Data Analysis

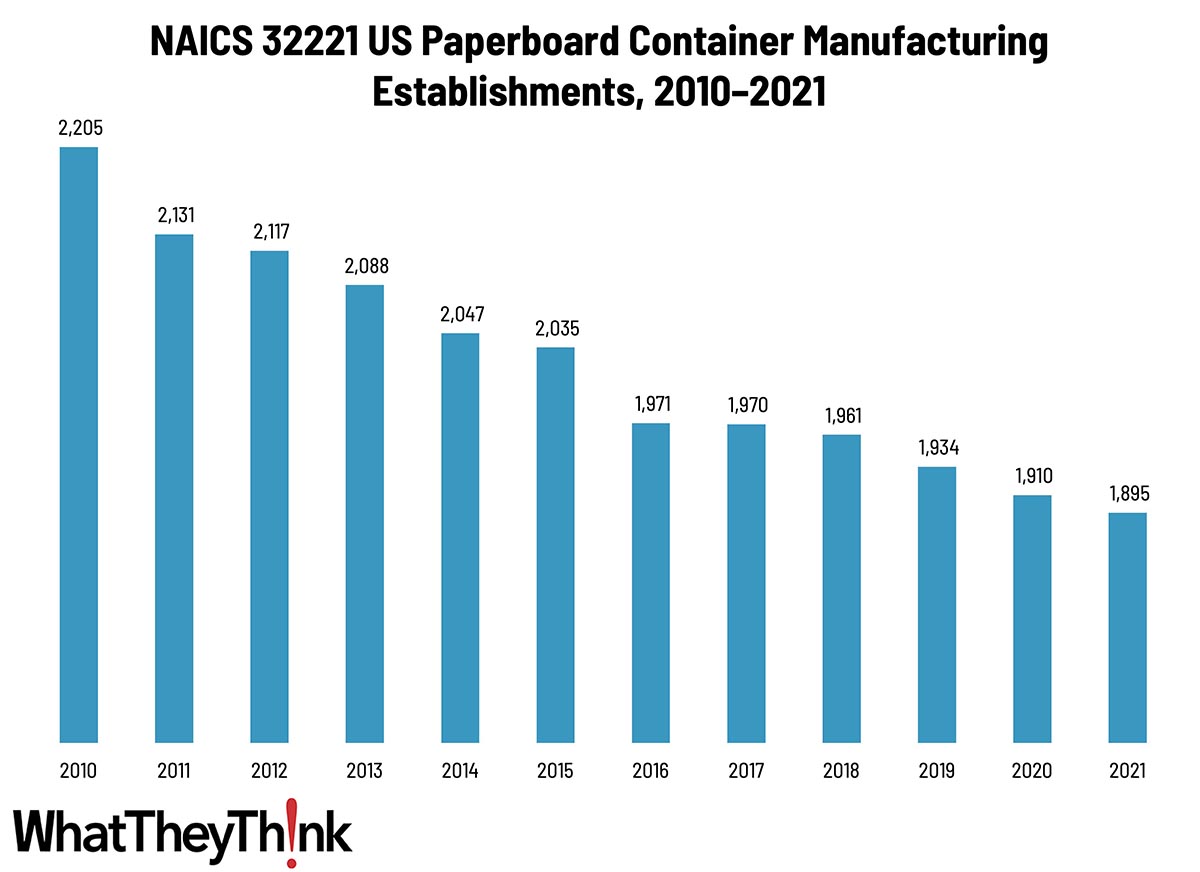

Paperboard Container Manufacturing Establishments—2010–2021

Published: May 10, 2024

According to County Business Patterns, in 2021 there were 1,895 establishments in NAICS 32221 (Paperboard Container Manufacturing). This category saw a net decrease of 15% since 2010. In macro news, early Q2 GDP predictions are bullish. Full Analysis

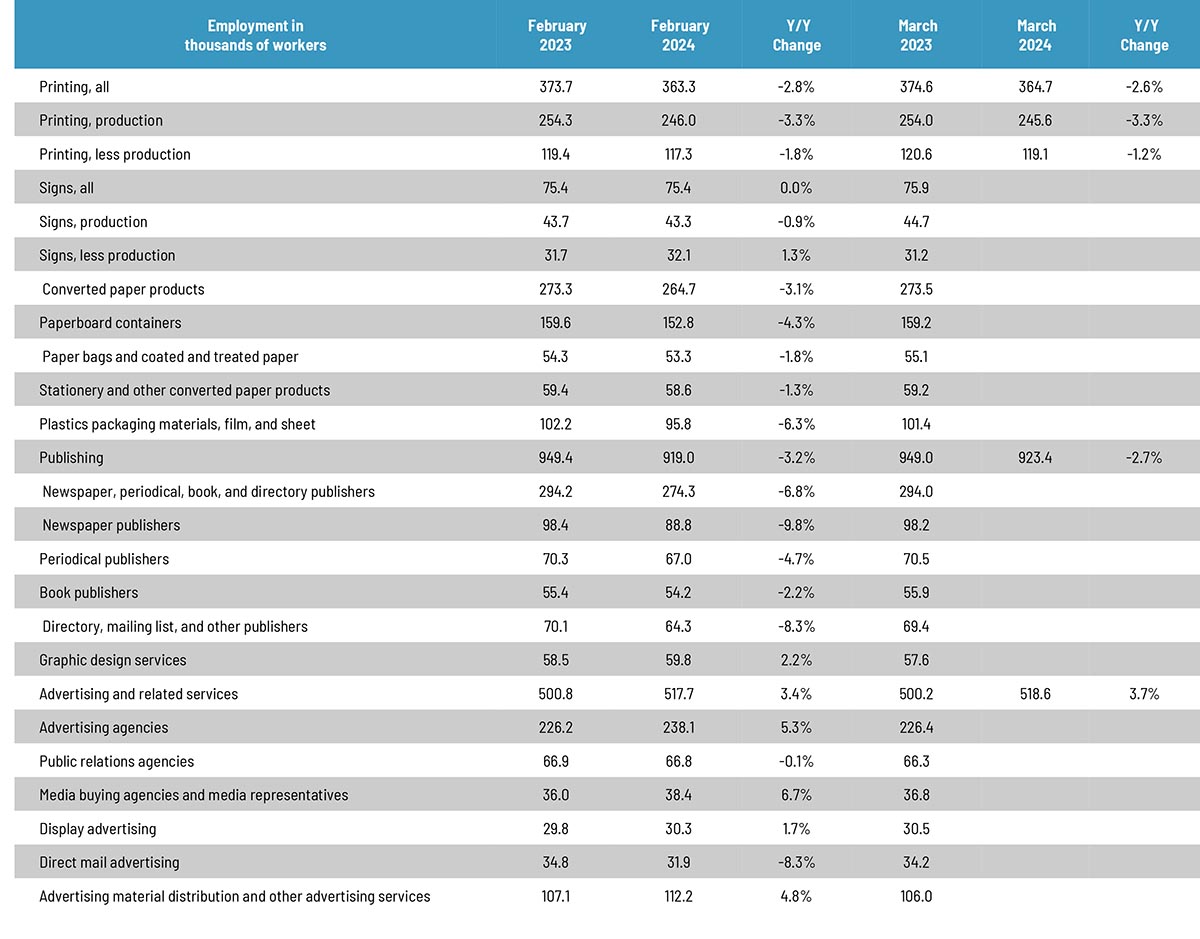

March Graphic Arts Employment A Mixed Bag

Published: May 3, 2024

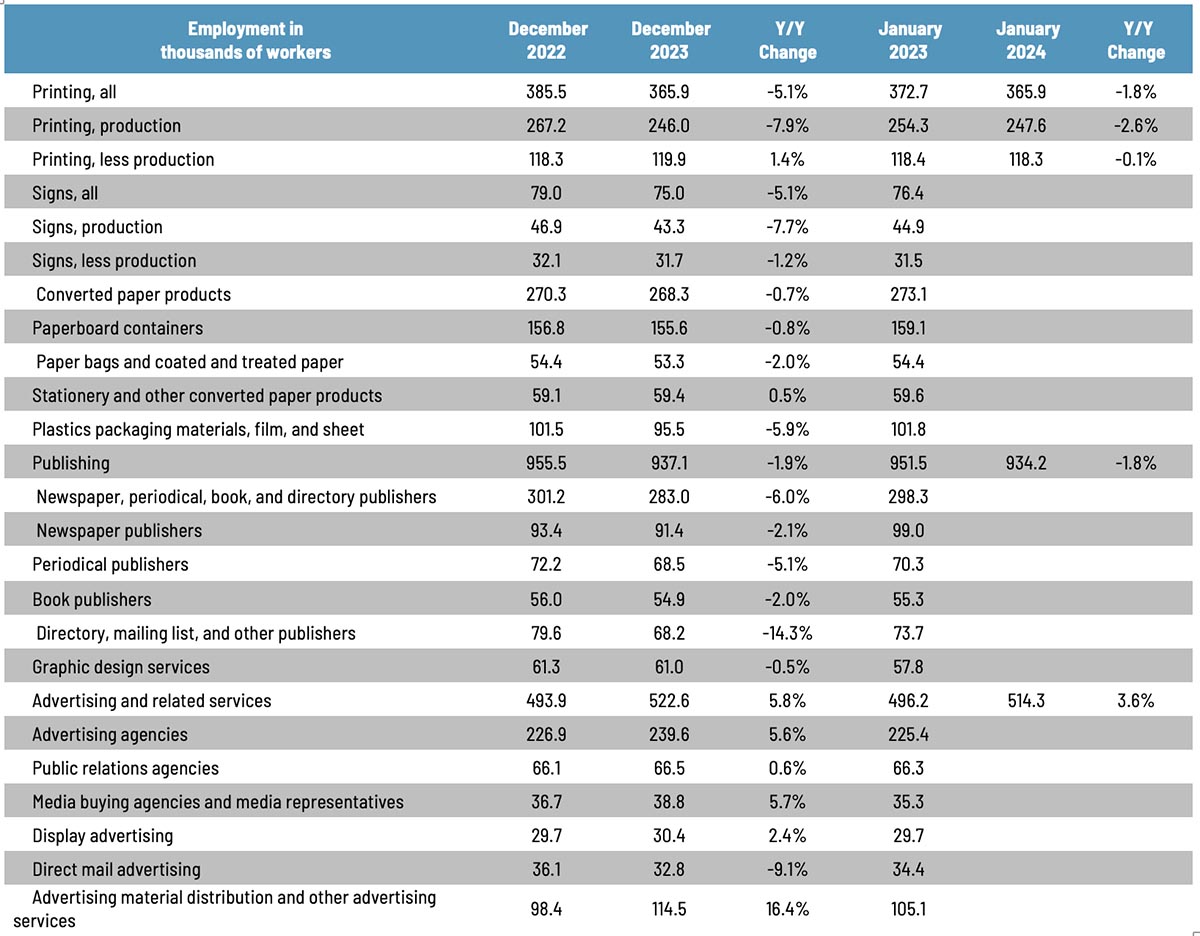

Overall printing employment in March 2024 was generally up—+0.4% from February—with production employment down -0.2% and non-production employment up +1.5%. Full Analysis

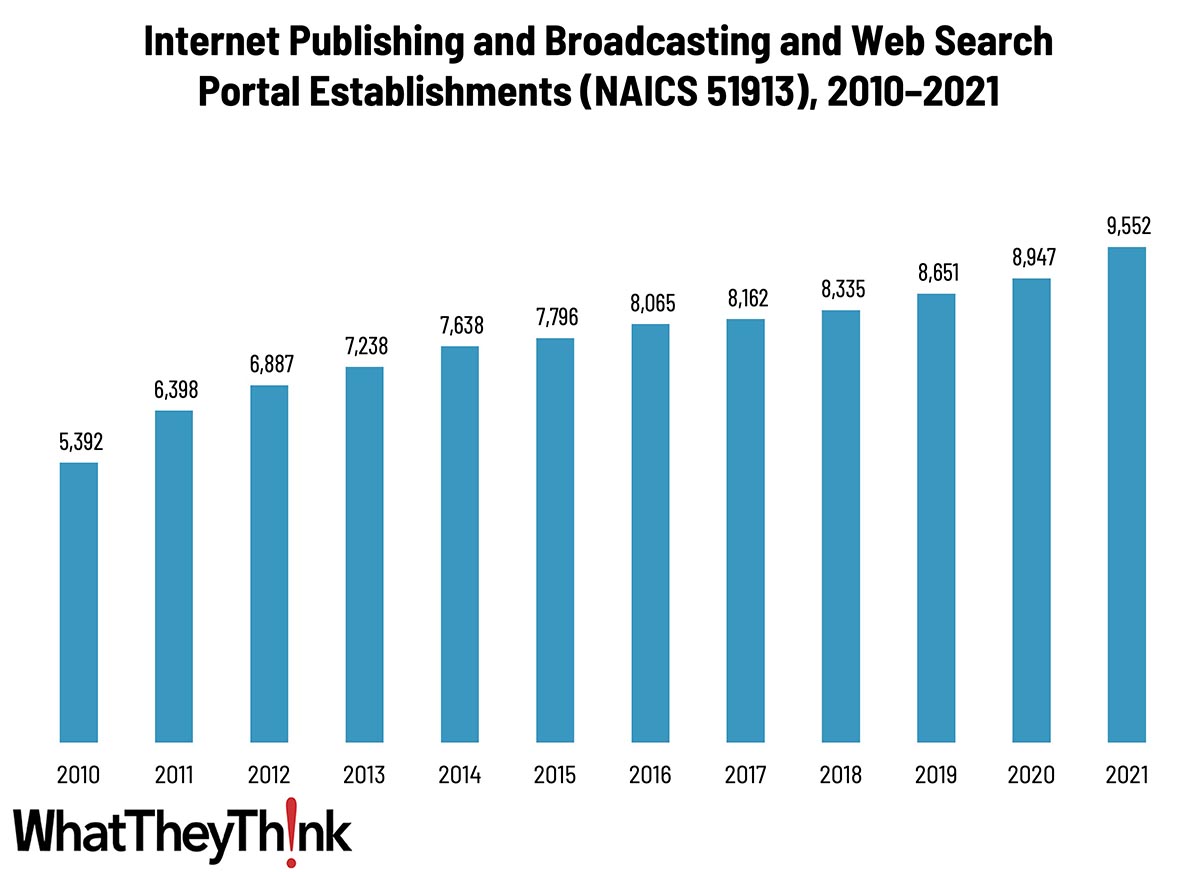

Internet Publishing and Broadcasting and Web Search Portal Establishments—2010–2021

Published: April 26, 2024

According to County Business Patterns, in 2020 there were 8,947 establishments in NAICS 51913 (Internet Publishing and Broadcasting and Web Search Portals). This category saw a net increase of 66% since 2010. In macro news, Q1 GDP is much lower than expected. Full Analysis

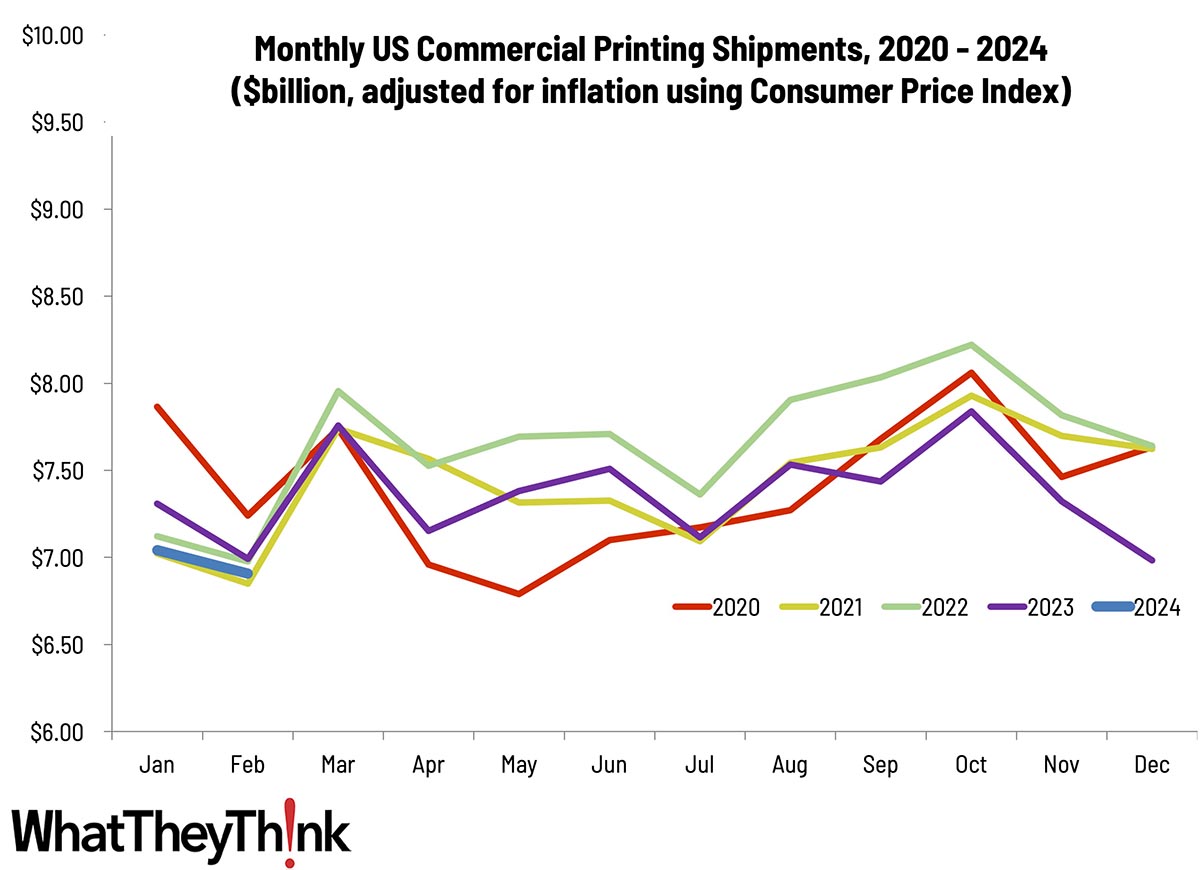

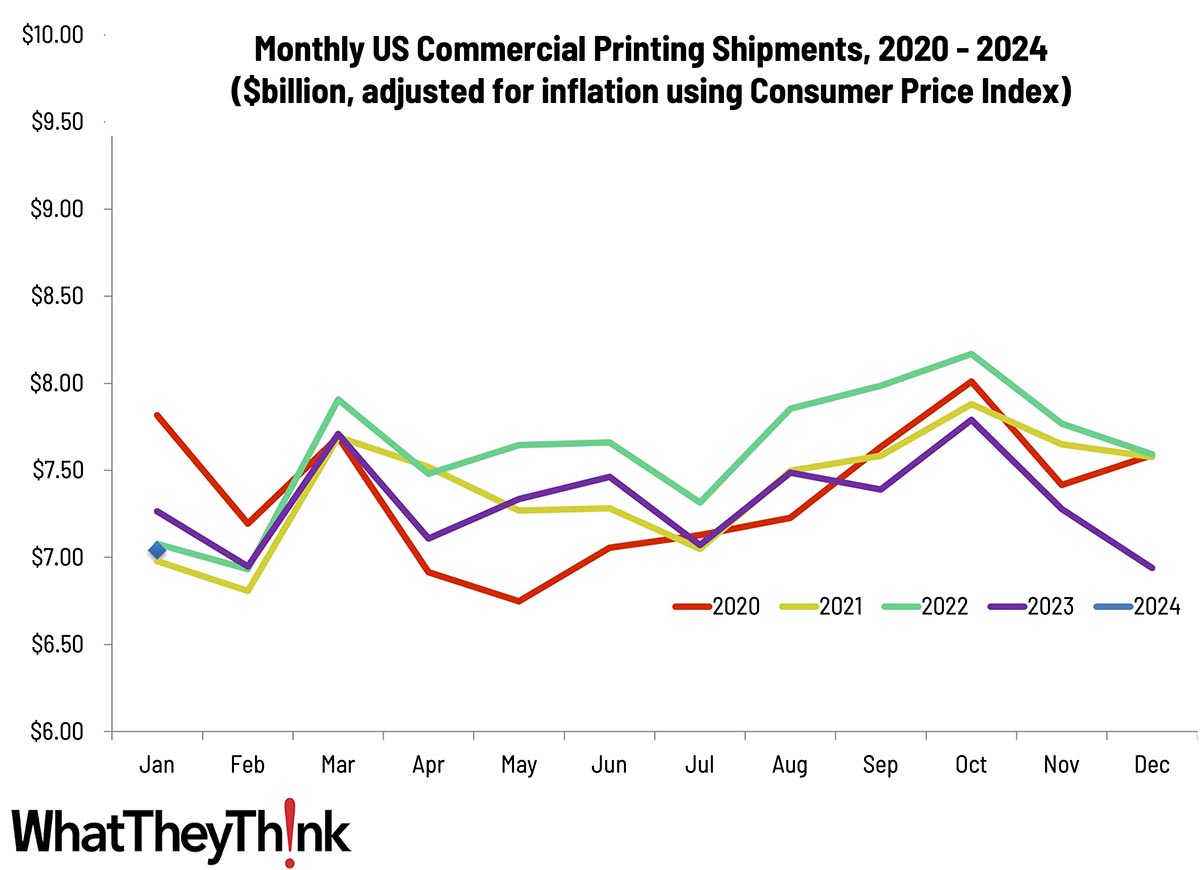

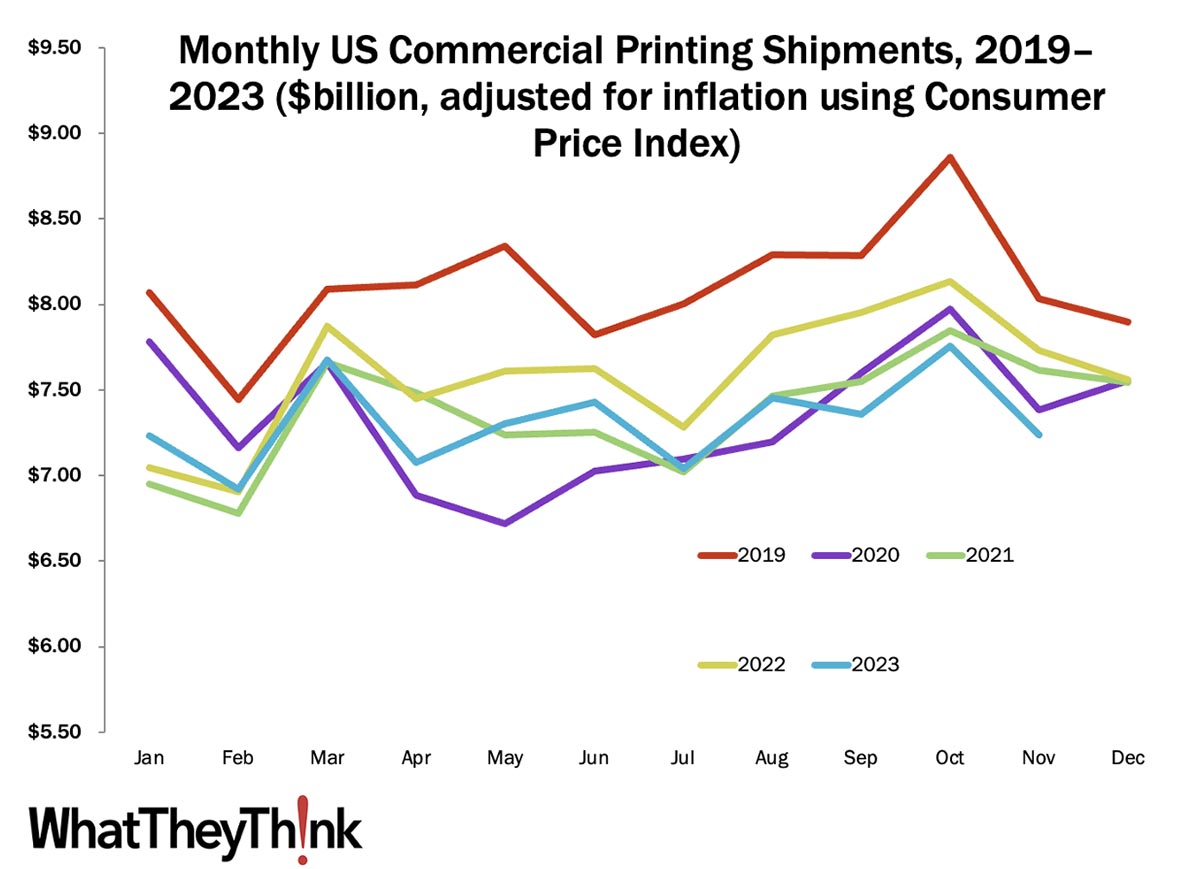

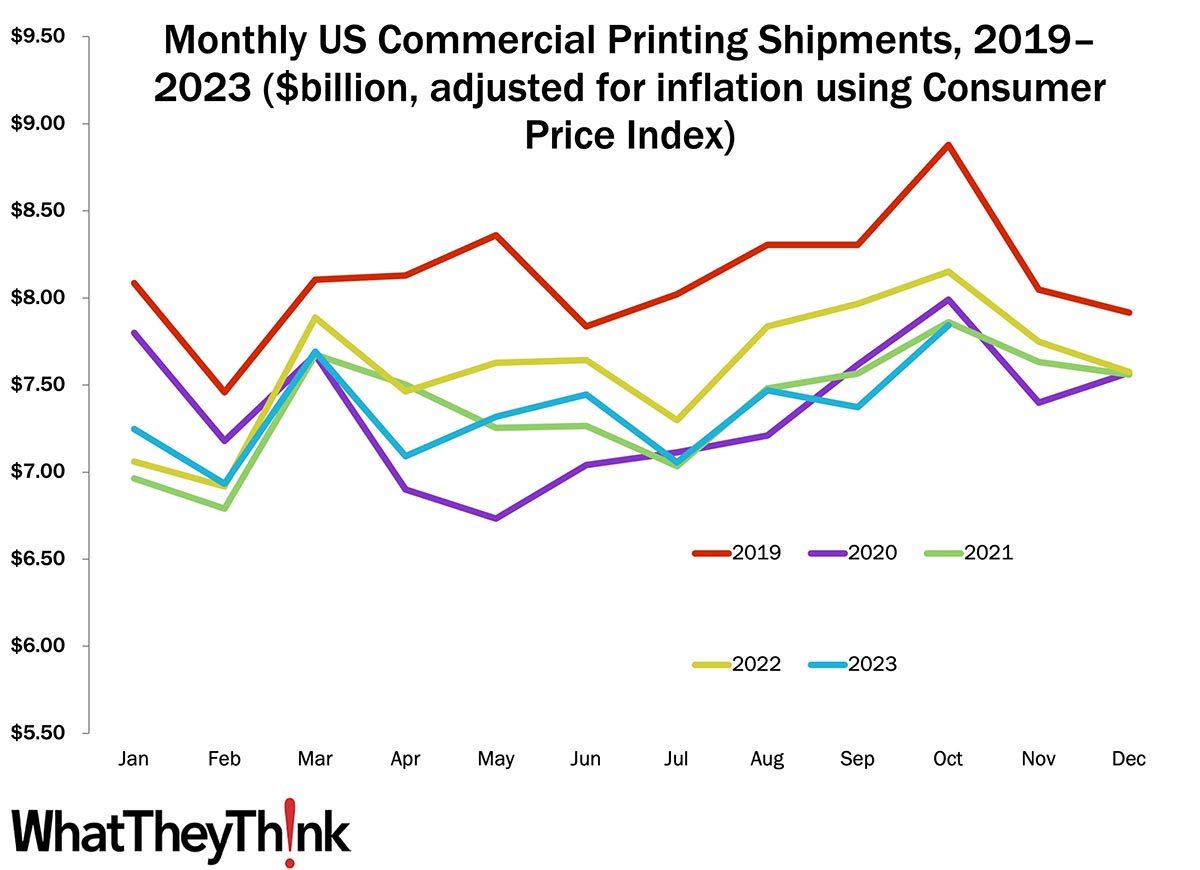

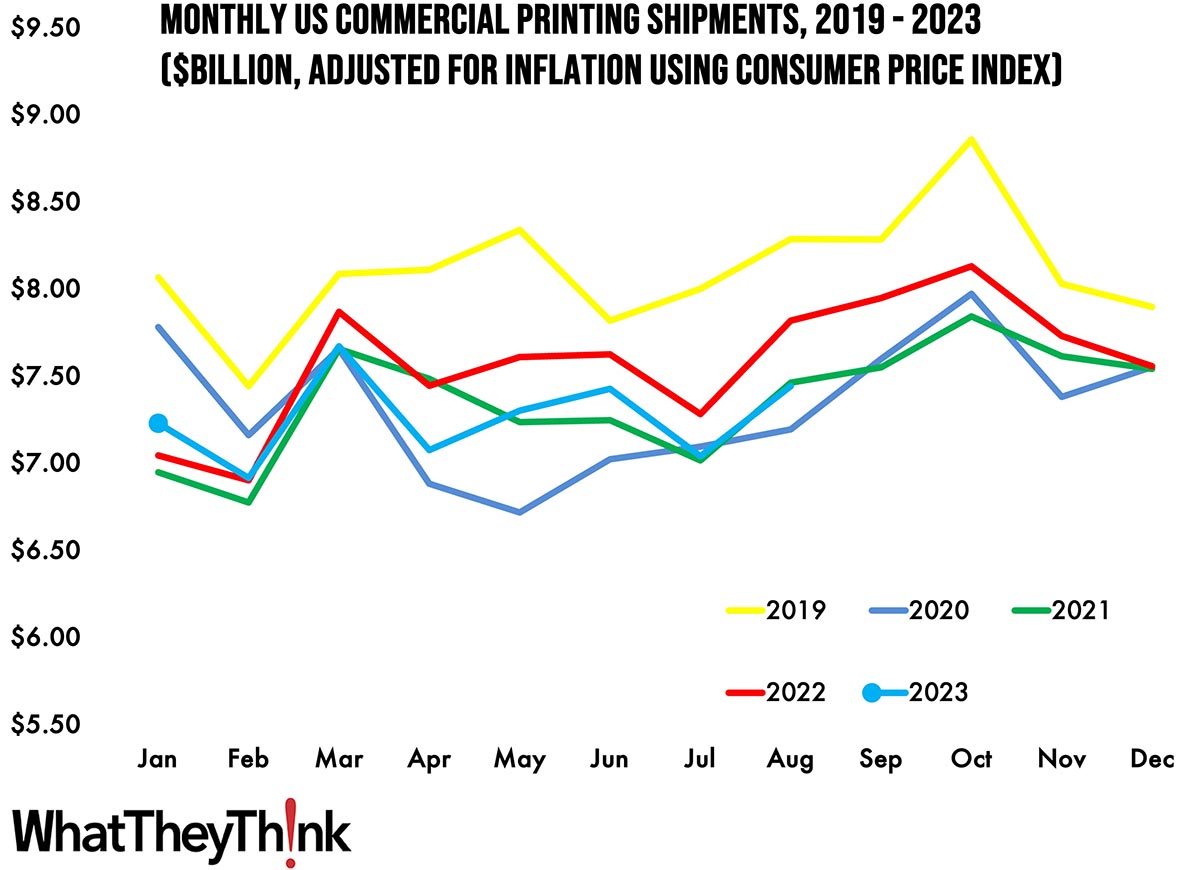

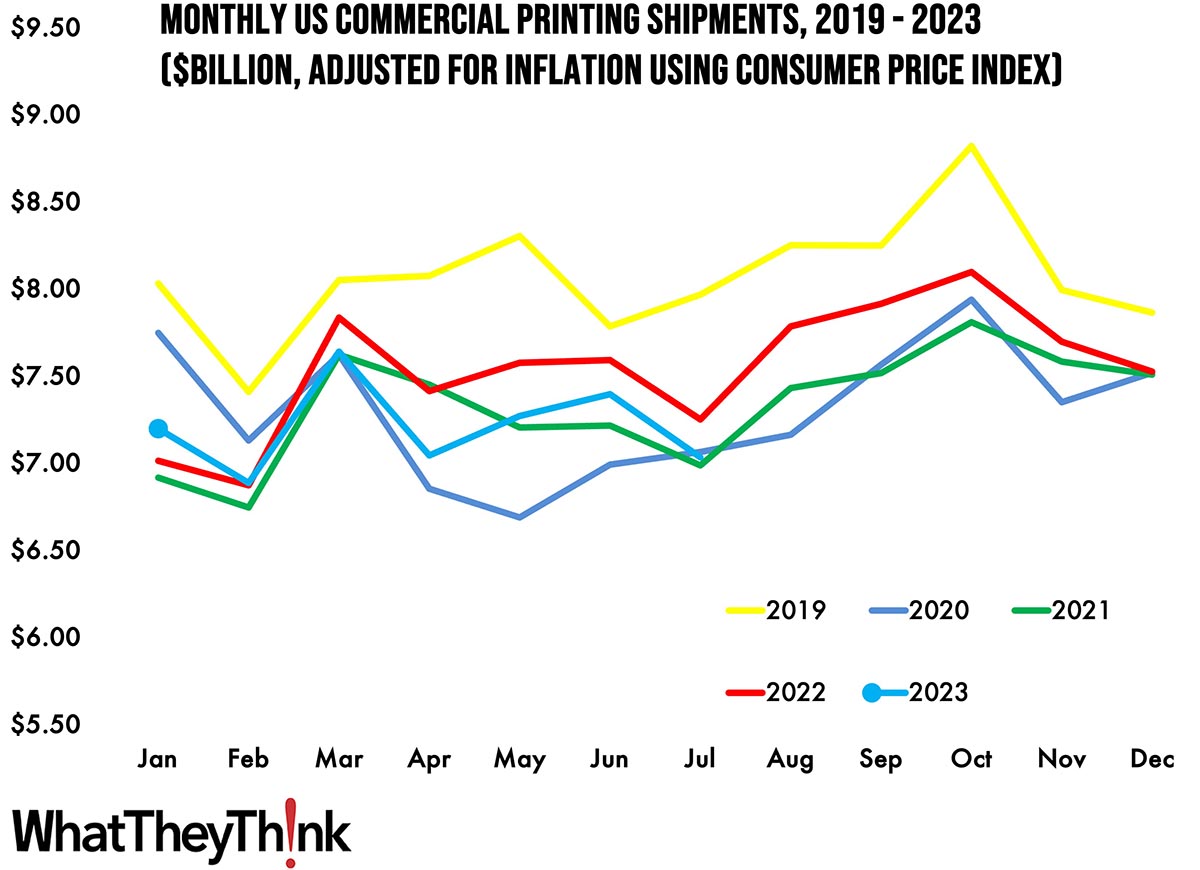

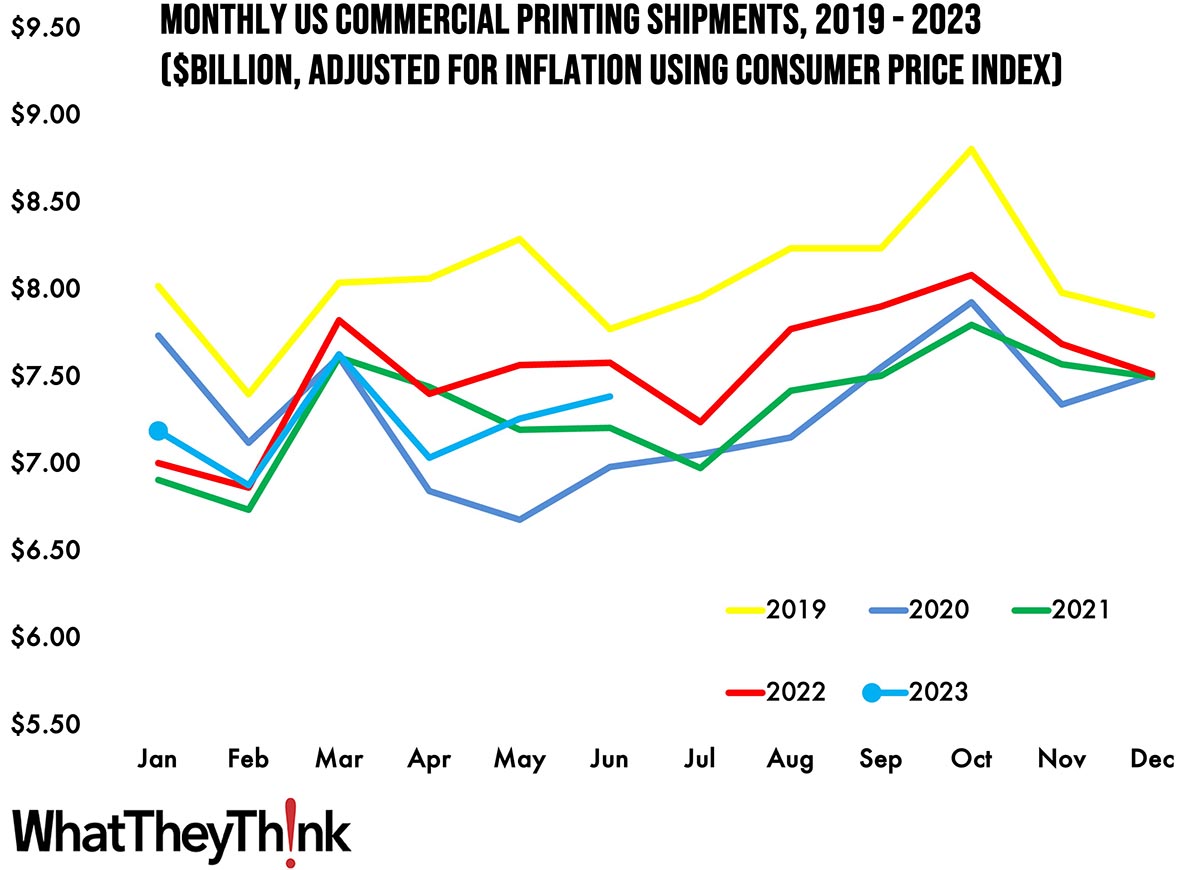

February Shipments: Well, At Least It’s Seasonal

Published: April 19, 2024

February 2024 shipments came in at $6.01 billion, down from January’s $7.04 billion—and right between February 2021 and 2022. Full Analysis

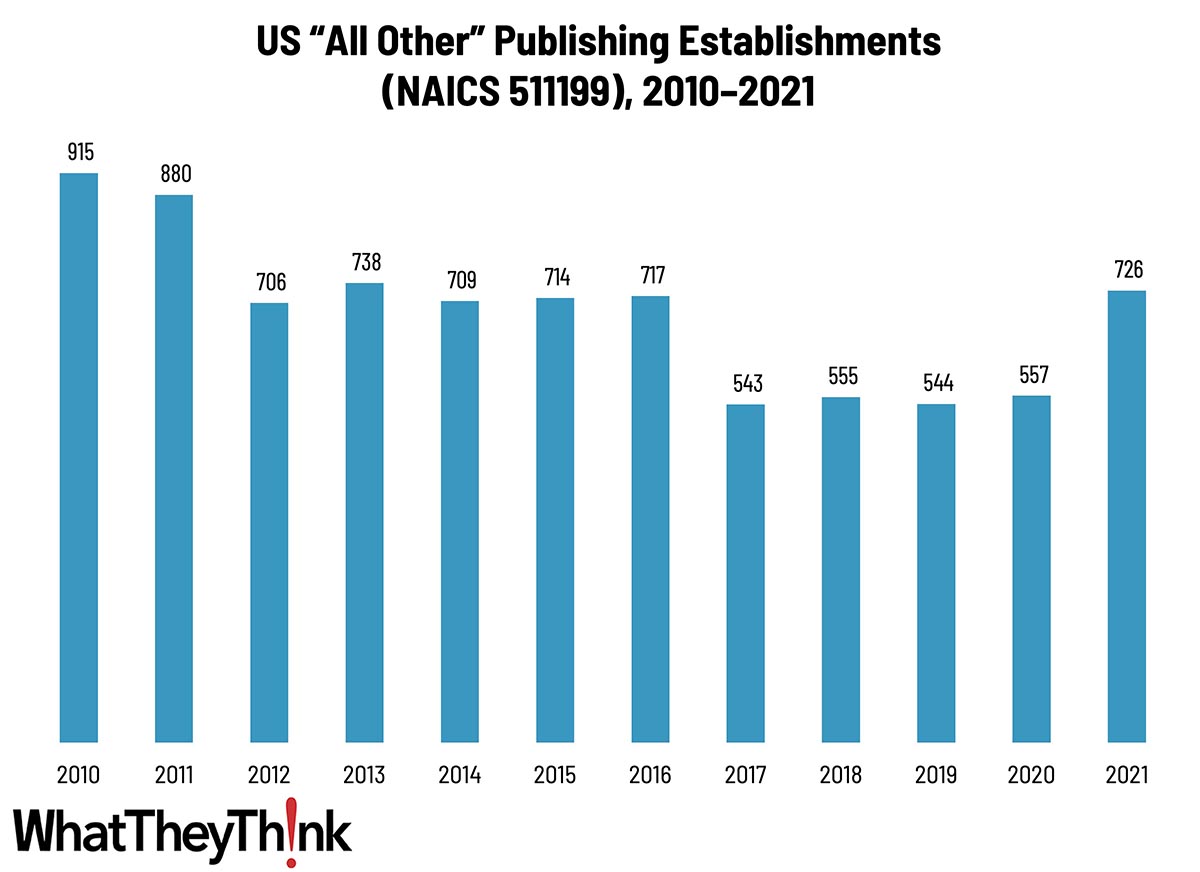

Assorted Publishing Establishments—2010–2021

Published: April 12, 2024

According to County Business Patterns, in 2021 there were 726 establishments in NAICS 511199 (All Other Publishing). This category saw a net decrease of 39% since 2010, although establishments spiked from 2020 to 2021. In macro news, estimates of Q1 GDP are running around +2%. Full Analysis

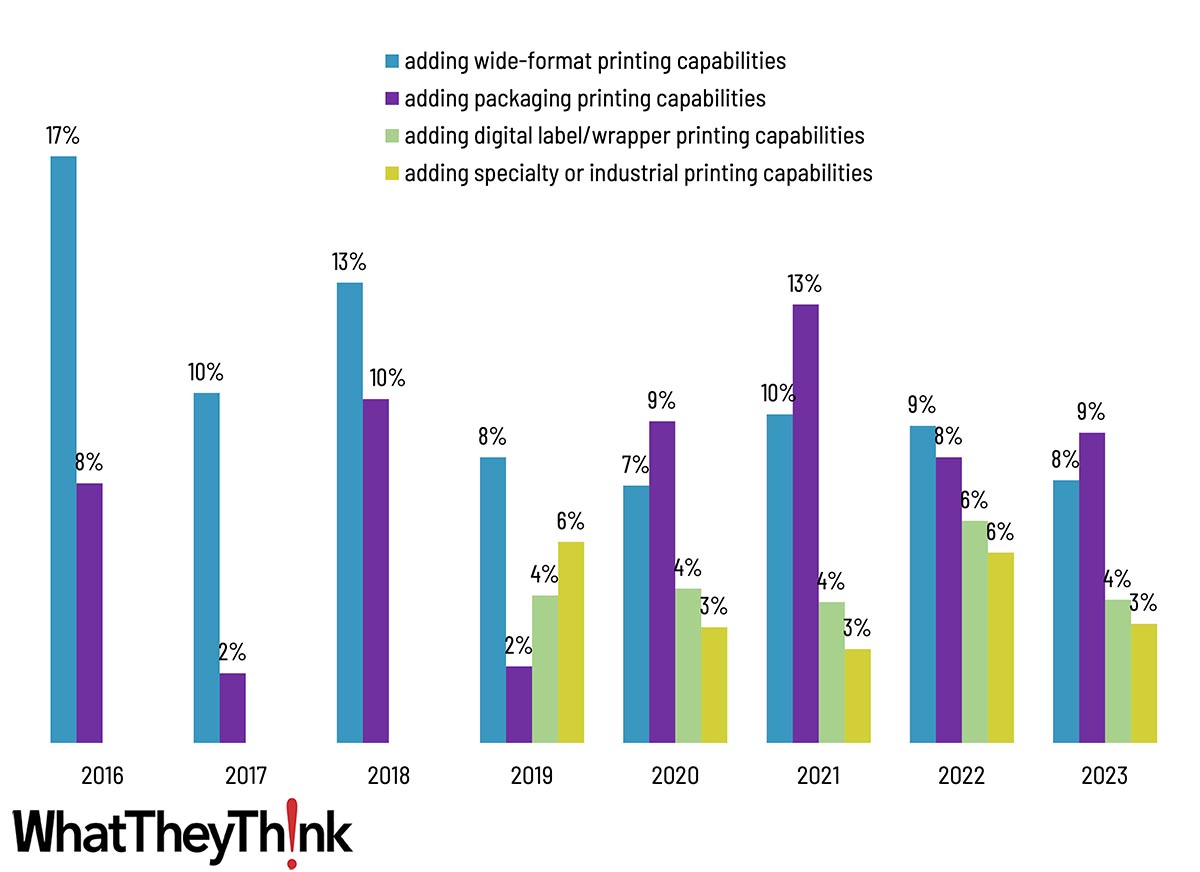

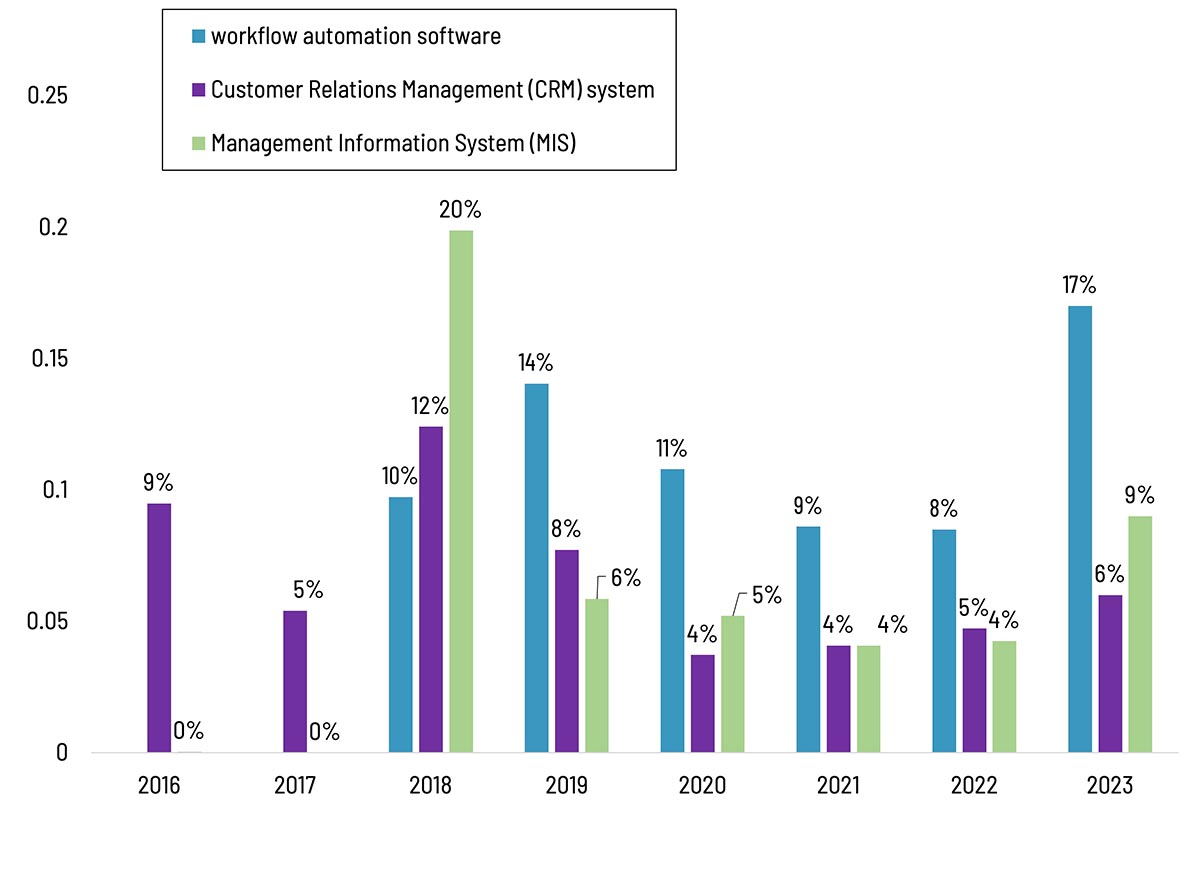

Tales from the Database: These Are Not the Applications You’re Looking For

Published: April 5, 2024

Drawing on six years’ worth of Print Business Outlook surveys, our “Tales from the Database” series looks at historical data to see if we can spot any particular hardware, software, or business trends. This issue, we turn our attention to specialty printing—or any printing beyond traditional offset or digital commercial work. Full Analysis

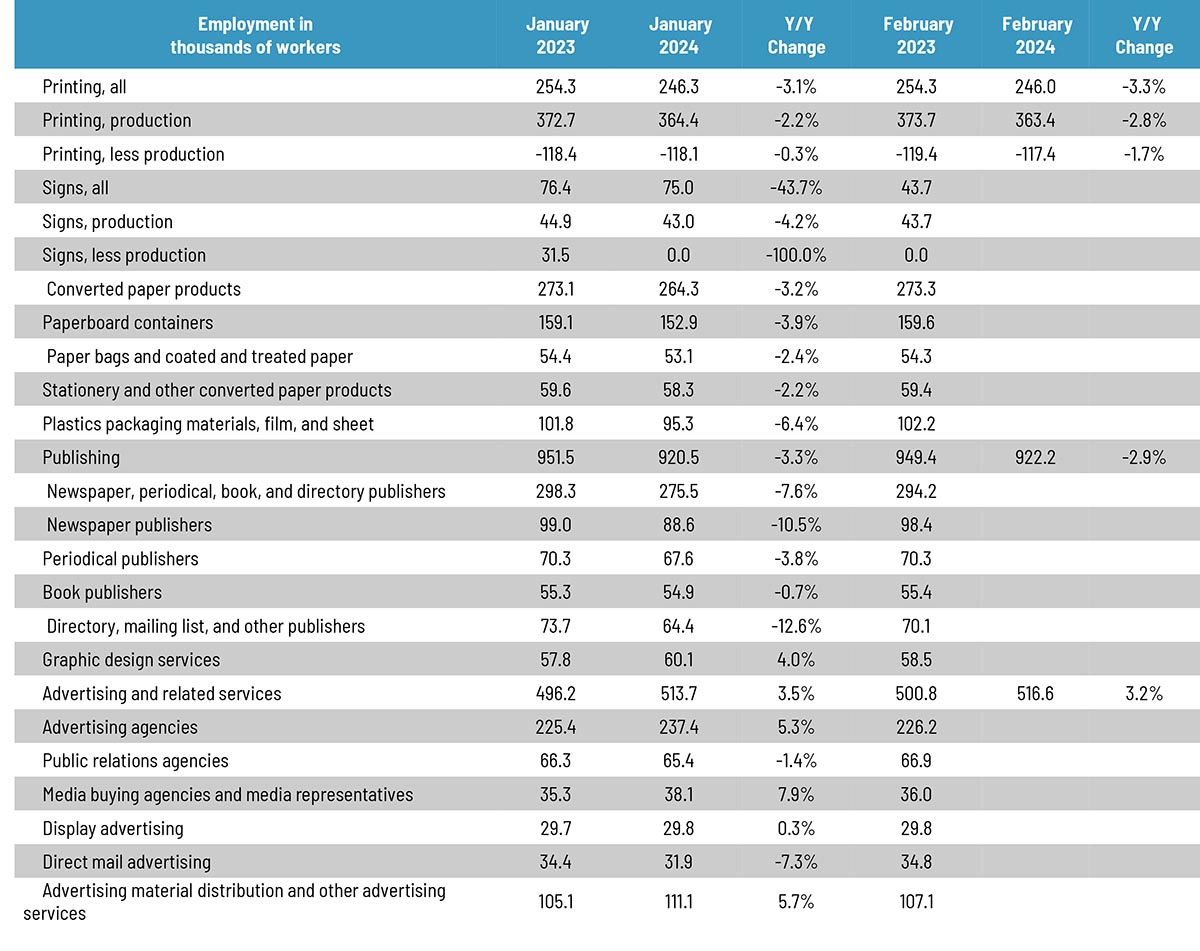

February Graphic Arts Employment Remains Generally Flat

Published: March 29, 2024

Overall printing employment in February 2024 was little changed from January, with production employment down -1.0%, while non-production employment was down -0.6%, with net employment down -0.1%. Full Analysis

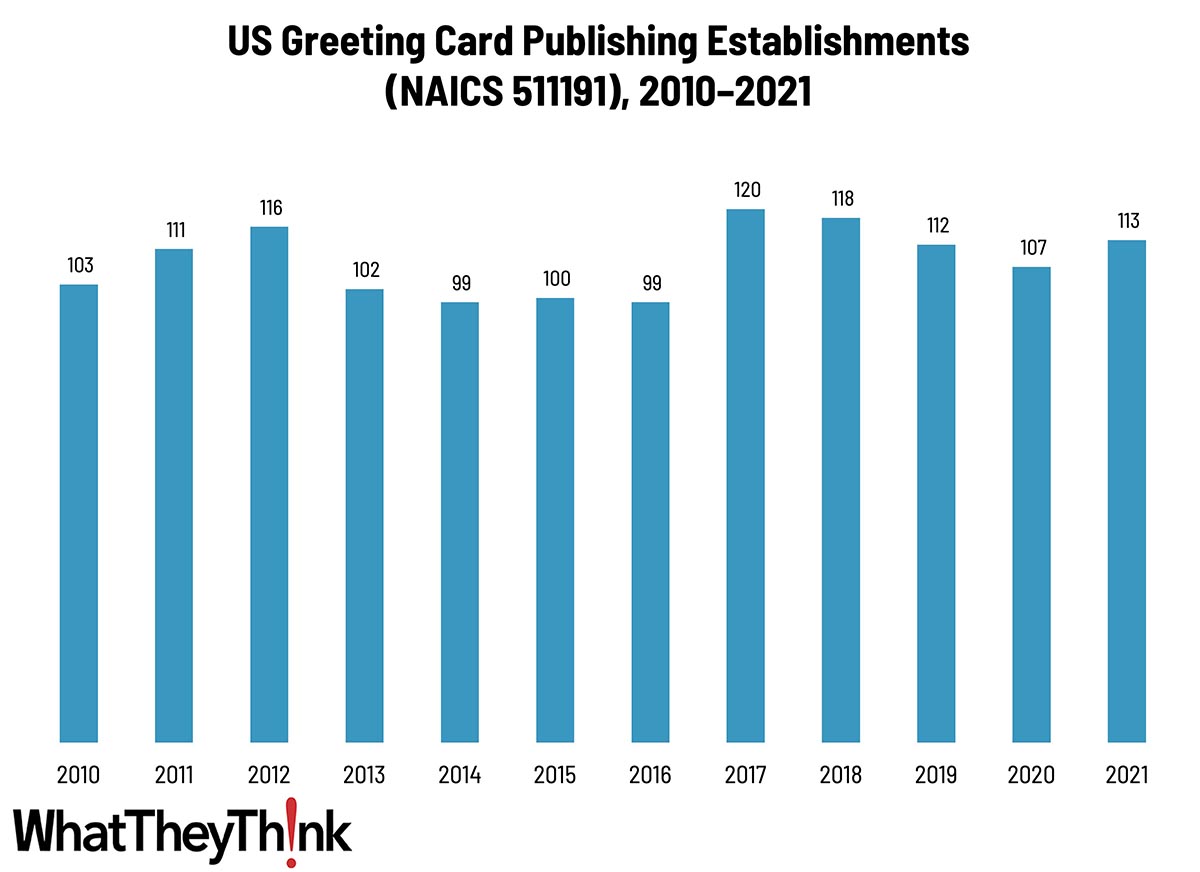

Greeting Card Publishing Establishments—2010–2021

Published: March 22, 2024

According to the latest edition of County Business Patterns, in 2021 there were 113 establishments in NAICS 511191 (Greeting Card Publishers). Although this represents a net increase of 10% since 2010, it has been a category that has ebbed and flowed over the course of the decade, although we’re not talking about a tremendous number of establishments. In macro news, inflation increased in February. Full Analysis

January Shipments: Back to Normal?

Published: March 15, 2024

January 2024 shipments came in at $7.04 billion, up from December’s $6.94 billion—and right between January 2021 and 2022. Full Analysis

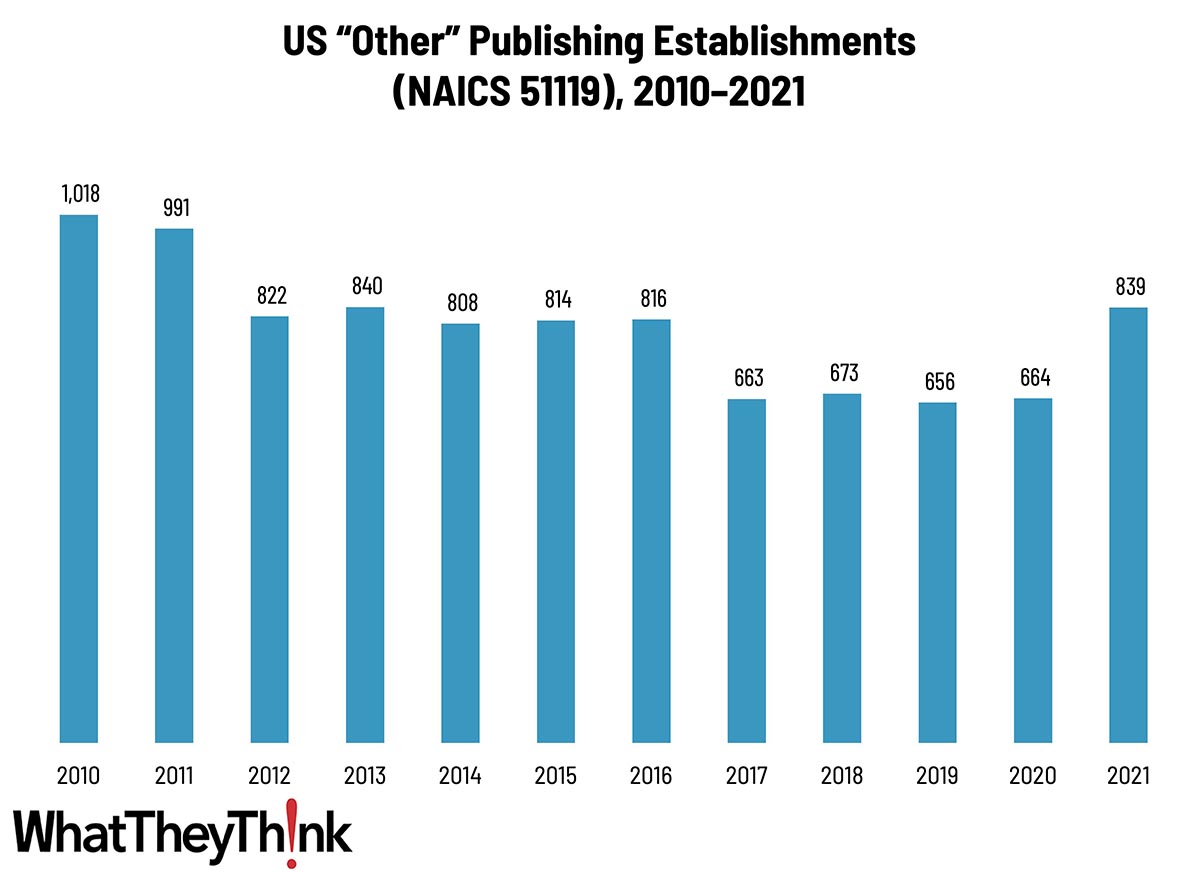

“Other” Publishing Establishments—2010–2021

Published: March 8, 2024

According to the latest edition of County Business Patterns, in 2021 there were 839 establishments in NAICS 51119 (Other Publishers). This represents a net decrease of 18% since 2010, but a 26% increase in the past year. In macro news, Q4 GDP was revised down slightly. Full Analysis

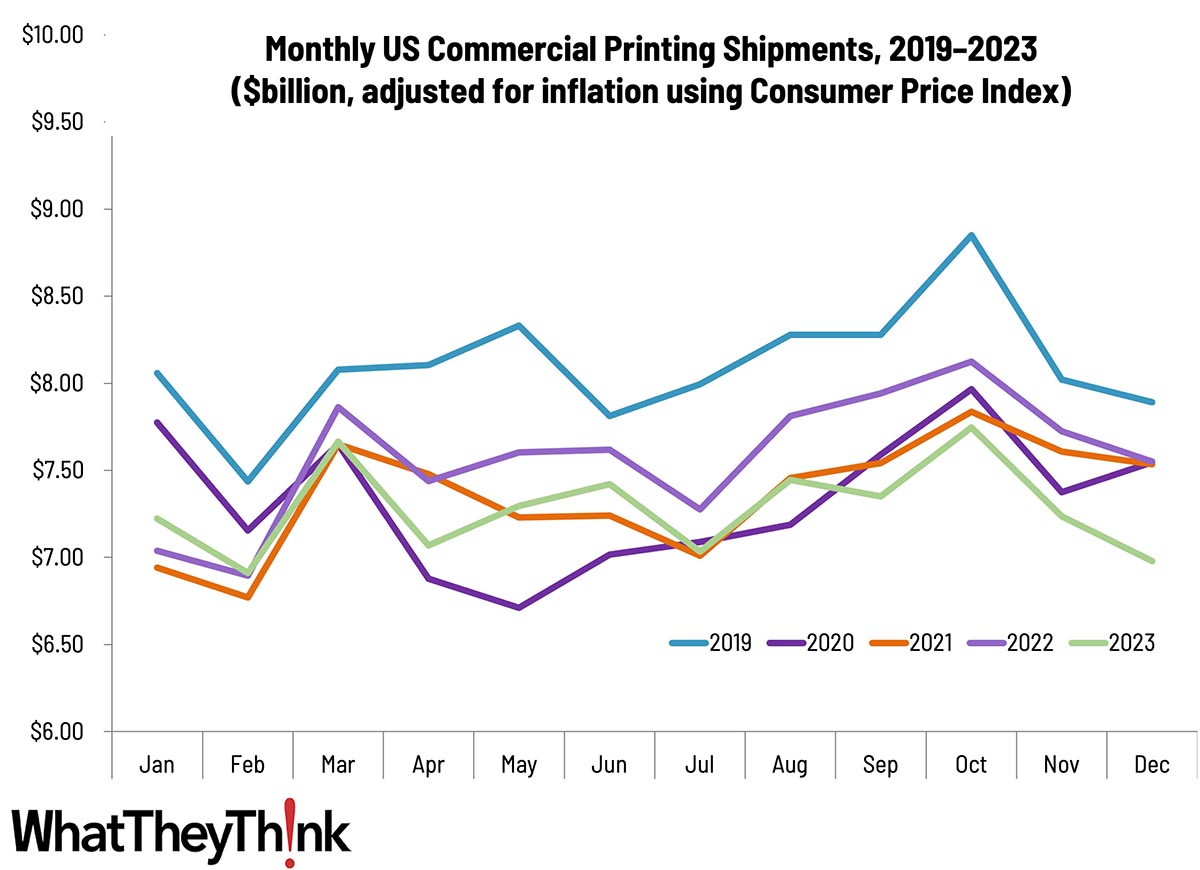

December Shipments: Ending the Year on a Low Note

Published: March 1, 2024

December 2023 shipments came in at $6.98 billion, down from November’s $7.24 billion—and, alas, the lowest of the year. Full Analysis

Directory and Mailing List Publishing Establishments—2010–2021

Published: February 23, 2024

According to the latest edition of County Business Patterns, in 2021 there were 548 establishments in NAICS 51114 (Directory and Mailing List Publishers). This represents a decrease of 67% since 2010. In macro news, retail sales dipped slightly in January. Full Analysis

January Graphic Arts Employment Generally Flat

Published: February 16, 2024

Overall printing employment in January 2024 was unchanged from December, with production employment up 0.7%, while non-production employment was down -1.3%. Full Analysis

Tales from the Database: Looking at the Cloud from Both Sides

Published: February 9, 2024

Drawing on eight years’ worth of Print Business Outlook surveys, our “Tales from the Database” series looks at historical data to see if we can glean any particular hardware, software, or business trends. This issue, we turn our attention to software—specifically, migration to the cloud. Full Analysis

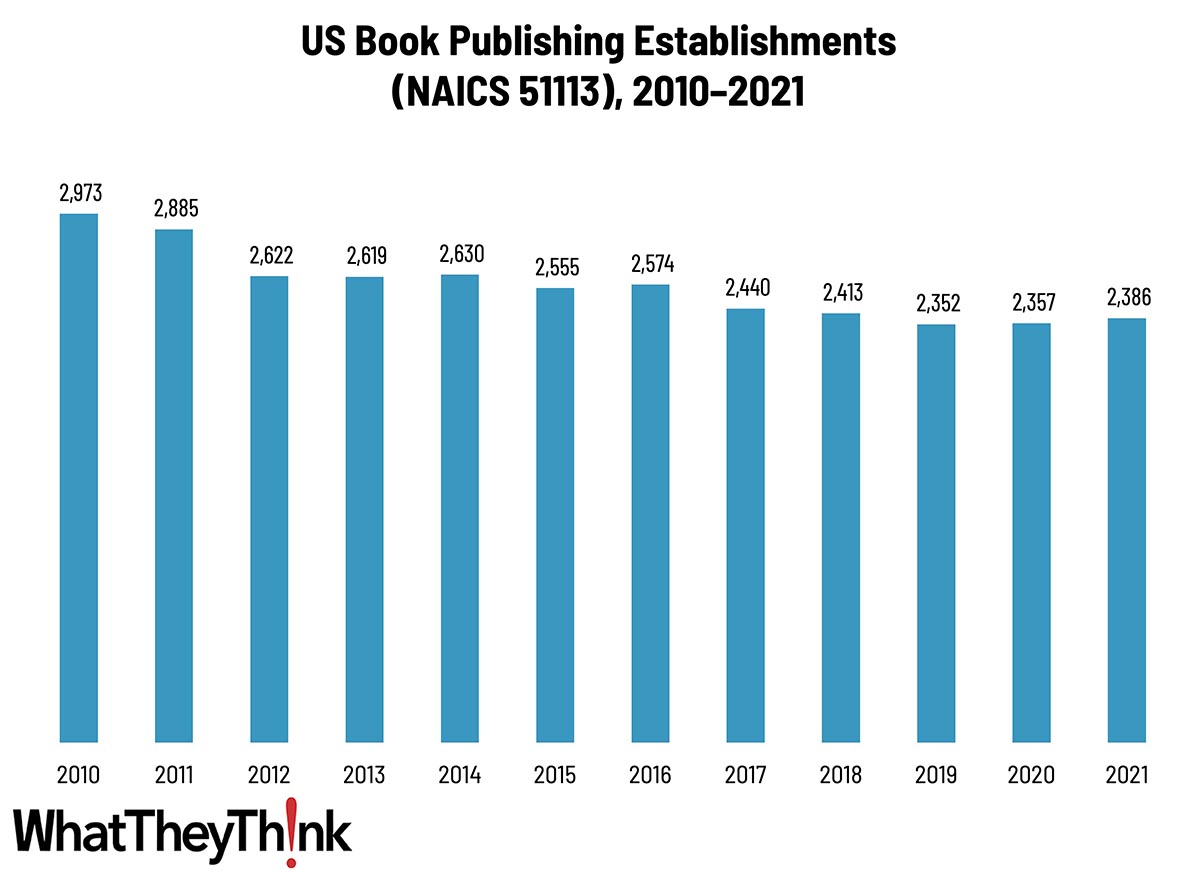

Book Publishing Establishments—2010–2021

Published: February 2, 2024

According to the latest edition of County Business Patterns, in 2021 there were 2,386 establishments in NAICS 51113 (Book Publishing). Although this represents a decrease of 20% since 2010, establishments ticked up by 29 establishments in 2021. In macro news, Q4 GDP grew 3.3%. Full Analysis

November Shipments: Tis the Season…

Published: January 26, 2024

November 2023 shipments came in at $7.24 billion, down from the year’s high of $7.76 billion a month earlier. Full Analysis

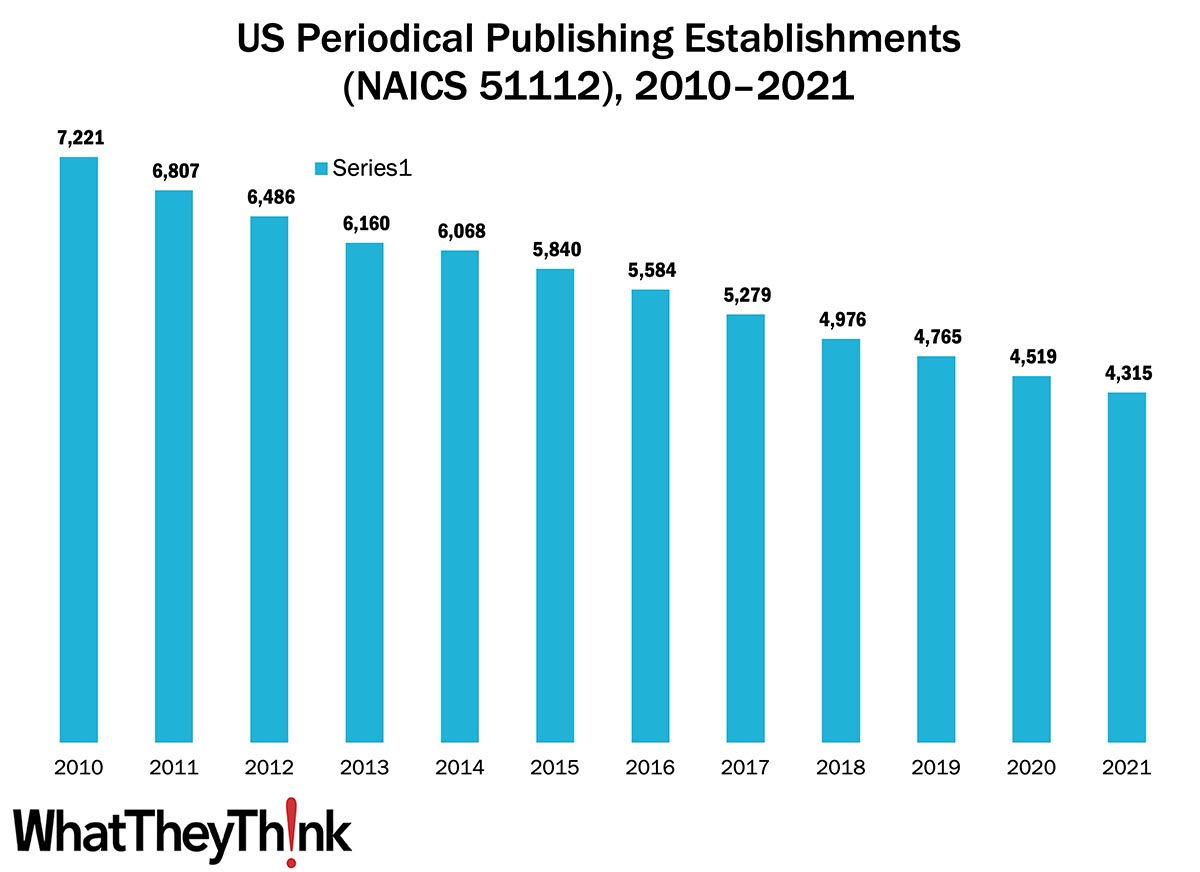

Periodical Publishing Establishments—2010–2021

Published: January 19, 2024

According to the latest edition of County Business Patterns, in 2021 there were 4,315 establishments in NAICS 51112 (Periodical Publishing). This represents a decrease of 40% since 2010. In macro news, December retail sales were up from November. Full Analysis

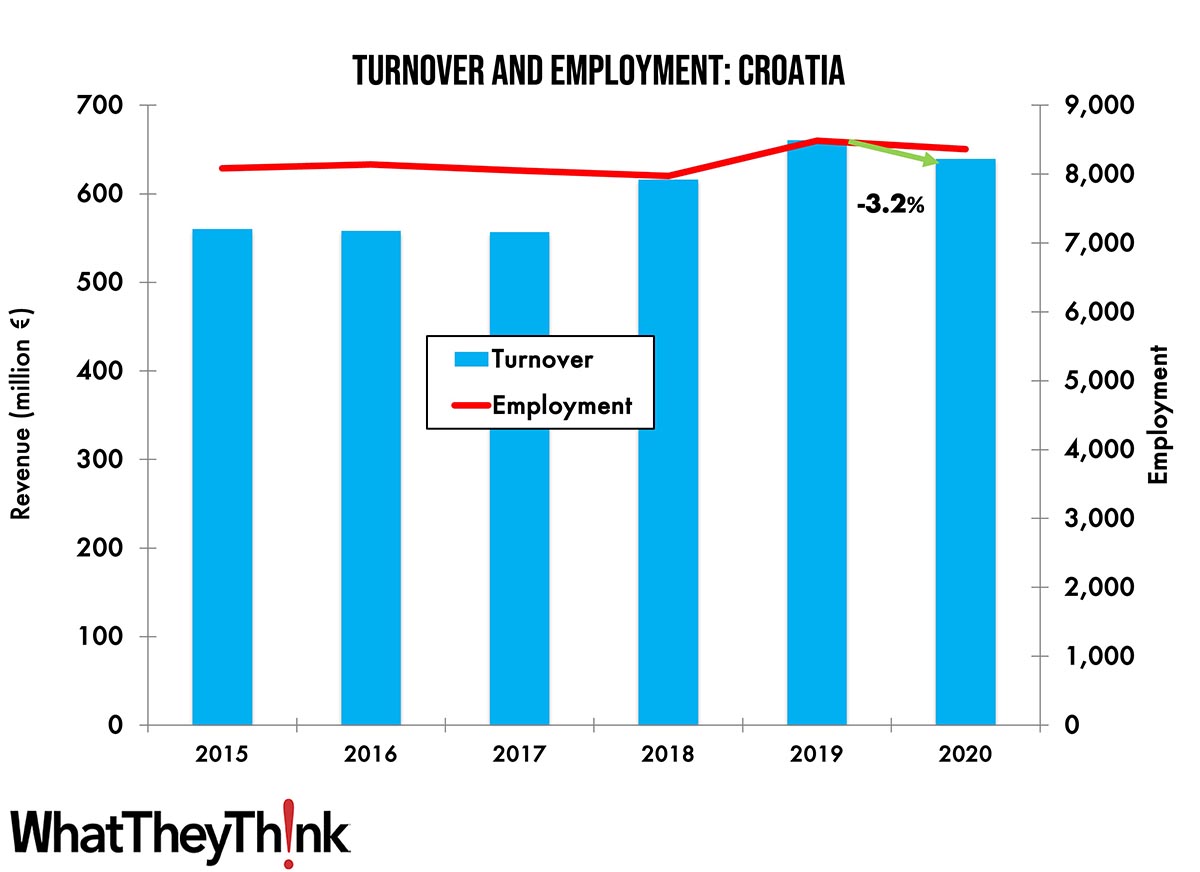

Turnover and Employment in Print in Europe—Croatia

Published: January 16, 2024

This bi-weekly series of short articles aims to shed a spotlight on the size of the printing industry in Europe per country and how revenues and employment developed in 2020, when the pandemic impacted businesses. In this final installment, we look at Croatia, which ranks at number 19 among the printing industries by turnover in Europe. Full Analysis

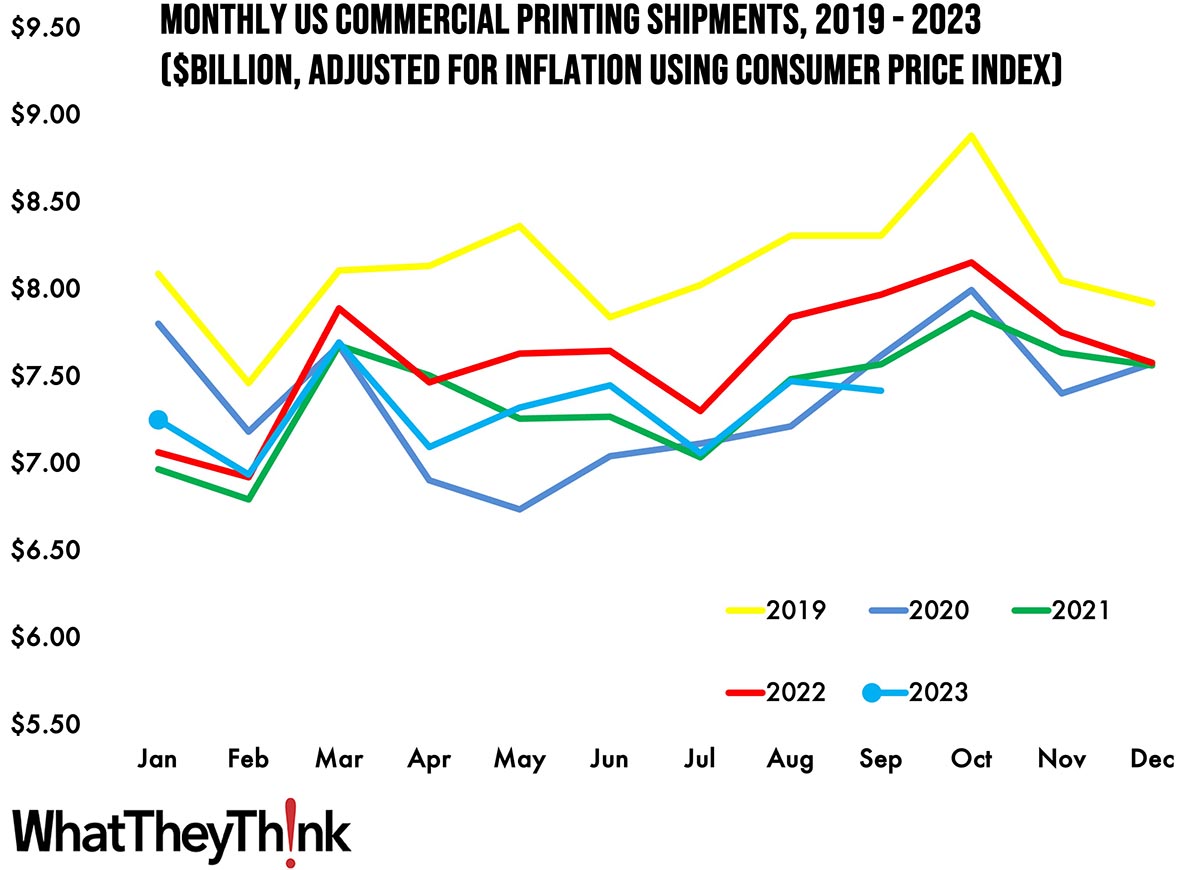

October Shipments: Peak Performance

Published: January 12, 2024

October 2023 printing shipments came in at $7.84 billion, up from September’s $7.37 billion. Full Analysis

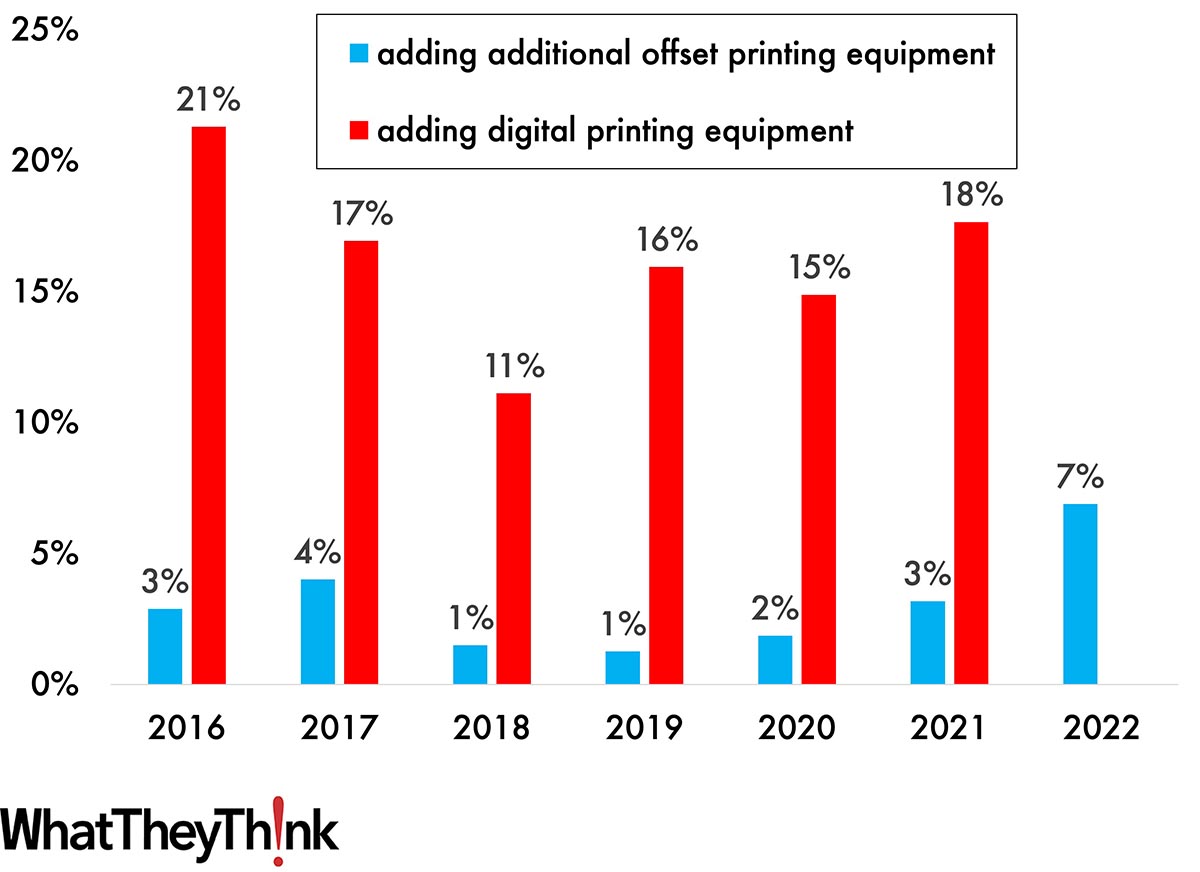

Tales from the Database: Prints Charming

Published: December 15, 2023

Drawing on six years’ worth of Print Business Outlook surveys, our “Tales from the Database” series looks at historical data to see if we can spot any particular hardware, software or business trends. In this installment, we turn our attention to printing technologies. Full Analysis

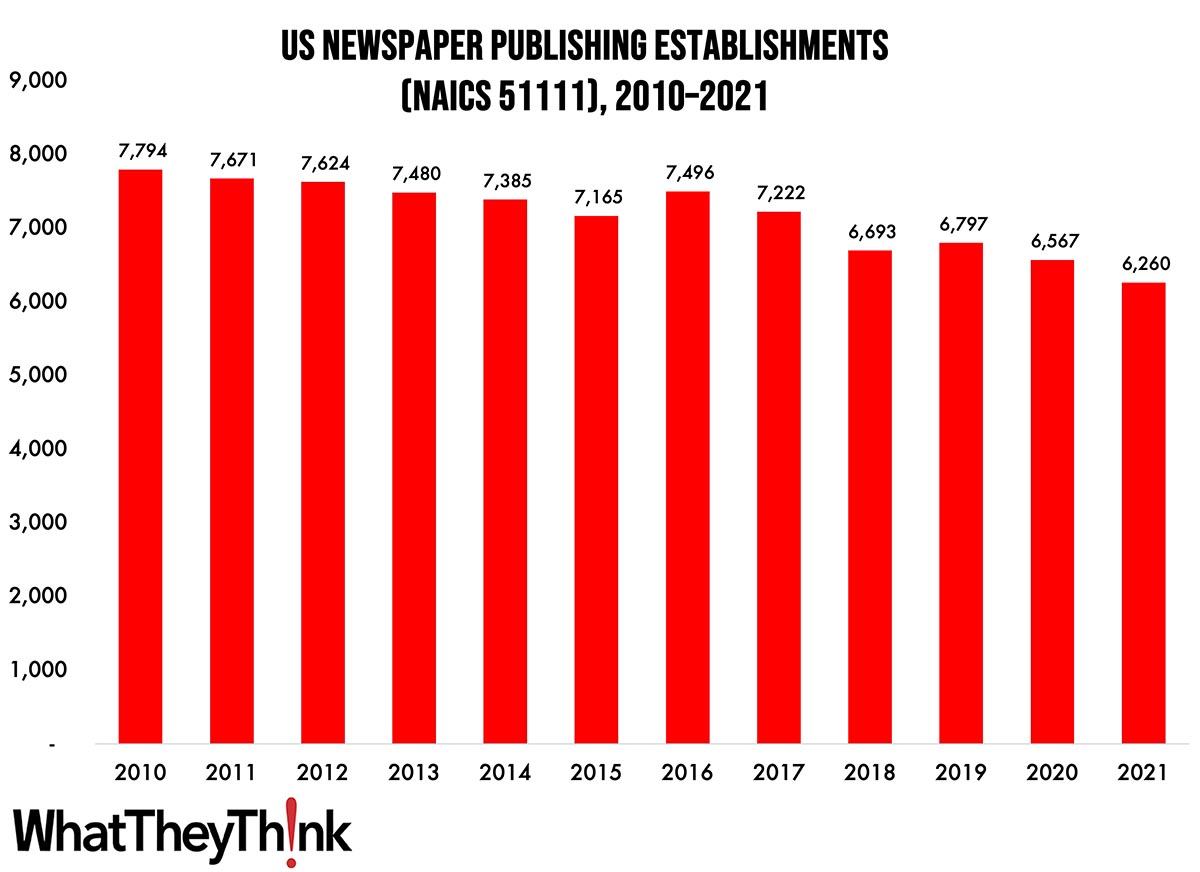

Newspaper Publishing Establishments—2010–2021

Published: December 8, 2023

According to the latest, recently released edition of County Business Patterns, in 2021 there were 6,260 establishments in NAICS 51111 (Newspaper Publishing). This represents a decrease of 20% since 2010. In macro news, what is going on with GDP? Full Analysis

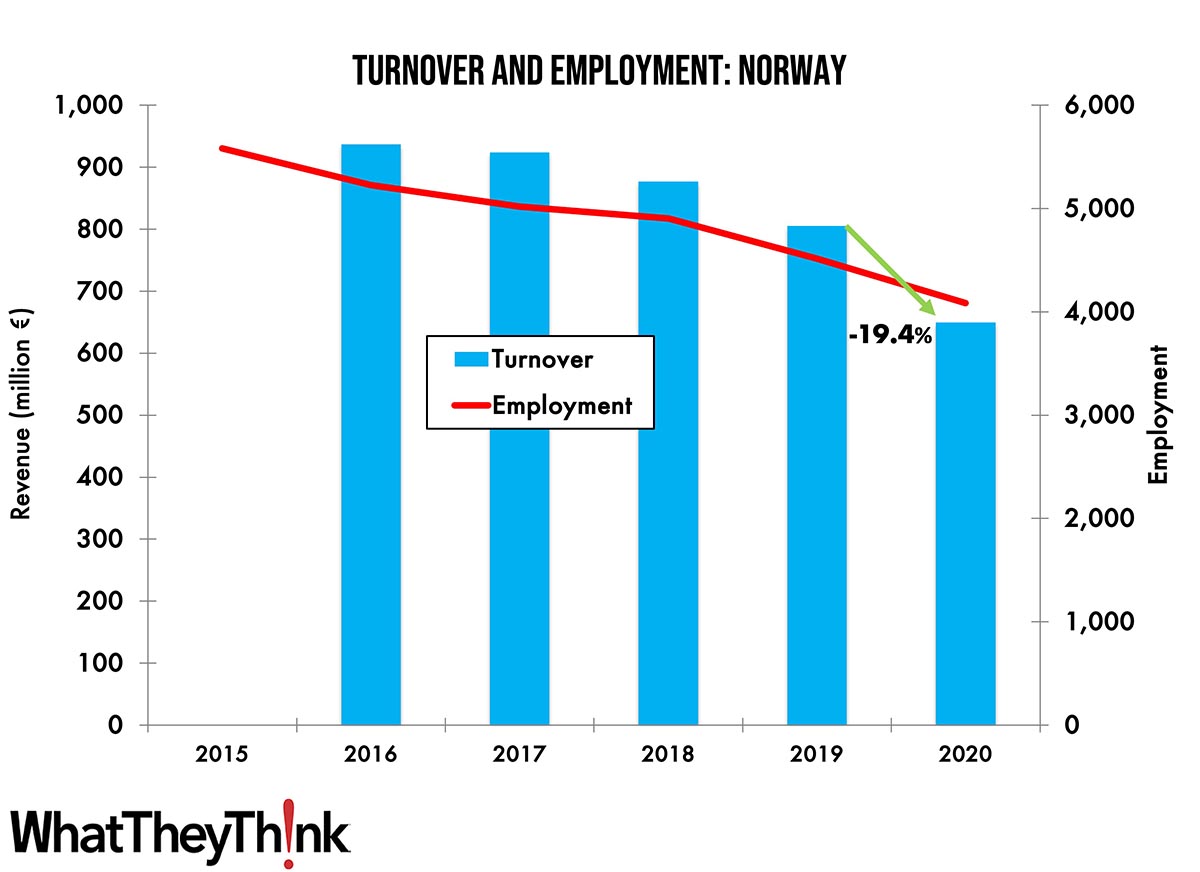

Turnover and Employment in Print in Europe—Norway

Published: December 5, 2023

This bi-weekly series of short articles aims to shed a spotlight on the size of the printing industry in Europe per country and how revenues and employment developed in 2020, when the pandemic impacted businesses. This time we look at Norway, which ranks at number 18 among the printing industries by turnover in Europe. Full Analysis

September Shipments: Heading into the Fall

Published: December 1, 2023

September 2023 printing shipments came in at $7.42 billion, down from August’s $7.47 billion. Full Analysis

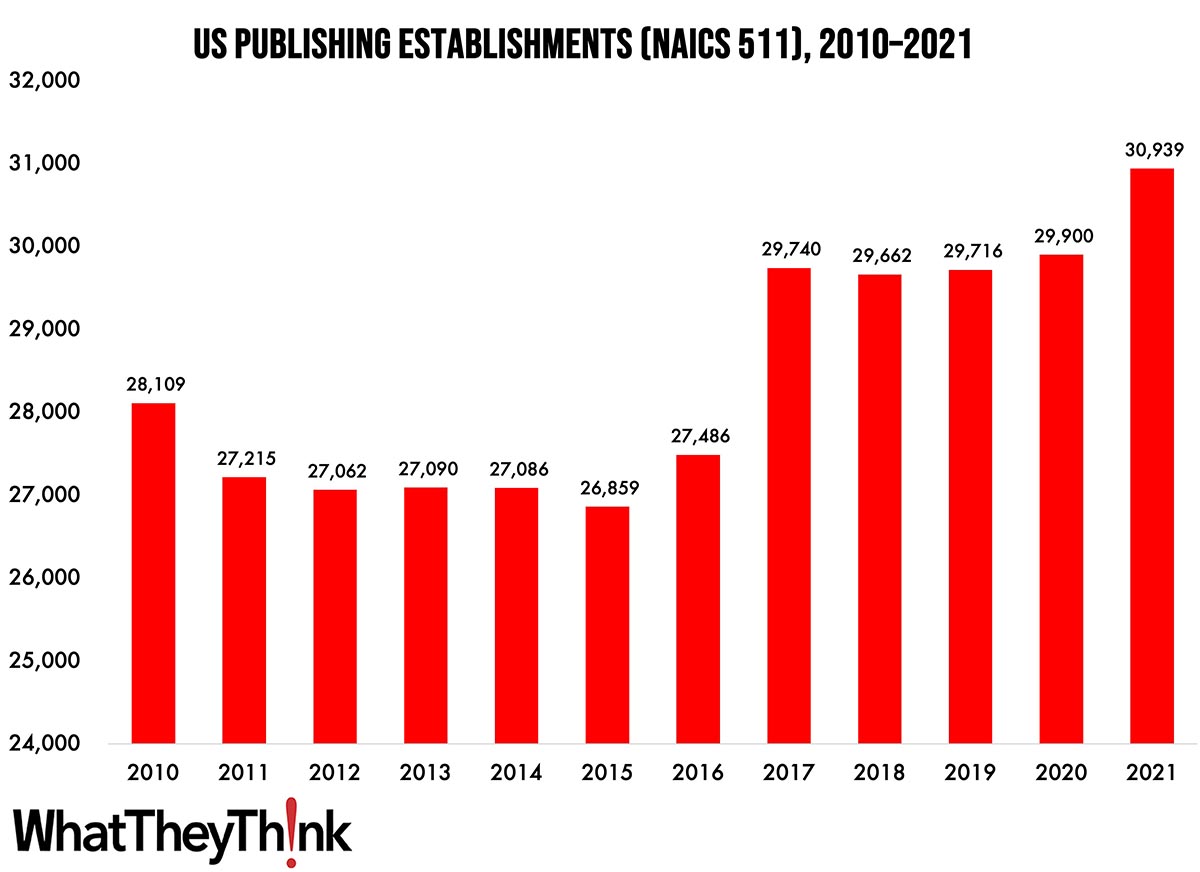

Publishing Establishments—2010–2021

Published: November 17, 2023

According to the latest, recently released edition of County Business Patterns, in 2020 there were 30,939 establishments in NAICS 511 (Publishing Industries [except Internet]). This represents an increase of 10% since 2010 and increase of 13% since 2016. In macro news, October inflation was unchanged from September. Full Analysis

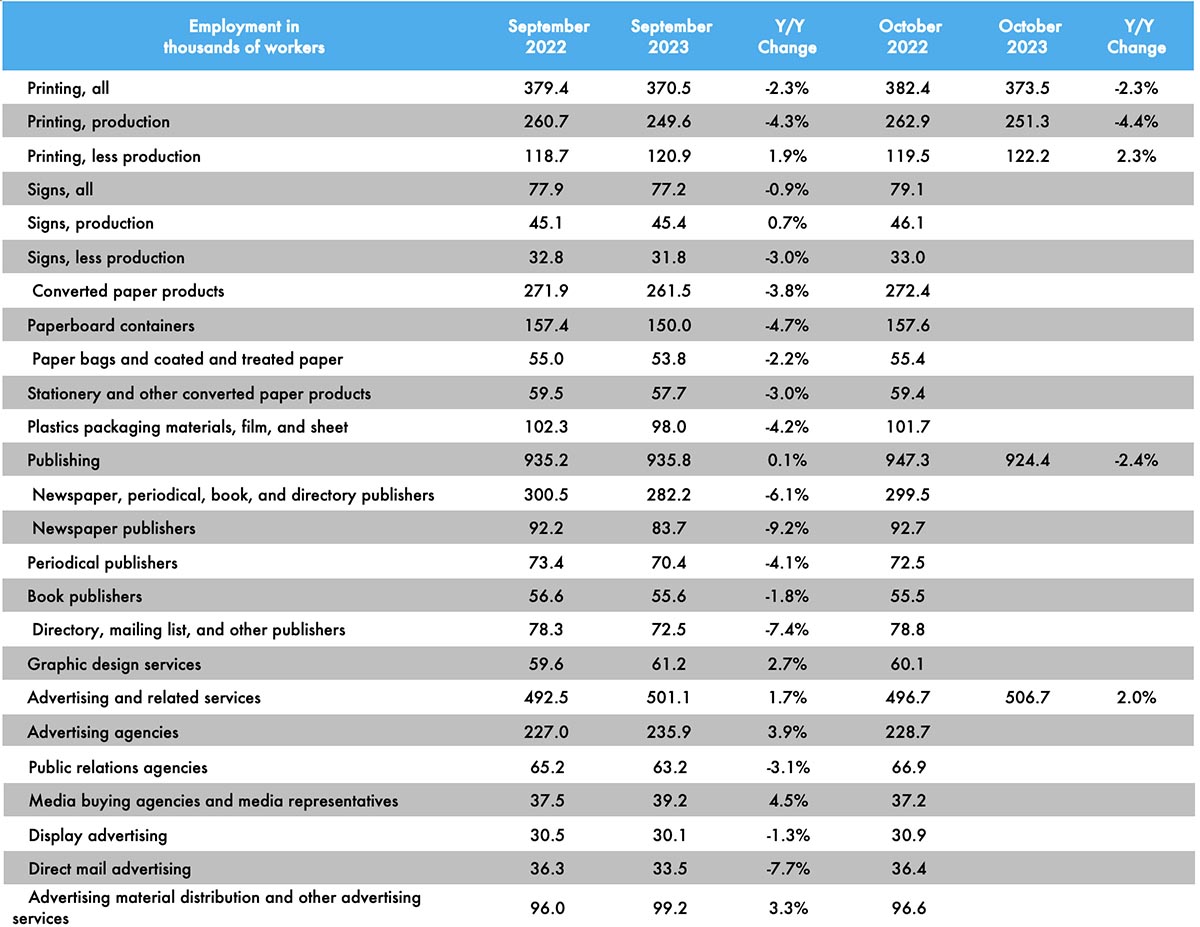

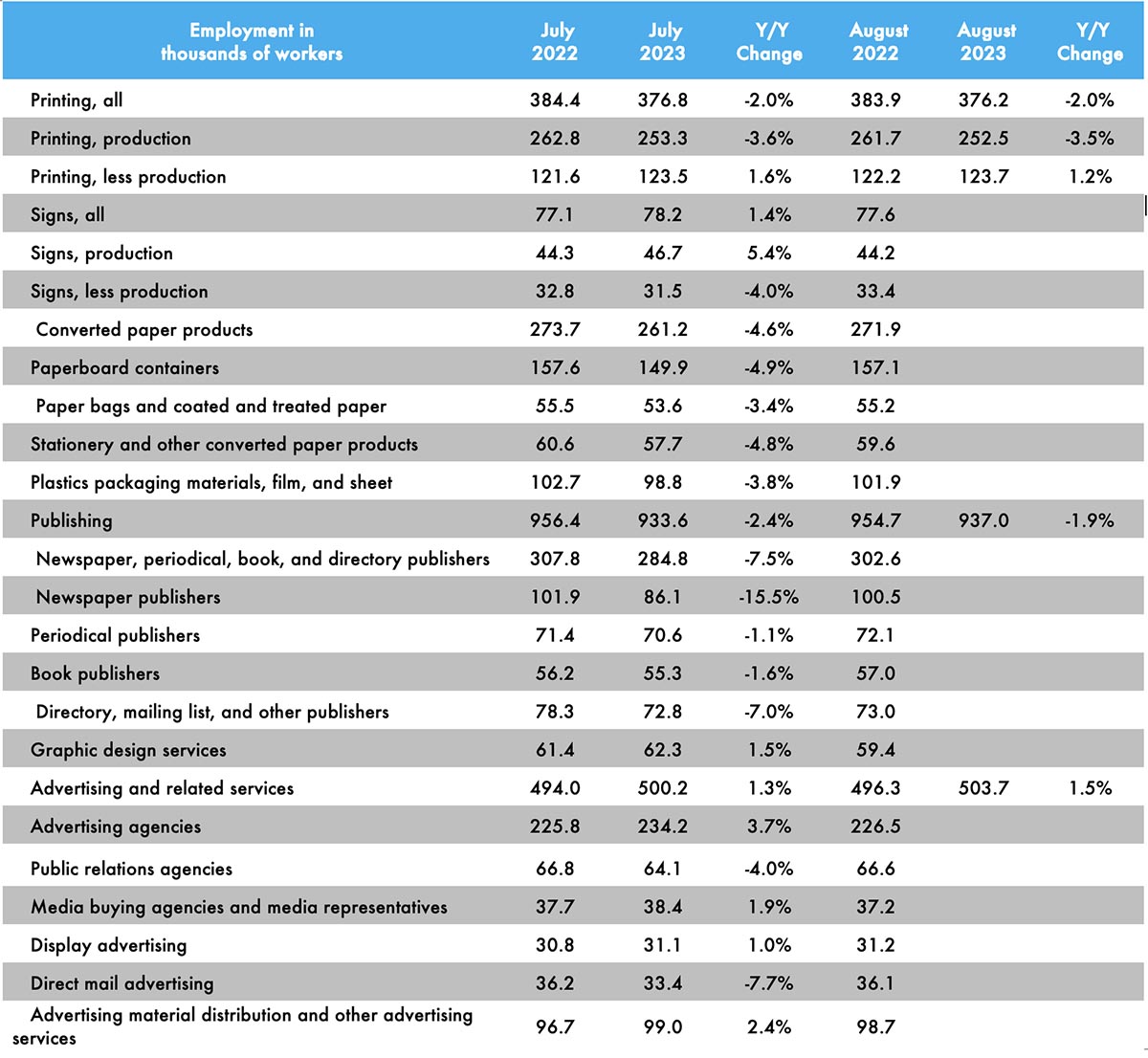

October Graphic Arts Employment Up Slightly

Published: November 10, 2023

Overall printing employment in October 2023 was up 0.8% from September. Production employment was up 0.7% while non-production employment was up 1.1%. Full Analysis

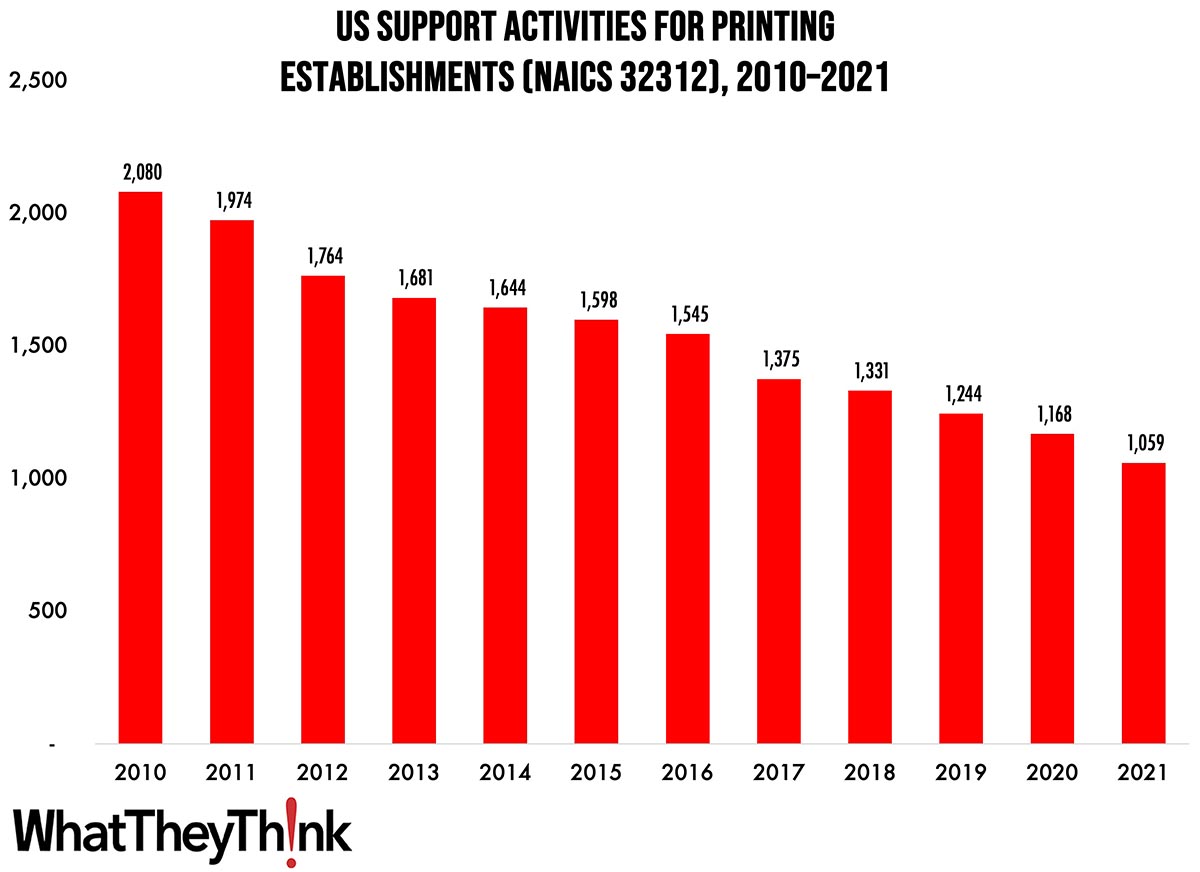

Pre- and Postpress Establishments—2010–2021

Published: November 3, 2023

According to the latest, recently released edition of County Business Patterns, in 2021 there were 1,059 establishments in NAICS 32312 (Support Activities for Printing). This represents a decrease of 49% since 2010. In macro news, Q3 GDP was up 4.9%. Full Analysis

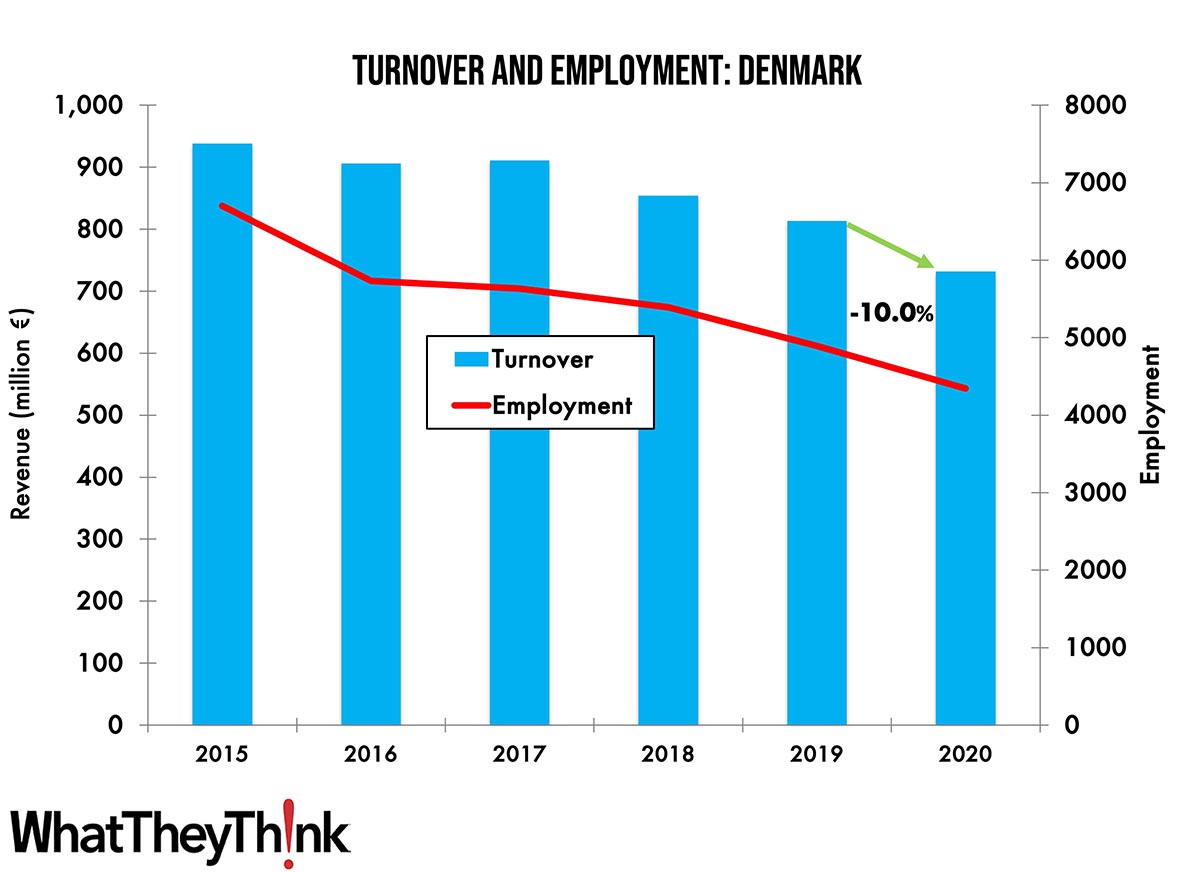

Turnover and Employment in Print in Europe—Denmark

Published: October 31, 2023

This bi-weekly series of short articles aims to shed a spotlight on the size of the printing industry in Europe per country and how revenues and employment developed in 2020, when the pandemic impacted businesses. This time we look at Denmark, the 17th largest printing industry by turnover in Europe and the third largest in the Nordic region. Full Analysis

August Shipments: …And We’re Up Again

Published: October 27, 2023

August 2023 printing shipments came in at $7.44 billion, up from July’s $7.04 billion. Full Analysis

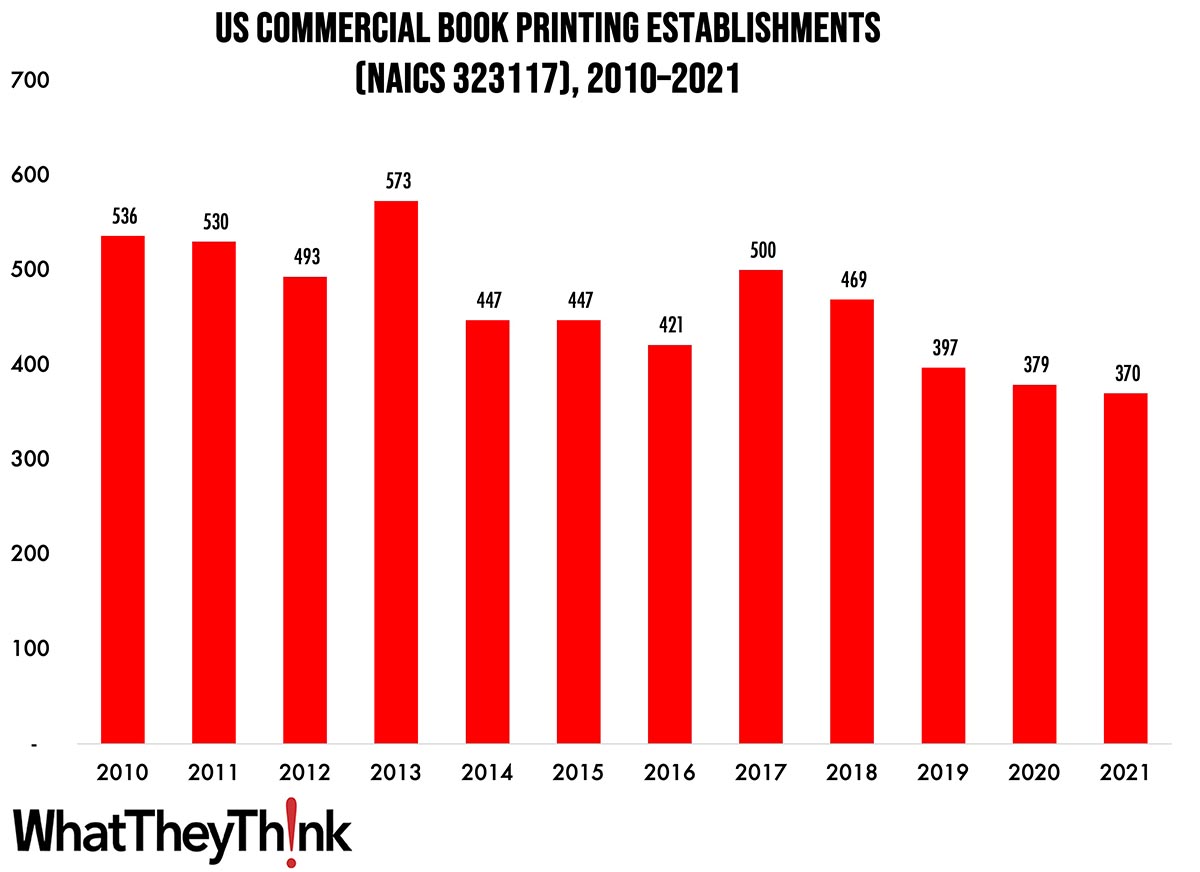

Book Printing Establishments—2010–2021

Published: October 20, 2023

According to the latest, recently released edition of County Business Patterns, in 2021 there were 370 establishments in NAICS 323117 (Commercial Book Printing). This represents a decrease of 31% since 2010—but a decrease of -2.4% from 2020. In macro news, AIA’s Architecture Billings Index (ABI) indicates that demand for design services decelerated in September, boding ill for commercial real estate construction and thus signage projects. Full Analysis

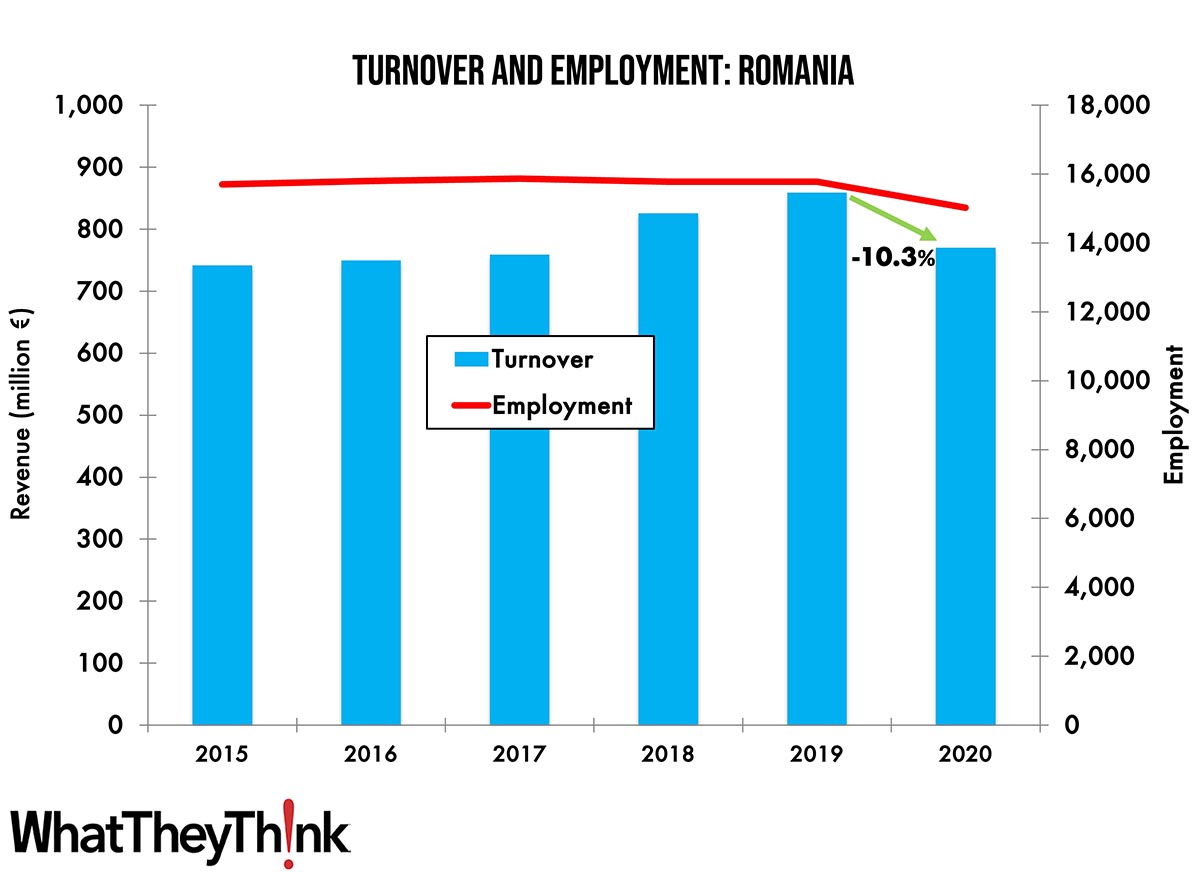

Turnover and Employment in Print in Europe—Romania

Published: October 17, 2023

This bi-weekly series of short articles aims to shed a spotlight on the size of the printing industry in Europe per country and how revenues and employment developed in 2020, when the pandemic impacted businesses. This time we look at Romania, the fourth-largest printing industry by turnover in Central and Eastern Europe. Full Analysis

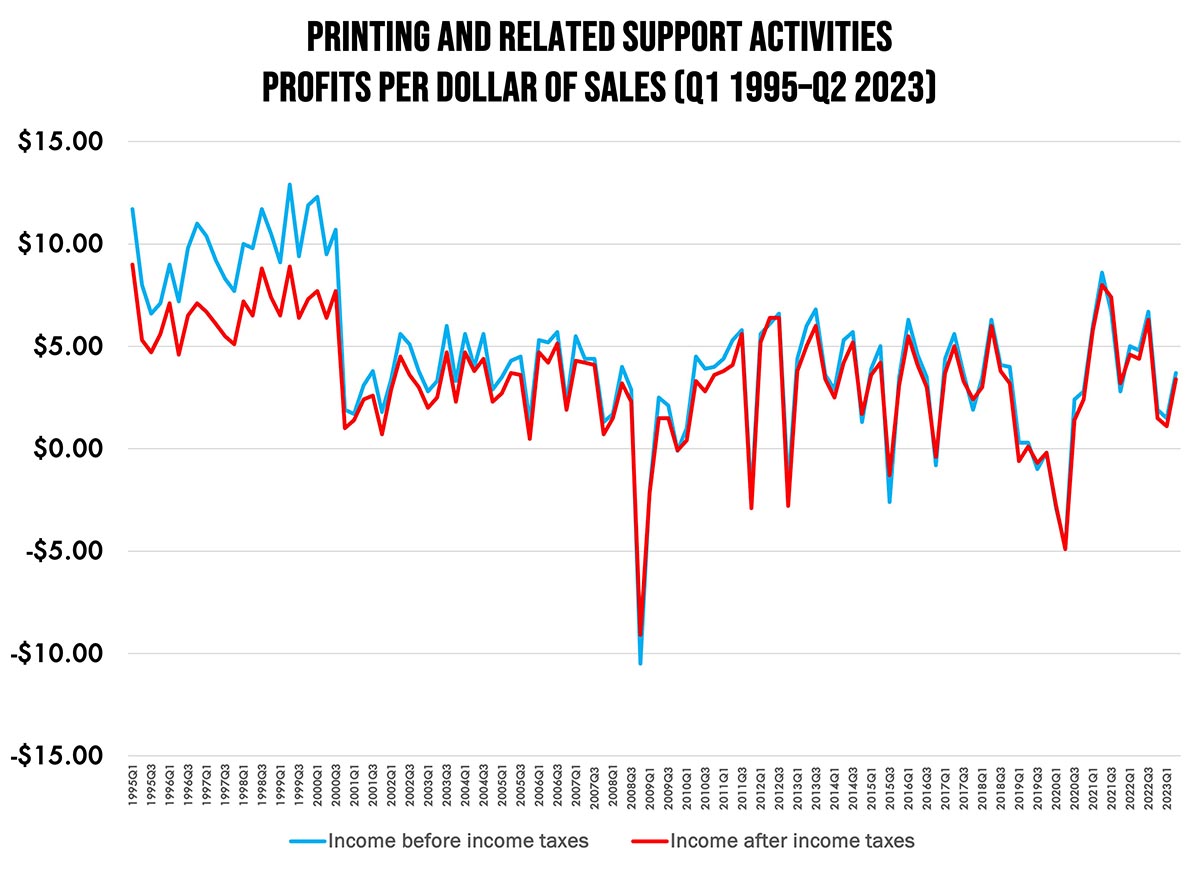

Q2 Industry Profits: The Latest From the Two Cities

Published: October 13, 2023

Quarter-over-quarter profit margin data can be fairly noisy but we’re on a general upward trend since the trough of the pandemic. Full Analysis

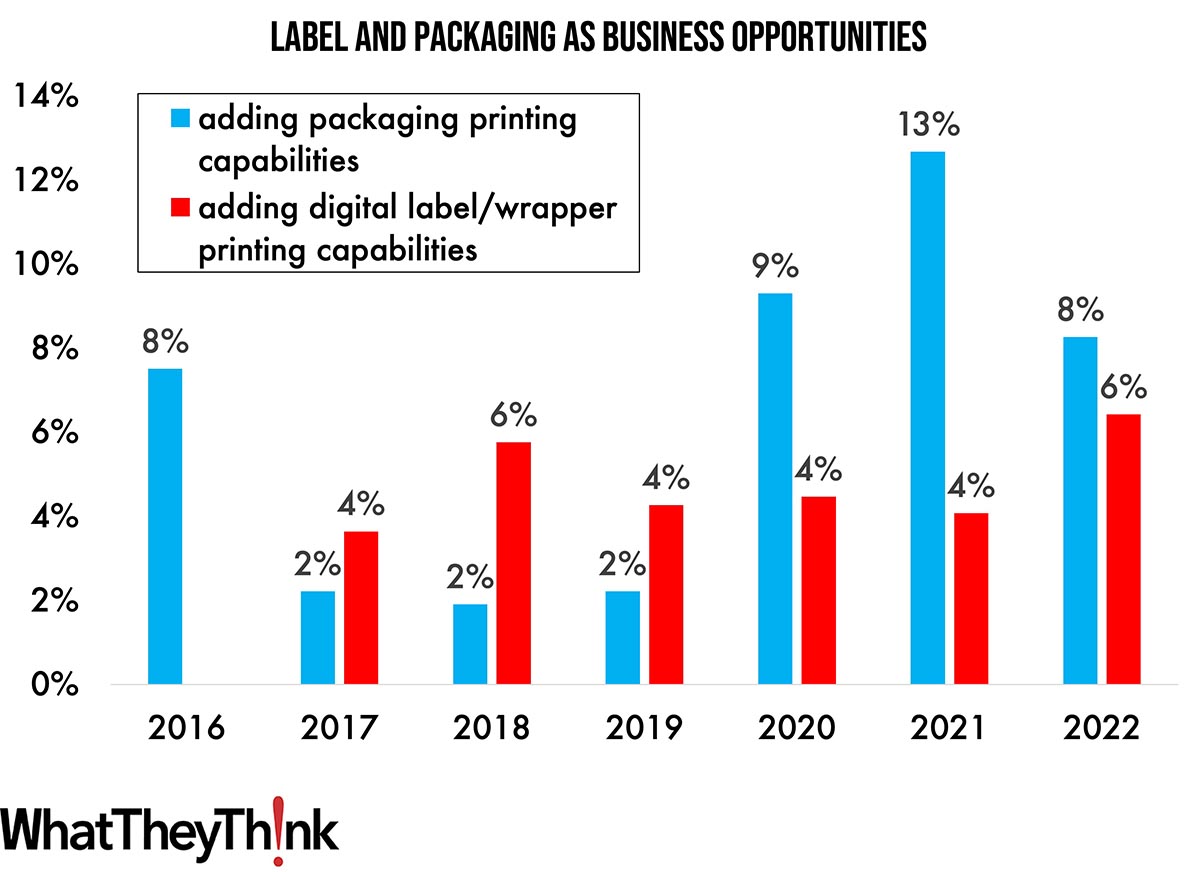

Tales from the Database: A Complete Package?

Published: October 6, 2023

Drawing on six years’ worth of Print Business Outlook surveys, our “Tales from the Database” series looks at historical data to see if we can spot any particular hardware, software or business trends. In this installment, we turn our attention to labels and packaging. Full Analysis

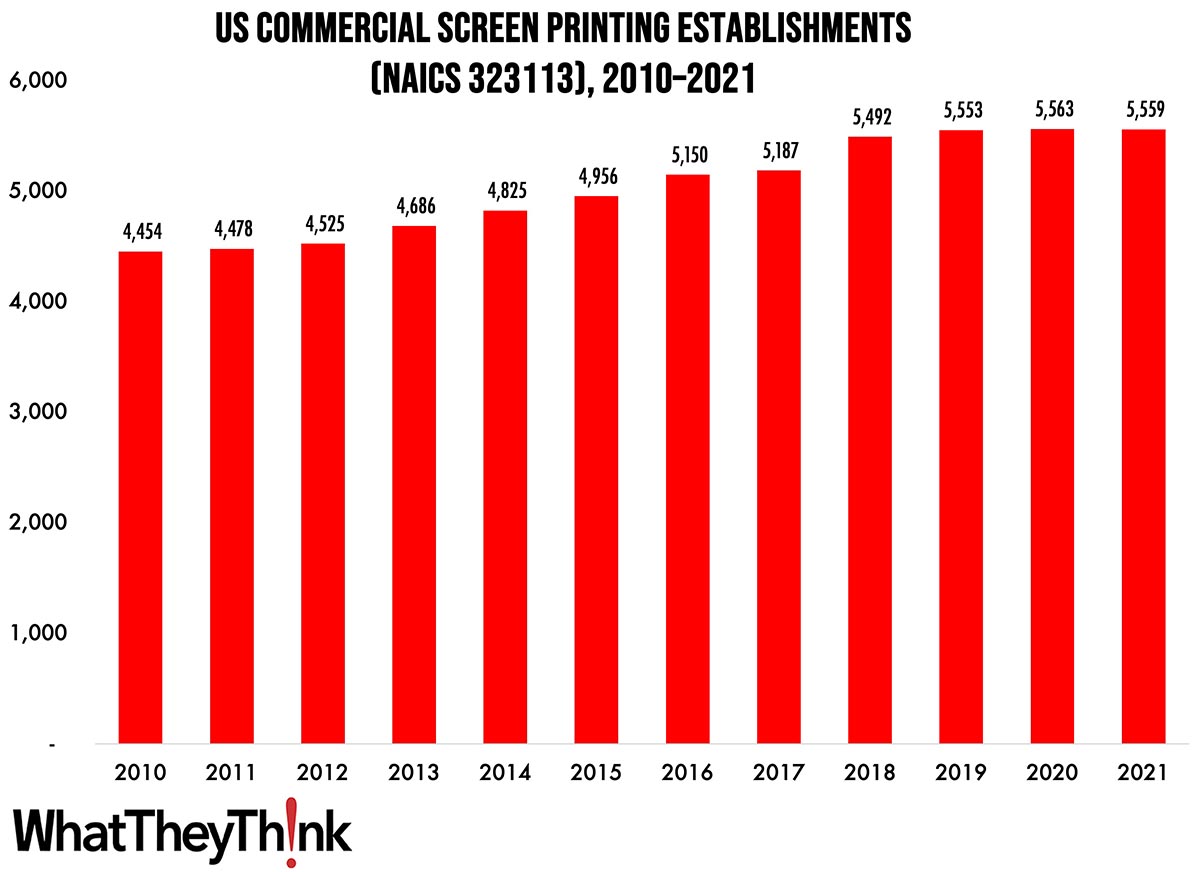

Screen Printing Establishments—2010–2020

Published: September 29, 2023

According to the latest, recently released edition of County Business Patterns, in 2021 there were 5,559 establishments in NAICS 323113 (Commercial Screen Printing). This represents an increase of 25% since 2010—but a decrease of -0.1% from 2020. In macro news, the third estimate of Q2 GDP is unchanged, but with some subtle changes “under the hood.” Full Analysis

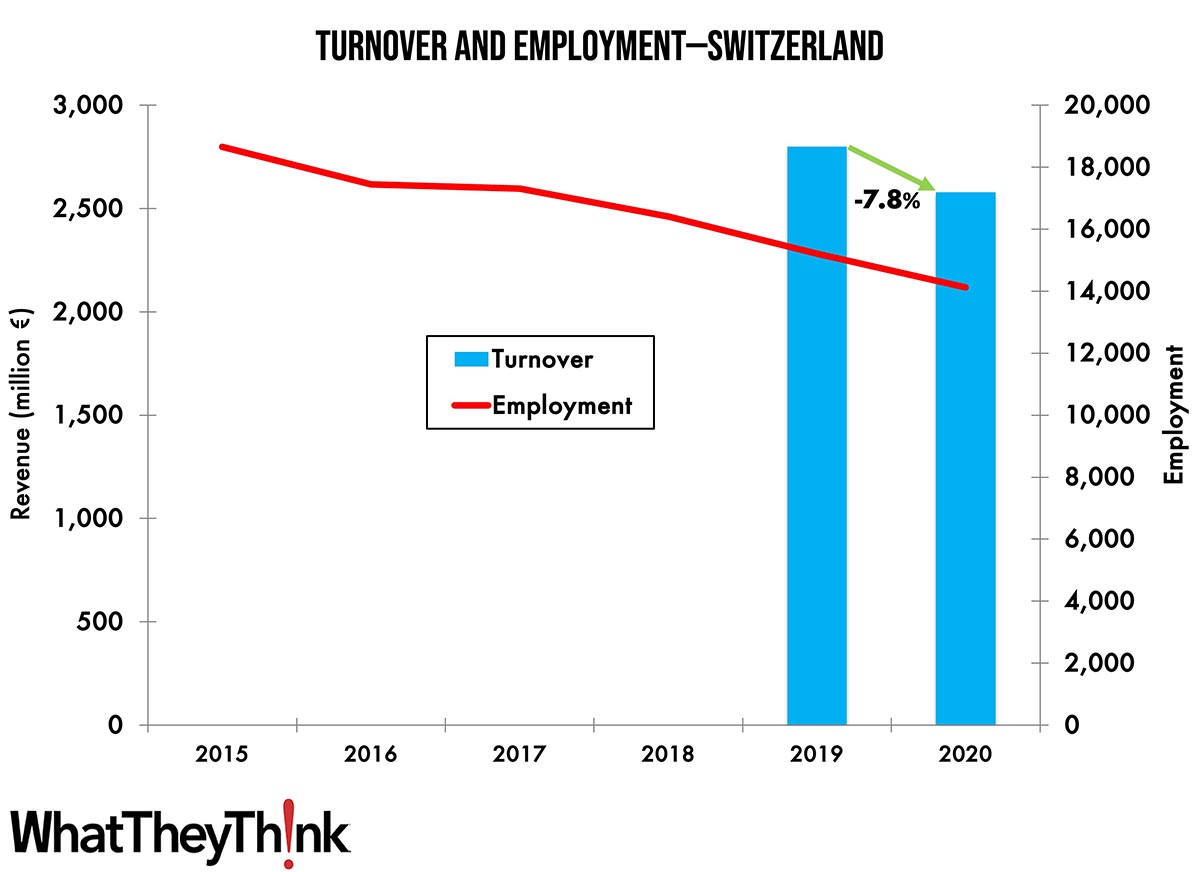

Turnover and Employment in Print in Europe—Switzerland

Published: September 27, 2023

This bi-weekly series of short articles aims to shed a spotlight on the size of the printing industry in Europe per country and how revenues and employment developed in 2020, when the pandemic impacted businesses. This time we look at Switzerland, the eighth-largest printing industry by turnover in Europe. Full Analysis

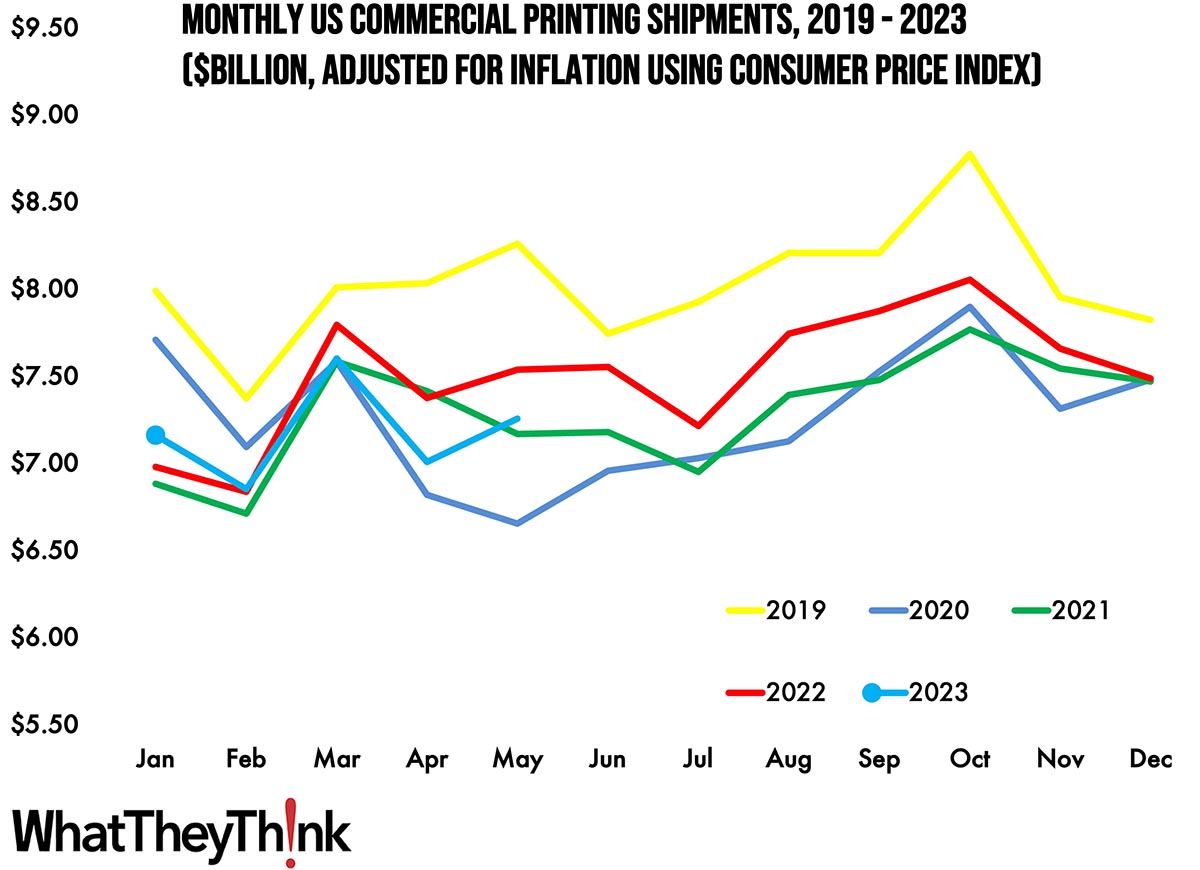

July Shipments: Down, Down We Go

Published: September 22, 2023

In a year that continues to surprise, July 2023 printing shipments came in at $7.04 billion, down from June’s $7.40 billion. Full Analysis

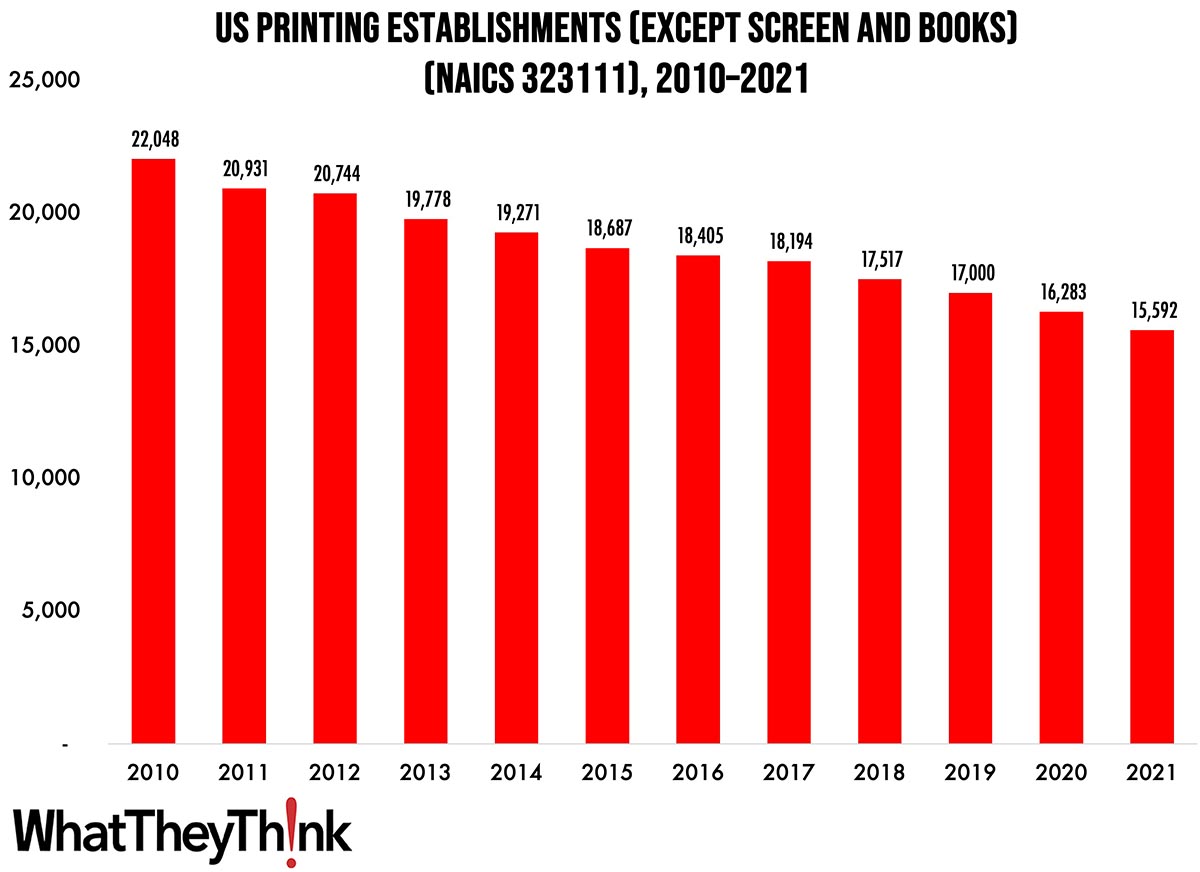

Commercial Printing Establishments—2010–2021

Published: September 15, 2023

According to the latest, recently released edition of County Business Patterns, in 2021 there were 15,592 establishments in NAICS 323111 (Commercial Printing except Screen and Books). This represents a decline of 26% since 2010. In macro news, inflation is alas up. Full Analysis

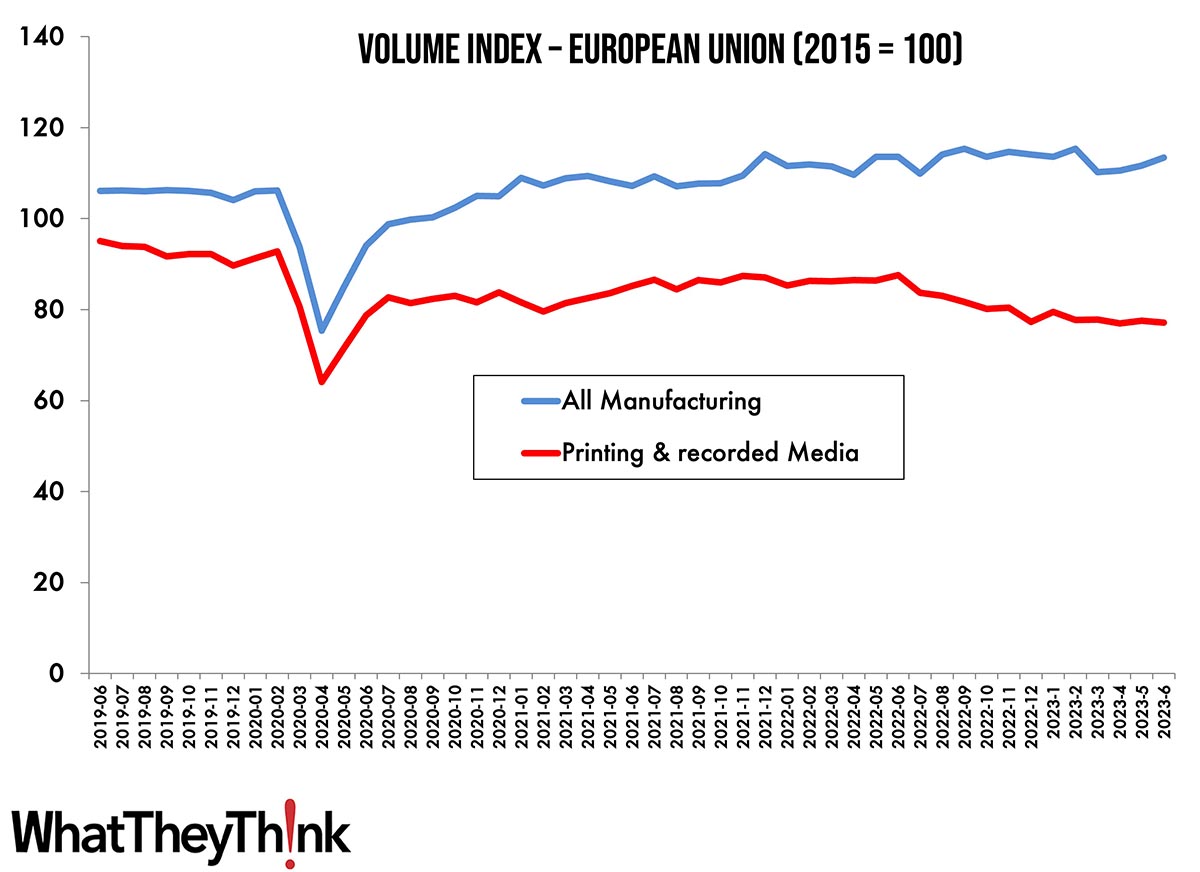

European Print Volume Trends

Published: September 12, 2023

European section editor Ralf Schlözer takes a break from the Europen country-by-country look at turnover and employment to provide a bigger-picture look at print volumes in Europe pre- and post-pandemic. Full Analysis

August Printing Production Employment Basically Flat

Published: September 8, 2023

Overall printing employment in August 2023 was down 0.2% from July. Production employment was down 0.3% while non-production employment was up 0.2%. Full Analysis

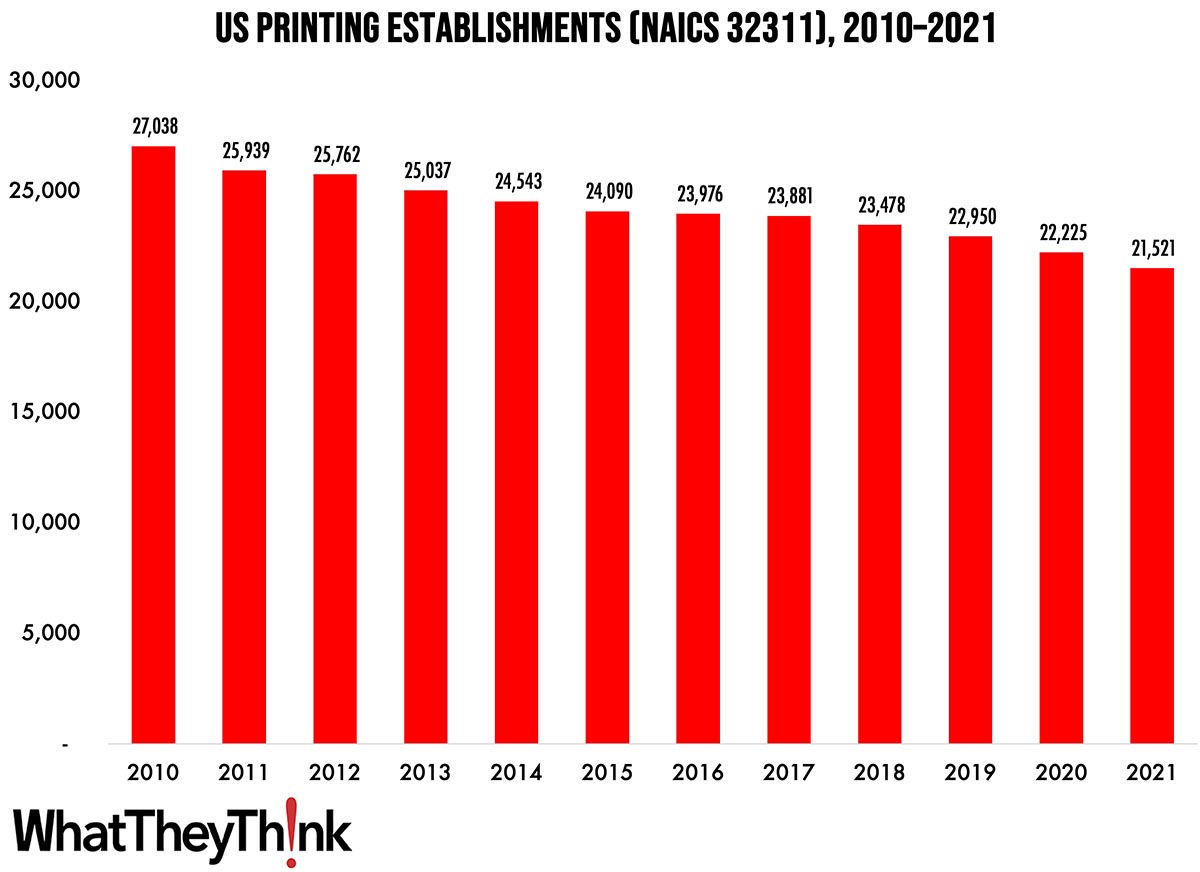

Printing Establishments—2010–2021

Published: September 1, 2023

According to the latest, just-released edition of County Business Patterns, in 2021 there were 21,521 establishments in NAICS 32311 (Printing). This represents a decline of 20% since 2010. In macro news, Q2 GDP revised downward. Full Analysis

June Shipments: Up, Up, and Away

Published: August 25, 2023

In a year that continues to surprise, June 2023 printing shipments came in at $7.38 billion, up from May’s $7.26 billion. Full Analysis

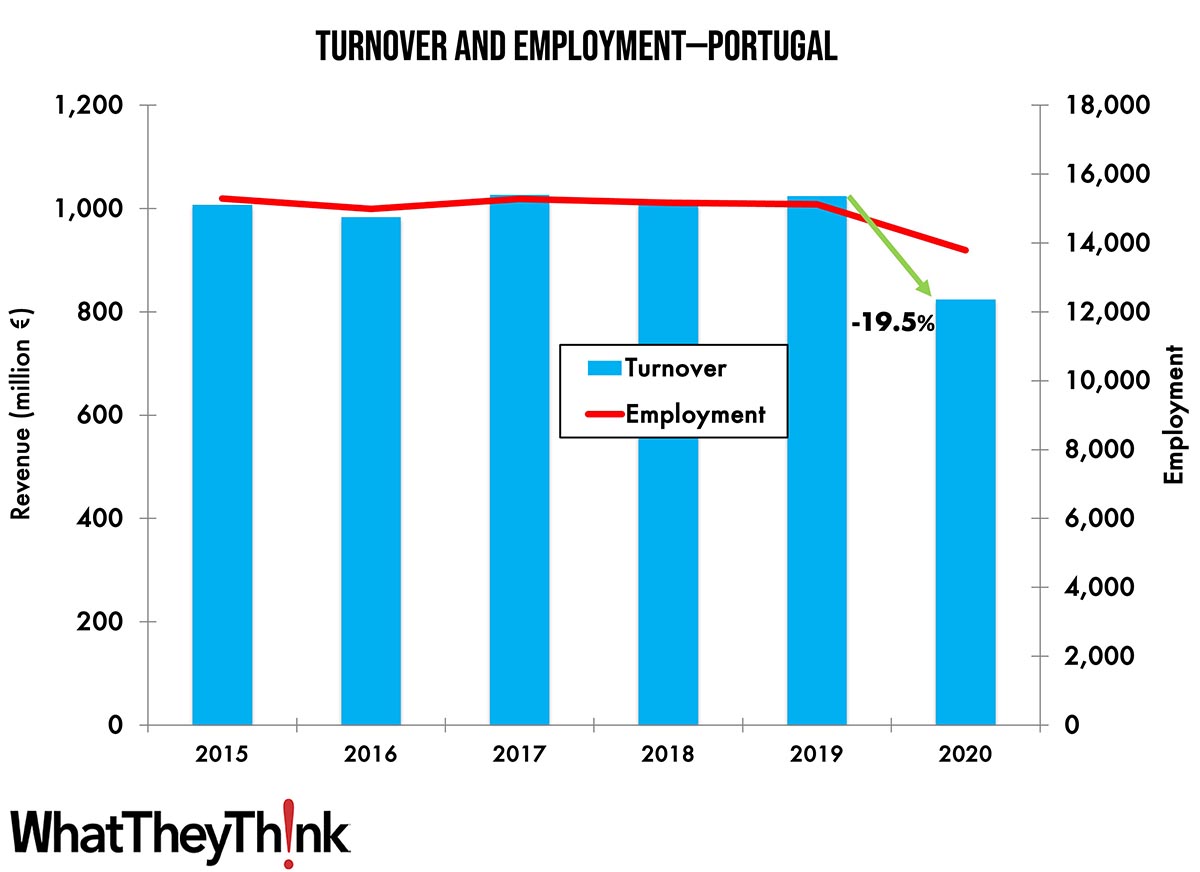

Turnover and Employment in Print in Europe—Portugal

Published: August 21, 2023

This bi-weekly series of articles aims at shedding a spotlight on the size of the printing industry in Europe per country and how revenues and employment developed in 2020, when the pandemic impacted businesses. This time we look at Portugal, the 15th-largest printing industry by turnover in Europe. Full Analysis

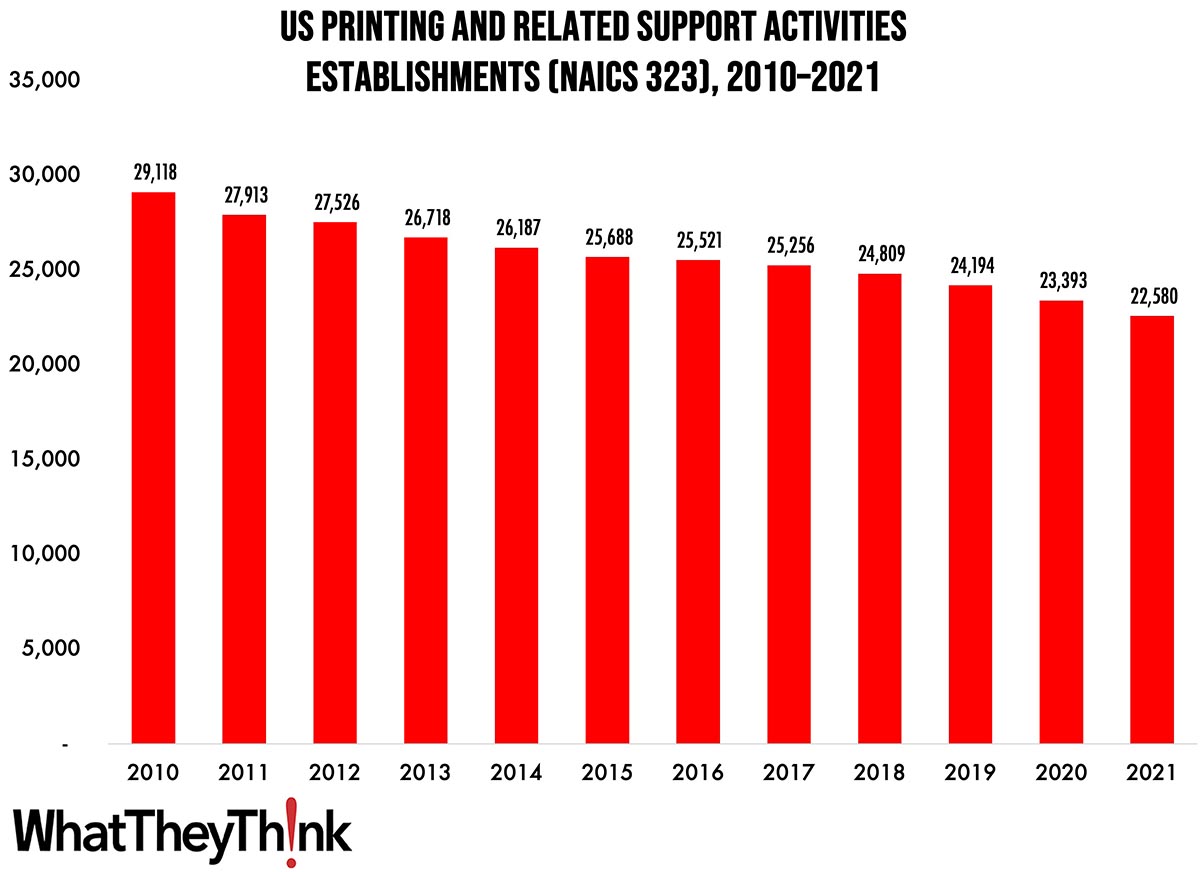

Printing Establishments—2010–2021

Published: August 18, 2023

According to the latest, just-released edition of County Business Patterns, in 2021 there were 22,580 establishments in NAICS 323 (Printing and Related Support Activities). This represents a decline of 22% since 2010. In macro news, July retail sales came in above expectations. Full Analysis

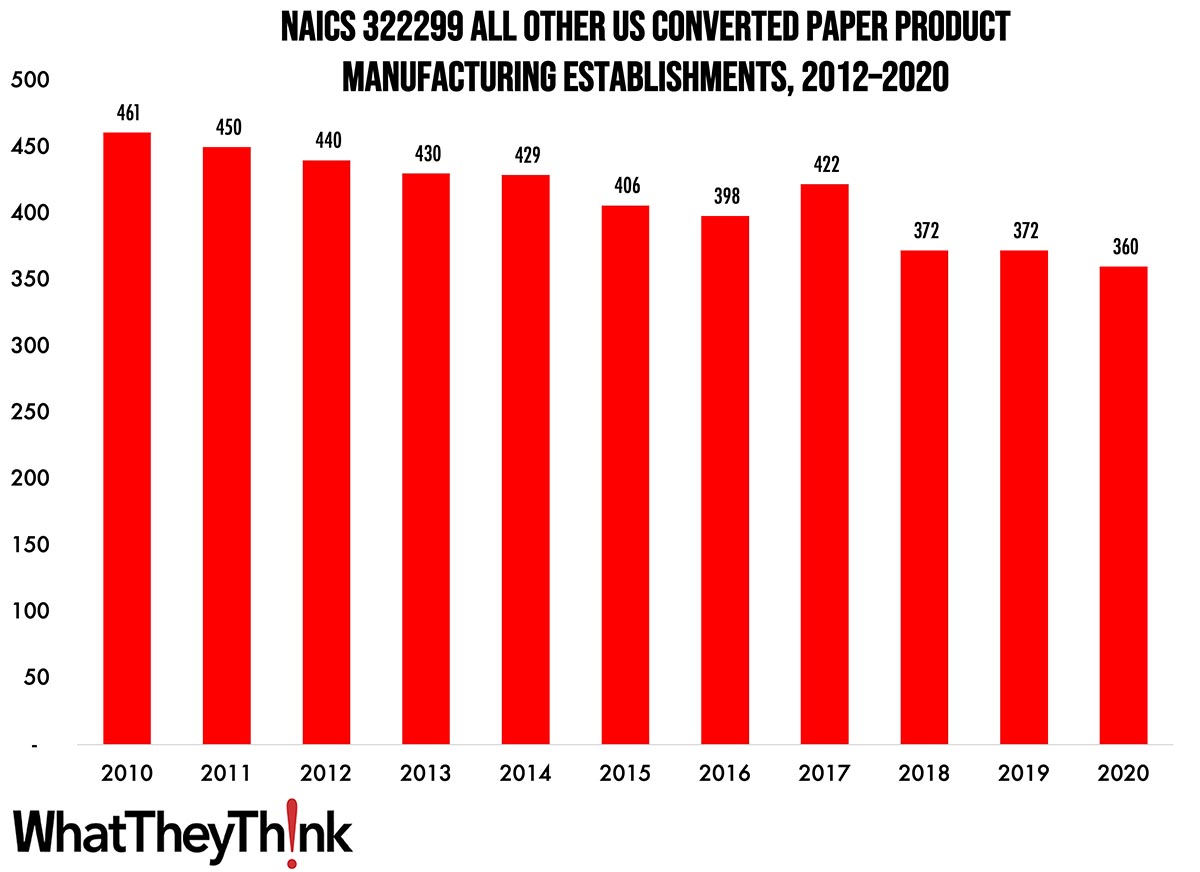

All Other Converted Paper Product Manufacturing Establishments—2010–2020

Published: August 4, 2023

According to County Business Patterns, in 2020 there were 360 establishments in NAICS 322299 (All Other Converted Paper Product Manufacturing). This category saw a net decrease in establishments of -22% since 2010. In macro news, Q2 GDP is up. Full Analysis

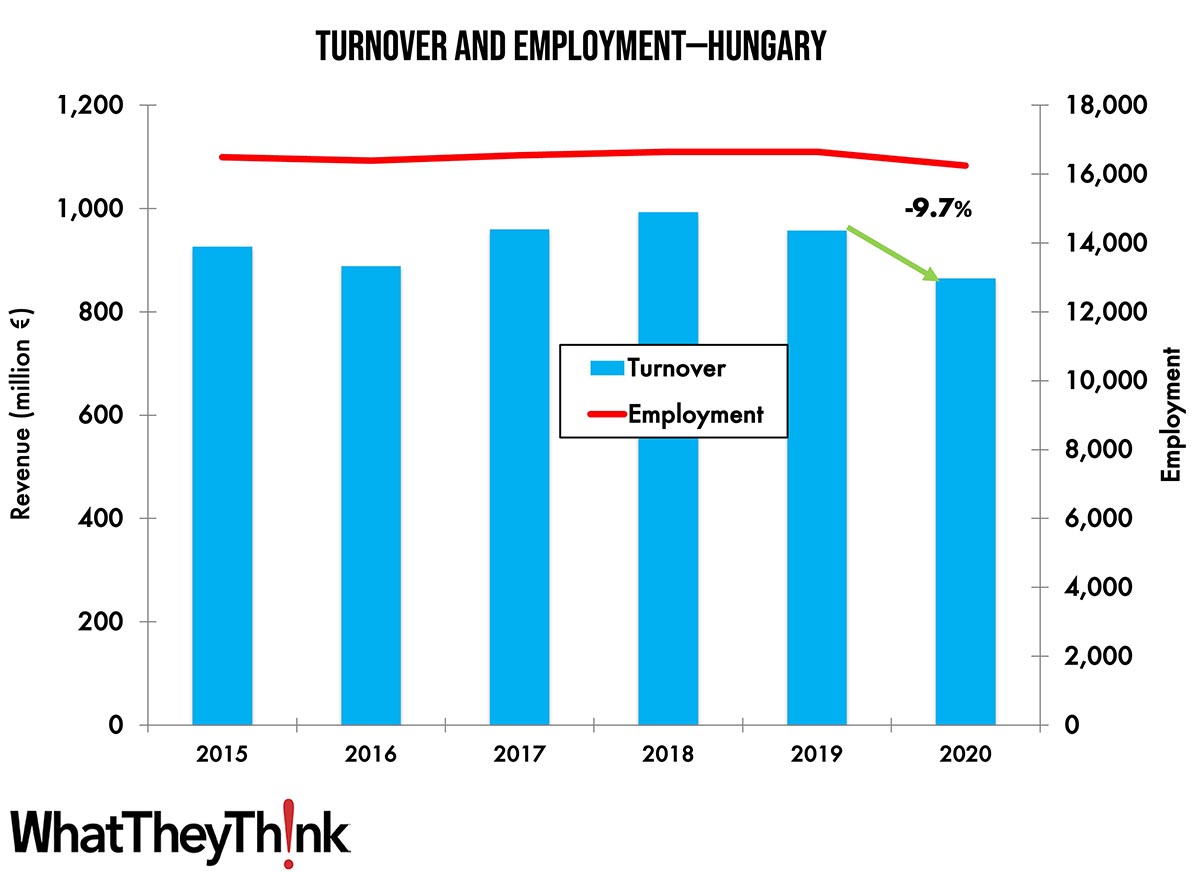

Turnover and Employment in Print in Europe—Hungary

Published: August 1, 2023

This series of short articles aims at shedding a spotlight on the size of the printing industry in Europe per country and how revenues and employment developed in 2020, when the pandemic impacted businesses. This time we look at Hungary, the 13th-largest printing industry by turnover in Europe and third largest in Central and Eastern Europe. Full Analysis

May Shipments Take an Unexpected—But Welcome—Turn

Published: July 28, 2023

May 2023 printing shipments came in at $7.26 billion, unexpectedly up from April’s $7.01 billion. Full Analysis

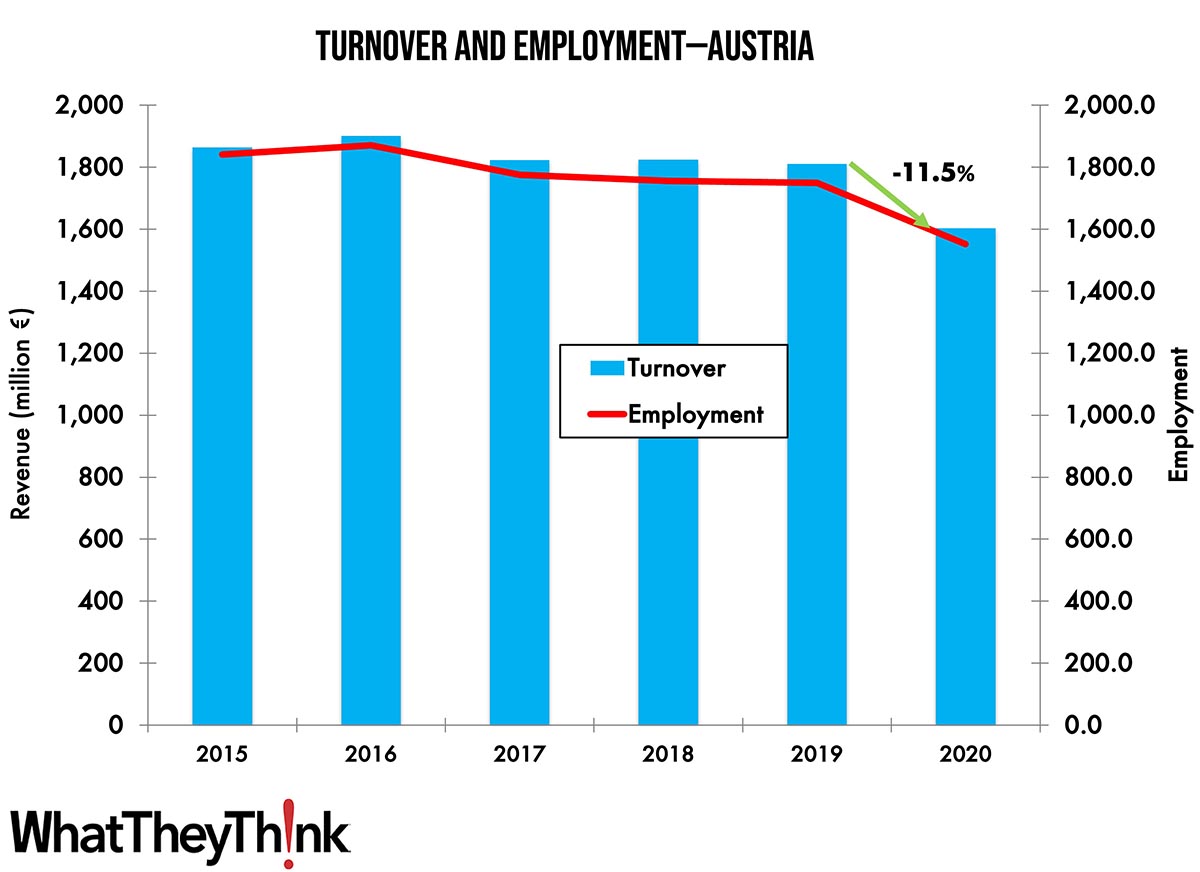

Turnover and Employment in Print in Europe—Austria

Published: July 25, 2023

This bi-weekly series of short articles aims at shedding a spotlight on the size of the printing industry in Europe per country and how revenues and employment developed in 2020, when the pandemic impacted businesses. This time we look at Austria, the tenth-largest printing industry by turnover in Europe. Full Analysis

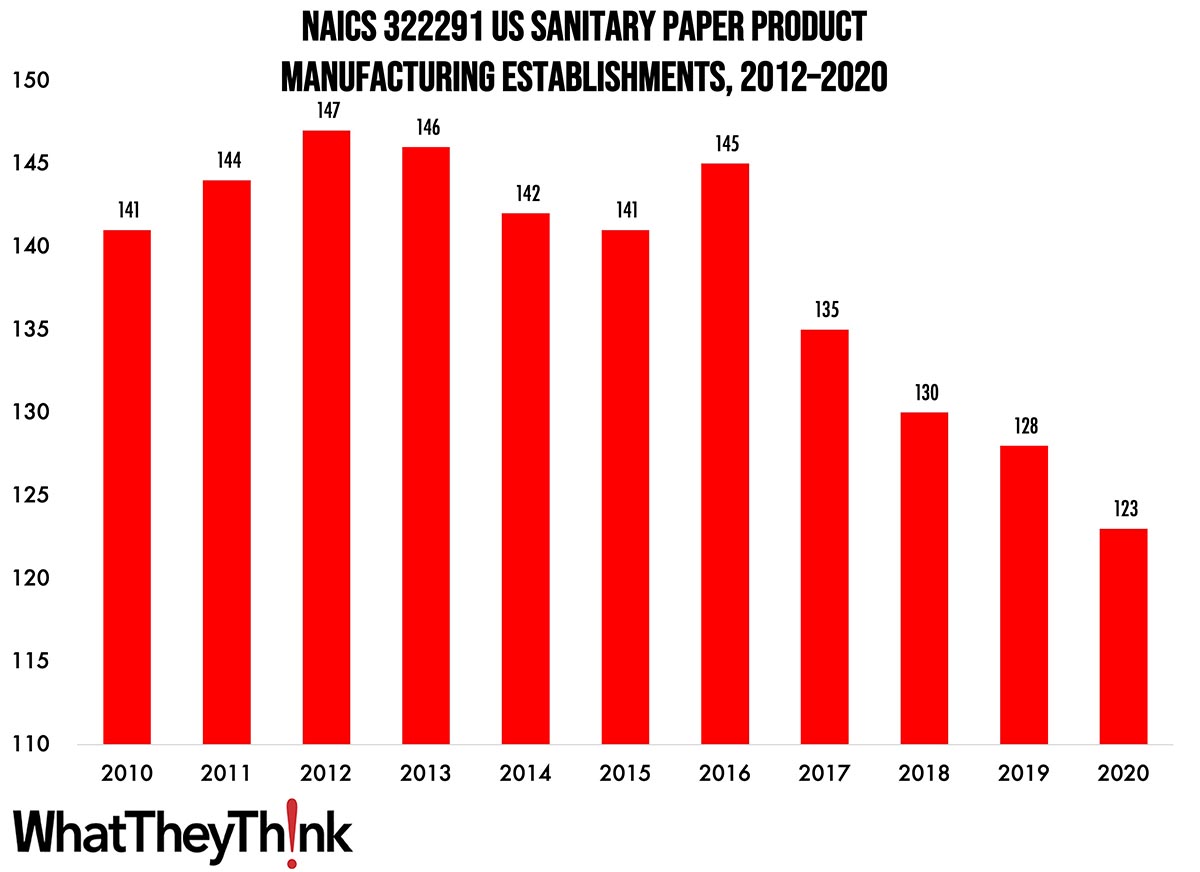

Sanitary Paper Product Manufacturing Establishments—2010–2020

Published: July 21, 2023

According to County Business Patterns, in 2020 there were 123 establishments in NAICS 322291 (Sanitary Paper Product Manufacturing). This category saw a net decrease in establishments of -13% since 2010. In macro news, new business applications continue to rise. Full Analysis

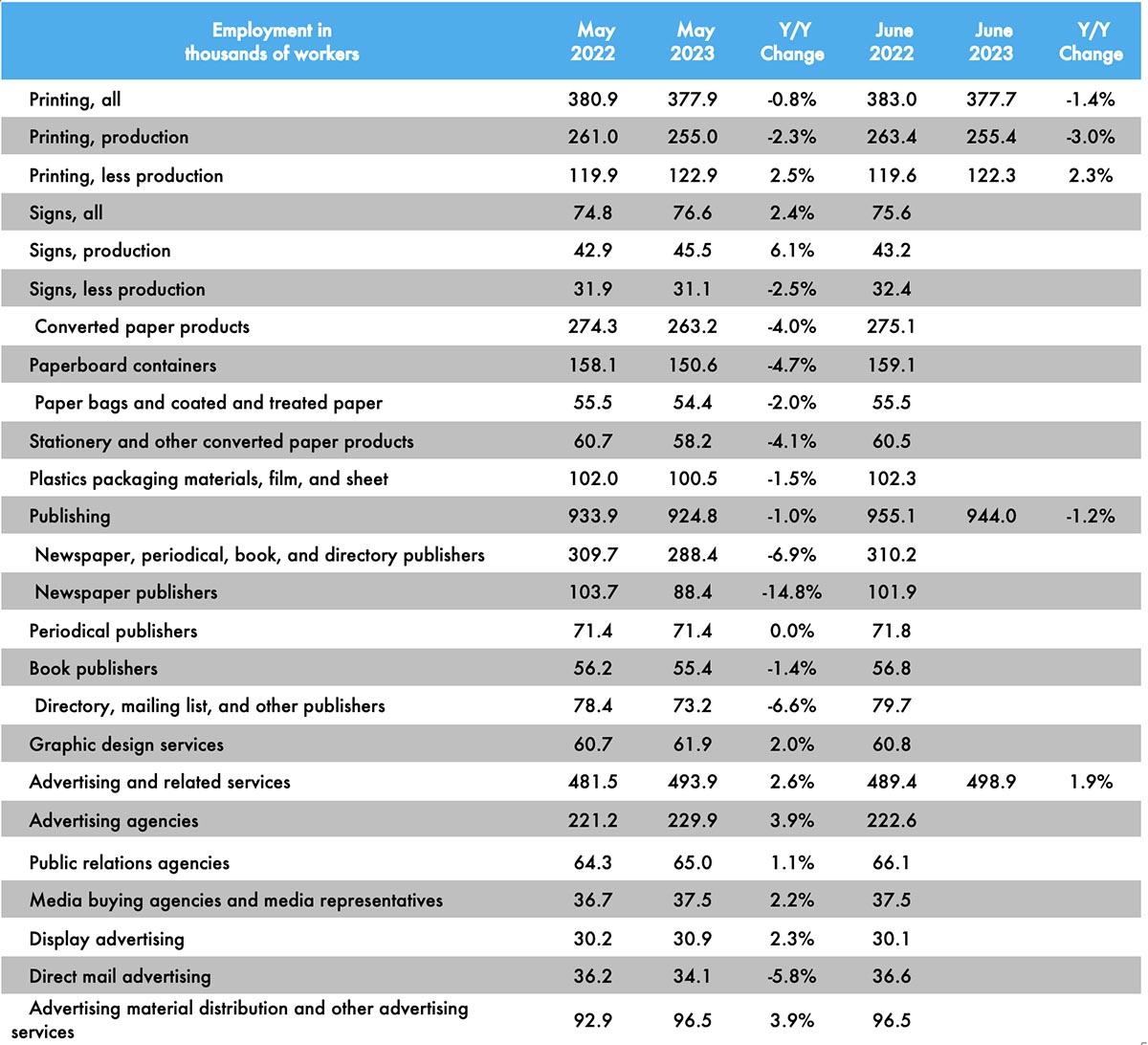

June Printing Production Employment Up Slightly, Non-Production Down

Published: July 14, 2023

Overall printing employment in June 2023 was down -0.2% from March. Production employment was up 0.4% while non-production employment was down -0.6%. Full Analysis

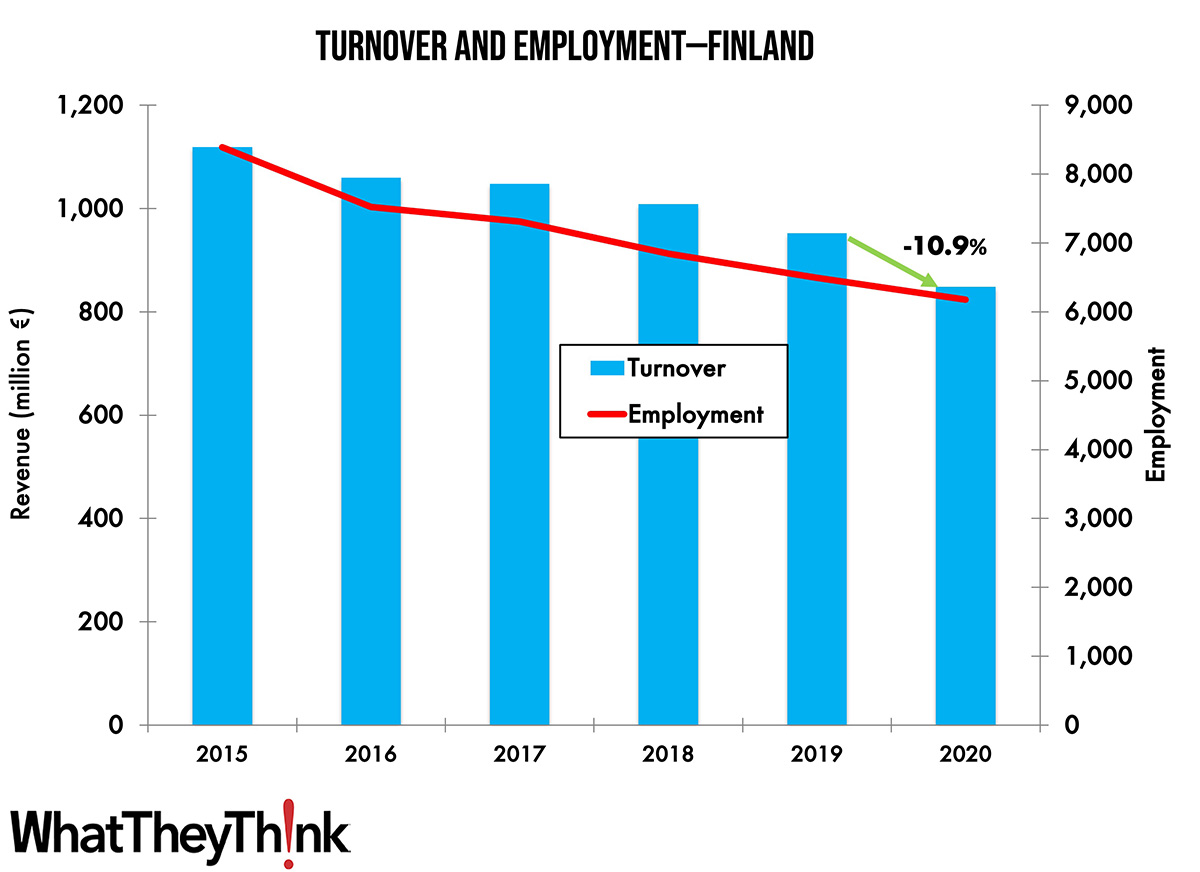

Turnover and Employment in Print in Europe—Finland

Published: July 11, 2023

This bi-weekly series of short articles aims at shedding a spotlight on the size of the printing industry in Europe per country and how revenues and employment developed in 2020, when the pandemic impacted businesses. This time we look at Finland, the 14th largest printing industry by turnover in Europe and the second largest in the Nordic region. Full Analysis

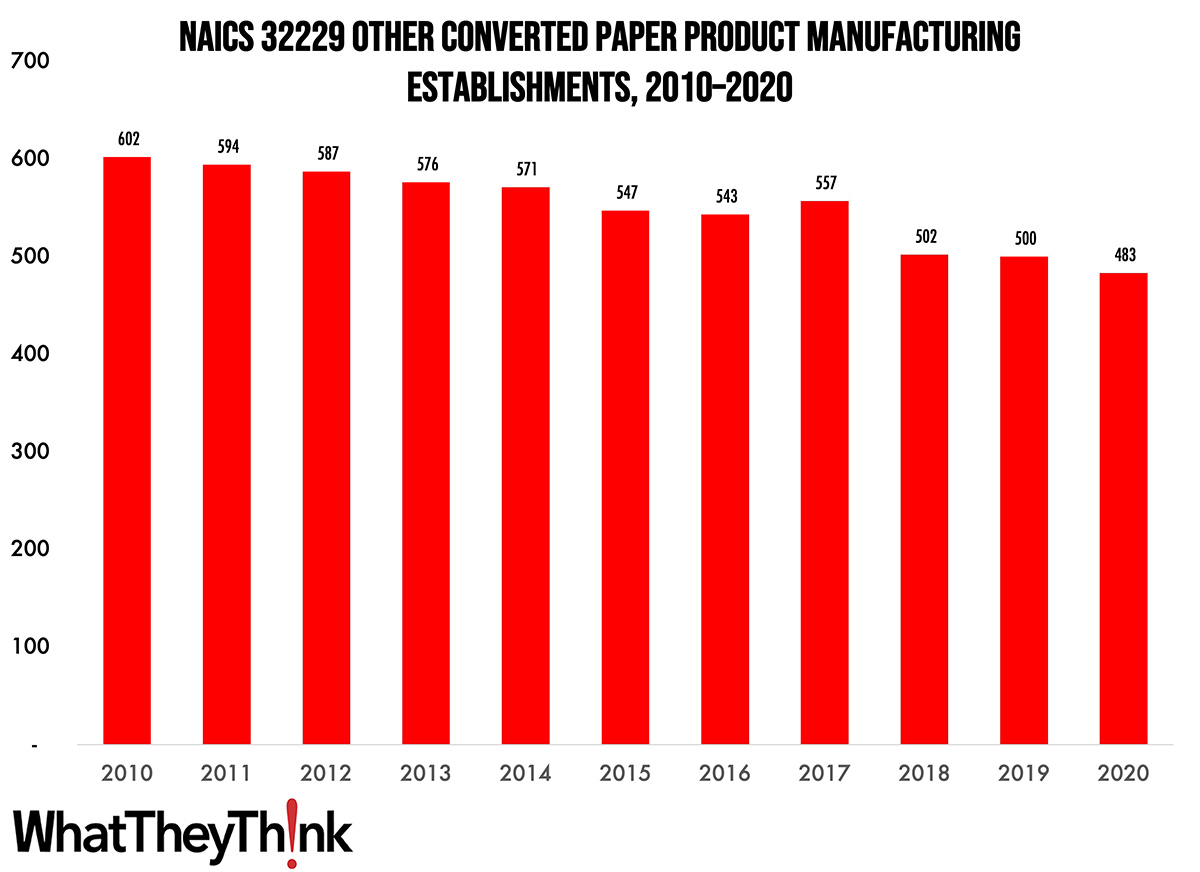

Other Converted Paper Product Manufacturing Establishments—2010–2020

Published: June 30, 2023

According to County Business Patterns, in 2020 there were 483 establishments in NAICS 32229 (Other Converted Paper Product Manufacturing). This category saw a net decrease in establishments of -20% since 2010. In macro news, BEA revises Q1 GDP up. Full Analysis

- Trigger Fresh Ideas in Customer Interviews

- MEGNAJET’S FLUID MANAGEMENT SYSTEMS SUPPORT C-MARX GROWTH

- Kyocera Belharra Photo Printing on the Road to drupa

- Summary of Drupa 2024 inkjet announcements Production Print

- Inkjet driving insourcing for state in-plants

- Real World AI for the Printing Industry

- Harnessing the Power of Synergy: HP High Speed Inkjet and Indigo Liquid Toner Technologies

- KYOCERA NIXKA INKJET SYSTEMS (KNIS) INTRODUCES BELHARRA, THE NEW WAVE OF PHOTO PRINTERS

WhatTheyThink is the official show daily media partner of drupa 2024. More info about drupa programs

© 2024 WhatTheyThink. All Rights Reserved.