The full results on turnover (revenues) in the printing industry in Europe for 2020 were published late in 2022—after index data was the only source for print volume developments during the pandemic. While the index data only allowed for volume developments, now real turnover data is available, even if the data is far from perfect.

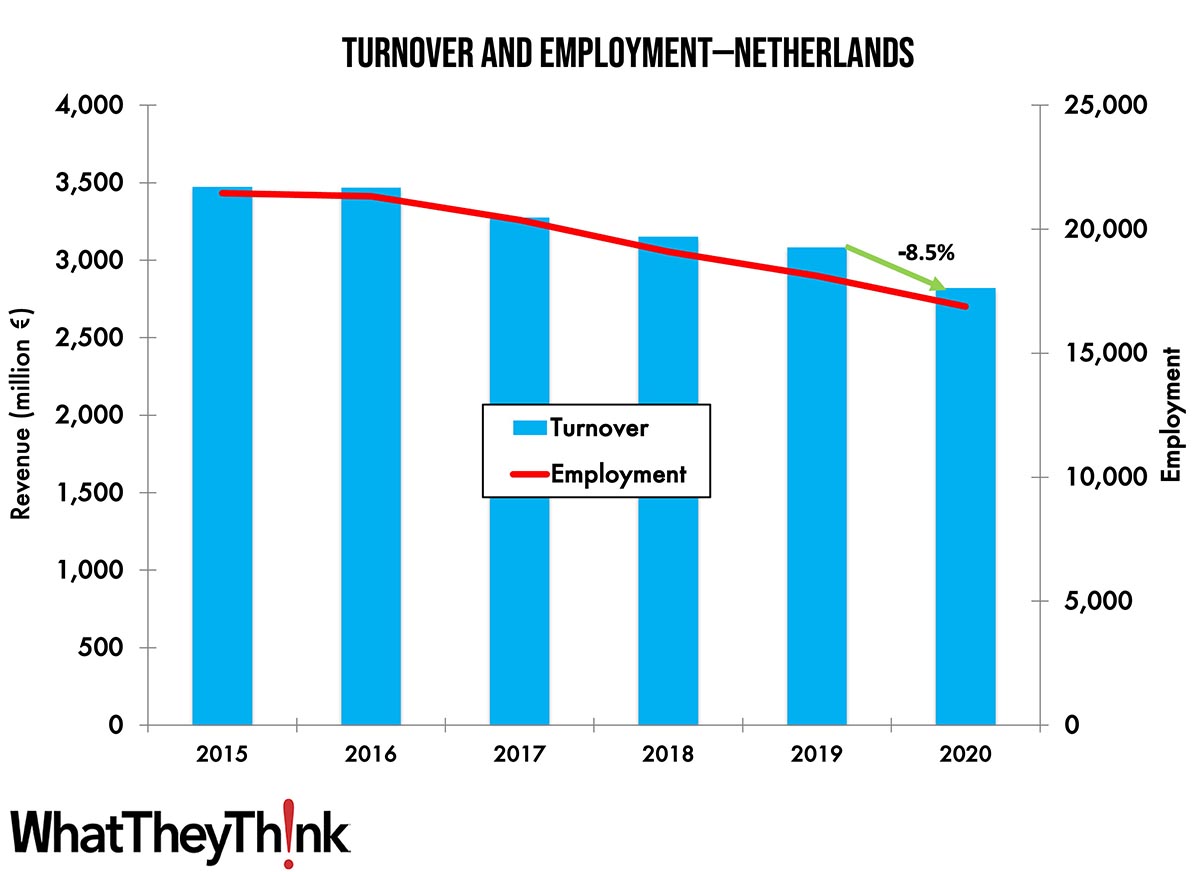

The turnover for commercial printing in the Netherlands dropped relatively steadily from 2015 to 2019 with an average annual rate of -2.4%. This was followed by a quicker decline of -8.5% in 2020 due to the pandemic to approximately €2.8 billion. The number of persons employed had a steady decline as well. Numbers declined from just over 21,500 in 2015 to about 16,900 in 2020 at an average rate of 3.3% until 2019, a sign of the productivity gains made. The 6.8% decline in employment in 2020 was higher than the average decline in the years before and relatively close to the turnover drop in the same year, indicating the printing industry reacting relatively quickly compared to other countries. The turnover decline in 2020 was lower than initially expected, based on the production volume index data.

Turnover and employment printing industry in the Netherlands

Source: Eurostat 2022 and digitalprintexpert.de

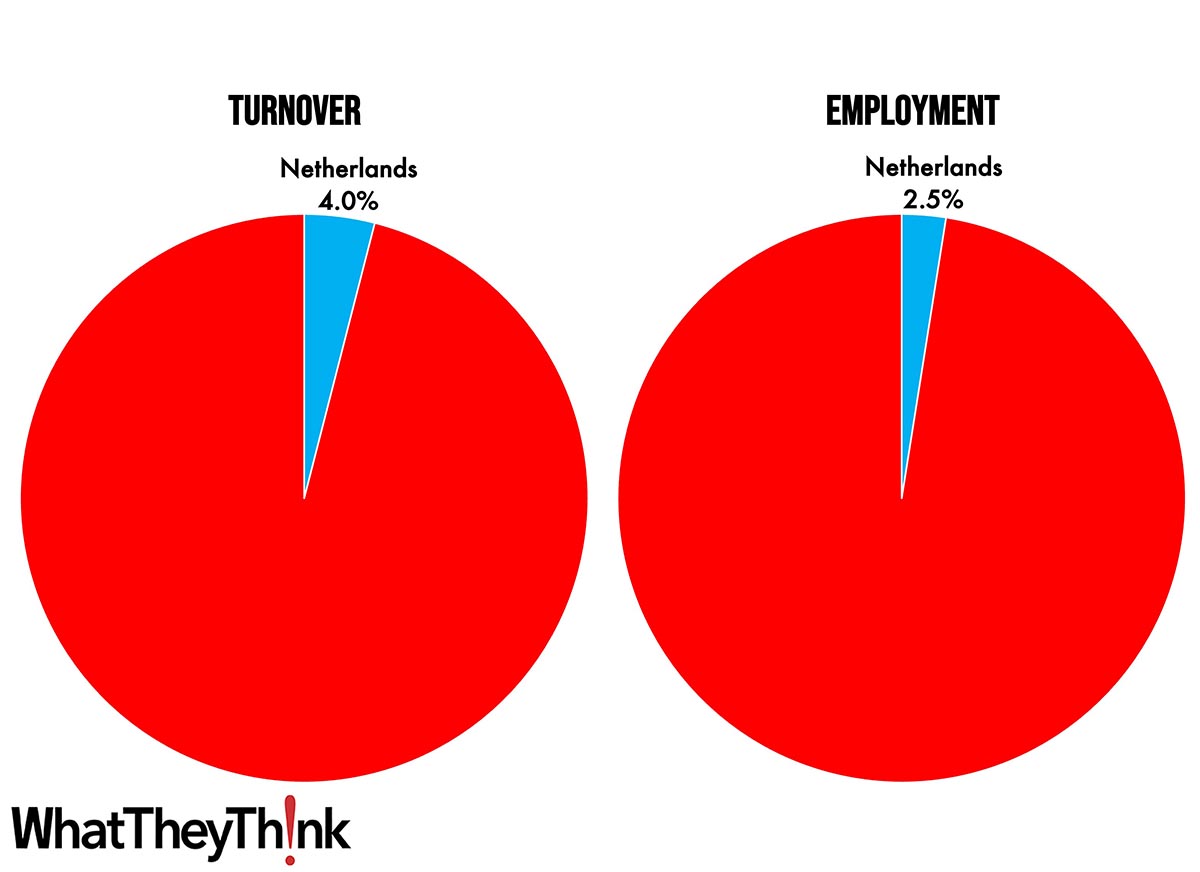

Overall, the printing industry in the Netherlands accounts for 4% of the total European printing industry, falling between Poland and Switzerland. In terms of the number of employees in print, the European share of the Netherlands is decidedly smaller at 2.5%.

Source: Eurostat 2022 and digitalprintexpert.de

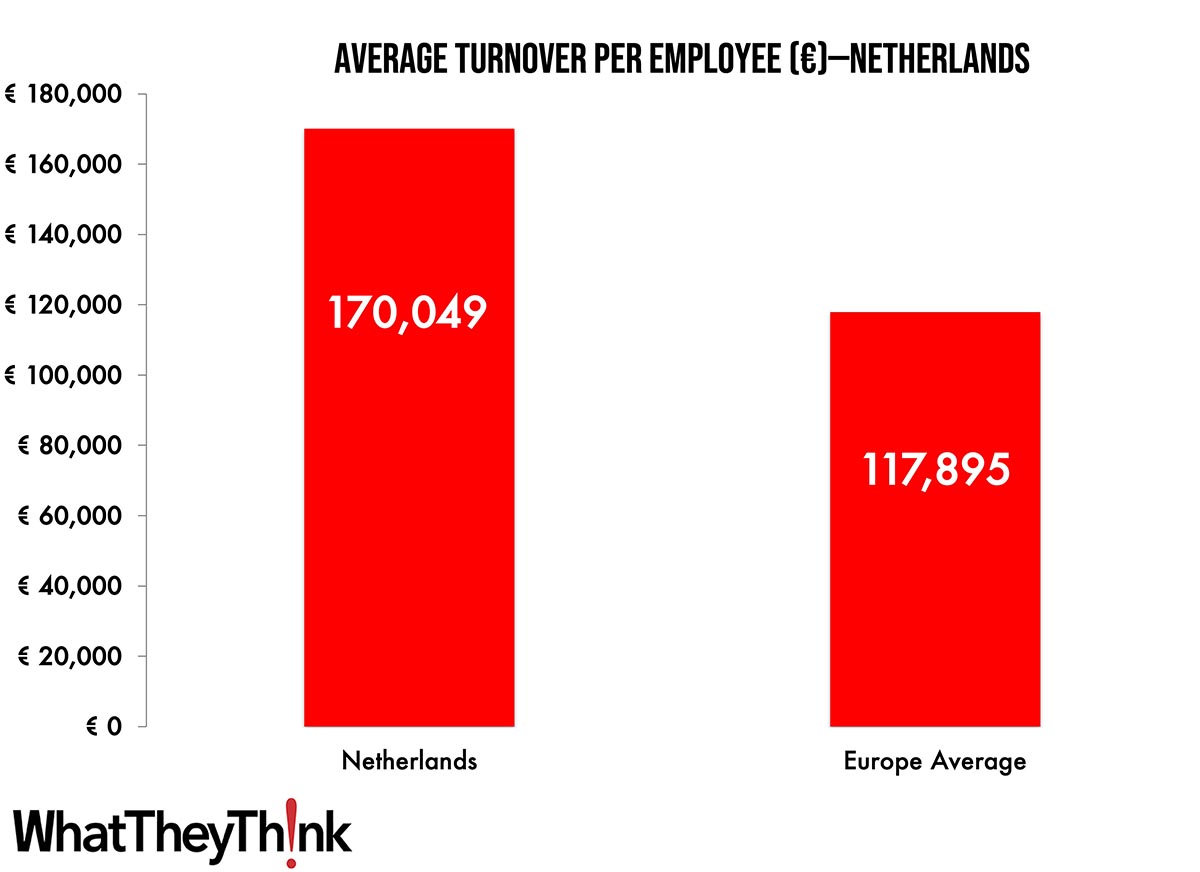

Based on Eurostat numbers for turnover and the number of employees in the printing industry, the average annual turnover per employee can be calculated. The €170,049 for 2019 is noticeably higher than the European average, surpassing even most Nordic countries, and is at the same level as Austria and Switzerland. The employment number does include part-time employees and owners with a salary. The year 2019 has been chosen for the comparison as 2020 could have been impacted by the COVID-19 pandemic.

Source: Eurostat 2022 and digitalprintexpert.de

Please keep in mind that the data is based on Eurostat numbers for printing and related services (complemented by some estimates), which consists mainly of commercial and publishing printing, including prepress and finishing companies. That means that packaging, data center, direct mail print, and quick print/copy shops are not included or only on a limited basis. In-house print/CRD are not included at all. Europe as used in the series of articles includes the EU countries plus Norway, Switzerland, and the UK. If you have questions about sizing the European printing industry or need clarification, please contact me at [email protected] .

This series on the turnover and employment development in commercial print in Europe will continue. Next time we will have a look at the printing industry in Belgium.