For years, industry analysts and other pundit types have identified opportunities for commercial printers in packaging printing, especially digitally printed packaging. But have printers themselves seen opportunities in these applications?

Drawing on seven years’ worth of Print Business Outlook surveys, our “Tales from the Database” series looks at historical data to see if we can glean any particular hardware, software, or business trends. This issue, we turn our attention to labels and packaging.

These surveys form the basis of our annual Printing Outlook reports, the most recent of which (2023) is available here. In every survey, we ask a broad cross-section of print businesses about business conditions, business challenges, new business opportunities, and planned investments. In our Business Outlook reports, we tend to focus (obviously) on the most recent survey data, occasionally looking back a survey or two to see how these items have changed in the short-term. Plumbing the depths of our survey database can give us a better sense of how these trends have changed since the mid-2010s.

Oh, by the way, the Fall 2023 survey is now in the field! You are welcome—nay, encouraged—to fill it out here.

Moving on…

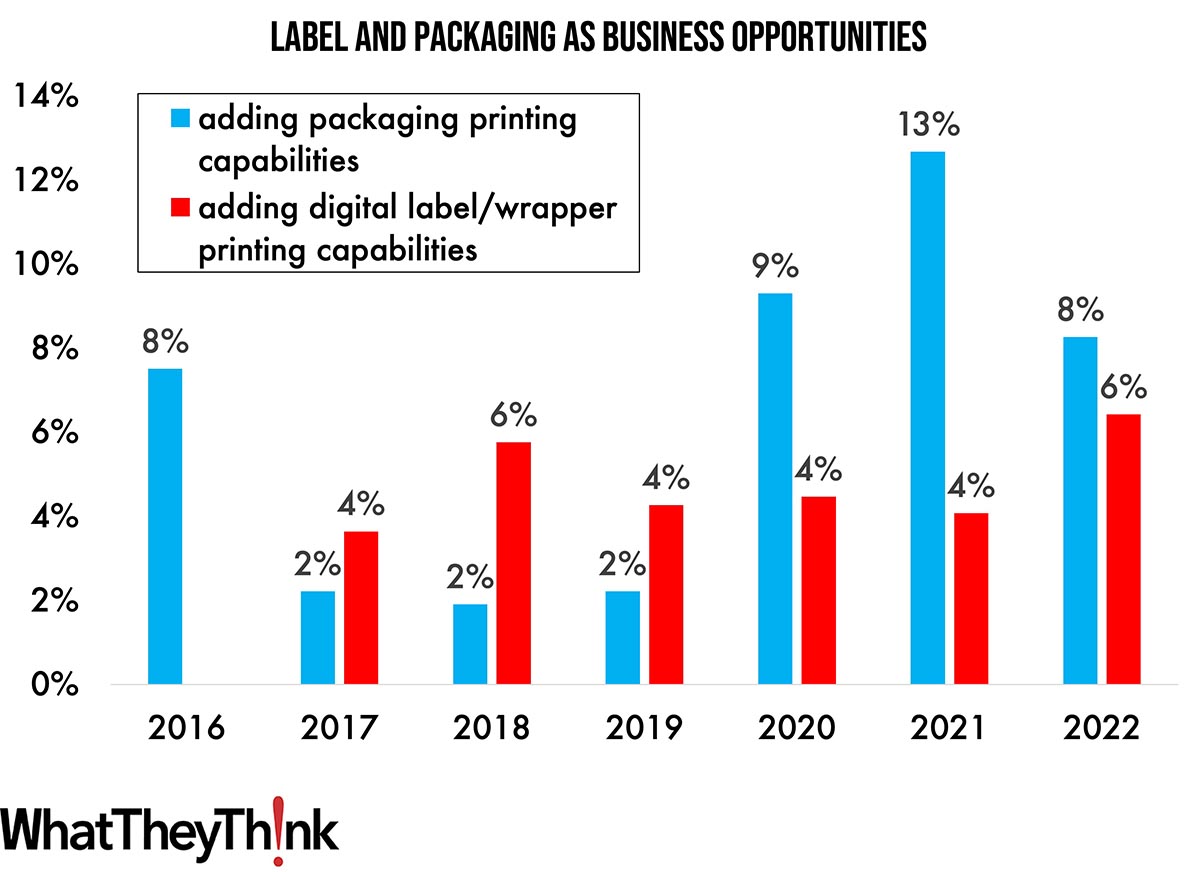

If we take a look back into our database of Print Business Outlook Survey results, we note that adding packaging printing capabilities has not been seen as a massive opportunity, peaking at 13% in Fall 2021, but generally hovering in the single digits. Digital label printing is a bit lower, averaging around 5% of all print businesses since we added it in our Fall 2017 survey. (See Figure 1.)

Figure 1. Label and packaging printing as new business opportunities.

Source: WhatTheyThink Printing Outlook Surveys, 2016–2022

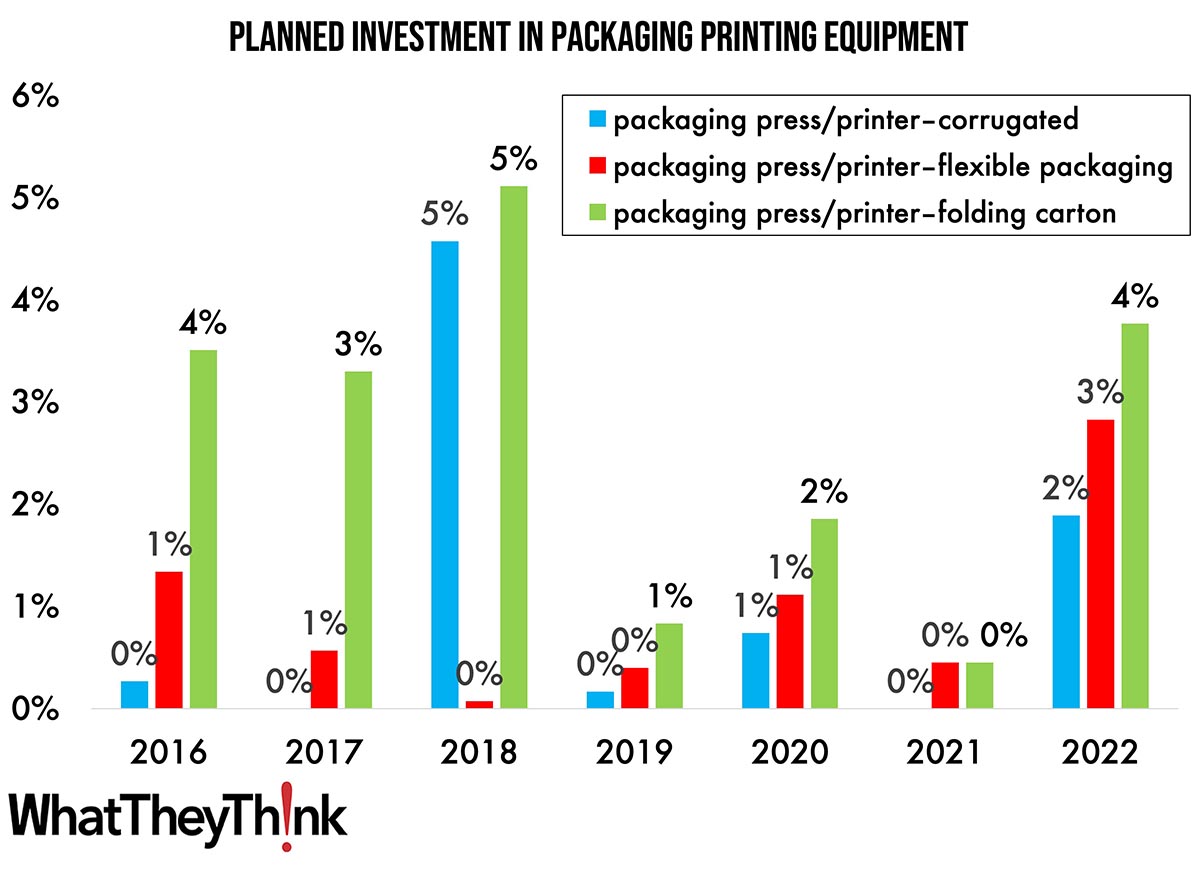

We also ask about the extent to which they are investing in equipment to produce these applications. In terms of packaging printing equipment (see Figure 2), folding carton capabilities have had the most appeal, although planned investment only averaged around 4% over the past seven years. Investment in flexible packaging and corrugated printing equipment have both averaged about 1% over the past seven years. All three printing equipment categories were up in our most recent survey. As the equipment—especially on the digital side—becomes more affordable and the market(s) become easier to enter, we may see some or all of these categories start to increase. Elsewhere in our surveys, we have been seeing that printers are looking at new areas to expand into—and most have expanded into wide format/display graphics years ago—so some form of packaging is a likely candidate.

Figure 2. Planned investment in packaging printing equipment. Source: WhatTheyThink Printing Outlook Surveys, 2016–2022.

Source: WhatTheyThink Printing Outlook Surveys, 2016–2022

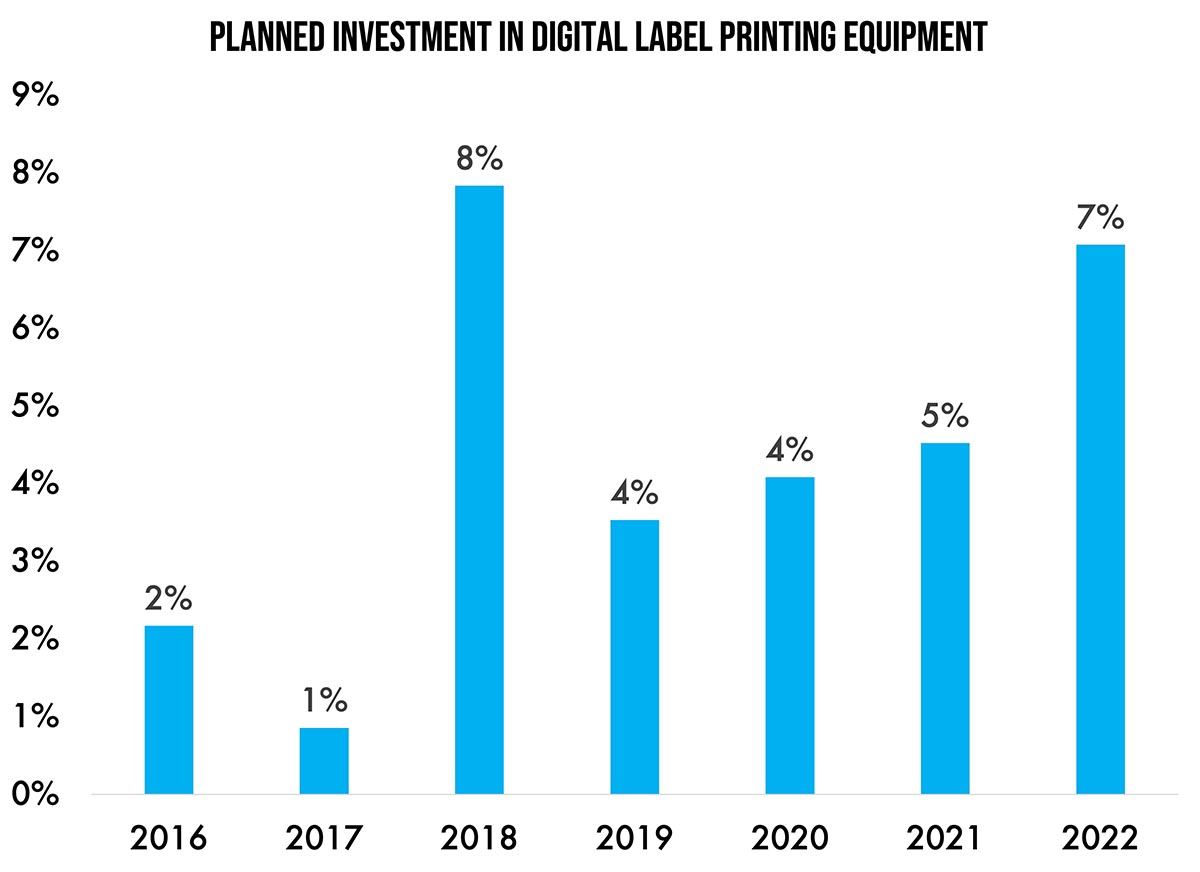

On the label printing side (see Figure 3), planned investment has been a little higher than packaging, averaging about 4% of commercial printers over the past seven years, although we have seen a modest rise since 2019, even accounting for 2020 (also note that the bars are not equal due to rounding). Investment has tracked fairly closely with perceived opportunity, so we suspect that printers are more sure of an expansion into label printing than packaging in general. (Seeing something as new business opportunity doesn’t necessarily mean they are going to definitively pursue it.)

Figure 3. Planned investment in label printing equipment.

Source: WhatTheyThink Printing Outlook Surveys, 2016–2022

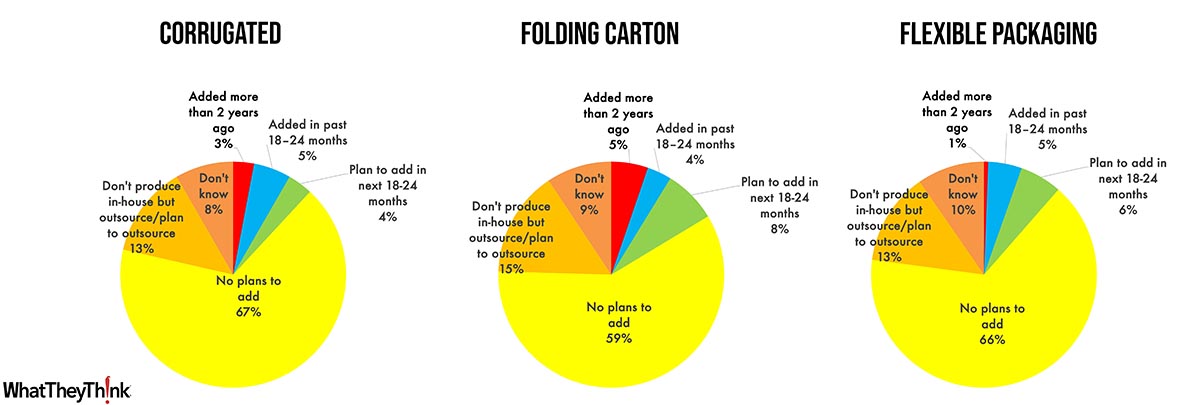

We also occasionally ask about specific expansion plans, and in Fall 2020 we asked about the extent to which they had already added—or planned to add—various packaging printing capabilities (see Figure 4). A modest number of printers have already added these capabilities, with an even more modest number looking to add them in the next 18 to 24 months. Generally, about two-thirds of print businesses have no plans to add packaging printing, although 13% to 15% will outsource it, which doesn’t preclude them adding these capabilities in-house at some point in the future. Admittedly, 2020 may not have been the best year to ask about these things (we will be revisiting this question in our Fall 2023 survey), but these numbers aren’t out of whack with the opportunities and investments data.

Figure 4. Interest in adding packaging printing equipment.

Source: WhatTheyThink Printing Outlook Survey, 2020

In some ways, packaging today is where wide format was a decade ago: an appealing prospect but with significant barriers to entry—and poised to take off as those barriers are lowered. What will the remainder of the decade bring? Stay tuned…