At this time, as we are being bombarded with bad economic data (viz. yesterday's initial unemployment claims) and anticipating dire industry data, this week we present the data equivalent of pictures of puppies: a segment of the industry showing a growing number of printing establishments.

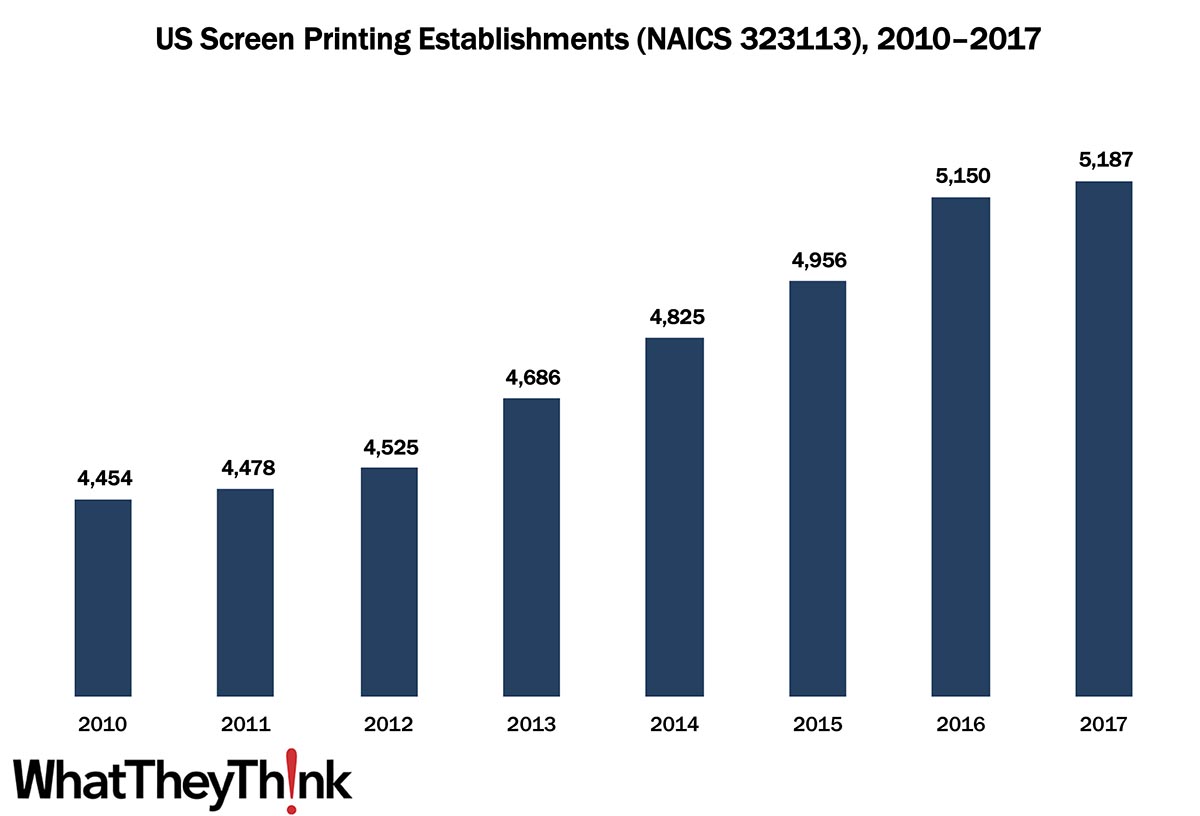

According to the latest edition of County Business Patterns, in 2017 there were 5,187 establishments in NAICS 323113 (Commercial Screen Printing). This represents an increase of +16% since the 2010s began. Growth in screen printing establishments has been consistent from year to year, which is almost exactly the opposite of general commercial printing, where establishments have been consistently declining.

This is thanks to the rise of specialty printing. Screen is commonly used to print on textiles (T-shirts being the emblematic example), and these kinds of items really started to take off in the past decade. Couple this with the rise of short-run and digital technologies that can complement screen, and as demand for specialty items has increased, establishments have grown to take advantage of this hot print application area. It’s very common to find hybrid screen/digital shops, and even hybrid screen/digital workflows for the same products—kind of like the “digital printing on offset shells” approach that used to be very popular (and still exists to a large extent) among commercial printers. And let’s also not forget the growth of industrial printing, in which screen and pad printing also play a very large role.

In 2018, we began highlighting data from our Commercial Printing Establishments, which complements and supplements our regular tracking of printing industry shipments and other industry data. These counts are based on data from the Census Bureau’s County Business Patterns. Throughout this year, we will be updating these data series with the latest CBP figures. County Business Patterns includes other data, as well, such as number of employees, payroll, etc. These counts are broken down by commercial printing business classification (based on NAICS, the North American Industrial Classification System):

- 323 (Printing and Related Support Activities)

- 32311 (Printing)

- 323111 (Commercial Printing, except Screen and Books)

- 323113 (Commercial Screen Printing)

- 323117 (Books Printing)

- 32312 (Support Activities for Printing—aka prepress and postpress services)

These data, and the overarching year-to-year trends, like other demographic data, can be used not only for business planning and forecasting, but also sales and marketing resource allocation.

Every other week, we will be breaking these establishment data down in different ways. Over time, we will be adding additional data from County Business Patterns, such as number of employees, payroll, and similar information for additional business classification of relevance to the graphic communications industry.