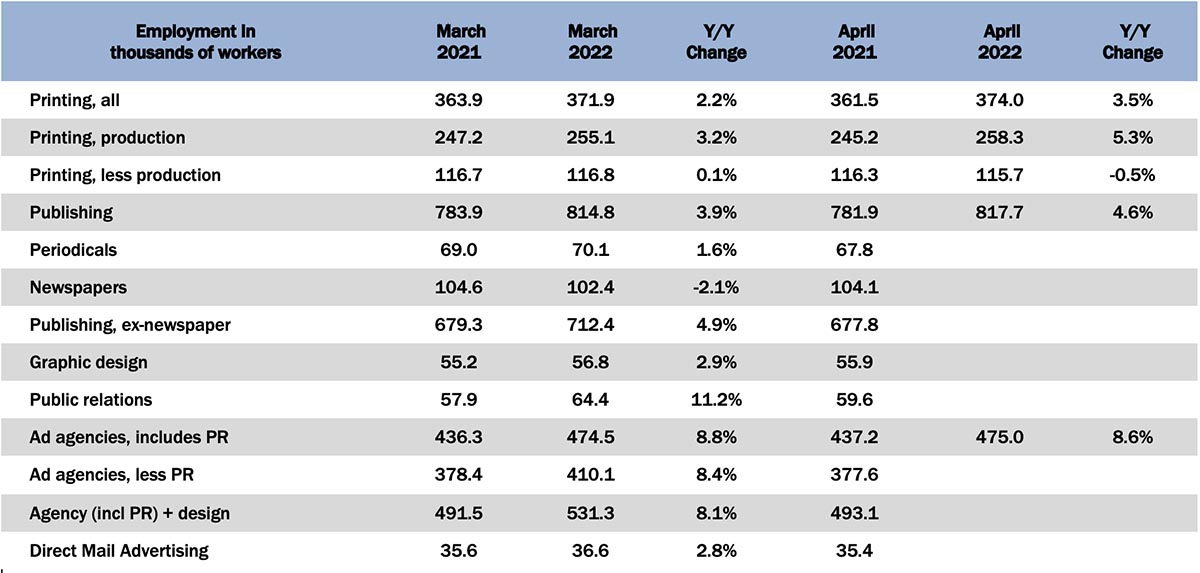

One gets the sense that the industry’s attempts at recruiting production staff are generally succeeding: in April 2022, all printing employment was up +1.6% from March, with non-production employment down -0.9%. This is the reverse of what we saw in March.

Publishing employment had been improving slightly over last summer, took a turn for the worse in the fall, and started to plateau at the end of the year. It was up a modest +0.6% in March, and now up another +0.4%.

Digging into the specific publishing segments (the reporting of which lags a month), things continue to stay in a bit of a holding pattern, although on a more upward one than last month: from February to March, periodical publishing employment was up +1.9%, while newspaper publishing employment was down -0.8%.

The creative markets were doing about the same. Graphic design employment was up +1.1% from February to March, ad agencies were also up +0.9%, and public relations—usually a standout segment—was only up +0.5%. Direct mail advertising employment has been up and down for the past year but in March 2022 was down -0.3%.

In the general April employment report, said the BLS in their May 6 report (no fooling):

Total nonfarm payroll employment increased by 428,000 in April, and the unemployment rate was unchanged at 3.6 percent, the U.S. Bureau of Labor Statistics reported today. Job growth was widespread, led by gains in leisure and hospitality, in manufacturing, and in transportation and warehousing.

The labor force participation rate decreased from 62.4% in March to 62.2% in April, and the employment-to-population ratio also decreased from 60.1% to 60.0%. The labor force participation rate for 24–54-year-olds also decreases from 82.5% to 82.4%, still slightly below pre-pandemic levels.

At the same time, February and March payrolls were revised down by 39,000 combined.

Despite these slight declines, the top-line figures were generally above economists’ expectations, and the employment situation in general continues to be exceptional. But the caveat we always add is that not all industries and segments are faring equally well.