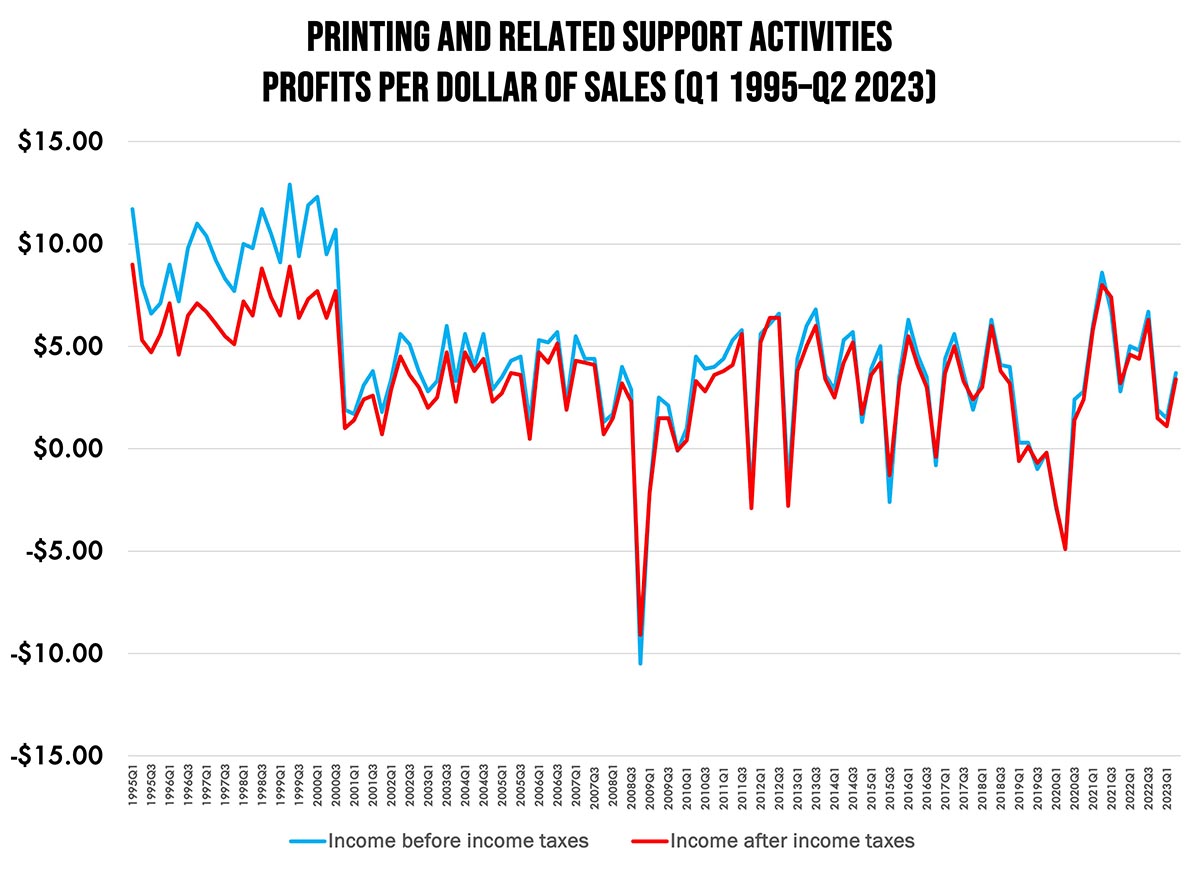

We havent looked at profits data in a while, and while quarter-over-quarter profit margin data can be fairly noisy (we used to look at profits as a four-quarter moving average to smooth things out a bit) the industry in general is on an upward trend since the trough of the pandemic. Profits took a bit of a hit in Q4 2022 and Q1 2023, but rebounded in Q2.

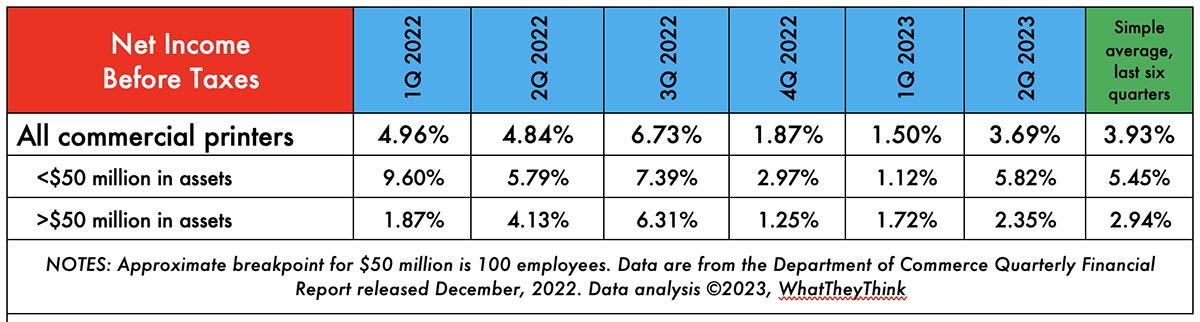

In Q2 2023, for large printers (those with more than $50 million in assets), profits before taxes had been +2.35% of revenues, while for smaller printers (less than $50 million in assets), profits before taxes in Q2 were +5.82% of revenues. We traditionally refer to this disparity between “big” and “small” printers as our “Tale of Two Cities” since there has historically been a great profit disparity between those two asset classes. That rift had temporarily closed up during the pandemic, but it looks like it’s back.

In Q2 2023, for the industry on average, profits before taxes were +3.69% of revenues, up from Q1’s +1.50%. For the last six quarters, profits have averaged +3.93% of revenues.

Basically, we are indeed returning to our normal, pre-pandemic trajectory.

The asset class division is based on the breakdowns in the Census Bureau’s Quarterly Services Report, whence we get our profits data. Starting with the Q4 2019 Quarterly Services Report, the Census Bureau changed their asset class breakdowns from more/less than $25 million to more/less than $50 million.

Our Fall 2023 Print Business Outlook Survey is in the field! All print business owners and operators are welcome—nay, encouraged—to participate. To take the survey, click here. Thanks!