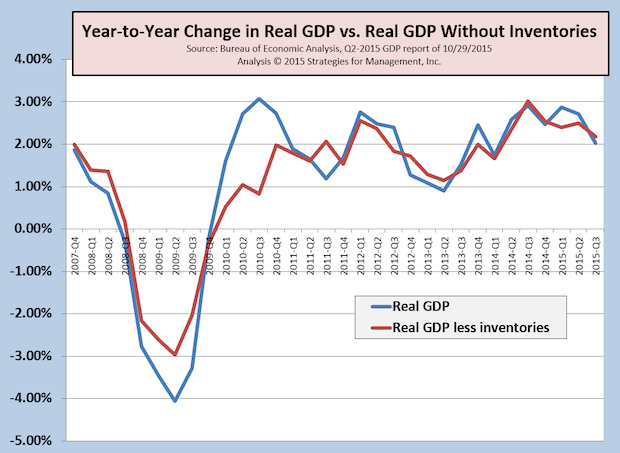

The advance estimate of third quarter 2015 real GDP is +1.5%. We much prefer the year-to-year comparison, and also without the fluctuations of inventories. Those figures, also indicated in the chart, are +2.03% and +2.18% respectively. Net inventories have been running very high, but in the third quarter were $56.8 billion. This figure was cut in half from Q2, and is close to the 2010 to 2014 average. Theoretically, net inventories should be zero when supply and demand are in perfect balance, but that is almost a chance occurrence. Inventory imbalances are usually cured by recessions. This is a better report, and better than many preview methods such as the Atlanta Fed's GDPNow had forecast the day before, at +1.1%. The advance estimate is just that: it is packed with estimates of estimates and becomes more certain as the figure goes through two more revisions. Using the year-to-year calculation, the economy peaked in 2010 and has been slow since then, coming close to that level only once. The economy appears to be slowing further now, with no sign of performing at the post-WW2 level of about +3.4%. Since the recovery beginning with Q3-2009, the economy has averaged +2.02% in real terms and +1.75% less inventories. Durable goods orders, released on October 28, have declined on a year-to-year basis for eight consecutive months. On a positive note, the GDP report shows that real personal consumption expenditures are up +3.2% compared to last year.