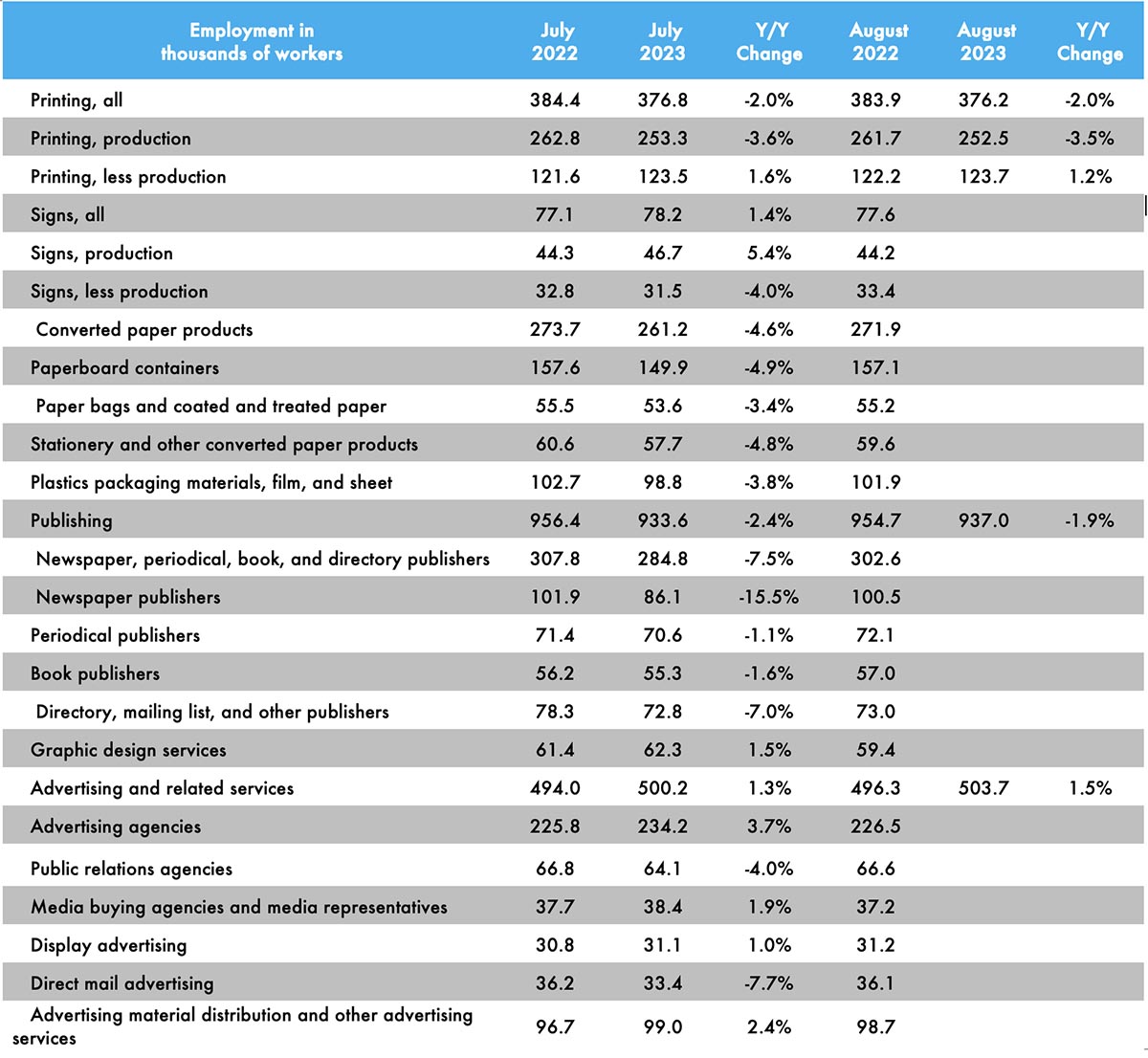

The printing employment situation flattened out over the course of the spring, and has remained so through the summer. Overall printing employment in August 2023 was down 0.2% from July and, drilling into carpeted/non-carpeted areas, production employment was down 0.3% while non-production employment was up 0.2%.

In terms of publishing, overall publishing employment was up 0.4% from July to August, while advertising and related services was up 0.7%.

Earlier this year, we started adding a number of other business categories to our employment table, the reporting of which, as you may recall from our tracking of the publishing and creative markets, lags a month.

Overall employment in the signage industry was up 0.6% from June to July, with sign production employment up 2.4%. (Non-production was down 1.9%.)

Converted paper products employment was down 0.6% from June to July, with paperboard container employment down 0.5% and paper bags and coated and treated paper employment down 0.7%.

Looking at some specific publishing and creative segments, from June to July, periodical publishing employment was down 1.5%, while newspaper publishing employment was down—yikes!—11.2% and book publishing down 0.2%. Graphic design employment was down 0.5%. Ad agency employment was up 1.1%, and PR agencies were down 2.3%. Direct mail advertising employment was down 1.2%.

As for August employment in general, the BLS reported on September 1 that total nonfarm payroll employment increased by 187,000 in August, and the unemployment rate ticked up from 3.7% to 3.8%. Meanwhile, change in total nonfarm payroll employment for June was revised down by 80,000 (from 185,000 to 105,000) and the change for July was revised down by 30,000 (from 187,000 to 157,000.) The U-6 rate (the so-called “real” unemployment rate which includes not just those currently unemployed but also those who are underemployed, marginally attached to the workforce, and have given up looking for work) ticked up from 6.7% to 7.1%.

The labor force participation rate increased from 62.6% in July to 62.8% in August and the employment-to-population ratio was unchanged at 60.4%. The labor force participation rate for 24–54-year-olds also ticked up from 83.4% to 83.5%.

Not a horrible employment report and about what economists expected.