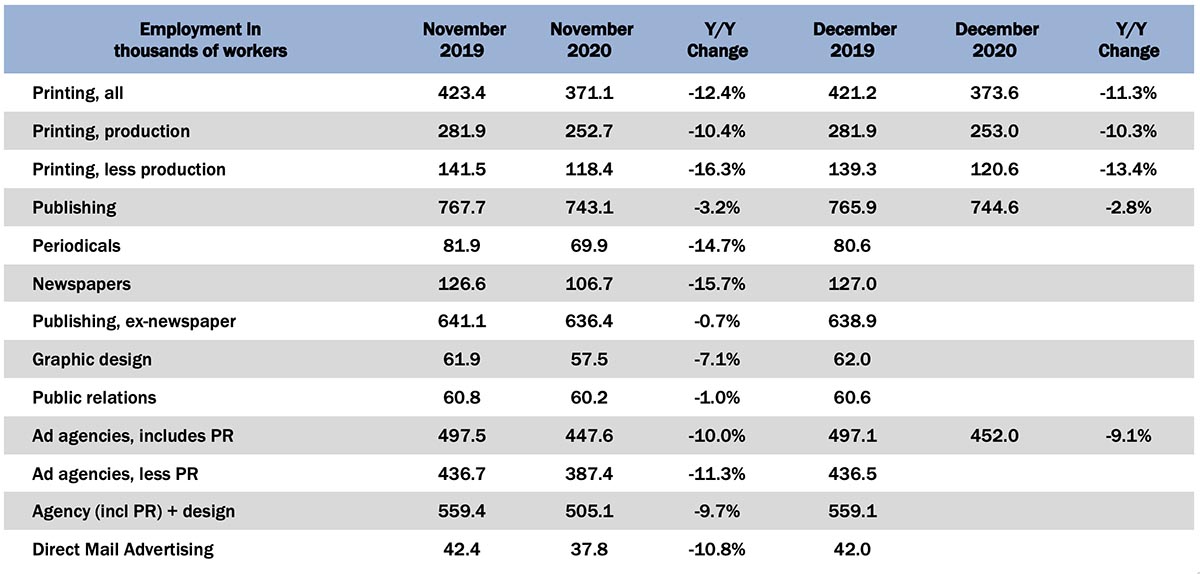

Employment figures from this year have been pretty bad (as we would expect), although we had been seeing slight improvements in the fall as businesses reopen (etc.). August and September had seen graphic communications employment in a bit of a holding pattern, with only minimal changes. October 2020 employment had been up +0.8% from September, mostly production staff continuing to come back: production employment had been up +1.6% from September, while non-production employment had been down -0.8% from September to October. In November, we saw another holding pattern; all printing employment had been up +0.8% from October, production employment up +0.5%, and non-production printing employment up +1.5%. That’s not great, but at least there were no negative numbers.

In December, it’s been more of the same, really: all printing employment is up +0.7% from November, production employment up +0.1%, and non-production printing employment up +1.9%.

(We’ll be concentrating on the month-to-month changes for this data series, at least for the next few months; looking at year-over-year changes doesn’t make an awful lot of sense—we know employment will be drastically down—until we get March 2021 data.)

The publishing and creative markets, also seem to be in a bit of a holding pattern. From October 2020 to November 2020 (publishing and creative market employment reports lag by a month), periodical publishing employment dropped -1.4%, newspaper publishing ticked up +0.7%, graphic design ticked down -0.3%, and ad agencies were essentially unchanged. What about PR, which not that long ago was the superstar of these employment reports? Down -2.4%. (And if you back PR out of agencies, ad agency employment grew +0.4% from October to November 2020.) Meanwhile, the laggard of the whole lot—direct mail advertising—grew +1.1%. We are definitely in Bizarro World.

As for overall US employment, said the BLS in their January 8 report:

Total nonfarm payroll employment declined by 140,000 in December, and the unemployment rate was unchanged at 6.7 percent, the U.S. Bureau of Labor Statistics reported today. The decline in payroll employment reflects the recent increase in coronavirus (COVID-19) cases and efforts to contain the pandemic. In December, job losses in leisure and hospitality and in private education were partially offset by gains in professional and business services, retail trade, and construction.

The latter point may be good for certain parts of our industry—sign and display graphics are often tied to new construction projects. The quarterly ISA economic webinar will take place next week, and their analysts tie a lot of their forecasting to building and construction. We’ll be covering that event, so stay tuned.