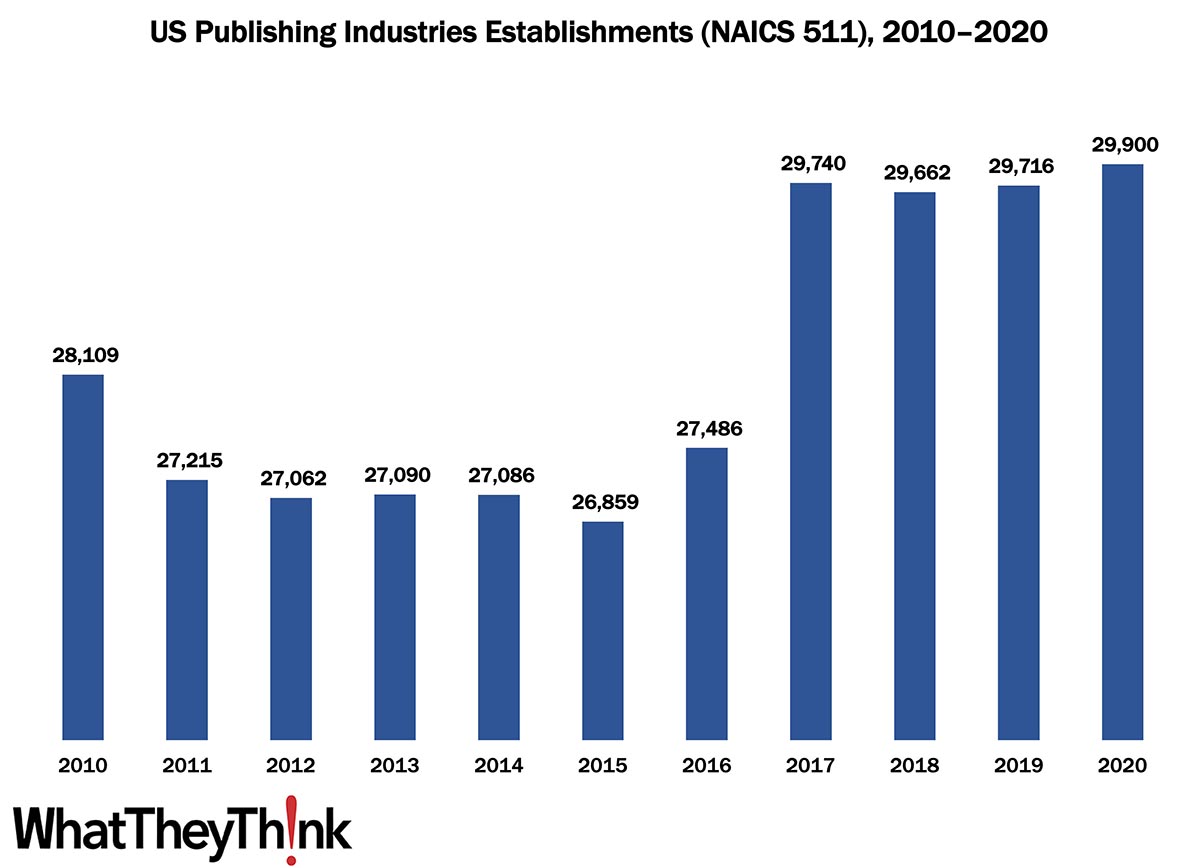

Our Friday data slice’n’dice look at the latest edition of County Business Patterns now turns to the publishing industries. As 2020 began, there were 29,900 establishments in NAICS 511 (Publishing Industries [except Internet]). This represents an increase of 6% since 2010 and increase of 9% since 2016.

We’ll have more to say when we dive into the specific publishing NAICS categories, as “Publishing” here refers to everything from books, magazines, and newspapers to greeting cards, to mailing lists and directories, and the catchall “other publishing” which can include maps and other specialty publishing products. Generally, though, the growth in establishments here is due to two basic factors: economic growth following the Great Recession, as well as lowered barriers to entry for small or self-publishers thanks to digital printing (enabling short-run on-demand publishing) and the Internet/ecommerce (easing distribution, which was always a challenge in the pre-Internet days). Spoiler alert: book and—believe it or not—greeting card publishers were the two sub-categories that drove up the average number of establishments toward the end of the decade.

To clarify what is included in the 2020 CBP, establishment counts represent the number of locations with paid employees at any time during the year. If an establishment existed at any point during the year, it would be included in the CBP count of the number of establishments for 2020 CBP. Thus, businesses lost during the COVID pandemic won’t be accounted for until the 2021 CBP.

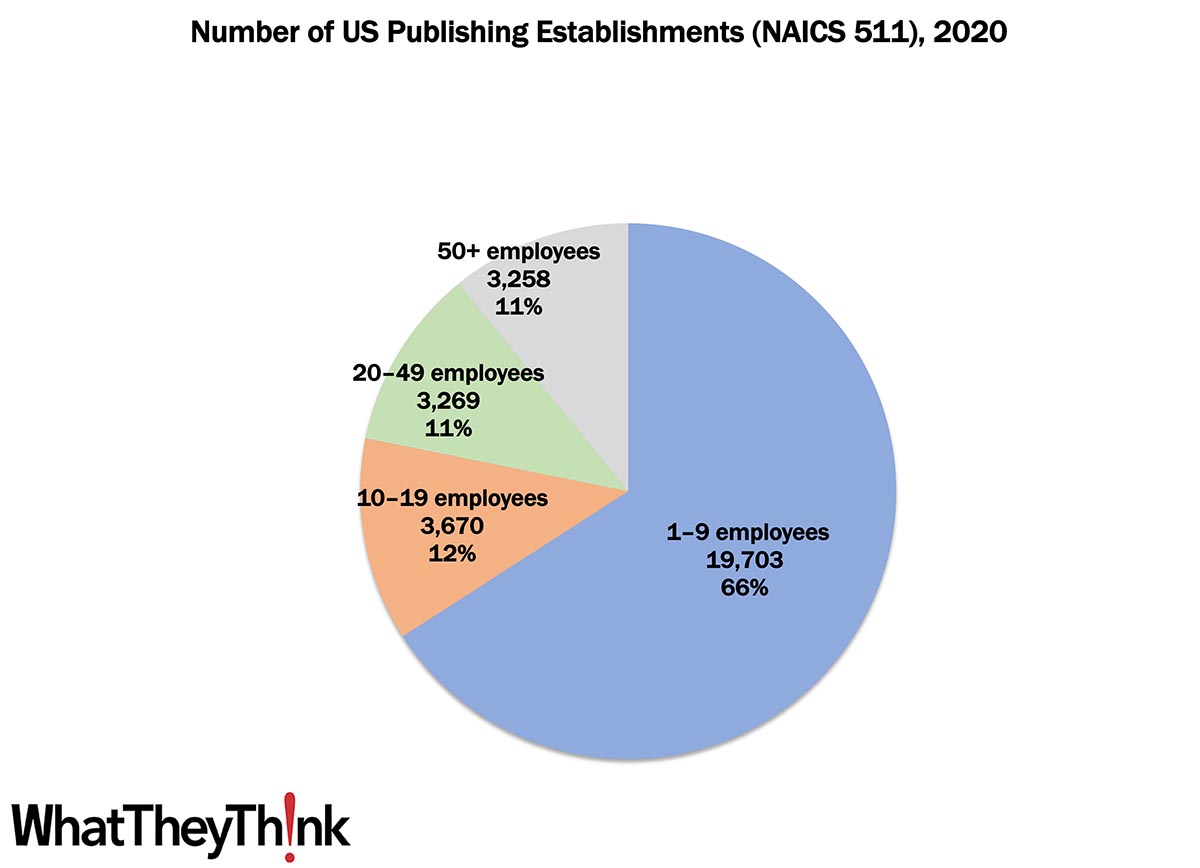

As we saw in the printing categories, publishing establishments are concentrated at the lower end of the employee-count spectrum. Small publishers (1 to 9 employees) comprise the bulk of the establishments, accounting for 66% of all establishments, with the other three employee size categories equally sized at 11–12% each.

These counts are based on data from the Census Bureau’s County Business Patterns. Throughout this year, we will be updating these data series with the latest CBP figures. County Business Patterns includes other data, such as number of employees, payroll, etc. These counts are broken down by commercial printing business classification (based on NAICS, the North American Industrial Classification System). Up next:

- 51111 Newspaper Publishers

- 51112 Periodical Publishers

- 51113 Book Publishers

- 51114 Directory and Mailing List Publishers

- 51119 Other Publishers

- 511191 Greeting Card Publishers

- 511199 All Other Publishers

These data, and the overarching year-to-year trends, like other demographic data, can be used not only for business planning and forecasting, but also sales and marketing resource allocation.

This Macro Moment…

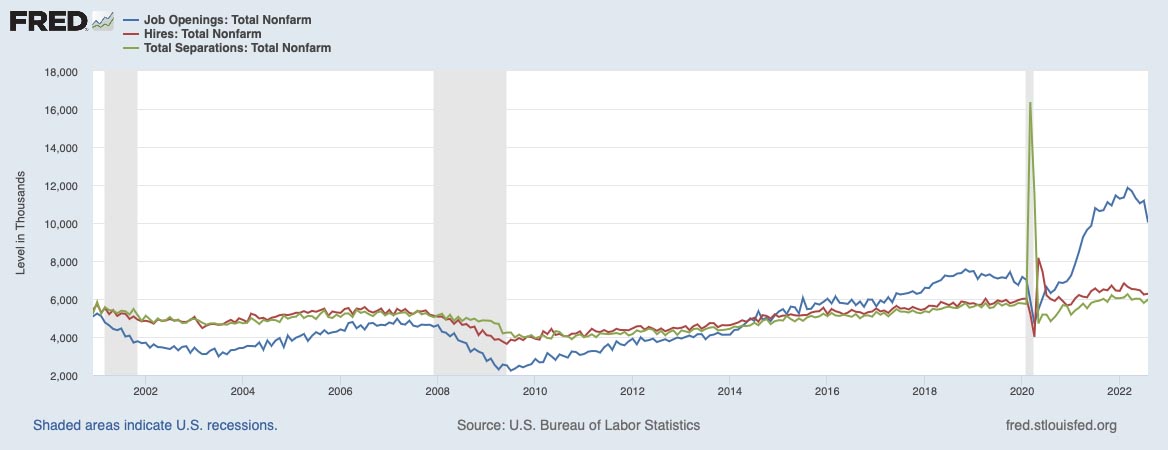

Earlier this week, the Bureau of Labor Statistics released its Job Openings and Turnover Summary (JOLTS), and it looks like all those companies that said they couldn’t find employees either found them or stopped looking—more likely the latter:

The number of job openings decreased to 10.1 million on the last business day of August, the U.S. Bureau of Labor Statistics reported today. Hires and total separations were little changed at 6.3 million and 6.0 million, respectively. Within separations, quits (4.2 million) and layoffs and discharges (1.5 million) were little changed. This release includes estimates of the number and rate of job openings, hires, and separations for the total nonfarm sector, by industry, and by establishment size class.

- The job openings number represents a decrease of 1.1 million from July.

- The hires number represents an increase from 6.2 million to 6.3 million.

- The total separations number (which includes quits, layoffs and discharges, and other separations) represents an increase from 5.8 million to 6.0 million.

With such little changes in quits, it also appears the Great Resignation is largely over.

It will be interesting to see the September employment report, which comes out today. (Nota bene: This JOLTS report covers August while today’s employment report will cover September.)