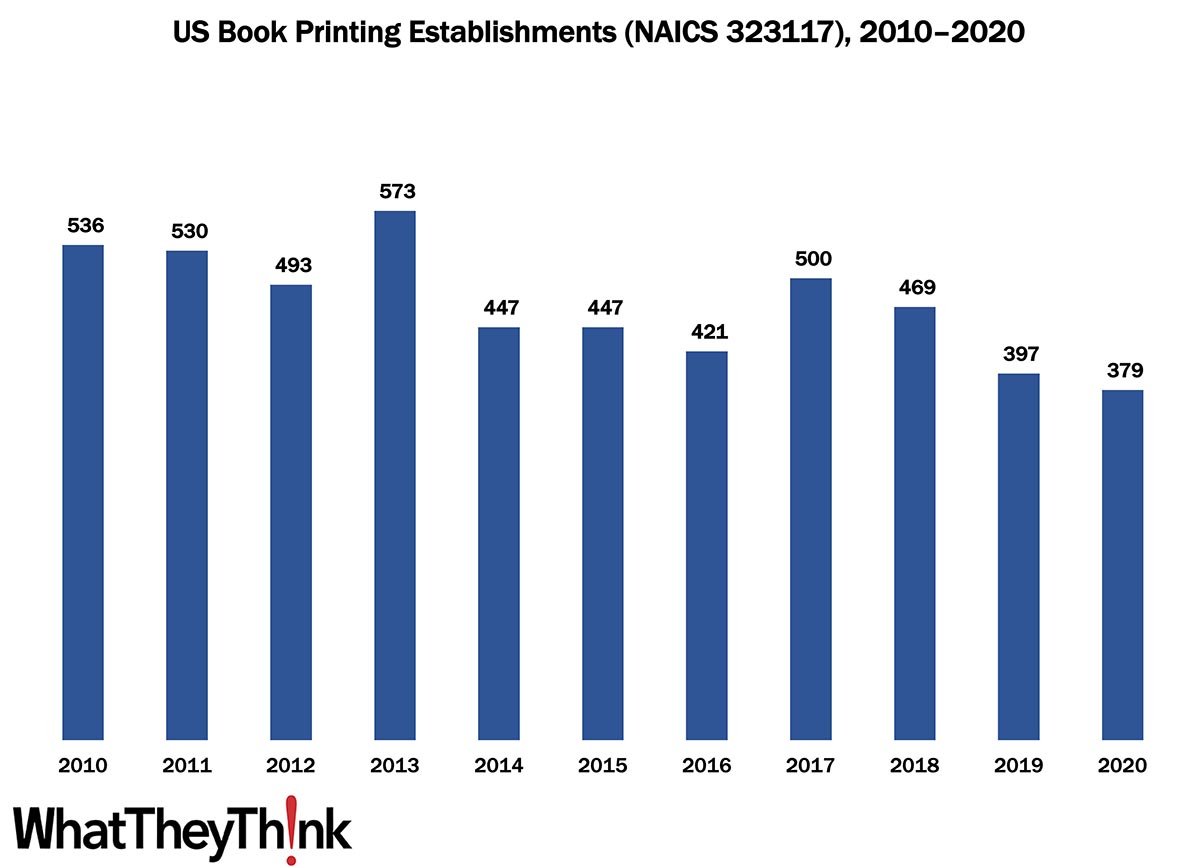

The latest edition of County Business Patterns was recently released, which includes 2020 data. As 2020 began, there were 379 establishments in NAICS 323117 (Book Printing). This represents a decrease of 29% since 2010. You can see that book printing establishments were up and down throughout the decade, the ebbing and flowing in this business category reflecting the old story of consolidation as well as the results of both shop diversification and specialization. Today’s equipment (production inkjet in particular) can produce a variety of print products, so shops don’t have to stick to any one particular niche the way they used to. So some quantity of “book printers” may not consider themselves just book printers, and thus they classify themselves as general commercial printers or some other business category that better describes what they do. It also goes in the other direction: books have remained a perennially popular print product, and as more book production moves to the digital on-demand variety, it can be a significant niche to pursue all on its own. Books also lend themselves to more dedicated workflows (highly integrated text printing, cover printing, binding, shipping) so it often makes sense to dedicate production solely to books, especially if the volume is there.

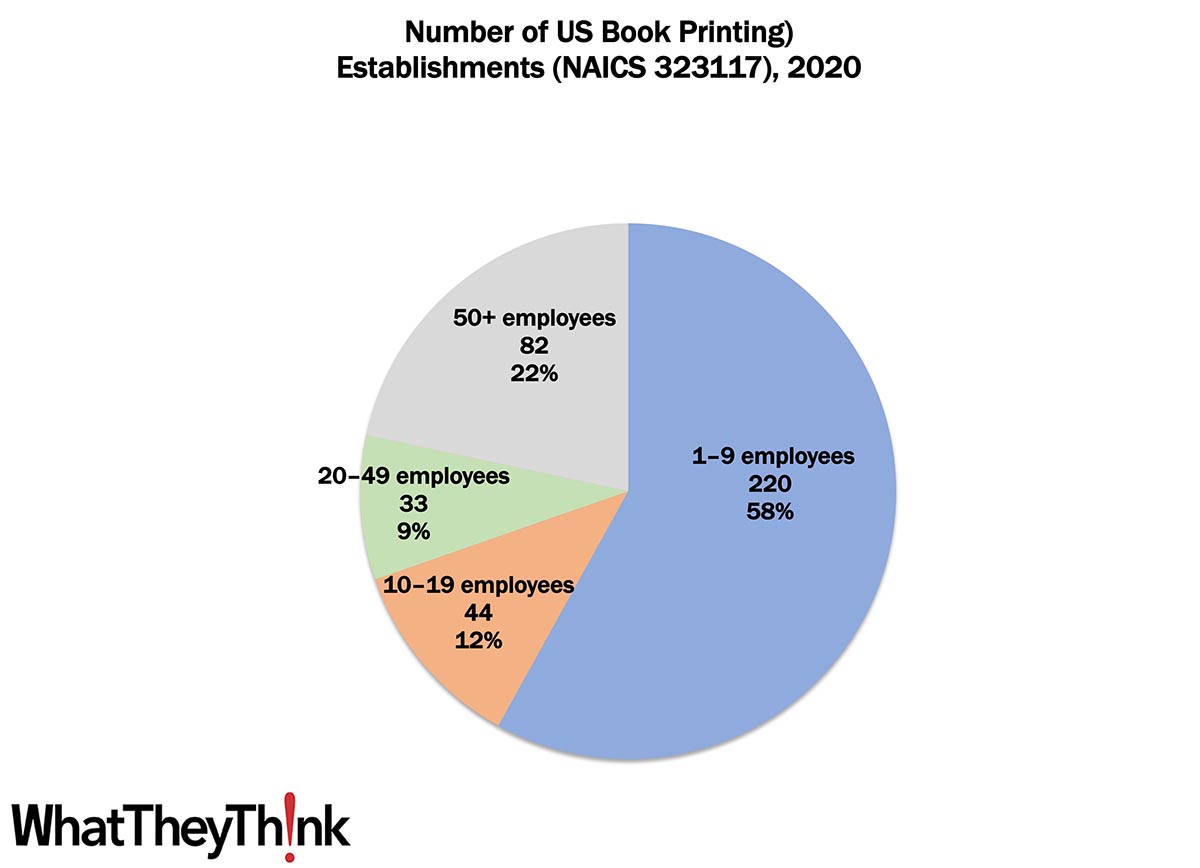

Unlike other printing categories, book printing establishments are not as concentrated at the lower end of the employee-count spectrum. Small shops (1 to 9 employees) still comprise the bulk of the book printing industry, but only account for 58% of all establishments. The largest shops account for almost one-fourth (22%) of industry establishments with mid-size shops accounting for 21% of establishments.

These counts are based on data from the Census Bureau’s County Business Patterns. Throughout this year, we will be updating these data series with the latest CBP figures. County Business Patterns includes other data, such as number of employees, payroll, etc. These counts are broken down by commercial printing business classification (based on NAICS, the North American Industrial Classification System). Up next:

- 32312 (Support Activities for Printing—aka prepress and postpress services)

These data, and the overarching year-to-year trends, like other demographic data, can be used not only for business planning and forecasting, but also sales and marketing resource allocation.

Coming to our Census: To clarify what is included in the 2020 CBP establishment counts, the Census Bureau gave us this response:

Establishment counts represent the number of locations with paid employees any time during the year.…

Thus, if an establishment was open at any point during the year, it would be included in the CBP count of the number of establishments for 2020 CBP. Hypothetically, if a business establishment was open in January 2020 but closed due to any number of factors (including COVID-19) during the year, it would have been included in the count of establishments for 2020 CBP.

Thanks, Census Bureau!

This Macro Moment…

This week, the Federal Reserve published its most recent “Beige Book” (aka “Summary of Commentary on Current Economic Conditions”), which is issued eight times a year. The Beige Book compiles more or less anecdotal information on economic conditions in each of the 12 Federal Reserve districts. Not quantitative, it is based on conversations with bank and branch directors and interviews with key business contacts, economists, market experts, and others. It is published as a prelude to Federal Open Market Committee meetings.

You can read the whole thing here, particularly the reports from your Fed district, but here are some selected comments. Note that it is based on information compiled before August 29, 2022.

Overall Economic Activity

Economic activity was unchanged, on balance, since early July, with five Districts reporting slight to modest growth in activity and five others reporting slight to modest softening. Most Districts reported steady consumer spending as households continued to trade down and to shift spending away from discretionary goods and toward food and other essential items. Auto sales remained muted across most Districts, reflecting limited inventories and elevated prices. Hospitality and tourism contacts highlighted overall solid leisure travel activity with some reporting an uptick in business and group travel. Manufacturing activity grew in several Districts, although there were some reports of declining output as supply chain disruptions and labor shortages continued to hamper production.

The biggest point of weakness was real estate and related activity. As for prices:

Price levels remained highly elevated, but nine Districts reported some degree of moderation in their rate of increase. Substantial price increases were reported across all Districts, particularly for food, rent, utilities, and hospitality services. While manufacturing and construction input costs remained elevated, lower fuel prices and cooling overall demand alleviated cost pressures, especially freight shipping rates. Several Districts reported some tapering in prices for steel, lumber, and copper. Most contacts expected price pressures to persist at least through the end of the year.