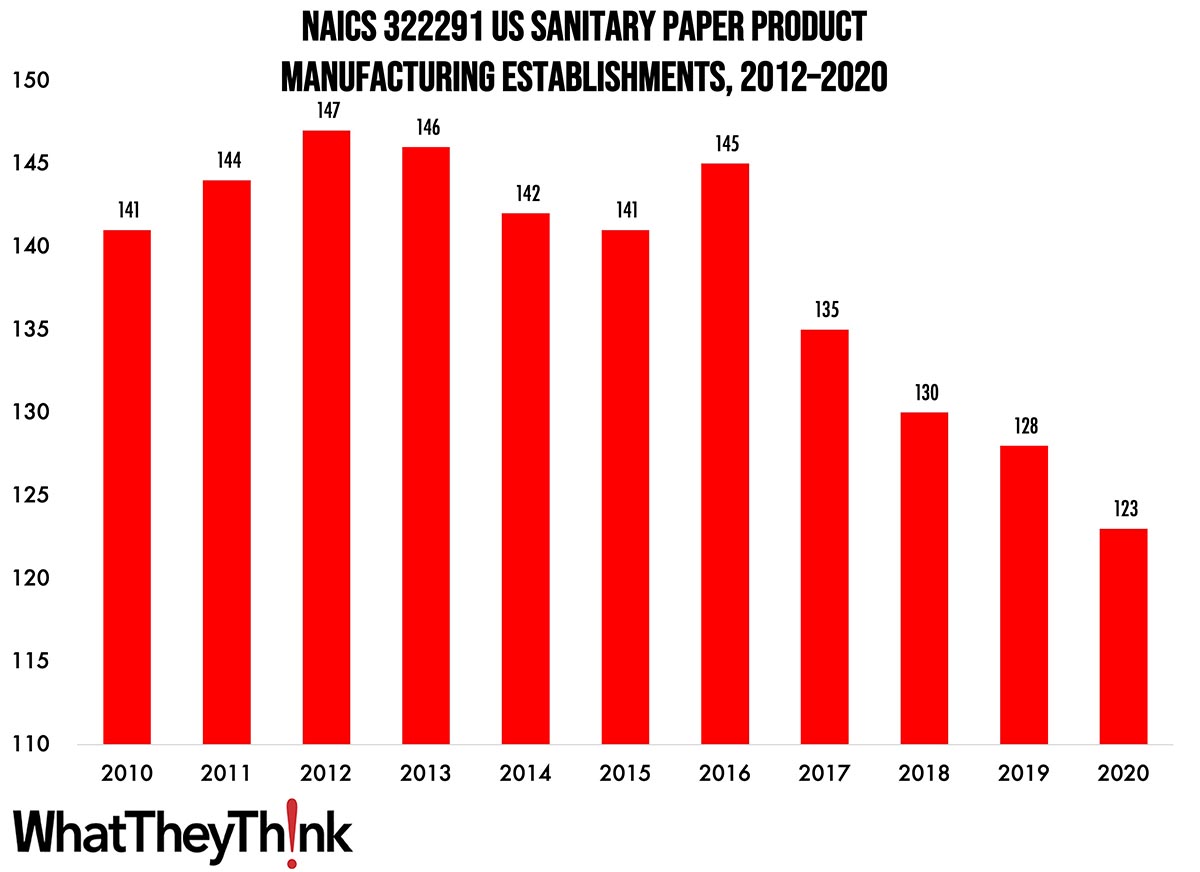

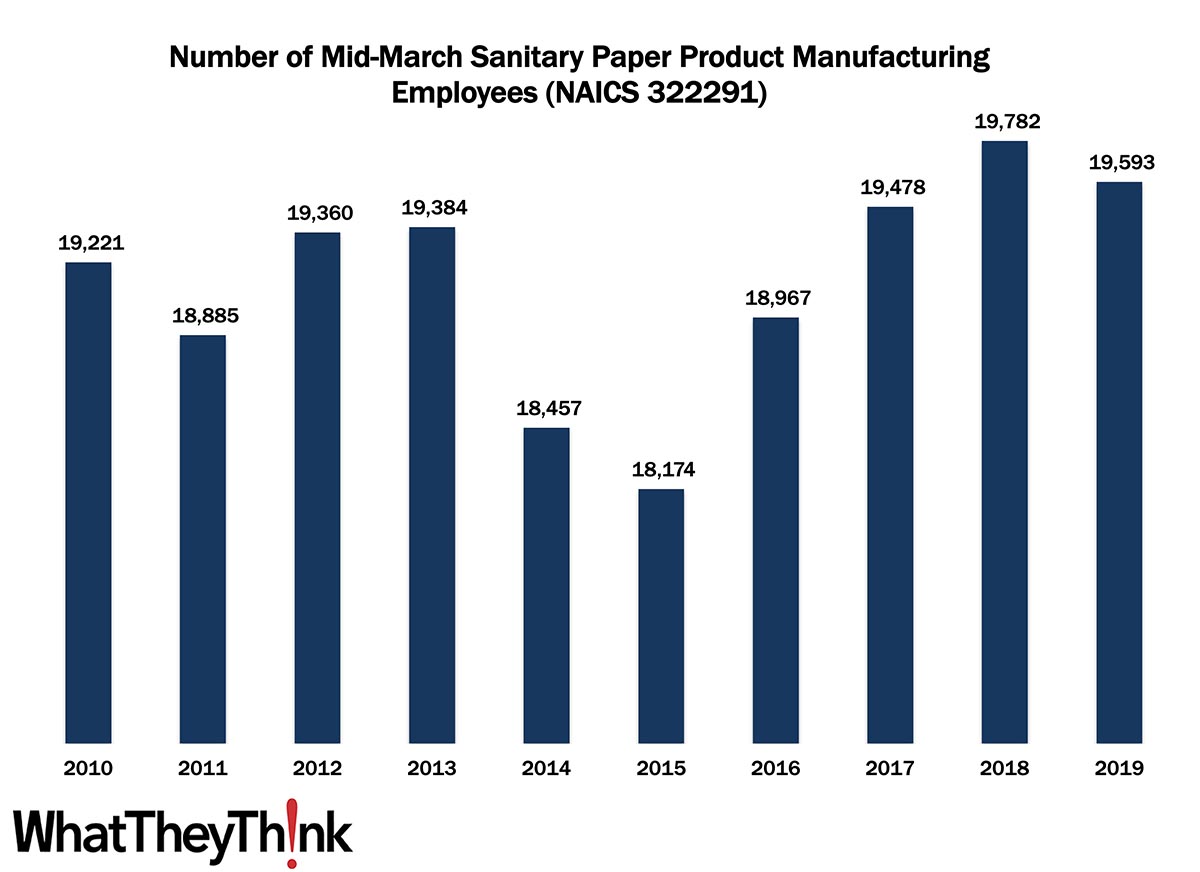

Sanitary Paper Product Manufacturing Establishments—2010–2020

Published: July 21, 2023

According to County Business Patterns, in 2020 there were 123 establishments in NAICS 322291 (Sanitary Paper Product Manufacturing). This category saw a net decrease in establishments of -13% since 2010. In macro news, new business applications continue to rise. Full Analysis

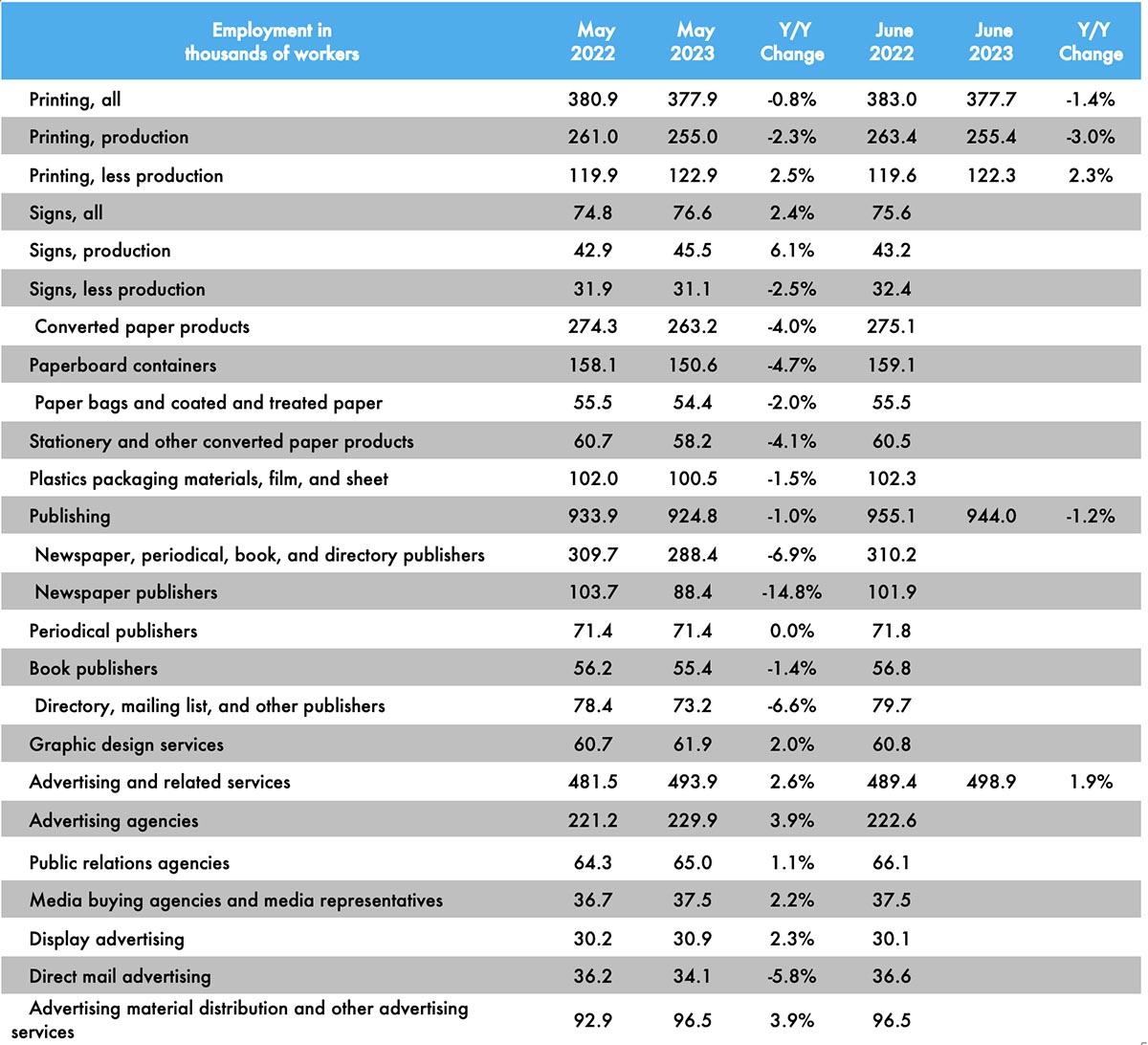

June Printing Production Employment Up Slightly, Non-Production Down

Published: July 14, 2023

Overall printing employment in June 2023 was down -0.2% from March. Production employment was up 0.4% while non-production employment was down -0.6%. Full Analysis

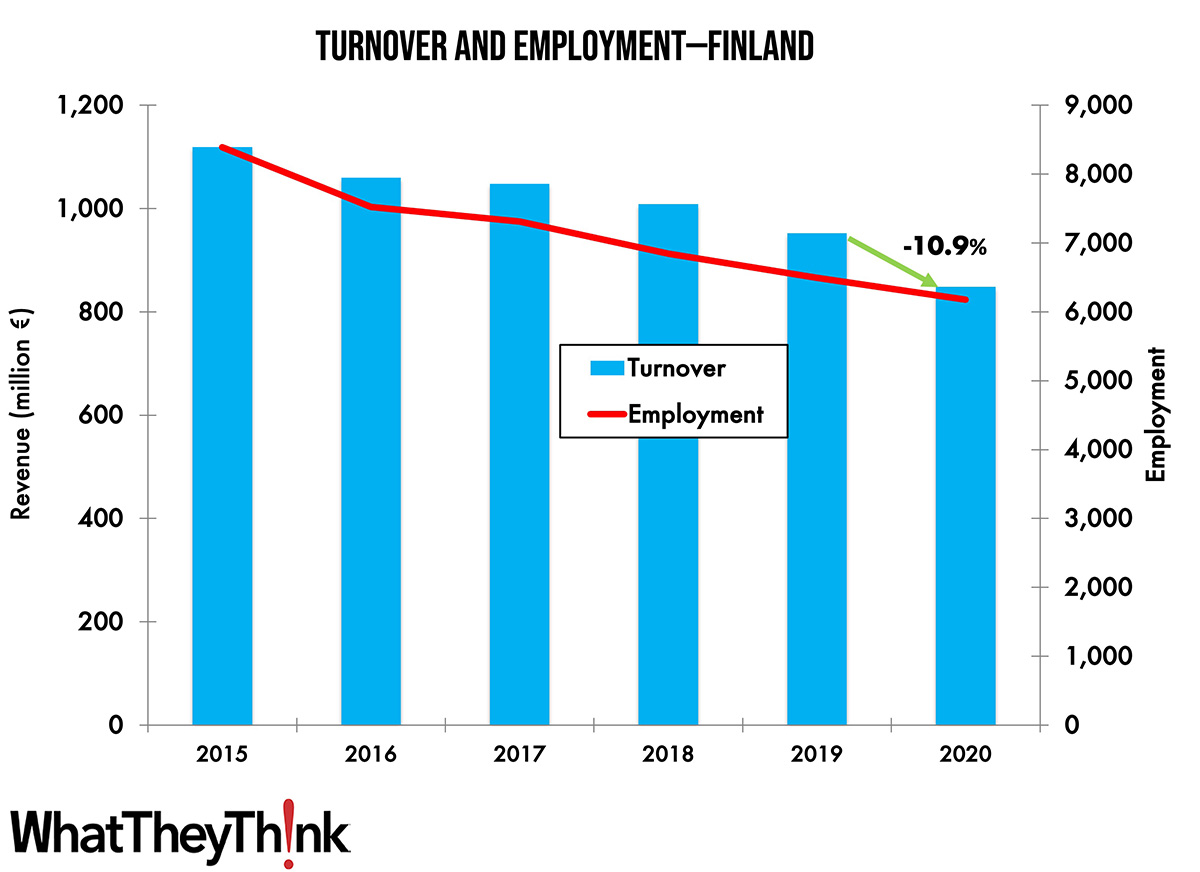

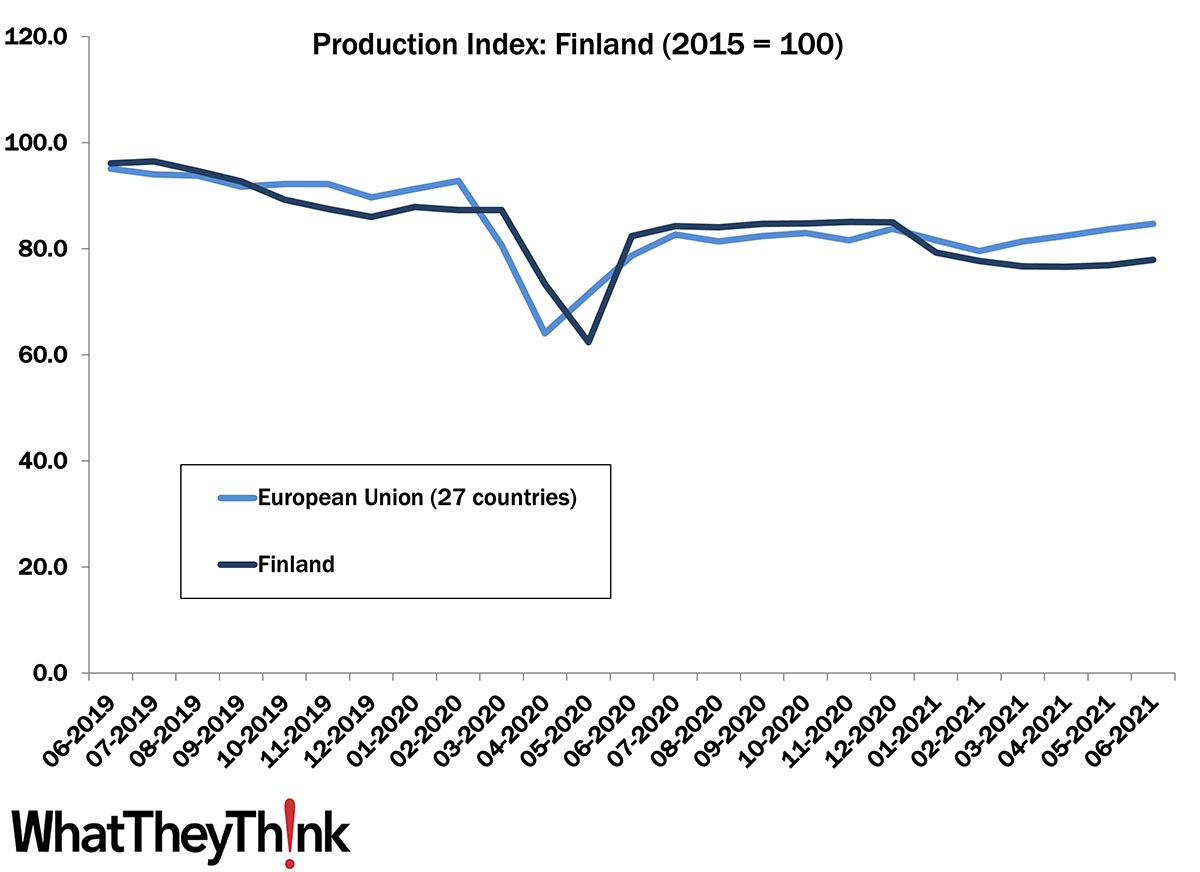

Turnover and Employment in Print in Europe—Finland

Published: July 11, 2023

This bi-weekly series of short articles aims at shedding a spotlight on the size of the printing industry in Europe per country and how revenues and employment developed in 2020, when the pandemic impacted businesses. This time we look at Finland, the 14th largest printing industry by turnover in Europe and the second largest in the Nordic region. Full Analysis

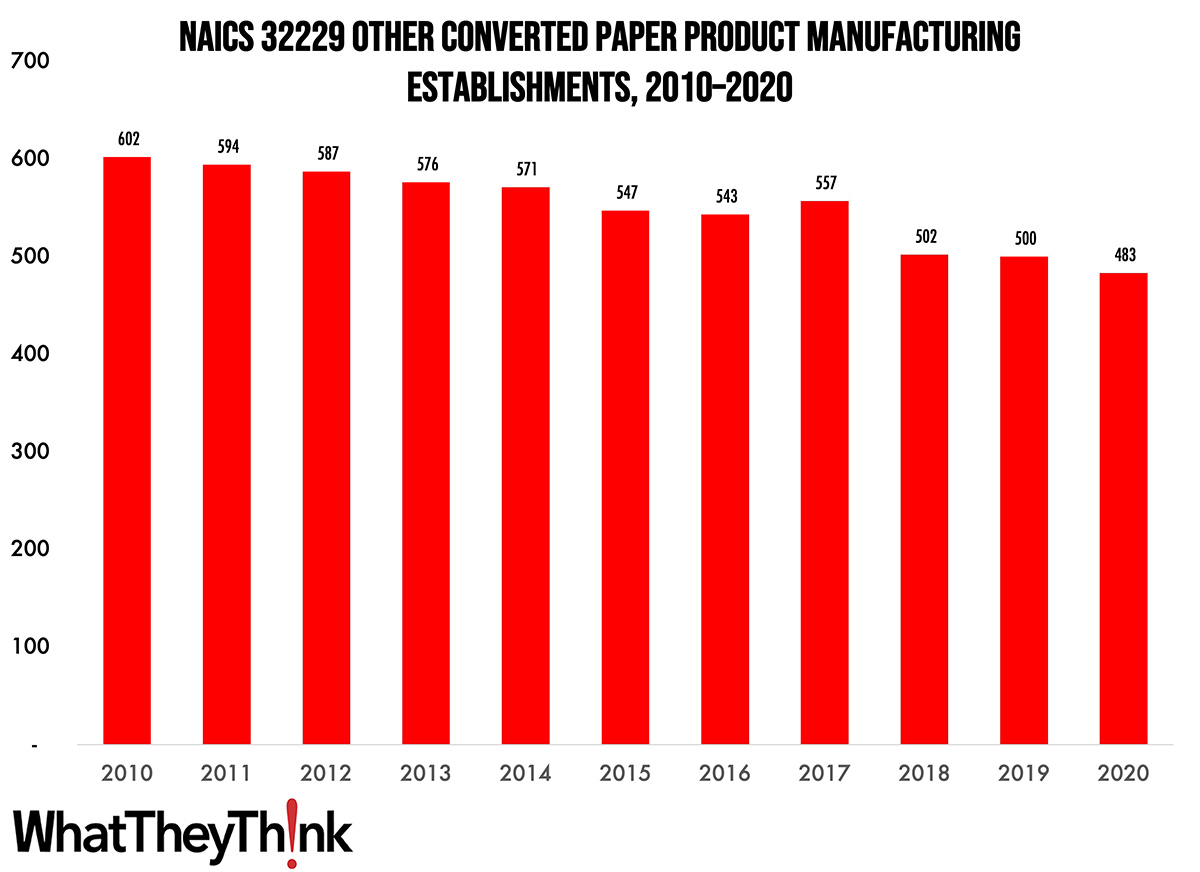

Other Converted Paper Product Manufacturing Establishments—2010–2020

Published: June 30, 2023

According to County Business Patterns, in 2020 there were 483 establishments in NAICS 32229 (Other Converted Paper Product Manufacturing). This category saw a net decrease in establishments of -20% since 2010. In macro news, BEA revises Q1 GDP up. Full Analysis

April Shipments Maintain Seasonality—Just as We Feared

Published: June 23, 2023

April 2023 printing shipments came in at $7.00 billion, down from March’s $7.58 billion and in line with annual seasonality—although it is a bit below the previous two Aprils. Full Analysis

Stationery Product Manufacturing Establishments—2010–2020

Published: June 16, 2023

According to County Business Patterns, in 2020 there were 324 establishments in NAICS 32223 (Stationery Product Manufacturing). This category saw a net decrease in establishments of -35% since 2010. In macro news, the US birth rate increased insignificantly in 2022—the latest in a worrying demographic trend. Full Analysis

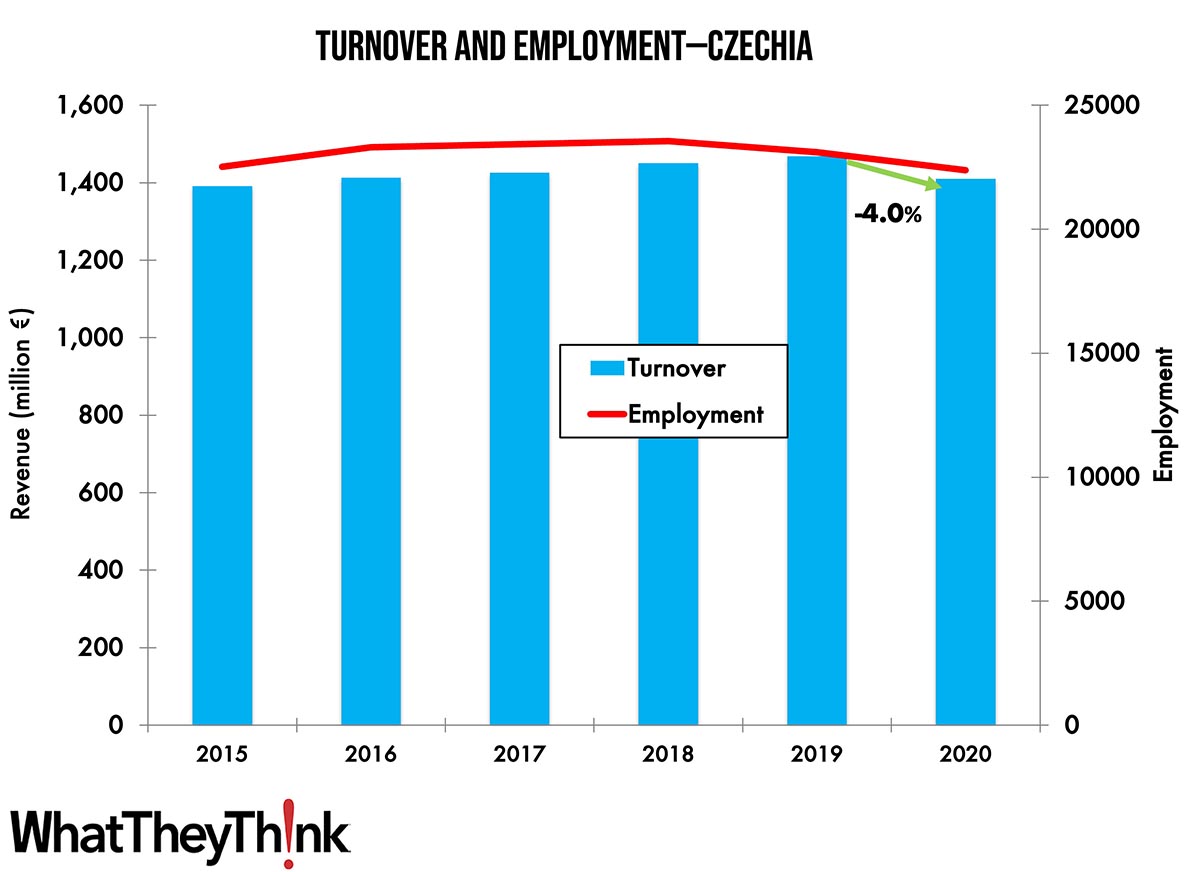

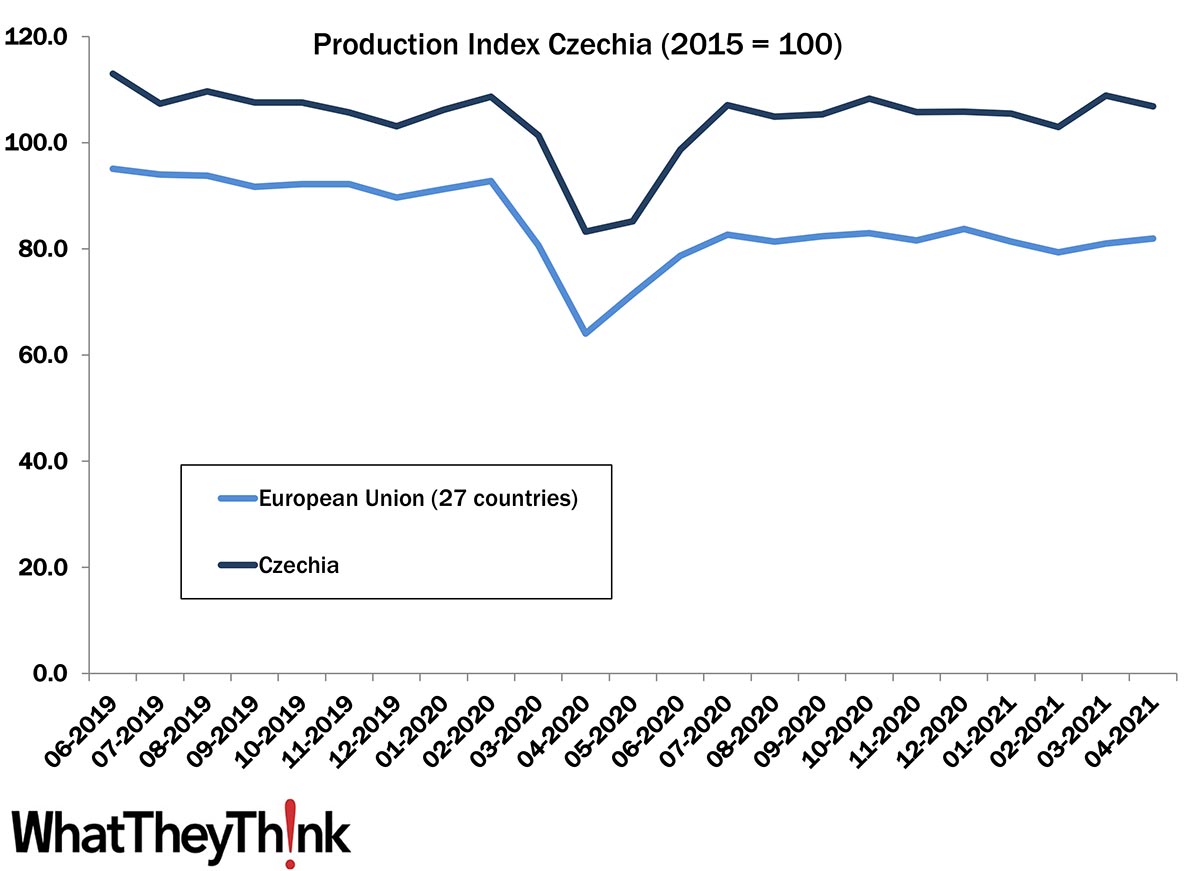

Turnover and Employment in Print in Europe—Czechia

Published: June 14, 2023

This bi-weekly series of short articles aims at shedding a spotlight on the size of the printing industry in Europe per country and how revenues and employment developed in 2020, when the pandemic impacted businesses. This time we look at Czechia (also called Czech Republic), the eleventh-largest printing industry by turnover in Europe and the second largest in Central and Eastern Europe. Full Analysis

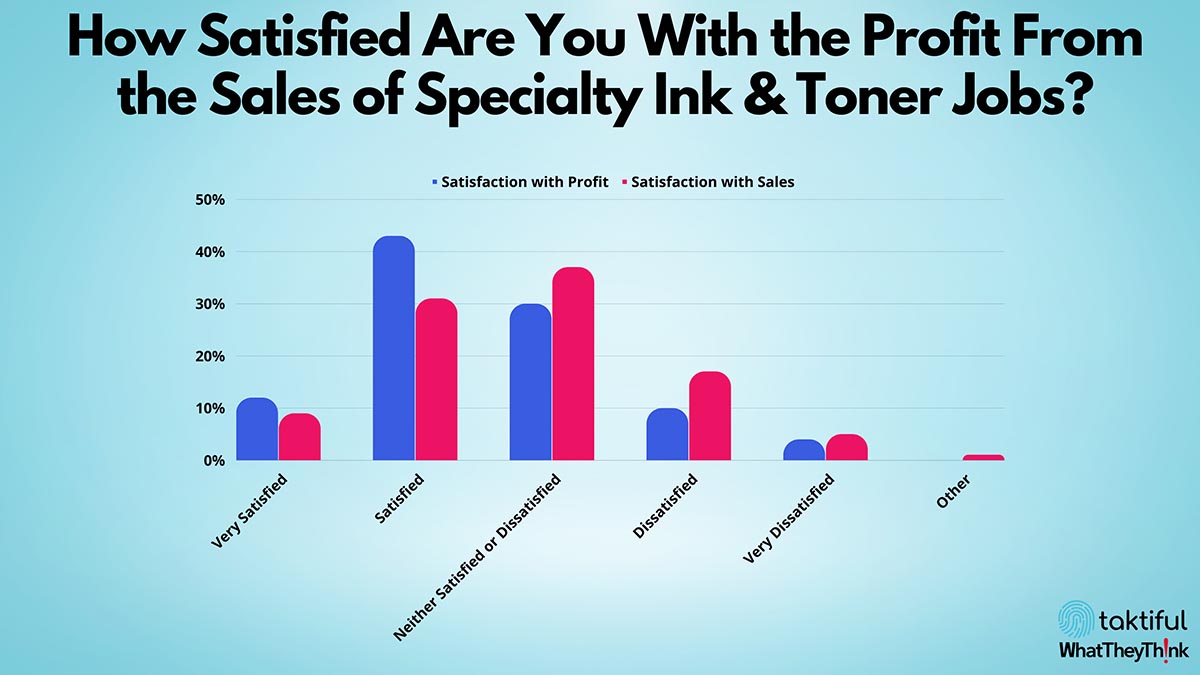

Printing Pulse: Embellishment Edition

Published: June 9, 2023

This edition of our Friday data series offers a preliminary “sneak peek” at the results of the Taktiful and WhatTheyThink 2023 Specialty Digital Ink and Toner Embellishment Study. This study takes a deep dive into how current users of digital ink and toner embellishment technologies are utilizing them, what the response from customers has been, how satisfied print providers have been with the sales and profitability of these jobs, where the challenges lie, and their general feelings about the future of digital ink and toner embellishment technologies. Full Analysis

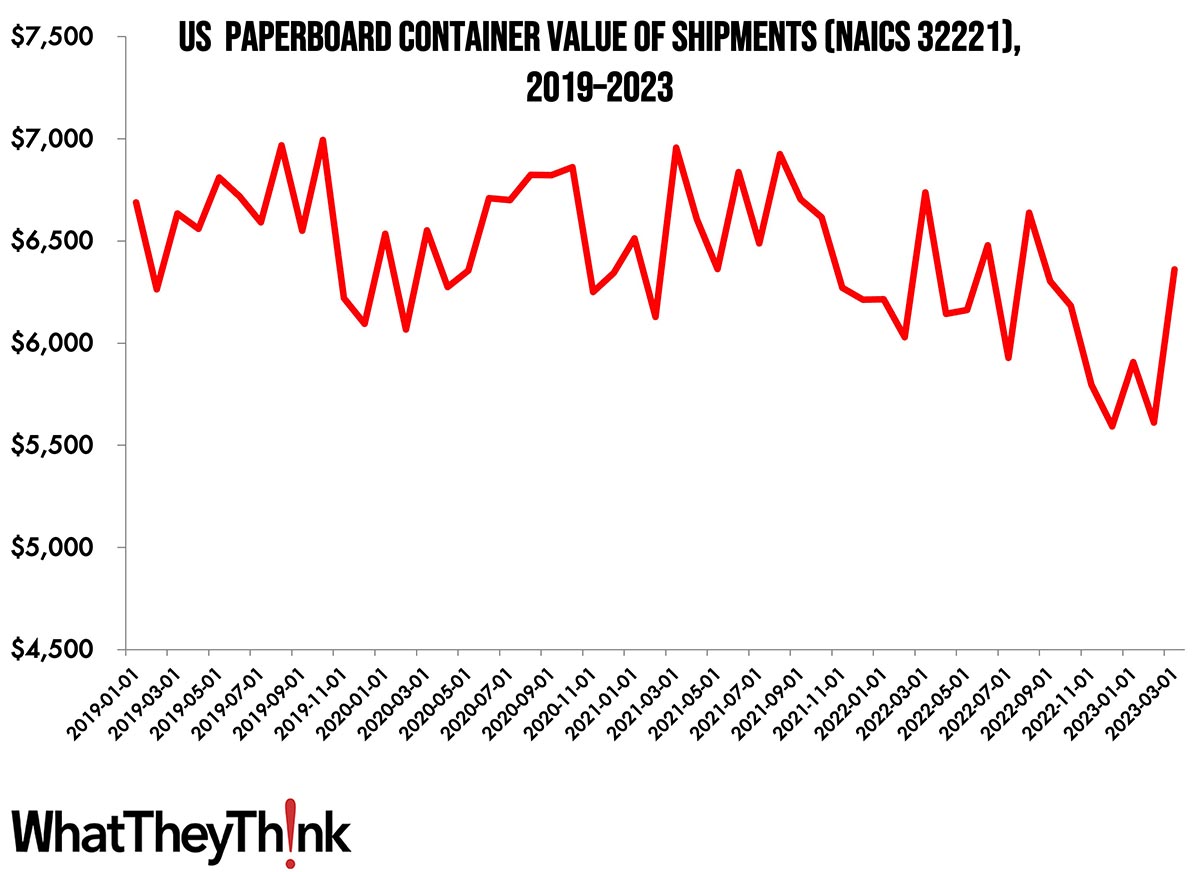

Paperboard Container Shipments Back up to Pandemic Levels

Published: June 2, 2023

In March 2023, the value of shipments of paperboard containers was $6.361 billion, the highest it has been since August 2022. Full Analysis

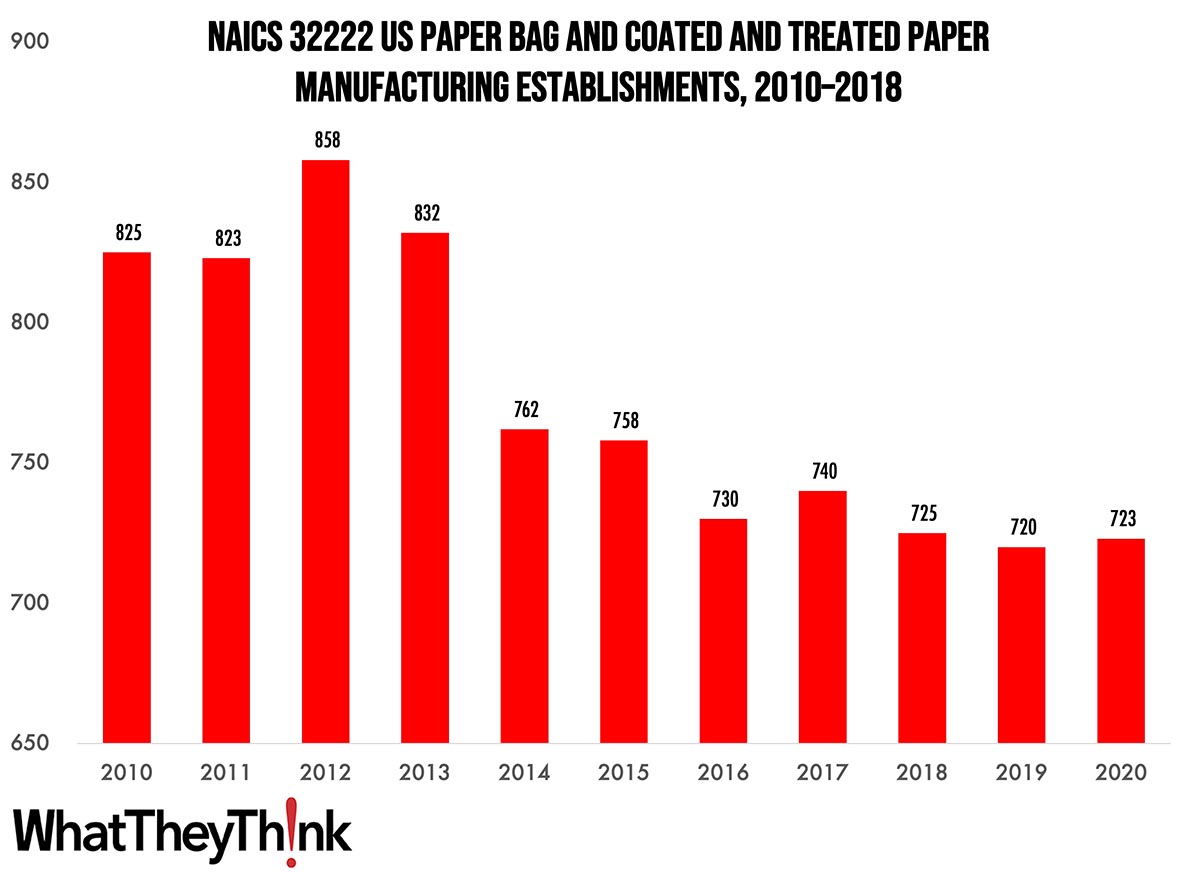

Paper Bag and Coated and Treated Paper Manufacturing Establishments—2010–2020

Published: May 26, 2023

According to County Business Patterns, in 2020 there were 723 establishments in NAICS 32222 (Paper Bag and Coated and Treated Paper Manufacturing). This category saw a net decrease in establishments of -12% since 2010. In macro news, the Architecture Billings Index suggests a recovery from the slowdown in the construction industry. Full Analysis

April Printing Production Employment Down Slightly, Non-Production Up

Published: May 19, 2023

Overall printing employment in April 2023 was down -0.2% from March. Production employment was down -0.8% while non-production employment was up 1.1%. Full Analysis

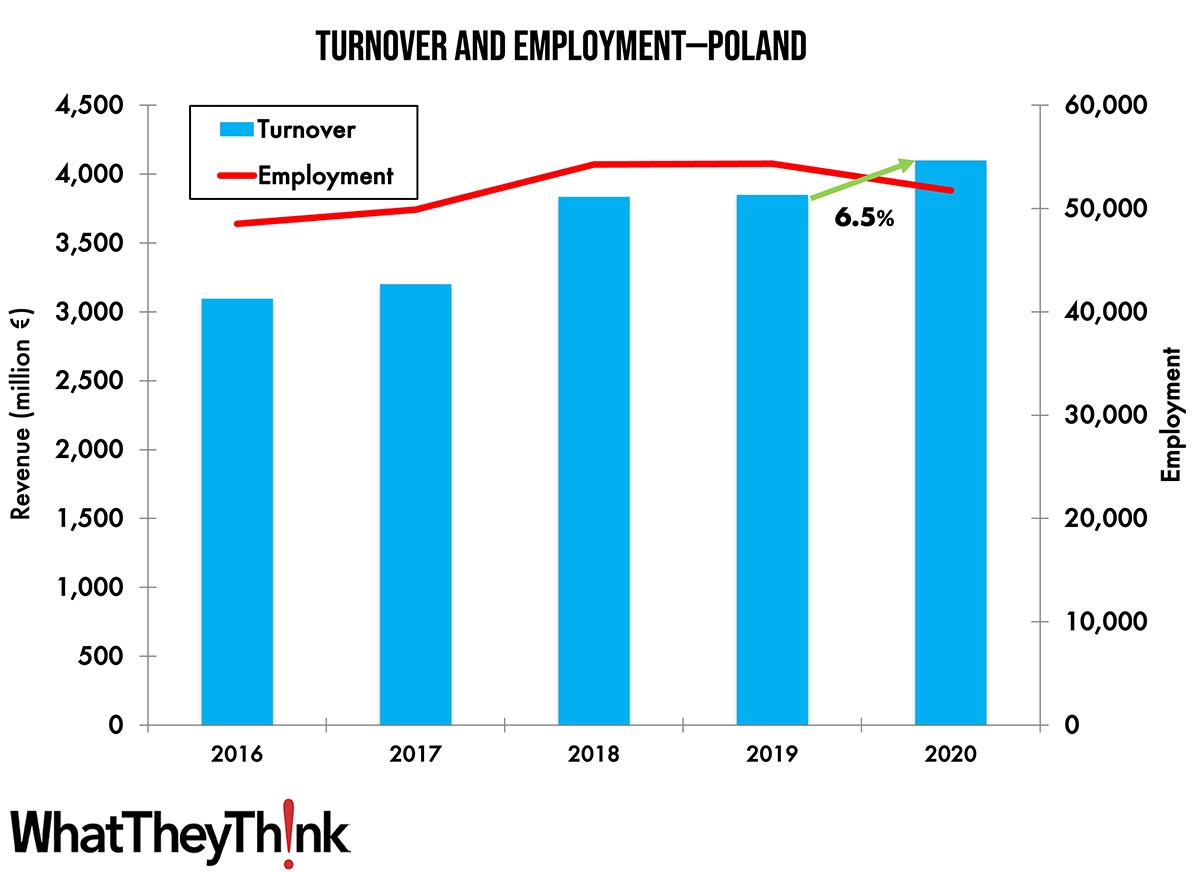

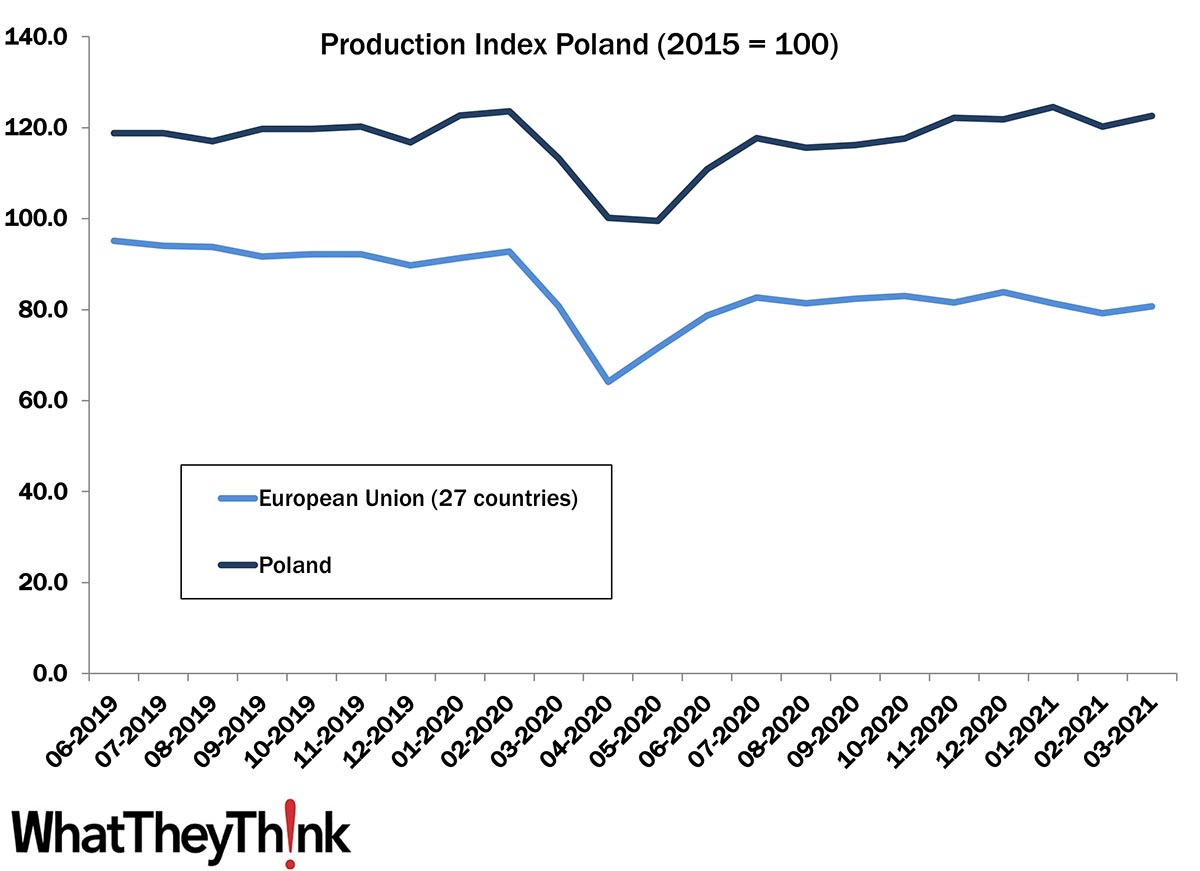

Turnover and Employment in Print in Europe—Poland

Published: May 15, 2023

This bi-weekly series of short articles aims at shedding a spotlight on the size of the printing industry in Europe per country and how revenues and employment developed in 2020, when the pandemic impacted businesses. This time we look at Poland, the sixth-largest printing industry by turnover in Europe and the largest in Central and Eastern Europe. Full Analysis

Other Paperboard Container Manufacturing Establishments—2010–2020

Published: May 12, 2023

According to County Business Patterns, in 2020 there were 278 establishments in NAICS 322219 (Other Paperboard Container Manufacturing). This category saw a net decrease in establishments of -20% since 2010. In macro news, inflation is slowing but still high. Full Analysis

March Shipments Maintain Seasonality—Make of That What You Will

Published: May 5, 2023

March 2023 printing shipments came in at $7.18 billion, up from February’s $6.46 billion and in line with annual seasonality—even if it is below the previous two Marches. Full Analysis

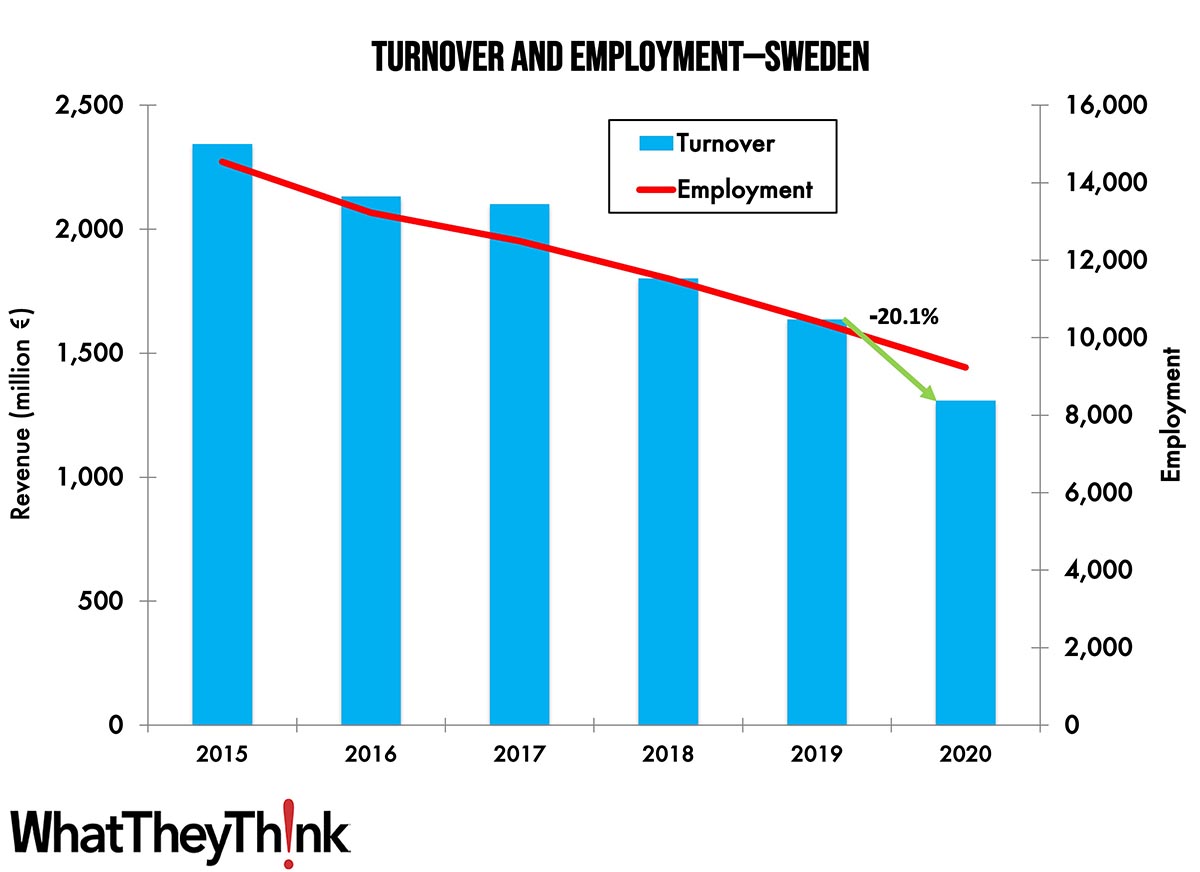

Turnover and Employment in Print in Europe—Sweden

Published: May 1, 2023

This bi-weekly series of short articles aims at shedding a spotlight on the size of the printing industry in Europe per country and how revenues and employment developed in 2020, when the pandemic impacted businesses. This time we look at Sweden, the 12th-largest printing industry by turnover in Europe. Full Analysis

Folding Paperboard Box Manufacturing Establishments—2010–2020

Published: April 28, 2023

According to County Business Patterns, in 2020 there were 546 establishments in NAICS 322212 (Folded Paperboard Box Manufacturing). This category saw a net increase in establishments of 11% since 2010. In macro news, Q1 2023 GDP shows third straight quarter of growth. Full Analysis

February Printing Employment Essentially Flat

Published: April 21, 2023

Overall printing employment in February 2023 was up 0.3% from January. Production employment was up 0.1% while non-production employment was up 0.7%. Full Analysis

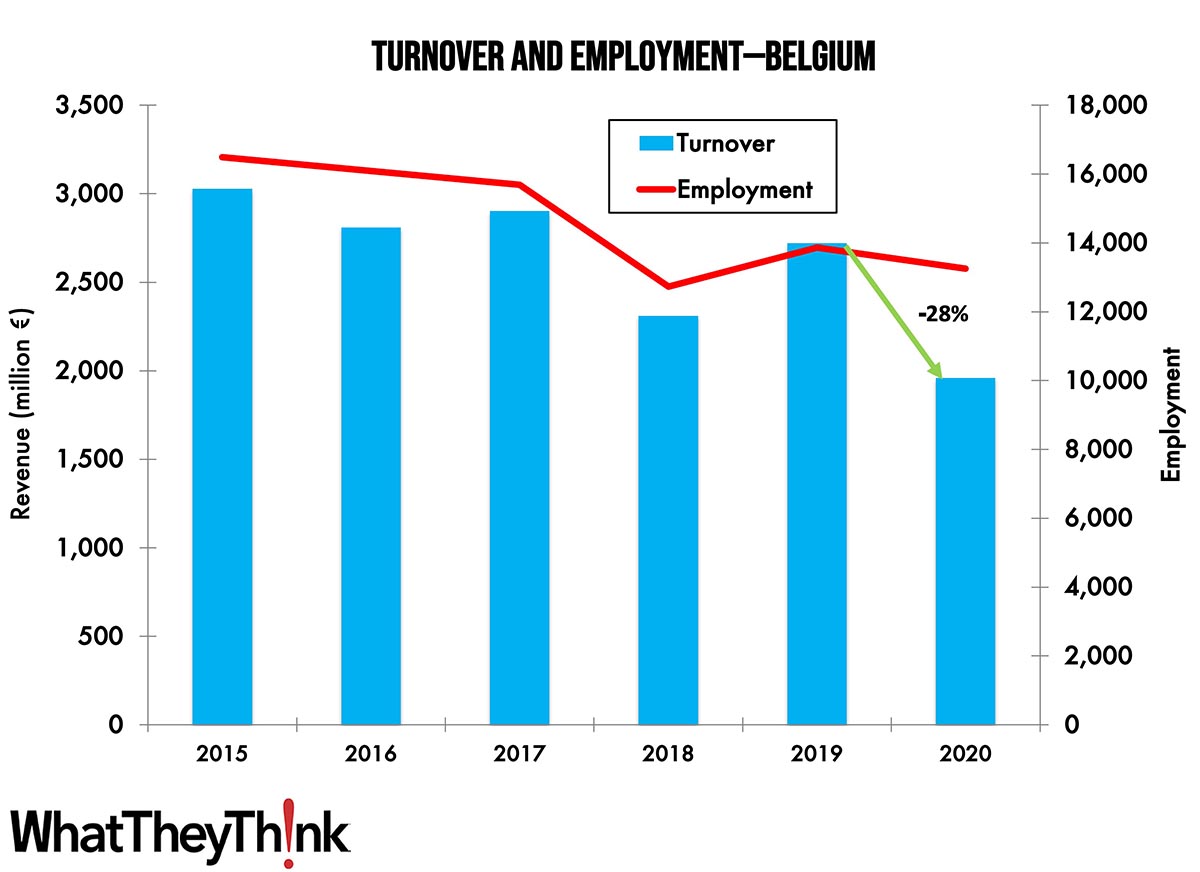

Turnover and Employment in Print in Europe—Belgium

Published: April 17, 2023

This bi-weekly series of short articles aims at shedding a spotlight on the size of the printing industry in Europe per country and how revenues and employment developed in 2020, when the pandemic impacted businesses. This time we look at Belgium, the ninth-largest printing industry by turnover in Europe. Full Analysis

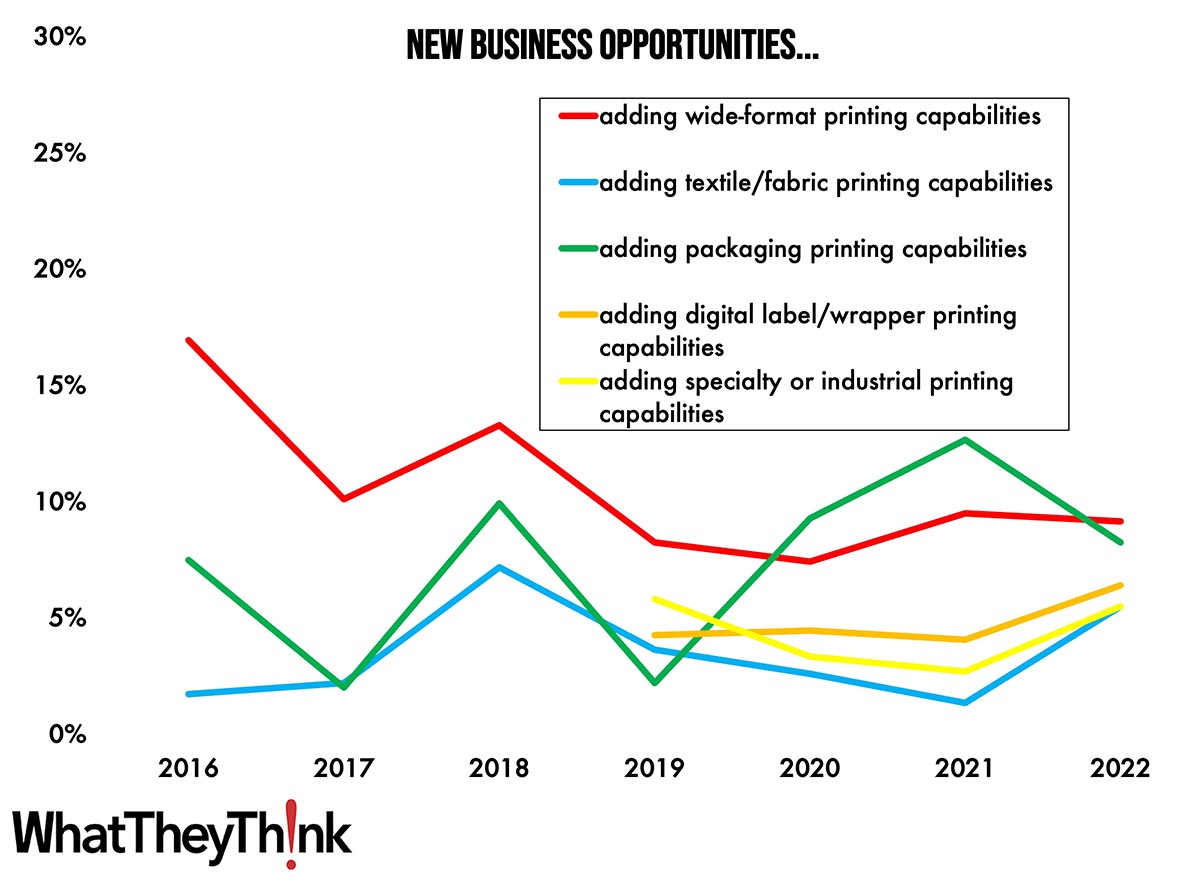

Tales from the Database: Beyond Commercial

Published: April 14, 2023

The latest installment in our “Tales from the Database” series looks at historical opportunities and investments related to adding not only things like wide-format printing and textile printing capabilities, but also packaging as well as other types of specialty printing. Full Analysis

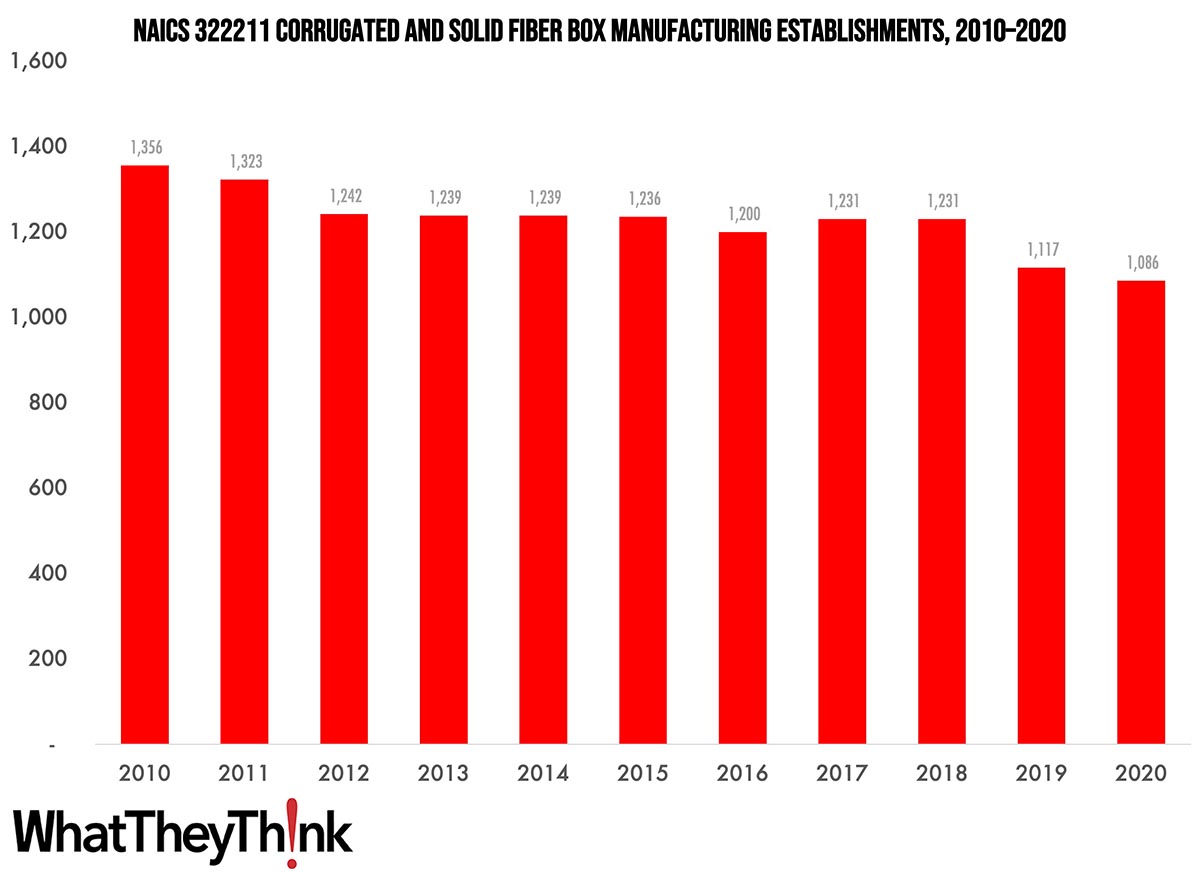

Corrugated and Solid Fiber Box Manufacturing Establishments—2010–2020

Published: March 31, 2023

According to County Business Patterns, in 2020 there were 1,086 establishments in NAICS 322211 (Corrugated and Solid Fiber Box Manufacturing). This category saw a net decrease of 20% since 2010. In macro news, Q4 GDP was revised down. Full Analysis

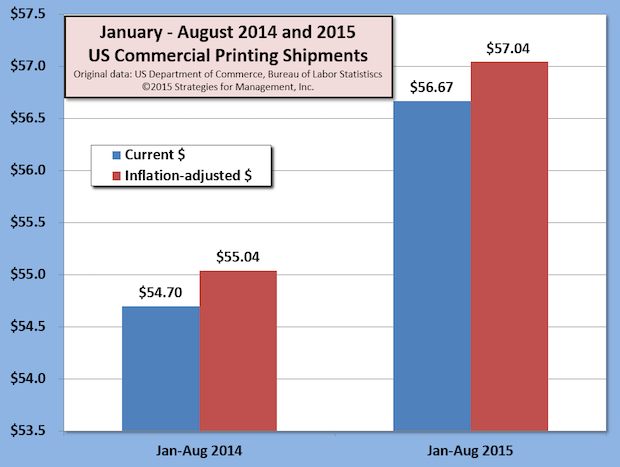

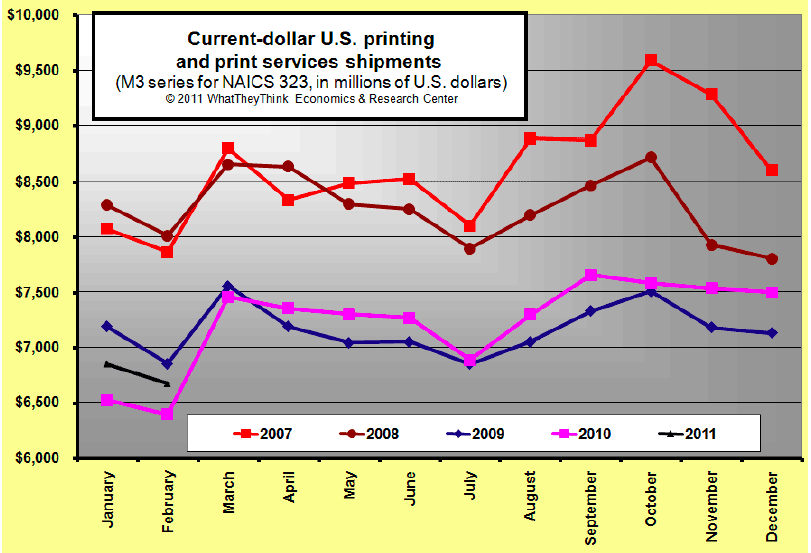

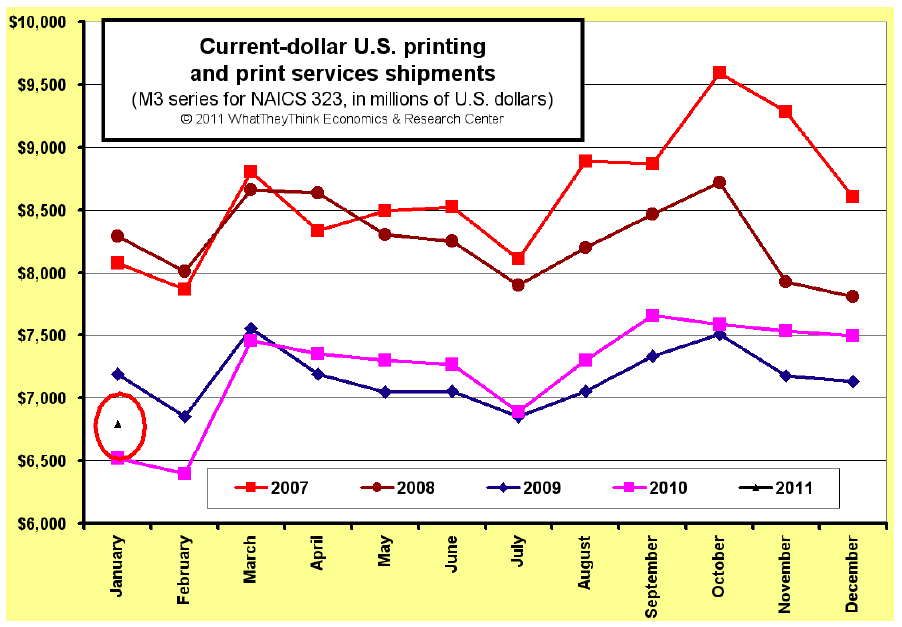

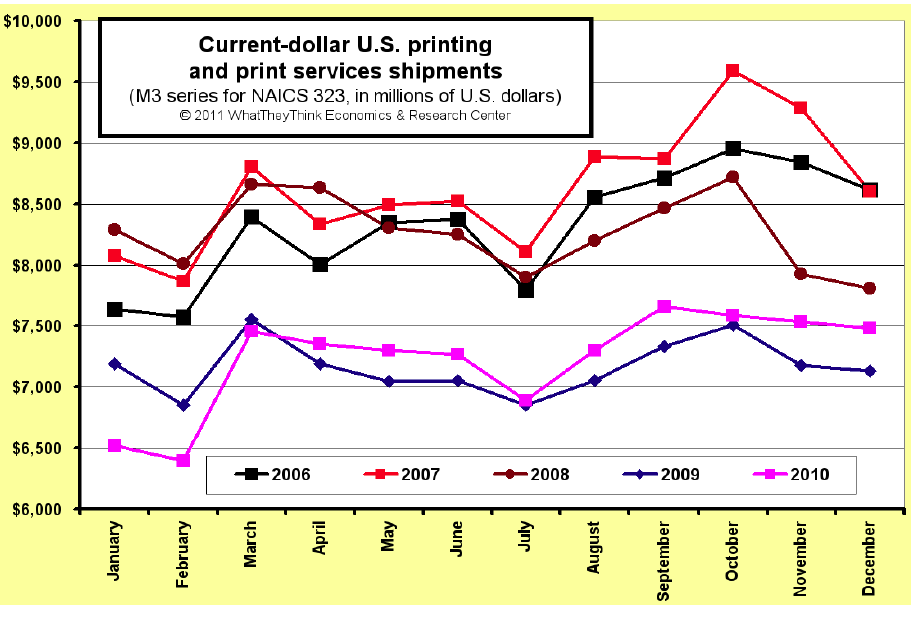

Kicking Off 2023: Best Shipments Since 2020

Published: March 24, 2023

January 2023 printing shipments came in at $6.67 billion, the best start to a year since 2020. Full Analysis

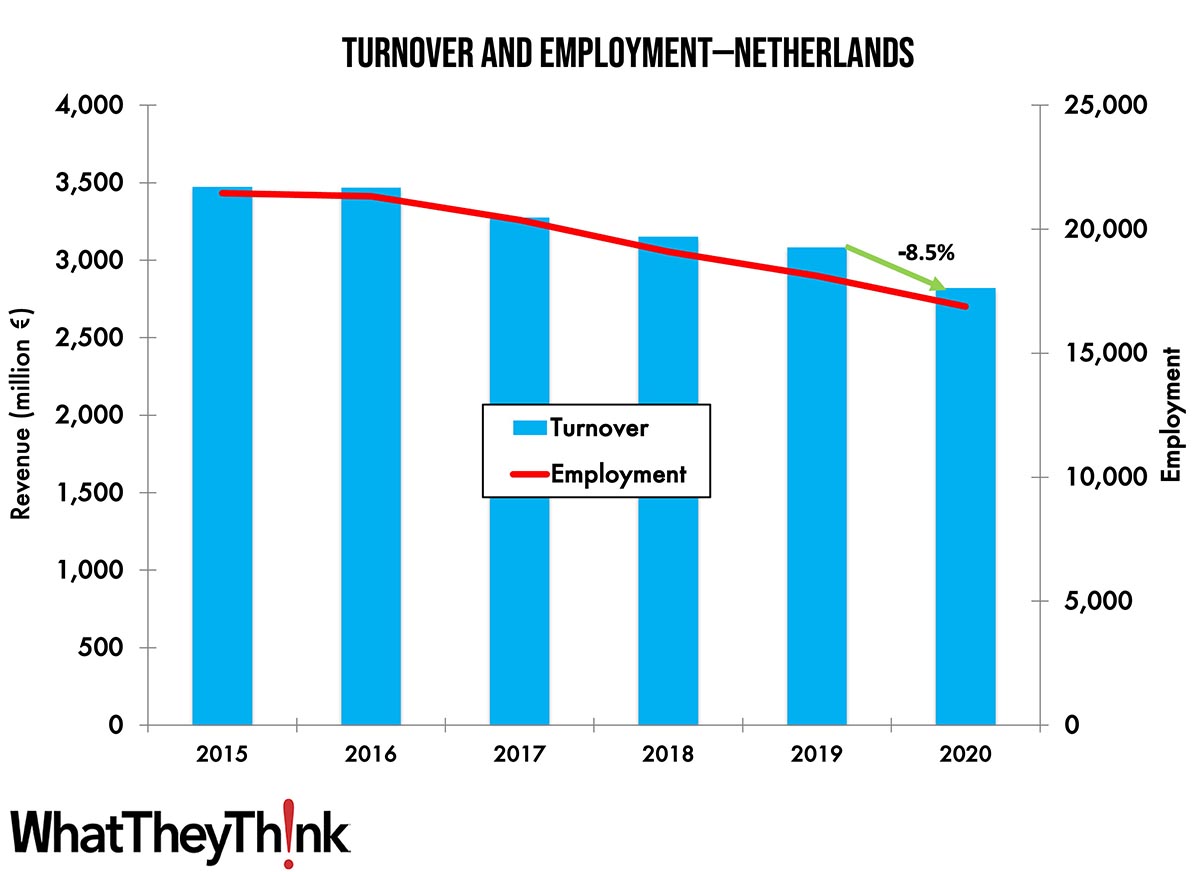

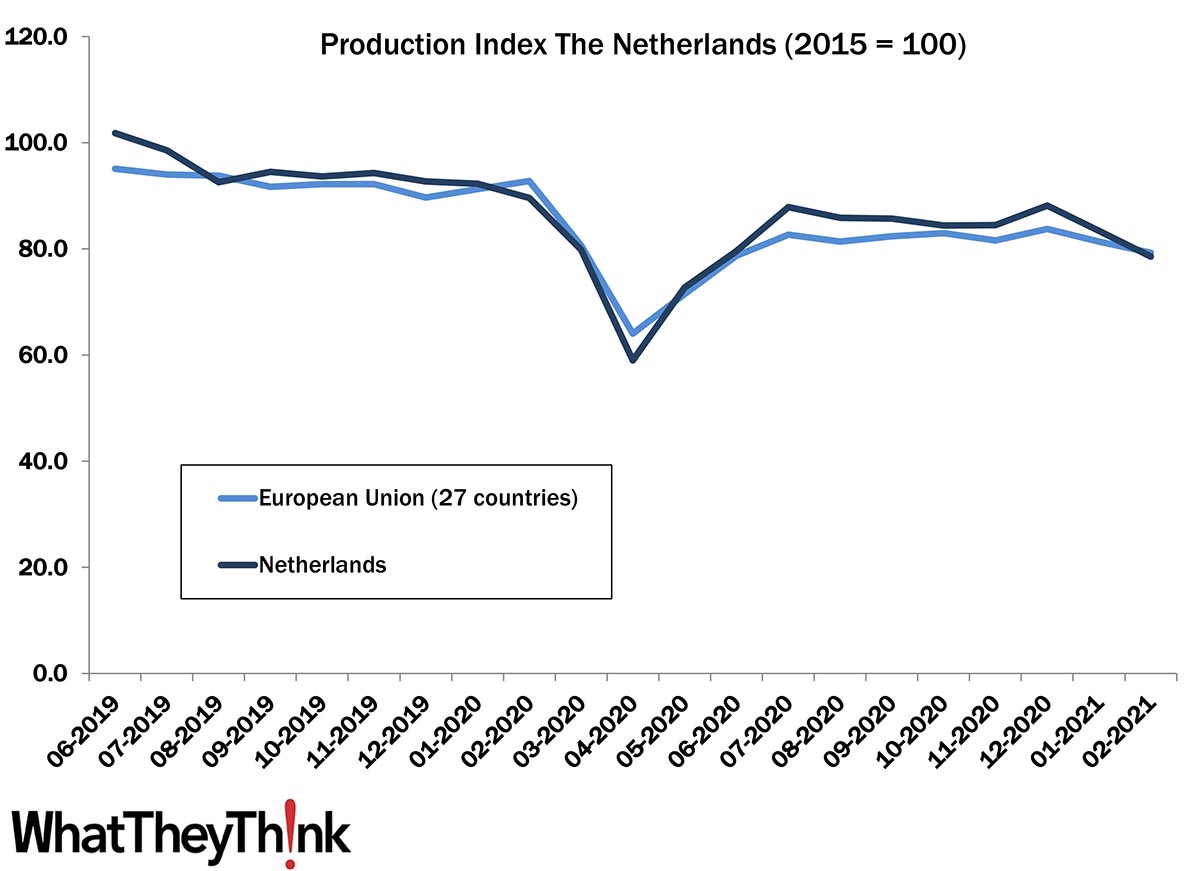

Turnover and Employment in Print in Europe—The Netherlands

Published: March 21, 2023

This bi-weekly series of short articles aims at shedding a spotlight on the size of the printing industry in Europe per country and how revenues and employment developed in 2020, when the pandemic impacted businesses. This time we look at the Netherlands, the seventh largest printing industry by turnover in Europe. Full Analysis

Paperboard Container Manufacturing Establishments—2010–2020

Published: March 17, 2023

According to County Business Patterns, in 2020 there were 1,910 establishments in NAICS 32221 (Paperboard Container Manufacturing). This category saw a net decrease of 13% since 2010. In macro news,inflation is sort of moving sideways. Full Analysis

January Production Employment Down

Published: March 10, 2023

Overall printing employment in January 2023 was down -1.7% from December, due entirely to a -4.2% drop in production employment, as non-production employment was up +4.1%. Full Analysis

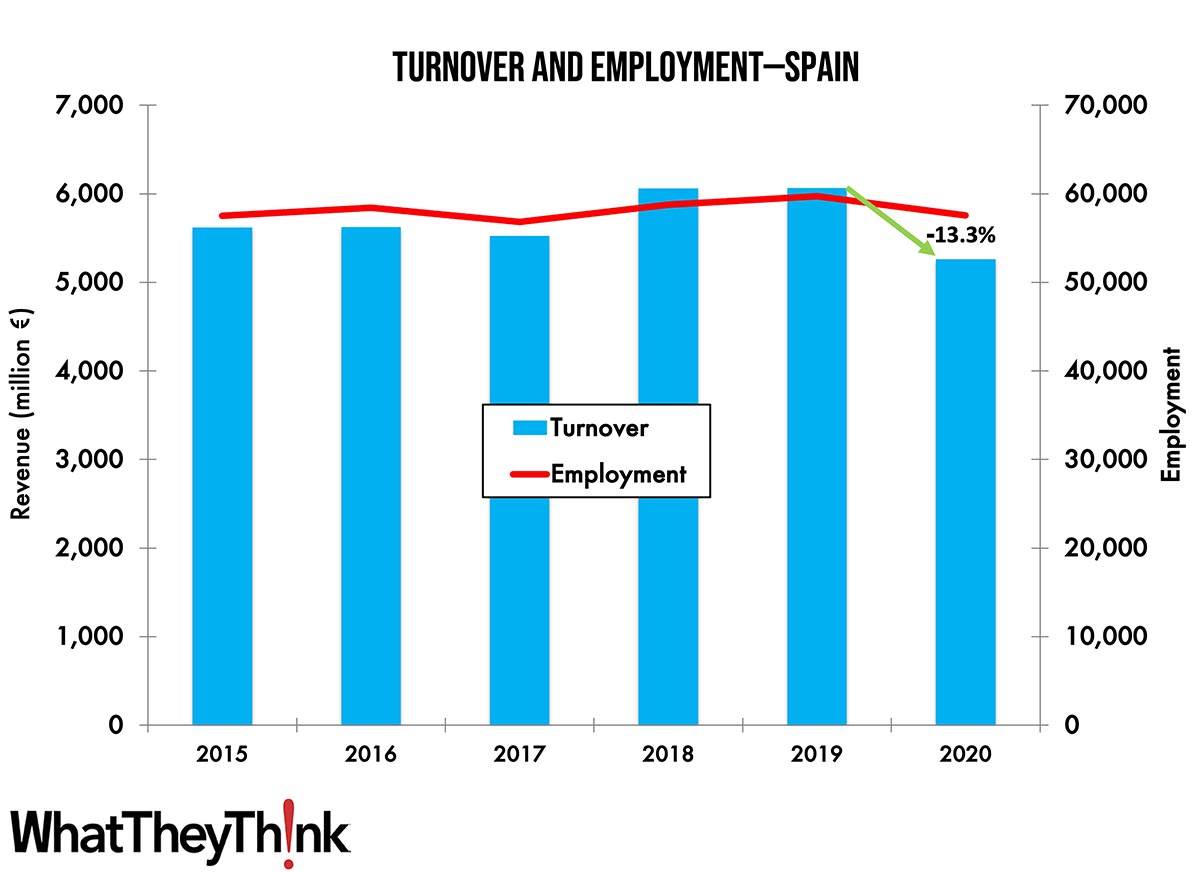

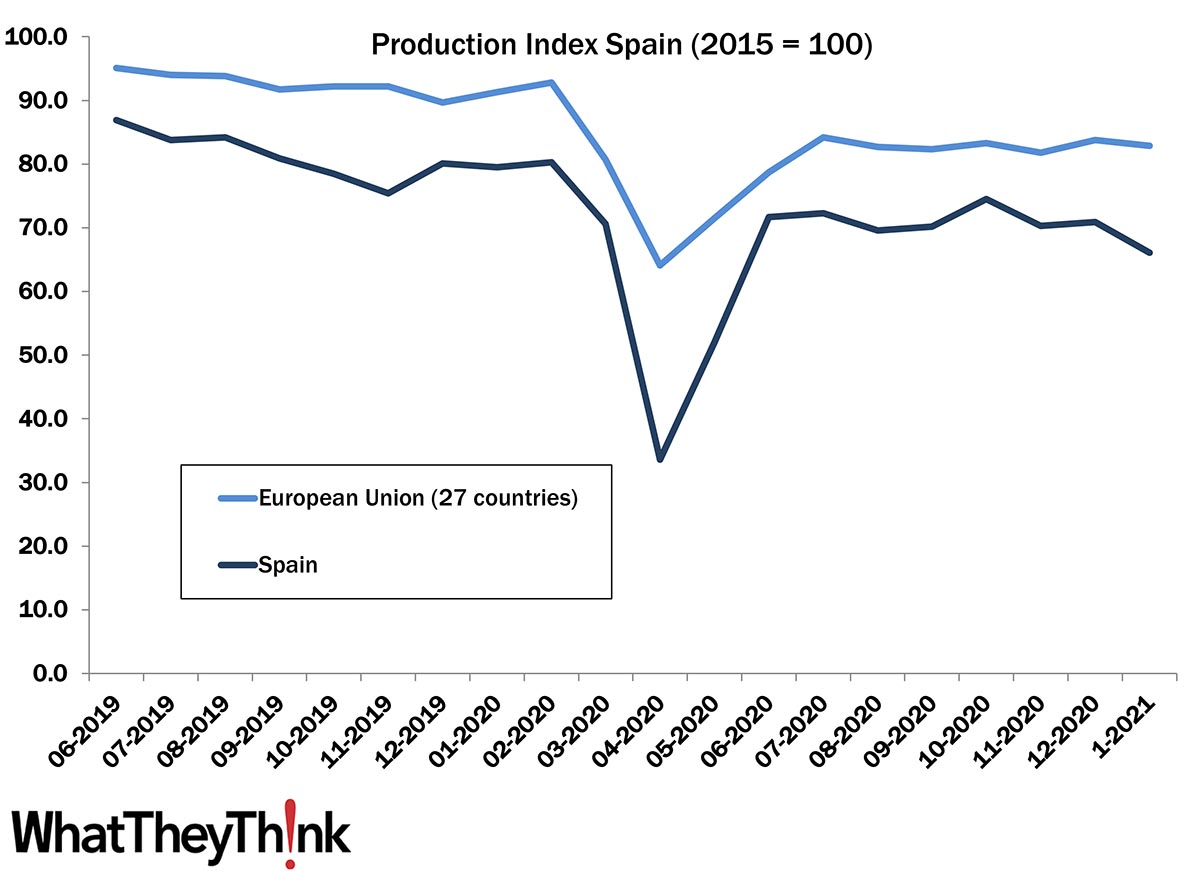

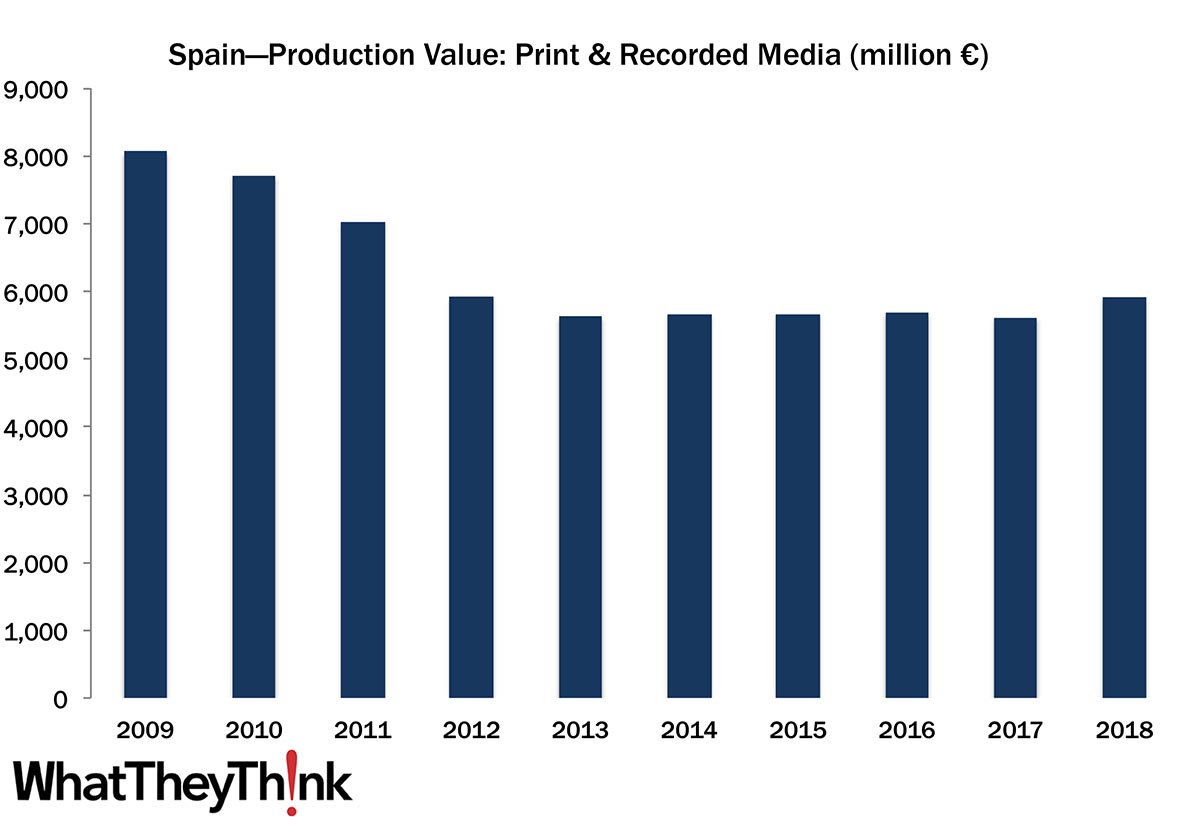

Print Turnover and Employment in Europe—Spain

Published: March 6, 2023

This bi-weekly series of short articles aims at shedding a spotlight on the size of the printing industry in Europe per country and how revenues and employment developed in 2020, when the pandemic impacted businesses. This time we look at Spain, the fifth largest printing industry by turnover in Europe. Full Analysis

Internet Publishing and Broadcasting and Web Search Portal Establishments—2010–2020

Published: March 3, 2023

According to County Business Patterns, in 2020 there were 8,947 establishments in NAICS 51913 (Internet Publishing and Broadcasting and Web Search Portals). This category saw a net increase of 66% since 2010. In macro news, early forecasts of Q1 GDP are running slightly bearish to slightly bullish. Full Analysis

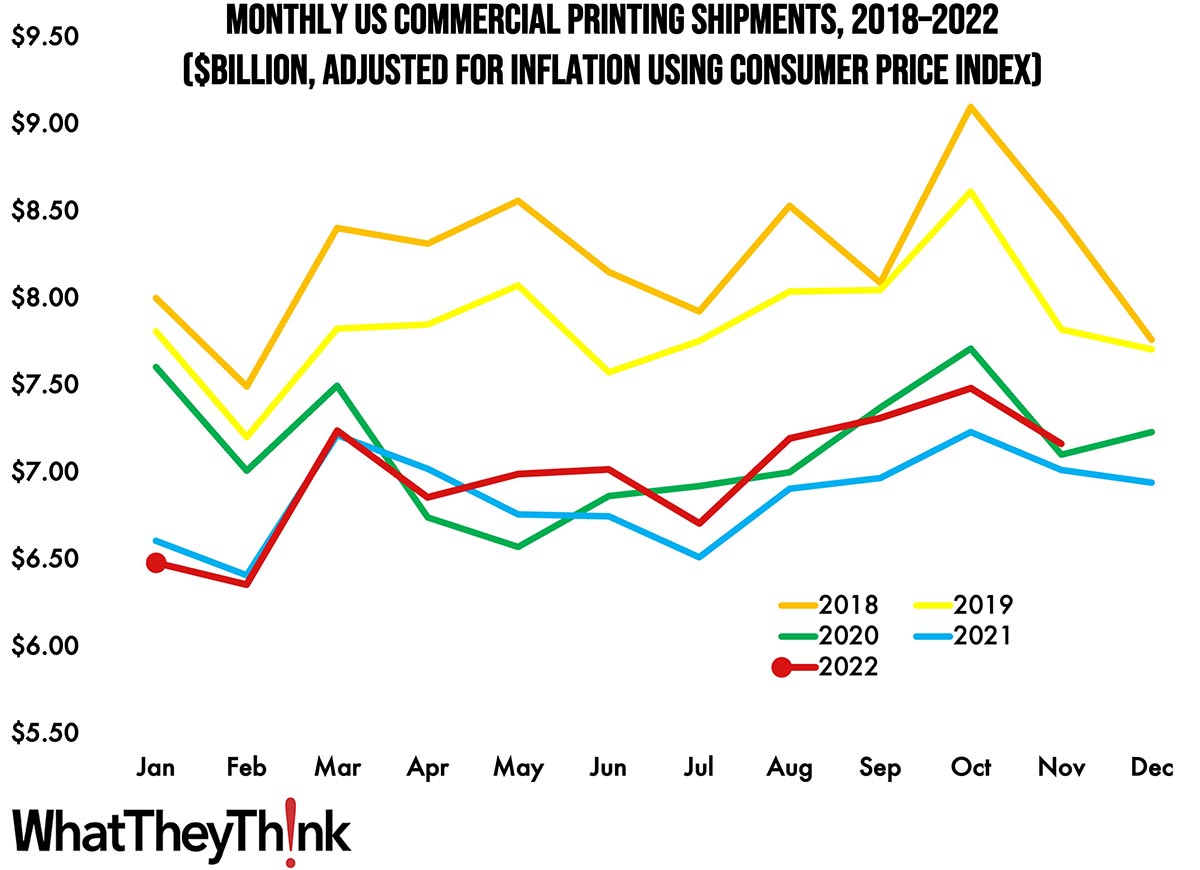

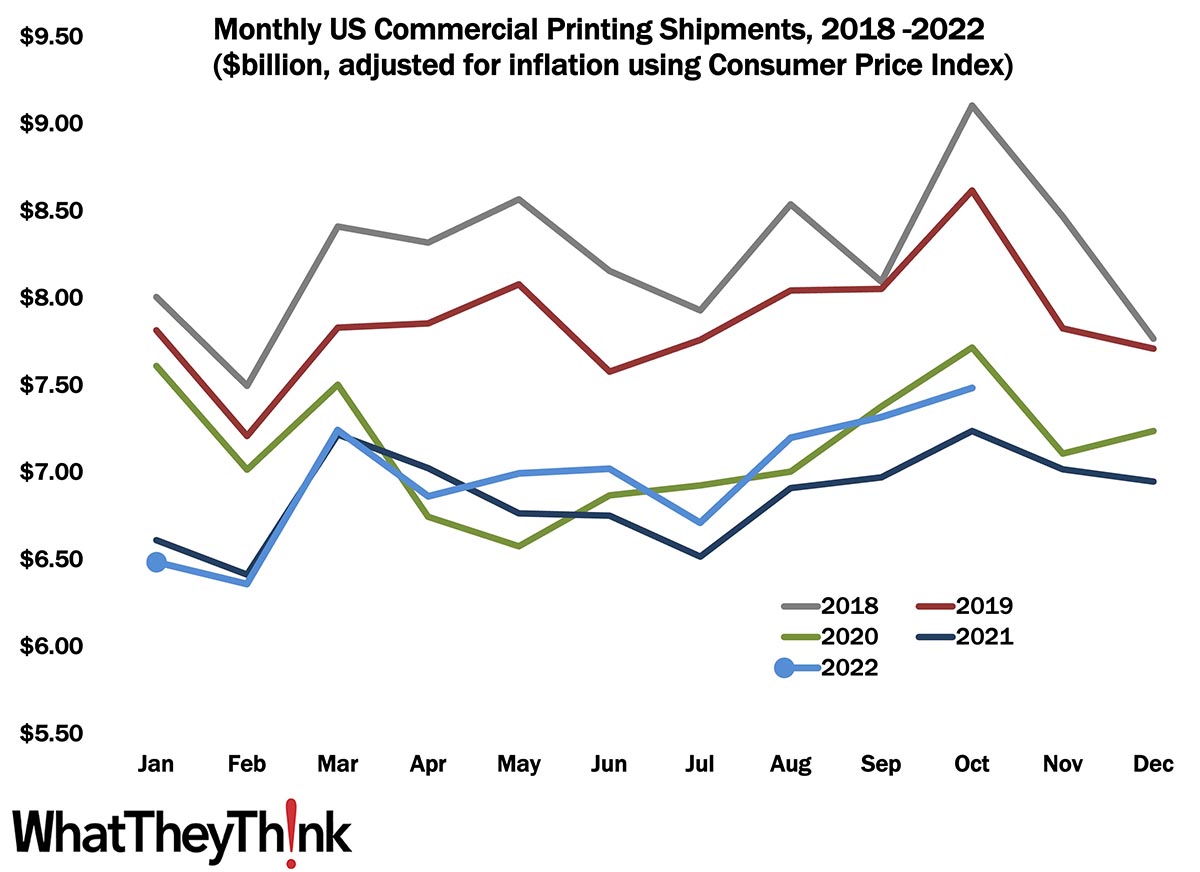

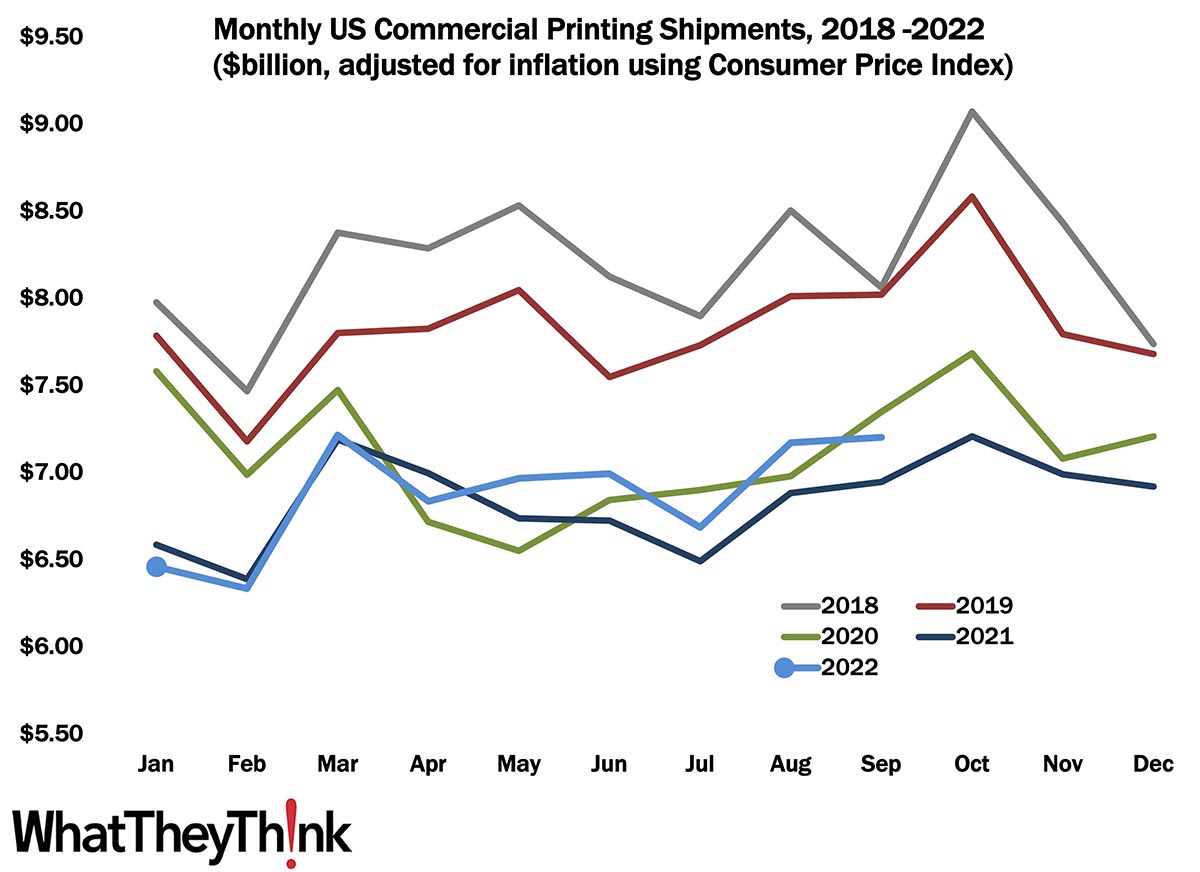

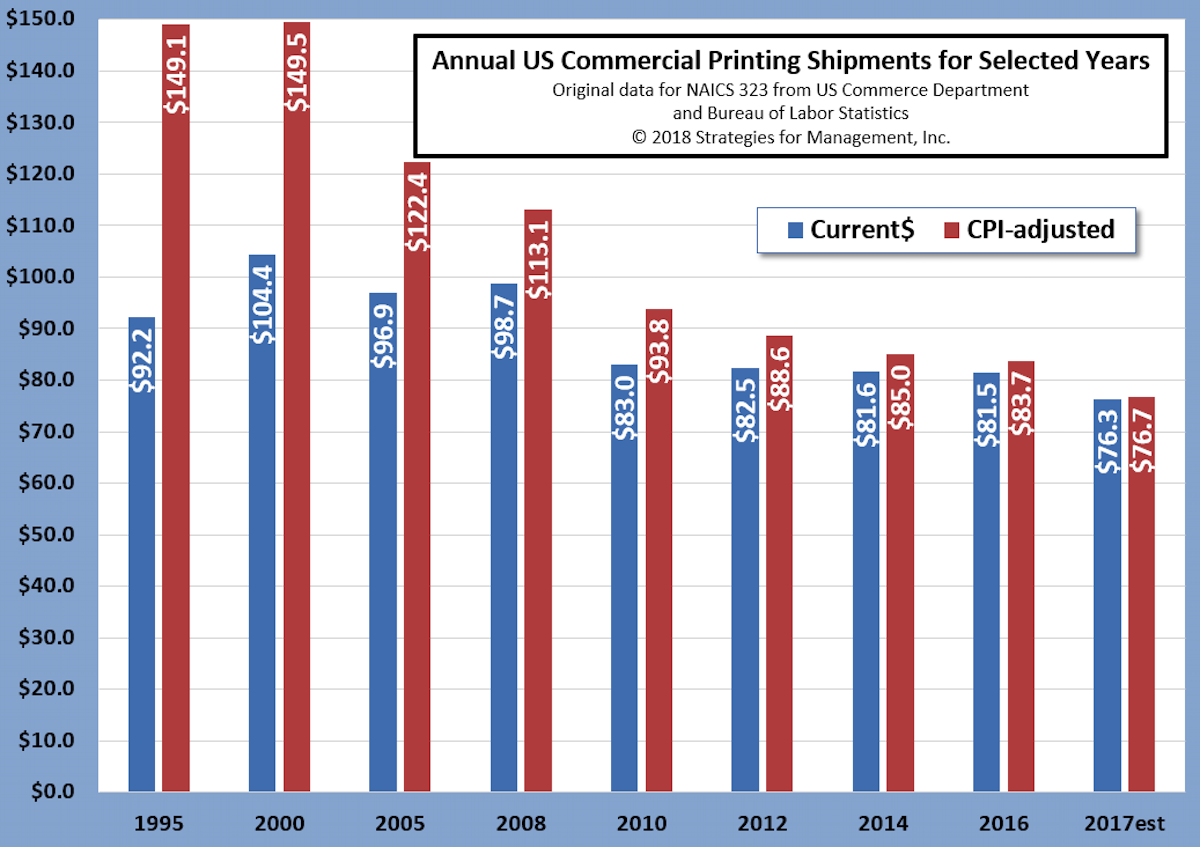

Hooray! 2022 Shipments Outpaced 2021

Published: February 24, 2023

December 2022 printing shipments came in at $6.97 billion, down from November’s $7.10 billion. But January-to-December shipments for 2022 came in at $83.47 billion, an improvement over 2021’s $82.05 billion. Full Analysis

Assorted Publishing Establishments—2010–2020

Published: February 17, 2023

According to County Business Patterns, in 2020 there were 557 establishments in NAICS 511199 (All Other Publishing). This category saw a net decrease of 39% since 2010, , although we’re not talking about a tremendous number of establishments. In macro news, inflation appears to have peaked. Full Analysis

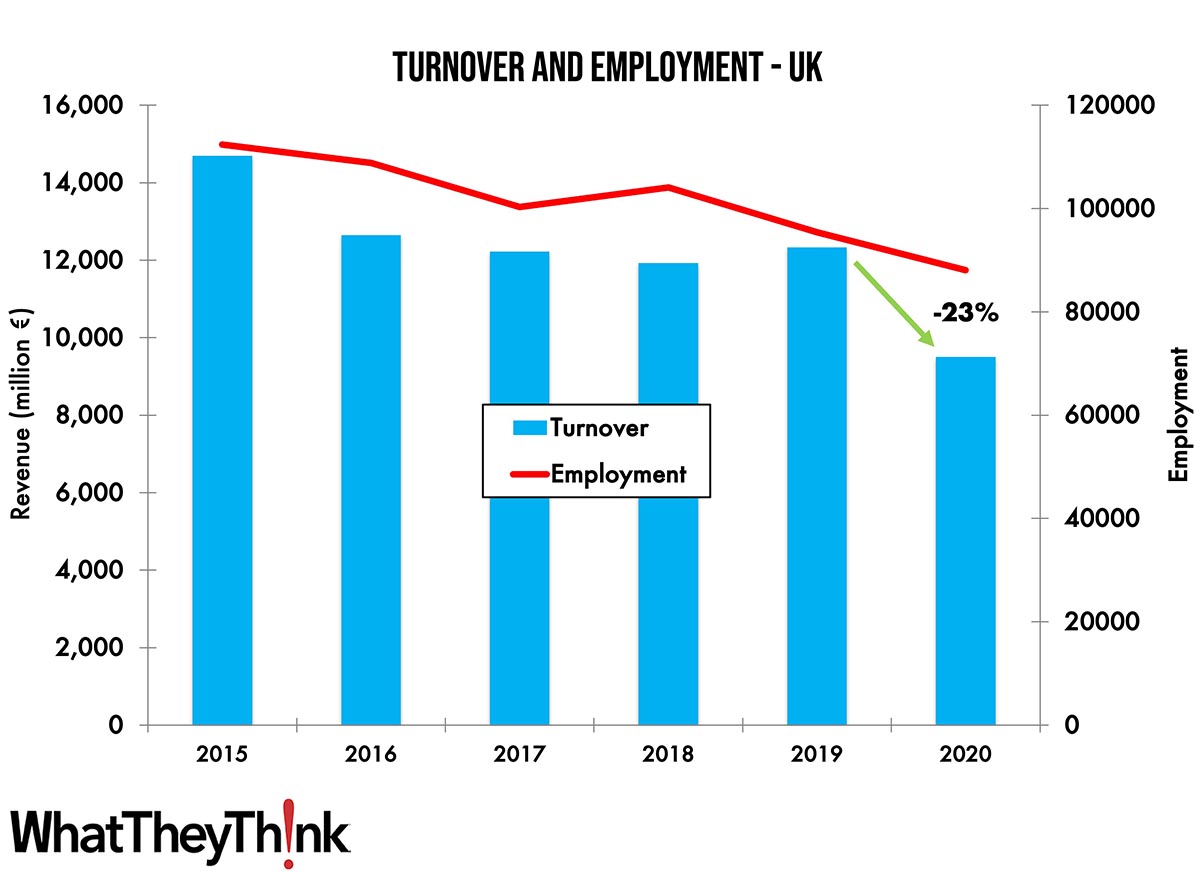

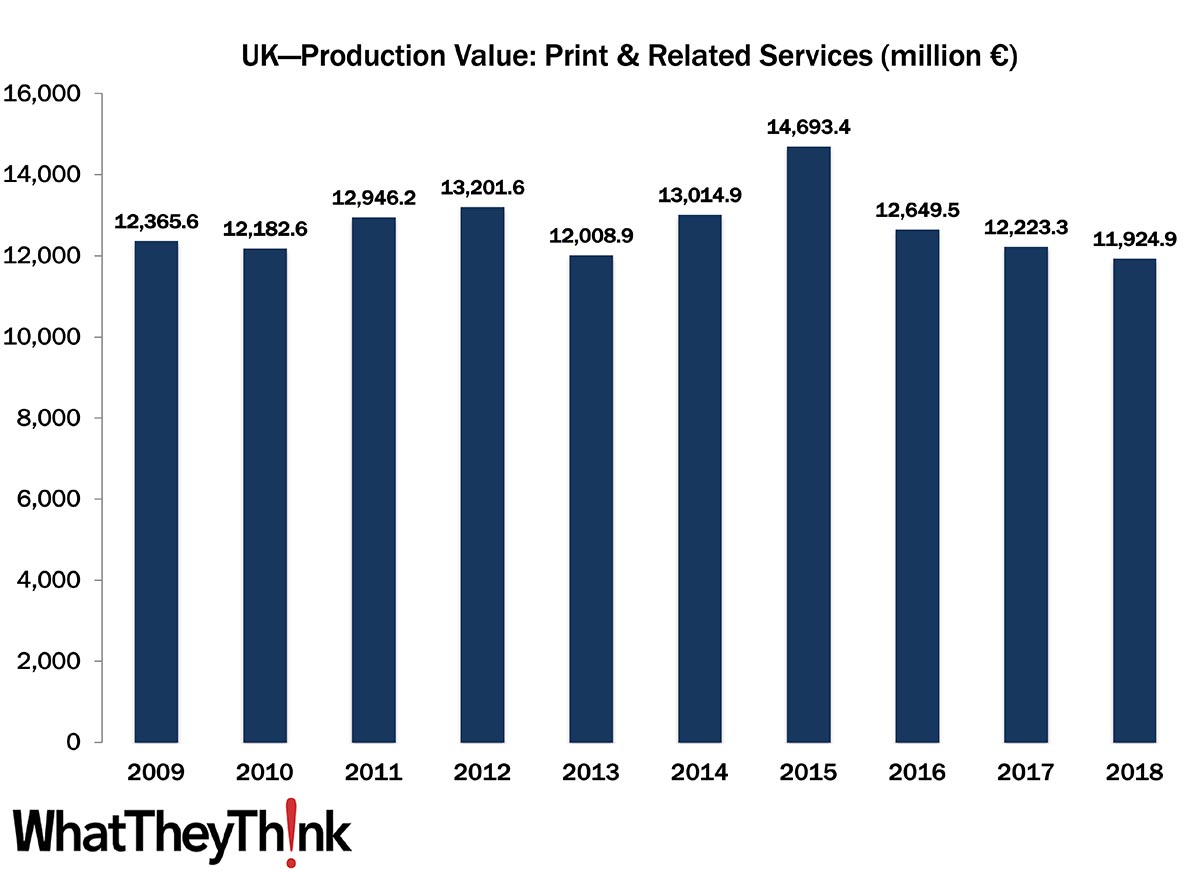

Turnover and Employment in Print in Europe—UK

Published: February 14, 2023

This bi-weekly series of short articles aims at shedding a spotlight on the size of the printing industry in Europe per country and how revenues and employment developed in 2020, when the pandemic impacted businesses. This time we look at the UK, the second-largest printing industry by turnover in Europe. Full Analysis

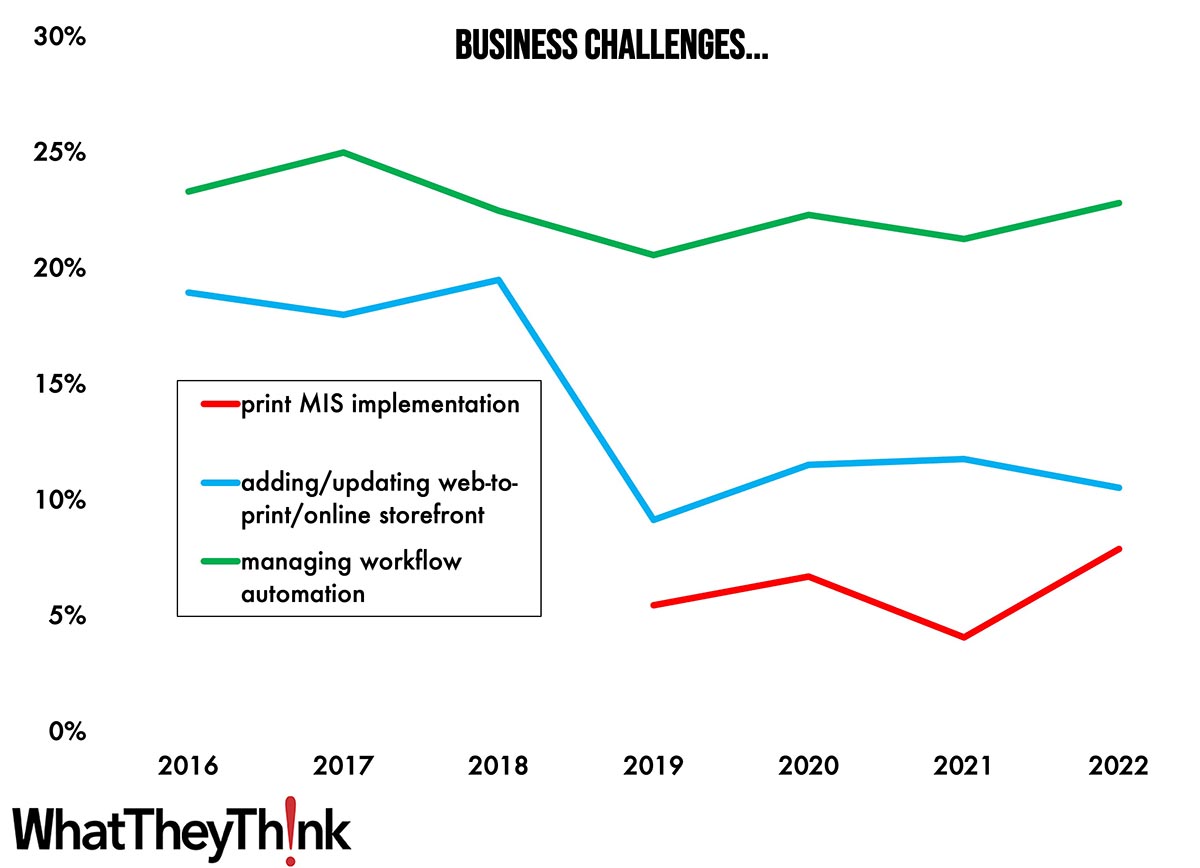

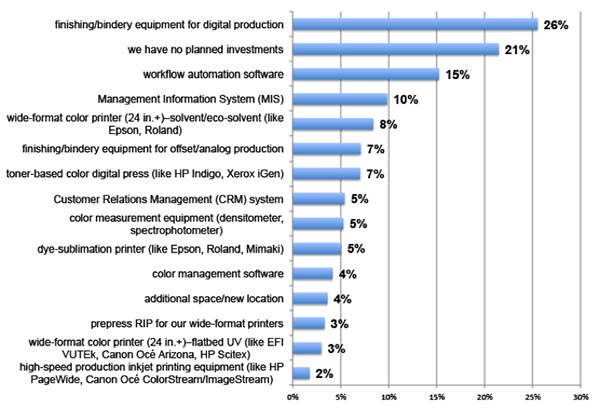

Tales from the Database: Software

Published: February 10, 2023

In our January/February 2023 print edition, we are launching a new series called “Tales from the Database,” drawing on six years’ worth of Print Business Outlook surveys. In every survey, we ask a broad cross-section of print businesses about business conditions, business challenges, new business opportunities, and planned investments. January/February is the software issue, so we rounded up a few software-related challenges, opportunities, and investments to see what the historical data can tell us. Full Analysis

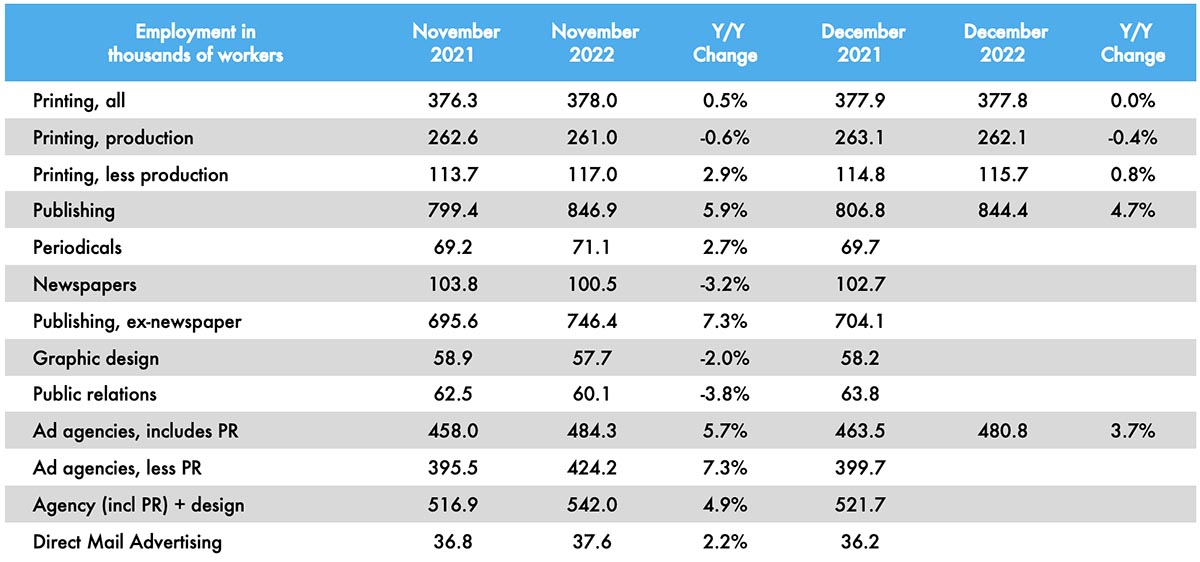

Graphic Arts Employment Flat or Declining in December

Published: February 3, 2023

Overall printing employment was essentially flat in December 2022, being down -0.1% from November, and essentially unchanged from December 2021. Production employment was up +0.4% while non-production employment was down -1.1% from November. Full Analysis

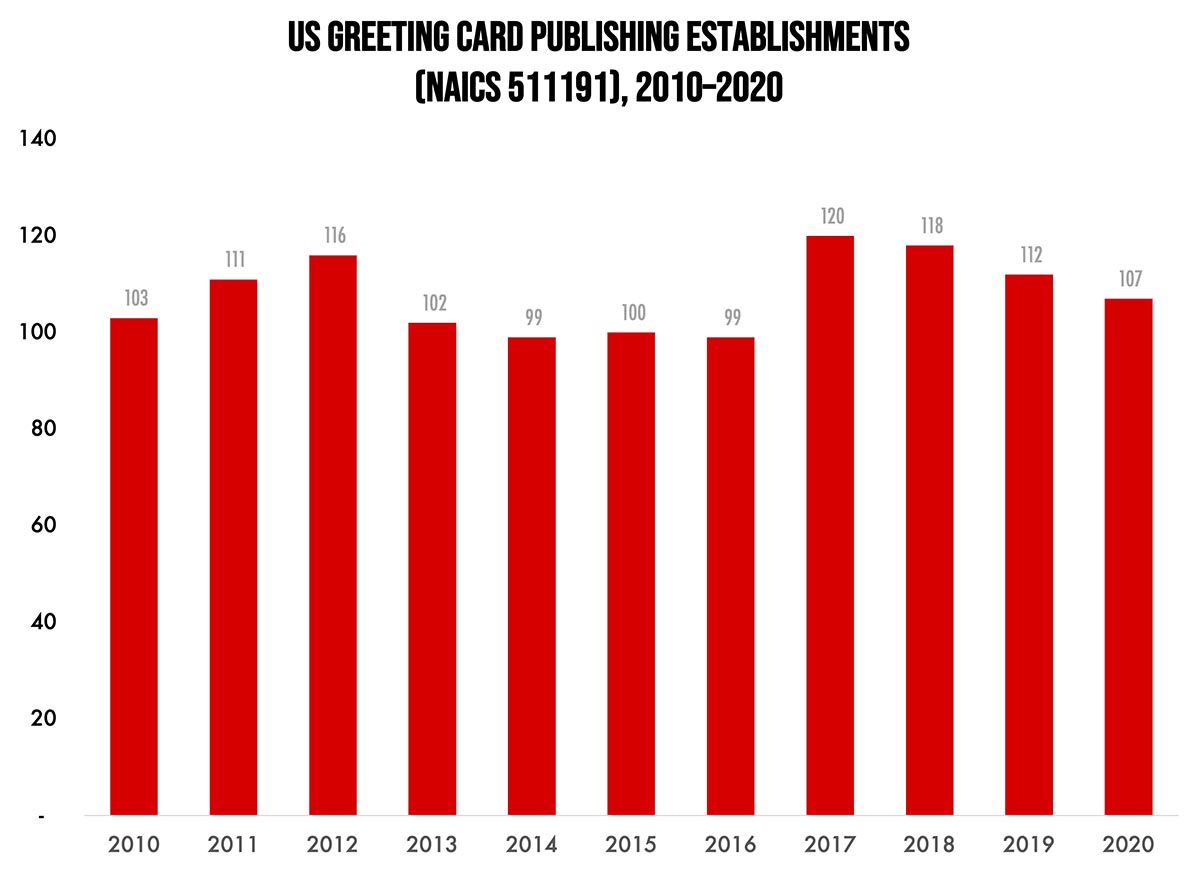

Greeting Card Publishing Establishments—2010–2020

Published: January 27, 2023

According to County Business Patterns, in 2020 there were 107 establishments in NAICS 511191 (Greeting Card Publishing). Although this represents a net increase of 4% since 2010, it has been a category that has ebbed and flowed over the course of the decade, although we’re not talking about a tremendous number of establishments. In macro news, real GDP increased 2.9% annualized in Q4. Full Analysis

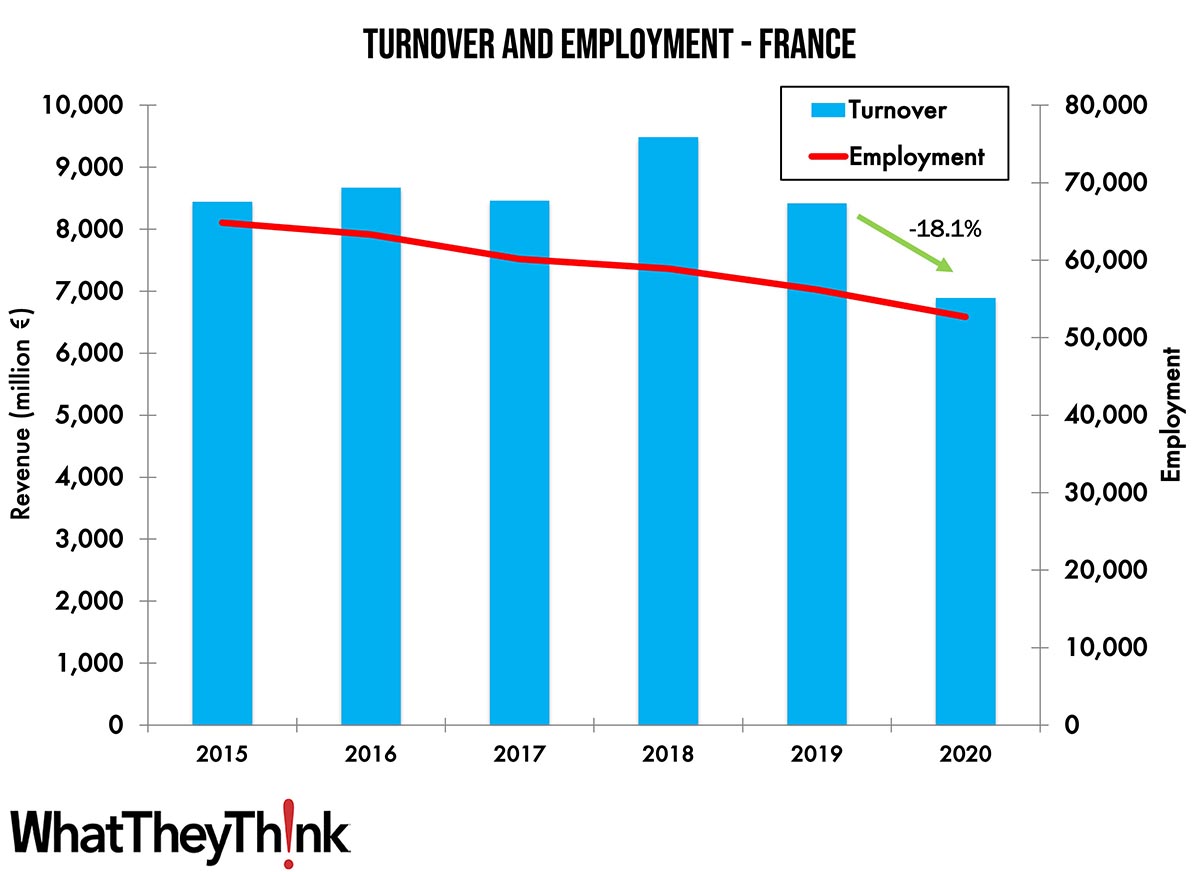

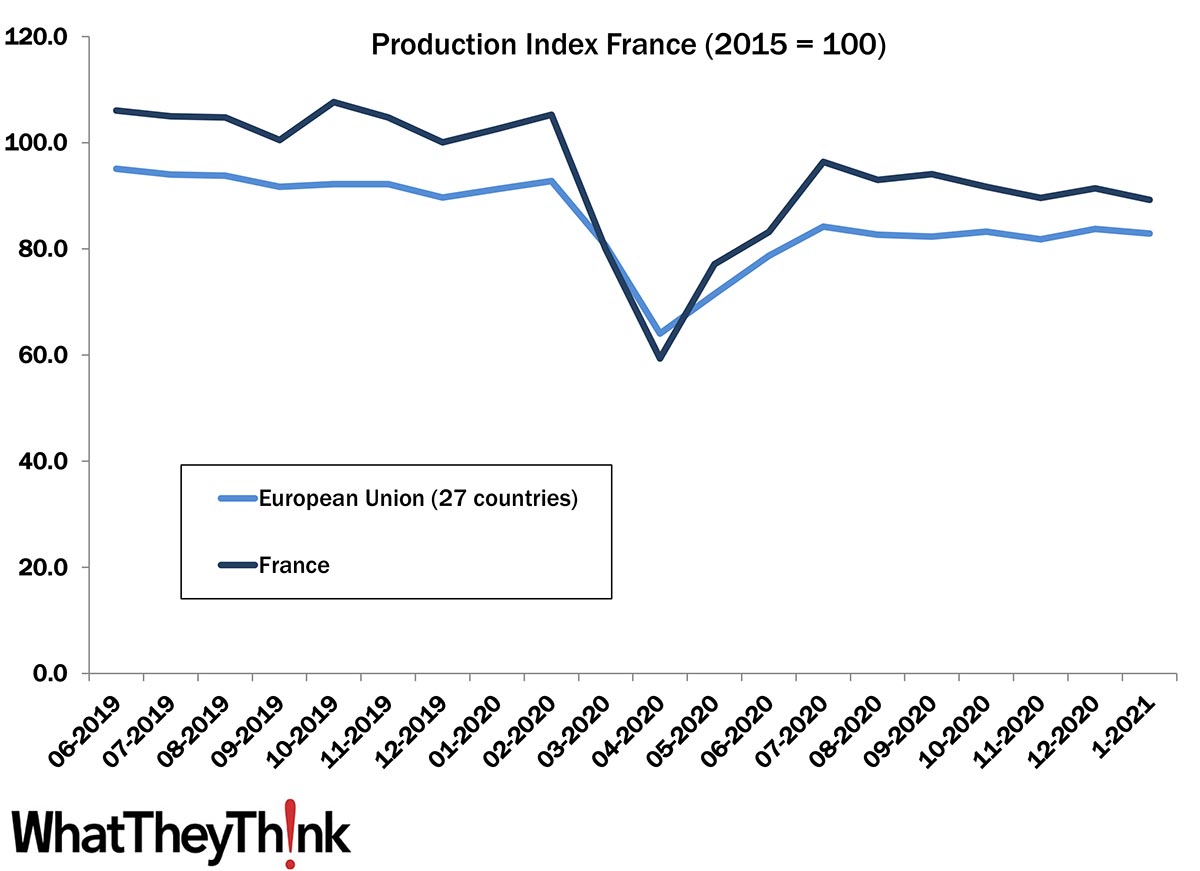

Turnover and Employment in Print in Europe—France

Published: January 24, 2023

This bi-weekly series of short articles aims at shedding a spotlight on the size of the printing industry in Europe per country and how revenues and employment developed in 2020, when the pandemic impacted the businesses. This time we look at France, the fourth-largest printing industry by turnover in Europe. Full Analysis

November 2022 Shipments Drop—But That’s Normal!

Published: January 20, 2023

November 2022 shipments came in at $7.16 billion, down from the year’s high of $7.48 billion in October. This should not be cause for concern, as business always drops in November and December as things slow down for the holidays. Full Analysis

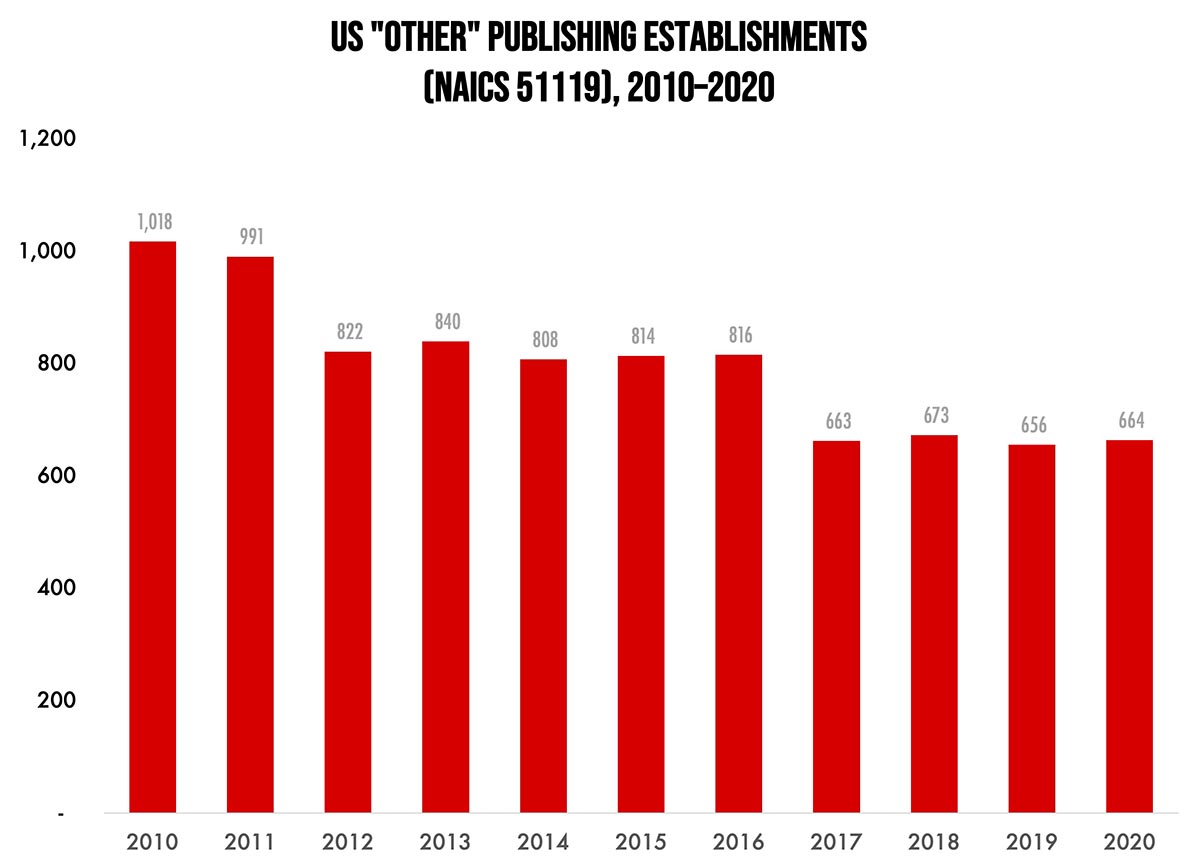

Other Publishing Establishments—2010–2020

Published: January 13, 2023

According to County Business Patterns, in 2020 there were 664 establishments in NAICS 51119 (Other Publishing). This represents a decrease of 35% since 2010. In macro news, what’s behind the employee shortages? Full Analysis

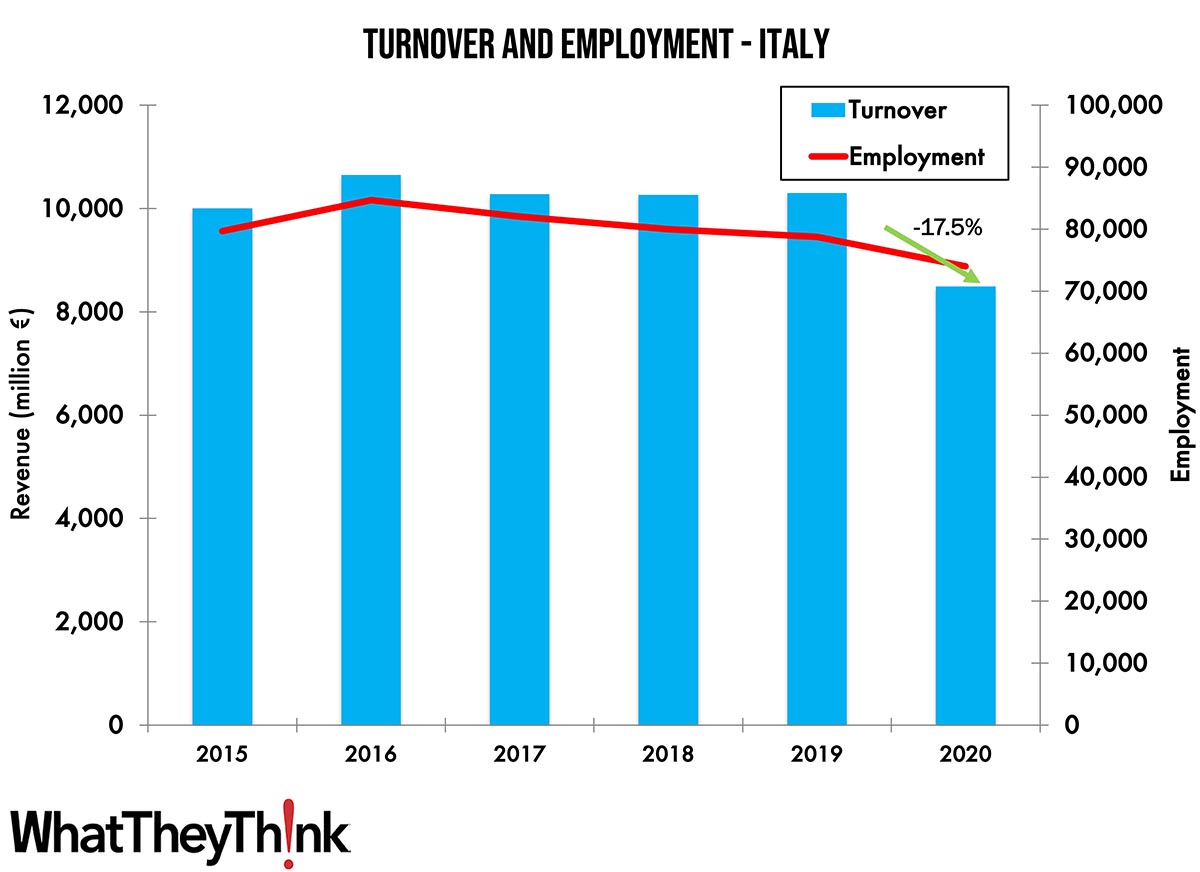

Turnover and Employment in Print in Europe—Italy

Published: January 10, 2023

This bi-weekly series of short articles aims at shedding a spotlight on the size of the printing industry in Europe per country and how revenues and employment developed in 2020, when the pandemic hit the market. This time we look at Italy, the third-largest printing industry by turnover in Europe. Full Analysis

Graphic Arts Employment Essentially Flat in November

Published: January 6, 2023

In November 2022, all printing employment was up +0.1% from October. Production employment was up +0.7% and non-production employment was down -1.2%. Full Analysis

Have a Little Holiday Cheer/October Shipments the Highest All Year

Published: December 16, 2022

October 2022 shipments came in at $7.48 billion, up from September’s $7.32 billion—the best month of the year for the industry. Full Analysis

Directory and Mailing List Publishing Establishments—2010–2020

Published: December 9, 2022

According to the latest edition of County Business Patterns, in 2020 there were 594 establishments in NAICS 51114 (Directory and Mailing List Publishers). This represents a decrease of 64% since 2010. In macro news, estimates for Q4 GDP are in the +1.4%–3.4% range. Full Analysis

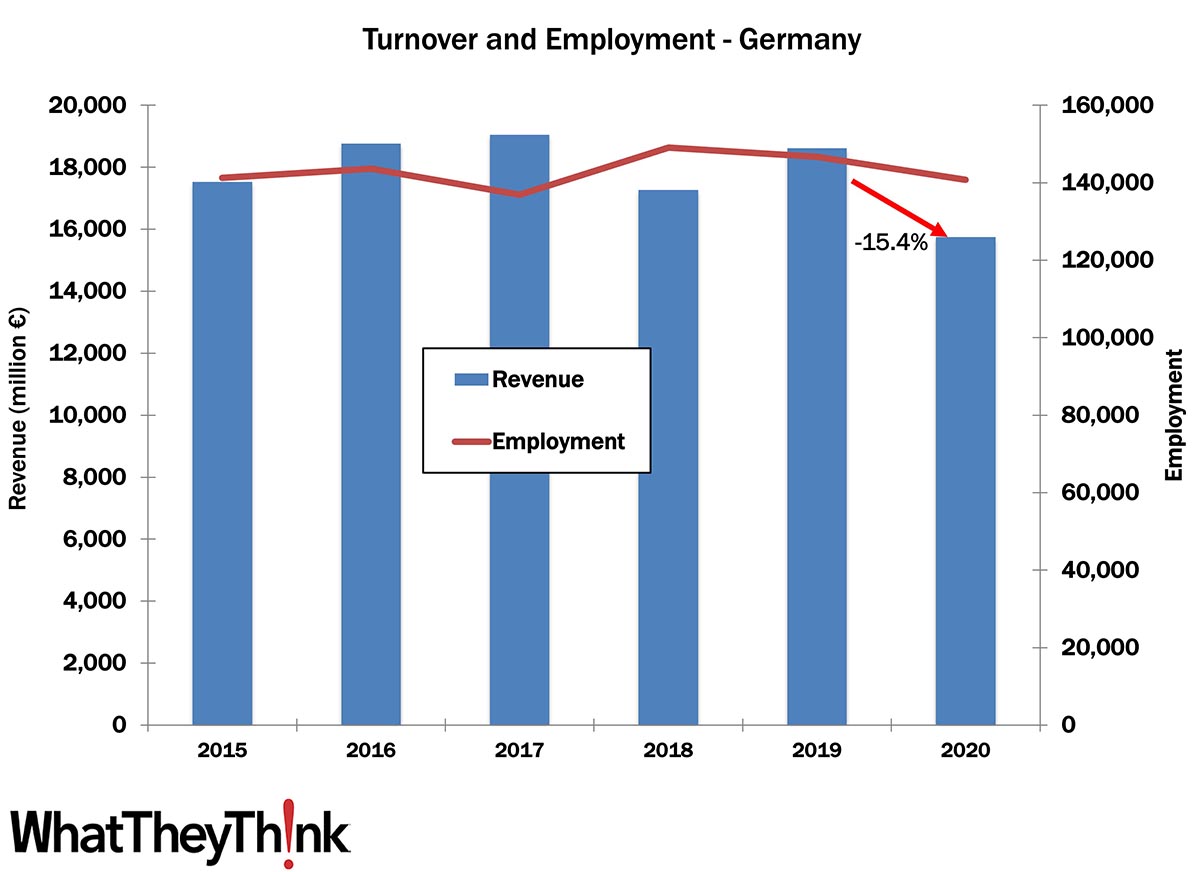

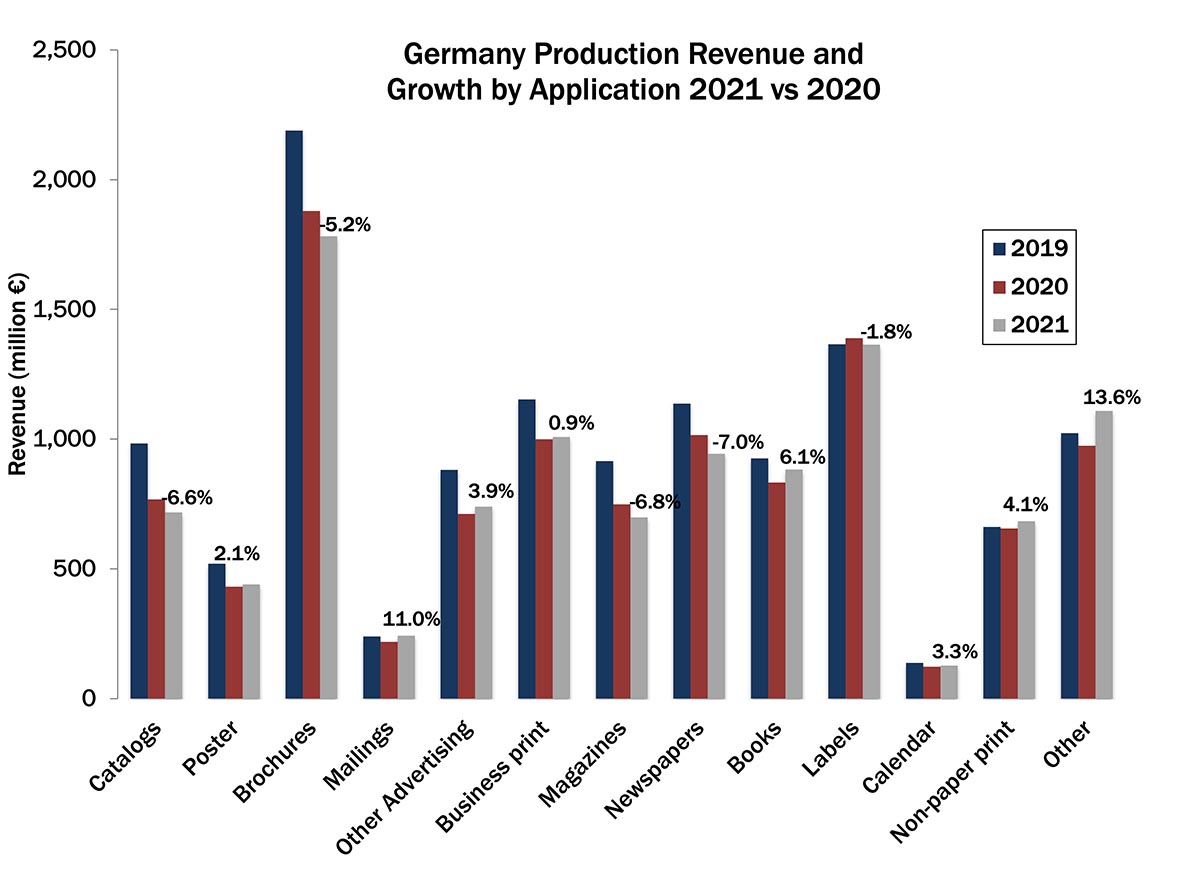

Turnover and Employment in Print in Europe—Germany

Published: December 6, 2022

This bi-weekly series of short articles aims at shedding a spotlight on the size of the printing industry in Europe per country and how revenues and employment developed in 2020, when the pandemic hit the market. Kicking off the series is Germany, the largest printing industry by turnover in Europe. Full Analysis

September Printing Shipments—The High Before the Holidays

Published: December 2, 2022

September 2022 shipments came in at $7.20 billion, up a little from August’s $7.17 billion—reflecting a return to the industry’s regular seasonality. Could we be back to normal? Full Analysis

Book Publishing Establishments—2010–2020

Published: November 18, 2022

According to the latest edition of County Business Patterns, in 2020 there were 2,357 establishments in NAICS 51113 (Book Publishing). This represents a decrease of 21% since 2010. In macro news, October retail sales were up. Full Analysis

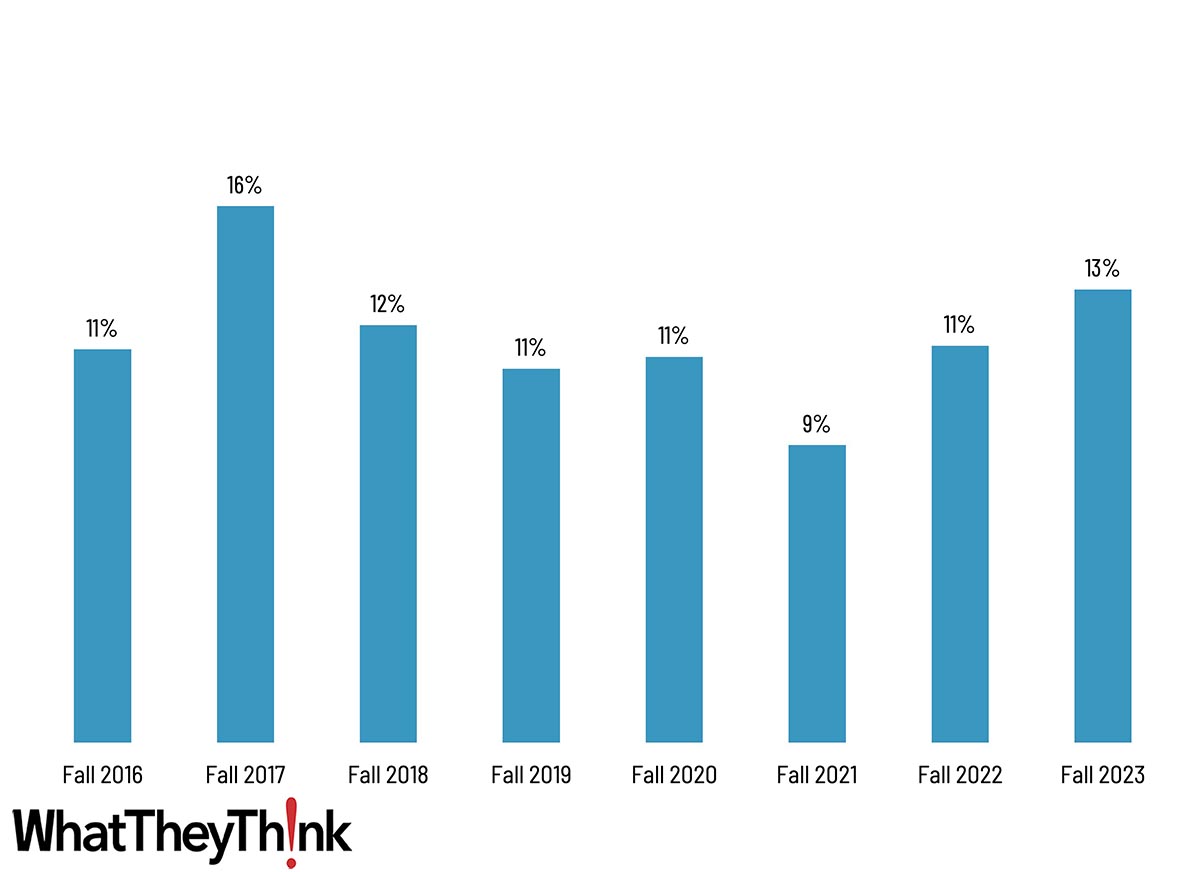

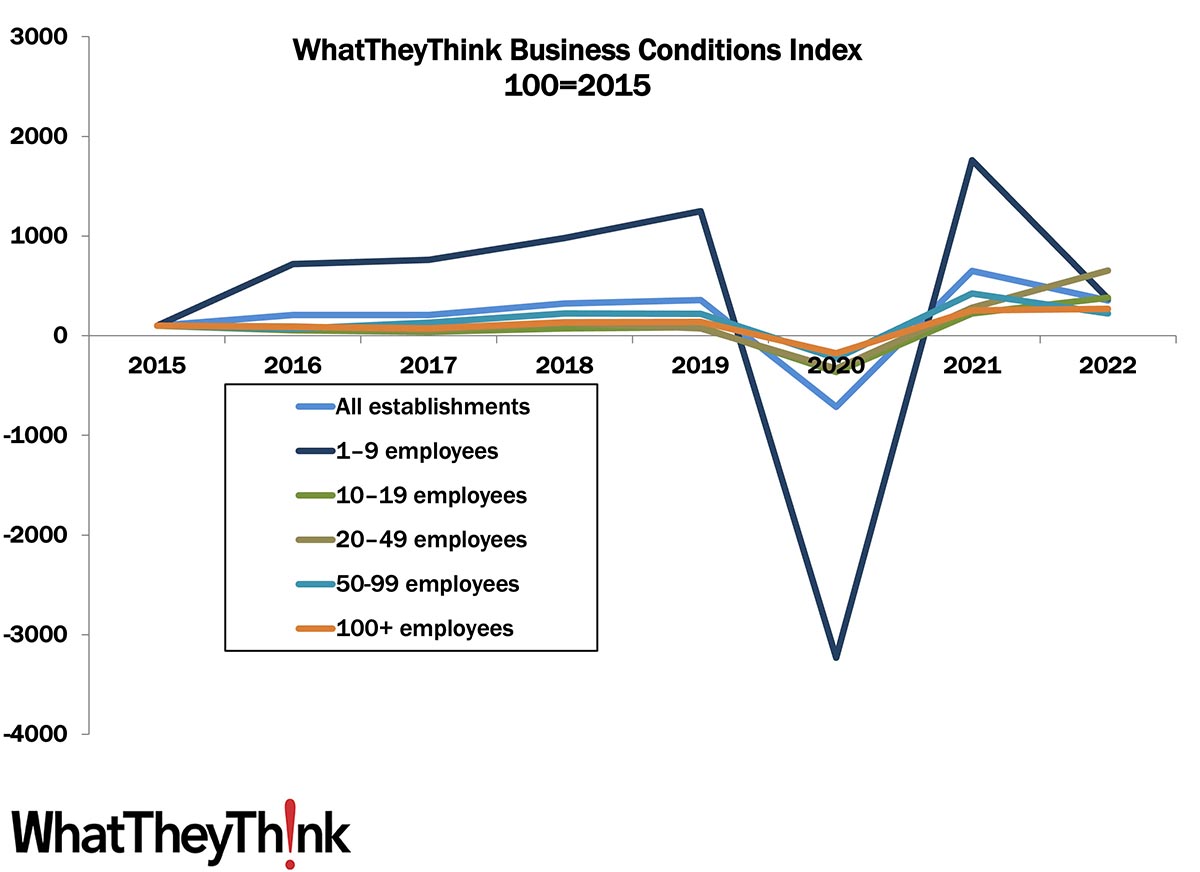

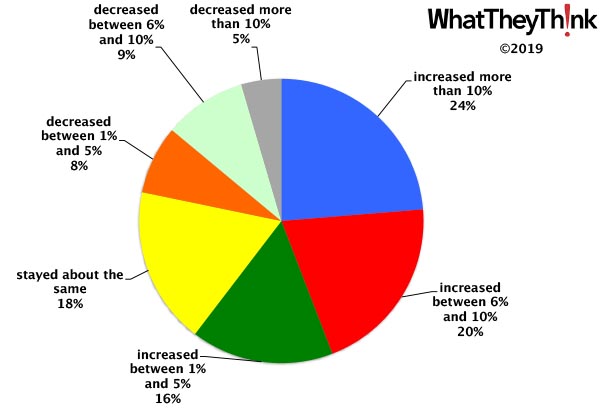

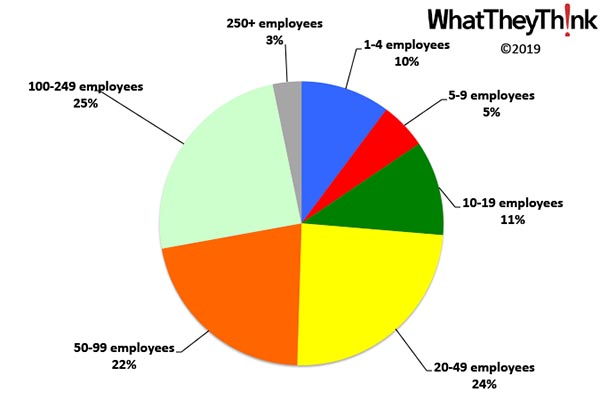

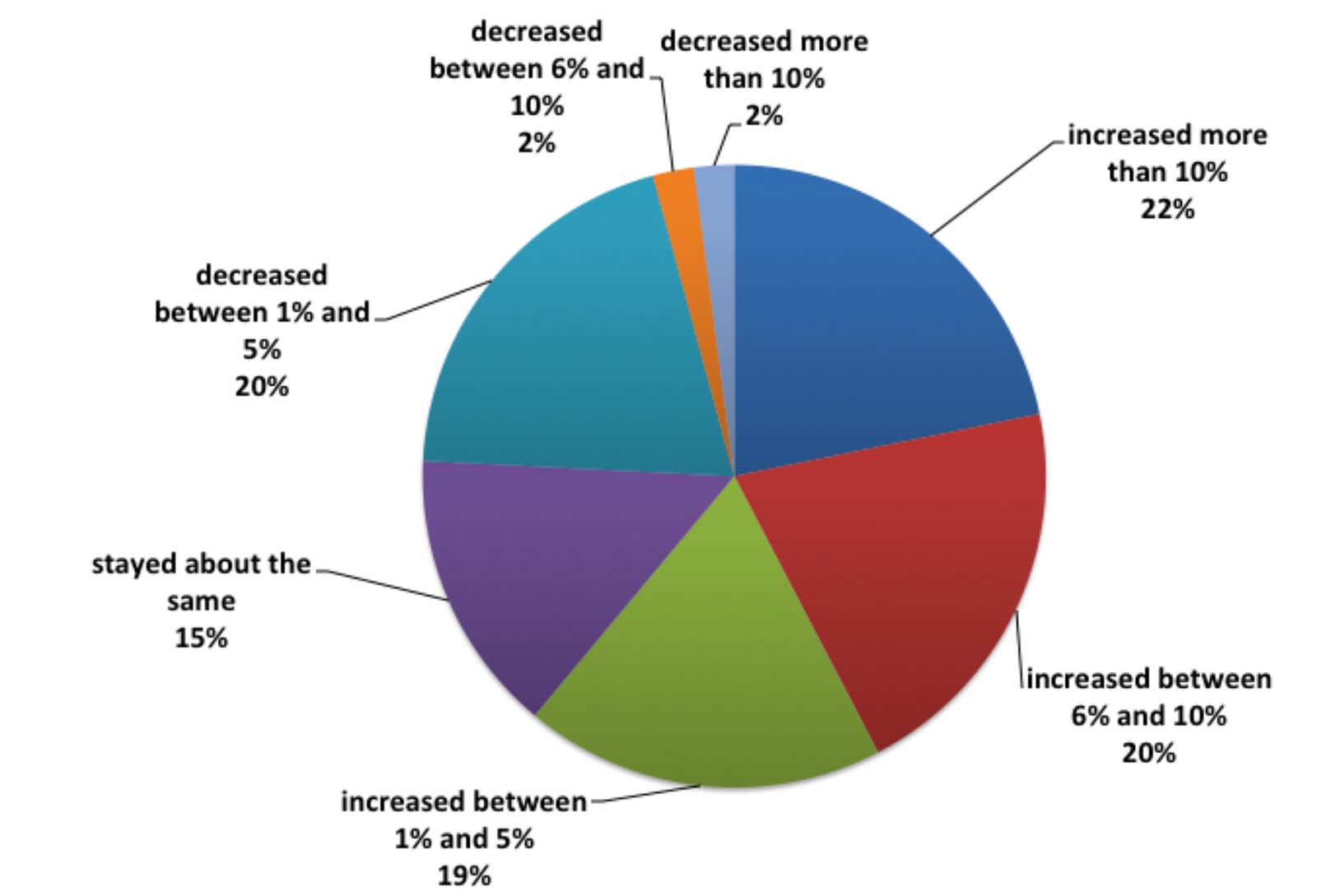

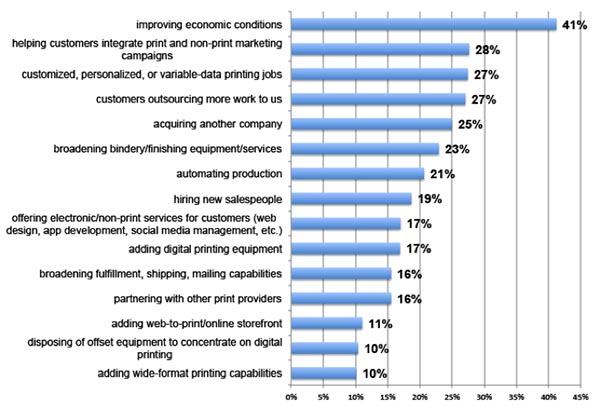

Printing Outlook 2023 Sneak Peek: Business Conditions Slipped in 2022

Published: November 11, 2022

Our preliminary Fall Print Business Survey results are in and our Business Conditions Index dropped slightly from 2021. Last year marked a rebound from the plummeting conditions in 2020, and 2022 likely represents a move toward stability. Full Analysis

Periodical Publishing Establishments—2010–2020

Published: November 4, 2022

According to the latest edition of County Business Patterns, in 2020 there were 4,519 establishments in NAICS 51112 (Periodical Publishing). This represents a decrease of 37% since 2010. In macro news, actual Q3 GDP was strong. Full Analysis

Graphic Arts Employment Down Slightly in September

Published: October 28, 2022

In September 2022, all printing employment was down -1.3% from August. Production employment was down -1.9% and non-production employment was down -0.1%. Full Analysis

Sizing the European Printing Industry

Published: October 25, 2022

European section editor Ralf Schlözer rounds up the latest data on European and UK printing industry establishments, revenues, and production volumes. Full Analysis

Newspaper Publishing Establishments—2010–2020

Published: October 21, 2022

According to the latest, recently released edition of County Business Patterns, in 2020 there were 6,567 establishments in NAICS 51111 (Newspaper Publishing). This represents a decrease of 16% since 2010. In macro news, early estimates of Q3 GDP getting more bullish. Full Analysis

August August Printing Shipments

Published: October 14, 2022

August 2022 shipments came in at $7.16 billion, up quite a bit from July’s $6.67 billion—august business conditions indeed, and reflecting a return to the industry’s regular seasonality. Full Analysis

Publishing Establishments—2010–2020

Published: October 7, 2022

According to the latest, recently released edition of County Business Patterns, in 2020 there were 29,900 establishments in NAICS 511 (Publishing Industries [except Internet]). This represents an increase of 6% since 2010 and increase of 9% since 2016. In macro news, job openings were down 1.1 million in August while hires and separations (quits, dismissals, and layoffs) were generally unchanged. Full Analysis

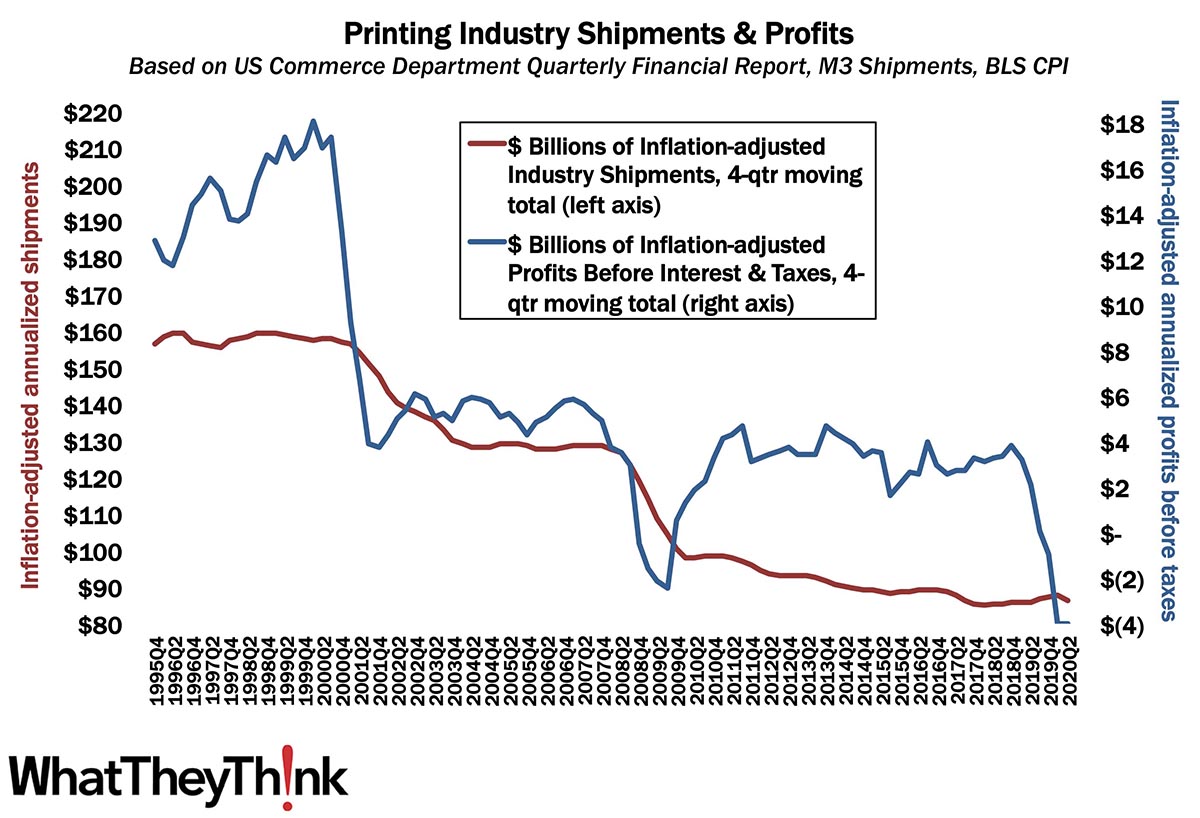

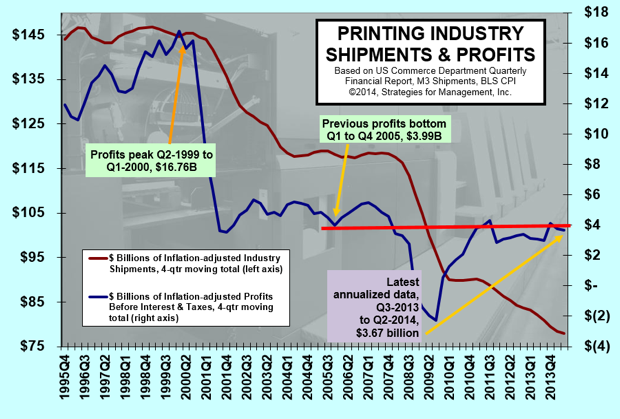

Q2 Printing Profits: An End to the Tale of Two Cities?

Published: September 30, 2022

Printing industry profits plunged during the pandemic peak but rebounded strongly afterward. But after hitting a peak in Q3 of last year, we’re on a downward trend, with annualized profits for Q2 2022 coming in at $3.92 billion, down a tad from $4.68 billion in Q1 2022. Full Analysis

Pre- and Postpress Establishments—2010–2020

Published: September 23, 2022

According to the latest, recently released edition of County Business Patterns, in 2020 there were 1,168 establishments in NAICS 32312 (Support Activities for Printing). This represents a decrease of 44% since 2010. In macro news, AIA’s Architecture Billings Index (ABI) indicates that demand for design services accelerated in August, boding well for commercial real estate construction and thus signage projects. Full Analysis

Printing Shipments: July Takes a Tumble

Published: September 16, 2022

July 2022 shipments came in at $6.68 billion, down from June’s $6.98 billion, as the dog days of summer kicked in. Full Analysis

Book Printing Establishments—2010–2020

Published: September 9, 2022

According to the latest, recently released edition of County Business Patterns, in 2020 there were 379 establishments in NAICS 323117 (Books Printing). This represents a decrease of 29% since 2010. In macro news, highlights from the most recent Federal Reserve “Beige Book.” Full Analysis

Graphic Arts Employment Up Slightly in July

Published: September 2, 2022

In July 2022, all printing employment was up +0.7% from June. Production employment was up 0.2% and non-production employment was up 1.8%. Full Analysis

Screen Printing Establishments—2010–2020

Published: August 26, 2022

According to the latest, recently released edition of County Business Patterns, in 2020 there were 5,563 establishments in NAICS 323113 (Commercial Screen Printing). This represents an increase of 25% since 2010. In macro news, 2Q GDP revised up to -0.6%. Full Analysis

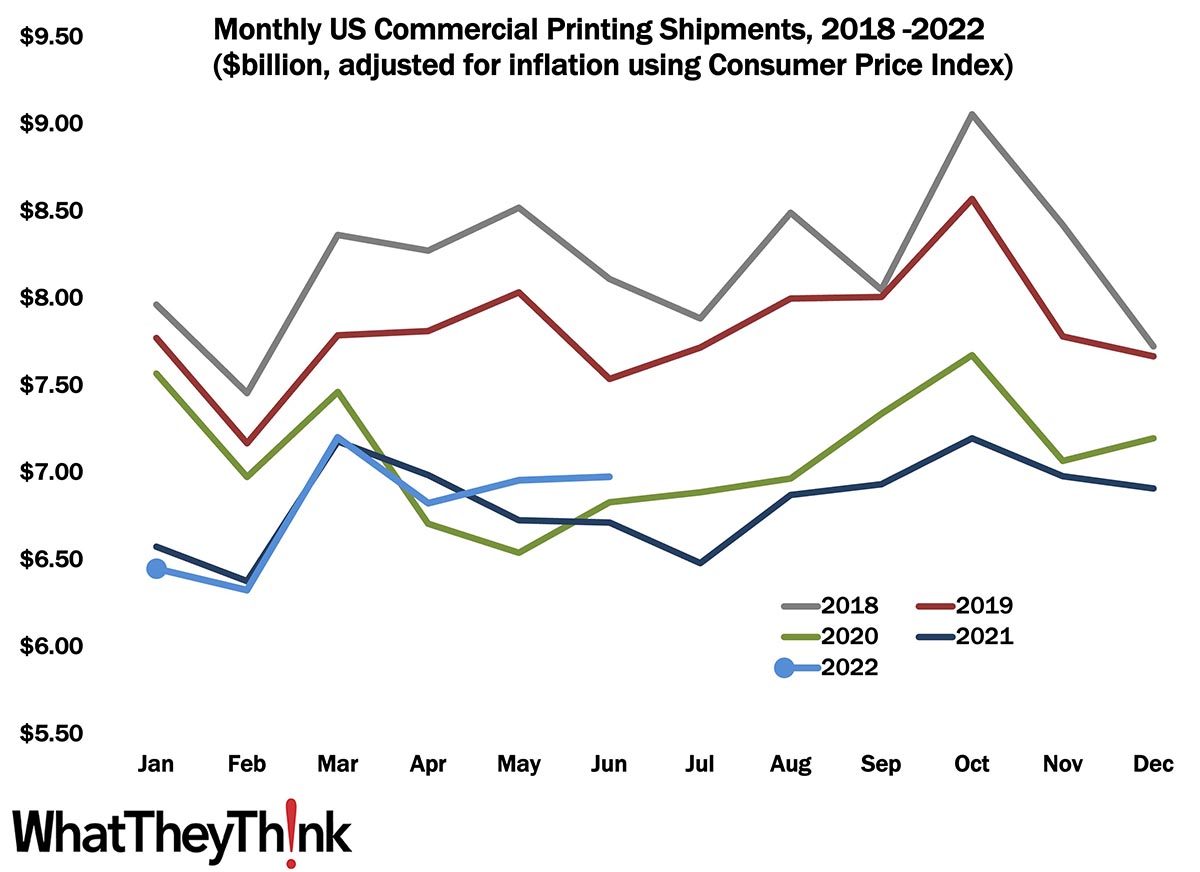

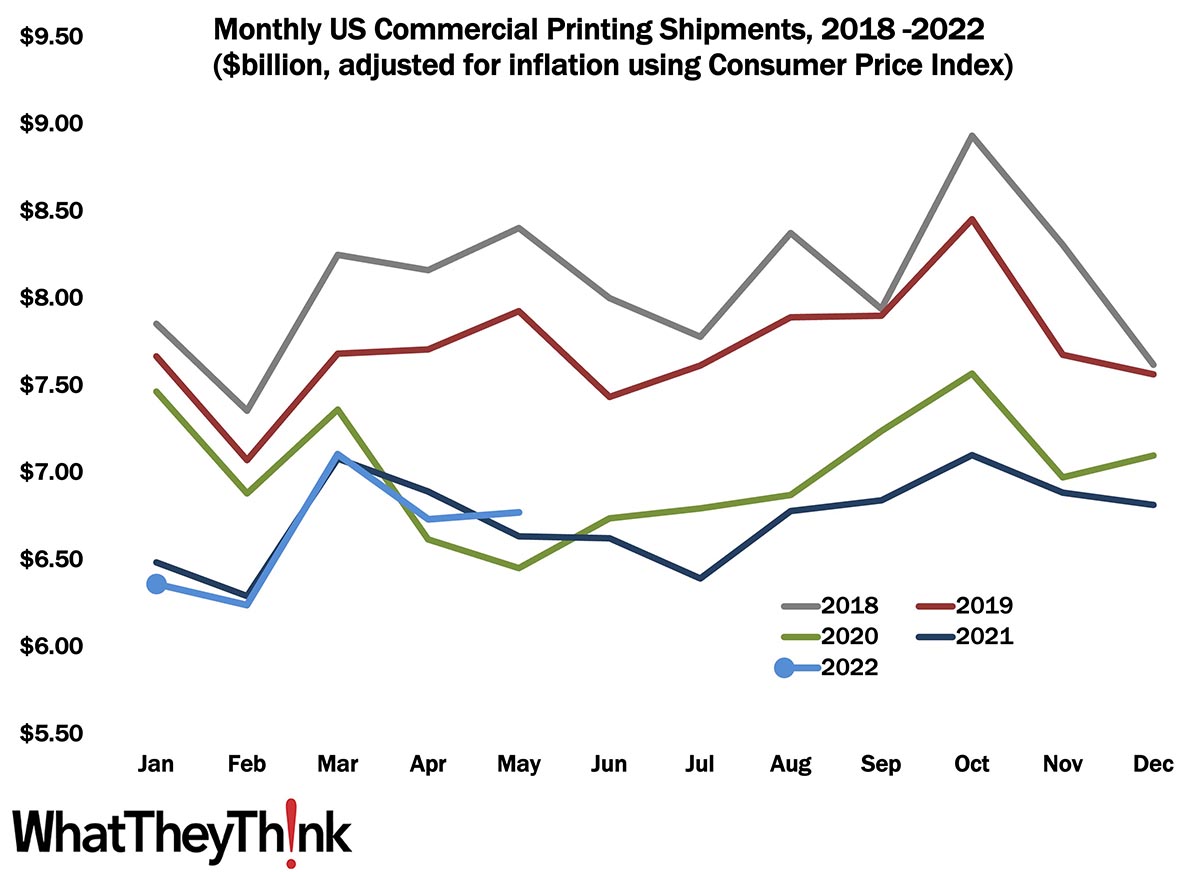

Printing Shipments: The Best June Since the Before Times

Published: August 19, 2022

June 2022 shipments came in at $6.98 billion, up a tad from May’s $6.96 billion. This is the best June the industry has had since 2019—although it’s well below that month’s $7.54 billion. Full Analysis

Commercial Printing Establishments—2010–2020

Published: August 12, 2022

According to the latest, recently released edition of County Business Patterns, in 2020 there were 16,283 establishments in NAICS 323111 (Commercial Printing except Screen and Books). This represents a decline of 26% since 2010. In macro news, inflation is flat! Full Analysis

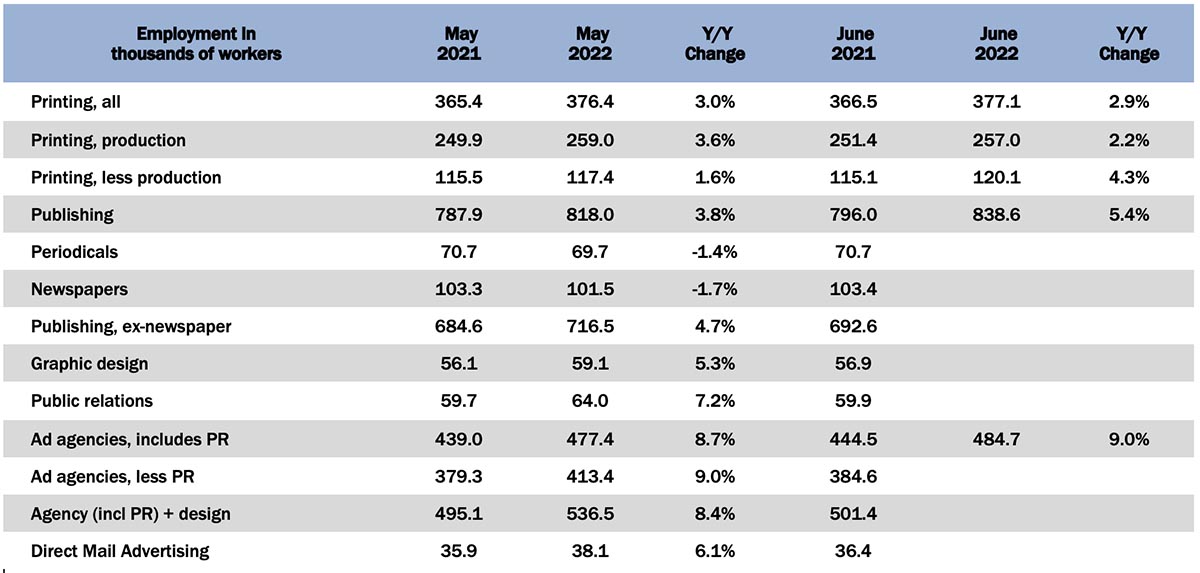

June Graphic Arts Employment—The Production/Non-Production See Saw This Month Favors Non-Production Workers

Published: August 5, 2022

In June 2022, all printing employment was up +0.2% from May. This time, it was production employment that was down (-0.8%) and non-production employment that was up (+2.3%). Full Analysis

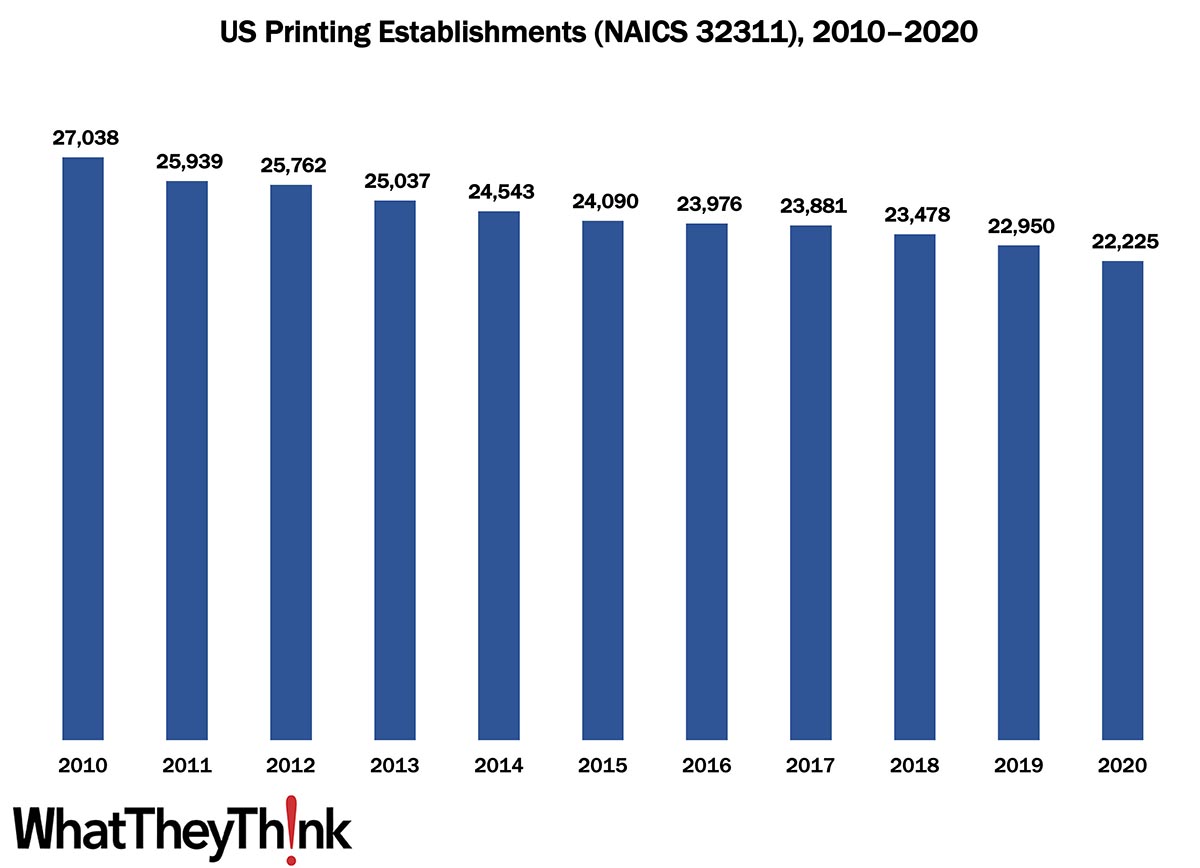

Printing Establishments—2010–2020

Published: July 29, 2022

According to the latest, just-released edition of County Business Patterns, in 2020 there were 22,225 establishments in NAICS 32311 (Printing). This represents a decline of 18% since 2010. In macro news, Q2 GDP declined -0.9%. Full Analysis

Post-Pandemic Print Applications in Germany—No Drop, No Growth

Published: July 26, 2022

The German printing industry association (BVDM) recently published its 2021 print industry statistics, which includes an overview of print application revenues. Ralf Schlözer takes a look at print revenue growth in Germany and the impact the pandemic and post-pandemic recovery had on individual print applications. Full Analysis

Printing Shipments: The Best May Since the Before Times

Published: July 22, 2022

May 2022 shipments came in at $6.77 billion, up from April’s $6.73 billion. This is the best May the industry has had since 2019—although it’s well below that month’s $7.92 billion. Full Analysis

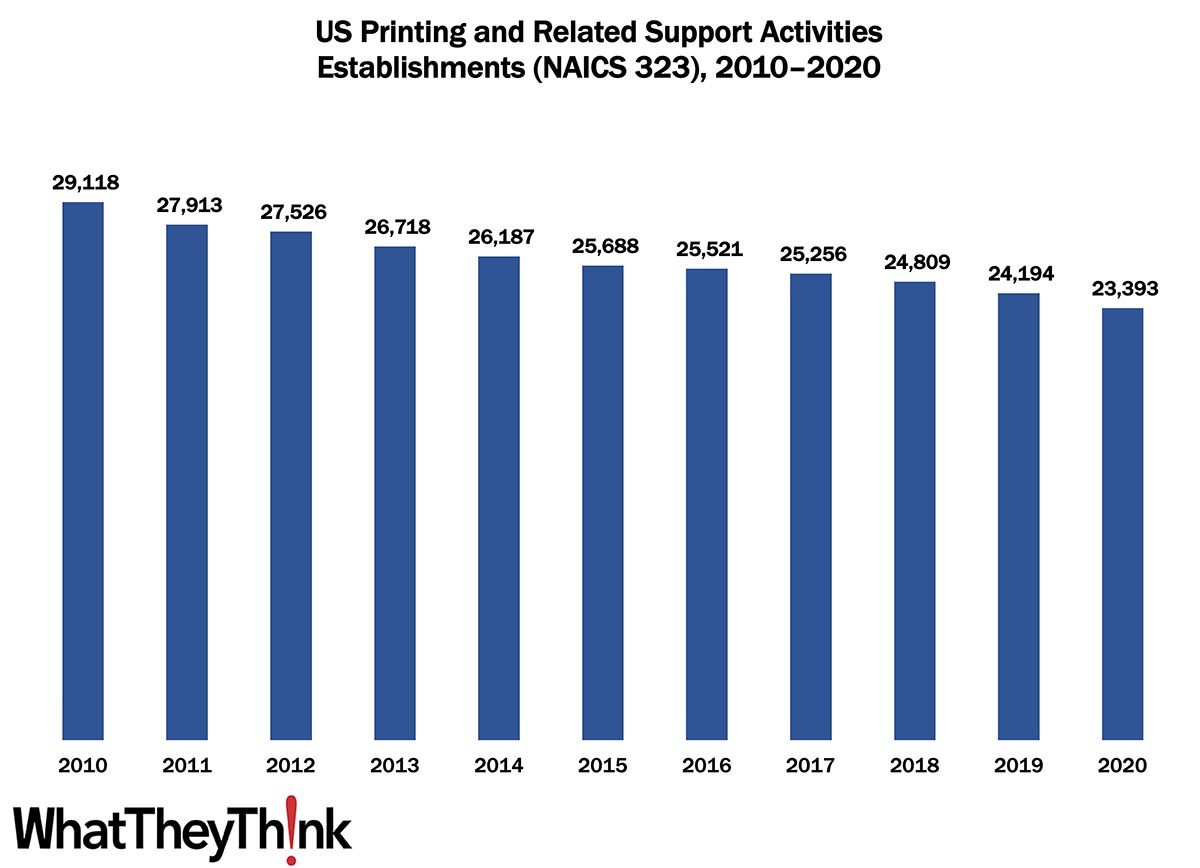

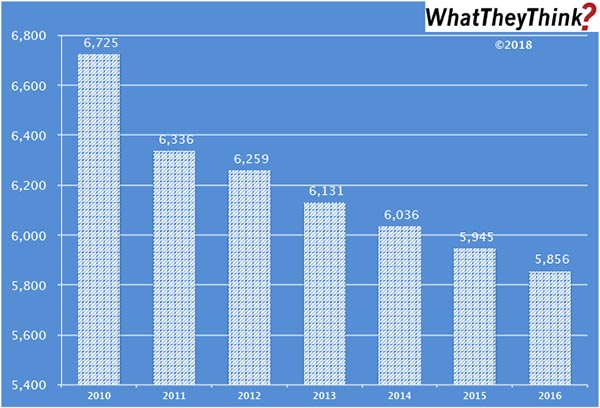

Printing Establishments—2010–2020

Published: July 15, 2022

According to the latest, just-released edition of County Business Patterns, in 2020 there were 23,393 establishments in NAICS 323 (Printing and Related Support Activities). This represents a decline of 20% since 2010. In macro news, Q2 GDP estimates are bearish—but that may not be cause for concern. Full Analysis

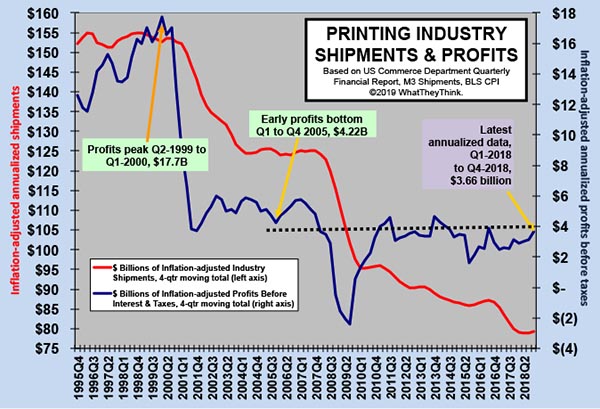

Printing Profits: Back to Pre-Pandemic Levels

Published: July 1, 2022

Despite COVID, printing industry profits have been pretty good, with annualized profits for Q1 2022 coming in at $4.55 billion, down from $4.79 billion in Q4 2021. Full Analysis

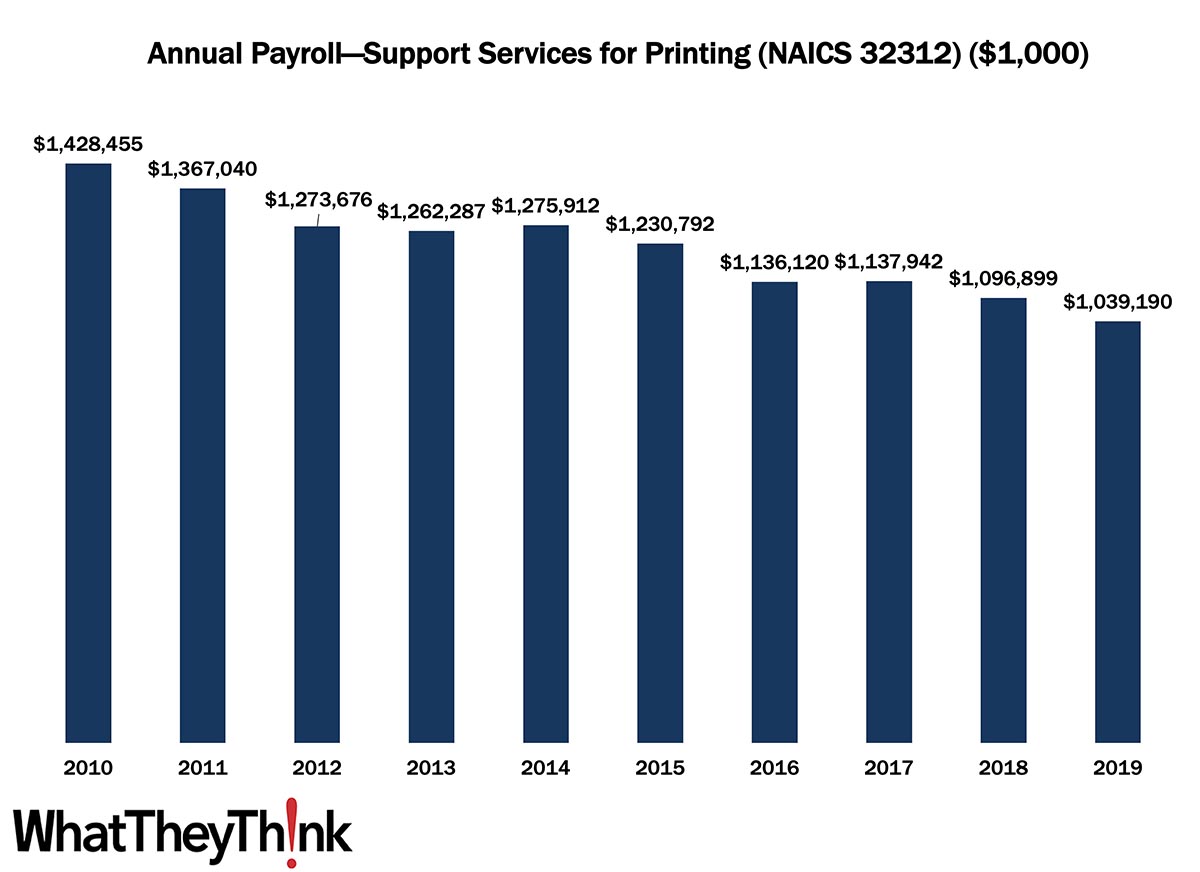

Support Activities for Printing Annual Payroll—2010–2019

Published: June 24, 2022

According to County Business Patterns, in 2010, US establishments in NAICS 32312 had an annual payroll of $1.4 billion. Payrolls declined steadily over the course of the 2010s, closing out the decade at $1.0 billion in 2019. However adjusting for inflation, payrolls declined by -38% over the course of the decade. In macro news: AIA’s Architecture Billings Index (ABI) indicates that demand for design services remains strong, boding well for commercial real estate construction and thus signage projects. Full Analysis

April Shipments: Returning to Regular Seasonality

Published: June 17, 2022

April 2022 shipments came in at $6.67 billion, down from March’s $7.03 billion. The general trend in all but two of the last seven years has been for April shipments to decline from March’s. That’s not really good news but suggests we’re at least getting back to normal. Full Analysis

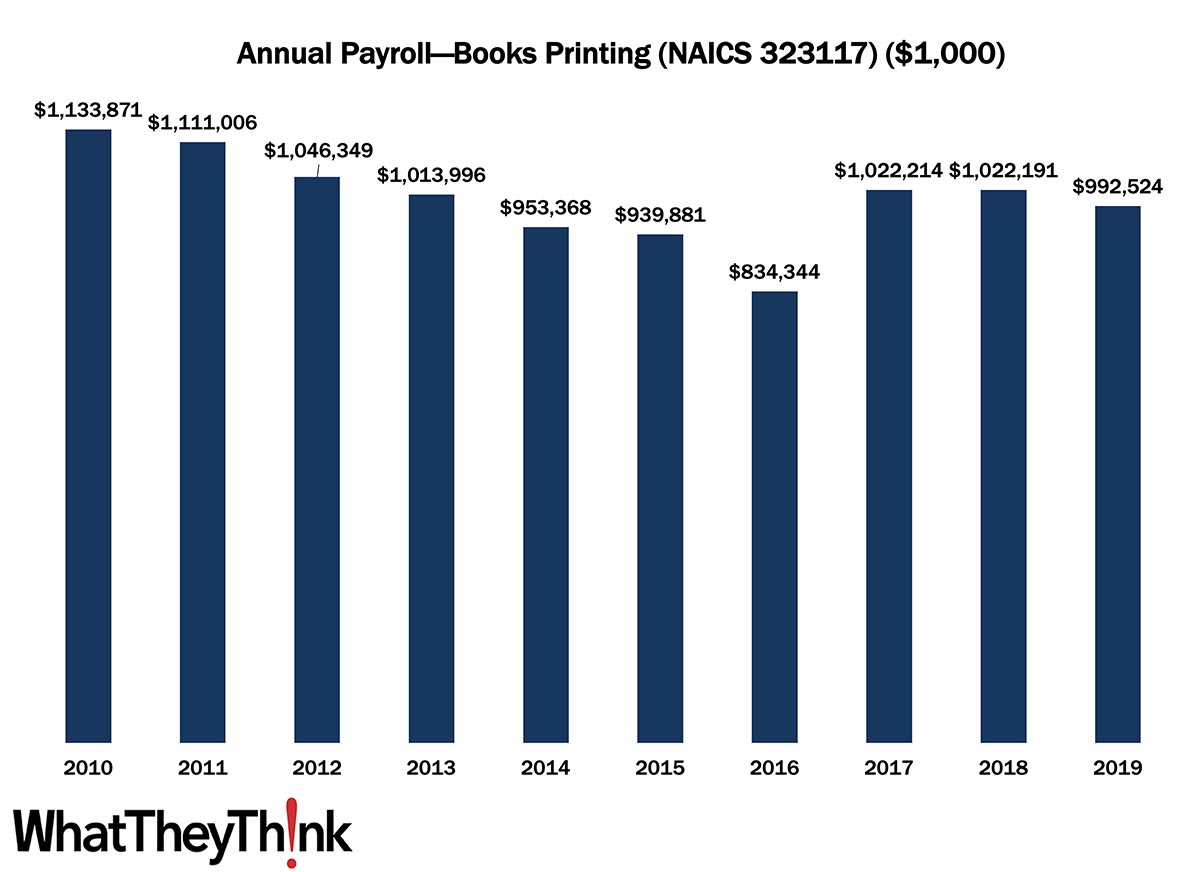

Book Printing Annual Payroll—2010–2019

Published: June 10, 2022

According to County Business Patterns, in 2010, US establishments in NAICS 323117 had an annual payroll of $1.1 billion. Payrolls declined over the first half of the 2010s, at least on a current dollar basis, but started to rise again, closing out the decade at $993 million in 2019. However adjusting for inflation, payrolls declined by -25% over the course of the decade. In macro news: what’s going on with the real estate market? Full Analysis

April Graphic Arts Employment—Print Production Up from March, Non-Production Down Slightly

Published: June 3, 2022

In March 2022, all printing employment was up +0.6% from March. This time, it was production employment that was up (+1.6%) and non-production employment that was down (-0.9%). Full Analysis

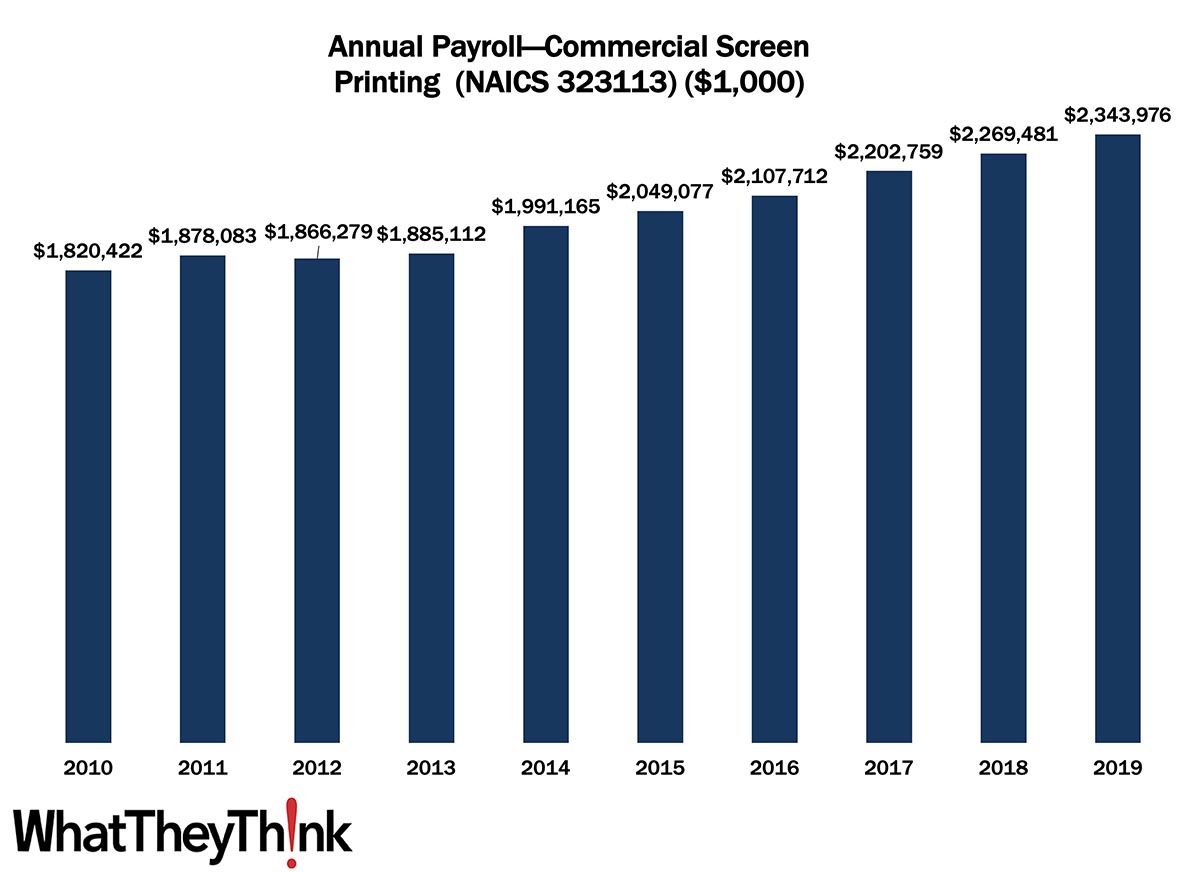

Commercial Screen Printing Annual Payroll—2010–2019

Published: May 27, 2022

According to County Business Patterns, in 2010, US establishments in NAICS 323113 had an annual payroll of $1.8 billion. Payrolls were generally unaffected by the Great Recession and rose over the course of the 2010s, at least on a current dollar basis, finishing out the decade at $2.3 billion in 2019. However adjusting for inflation, payrolls declined by -10% over the course of the decade. In macro news: Q1 GDP revised down. Full Analysis

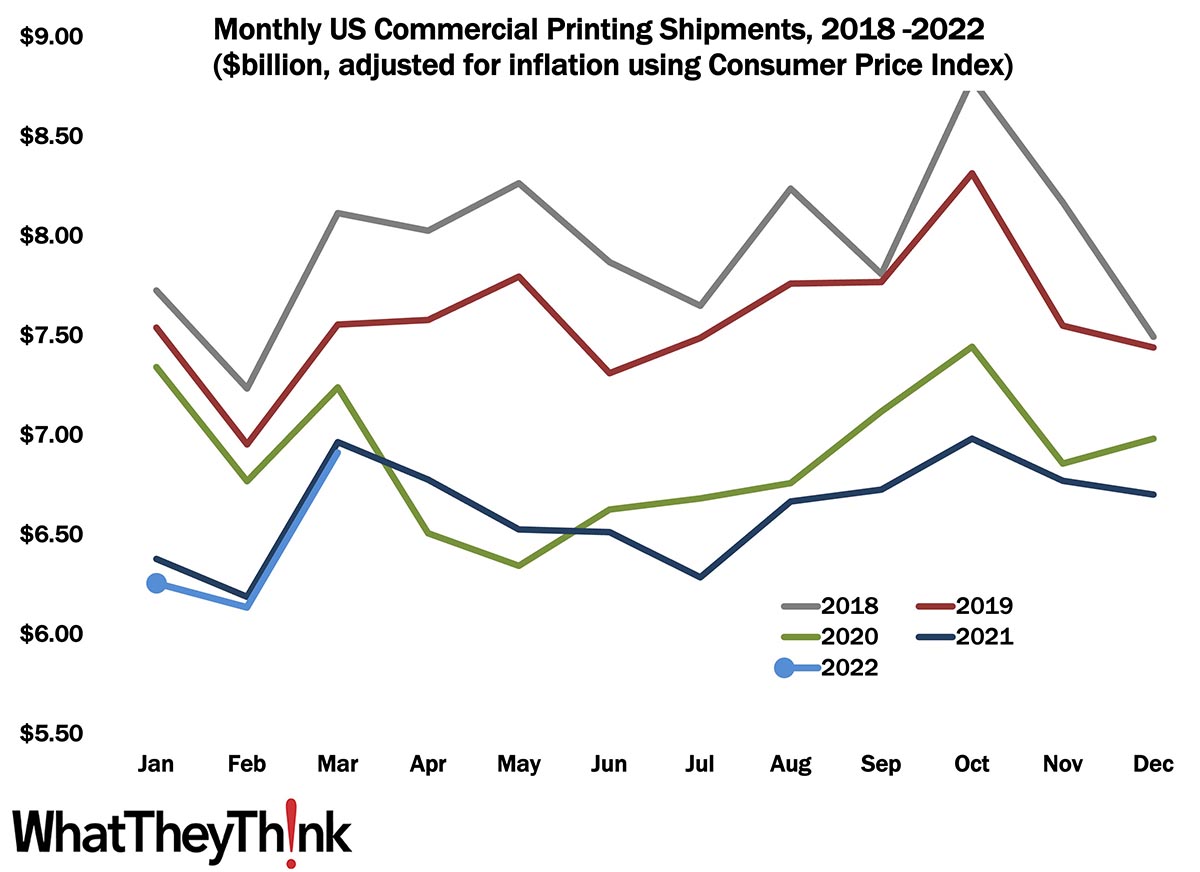

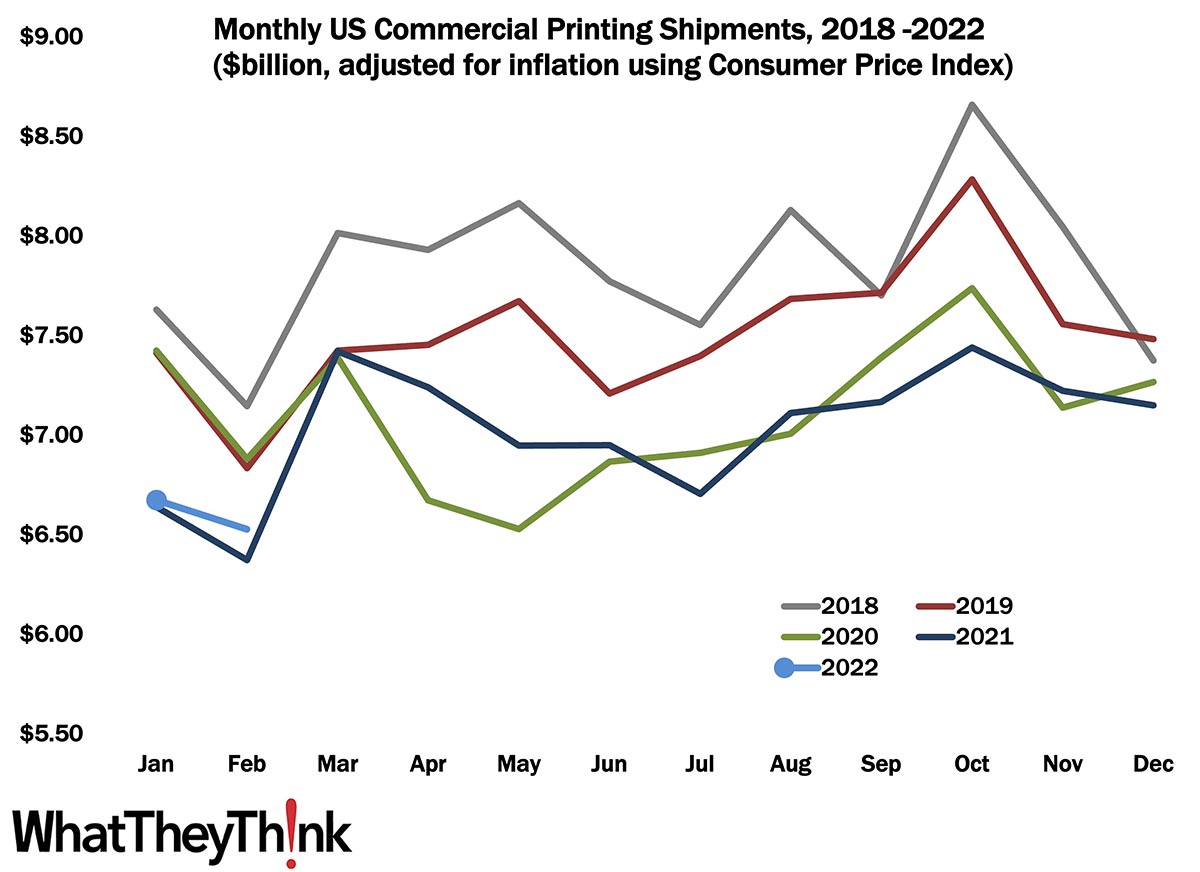

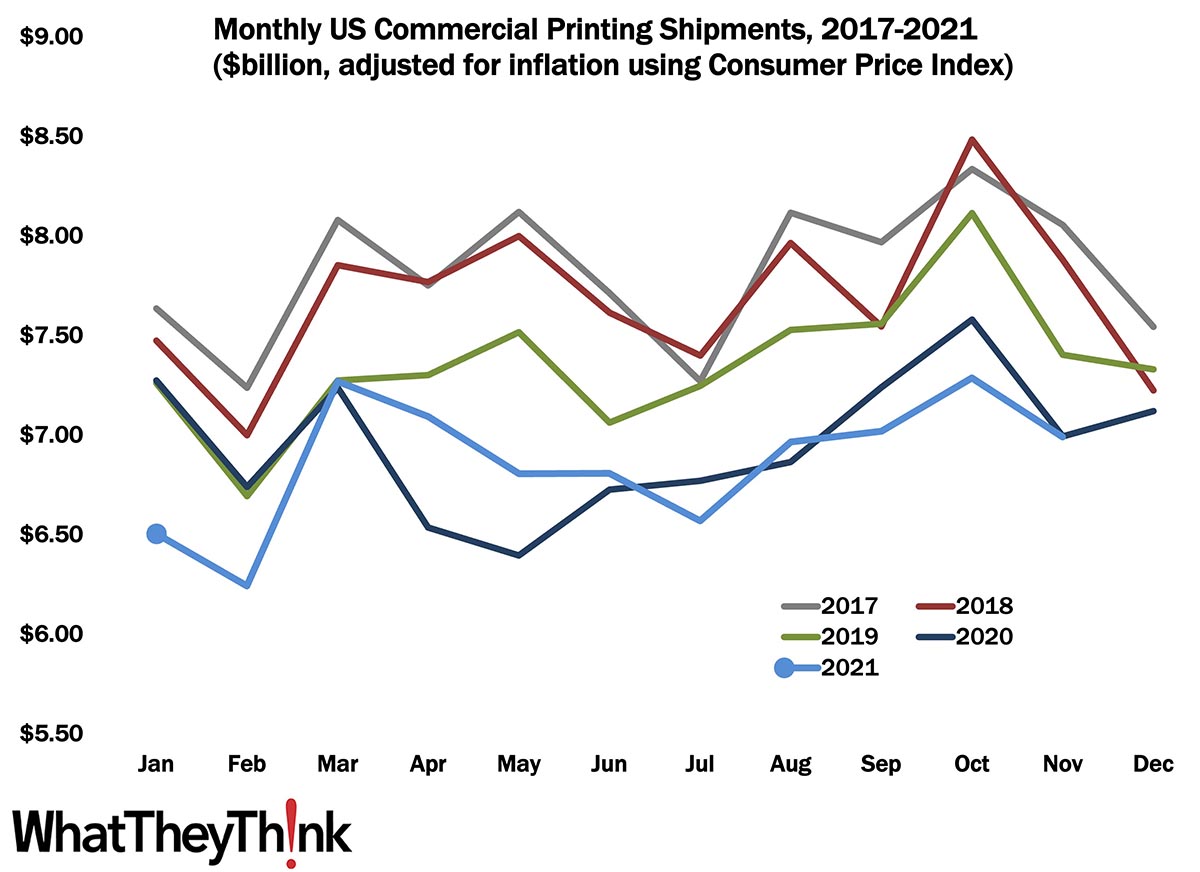

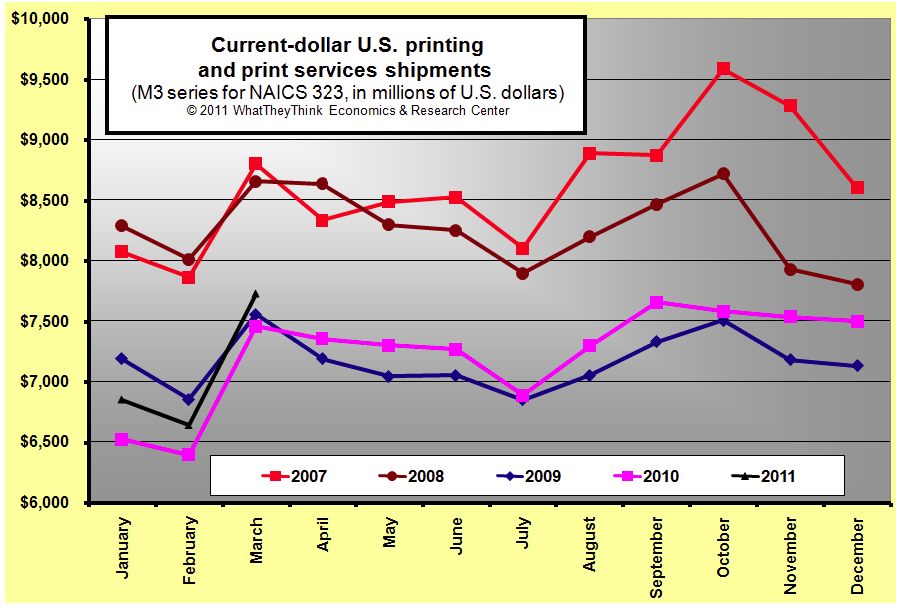

March Shipments: It’s Déjà Vu All Over Again

Published: May 20, 2022

March 2022 shipments came in at $6.91 billion, up from February’s $6.14 billion. So far, it looks like 2022 is closely mirroring 2021—which isn’t necessarily a bad thing. Full Analysis

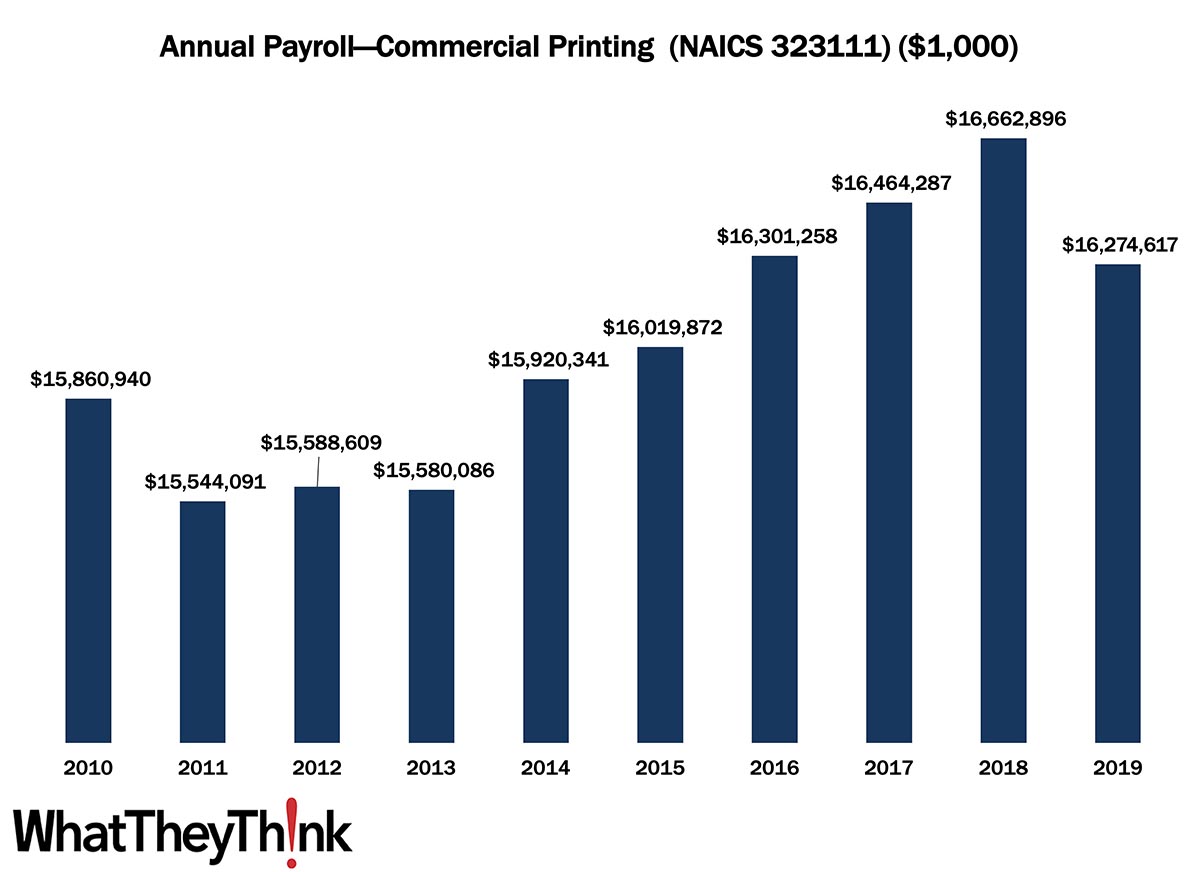

Commercial Printing Annual Payroll—2010–2019

Published: May 13, 2022

According to County Business Patterns, in 2010, US establishments in NAICS 323111 had an annual payroll of $15.9 billion. Payrolls dipped during and in the aftermath of the Great Recession and then rose, at least on a current dollar basis, over the latter half of the decade before dropping in 2019, finishing out the decade at $16.3 billion in 2019. However adjusting for inflation, payrolls declined by -12% over the course of the decade. In macro news: inflation is starting to slow ever so slightly. Full Analysis

March Graphic Arts Employment—Print Production Drops from February, Non-Production Up a Bit

Published: May 6, 2022

In March 2022, all printing employment was up +0.2% from February. Non-production printing employment was up +2.7%, but production employment was down -0.9%. Full Analysis

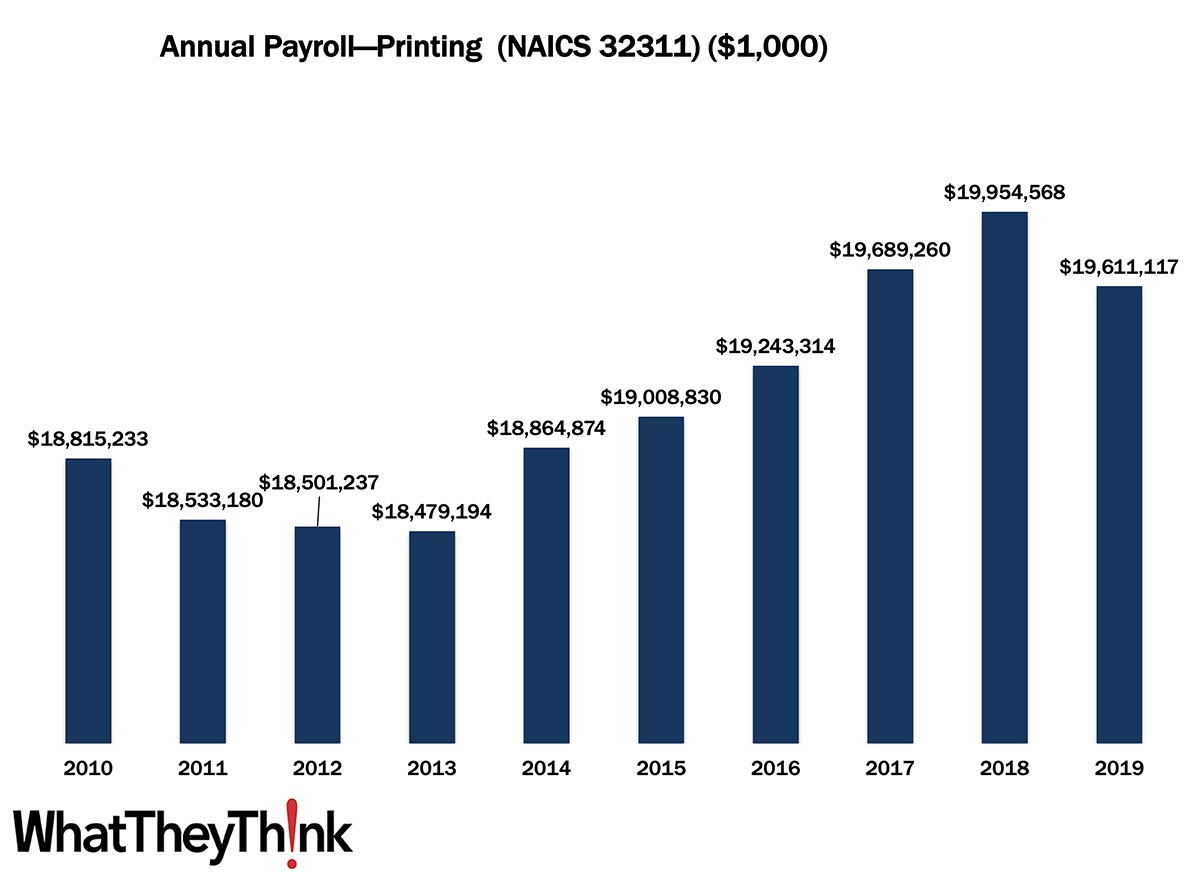

Printing Annual Payroll—2010–2019

Published: April 29, 2022

According to County Business Patterns, in 2010, US establishments in NAICS 32311 had an annual payroll of $18.8 billion. Payrolls dipped during and in the aftermath of the Great Recession and then rose, at least on a current dollar basis, over the latter half of the decade, coming in at $19.6 billion in 2019. However adjusting for inflation, payrolls declined by -11% over the course of the decade. In macro news: GDP decreased by 1.4% in Q1 2022. Full Analysis

February Shipments: OK, About What We Expected

Published: April 22, 2022

February 2022 shipments came in at $6.53 billion, down from January’s $6.67 billion. As we remarked last month we’re starting the year better than we did 2021 and reverting back to our normal seasonality trends. Full Analysis

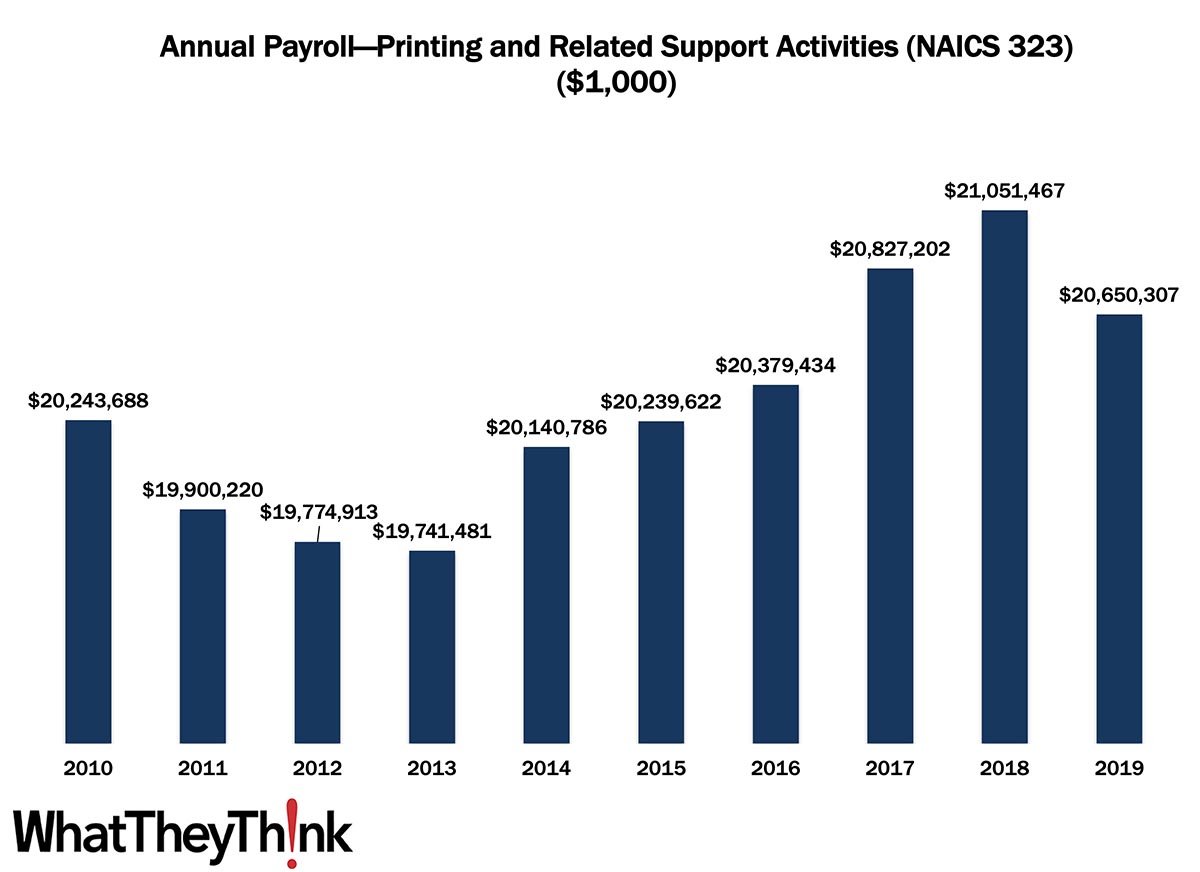

Printing Industry Annual Payroll—2010–2019

Published: April 8, 2022

According to County Business Patterns, in 2010, US establishments in NAICS 323 had an annual payroll of $20.2 billion. Payrolls dipped during and in the aftermath of the Great Recession. They rose, at least on a current dollar basis, over the latter half of the decade, coming in at $20.7 billion in 2019. However adjusting for inflation, payrolls declined by -13% over the course of the decade. In macro news: forecasters are not expecting a happy Q1 GDP report. Full Analysis

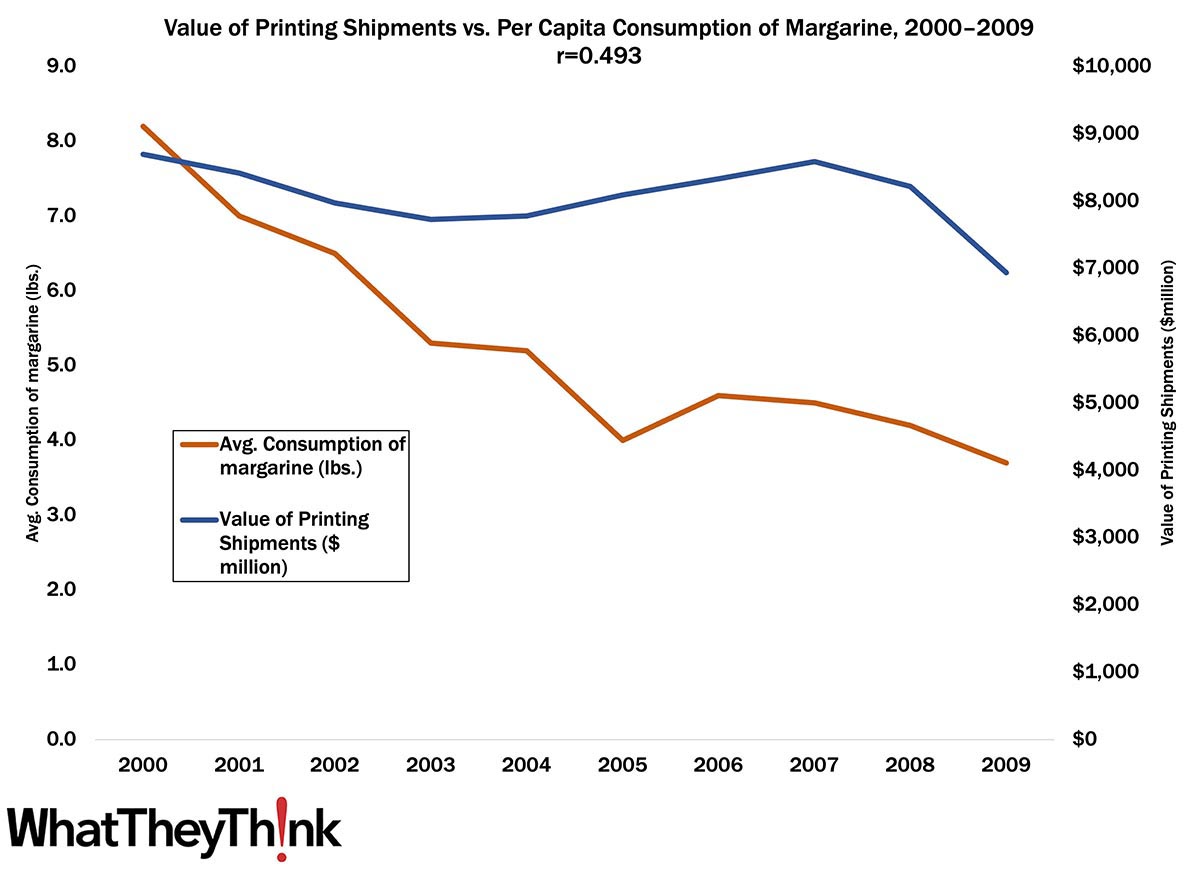

Now it Can be Told: Why Printing Shipments Declined! (April Fools 2022 Edition)

Published: April 1, 2022

In this exclusive report, we found a modest positive relationship between the decline in average consumption of margarine and the value of printing shipments. Full Analysis

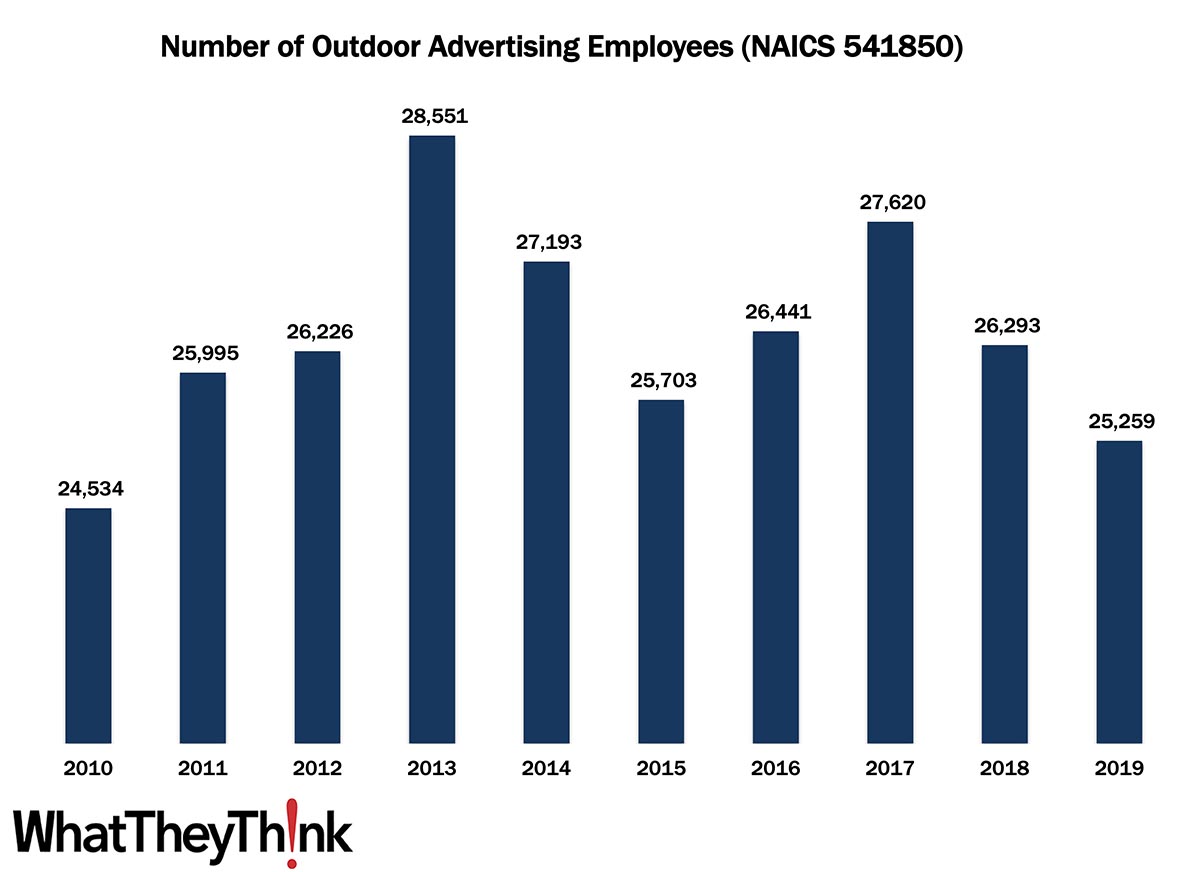

Outdoor Advertising Employees—2010–2019

Published: March 25, 2022

According to County Business Patterns, in 2010, there were 24,534 employees in NAICS 541850 (Outdoor Advertising). This NAICS actually grew post-Great Recession, with a slight decline mid-decade before climbing back up to 27,620 establishments in 2017. 2018 and 2019 saw a drop in employees. In macro news: AIA’s Architecture Billings Index (ABI) indicates that demand for design services continues to grow, boding well for commercial real estate construction and thus signage projects. Full Analysis

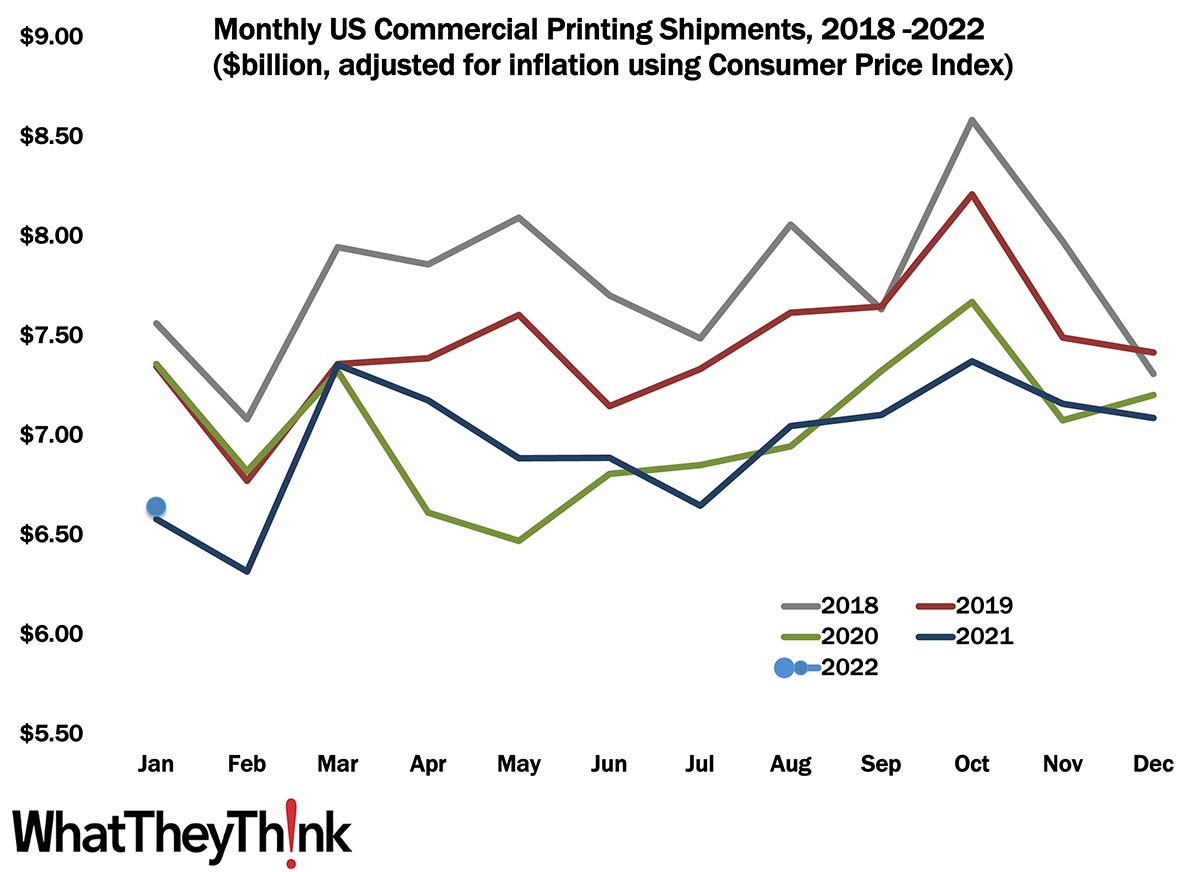

January Shipments: Let’s Get This Year Right

Published: March 18, 2022

January 2022 shipments came in at $6.64 billion, down from December’s $7.09 billion. We’re starting the year better than we did 2021 and reverting back to our normal seasonality trends. Full Analysis

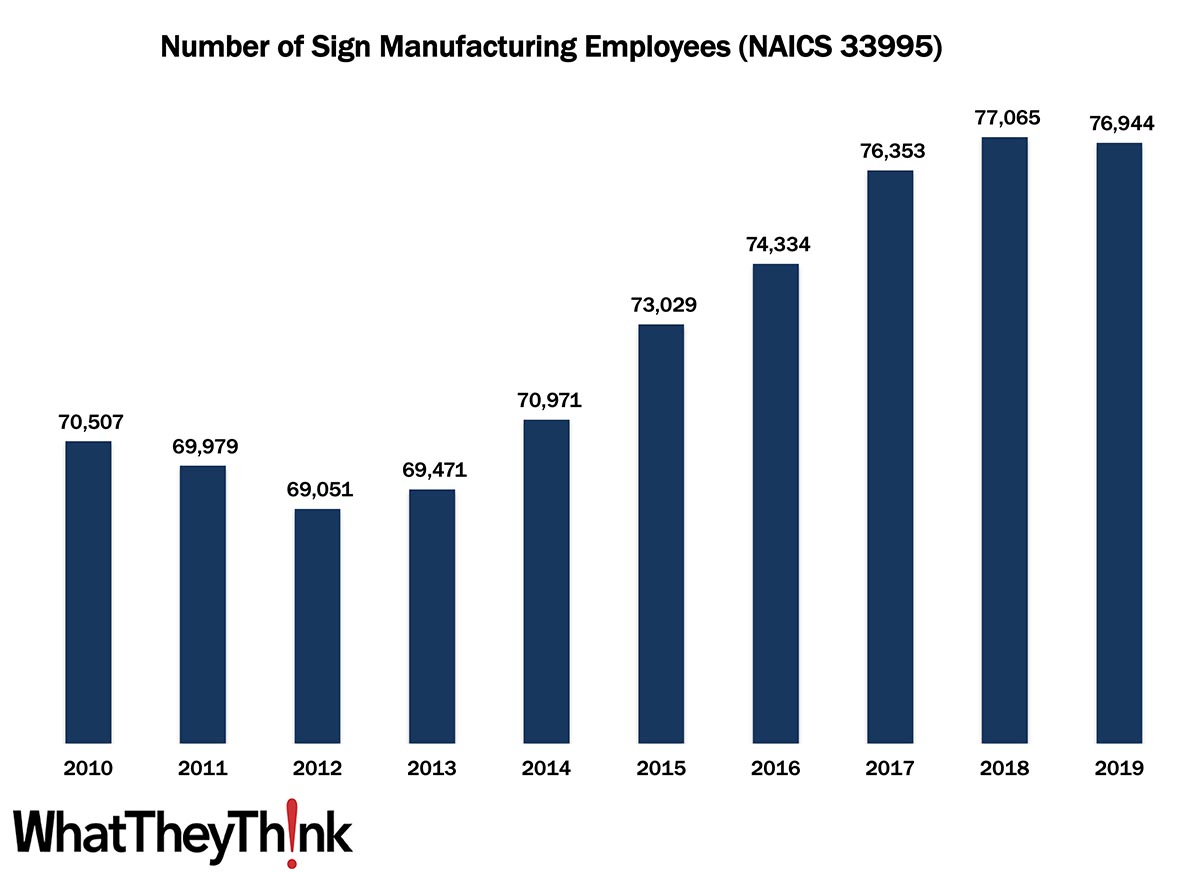

Sign Manufacturing Employees—2010–2019

Published: March 11, 2022

According to County Business Patterns, in 2010, there were 70,507 employees in NAICS 33995 (Sign Manufacturing). This NAICS category tumbled in the wake of the Great Recession, ultimately climbing to 76,944 employees in 2019. In macro news: Inflation continues to continue to climb. Full Analysis

January Graphic Arts Employment—Print Production Drops from December, Non-Production Up Slightly

Published: March 4, 2022

In January 2022, all printing employment was down -2.6% from December, with production employment down -4.1%. Non-production printing employment offset that a bit by being up a modest +0.9%. Full Analysis

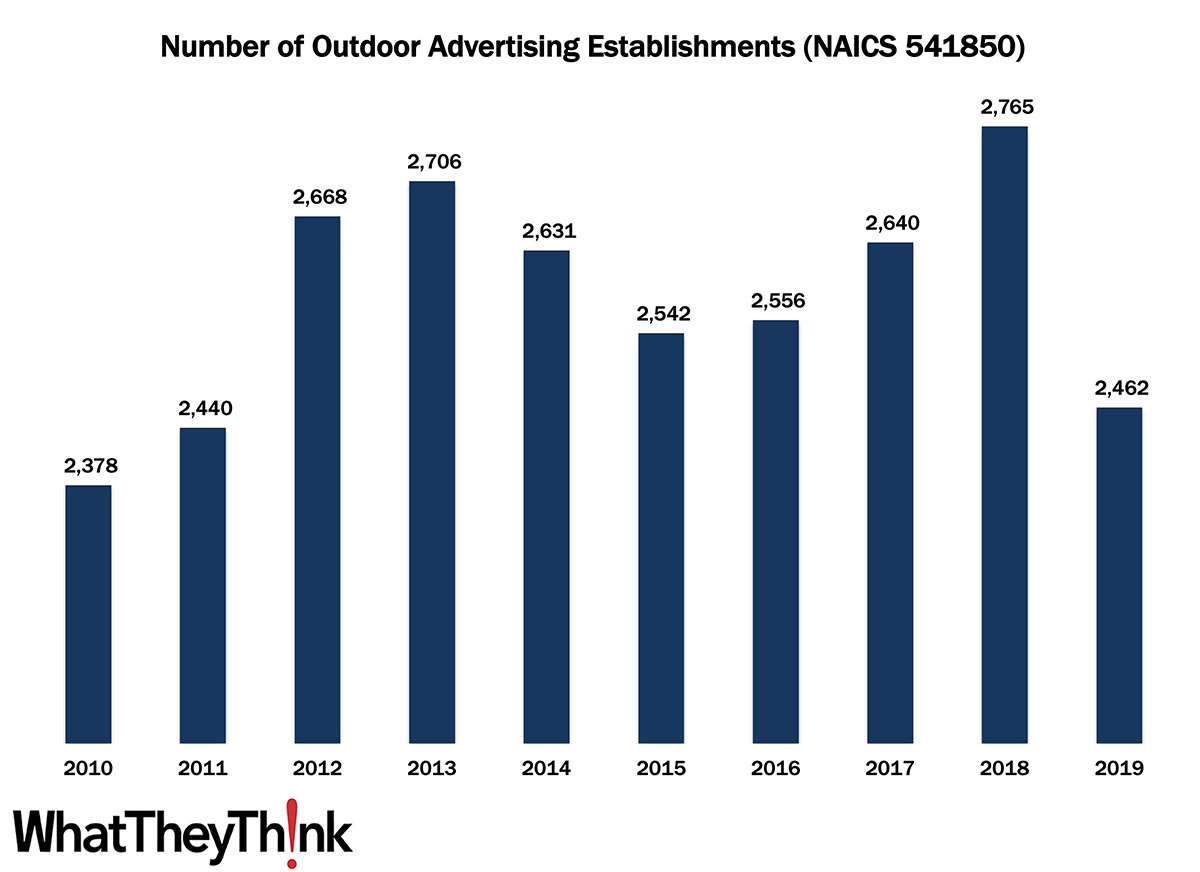

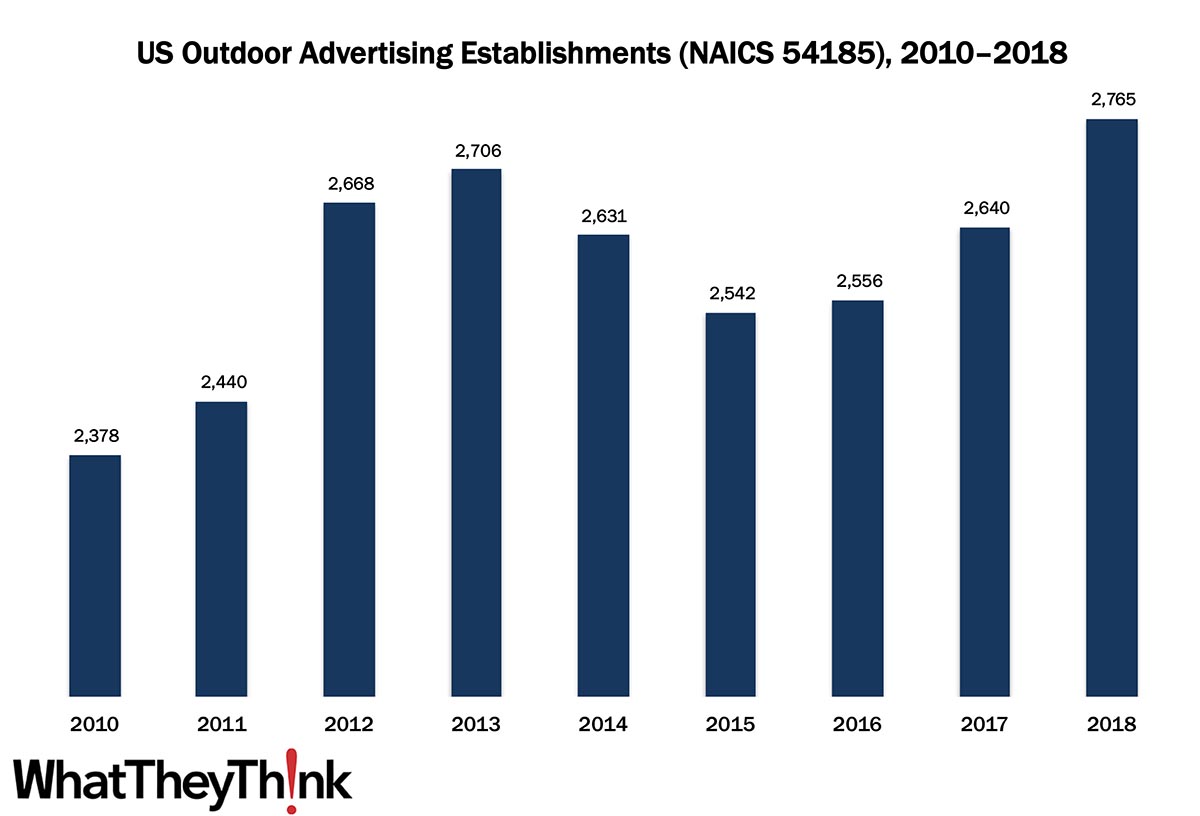

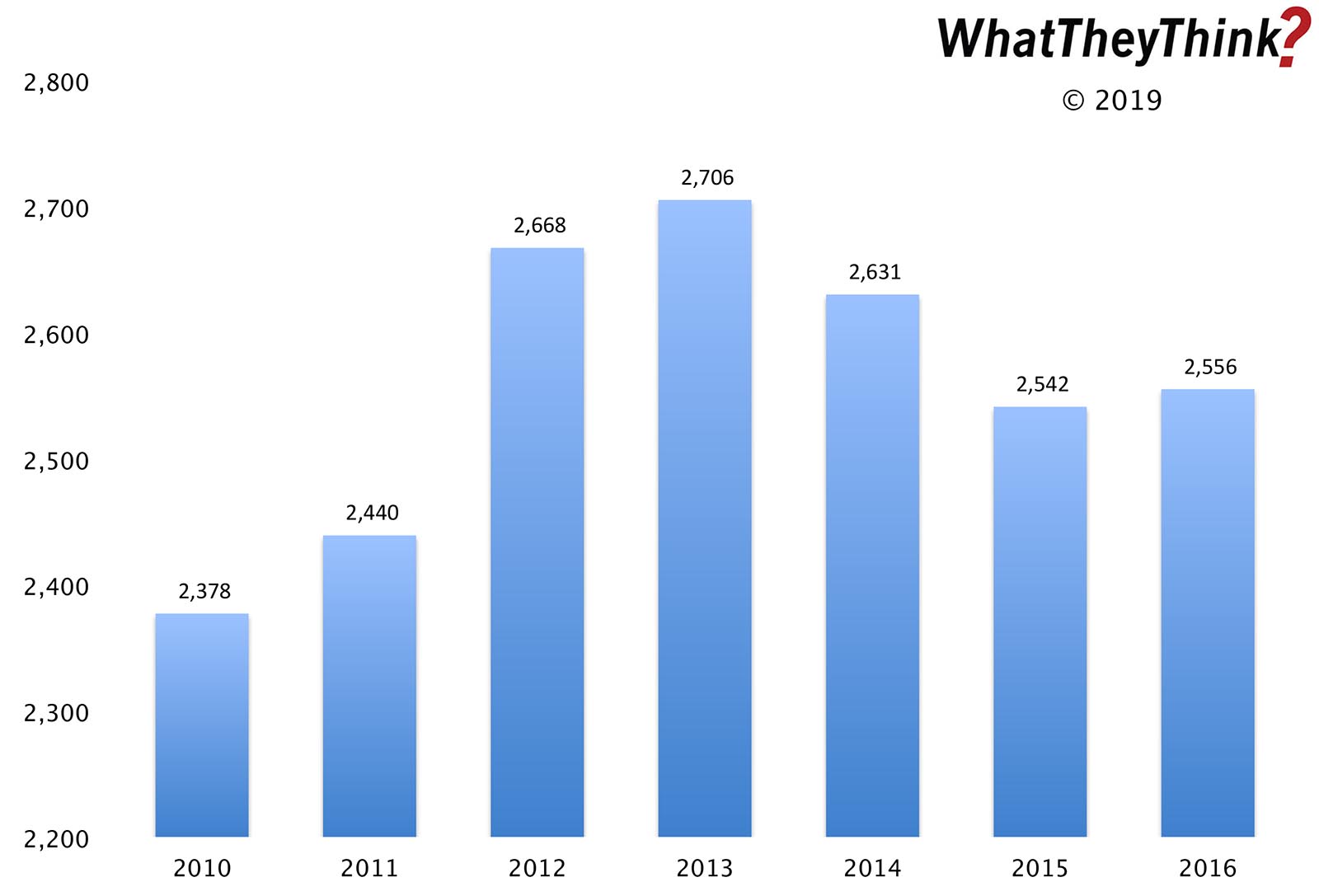

Outdoor Advertising Establishments—2010–2019

Published: February 25, 2022

According to County Business Patterns, in 2010, there were 2,378 establishments in NAICS 541850 (Outdoor Advertising). This NAICS actually grew post-Great Recession, with a slight decline mid-decade before climbing back up to 2,765 establishments in 2018. 2019 saw a massive drop in establishments. In macro news: Q4 2021 GDP revised up to 7.0%. Full Analysis

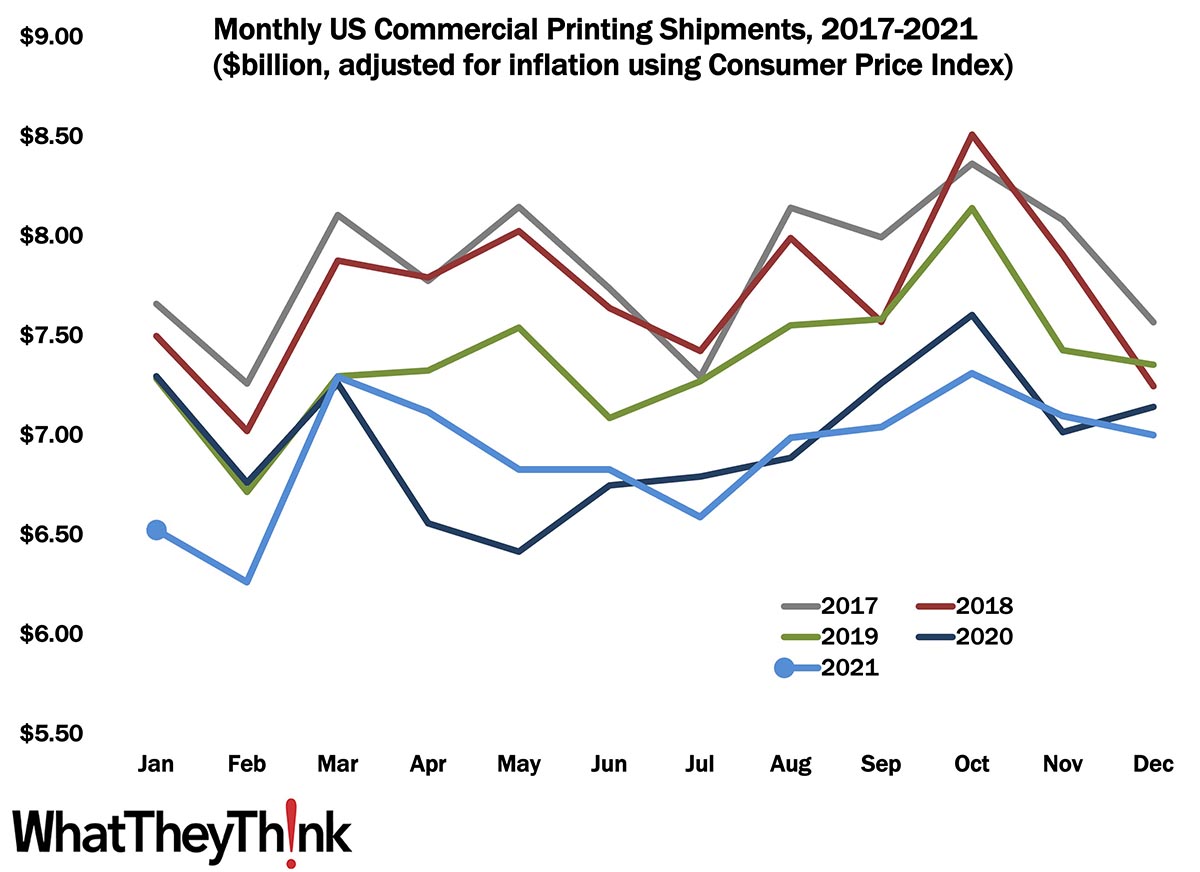

December Shipments: No Christmas Miracle

Published: February 18, 2022

As 2021 drew to a close, December printing shipments came in at $7.00 billion, down from $7.10 billion in November, keeping with the usual seasonality of a slow December. For 2021 overall, we came in at $82.87 billion for the year, just below 2020’s $83.73 billion. Full Analysis

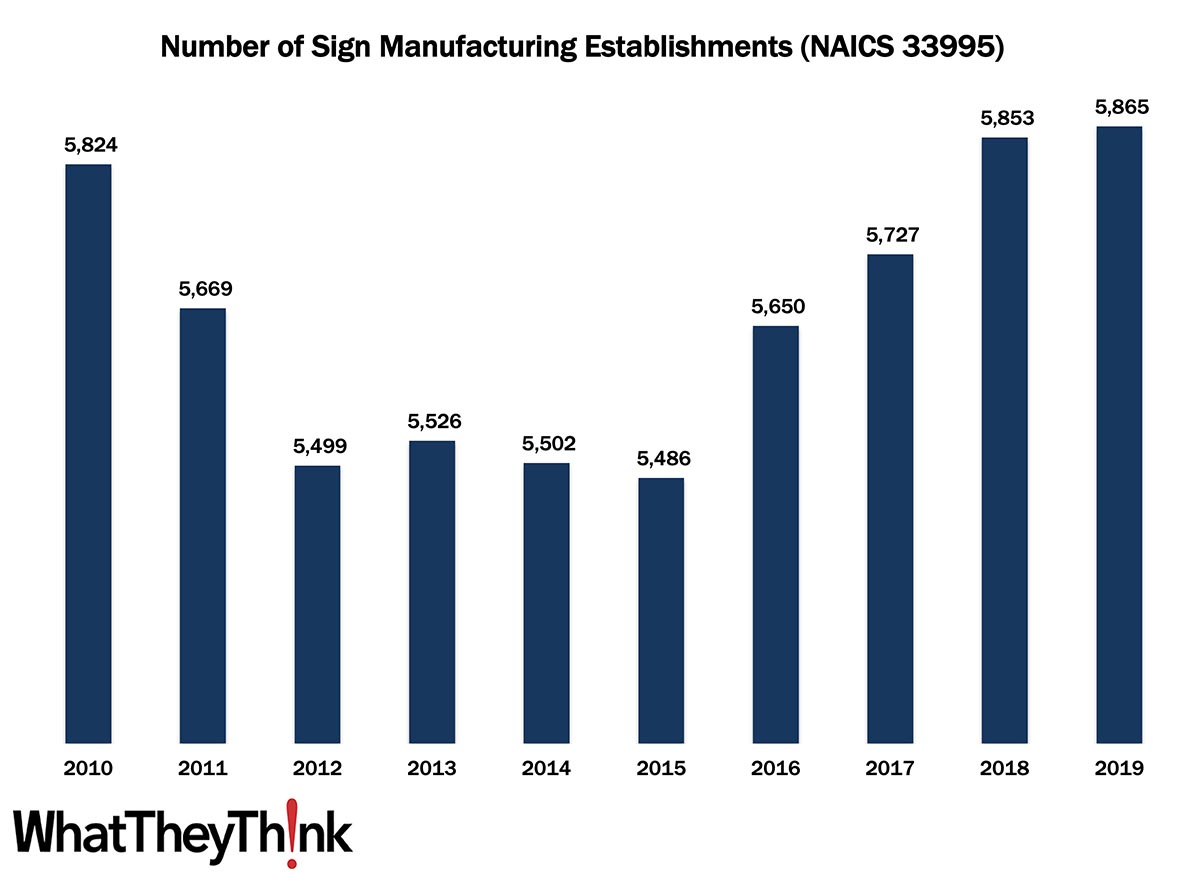

Sign Manufacturing Establishments—2010–2019

Published: February 11, 2022

According to County Business Patterns, in 2010, there were 5,824 establishments in NAICS 33995 (Sign Manufacturing). This NAICS category tumbled in the wake of the Great Recession, ultimately climbing back up to 5,865 establishments in 2019. In macro news: Inflation continues to climb. Full Analysis

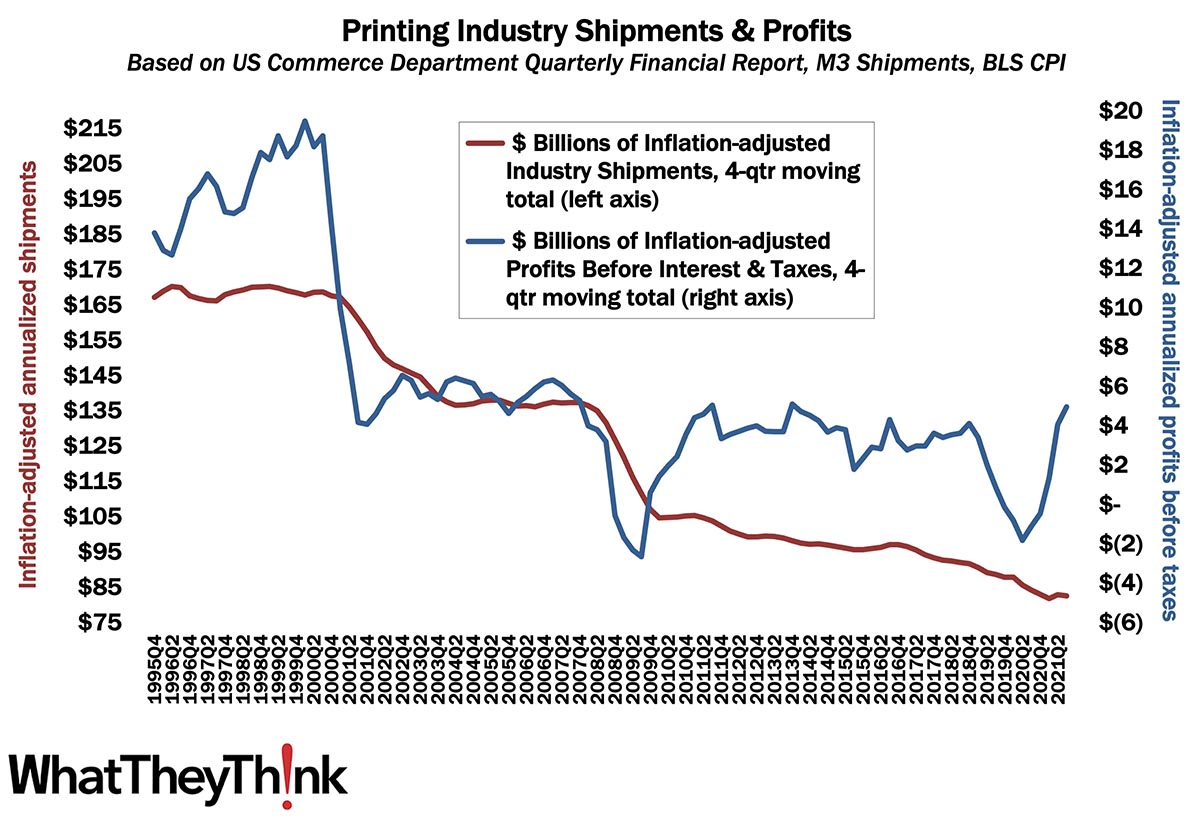

Post-Pandemic Profits on the Upturn

Published: February 4, 2022

Shipments have been slowly climbing back from the pandemic recession of 2020, but profits have been on a sharp upturn. However there still remains a bit of a profitability gap between the two major asset class distinctions. Full Analysis

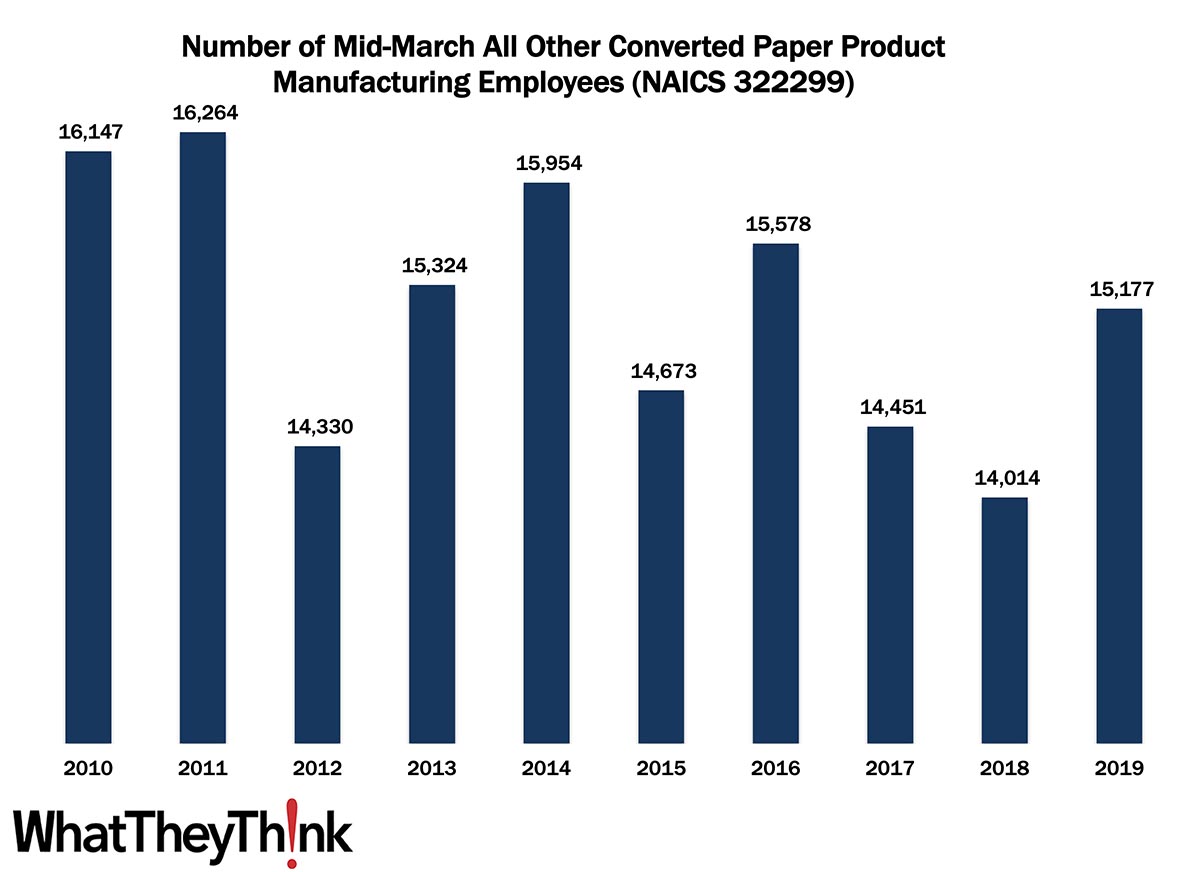

All Other Converted Paper Product Manufacturing Employment—2010–2019

Published: January 28, 2022

According to County Business Patterns, in 2010, there were 16,147 employees in 322299 (All Other Converted Paper Product Manufacturing establishments). This NAICS category bounced up and down over the course of the 2010s, ending with 15,177 employees in 2019. In macro news: Yesterday was Q4 GDP Day! Full Analysis

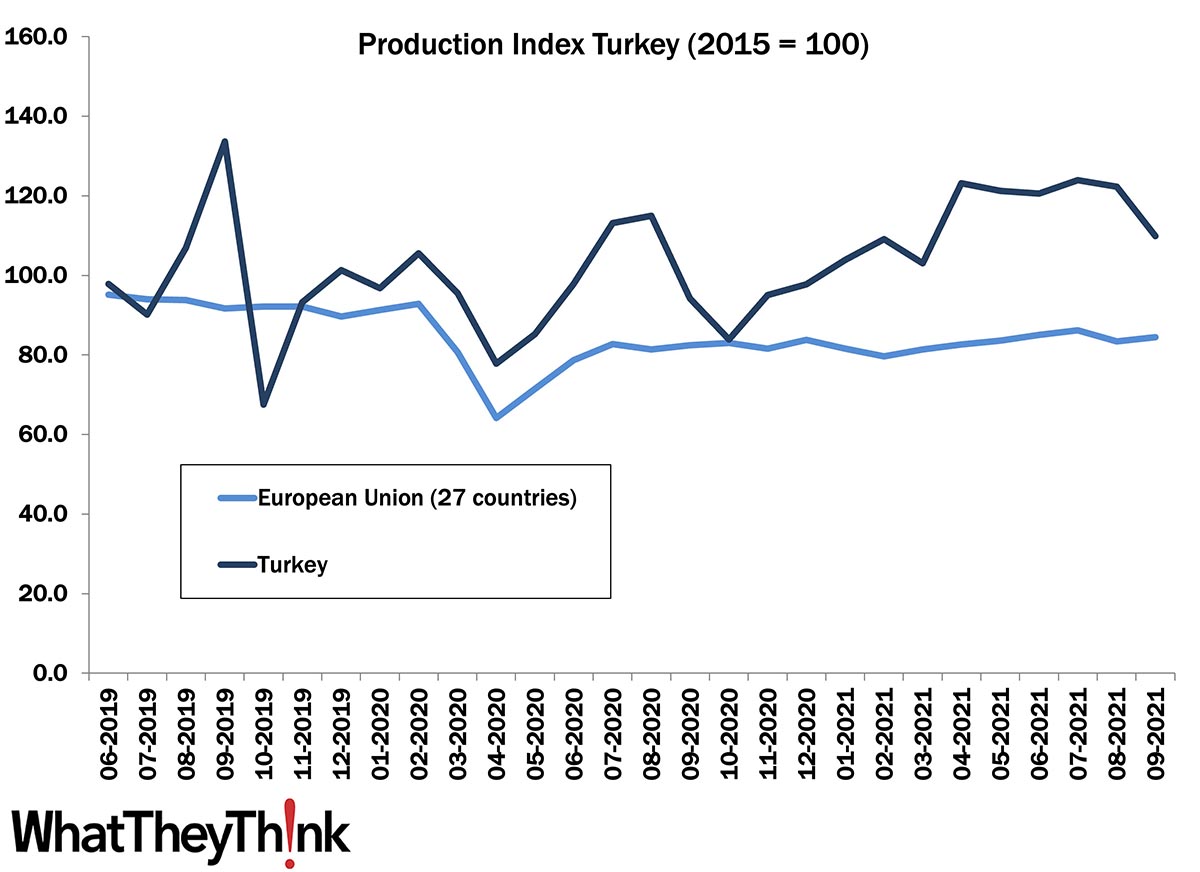

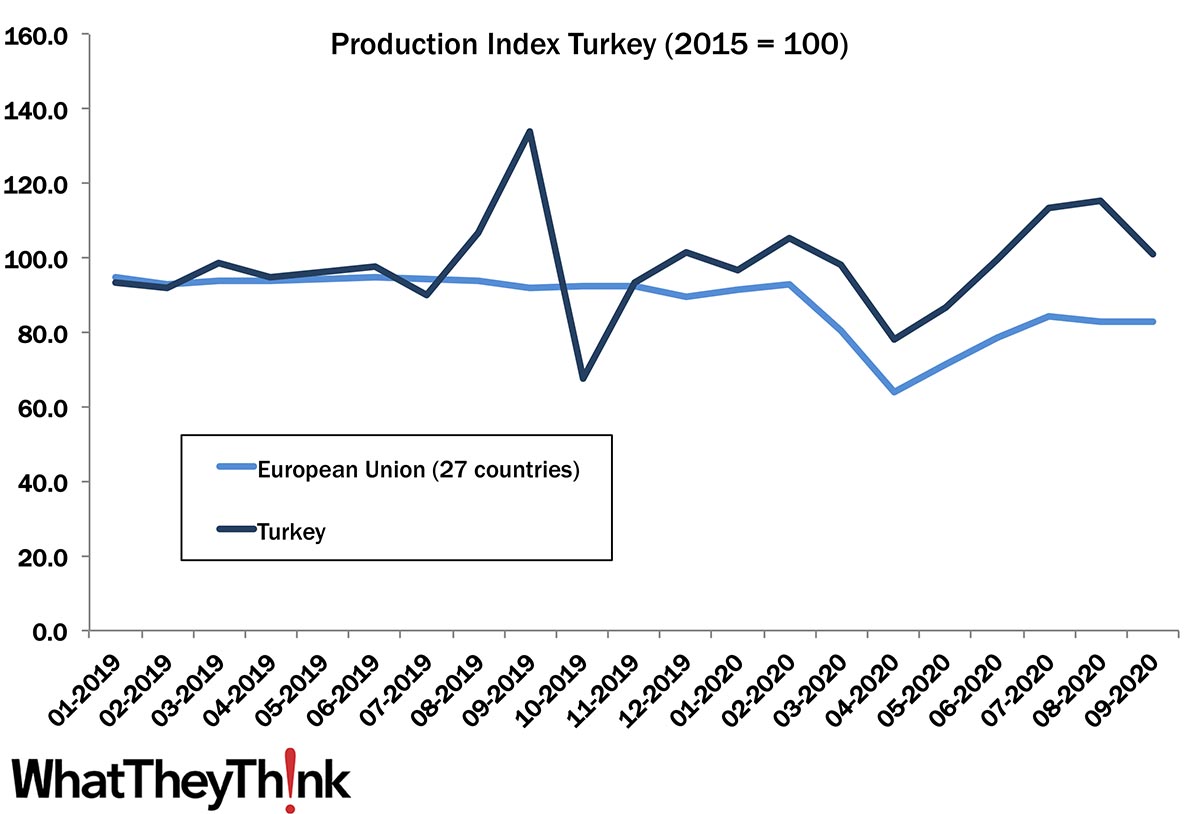

European Print Industry Snapshot: Turkey

Published: January 25, 2022

In this bimonthly series, WhatTheyThink is presenting the state of the printing industry in different European countries based on the latest monthly production numbers. This week, we take an updated look at the printing industry in Turkey. Full Analysis

November Shipments: Reversion to the Mean

Published: January 21, 2022

November 2021 printing shipments came in at $6.99 billion, down from $7.29 billion in October, and the first month that shipments dropped since early summer. Year to date, January-to-November shipments are $75.56 billion, only a bit off 2020’s January-to-November number of $76.36. If we have a really good December, 2021 could come in slightly above 2020. Full Analysis

Sanitary Paper Product Manufacturing Employment—2010–2019

Published: January 14, 2022

According to County Business Patterns, in 2010, there were 19,221 employees in NAICS 322291 (Sanitary Paper Product Manufacturing establishments). This NAICS category bounced up and down over the course of the 2010s, ending with 19,593 employees in 2019. In macro news: CPI increased 0.5% in December. Full Analysis

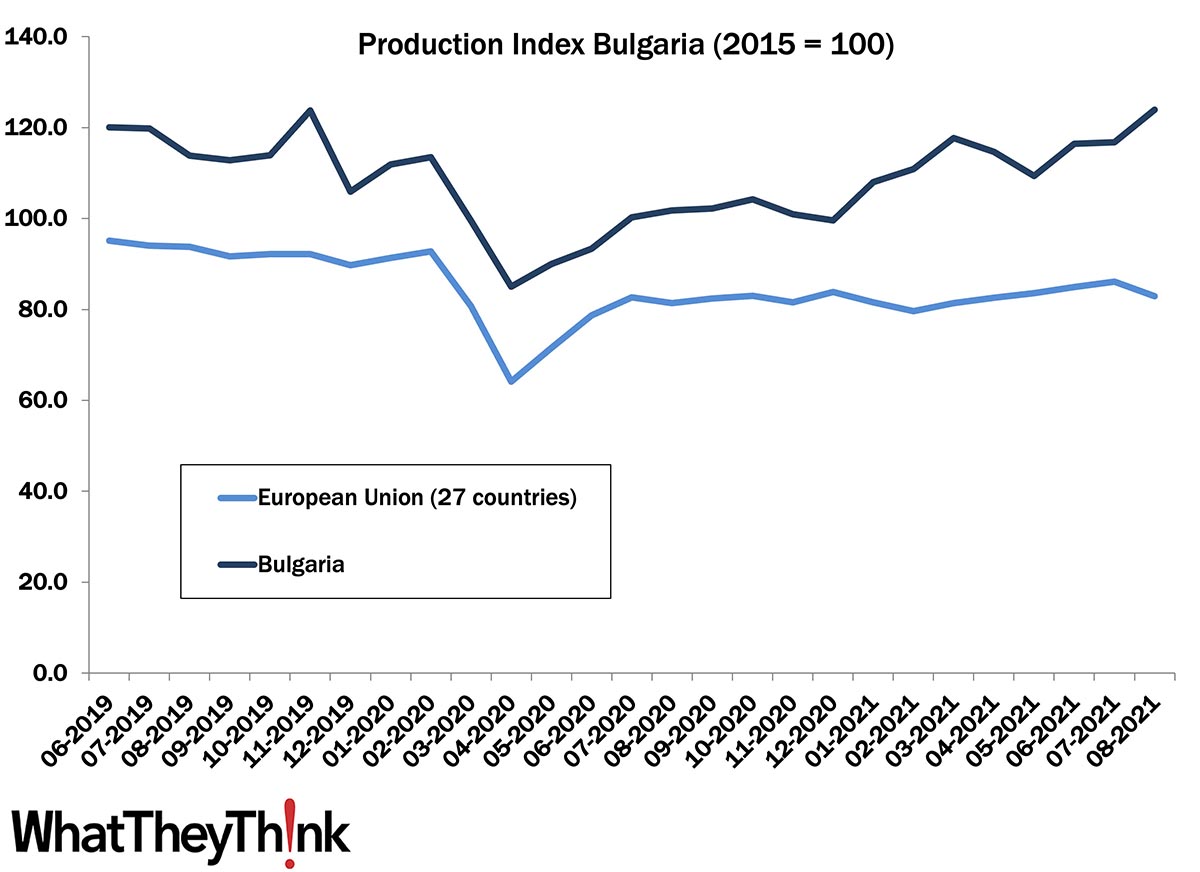

European Print Industry Snapshot: Bulgaria

Published: January 11, 2022

In this bimonthly series, WhatTheyThink is presenting the state of the printing industry in different European countries based on the latest monthly production numbers. This week, we take an updated look at the printing industry in Bulgaria. Full Analysis

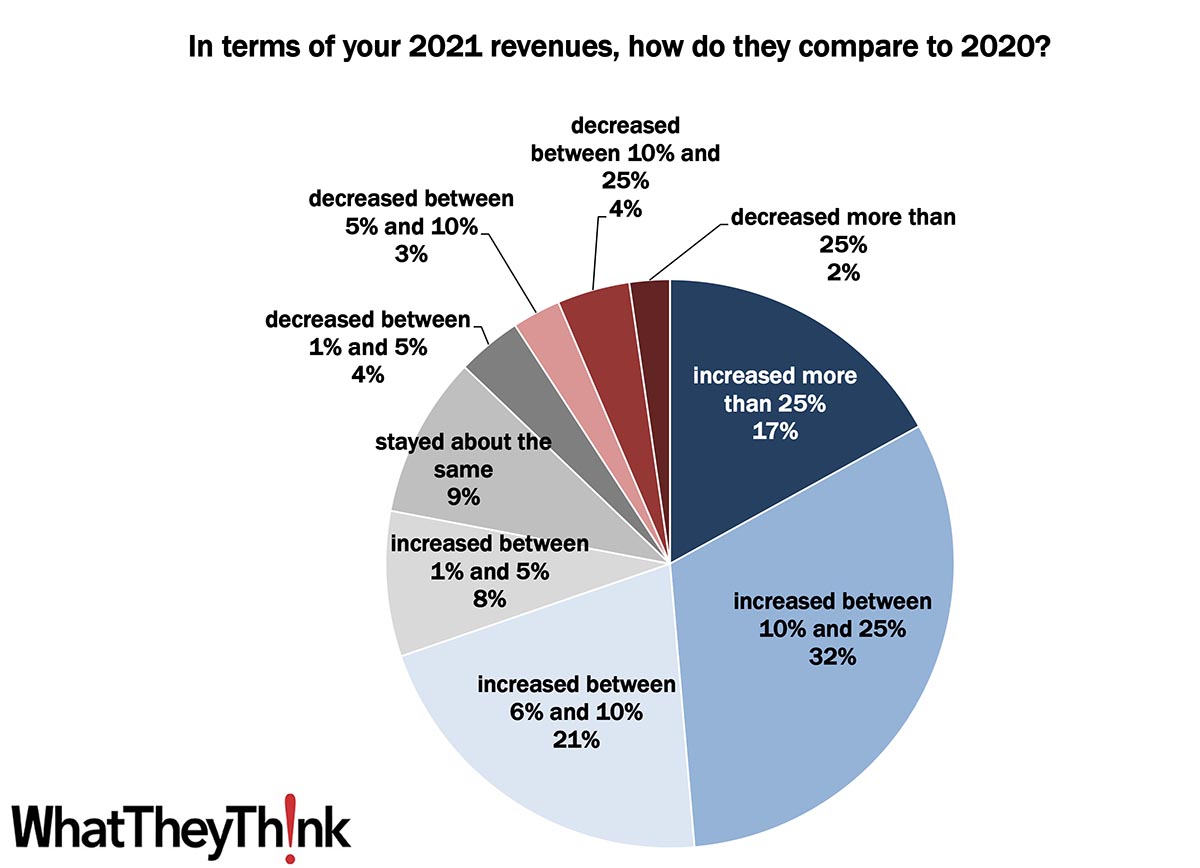

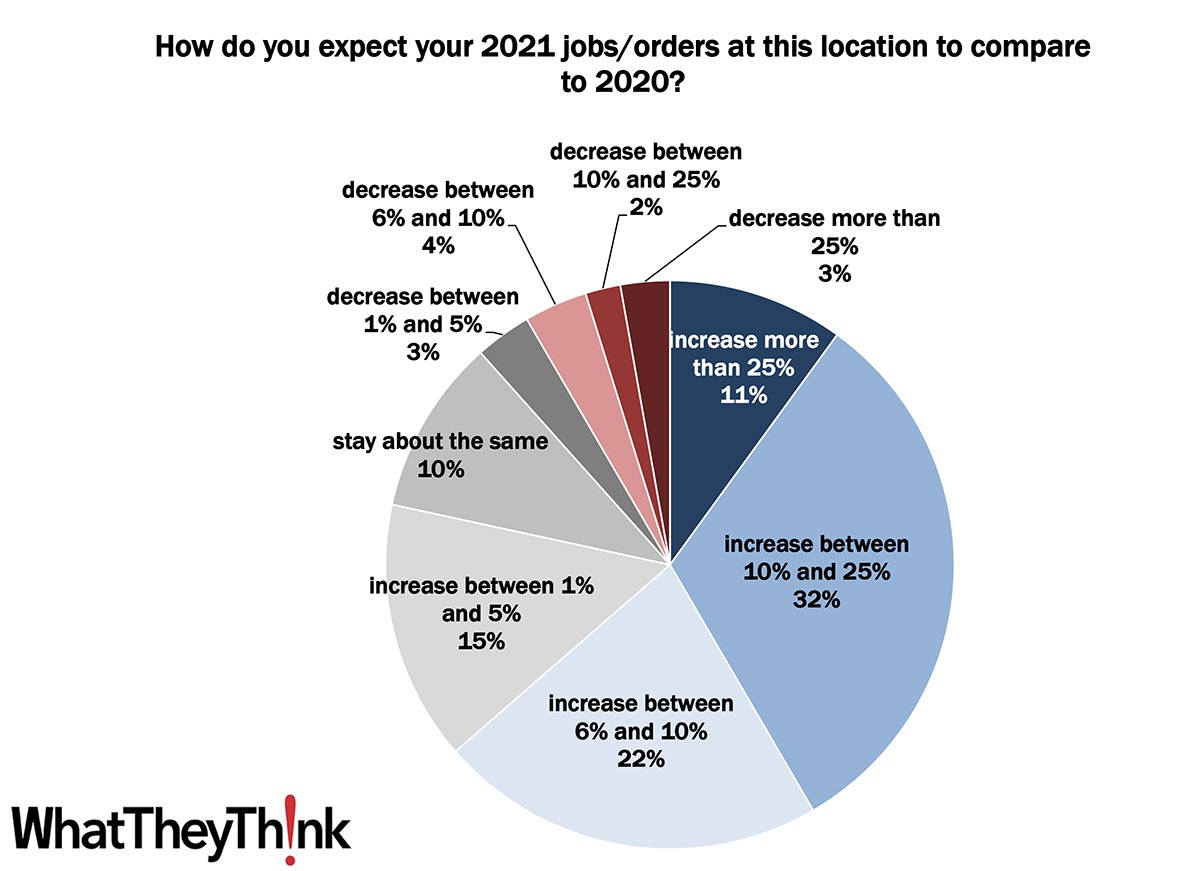

Preliminary 2021 Business Conditions: Help Ruin This Chart!

Published: January 7, 2022

We are sifting through the preliminary data from our 2021 Print Outlook Survey, and so far we have found that 17% of print businesses reported that revenues in 2021 increased more than 25% over 2020, and a further one-third (32%) saw revenues up 10–25%. But our survey is still open, so here is your chance to wreck this chart. Full Analysis

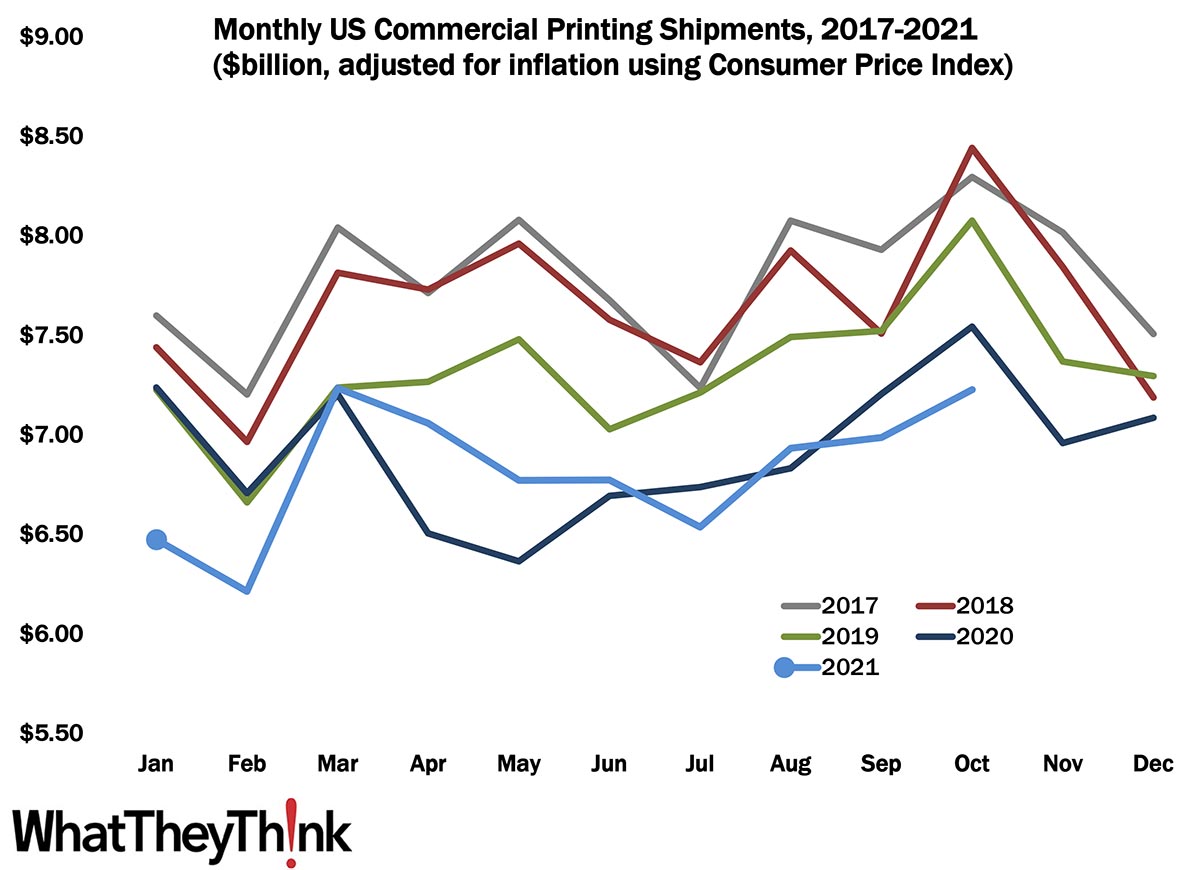

October Shipments: Still On the Rise

Published: December 17, 2021

October 2021 printing shipments came in at $7.23 billion, up from September’s $6.99 billion. This is the third month in a row in which shipments increased. Year to date, January-to-October shipments are $68.21 billion, a bit off 2020’s January-to-October number of $69.03. Unless November and December are higher than expected, 2021 will come in slightly below 2020. Full Analysis

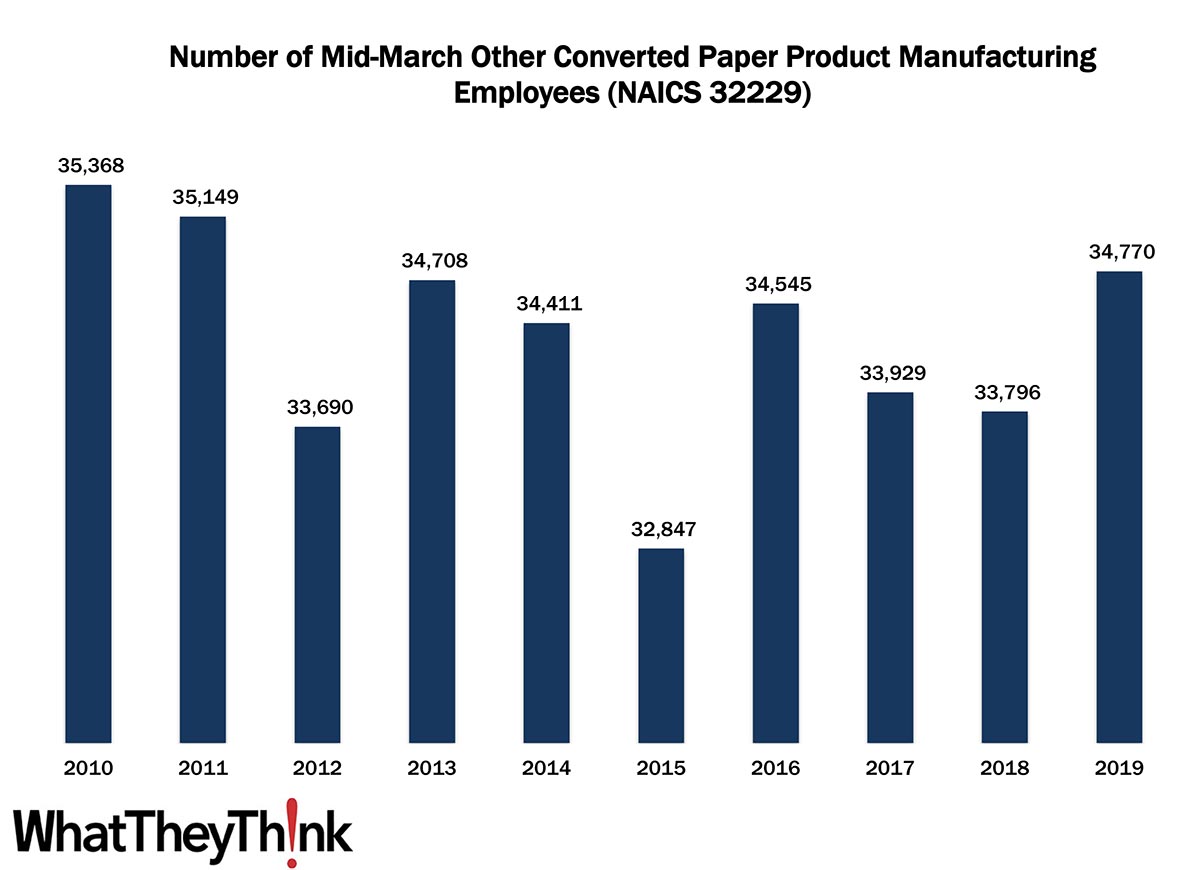

Other Converted Paper Product Manufacturing Employment—2010–2019

Published: December 10, 2021

According to County Business Patterns, in 2010, there were 35,368 employees in NAICS 32229 (Other Converted Paper Product Manufacturing establishments). This NAICS category bounced up and down over the course of the 2010s, ending with 34,770 employees in 2019. In macro news: Beige Alert! Full Analysis

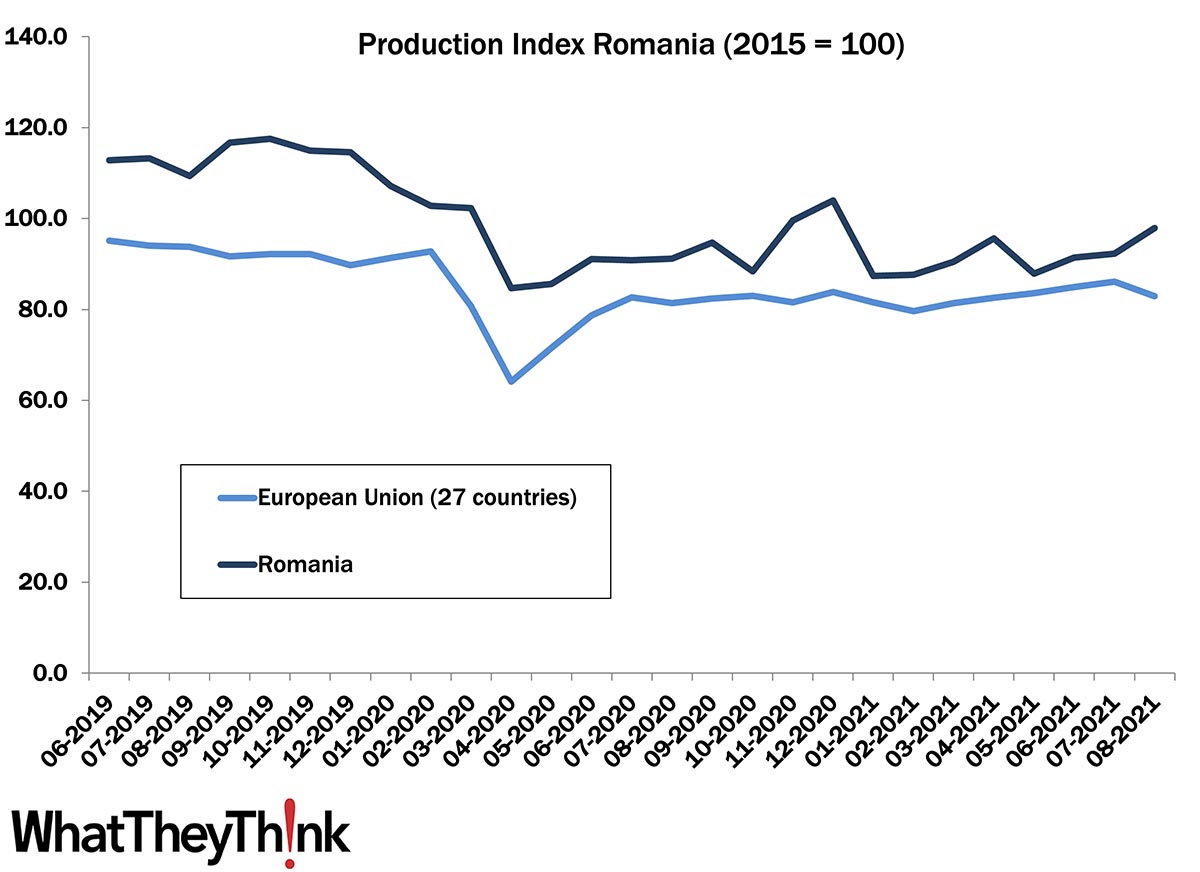

European Print Industry Snapshot: Romania

Published: December 7, 2021

In this bimonthly series, WhatTheyThink is presenting the state of the printing industry in different European countries based on the latest monthly production numbers. This week, we take an updated look at the printing industry in Romania. Full Analysis

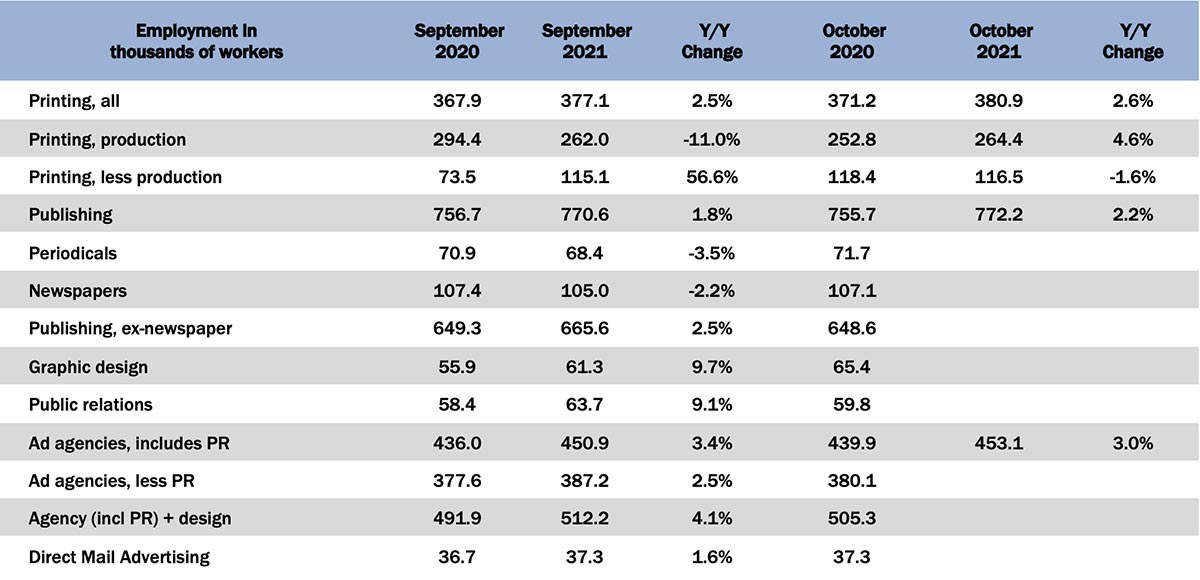

October Graphic Arts Employment—Print Production Up, Non-Production Also Up

Published: December 3, 2021

In October 2021, all printing employment was up +1.0% from September, with production employment up +0.9%, and non-production printing employment up +1.2%. Full Analysis

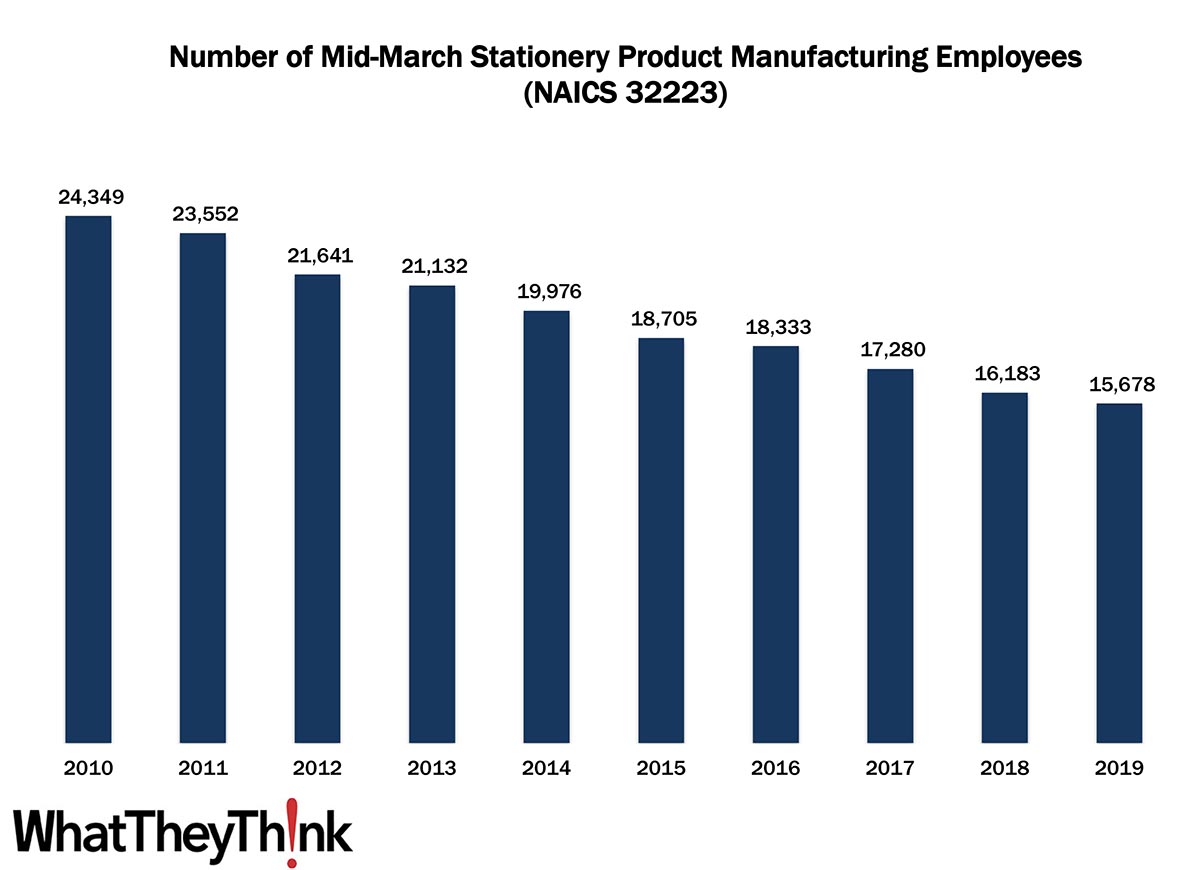

Stationery Product Manufacturing Employment—2010–2019

Published: November 19, 2021

According to County Business Patterns, in 2010, there were 24,349 employees in NAICS 32223 (Stationery Product Manufacturing establishments). This NAICS category declined slowly over the rest of the decade, ending with 15,678 employees in 2019. Also: following up a BoSacks tweet about newspaper circulation. Full Analysis

September Shipments: We Got Good News and We Got Bad News

Published: November 12, 2021

September 2021 printing shipments came in at $6.93 billion, up from August’s $6.87 billion. It’s not a massive increase, but we’ll take it. Year to date, January-to-September shipments are $60.48 billion, a bit off 2020’s January-to-September number of $60.97. Can we close the gap in Q4? Full Analysis

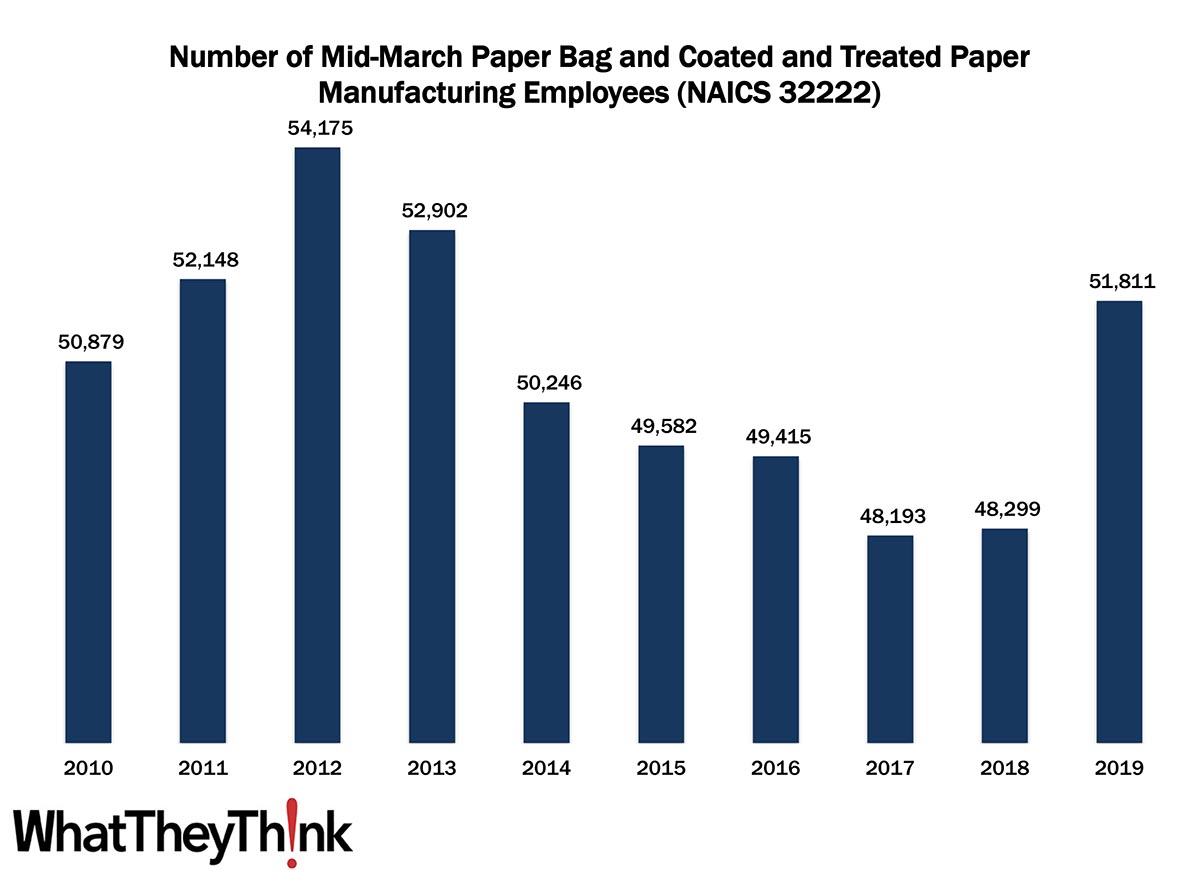

Paper Bag and Coated and Treated Paper Manufacturing Employment—2010–2019

Published: November 5, 2021

According to County Business Patterns, in 2010, there were 50,879 employees in NAICS 32222 (Paper Bag and Coated and Treated Paper Manufacturing establishments). This NAICS category peaked two years later at 54,175, declined slowly over the rest of the decade before shooting back up to 51,811 employees in 2019. In macro news, Q3 GDP growth is up 2.0%. Full Analysis

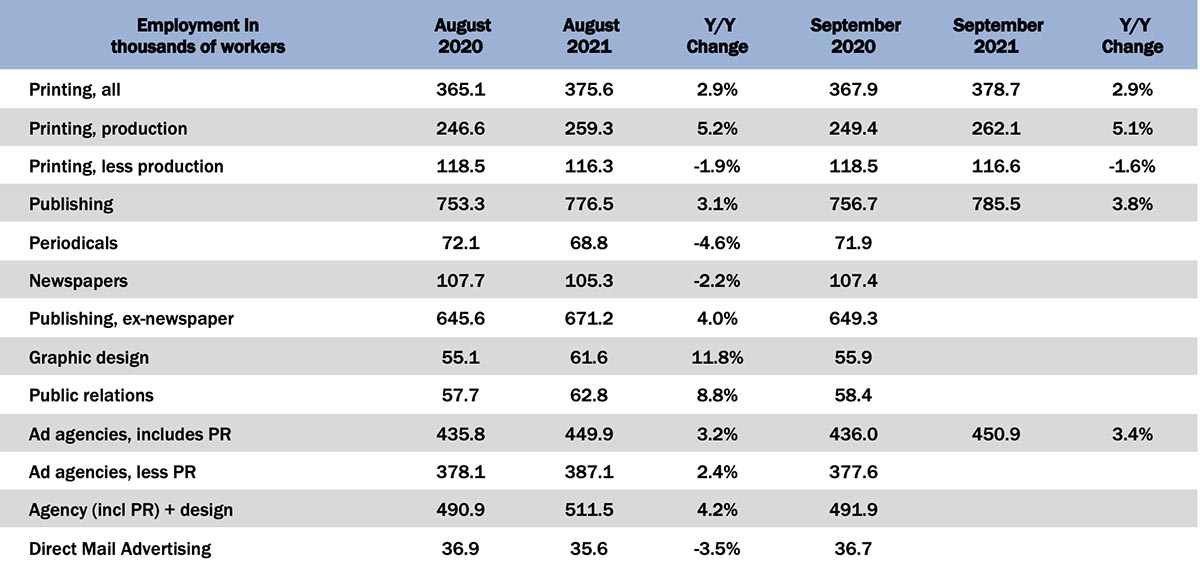

September Graphic Arts Employment—Print Production Up, Non-Production Down

Published: October 29, 2021

In September 2021, all printing employment was up +0.8% from August, production employment up +1.1%, and non-production printing employment up +0.3%. Full Analysis

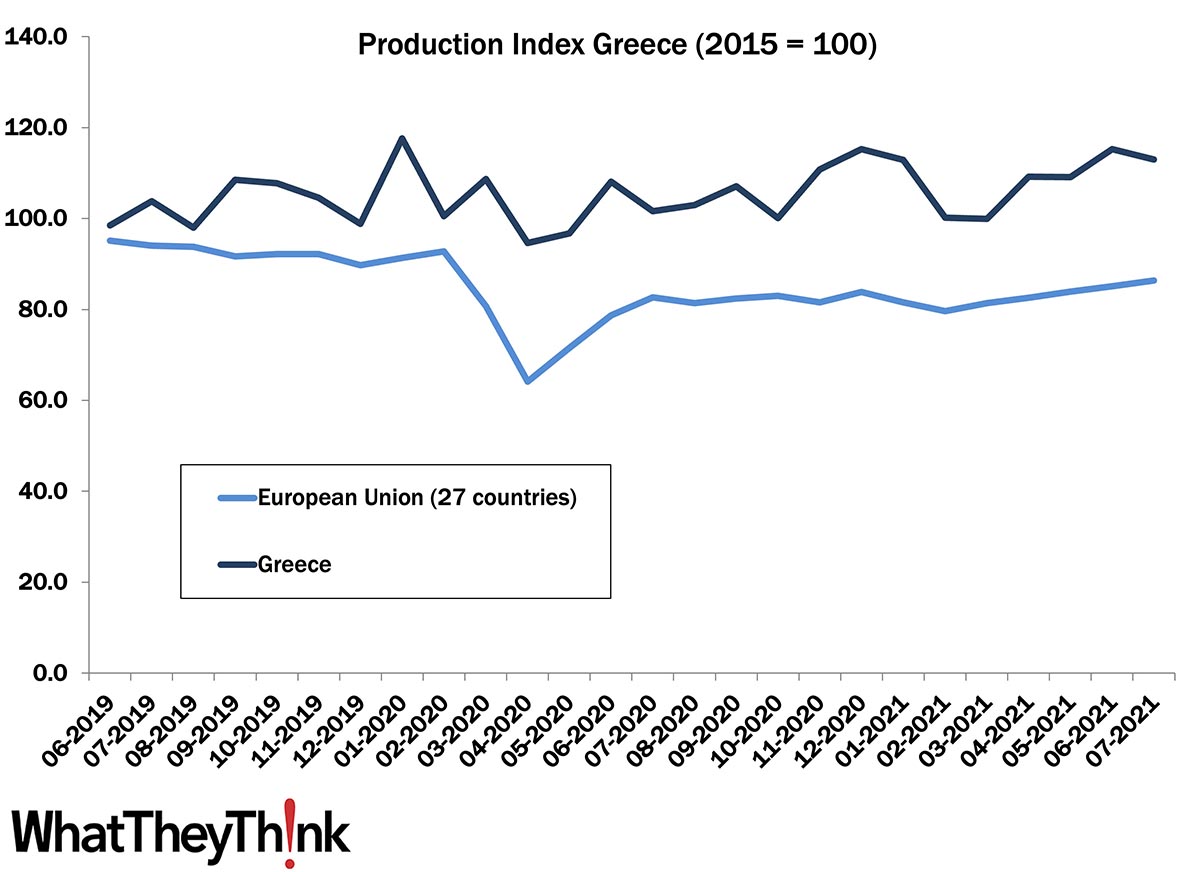

European Print Industry Snapshot: Greece

Published: October 26, 2021

In this bimonthly series, WhatTheyThink is presenting the state of the printing industry in different European countries based on the latest monthly production numbers. This week, we take an updated look at the printing industry in Greece. Full Analysis

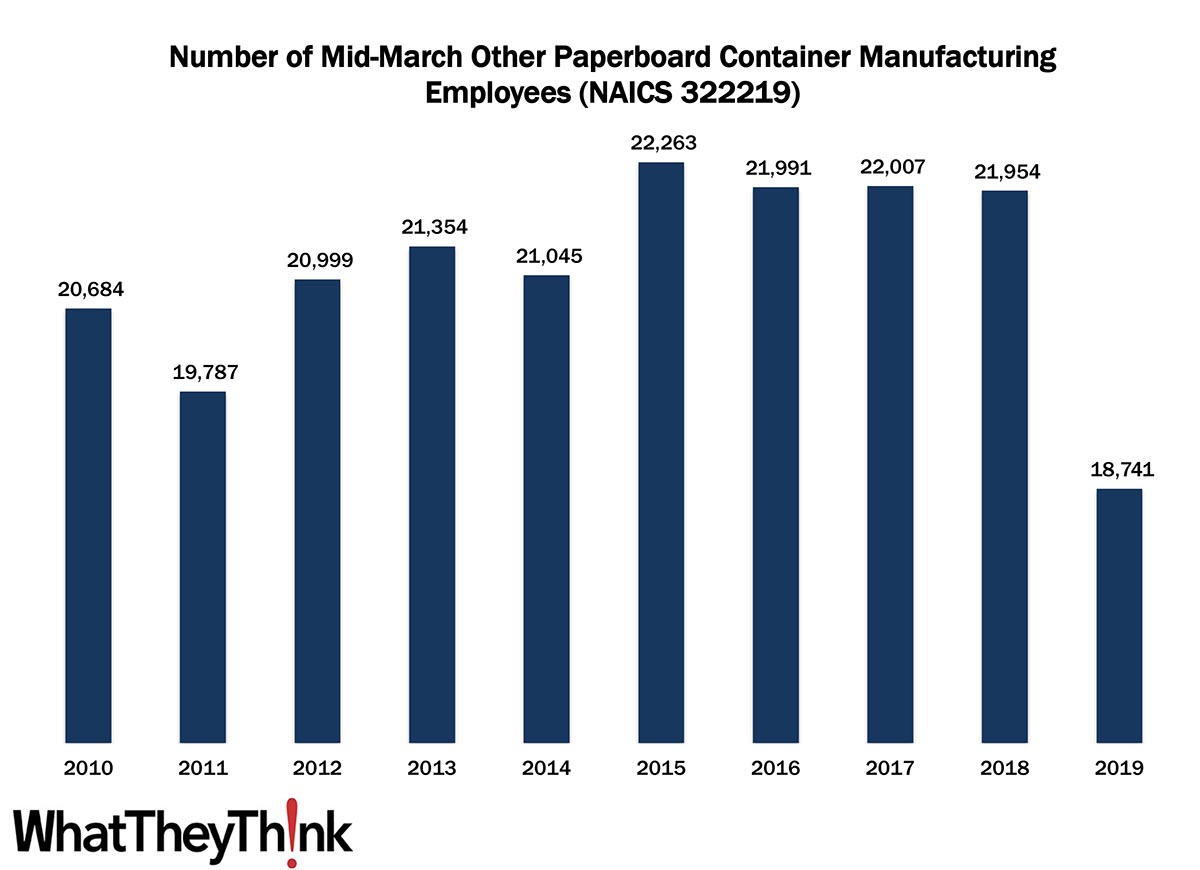

Other Paperboard Container Manufacturing Employment—2010–2019

Published: October 22, 2021

According to County Business Patterns, in 2019, there were 18,741 employees in NAICS 322219 (Other Paperboard Container Manufacturing establishments), a drop from 21,954 employees a year earlier, and the lowest ebb for this NAICS category. In macro news, new business formation goes “bezonkers.” Full Analysis

August Shipments: Summer Ends on a High Note

Published: October 15, 2021

August 2021 printing shipments came in at $6.87 billion, up from July’s $6.47 billion. Year to date, January-to-August shipments are $53.42 billion, not far off 2020’s January-to-August number of $53.68. Full Analysis

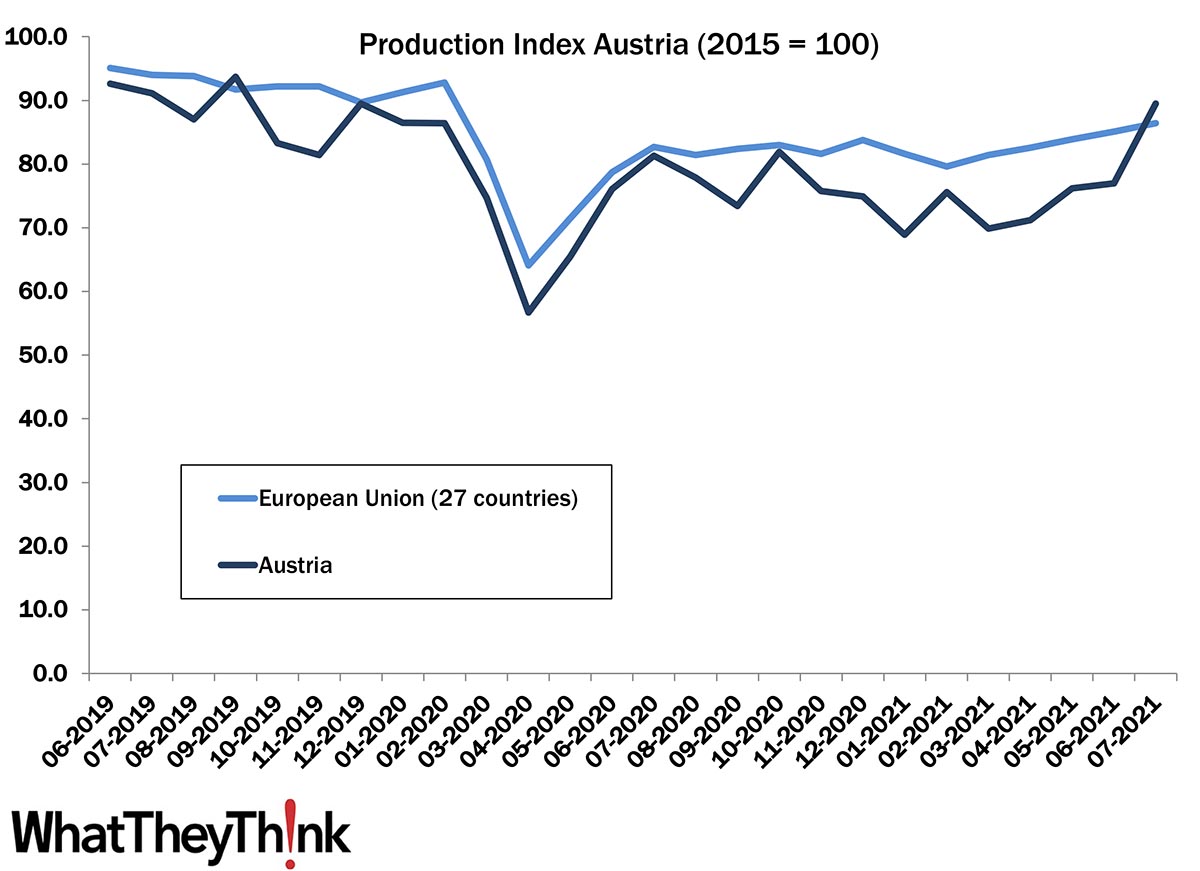

European Print Industry Snapshot: Austria

Published: October 12, 2021

In this bimonthly series, WhatTheyThink is presenting the state of the printing industry in different European countries based on the latest monthly production numbers. This week, we take an updated look at the printing industry in Austria. Full Analysis

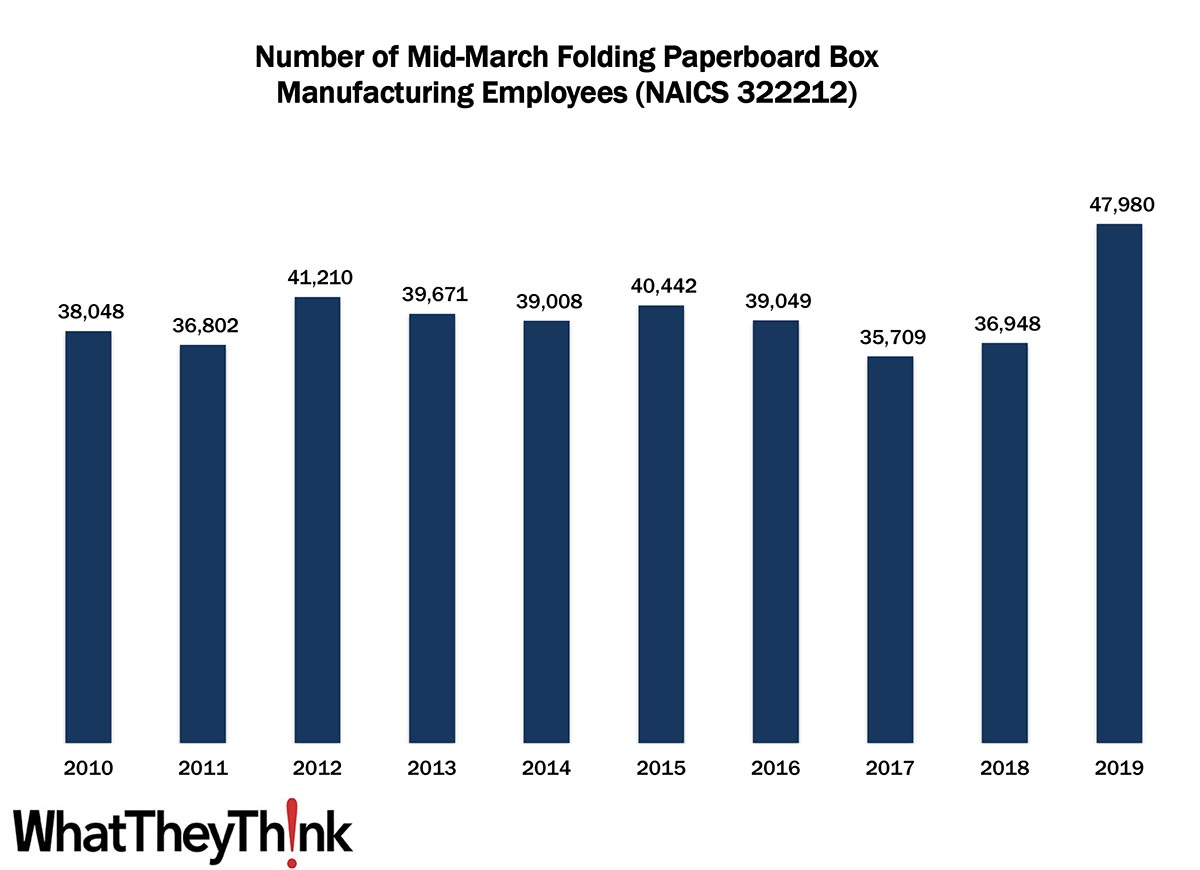

Folding Paperboard Box Manufacturing Employment—2010–2019

Published: October 8, 2021

According to County Business Patterns, in 2010, there were 30,048 employees in NAICS 322212 (Folding Paperboard Box Manufacturing establishments). Employment in this category stayed fairly steady throughout the decade, then spiked in 2019 to 47,980 employees. In macro news, sales of light vehicle sales plummeted in September 2021, even as profits reached record highs. Full Analysis

August Graphic Arts Employment—Staying on the Plateau

Published: October 1, 2021

In August 2021, all printing employment was up +0.4% from July, production employment up +0.4%, and non-production printing employment also up +0.4%. Full Analysis

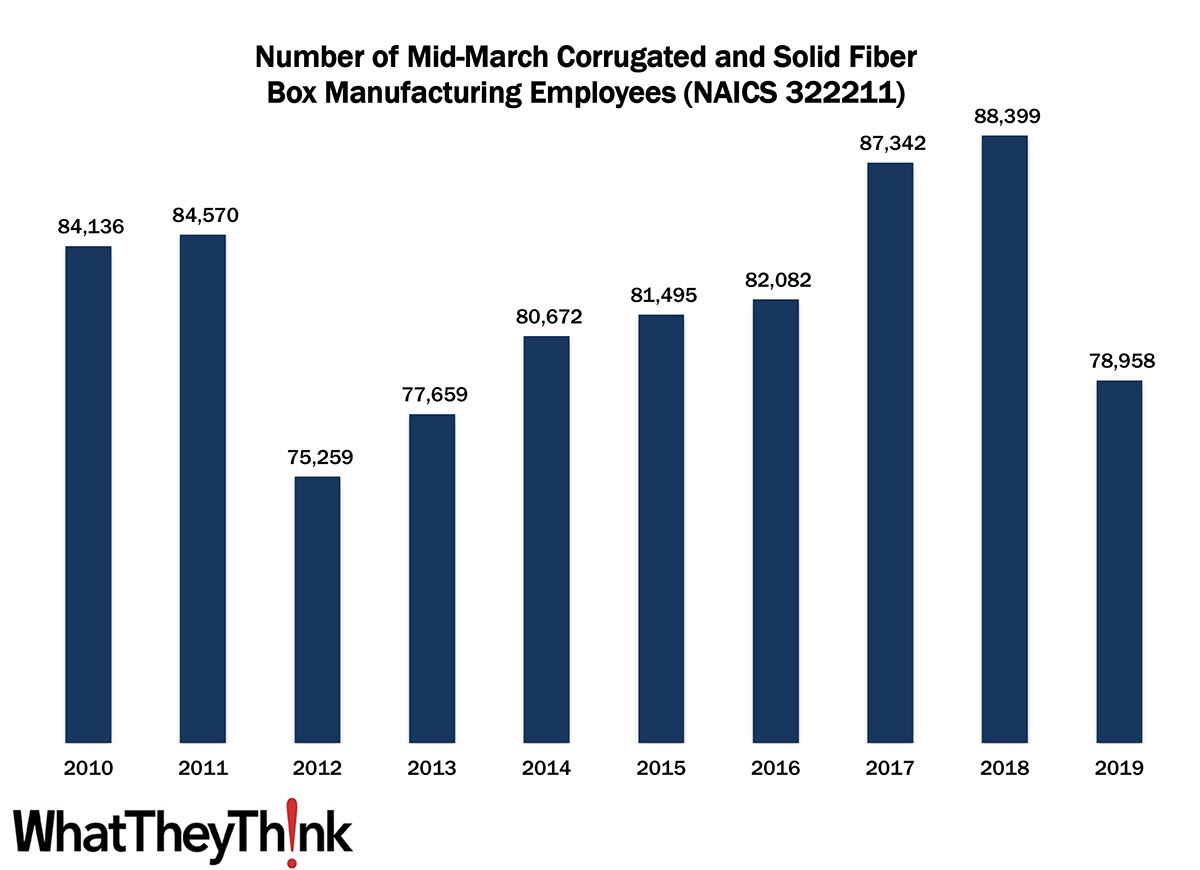

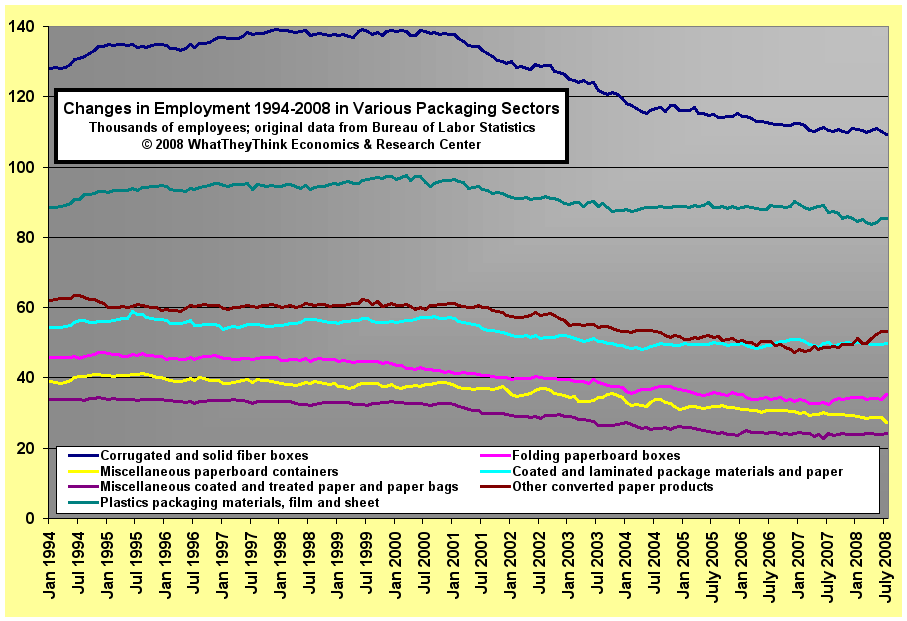

Corrugated and Solid Fiber Box Manufacturing Employment—2010–2019

Published: September 24, 2021

According to County Business Patterns, in 2010, there were 84,136 employees in NAICS 32221 (Corrugated and Solid Fiber Box Manufacturing establishments). Employment in this category dropped abruptly in 2012, then continued to rise over the course of the decade, peaking in 2018 at 88,399 before dropping again in 2019. In macro news, three estimates of Q3 GDP. Full Analysis

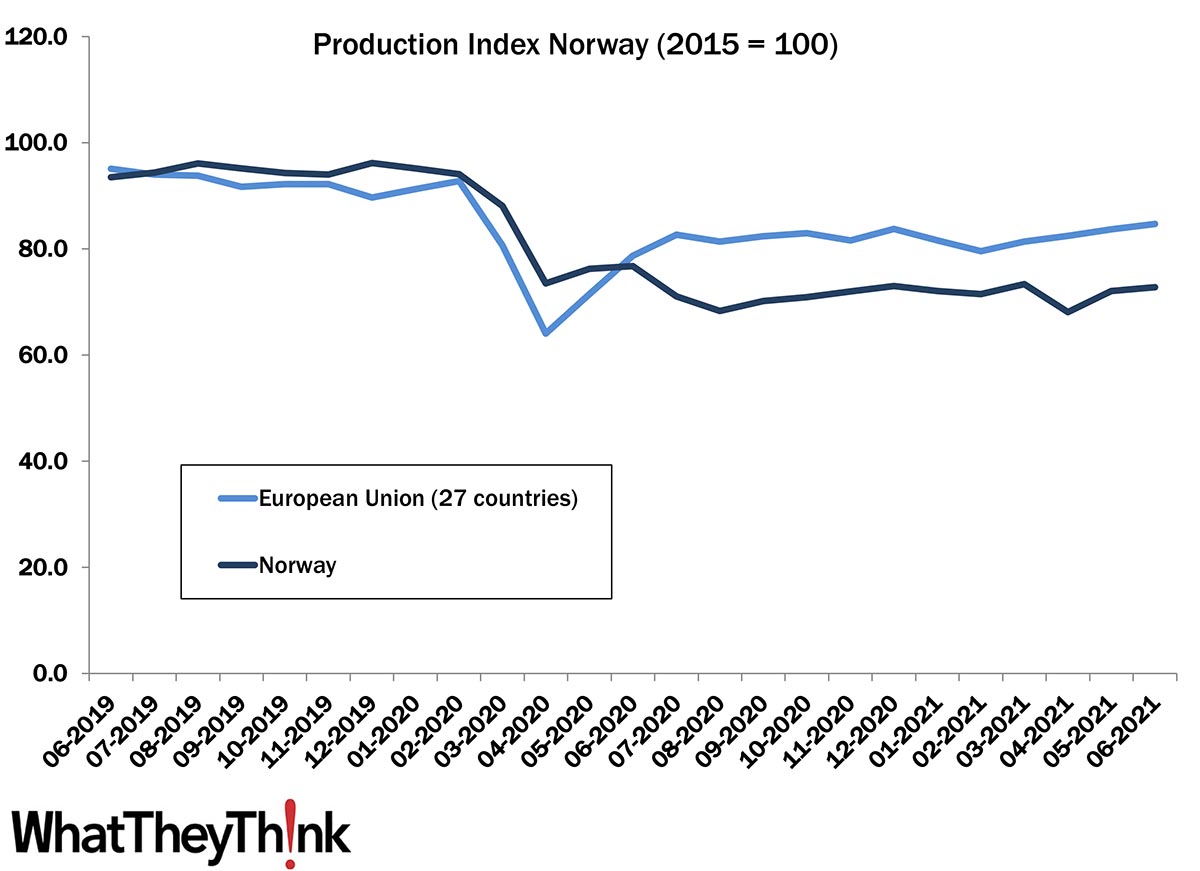

European Print Industry Snapshot: Norway

Published: September 21, 2021

In this bimonthly series, WhatTheyThink is presenting the state of the printing industry in different European countries based on the latest monthly production numbers. This week, we take a look at the printing industry in Norway. Full Analysis

July Shipments: Back on the Decline

Published: September 17, 2021

July 2021 printing shipments came in at $6.45 billion, down from June’s $6.69 billion. Year to date, January-to-July shipments are $46.44 billion. At this point in 2020, year-to-date shipments were slightly higher at $46.83. The recovery is proving more challenging than the actual pandemic, it seems. Full Analysis

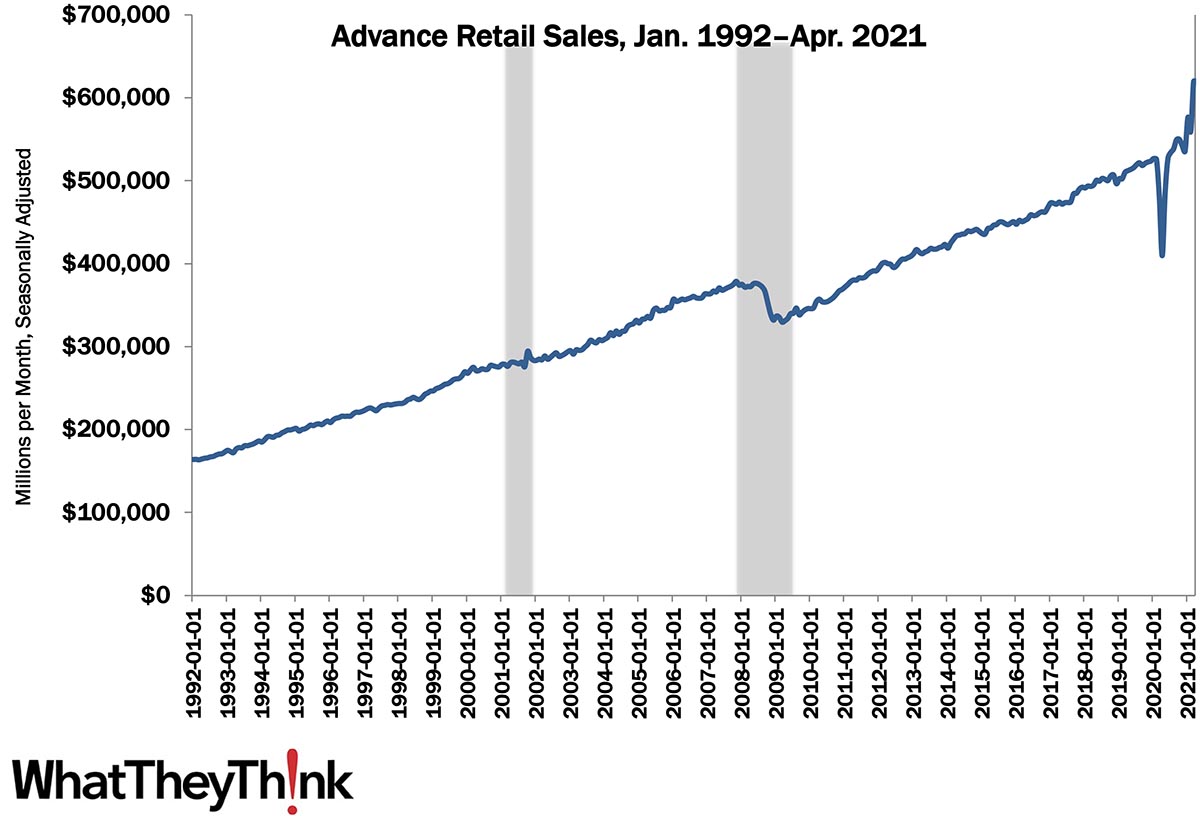

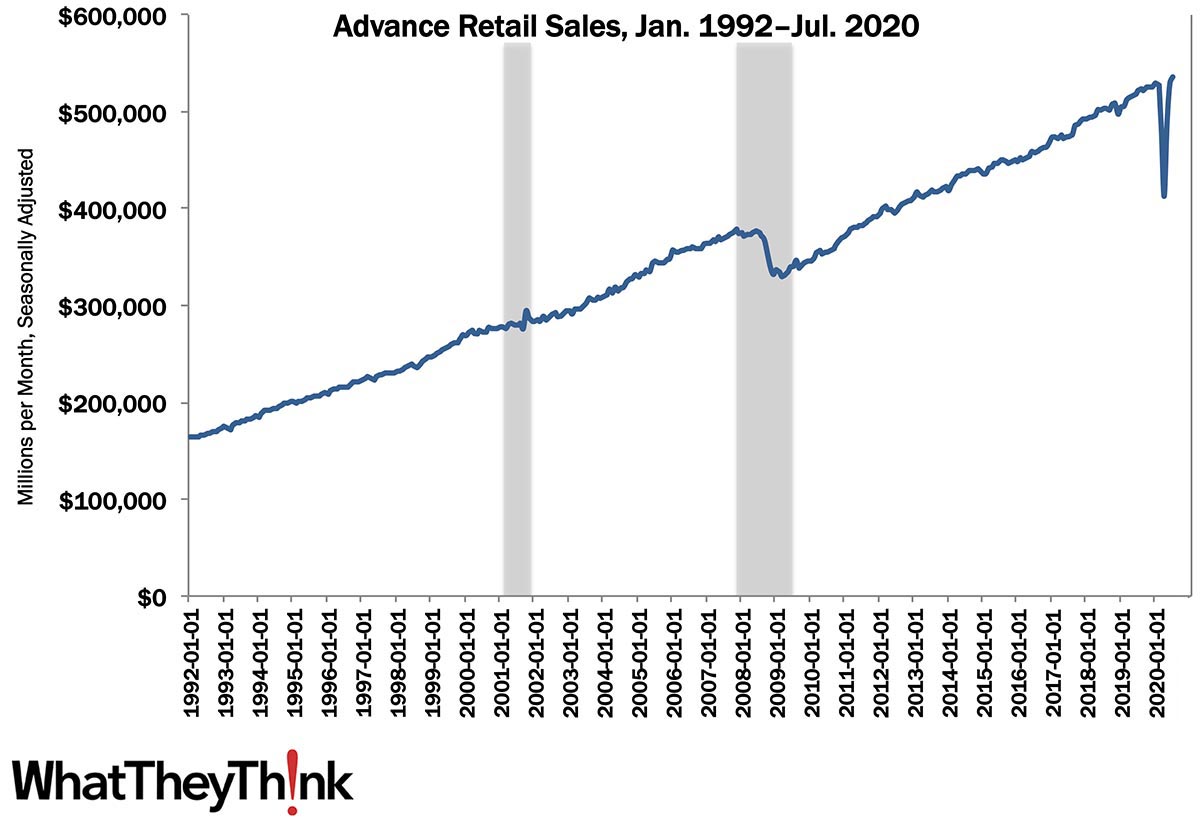

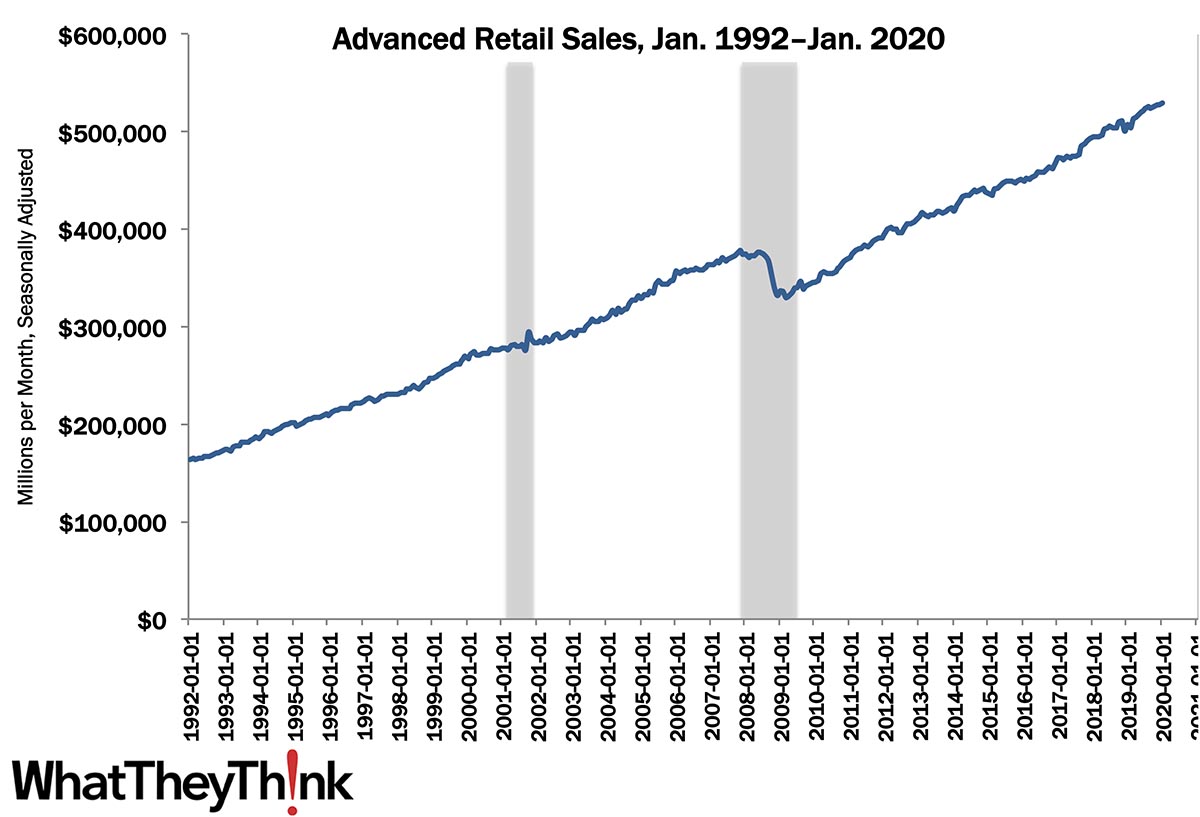

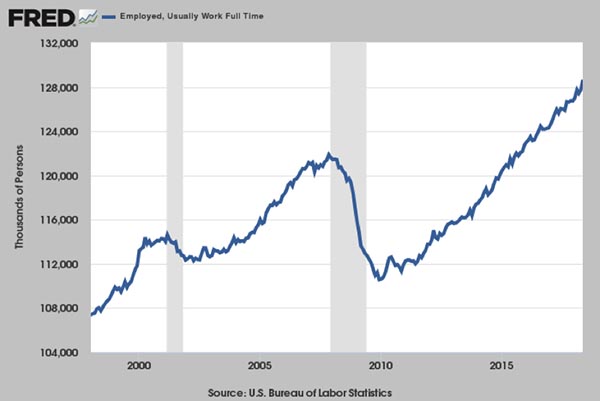

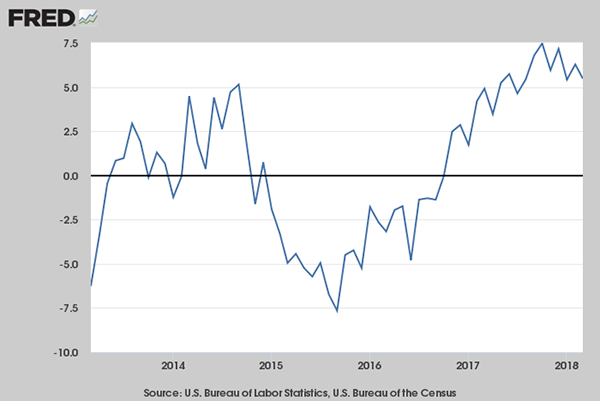

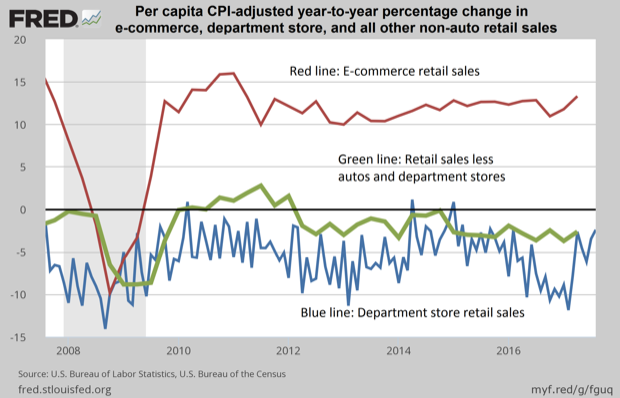

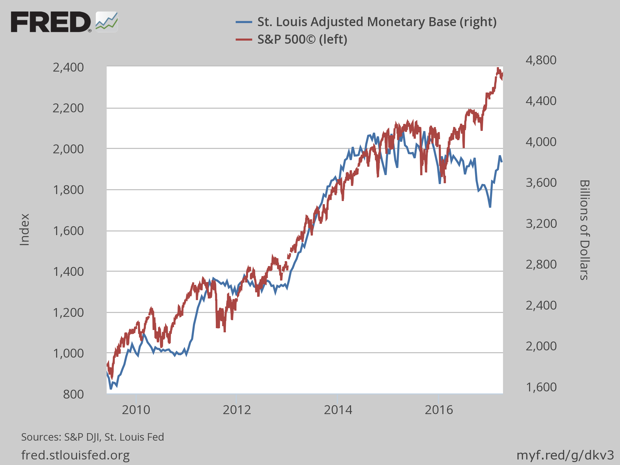

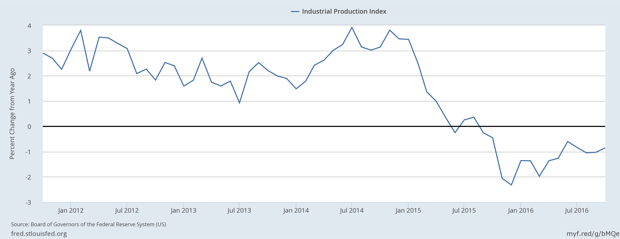

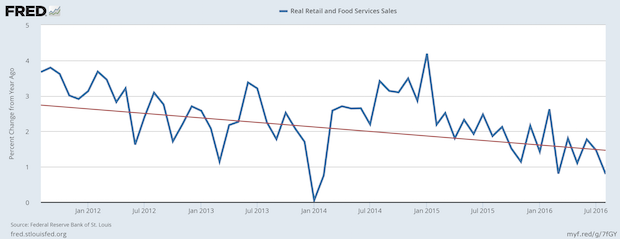

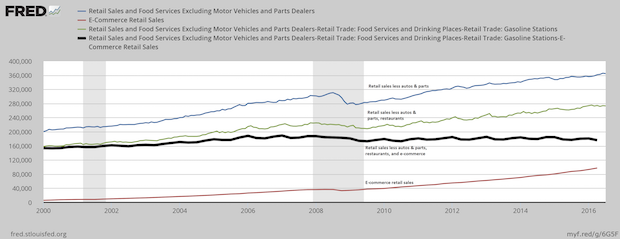

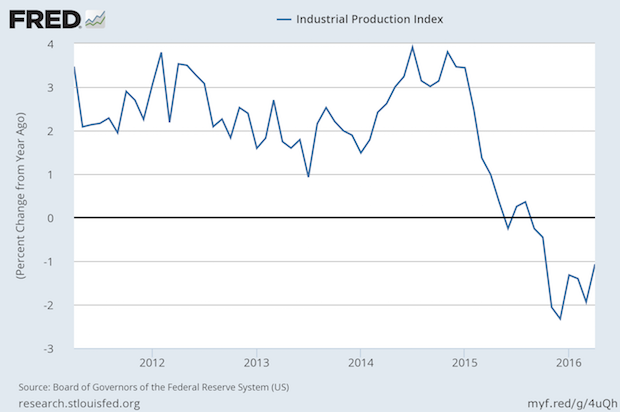

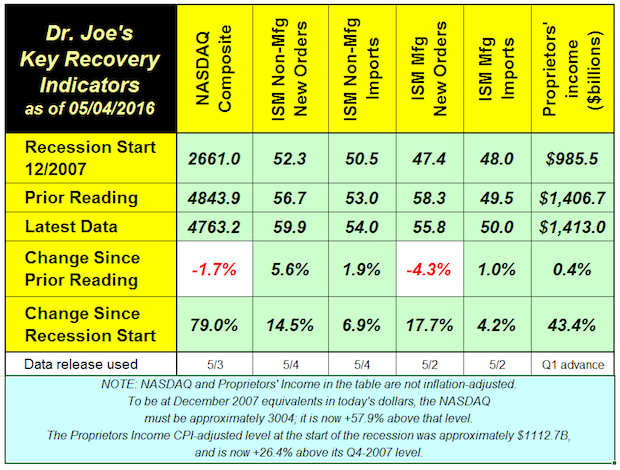

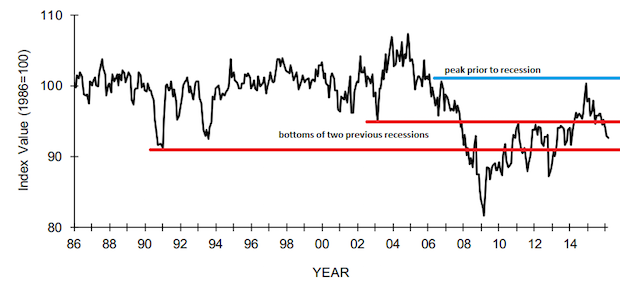

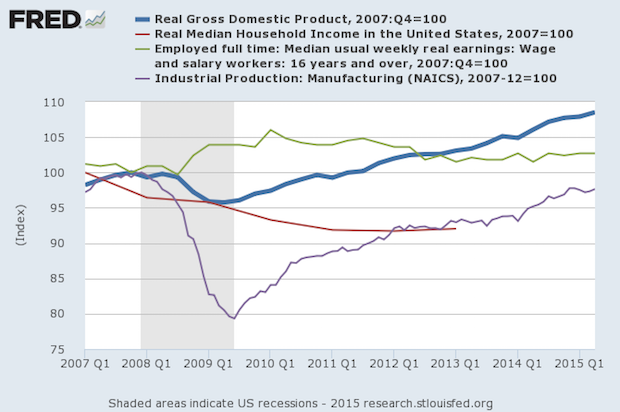

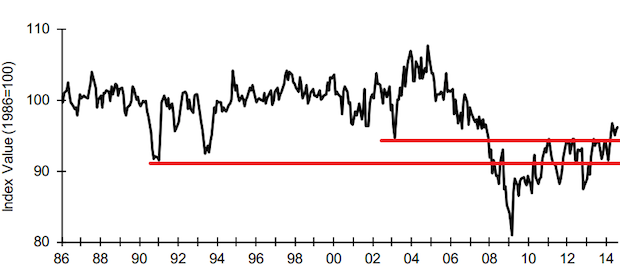

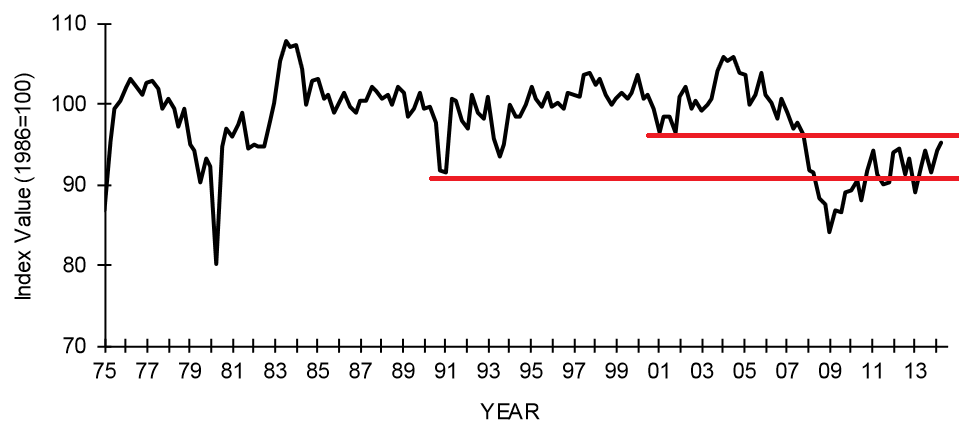

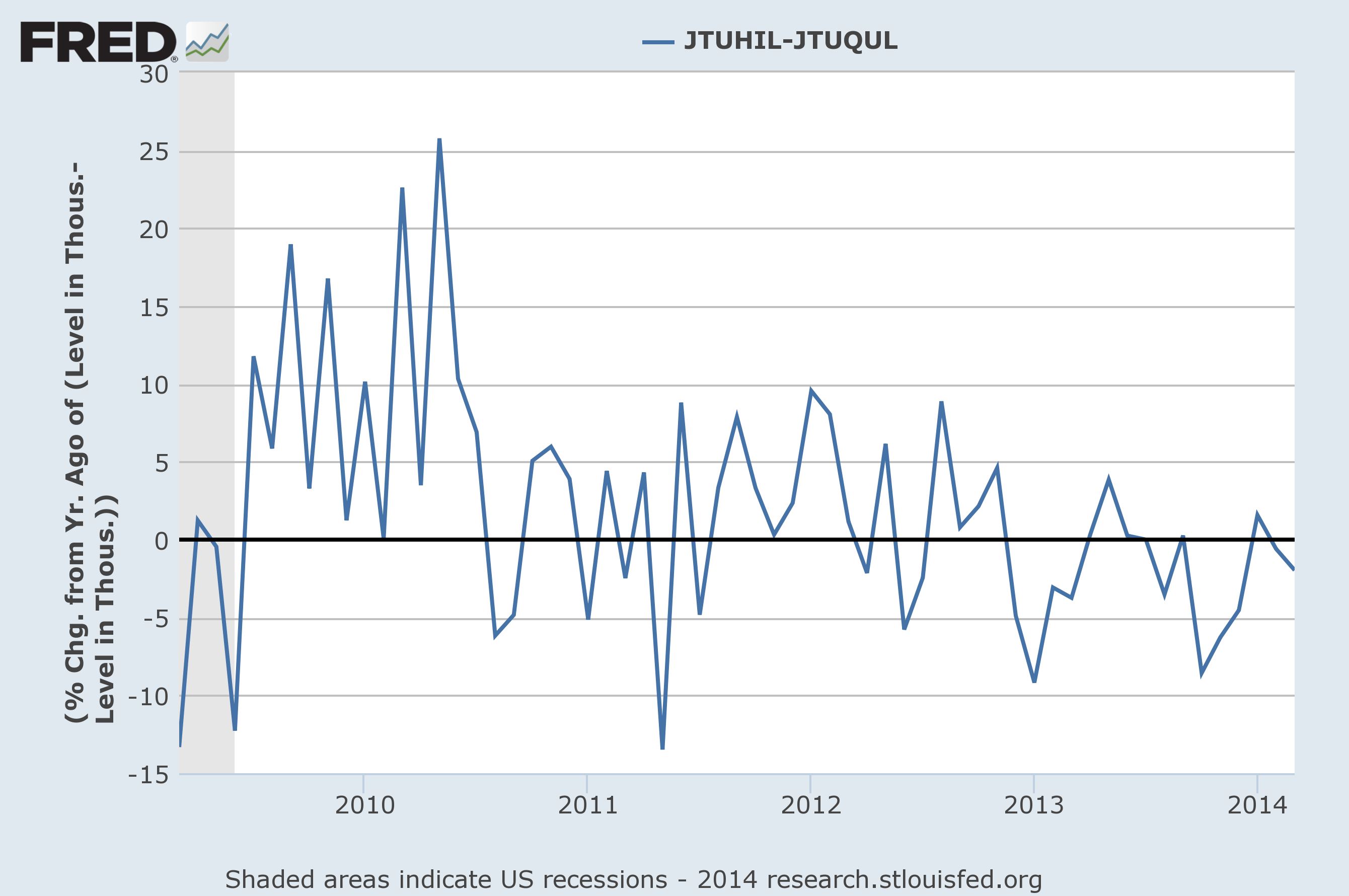

Two Indicators: Retail Sales and Industrial Production

Published: September 10, 2021

This week’s Friday data dump looks at two macroeconomic indicators that will give us some sense of how we are bouncing back from the pandemic—Retail sales and the Industrial Production Index. Full Analysis

European Print Industry Snapshot: Finland

Published: September 7, 2021

In this bimonthly series, WhatTheyThink is presenting the state of the printing industry in different European countries based on the latest monthly production numbers. This week, we take a look at the printing industry in Finland. Full Analysis

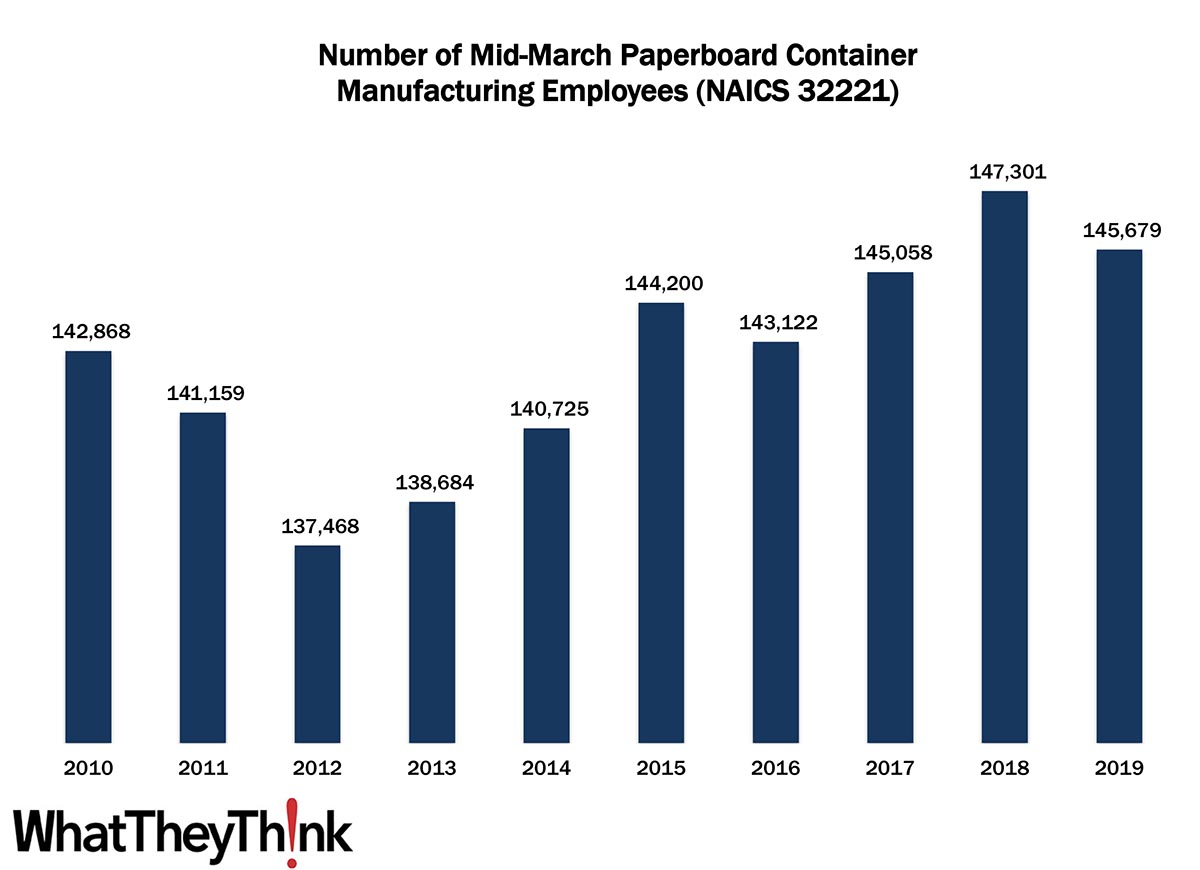

Paperboard Container Manufacturing Employment—2010–2019

Published: September 3, 2021

According to County Business Patterns, in 2010, there were 142,868 employees in NAICS 32221 (Paperboard Container Manufacturing establishments). Employment in this category dropped abruptly in 2011 and 2012, then continued to rise over the course of the decade, peaking in 2018 at 147,301 before dropping a bit in 2019. In macro news, office and mall vacancy rates are at historic highs, the pandemic having accelerated trends that had been well underway beforehand. Full Analysis

July Graphic Arts Employment—Reaching a Plateau

Published: August 27, 2021

In July 2021, all printing employment was down -0.2% from June, production employment up +0.7%, and non-production printing employment down -2.0%. Full Analysis

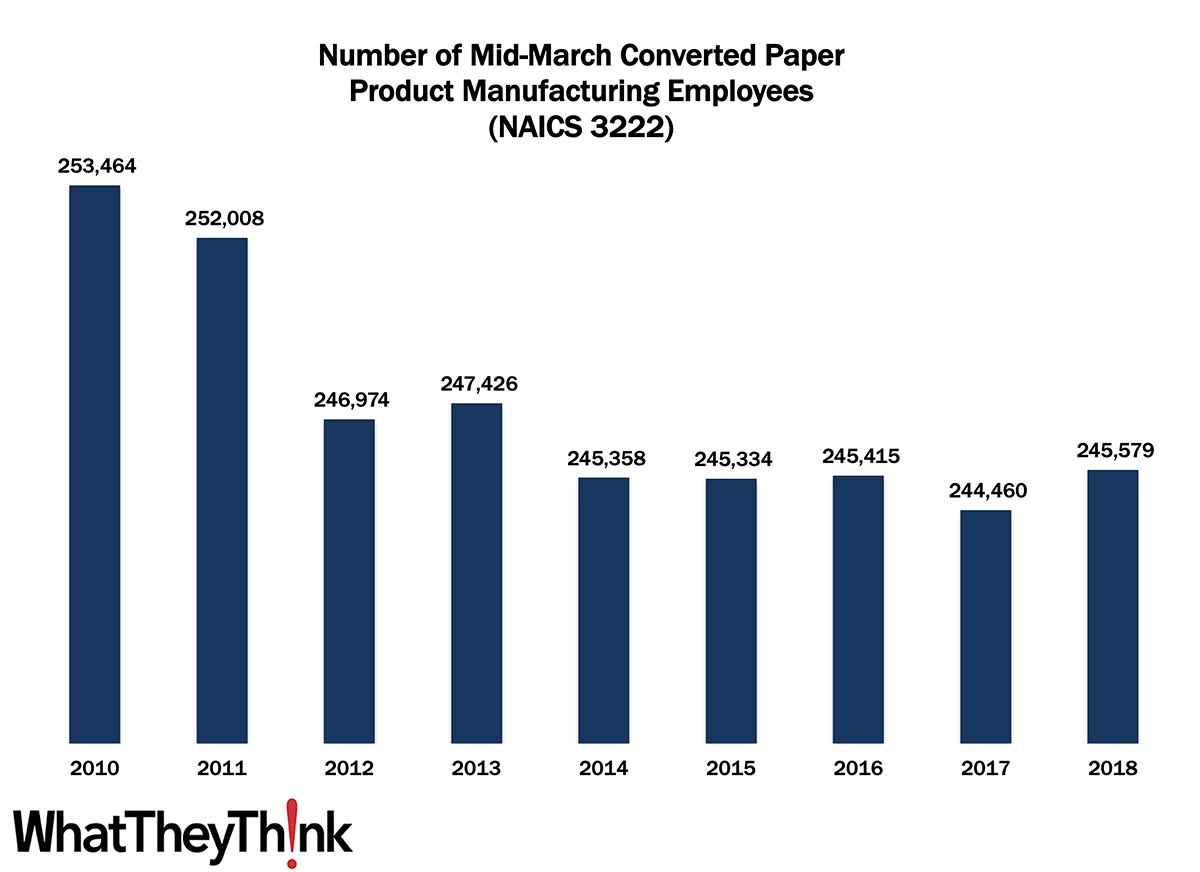

Converted Paper Product Manufacturing Employment—2010–2018

Published: August 20, 2021

According to County Business Patterns, in 2010, there were 253,464 employees in NAICS 3222 (Converted Paper Product Manufacturing establishments). Employment in this category dropped abruptly in 2012, then remained somewhat stable over the course of the decade and reaching 245,579 in 2018. In macro news, the American Institute of Architects (AIA) monthly Architecture Billings Index (ABI) show increased demand for architectural design services, good news for the signage industry. Full Analysis

European Print Industry Snapshot: Denmark

Published: August 16, 2021

In this bimonthly series, WhatTheyThink is presenting the state of the printing industry in different European countries based on the latest monthly production numbers. This week, we take a look at the printing industry in Denmark. Full Analysis

June Shipments: A Lateral Move

Published: August 13, 2021

June 2021 printing shipments came in at $6.65 billion, unchanged from May. We usually see declines from May to June, but at least the lateral move has halted two months of declining shipments. Full Analysis

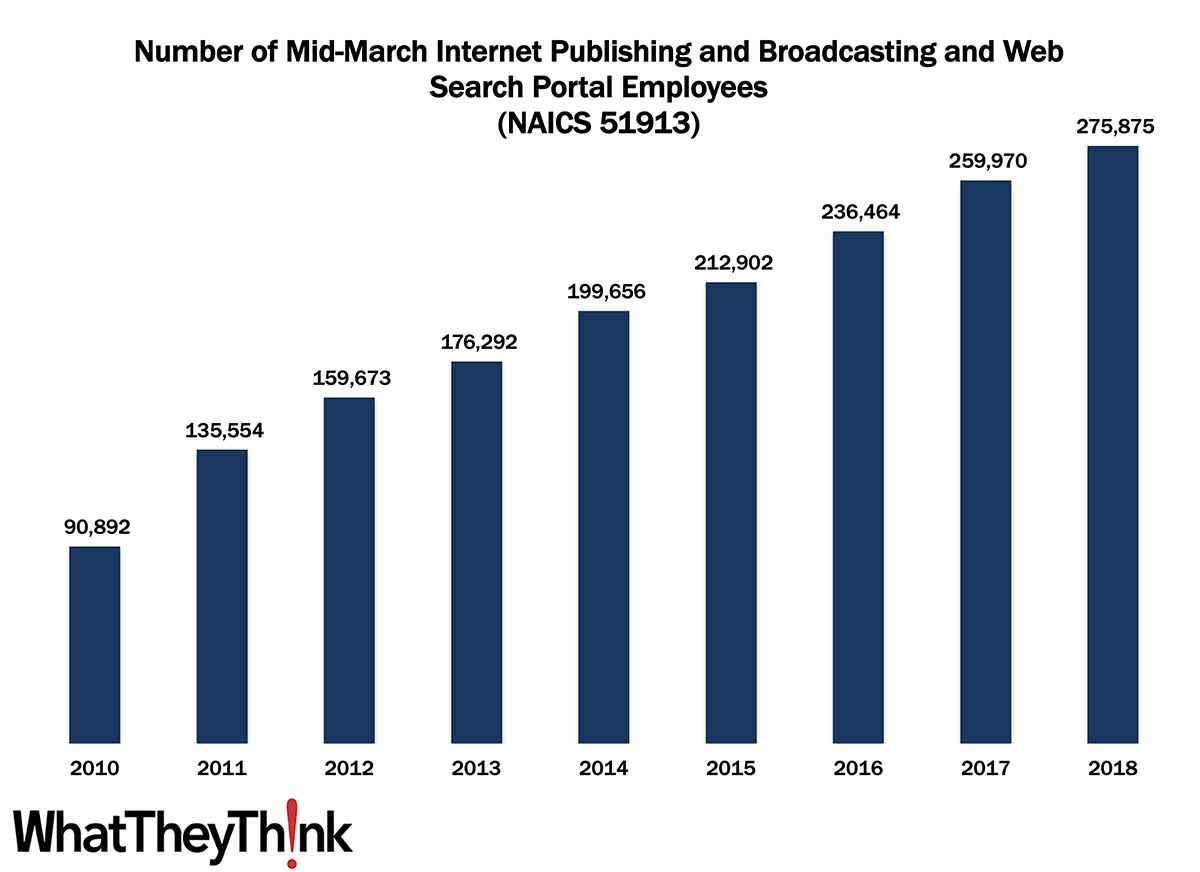

Internet Publishing Employment—2010–2018

Published: August 6, 2021

According to County Business Patterns, in 2010, there were 90,892 employees in NAICS 51913 (Internet Publishing and Broadcasting and Web Search Portals). Over the course of the decade, employment in this category grew steadily to reach 275,875 in 2018. In macro news, real GDP increased at an annual rate of 6.5% in Q2 2021. Full Analysis

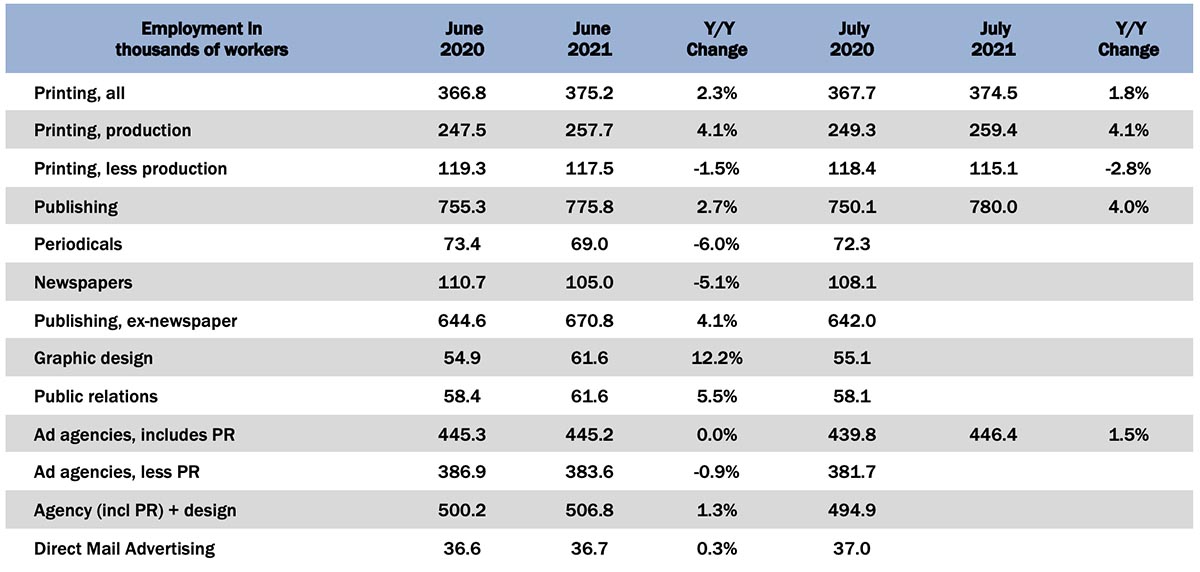

June Graphic Arts Employment—Continuing to Get a Little Better

Published: July 30, 2021

In June 2021, all printing employment was up +0.1% from May, production employment up +0.7%, and non-production printing employment down -1.2%. Full Analysis

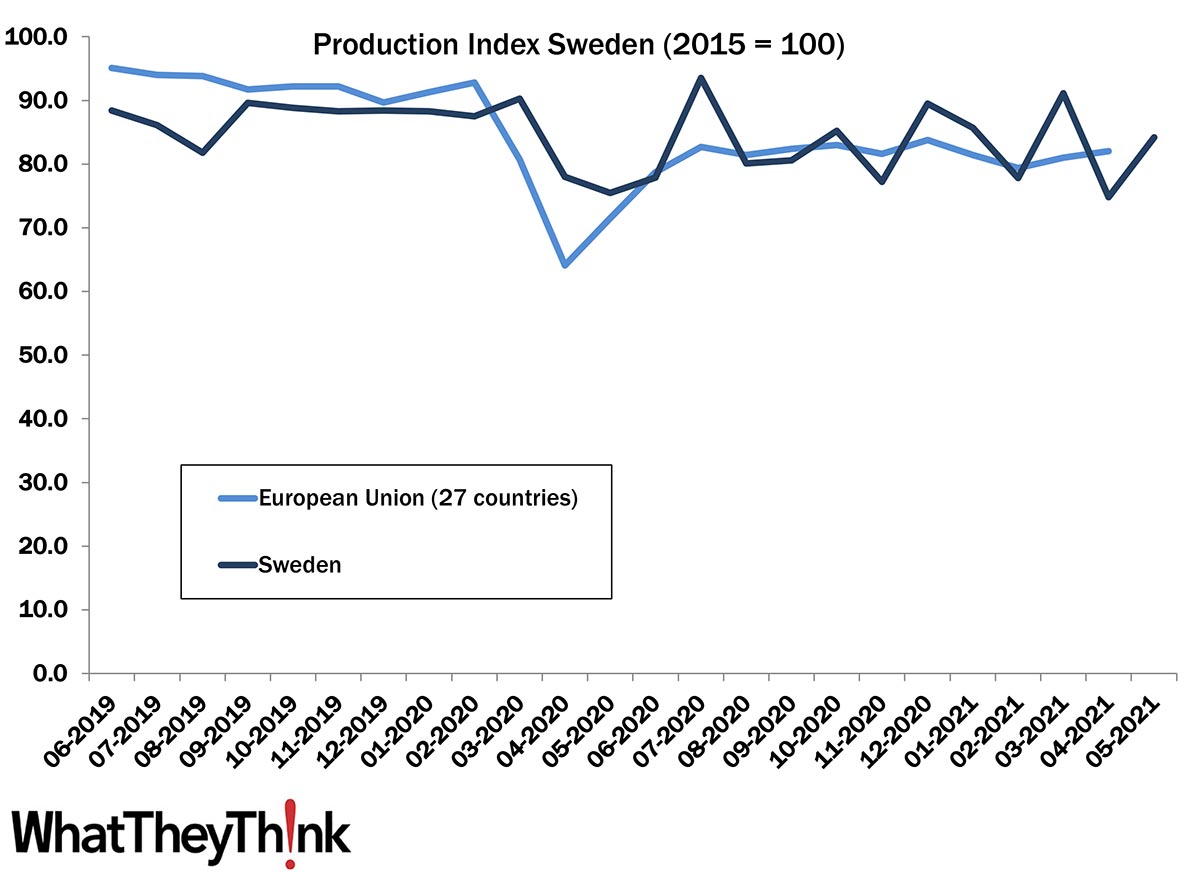

European Print Industry Snapshot: Sweden

Published: July 27, 2021

In this bimonthly series, WhatTheyThink is presenting the state of the printing industry in different European countries based on the latest monthly production numbers. This week, we take a look at the printing industry in Sweden. Full Analysis

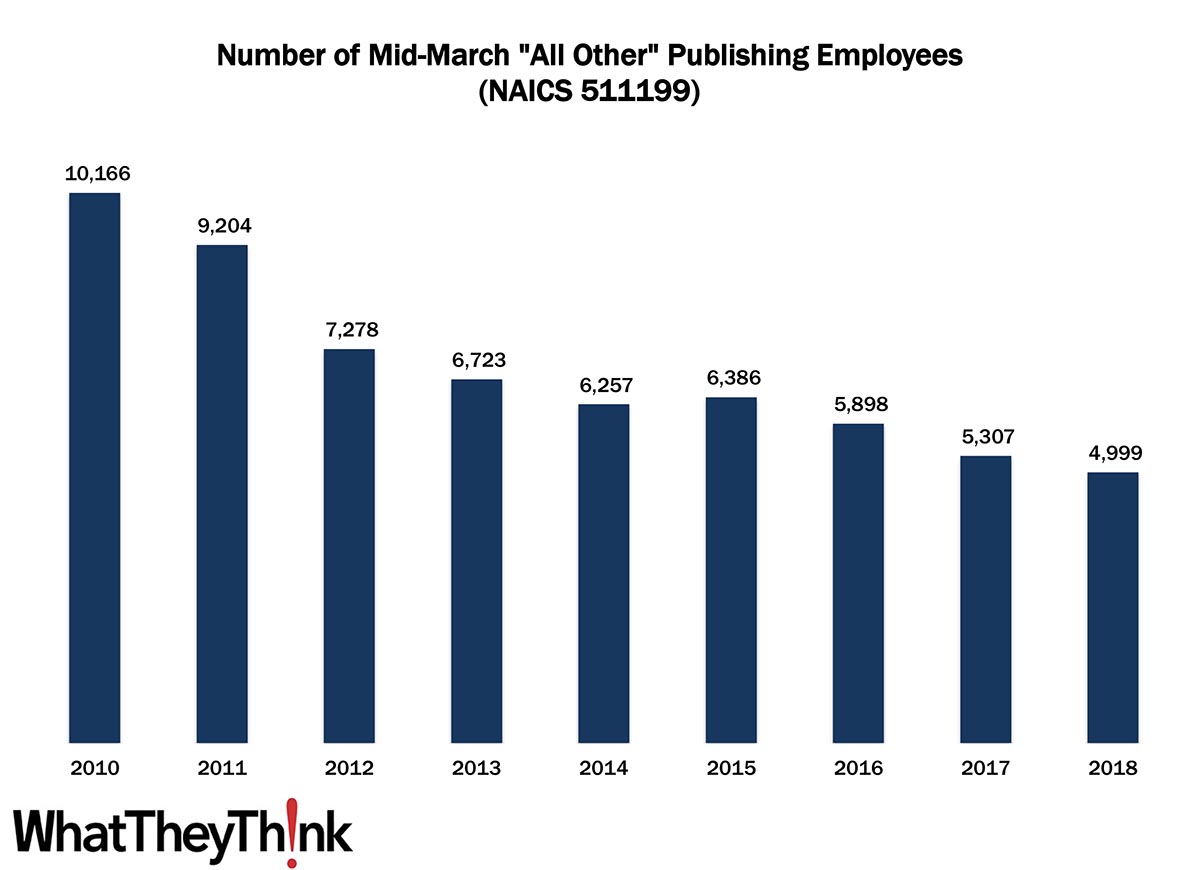

Assorted Publishing Employment—2010–2018

Published: July 23, 2021

According to County Business Patterns, in 2010, there were 10,166 employees in NAICS 511199 (All Other Publishers). Over the course of the decade, employment in this category steadily declined to bottom out at 4,999 in 2018. In macro news, last year’s “official” COVID recession lasted only two months, according to the NBER. Full Analysis

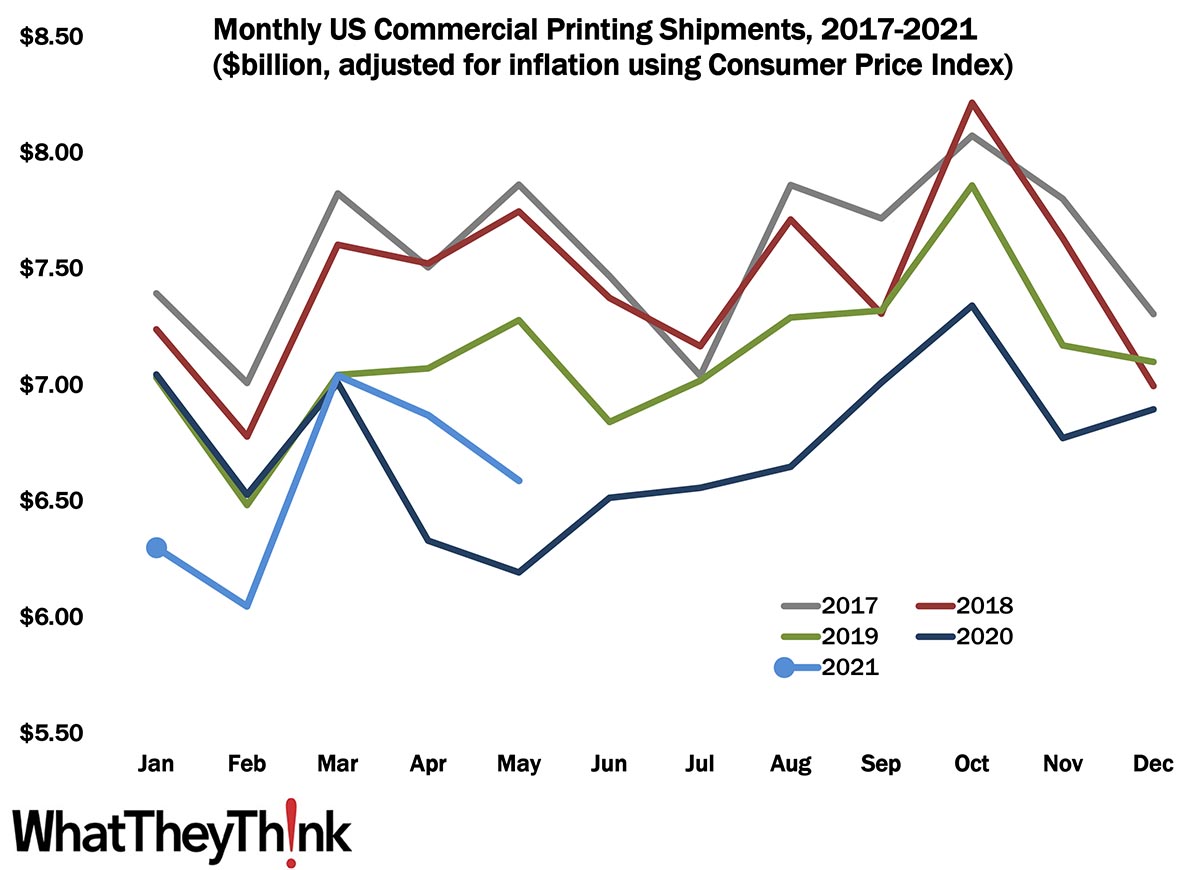

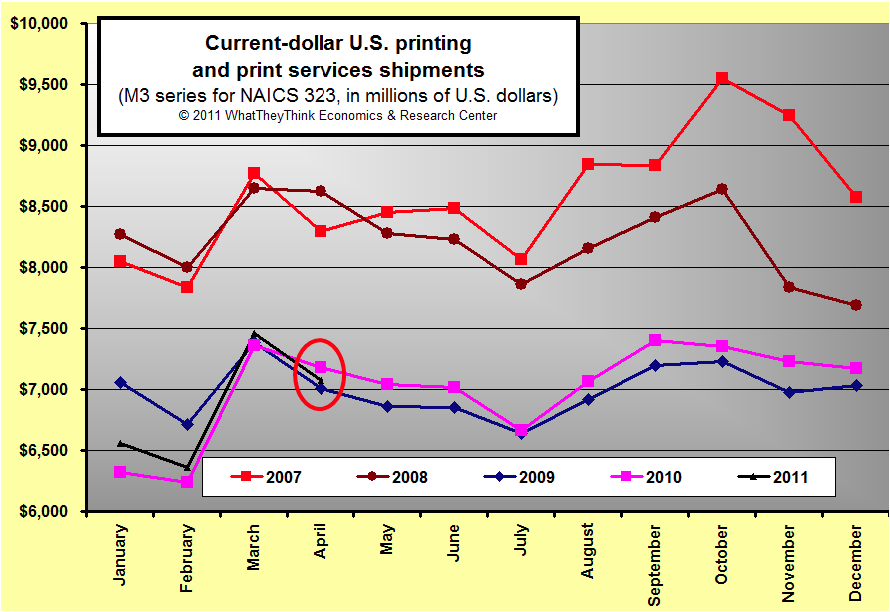

Shipments: An Evening Out

Published: July 16, 2021

May 2021 printing shipments came in at $6.59 billion, a slight downturn from April’s $6.87 billion, and the second consecutive month of decline, but is consistent with the pattern we have been tracking over the past five years. Full Analysis

European Print Industry Snapshot: Czech Republic

Published: July 13, 2021

In this bimonthly series, WhatTheyThink is presenting the state of the printing industry in different European countries based on the latest monthly production numbers. This week, we take a look at the printing industry in the Czech Republic. Full Analysis

Greeting Card Publishers—2010–2018

Published: July 2, 2021

According to County Business Patterns, in 2010, there were 10,258 employees in NAICS 511191 (Greeting Card Publishers). Over the course of the decade, employment has been up and down, reaching 13,690 in 2018. In sort of macro news, Las Vegas tourism traffic rose substantially in May 2021, as conventions were poised to reopen. Full Analysis

May Graphic Arts Employment—Getting a Little Better

Published: June 25, 2021

In May 2021, all printing employment was up +0.7% from February, production employment up +1.4%, and non-production printing employment down -0.8%. Full Analysis

European Print Industry Snapshot: Poland

Published: June 22, 2021

In this bimonthly series, WhatTheyThink is presenting the state of the printing industry in different European countries based on the latest monthly production numbers. This week, we take a look at the printing industry in Poland. Full Analysis

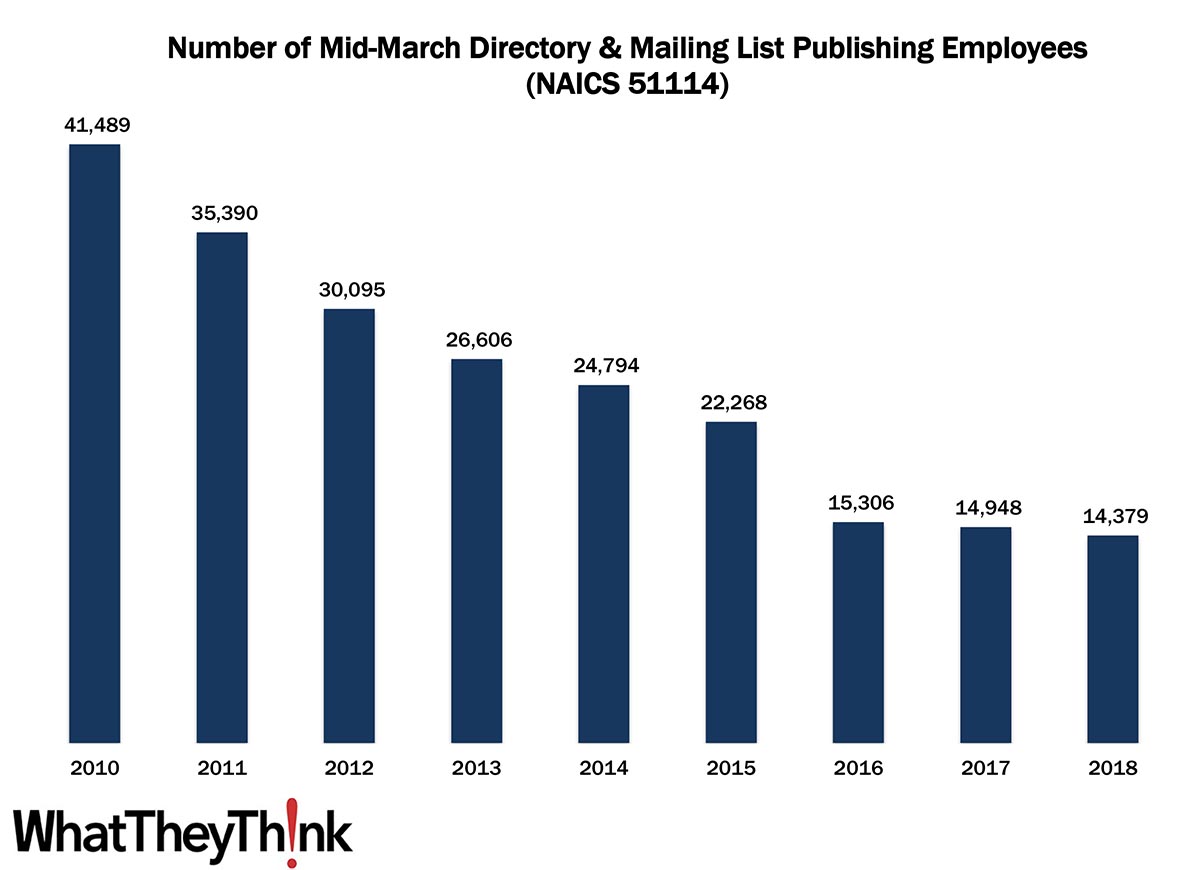

Directory and Mailing List Publishers—2010–2018

Published: June 18, 2021

According to County Business Patterns, in 2010, there were 41,489 employees in NAICS 51114 (Directory and Mailing List Publishing). Over the course of the decade, employment had plummeted to a low of 14,379. In macro news, new business creation has been at record highs. Full Analysis

Shipments: A New Season?

Published: June 11, 2021

April 2021 printing shipments came in at $6.80 billion, a slight downturn from March’s $6.98 billion, but is consistent with the pattern we have been tracking over the past five years. Full Analysis

European Print Industry Snapshot: Belgium

Published: June 8, 2021

In this bimonthly series, WhatTheyThink is presenting the state of the printing industry in different European countries based on the latest monthly production numbers. This week, we take a look at the printing industry in Belgium Full Analysis

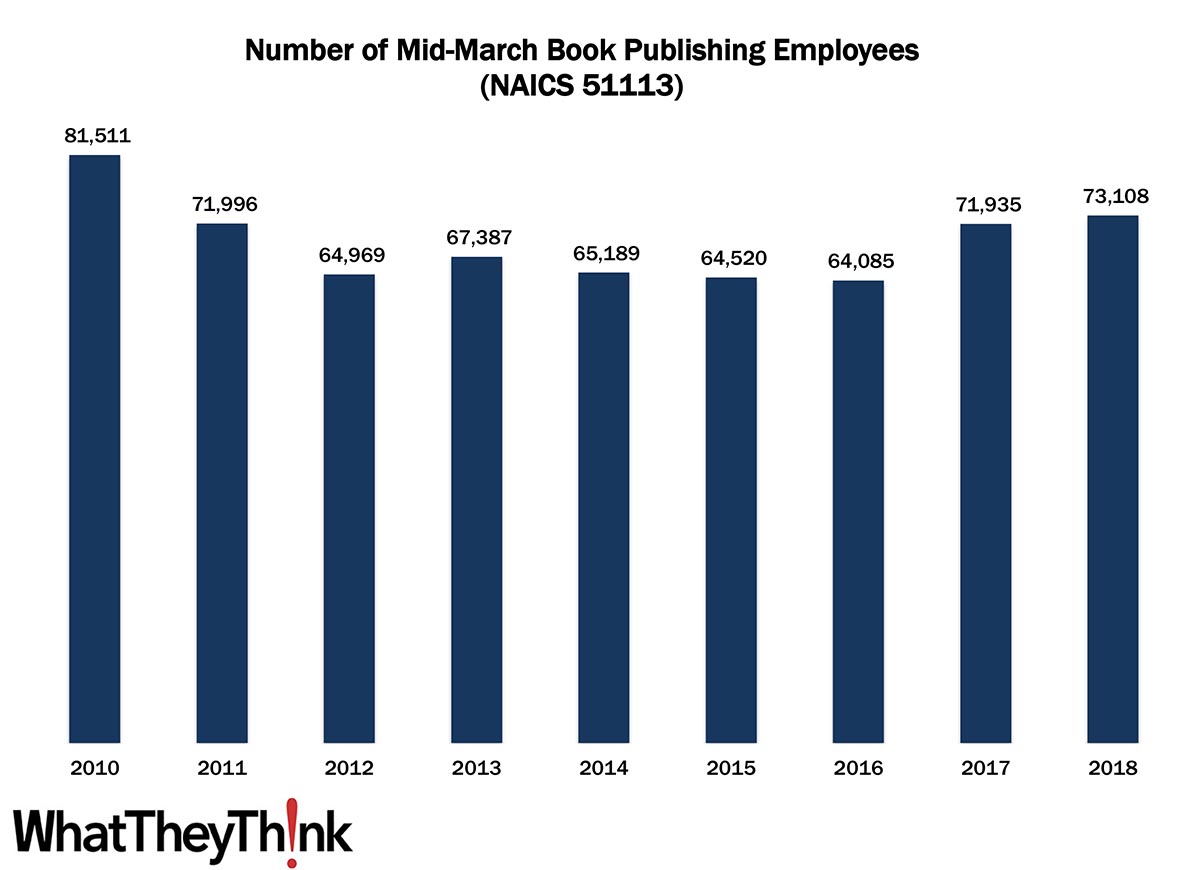

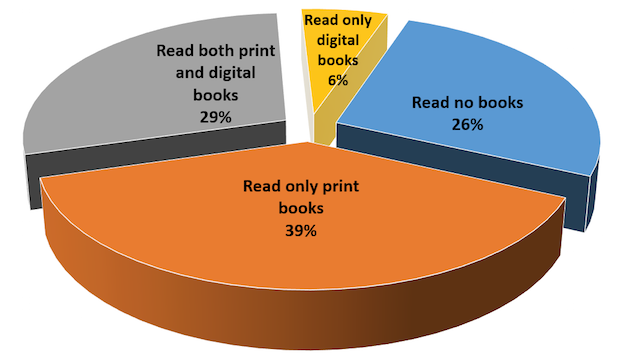

Book Publishing Employees—2010–2018

Published: June 4, 2021

According to County Business Patterns, in 2010, there were 81,511 employees in NAICS 51113 (Book Publishing). Over the course of the decade, employment had dropped to a low of 64,085, but climbed back up to 73,108 in 2018. In macro news, the Great Rebound is underway. Full Analysis

Two Macroeconomic Indicators

Published: May 28, 2021

This week’s Friday data dump looks at two macroeconomic indicators that will give us some sense of how we are bouncing back from the pandemic—the Industrial Production Index, and Retail Sales. Full Analysis

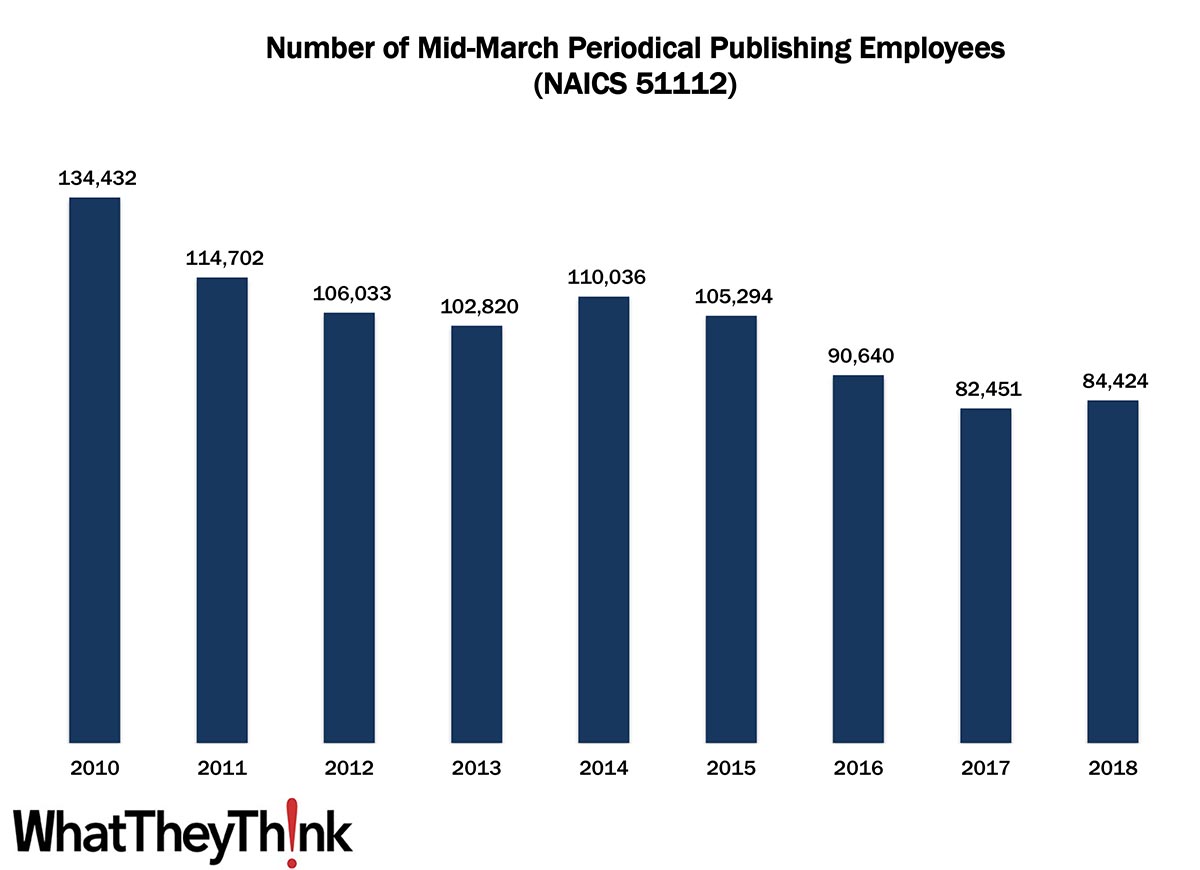

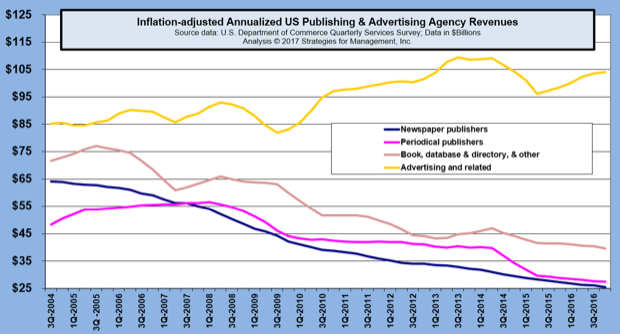

Periodical Publishing Employees—2010–2018

Published: May 21, 2021

According to County Business Patterns, in 2010, there were 134,432 employees in NAICS 51112 (Periodical Publishing). By 2018, employees had decreased to 84,424. In macro news, ecommerce as a percent of retail sales has dropped almost back to its pre-pandemic level. Full Analysis

European Print Industry Snapshot: Netherlands

Published: May 18, 2021

In this bimonthly series, WhatTheyThink is presenting the state of the printing industry in different European countries based on the latest monthly production numbers. This week, we take a look at the printing industry in the Netherlands Full Analysis

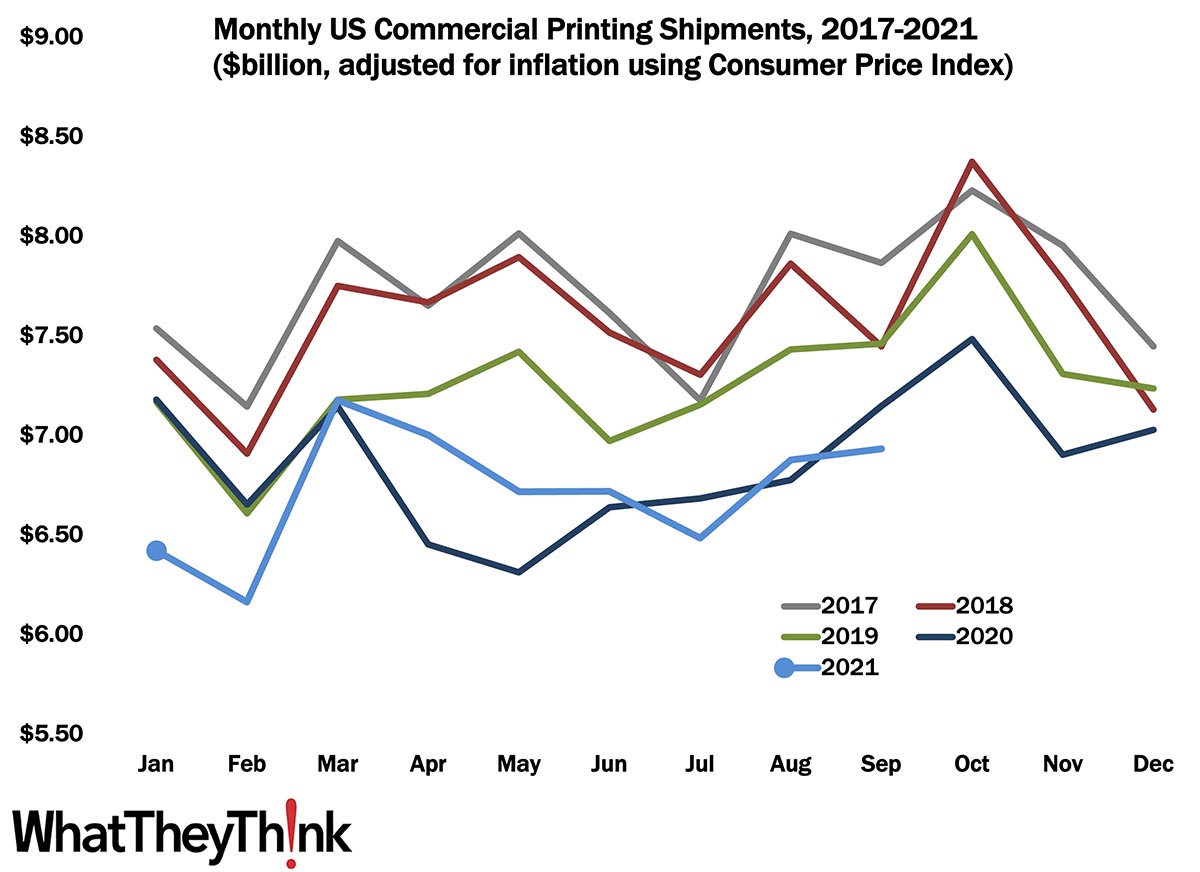

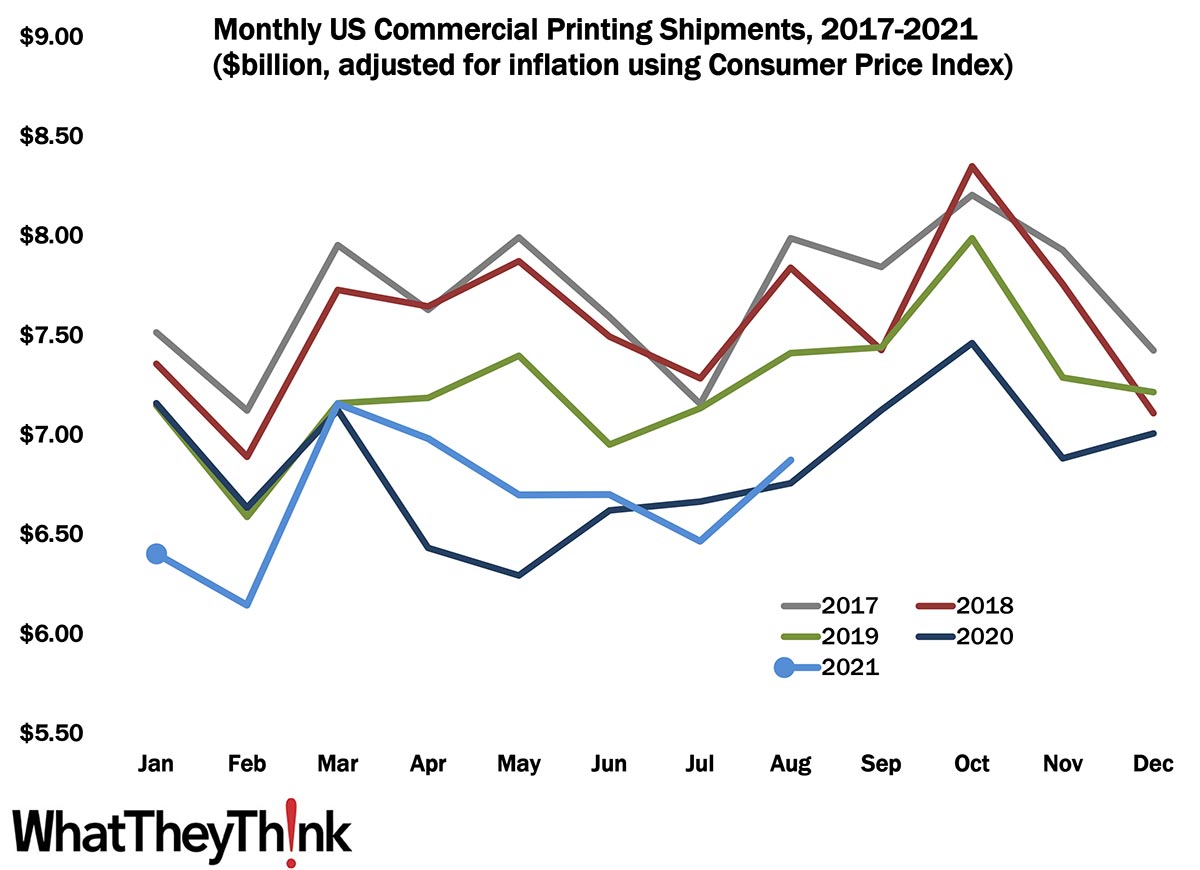

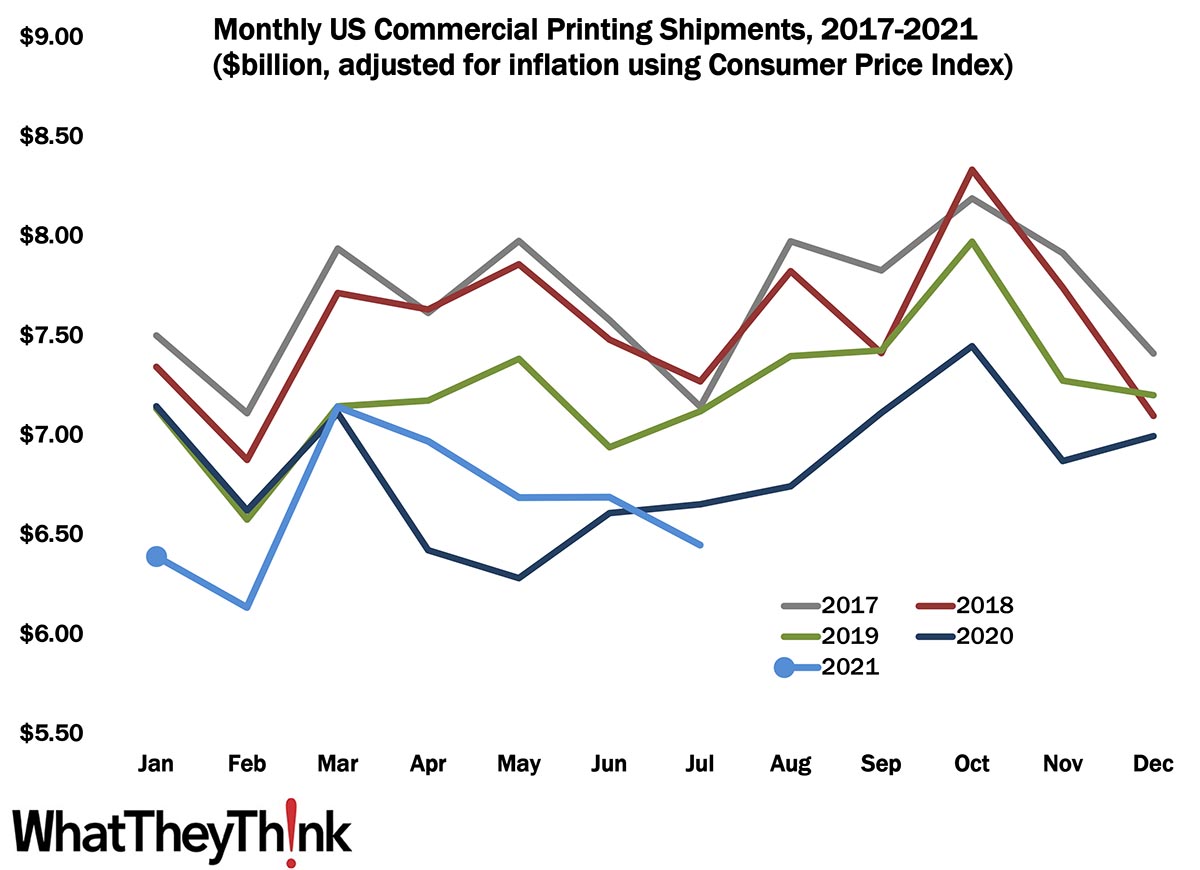

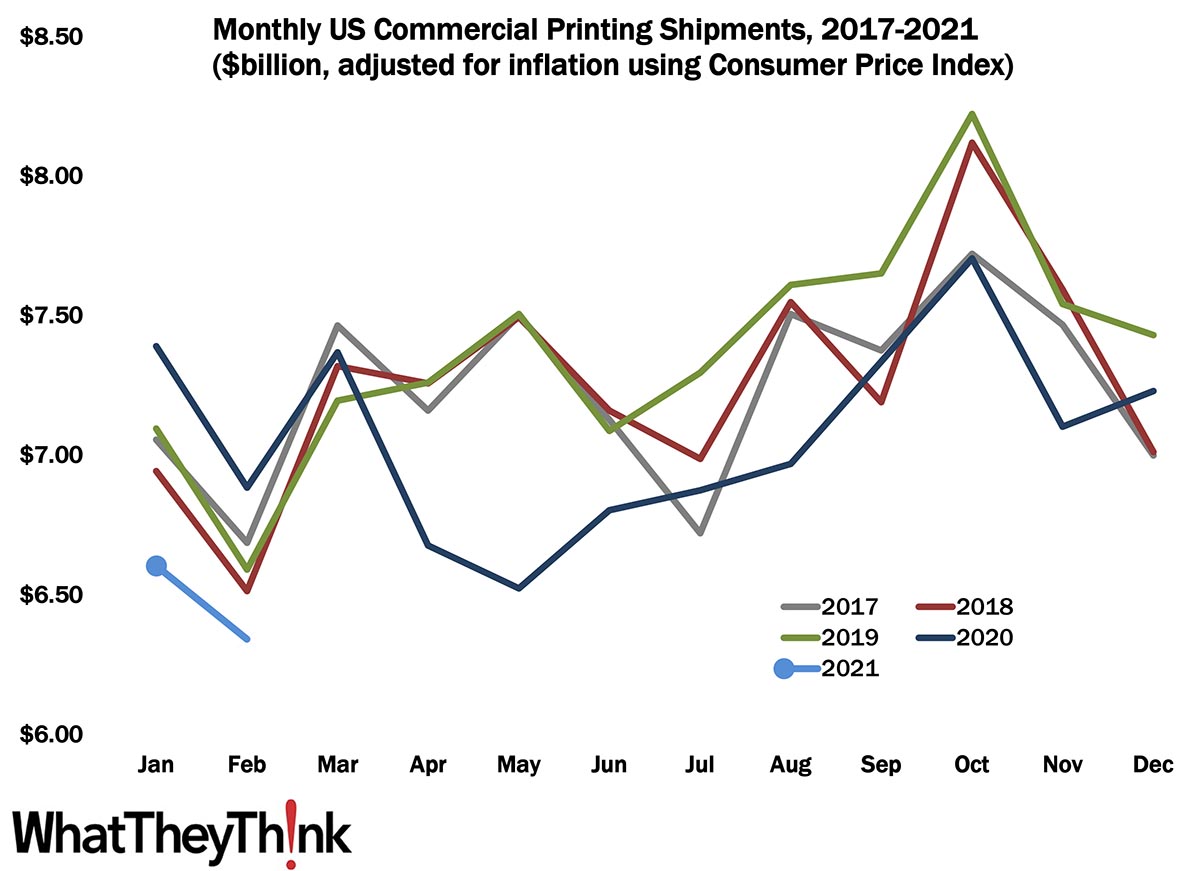

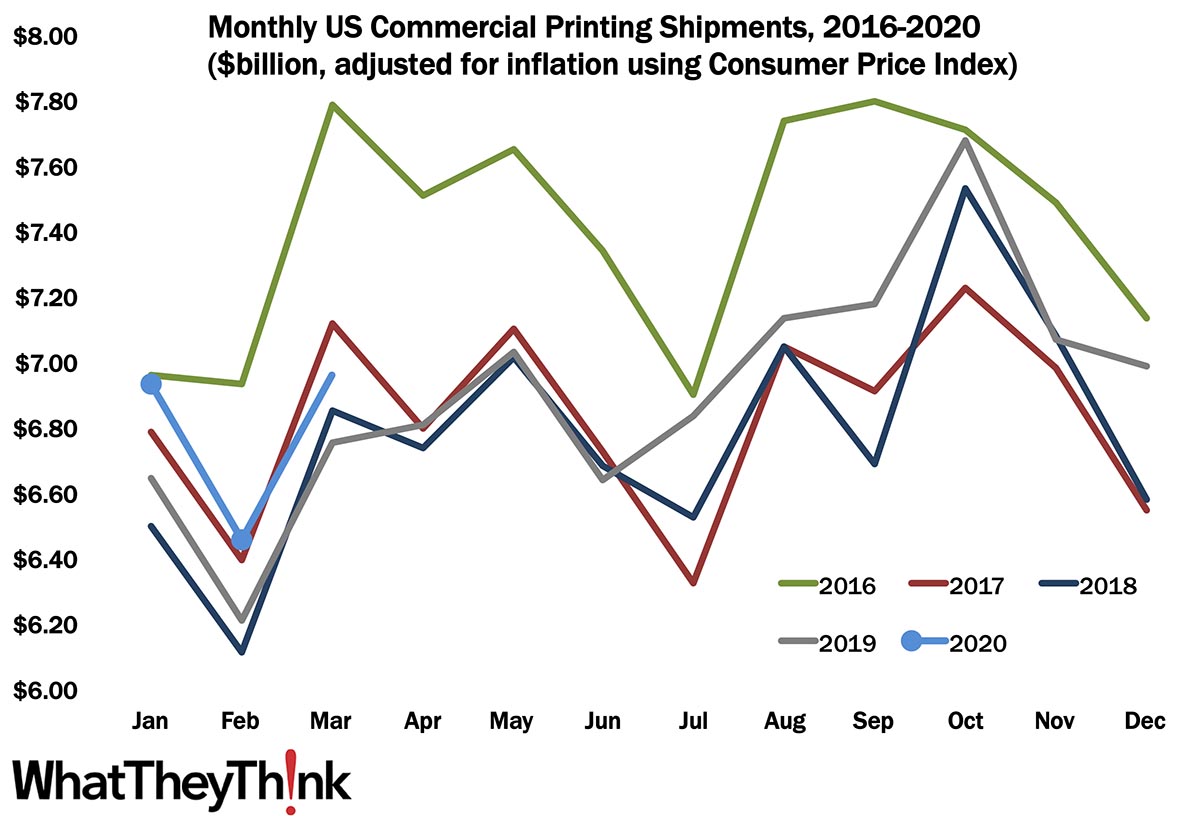

Shipments: We Told You

Published: May 14, 2021

Last month, we said that “shipments can only get better from here”—and we were right. March shipments roared back from a historical low of $6.39 billion in February to $7.44 billion in March, the second best March in the past five years. Full Analysis

March Graphic Arts Employment—Getting Back to Work

Published: May 7, 2021

In March 2021, all printing employment was up +1.5% from February, production employment up +1.1%, and non-production printing employment up +2.2%. Full Analysis

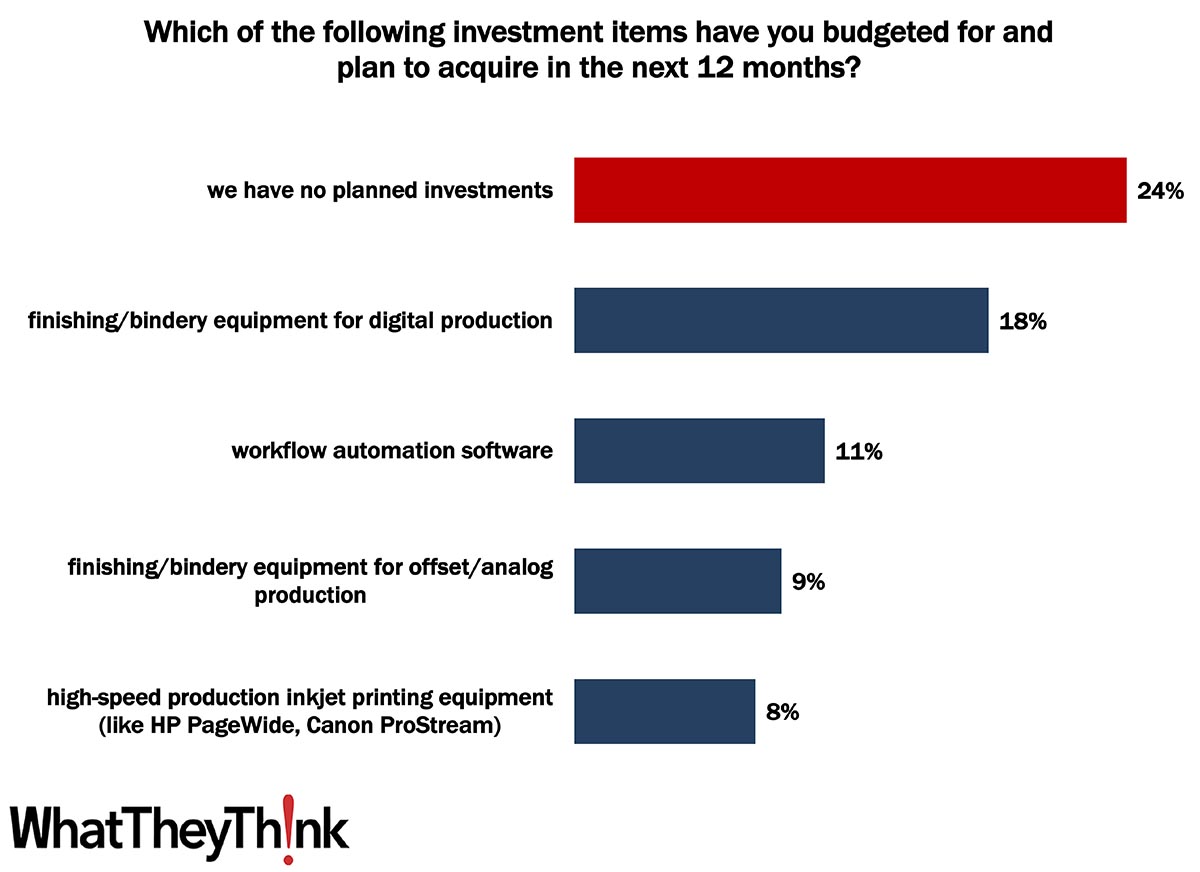

Printing 2021 Quick Look: Top Investments

Published: May 5, 2021

According to data from our recently published Printing Outlook 2021 special report, one-fourth of print businesses have no major investment plans for 2021. Full Analysis

European Print Industry Snapshot: Portugal

Published: May 4, 2021

In this bimonthly series, WhatTheyThink is presenting the state of the printing industry in different European countries based on the latest monthly production numbers. This week, we take a look at the printing industry in Portugal. Full Analysis

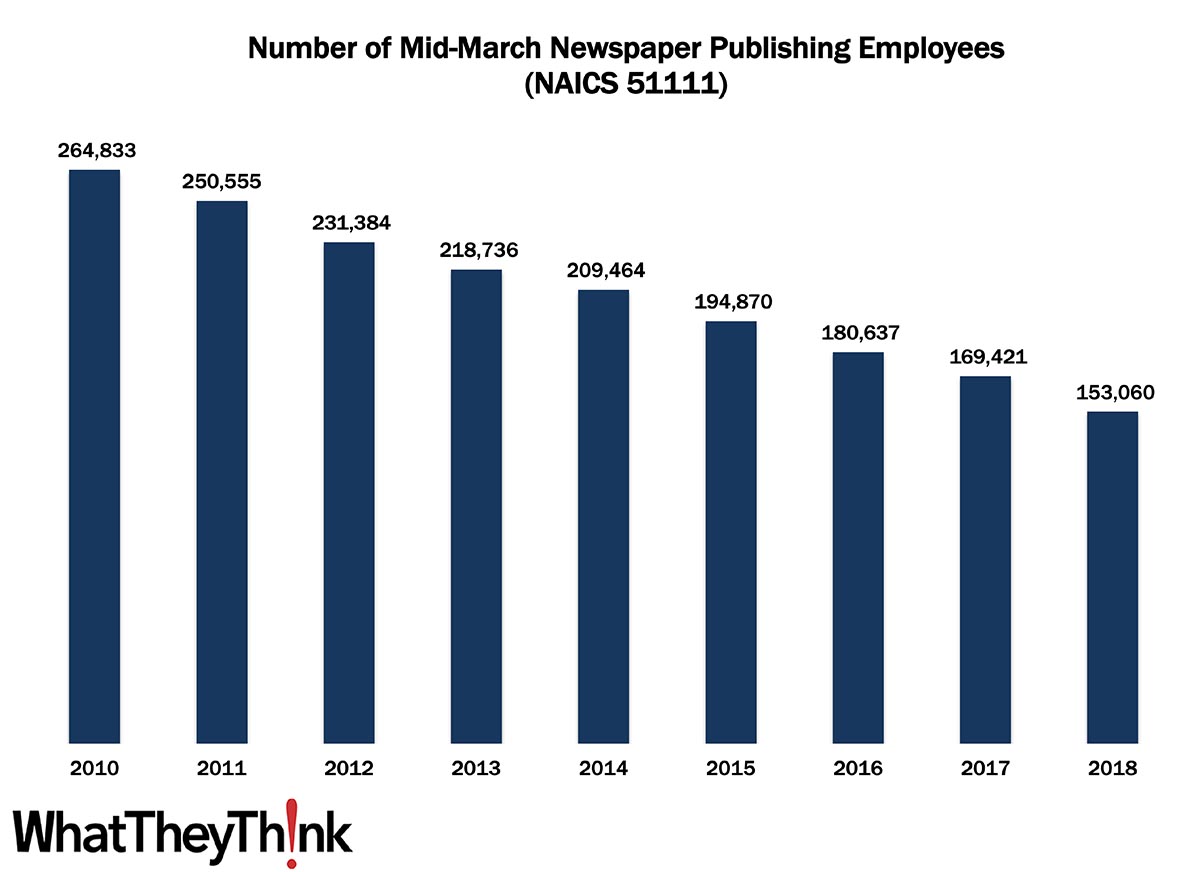

Newspaper Publishing Employees—2010–2018

Published: April 30, 2021

According to County Business Patterns, in 2010, there were 264,833 employees in NAICS 51111 (Newspaper Publishing). By 2018, employees had decreased to 153,060. In macro news, Q1 GDP was up 6.4%. Full Analysis

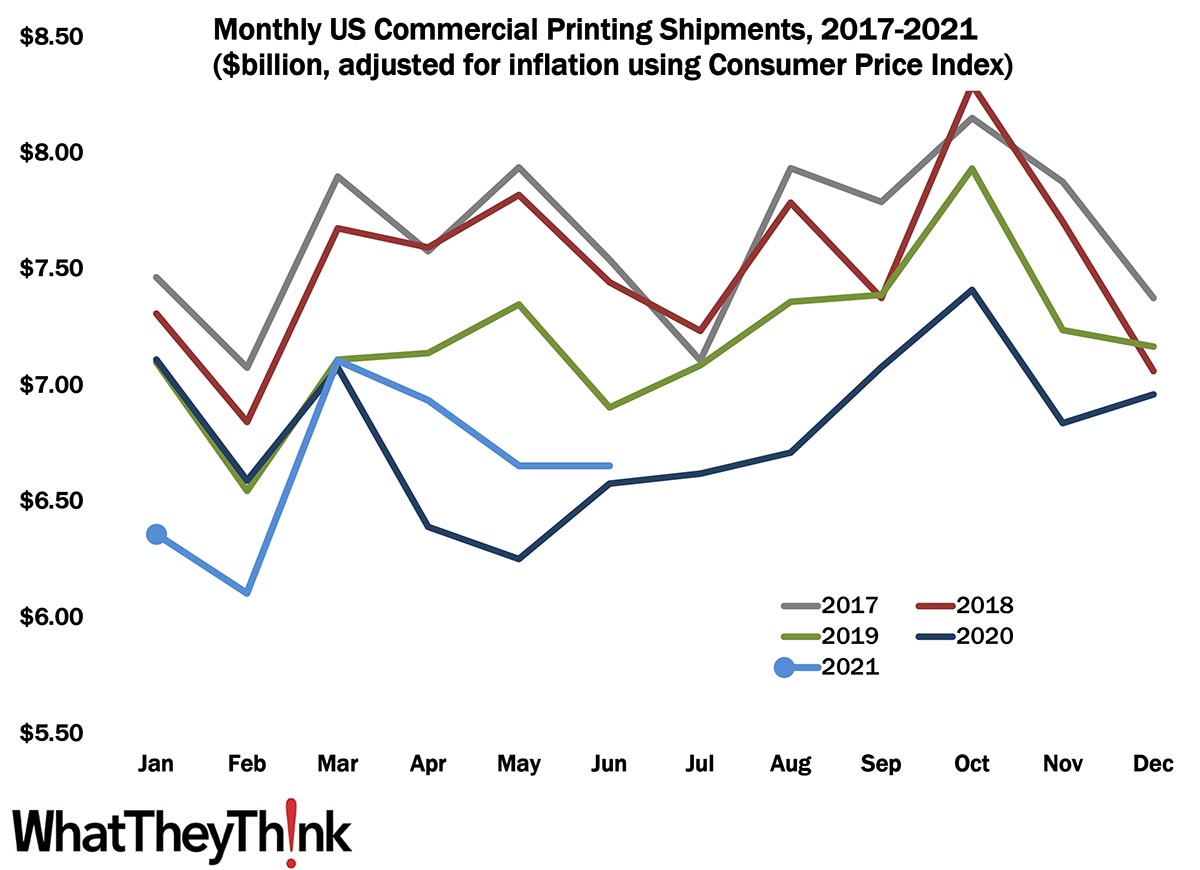

Shipments: They Can Only Get Better from Here

Published: April 23, 2021

We didn’t kick off 2021 very auspiciously, with January printing shipments coming in at $6.57 billion, down from December 2020’s $7.17 billion, and then a further drop in February to $6.34 billion. Full Analysis

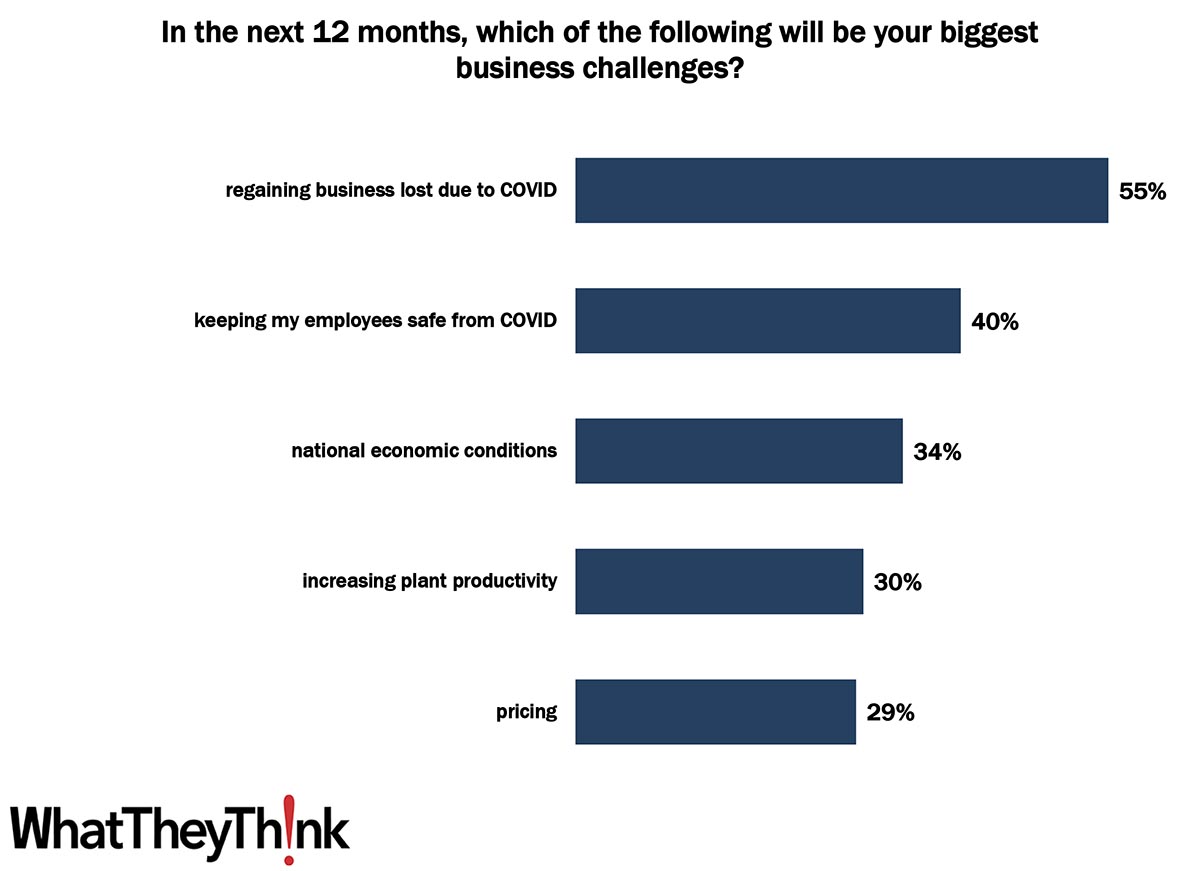

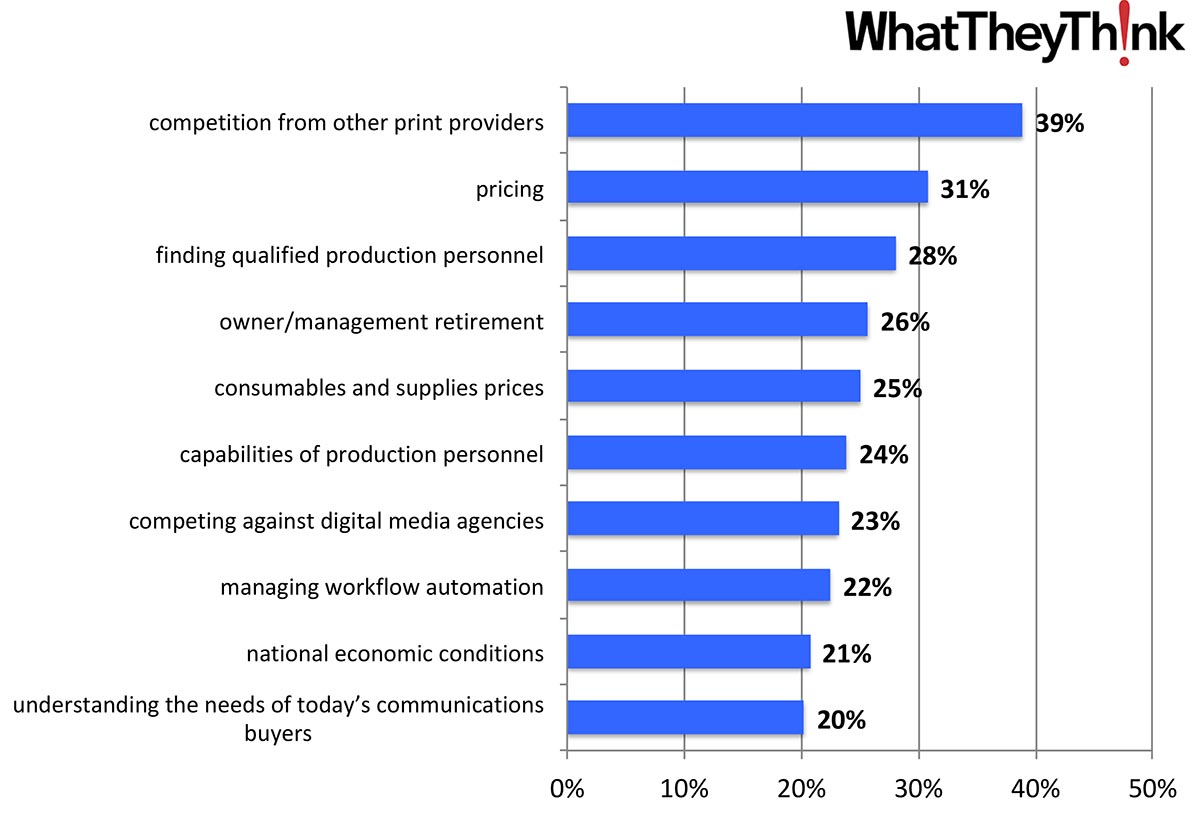

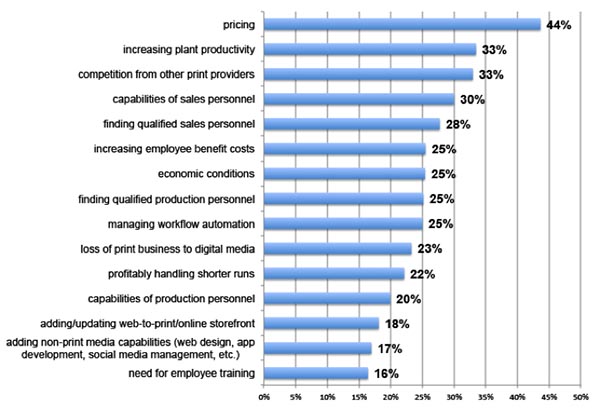

Printing 2021 Quick Look: Top Challenges

Published: April 21, 2021

According to data from our recently published Printing Outlook 2021 special report, recovering business lost to COVID and national economic conditions dominated printers’ top challenges—but traditional challenges will gain prominence post-COVID. Full Analysis

European Print Industry Snapshot: Spain

Published: April 20, 2021

In this bimonthly series, WhatTheyThink is presenting the state of the printing industry in different European countries based on the latest monthly production numbers. This week, we take a look at the printing industry in Spain. Full Analysis

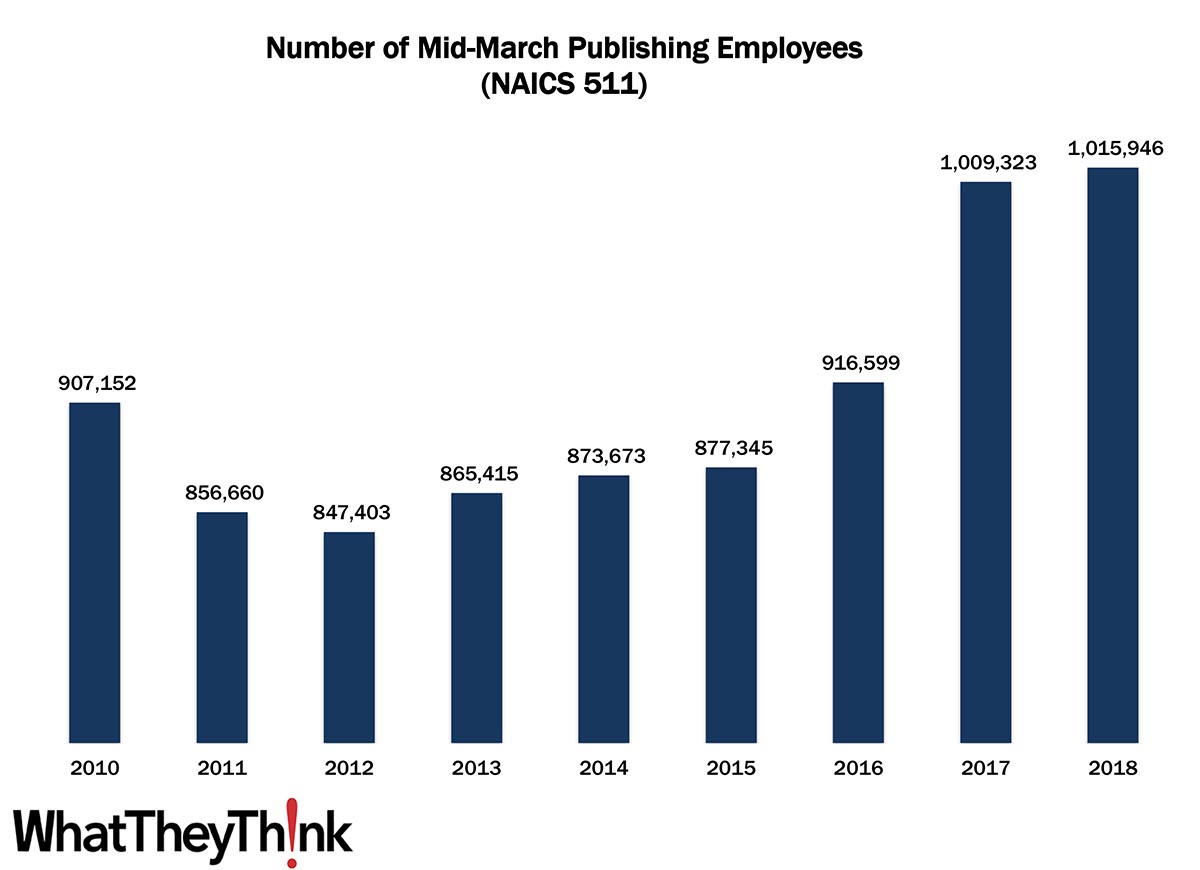

Publishing Employees—2010–2018

Published: April 16, 2021

According to County Business Patterns, in 2010, there were 907,152 employees in NAICS 511 (Publishing Industries—except Internet). By 2018, employees had increased to 1,015,946. In macro news, retail sales were up 9.8% in March. Full Analysis

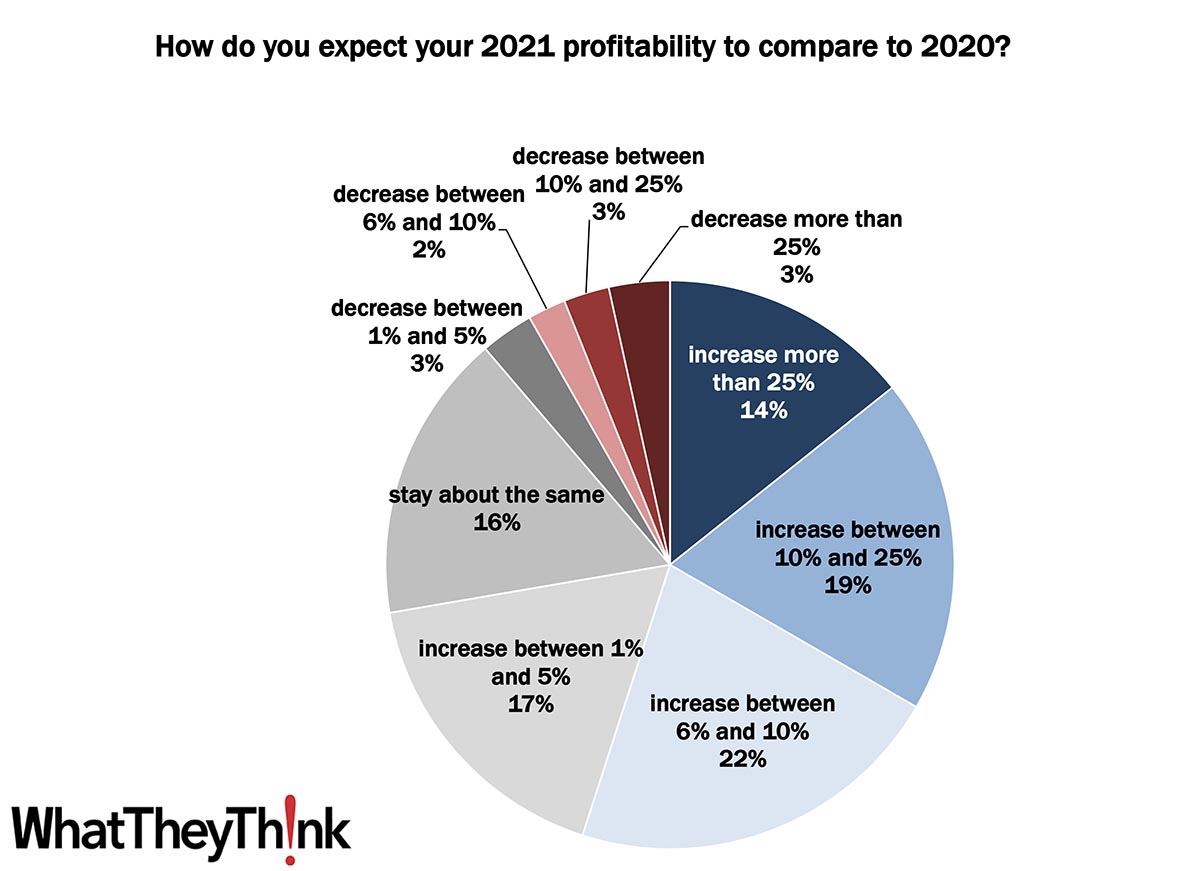

Printing 2021 Quick Look: 2021 Profits

Published: April 14, 2021

According to data from our recently published Printing Outlook 2021 special report, print businesses expect a +8.1% increase in profits from 2020 to 2021. Full Analysis

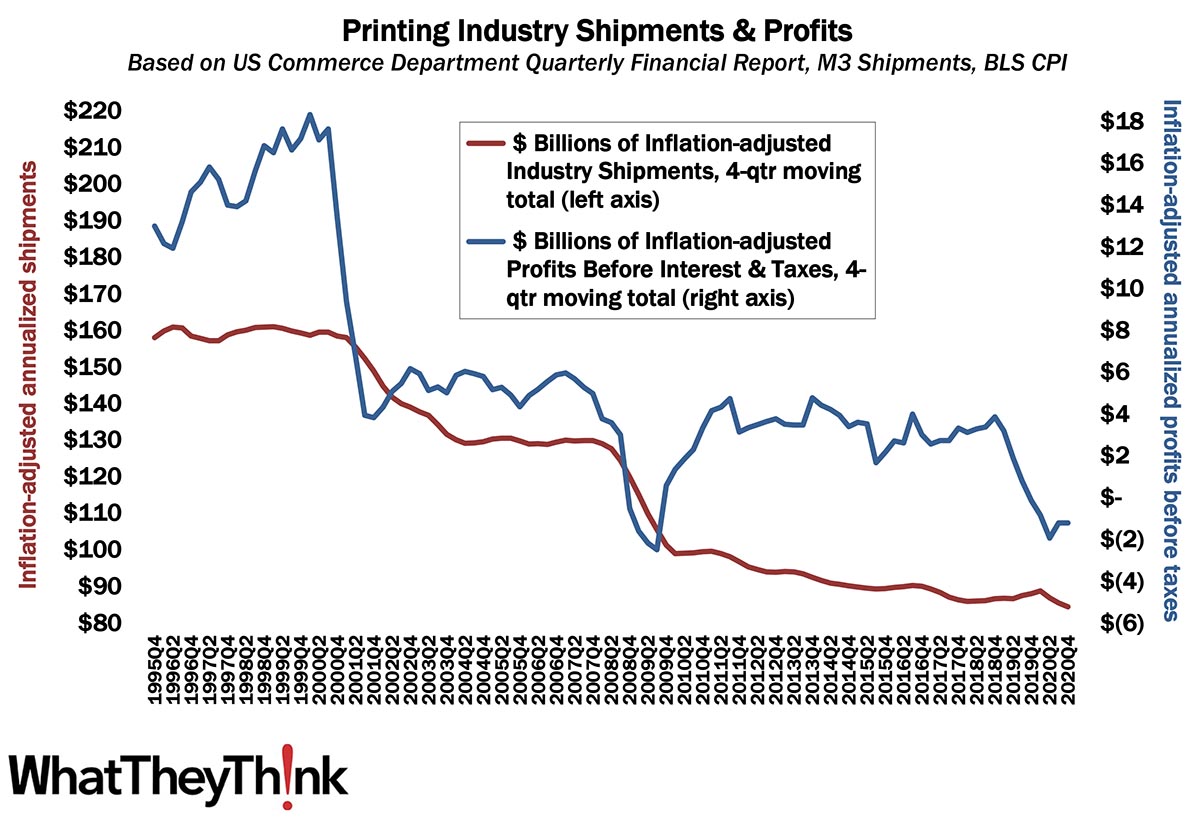

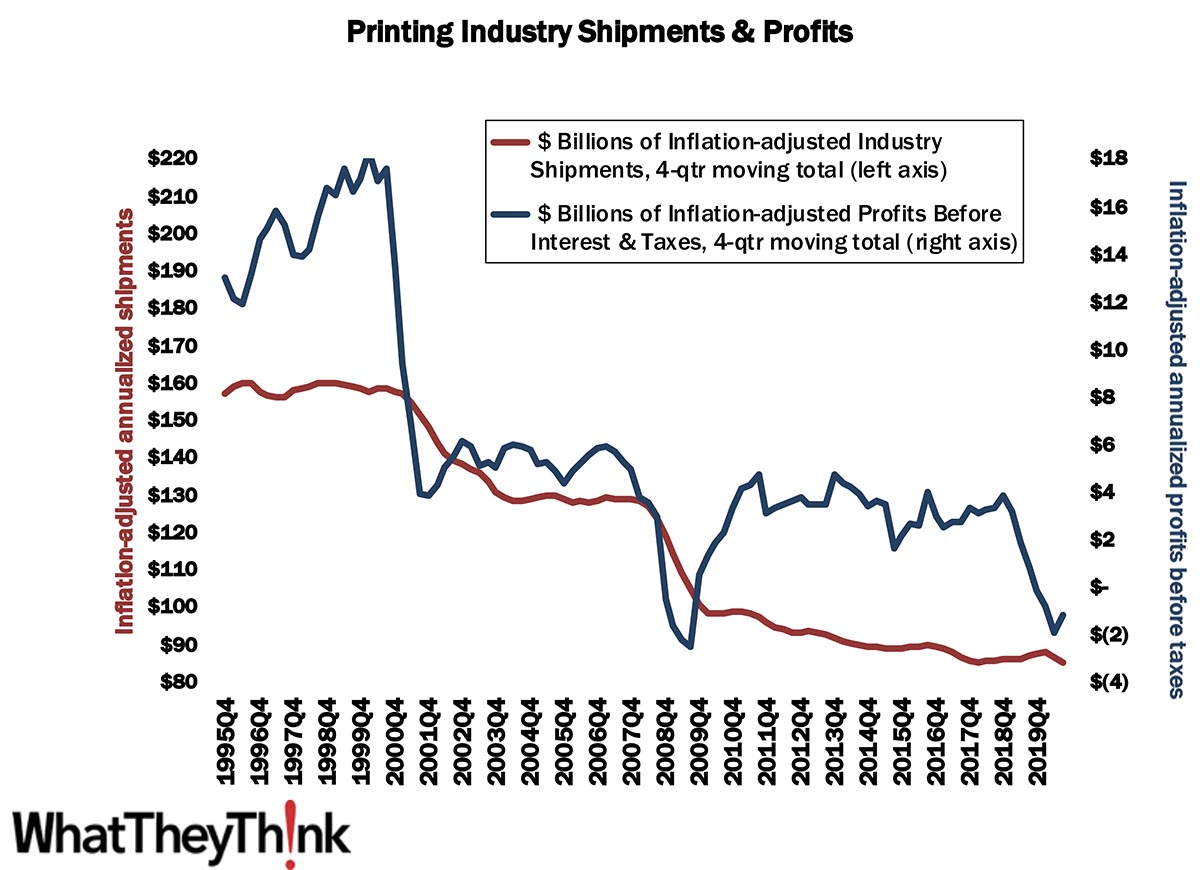

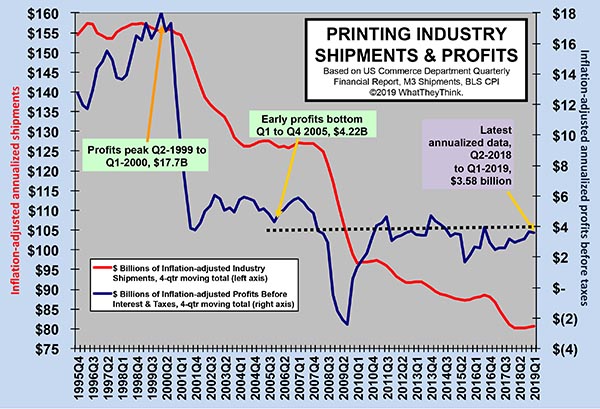

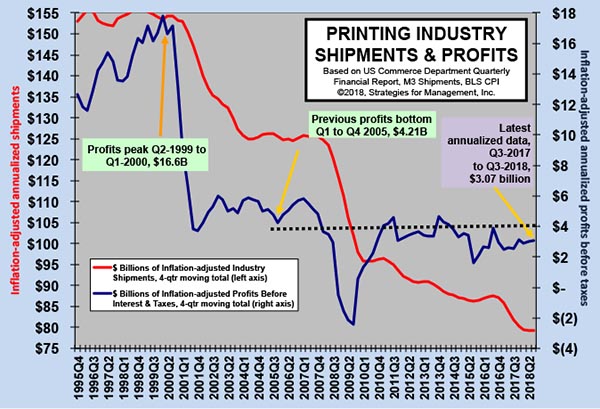

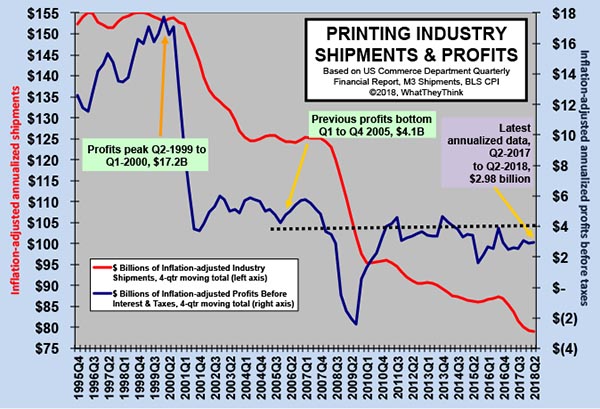

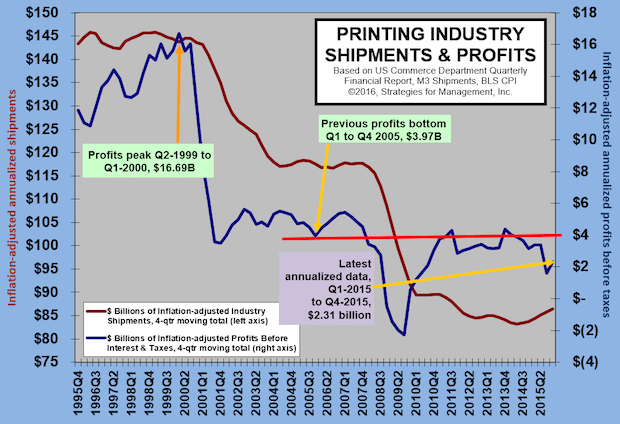

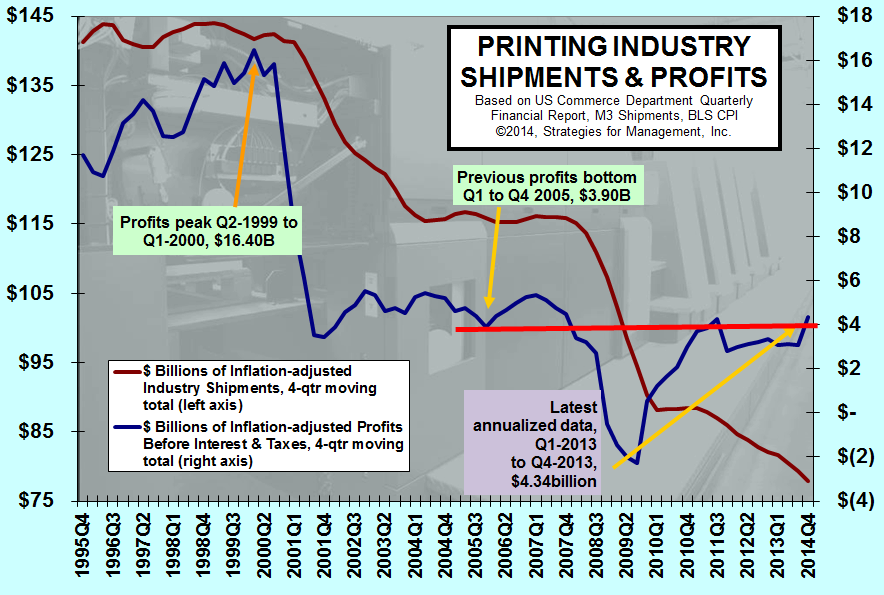

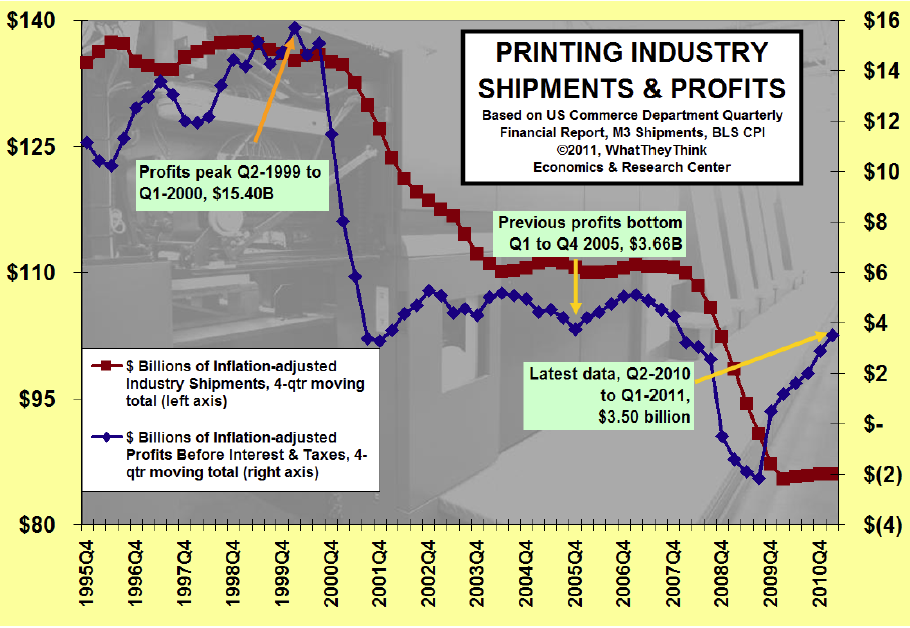

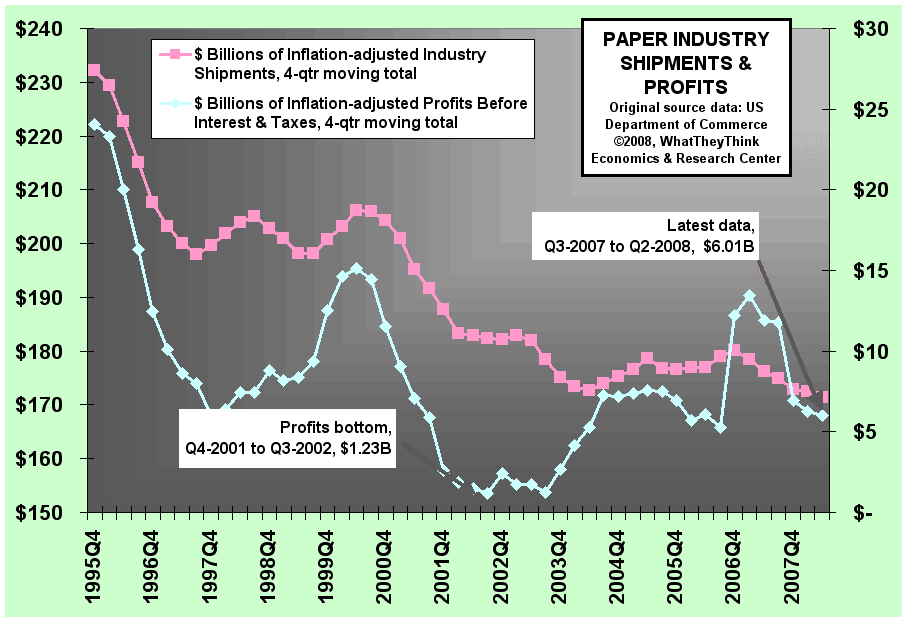

Profits: Back to the Tale of Two Cities

Published: April 9, 2021

We’ve long been calling it “a tale of two cities”—large printers and small/mid-size printers and the profitability gap between them. The pandemic interrupted this ongoing narrative temporarily, but back in Q3 2020, we started to return to normal, at least in terms of industry profits trends, which continued into Q4. Full Analysis

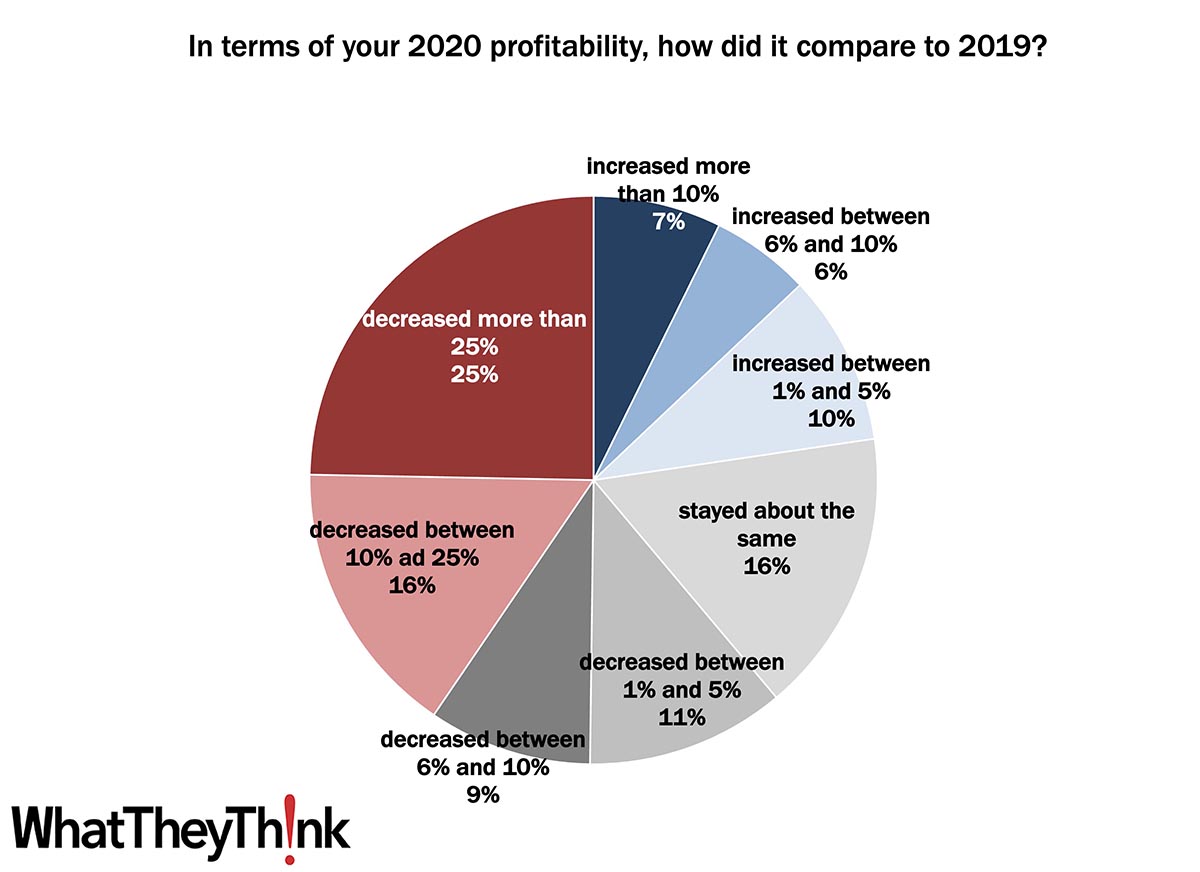

Printing 2021 Quick Look: 2020 Profits

Published: April 7, 2021

According to data from our recently published Printing Outlook 2021 special report, print businesses reported a -9.1% decline in profits from 2019 to 2020. Full Analysis

European Print Industry Snapshot: France

Published: April 5, 2021

In this bimonthly series, WhatTheyThink is presenting the state of the printing industry in different European countries based on the latest monthly production numbers. This week, we take a look at the printing industry in France. Full Analysis

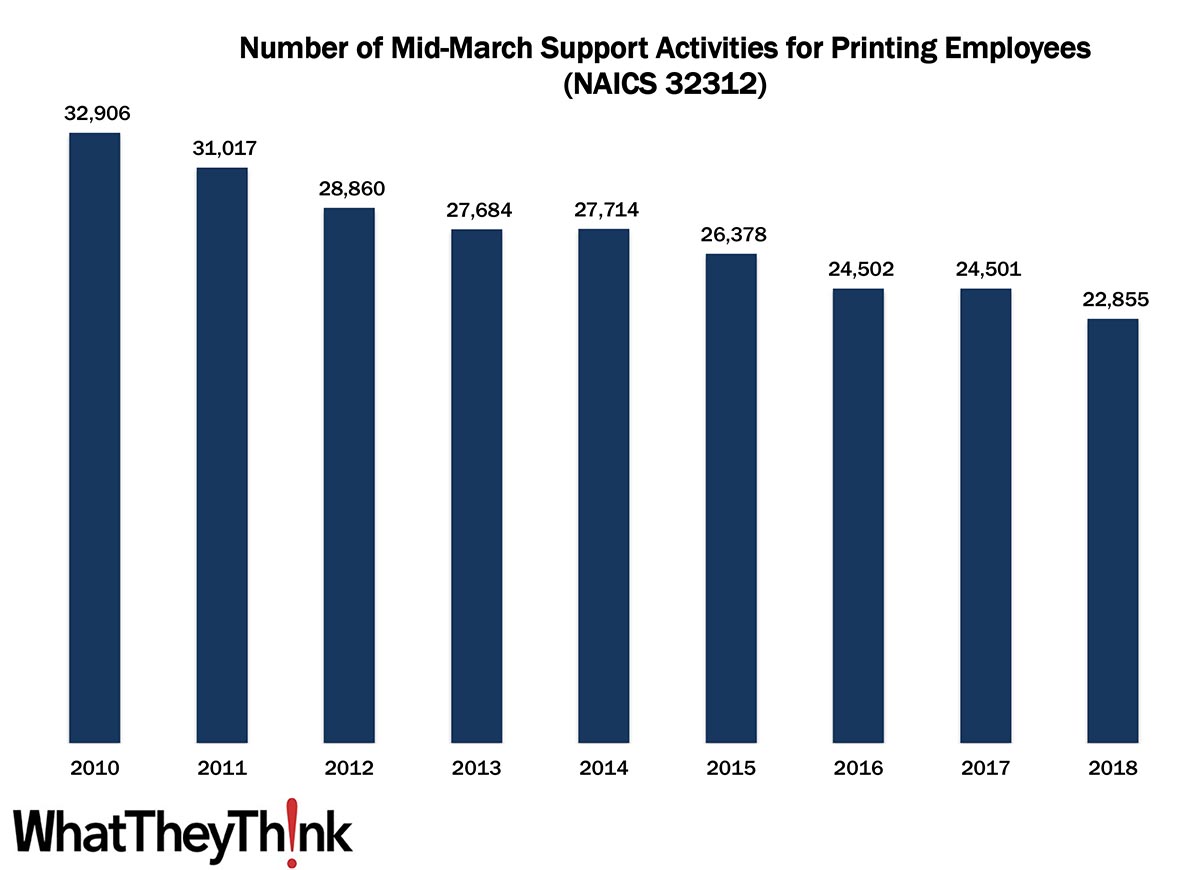

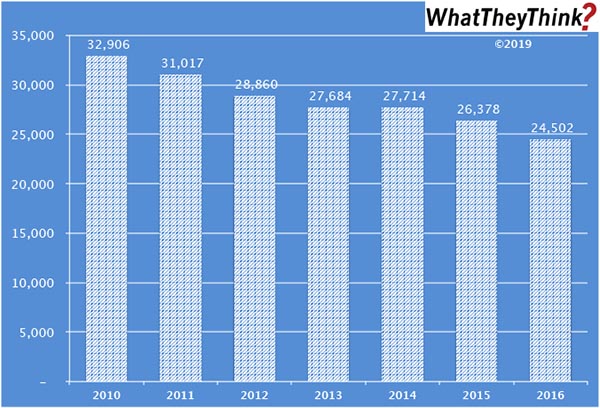

Pre- and Postpress Employees—2010–2018

Published: March 26, 2021

According to County Business Patterns, in 2010, there were 32,906 employees in NAICS 32312 (Support Activities for Printing). By 2018, employees had declined to 22,855. In macro news, Q4 2020 GDP was revised up. Full Analysis

Printing 2021 Quick Look: Anticipated 2021 Jobs/Orders

Published: March 24, 2021

According to data from our recently published Printing Outlook 2021 special report, print businesses expect print industry jobs/orders to rebound +9.0% from 2020 to 2021. Full Analysis

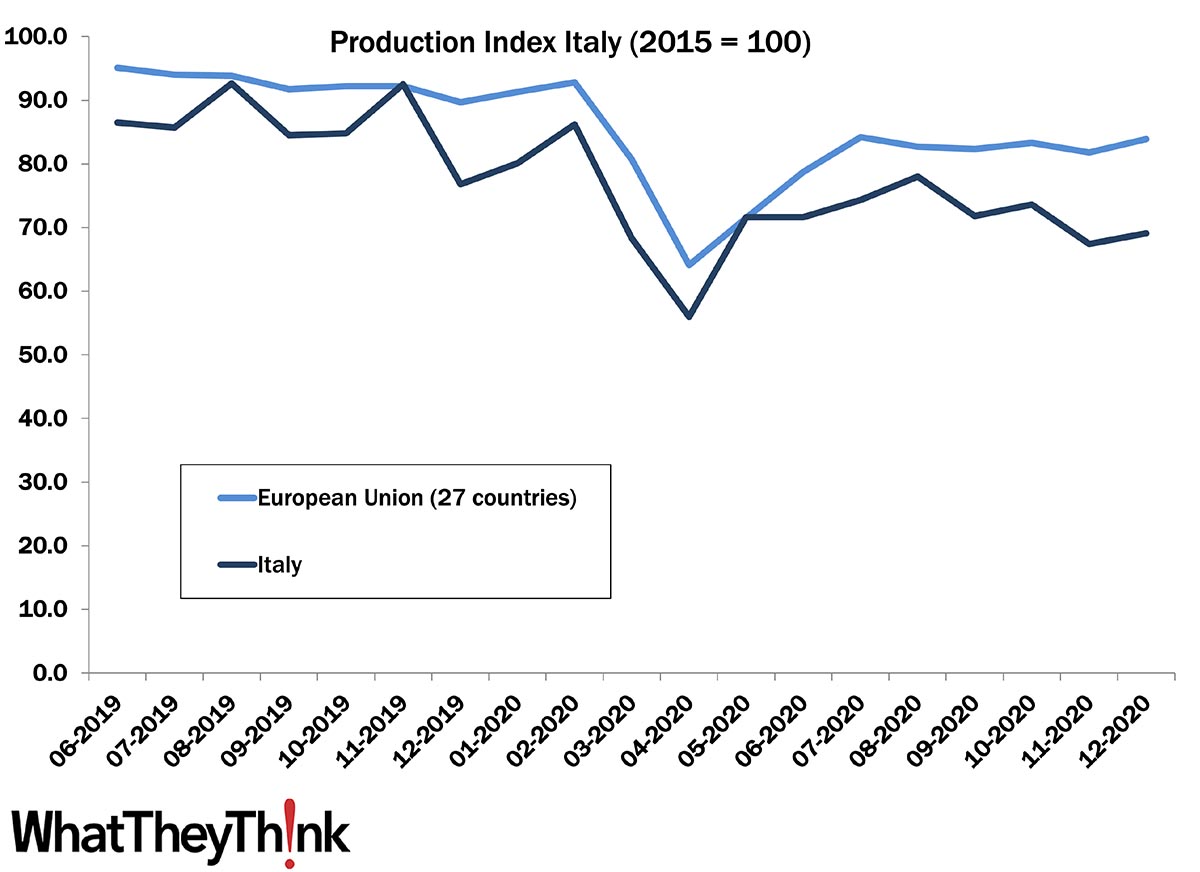

European Print Industry Snapshot: Italy

Published: March 23, 2021

In this bimonthly series, WhatTheyThink is presenting the state of the printing industry in different European countries based on the latest monthly production numbers. This week, we take a look at the printing industry in Italy. Full Analysis

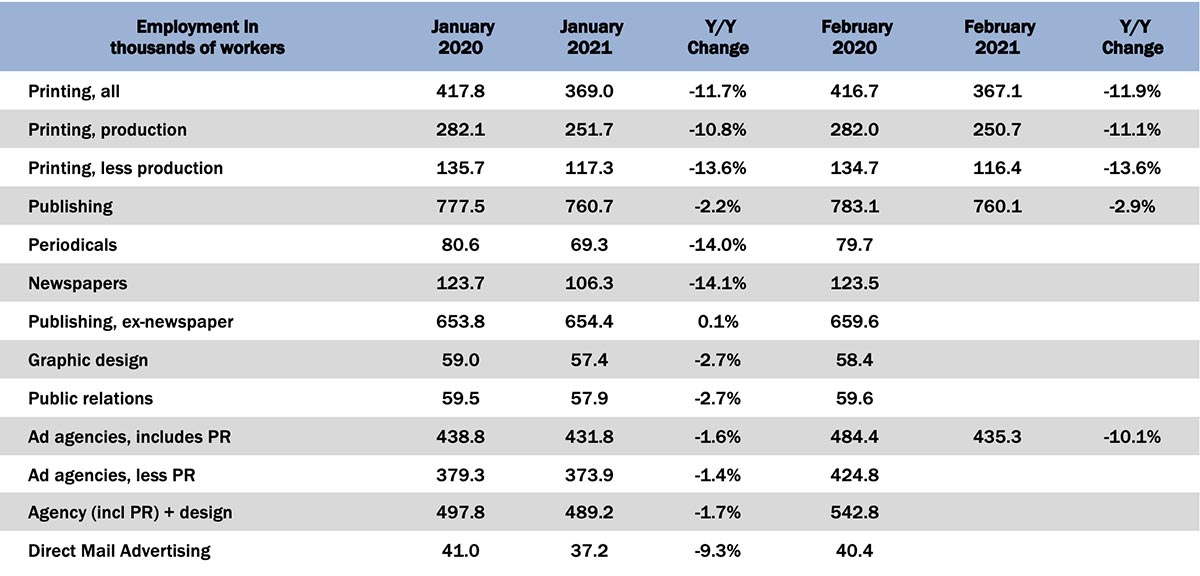

Graphic Arts Employment—February 2021

Published: March 19, 2021

In February 2021, all printing employment is down -0.5% from January, production employment down -0.4%, and non-production printing employment down -0.8%. Full Analysis

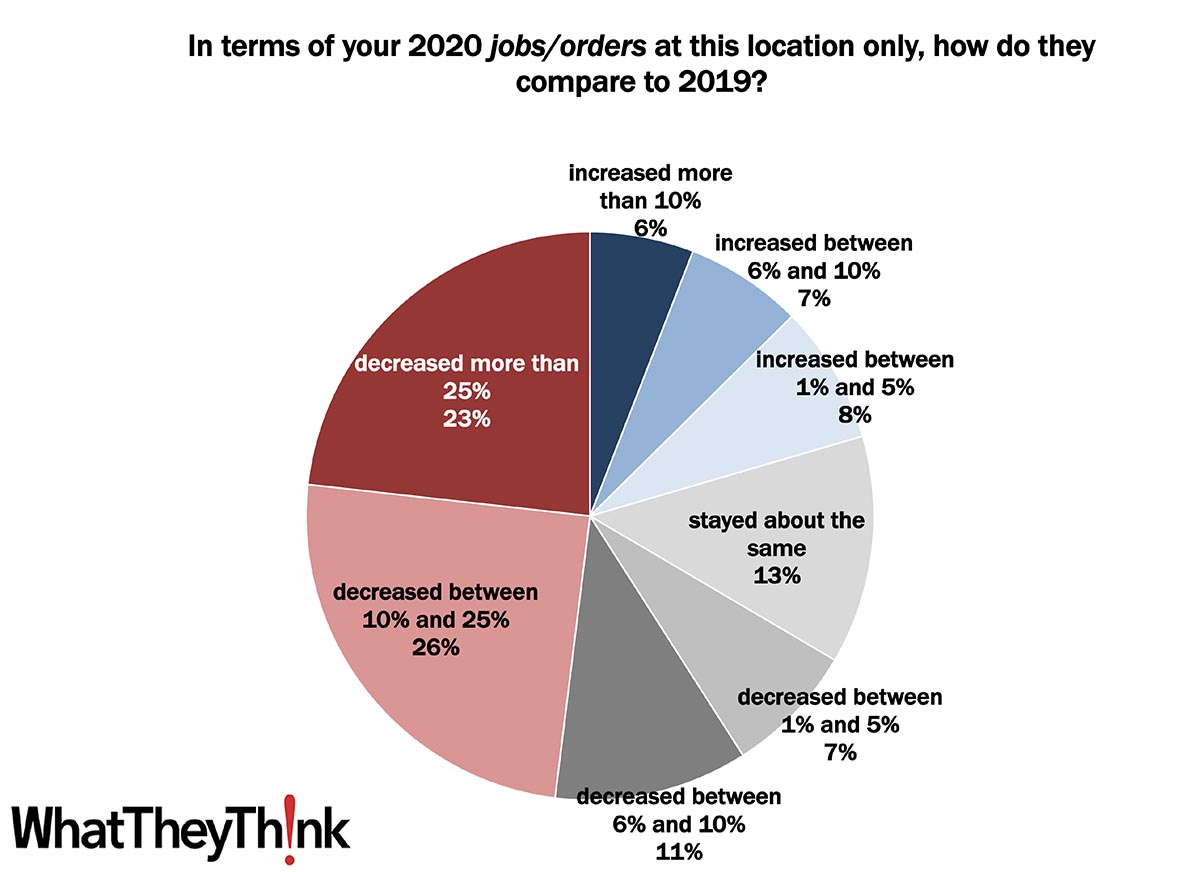

Printing 2021 Quick Look: 2020 Jobs/Orders

Published: March 17, 2021

According to data from our recently published Printing Outlook 2021 special report, the average number of jobs decreased -10.8% from 2019 to 2020. Full Analysis

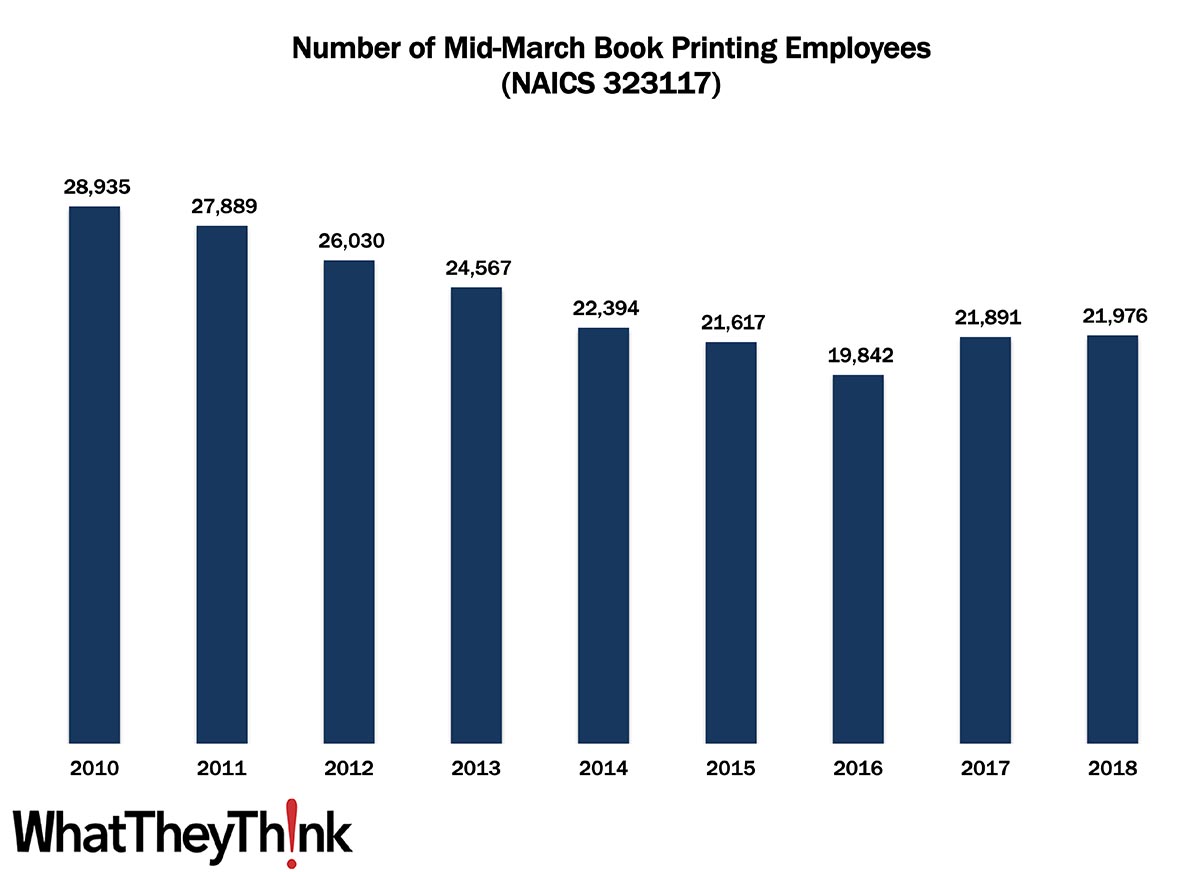

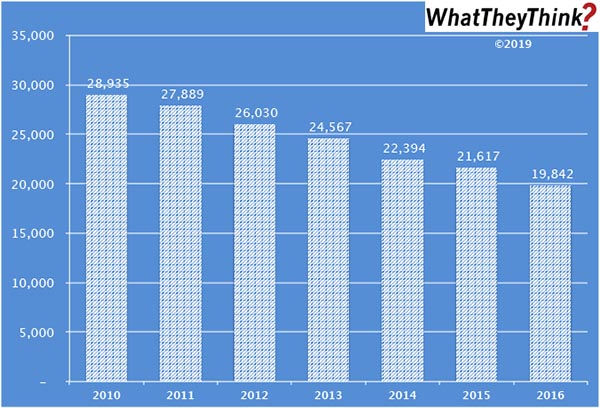

Book Printing Employees—2010–2018

Published: March 12, 2021

According to County Business Patterns, in 2010, there were 28,935 employees in NAICS 323117 (Book Printing Establishments). By 2018, employees had declined to 21,976. In macro news, inflation was soft in February. Full Analysis

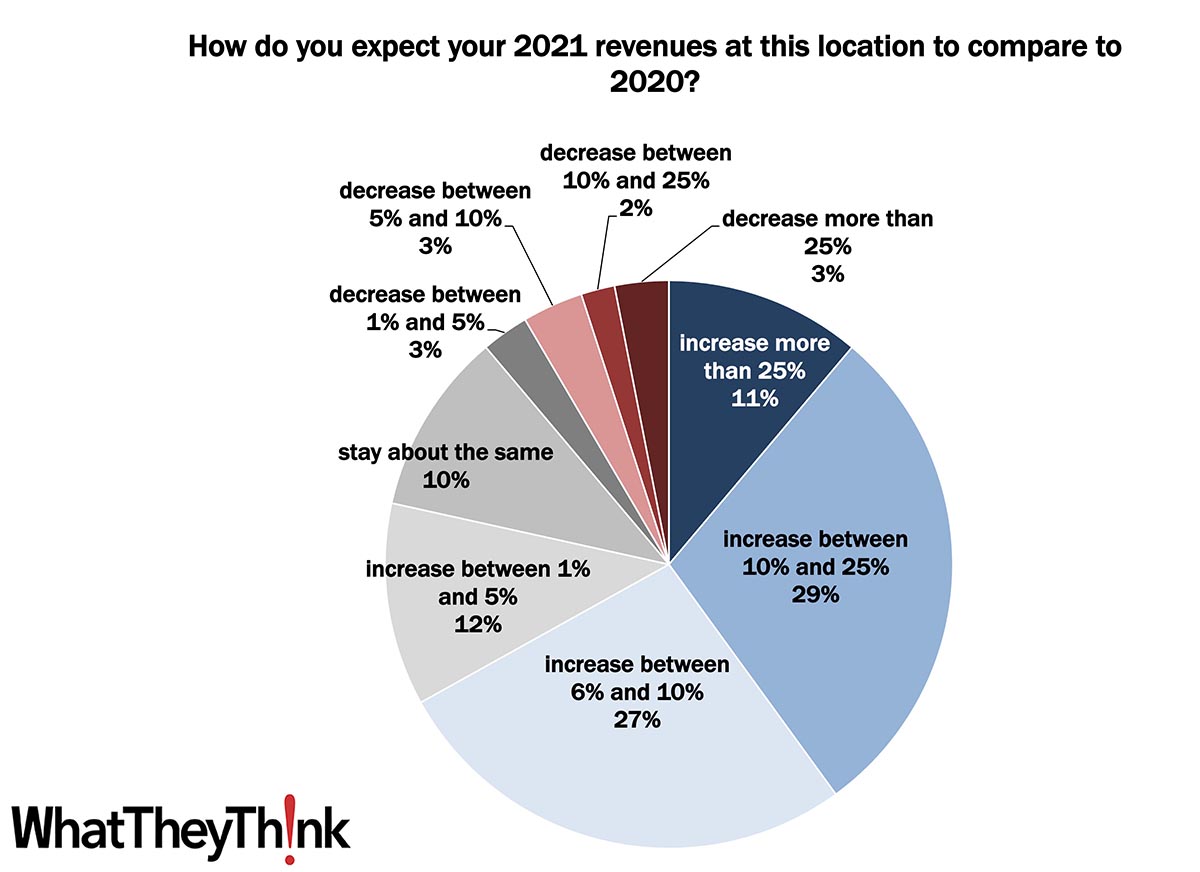

Printing 2021 Quick Look: Anticipated 2021 Revenues

Published: March 10, 2021

According to data from our recently published Printing Outlook 2021 special report, print businesses expect print industry revenues to rebound +9.1% from 2020 to 2021. Full Analysis

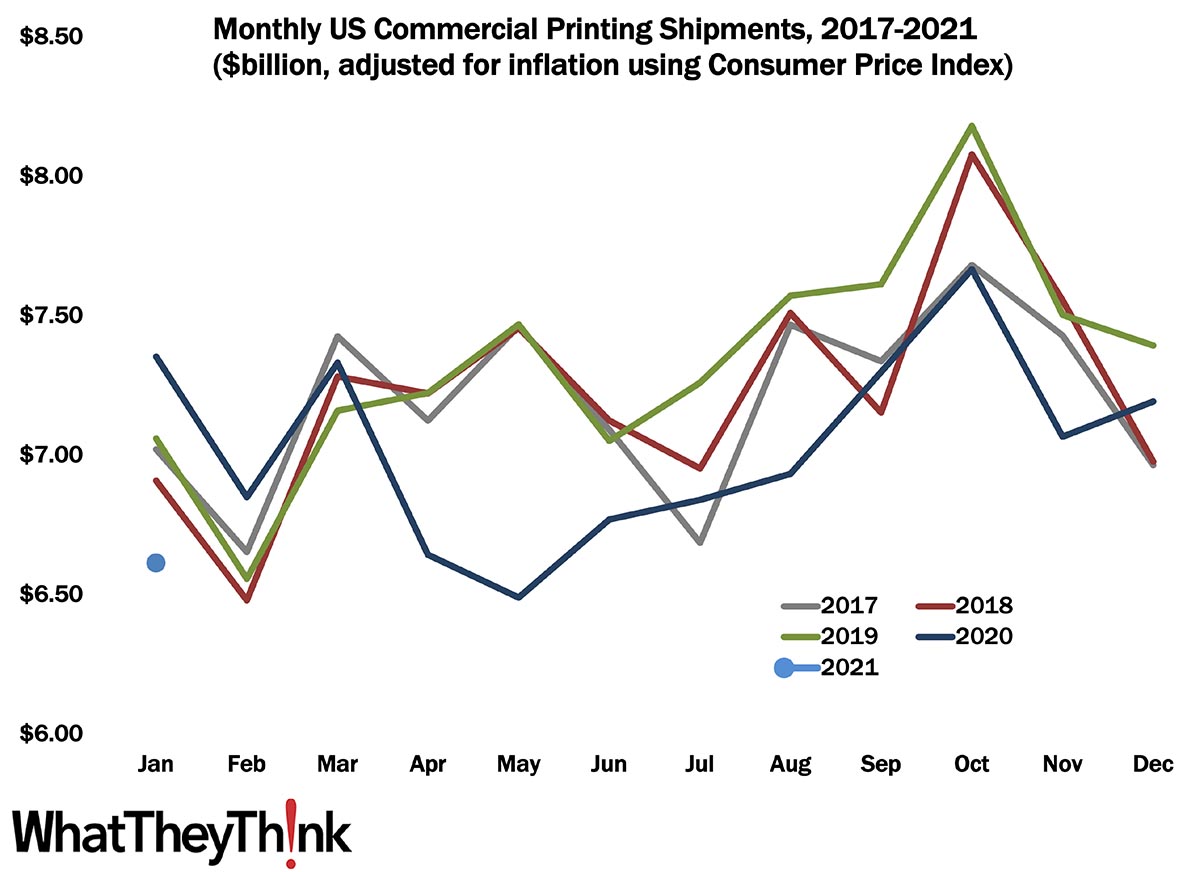

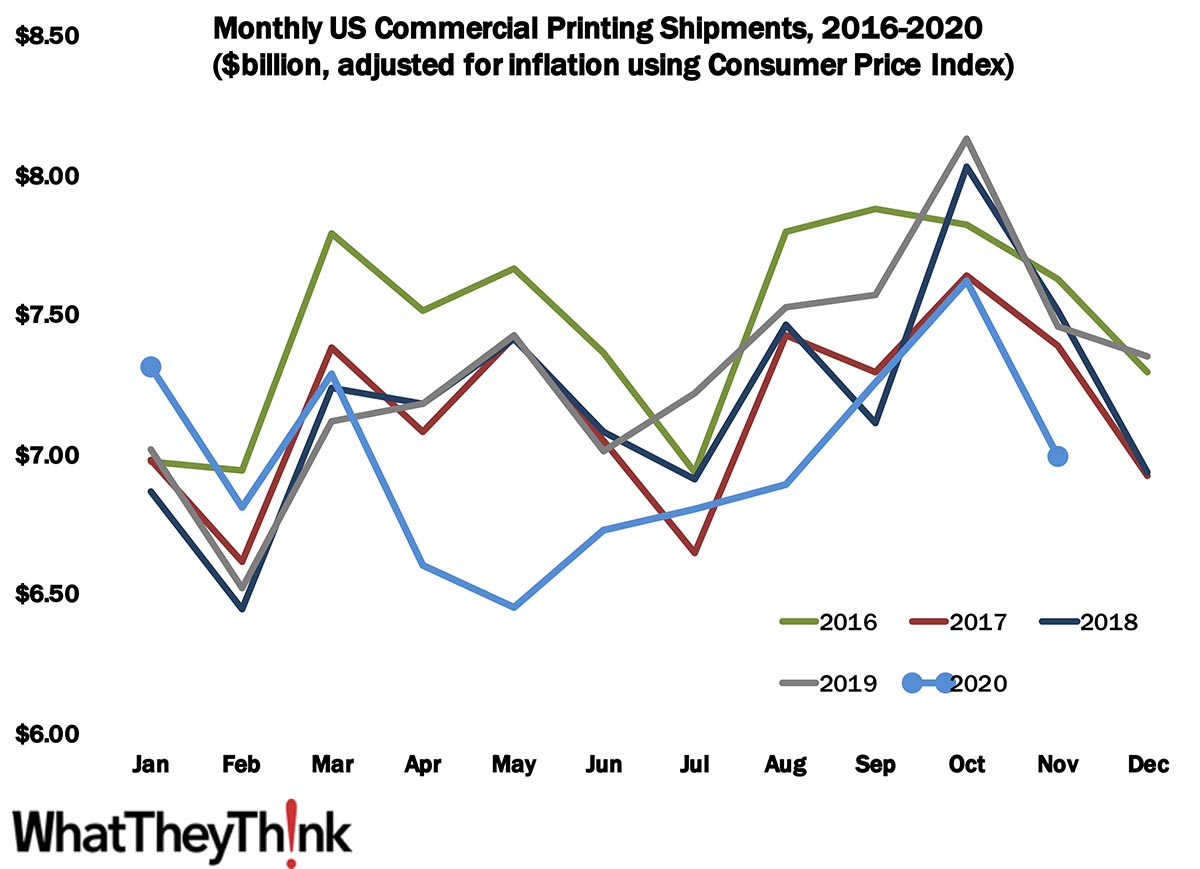

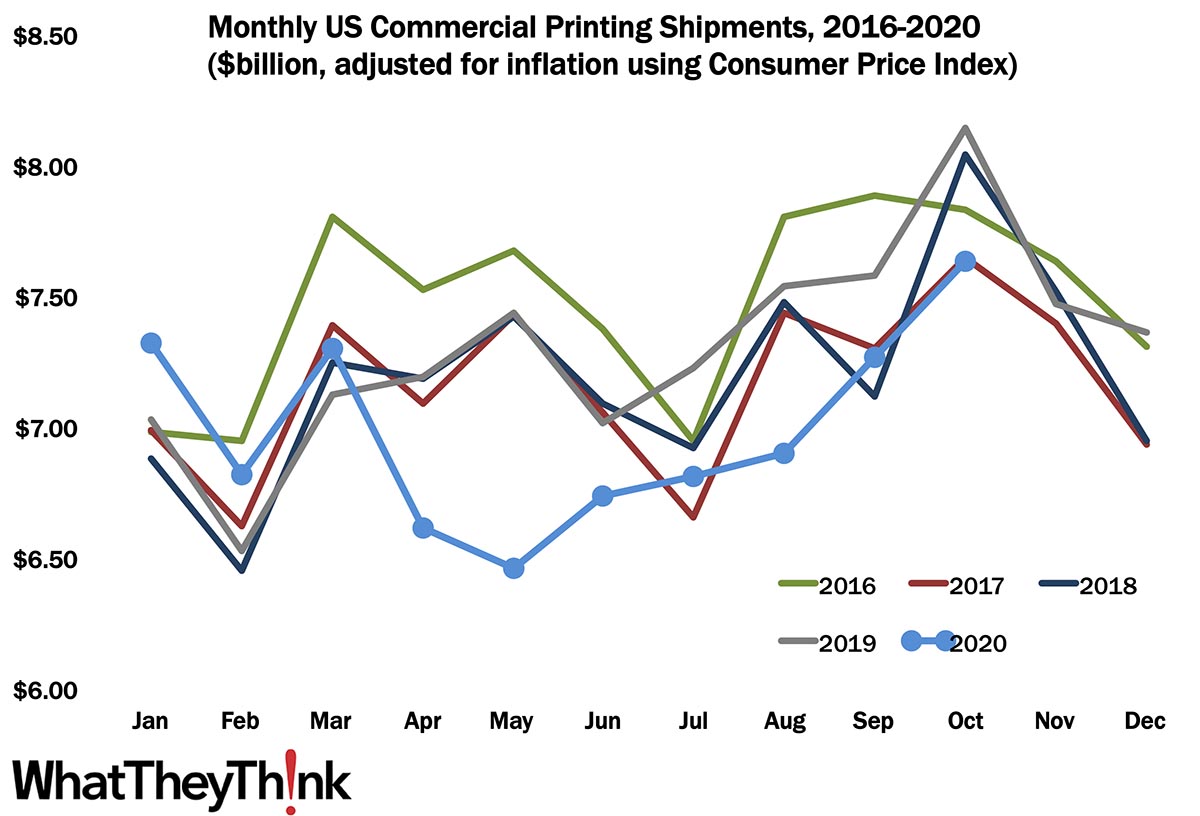

January Printing Shipments—They Can Only Get Better from Here

Published: March 5, 2021

We kicked off 2021 inauspiciously with January printing shipments coming in at $6.61 billion, down from 2020’s $7.17 billion. It's the worst January in at least the last five years, but already things are boding well for the rest of 2021. Full Analysis

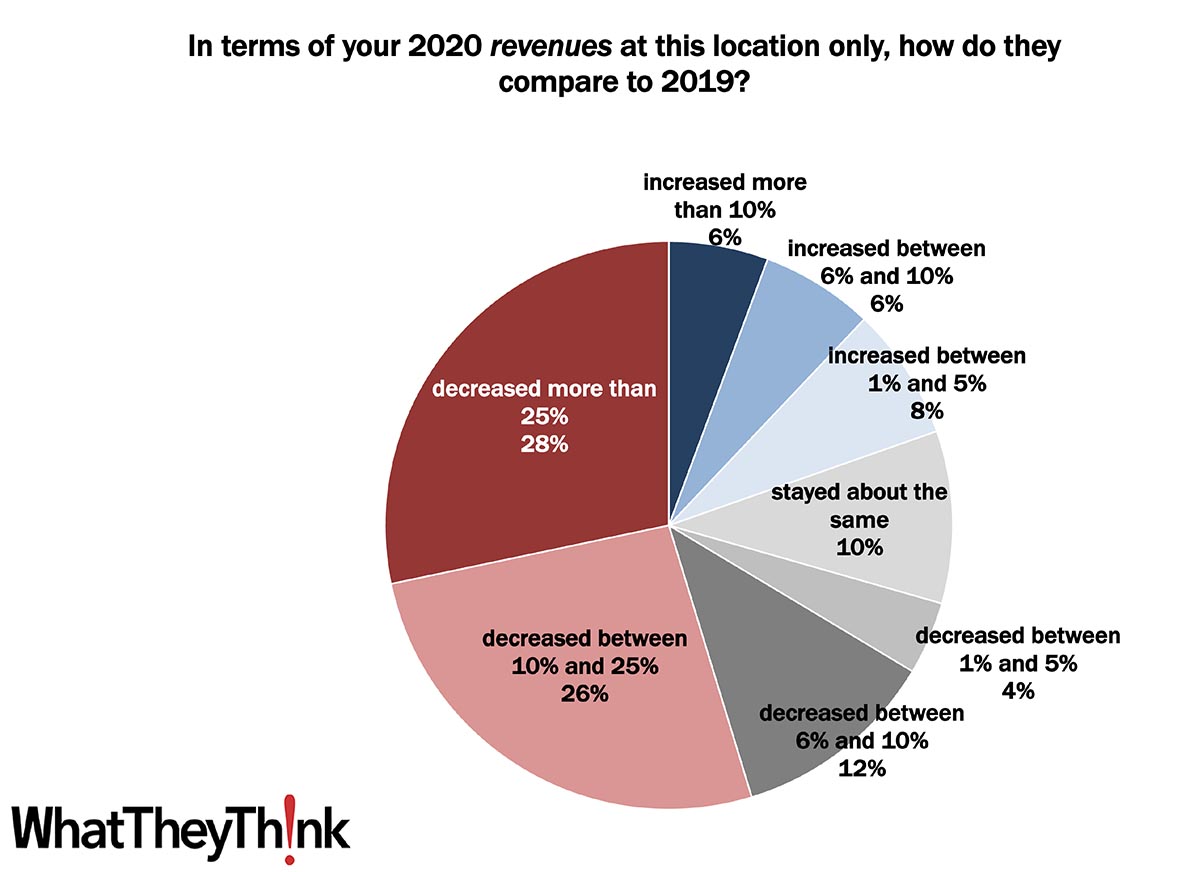

Printing Outlook 2021 Quick Look: 2020 Revenues

Published: March 3, 2021

According to data from our recently published Printing Outlook 2021 special report, print industry revenues dropped -12.6% from 2019 to 2020, compared to +4.1% from 2018 to 2019. Full Analysis

European Print Industry Snapshot: United Kingdom

Published: March 2, 2021

In this bimonthly series, WhatTheyThink is presenting the state of the printing industry in different European countries based on the latest monthly production numbers. This week, we take a look at the printing industry in the United Kingdom. Full Analysis

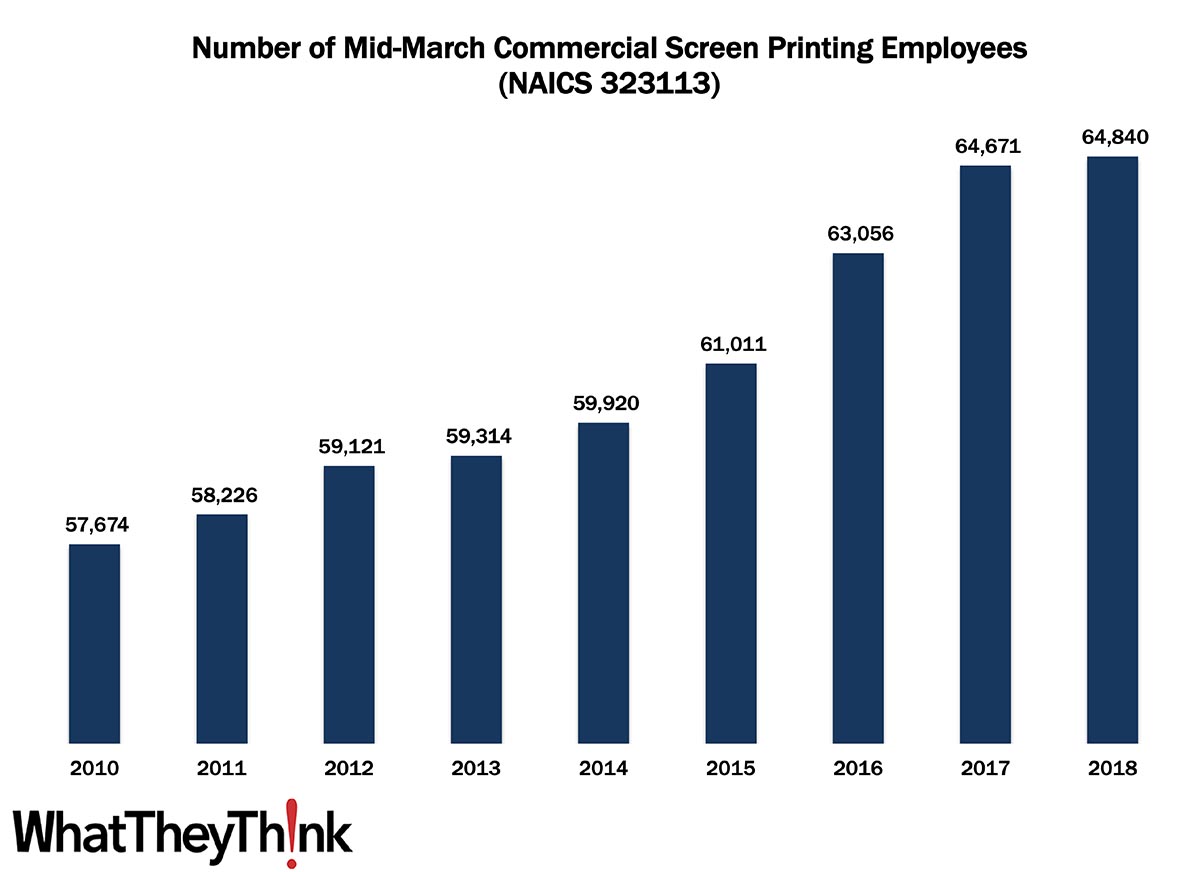

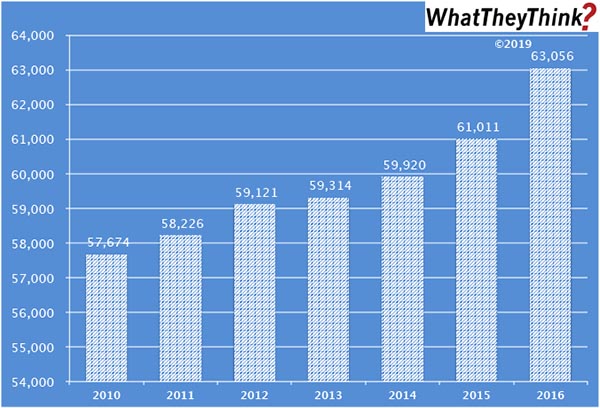

Commercial Screen Printing Employees—2010–2018

Published: February 26, 2021

In 2010, there were 57,674 employees working in US screen printing establishments (NAICS 323113). By 2018, that number had increased +12.4% to 64,840. In macro news, seven “recovery indicators” for parts of the economy most acutely impacted by the pandemic. Full Analysis

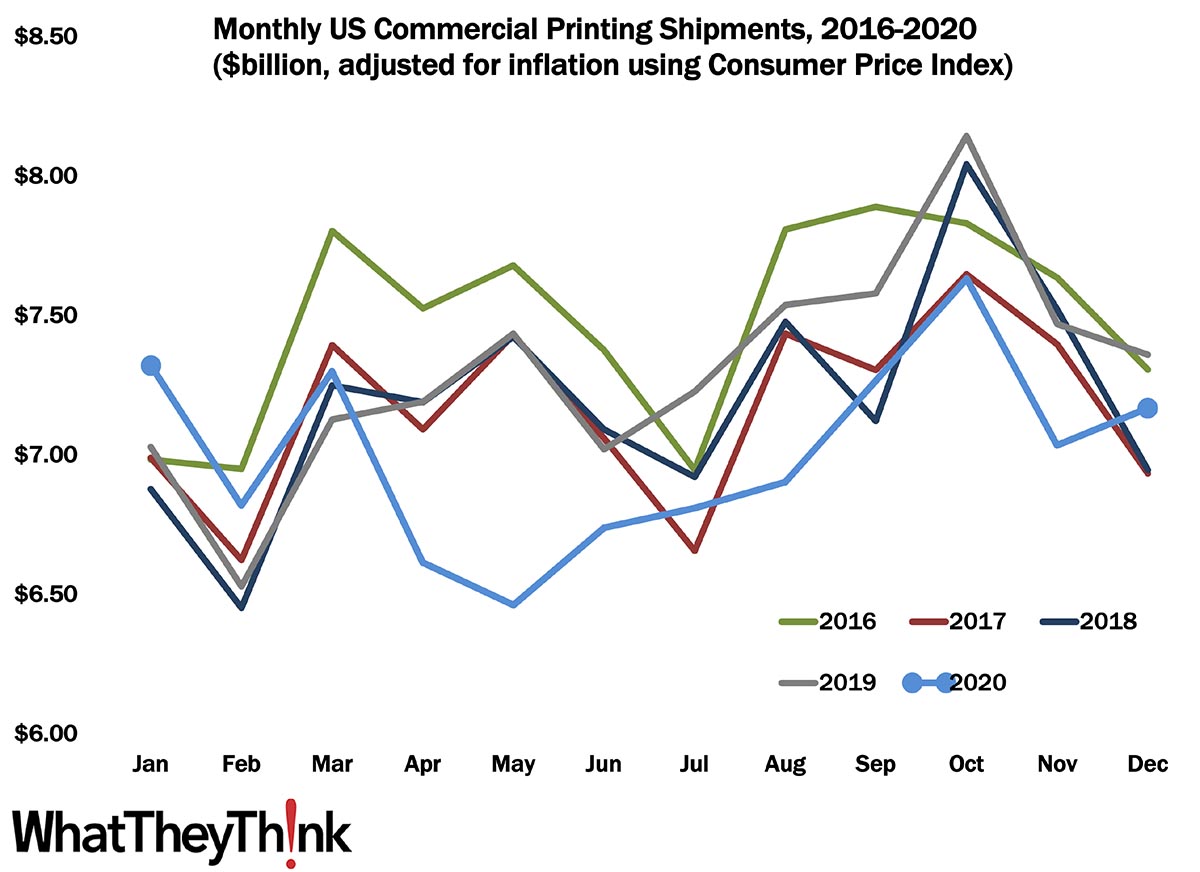

December Printing Shipments—One Last Unexpected Twist for 2020

Published: February 19, 2021

In December 2020, in one last, end-of-the-year rally, printing shipments grew from $7.0 billion to $7.17 billion. Full Analysis

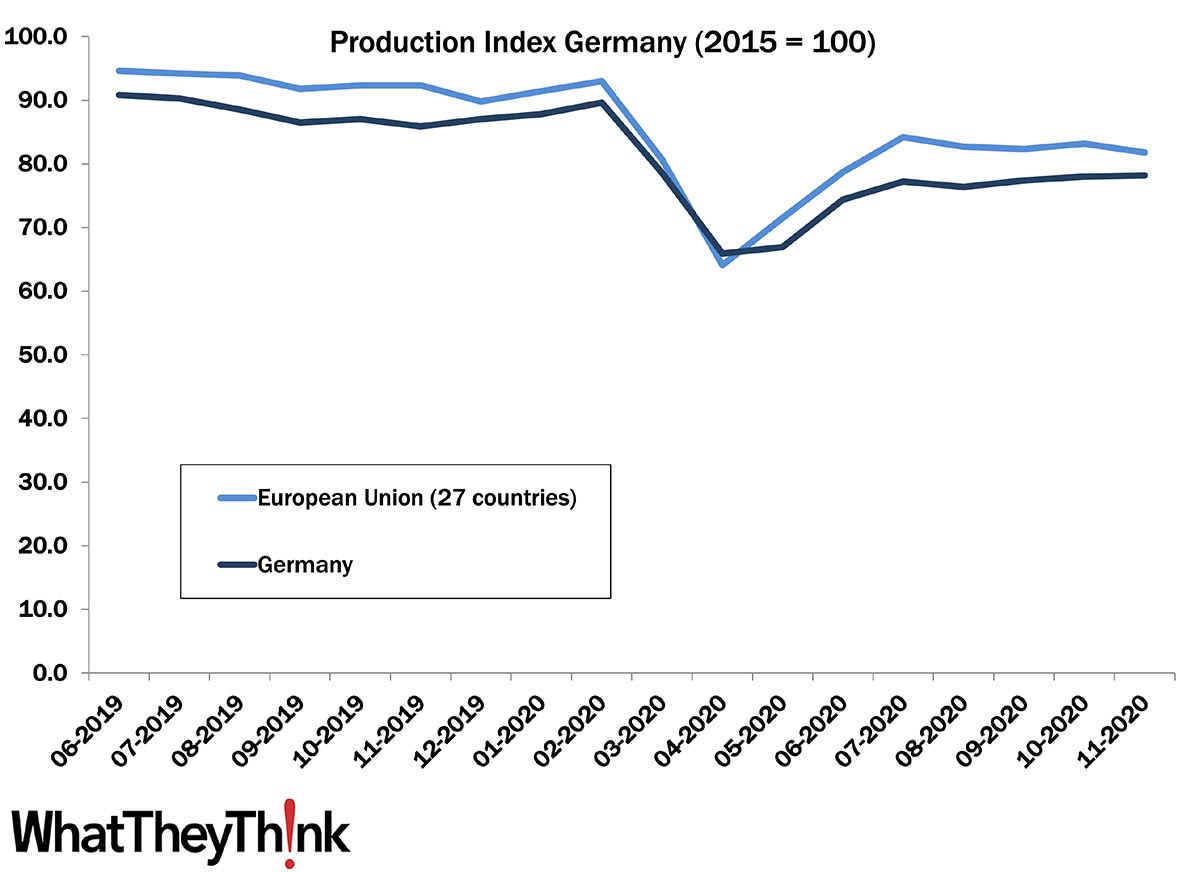

European Print Industry Snapshot: Germany

Published: February 15, 2021

In this bimonthly series, WhatTheyThink is presenting the state of the printing industry in different European countries based on the latest monthly production numbers. This week, we take a look at the printing industry in Germany. Full Analysis

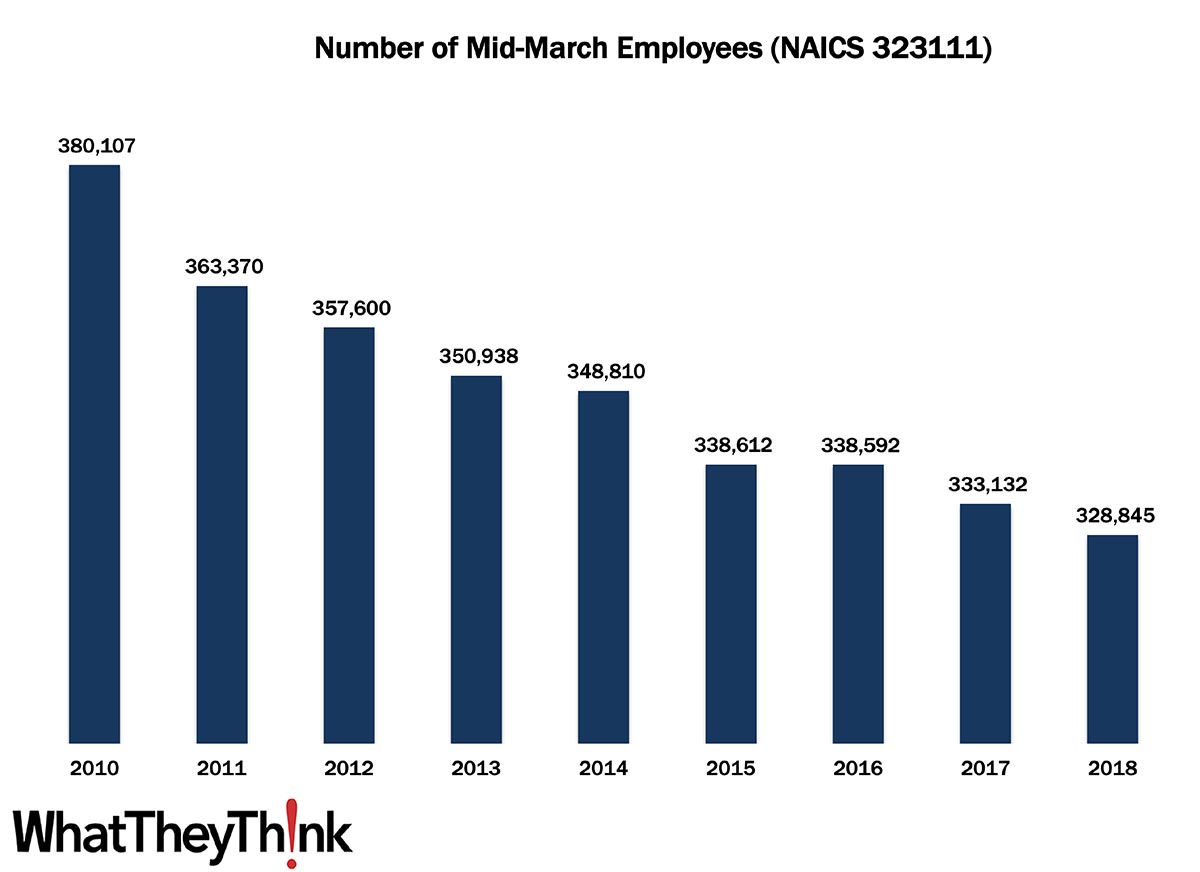

Commercial Printing Employees (Less Screen and Books)—2010–2018

Published: February 12, 2021

In 2010, there were 380,107 employees working in US establishments in NAICS 323111 (Commercial Printing–Except Screen and Books). By 2018, that number had declined -13.5% to 328,845. In macro news, the Consumer Price Index (CPI) increased 0.3% in January, or 1.4% over the last 12 months. Full Analysis

Q3 2020 Profits—Back on Track…Sort Of

Published: February 5, 2021

Annualized printing industry profits for Q3 2020 rose from -$1.92 billion to -$1.19 billion. That’s still really low, but at least it’s headed back toward positive territory. Full Analysis

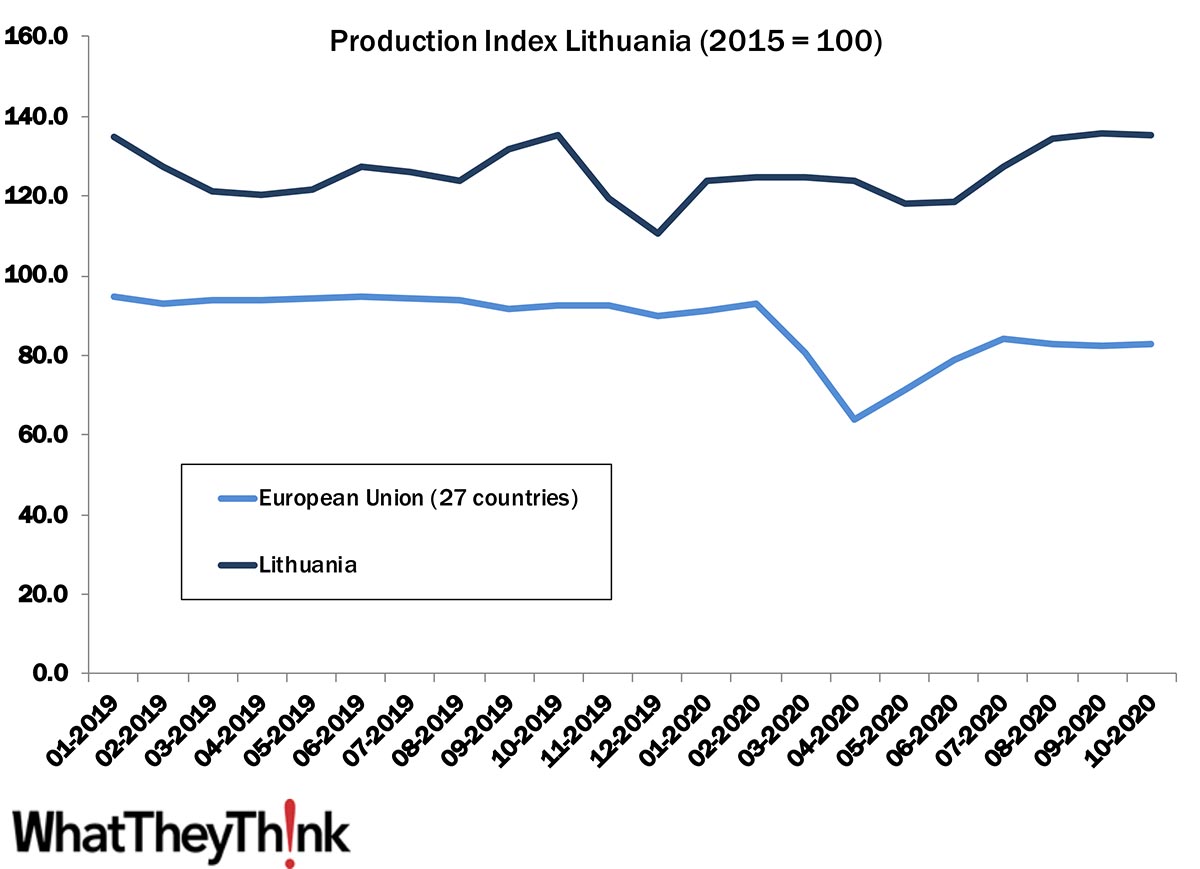

European Print Industry Snapshot: Lithuania

Published: February 1, 2021

In this bimonthly series, WhatTheyThink is presenting the state of the printing industry in different European countries based on the latest monthly production numbers. This week, we take a look at the printing industry in Lithuania and the Baltic states. Full Analysis

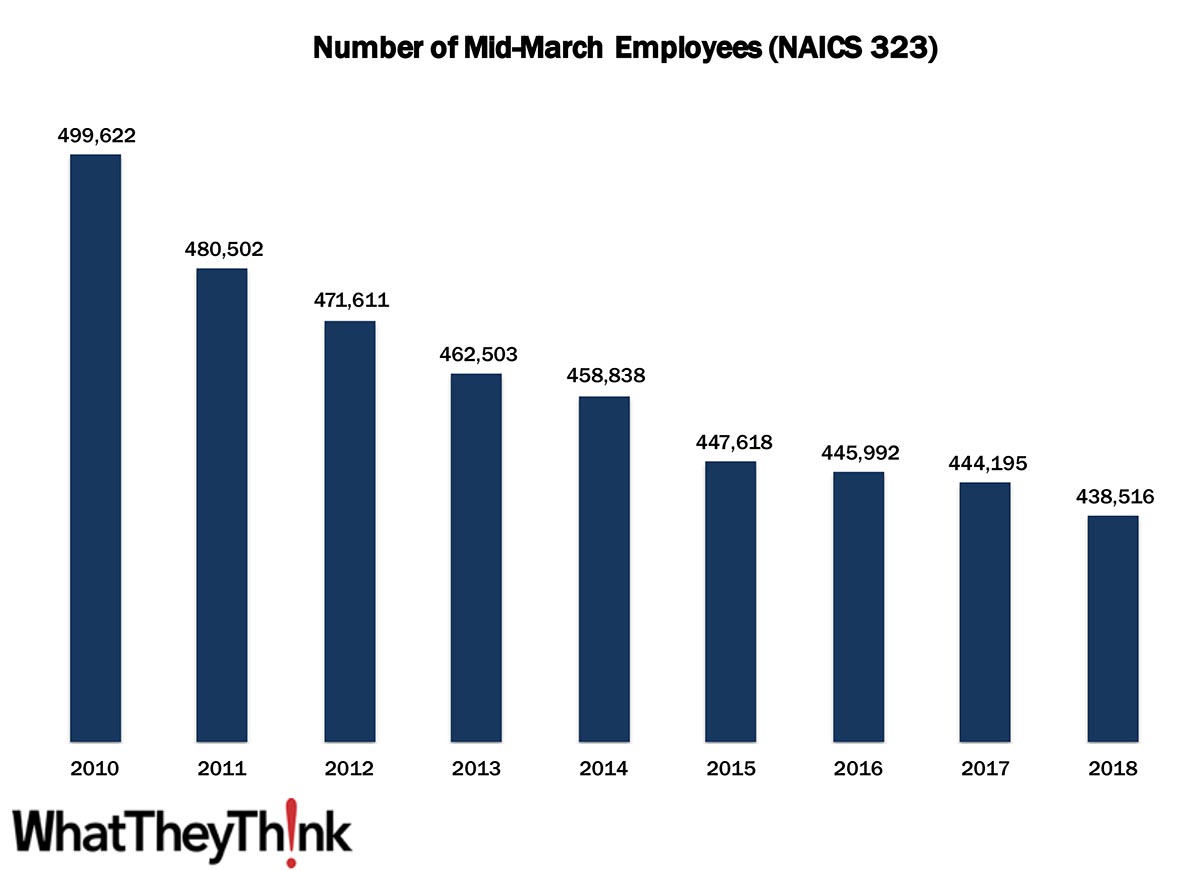

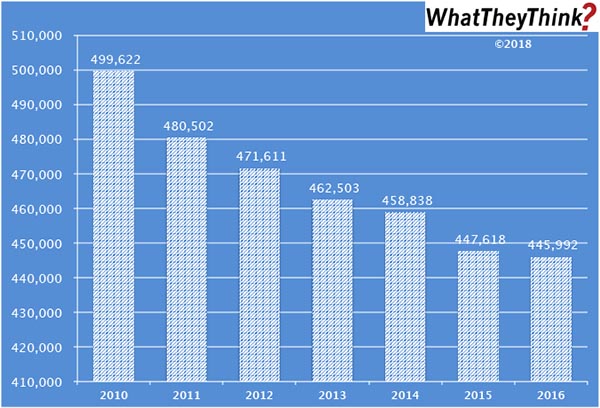

Commercial Printing Employees—2010–2018

Published: January 29, 2021

In 2010, there were 499,622 employees working in US establishments in NAICS 323. By 2018, that number had declined -12.2% to 438,516. In macro news, real GDP increased at an annual rate of 4.0% in Q4 2020. Full Analysis

Graphic Arts Employment—December 2020

Published: January 22, 2021

In December 2020, all printing employment was up +0.7% from November, production employment up +0.1%, and non-production printing employment up +1.9%. So, basically, a holding pattern—although it’s nice that there are no negative numbers…for almost everyone. Full Analysis

European Print Industry Snapshot: Hungary

Published: January 18, 2021

In this bimonthly series, WhatTheyThink is presenting the state of the printing industry in different European countries based on the latest monthly production numbers. This year kicks off with a look at the printing industry in Hungary. Full Analysis

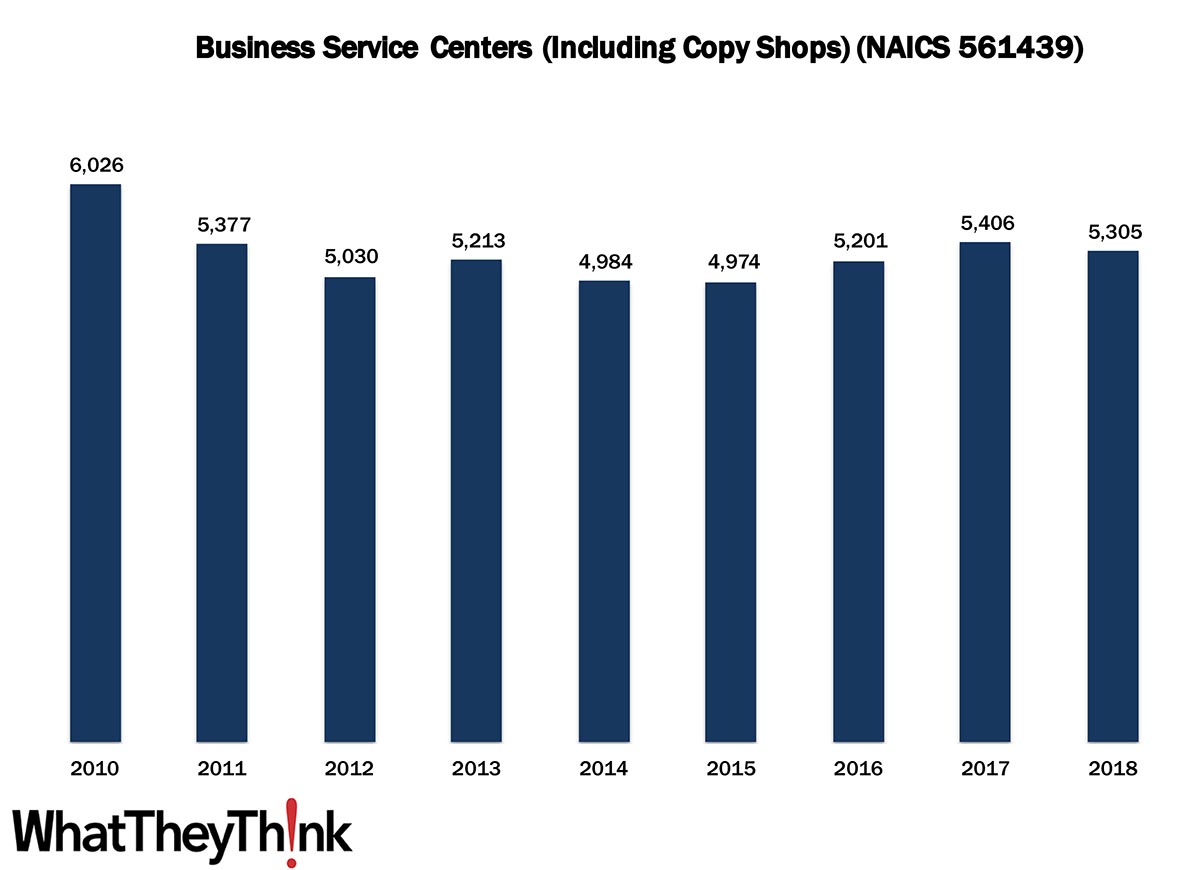

US Copy Center Establishments—2010–2018

Published: January 15, 2021

In 2010, there were 6,026 establishments in NAICS 561439 (Business Service Centers [Including Copy Shops]). By 2018, that number had declined to 5,305. In macro news, weekly initial unemployment claims were at 965,000, an increase of 181,000 from the previous week. Full Analysis

November Printing Shipments—It Was Nice While It Lasted

Published: January 8, 2021

In November 2020, after rising for five straight months, printing shipments plunged from $7.63 billion to $7.0 billion. Full Analysis

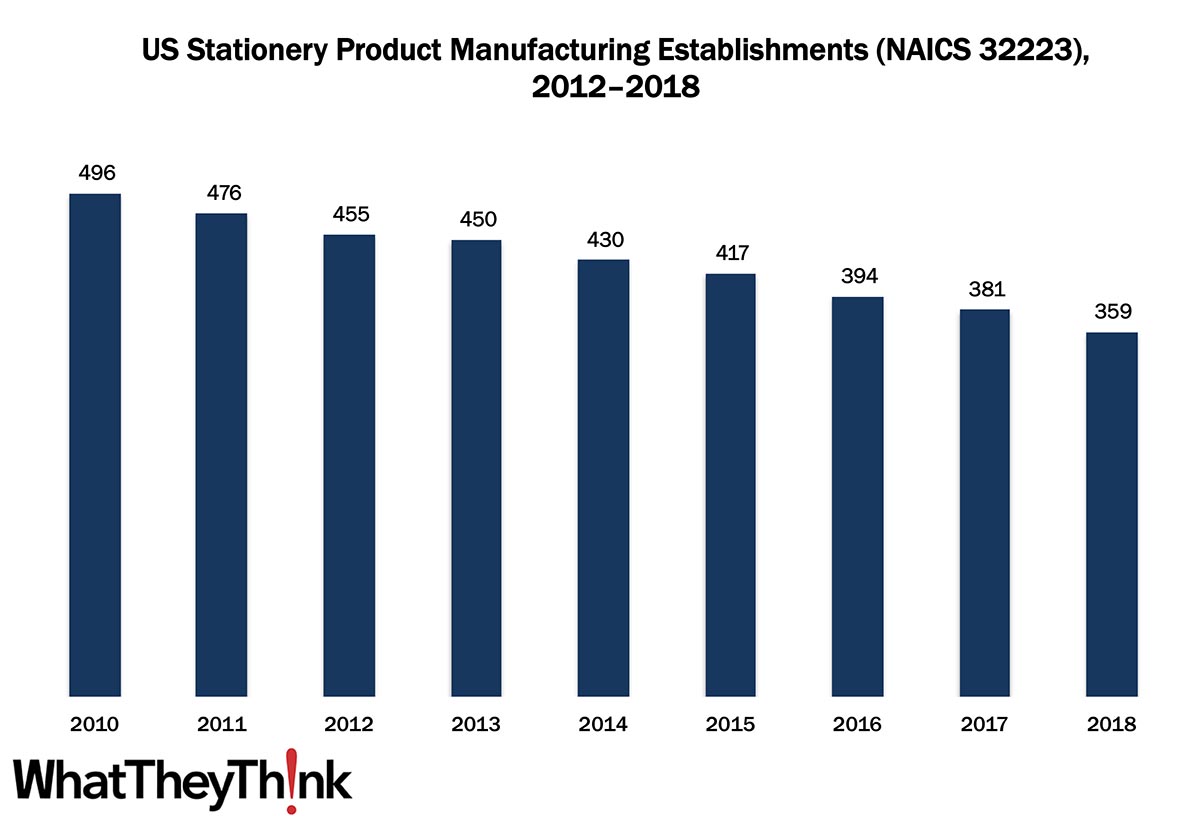

Stationery Product Manufacturing Establishments—2012–2018

Published: December 18, 2020

In 2010, there were 496 establishments in NAICS 32223 (Stationery Product Manufacturing). By 2018, that number had declined to 359. In macro news, retail sales for November took a dip. Full Analysis

European Print Industry Snapshot: Turkey

Published: December 15, 2020