Data Analysis

October 2018 Printing Shipments: Suitable for Framing

Published: December 14, 2018

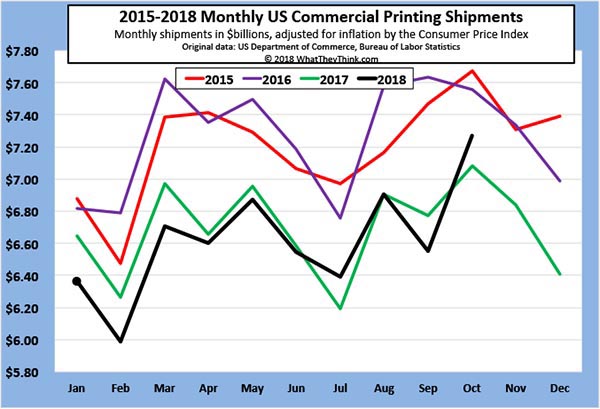

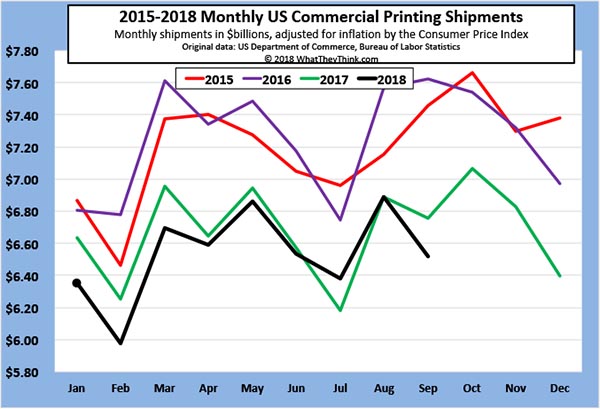

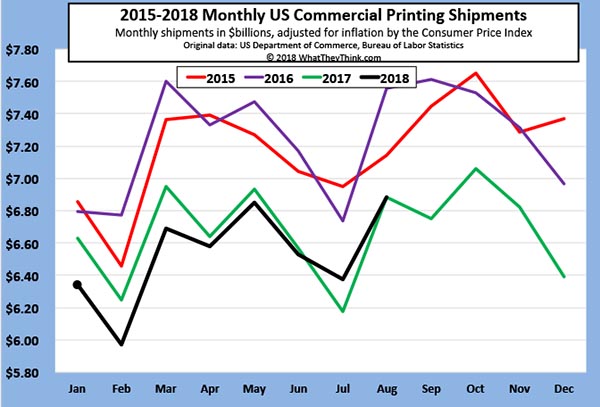

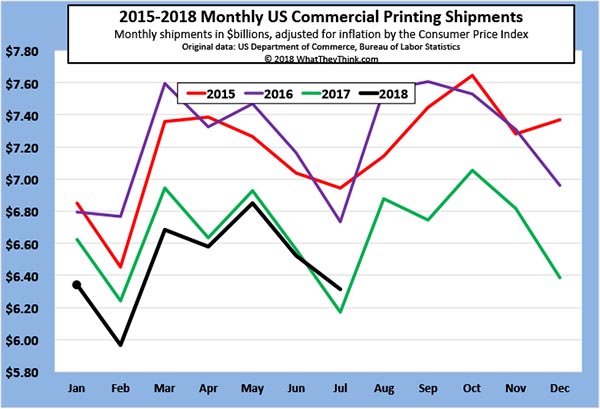

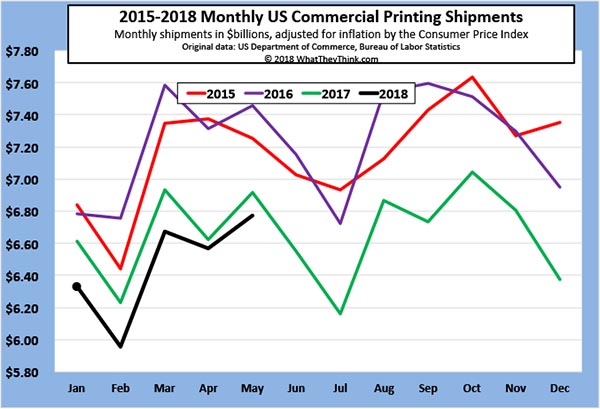

Printing shipments for October 2018 came in at $7.27 billion. That’s up from September—and it’s well above October 2018’s $7.08 billion. Welcome to the new seasonality. Full Analysis

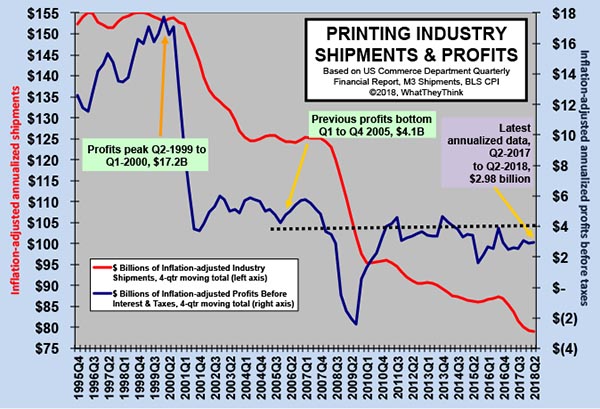

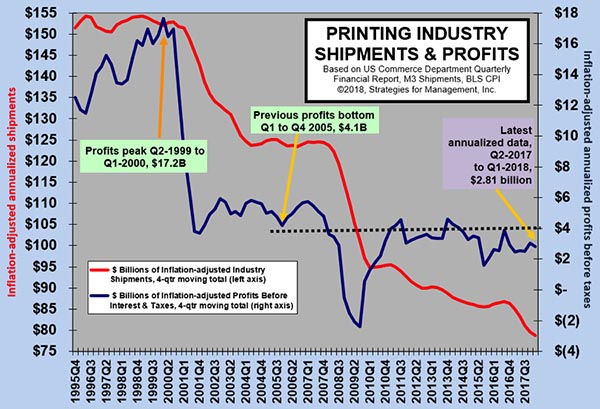

Printing Industry Profits: The Tale of Two Cities Continues

Published: December 7, 2018

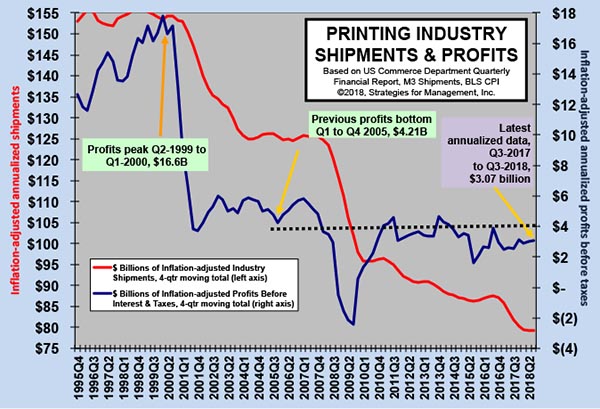

Industry profits data came out earlier this week, and it was good and bad news. Overall, annualized profits for Q3 2018 were $3.07 billion—not a huge gain from Q2, but a gain nonetheless. But it’s the ongoing saga of the low profitability of large printers dragging down average industry profitability. Full Analysis

Prepress and Postpress Services Establishments—2016

Published: November 30, 2018

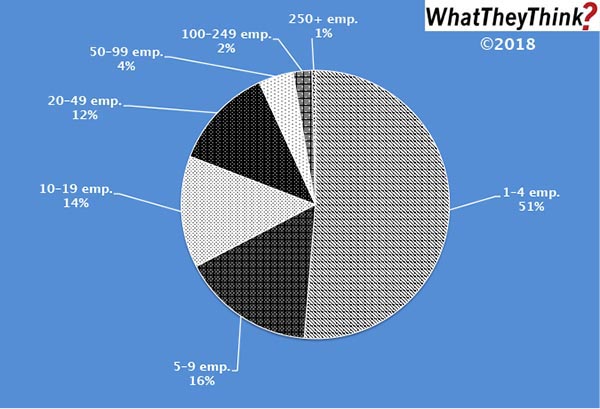

In 2016, there were 1,545 total U.S. establishments offering prepress and/or postpress services (NAICS 32312); 51% of these establishments had fewer than 10 employees. Full Analysis

Prepress and Postpress Services Establishments

Published: November 16, 2018

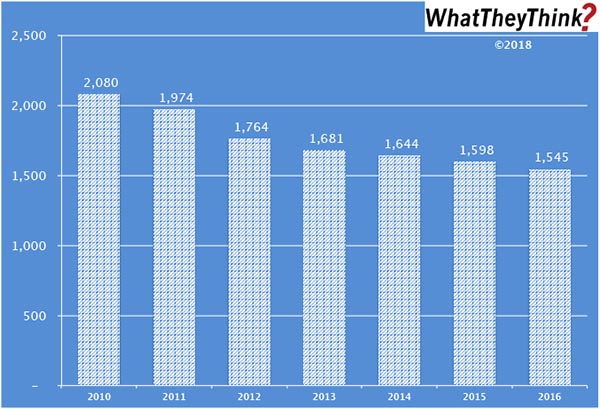

In 2010, there were 2,080 establishments offering prepress and/or postpress services; by 2016, that number had dropped to 1,545. (The Census Bureau stopped breaking out prepress and postpress establishments separately in 2012.) It’s not difficult to understand why the number of these establishments has been dropping; prepress is being absorbed into the printing process itself (especially in digital printing), and more print businesses are acquiring their own finishing capabilities. Full Analysis

End of the Season? September 2018 Printing Shipments

Published: November 9, 2018

Printing shipments for September 2018 came in at $6.52 billion. That’s down from August—and it’s well below August 2017’s $6.76 billion. Are we seeing a new seasonality in the printing industry—or the end of any seasonality? Full Analysis

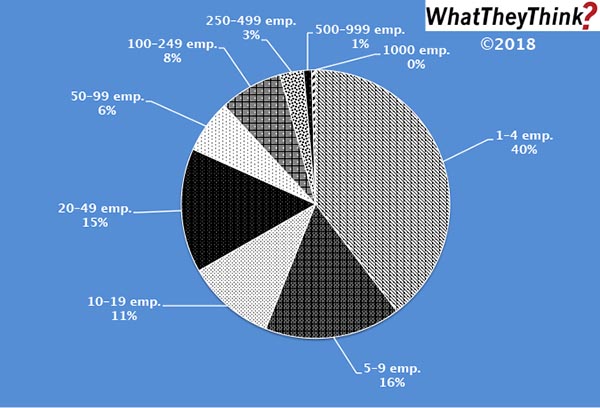

Screen Printers—2016

Published: November 2, 2018

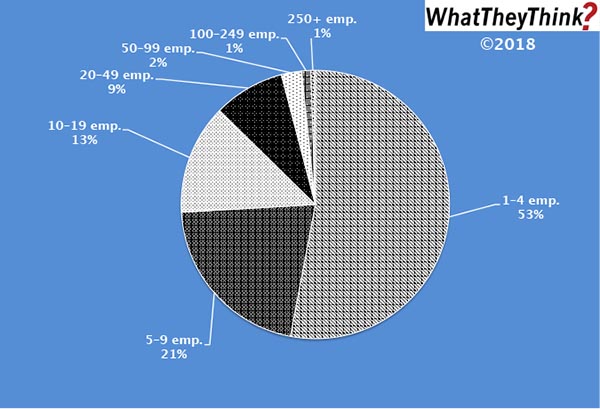

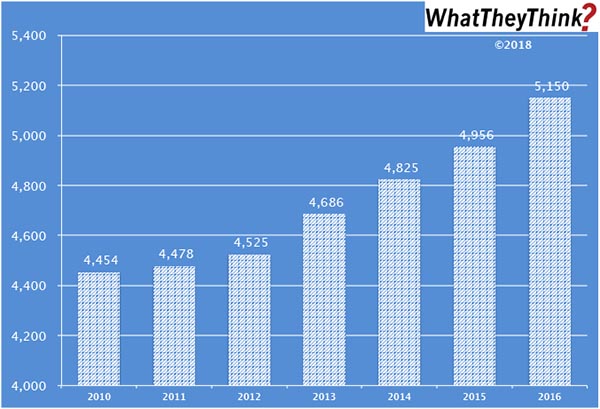

In 2016, there were 5,150 total U.S. commercial screen printing establishments. As with most printing categories, the majority have under 10 employees, but screen shops tend to be smaller than other kinds of printing establishments. Full Analysis

Graphic Arts Employment Continues to Decline; PR Employment Continues to Grow

Published: October 26, 2018

Overall printing employment dropped from August to September 2018, and on a year-over-year basis is down -1.5%. Non-production printing employment was up slightly, indicating that production staff are the hardest employees to find. PR employment is again the industry bright spot, employment-wise. Full Analysis

Screen Printers 2010–2016

Published: October 19, 2018

From 2010 to 2016, the number of U.S. commercial screen printing establishments increased from 4,454 to 5,150. Growth in screen printing establishments has been consistent from year to year. Chalk this up to the rise of specialty printing. Full Analysis

Dead Heat: August 2018 Printing Shipments

Published: October 12, 2018

Printing shipments for August 2018 came in at $6.89 billion. That’s essentially even with August 2017’s $6.88 billion on an inflation-adjusted basis. Full Analysis

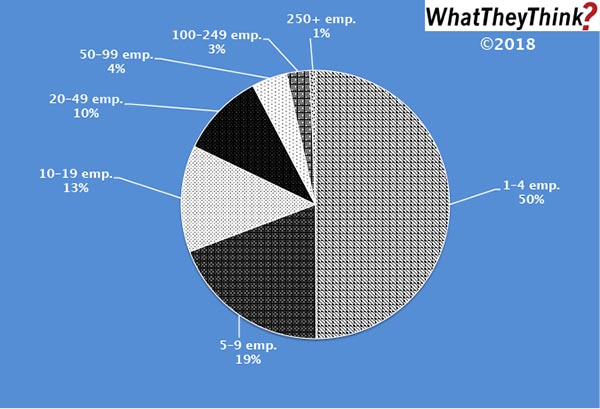

Commercial Printers—2016

Published: October 5, 2018

In 2016, there were 18,405 total commercial printing establishments (excluding screen and book printers). Half of them have fewer than 5 employees. Full Analysis

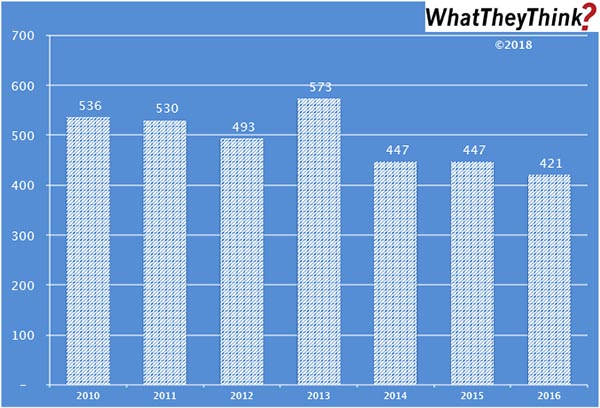

Book Printers—2016

Published: September 28, 2018

In 2016, there were 421 total book printing establishments. The majority have under 10 employees. This is similar to what we find in general commercial printing—yet different. Full Analysis

July 2018 Printing Shipments: We Have Some Good News and Some Bad News

Published: September 21, 2018

Printing shipments for July 2018 came in at $6.31 billion—that’s down -3.4% from June, but it’s up +2.3% from July 2017. We’ll take whatever victories we can. Full Analysis

Book Printers—2010–2016

Published: September 14, 2018

In 2010, there were 536 book printing establishments. In the ensuing six years, the establishment count would drop -21%. So says our Commercial Printing Establishments tracker. Full Analysis

Words of the Profits

Published: September 7, 2018

Looking at the most recent industry profits data that came out earlier this week, we continue to tell the “tale of two cities.” Low profitability of large printers is dragging down average industry profitability. For the industry as a whole, cracking—or re-cracking—$4 billion in profits is proving to be an elusive goal. Full Analysis

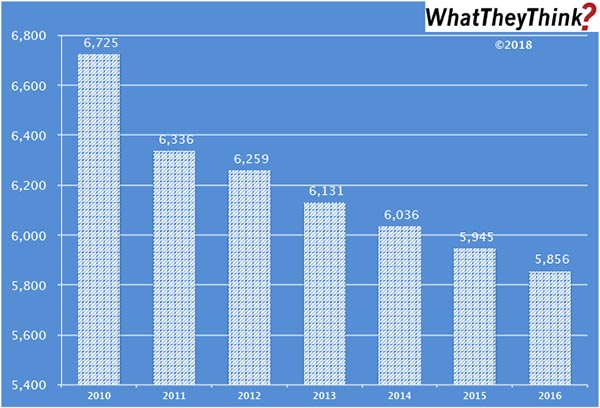

Mid-Size Establishments—2010–2016

Published: August 31, 2018

In 2010, there were 6,725 10–19-employee commercial printing establishments. Among this demographic category, there was the most precipitous drop from 2010 to 2011—the fallout from the Great Recession which started to take its toll after 2009. By 2012, the bleeding had been largely stanched, and the year-to-year declines were more modest. So says our recently launched Commercial Printing Establishments tracker. Full Analysis

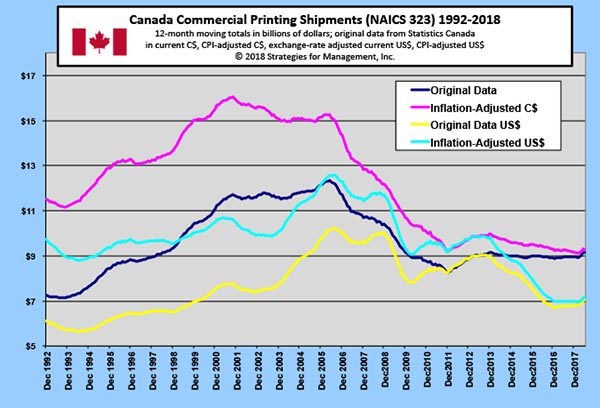

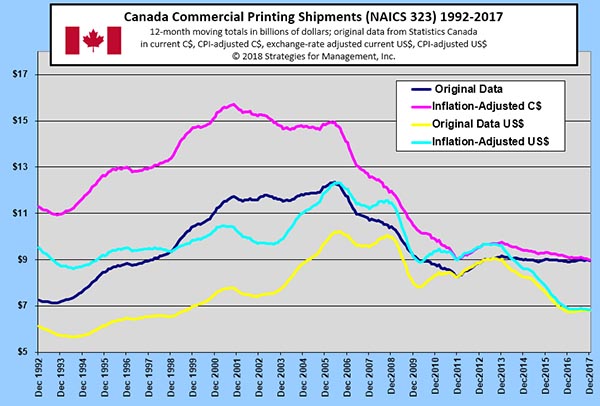

Canadian Printing Shipments

Published: August 24, 2018

Looking at the 12-month moving average of Canada’s printing shipments, it may look like Canada’s printing industry has been holding steady, but the inflation-adjusted figures show a slight decline from a recent peak at the end of 2013. Full Analysis

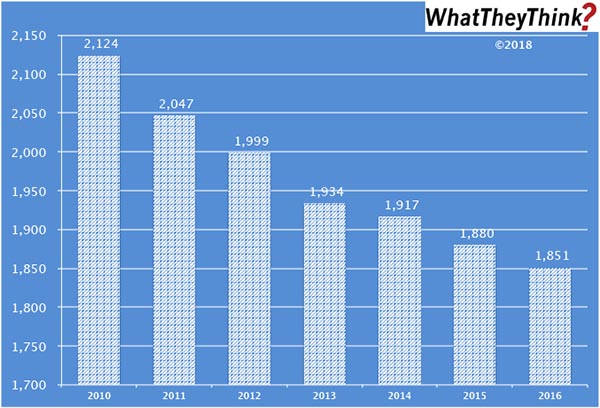

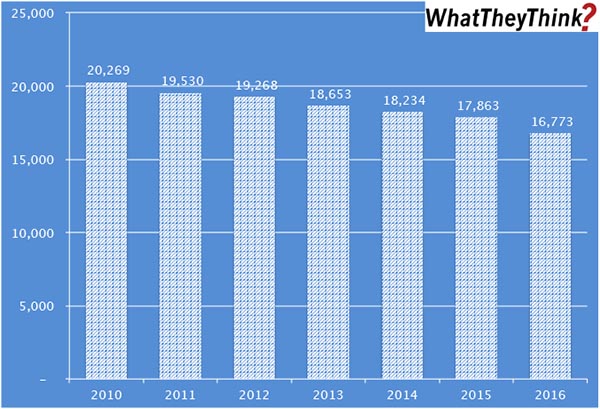

Consolidation Among Large Print Businesses: 2010–2016

Published: August 17, 2018

In 2010, there were 2,124 establishments having 50 or more employees. By 2016, they had dropped to 1,851 (down -13%). So says our new Commercial Printing Establishments tracker, based on data from the Census Bureau’s County Business Patterns, which presents—in spreadsheet form—U.S. commercial printing establishments from 2010 to 2016, broken down by six different print business classifications and nine employee-size breakdowns. Full Analysis

Printing Shipments Head Into the Dog Days of Summer

Published: August 10, 2018

The inflation-adjusted value of printing shipments for June 2018 were down from $6.9 billion in May to $6.5 billion in June. On the plus side, it’s not appreciably below the $6.6 billion reported in June 2017. Full Analysis

WhatTheyThink Launches New Industry Establishment Data Series

Published: August 3, 2018

Our new Commercial Printing Establishments tracker, based on data from the Census Bureau’s County Business Patterns, presents—in spreadsheet form—U.S. commercial printing establishments from 2010 to 2016, broken down by six different print business classifications and nine employee-size breakdowns. Full Analysis

June Printing Employment Down Y/Y

Published: July 27, 2018

Overall, printing employment ticked up from May to June 2018, but on a year-over-year basis is down -1.8% from June 2017. Among the creative markets, PR is the place to be. Full Analysis

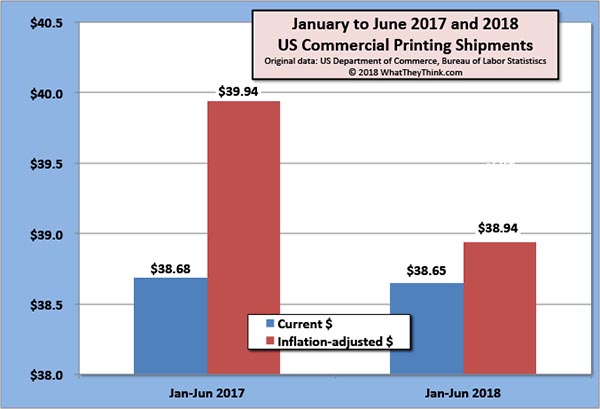

May Printing Shipments Up from April, Closing in on 2017 Levels

Published: July 13, 2018

Printing shipments for May 2018 came in at $6.77 billion, up +3.1% from April. However, on an inflation-adjusted basis, May 2018 came in below the $6.92 billion reported in May 2017, and is well below the recent high of $7.46 billion back in May 2016. Full Analysis

Big Printers' Writedowns and Interest Payments Are a Big Drag on Printing Industry Profits

Published: June 22, 2018

Writedowns in the first quarter of 2018 for commercial printers with $25 million or more in assets were $157 million, or 1.9% of sales. The assets may be written down, but the borrowing that was created to finance them remains. Interest expense was 4.8% of sales. For the quarter, losses were -1.47% of sales. That rate of loss made average profits before taxes for the industry a mediocre 3% of sales—which means that printers with less than $25 million in assets must have done well. Full Analysis

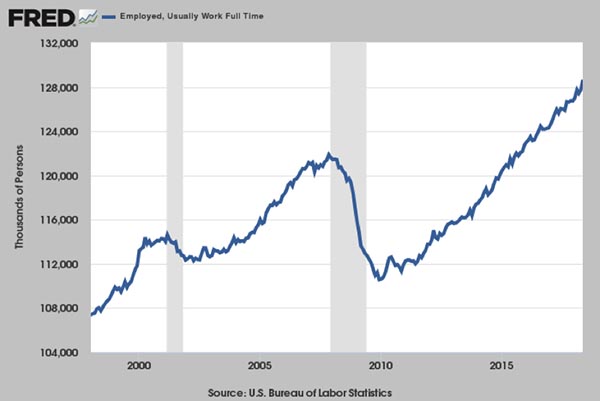

Full-Time Employment, Sets New Record, Up +904,000, But Does It Really Feel that Good?

Published: June 8, 2018

The May employment report was regarded as good, but when you dig past the top-level numbers, it was better than it looked. However, while the 3.8% unemployment rate looks good on the surface, it really can’t be compared to when it was last attained nearly 20 years ago. So many workers left the workforce that this figure implies a tighter labor than it really is. We will really know we have a strong economy when the active labor force starts increasing. Full Analysis

Consumer Durable Goods Orders Moving at Almost 2X GDP Rate

Published: May 18, 2018

Durable goods orders for consumers (less transportation) are growing at a rate almost two times faster than Real GDP. This data series remains -14% below where it was at the start of the recession in December 2017, and is a critical one to monitor for indications of an improved economy. Full Analysis

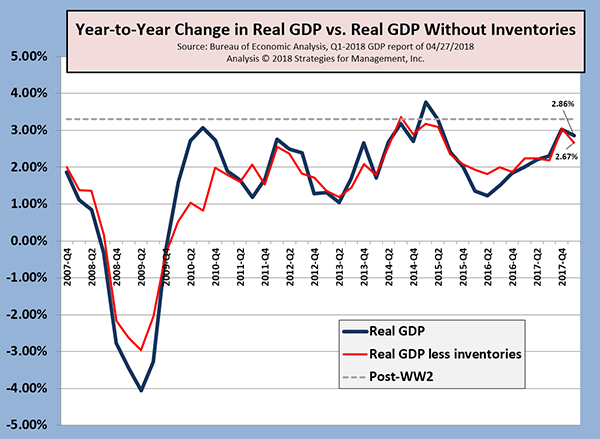

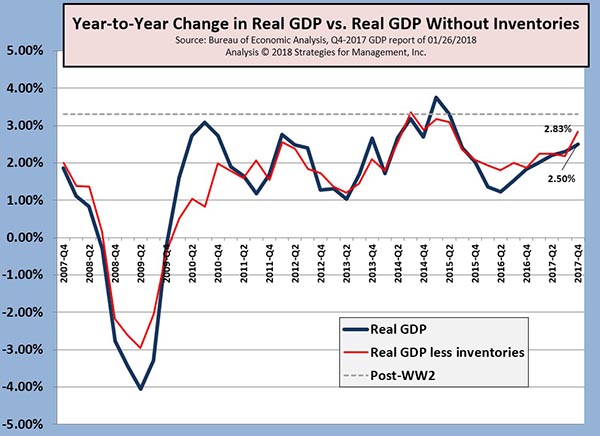

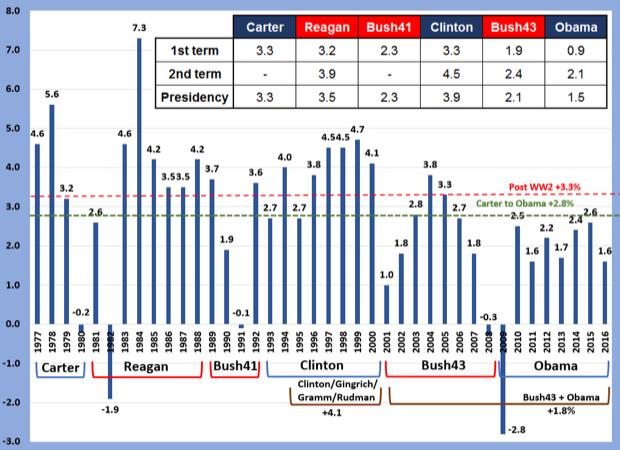

Q1-2018 Rises +2.3%, Slower Rate than Q4-2017

Published: May 11, 2018

The Bureau of Economic Analysis’ advance report estimated that Q1-2018 real gross domestic product was up at an annual rate of +2.3%, which was slower than the +2.9% for Q4-2017. Because companies and individuals, especially corporations, shifted expenses into 2017 and delayed revenue recognition to 2018 to take advantage of the rates in the new tax law, many key economic data series—such as this one—will be subject to larger than usual revision. Full Analysis

Federal Reserve Updates Industrial Production Data Series

Published: April 13, 2018

The Federal Reserve revised 2015–2017 industrial production down from its original reports, meaning that industrial production peaked in 2014 and then slowed. The initial data made things seem better than what consumers and employees were actually experiencing. Full Analysis

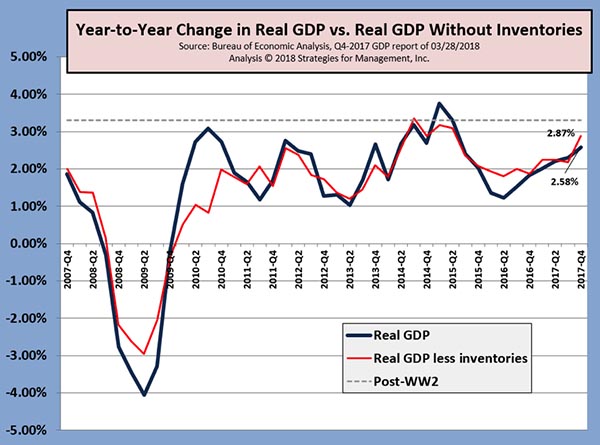

Q4-2017 GDP Revisions Stronger than Earlier Reports

Published: April 6, 2018

Q4-2017 GDP estimates were raised to +2.9% from the original estimate of +2.5%. (But beware inventories.) At the same time, shenanigans resulting from the latest tax bill are blurring statistics visibility, especially where corporate profits are concerned. Full Analysis

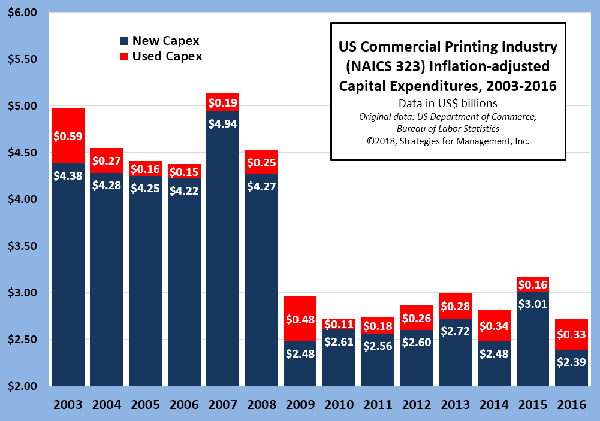

US Commercial Printing Capital Expenditures

Published: March 9, 2018

The capital expenditures of commercial printers fell in 2016, but the investment in less expensive used equipment may have been a major factor. Full Analysis

Canada’s Commercial Printing Shipments 1992-2017

Published: March 2, 2018

Canada’s printing industry has been holding steady compared to the US, despite being subject to the same competition from digital media Full Analysis

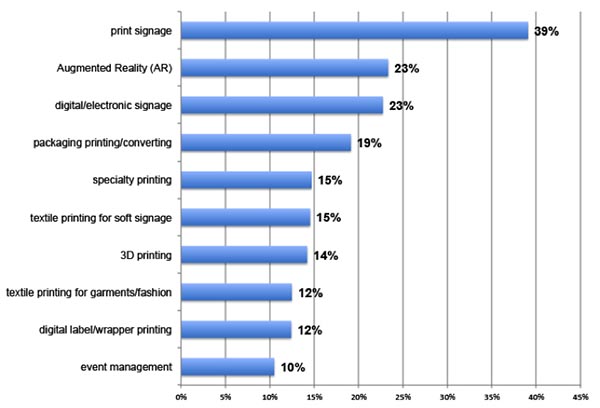

Print Business Outlook Survey: Areas of interest in new print-related applications

Published: February 28, 2018

WhatTheyThink surveyed printing business owners and executives: "What are your areas of interest in new print-related applications." Full Analysis

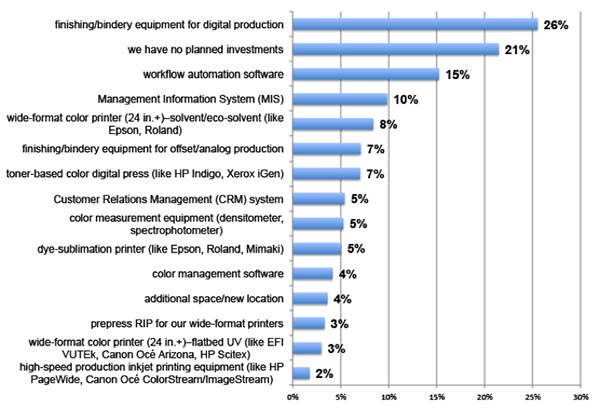

Print Business Outlook Survey: Which of the following investment items have you budgeted for and plan to acquire in the next 12 months?

Published: February 20, 2018

WhatTheyThink surveyed printing business owners and executives: "Which of the following investment items have you budgeted for and plan to acquire in the next 12 months?" Full Analysis

Consumer Durable Goods Still Struggle to Reach Recession Levels

Published: February 16, 2018

CPI-adjusted consumer durable goods manufacturing remains well below its pre-recession level—one of the reasons that GDP has been so lackluster. Full Analysis

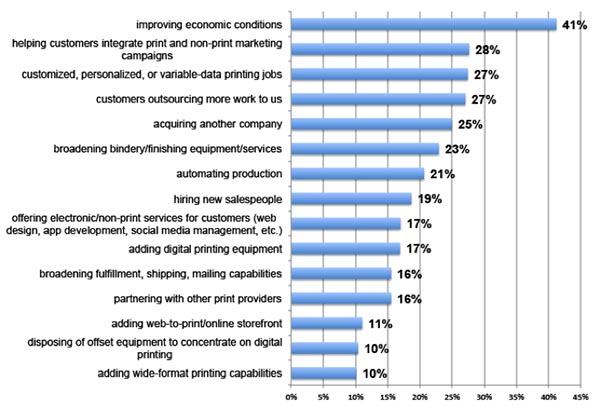

Print Business Outlook Survey: In the next 12 months, which of the following will be your biggest business opportunities?

Published: February 15, 2018

WhatTheyThink surveyed printing business owners and executives: "In the next 12 months, which of the following will be your biggest business opportunities?" Full Analysis

Q4-2018 GDP +2.6%, But +3.2% Excluding Inventory Effects

Published: February 9, 2018

The first report of fourth quarter GDP was a disappointing +2.6%. Sources such as the Atlanta Federal Reserve’s GDPNow and the New York Fed’s Nowcast were for a stronger reading. Inventories are a major factor in the volatility of GDP data, and excluding that data, the economy neared those estimates, producing a much better +3.2% rate compared to Q3. Full Analysis

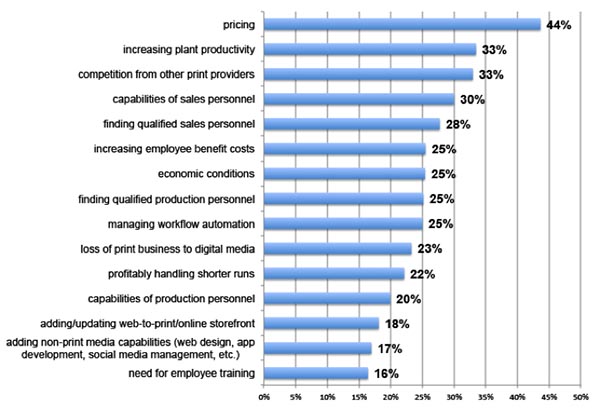

Print Business Outlook Survey: In the next 12 months, which of the following will be your biggest business challenges?

Published: February 5, 2018

WhatTheyThink surveyed printing business owners and executives: "In the next 12 months, which of the following will be your biggest business challenges?" Full Analysis

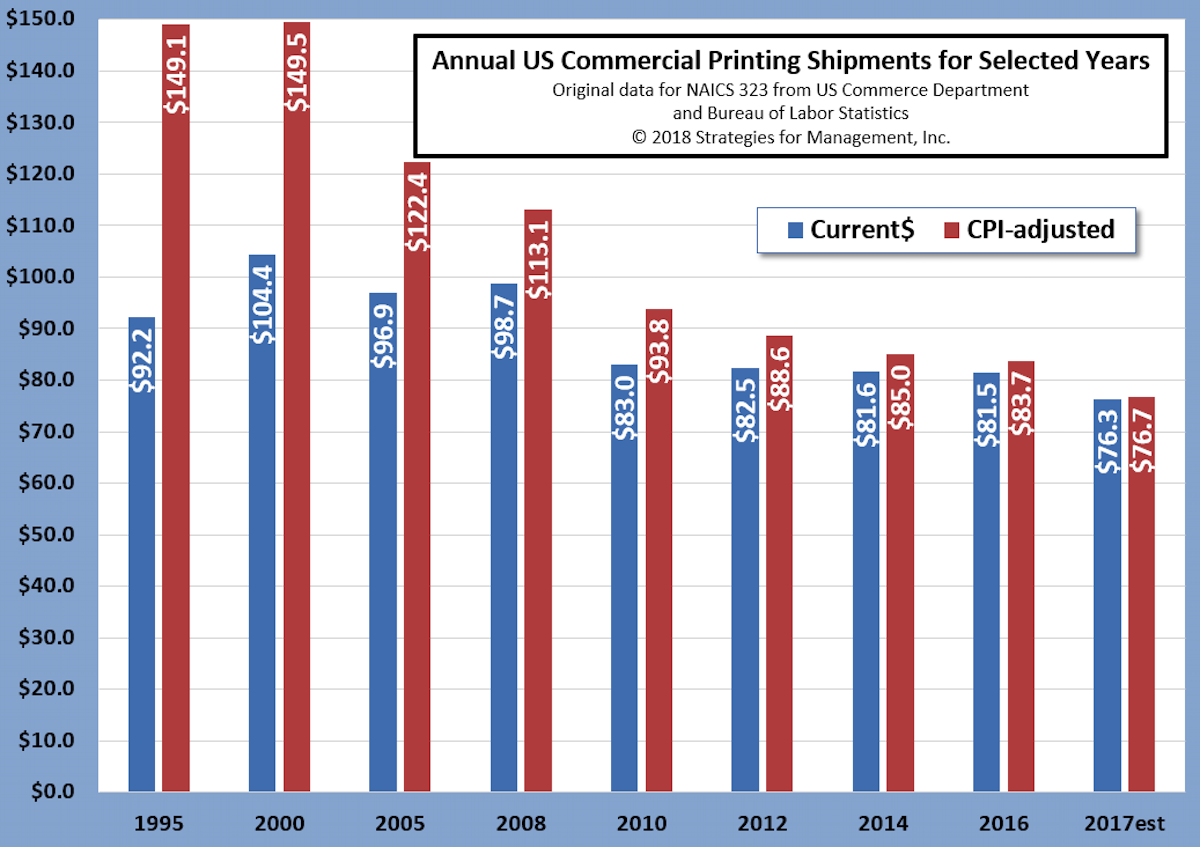

2017 NAICS 323 US Commercial Printing Industry Shipments

Published: February 2, 2018

The US Commerce Department has released data for November 2017, and this is the first look at the full year by making an estimate for December. Based on shipment and employment trends, it appears that 2017 came in at $76.3 in current dollars. That's a -6.4% decrease in current dollars compared to 2016, and a -8.4% decrease on an inflation-adjusted basis. The chart includes selected prior years starting at 1995. December data will be released at the beginning of February, and will be revised in March. In May, the Commerce Department will revise the last three years of data, plus minor revisions to the years prior to that. Full Analysis

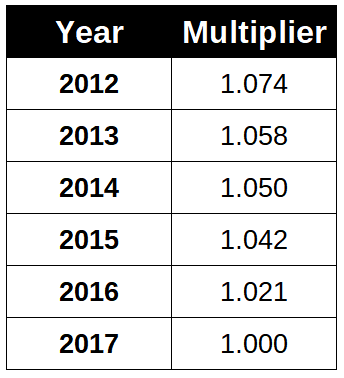

Latest Inflation Adjustment Multipliers

Published: January 29, 2018

Inflation distorts our interpretation of history and clouds business decisions. All dollars may look alike, but what a dollar bought in 1950 is a lot different than a dollar in 2017. Unfortunately, commercial printing prices have not kept up with inflation, but the costs of running a printing business usually have. This means that it's harder to keep earnings and payrolls up to this level. If past dollars had greater value, this chart can be used to adjust past financial statements to bring those data to current value. This is especially important in budgeting processes where looking for trends in prior years is one way of assessing performance and goals. Full Analysis

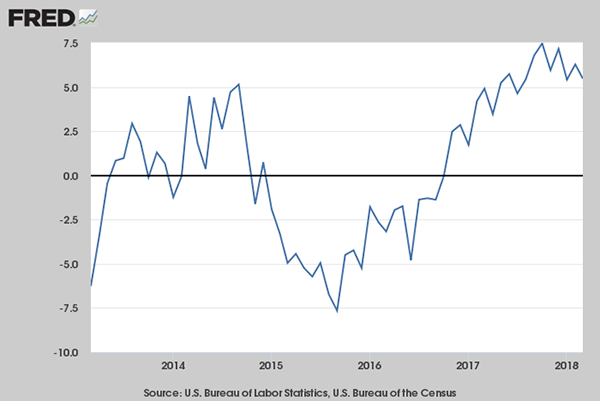

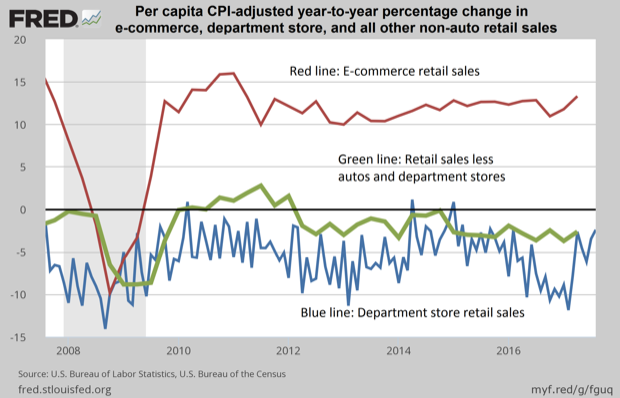

E-commerce is the only reason retail is growing

Published: October 5, 2017

Inflation and population changes often distort the analysis of economic trends. This chart shows the changing nature of retail sales on a per capita (per person) and inflation-adjusted (using the Consumer Price Index) basis by the percentage change compared to the same period of the prior year. Full Analysis

Dr. Joe's Key Recovery Indicators

Published: September 11, 2017

The recovery indicators (when we started these we thought they’d be around for about a year or so) had four of its six factors turn negative, with one of those falling back to its recession level of December 2007. Yes, that’s when the recession started. That long ago. Full Analysis

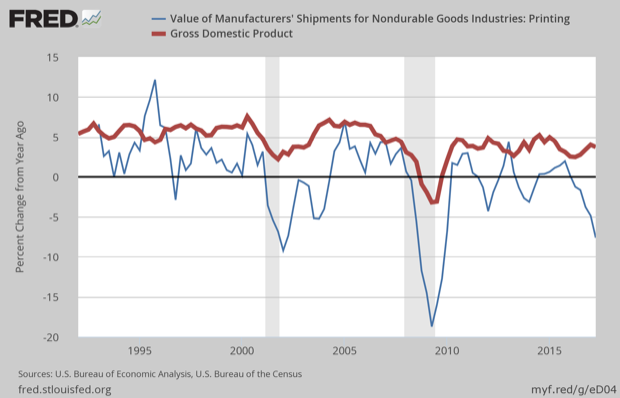

Updated Commercial Printing and New GDP Data

Published: August 17, 2017

The Bureau of Economic Analysis released the Q2-2017 GDP data and revisions to historical data beginning with 2014. Back in mid-May, the Commerce Department updated historical commercial printing shipments (NAICS 323) as part of its manufacturing shipments revisions. This week’s chart shows an updated view of both data series in current dollars (sometimes called “nominal;” both terms mean that data are not adjusted for inflation). The red line is year-to-year growth rate in GDP, and the blue line is year-to-year change in quarterly shipments. Since around 1997 printing shipments have not met GDP growth except for a moment between 2010 and 2015. The most recent printing shipments trend at the right of the chart are remarkable for their direction. A discussion of the GDP revisions and the current status of printing shipments can be found in the column of August 7.

Full Analysis

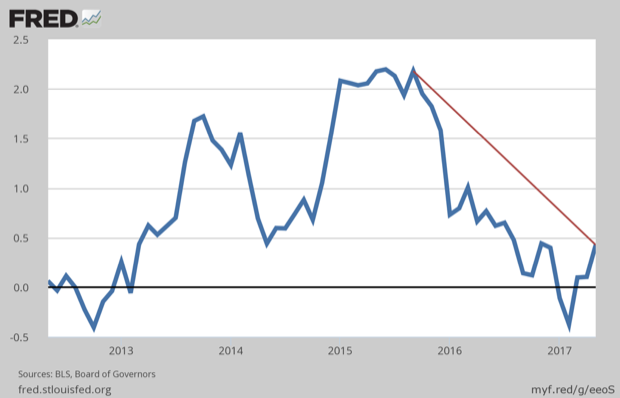

Did You Know Interest Rates Have Been Falling?

Published: July 6, 2017

The Fed has been so reticent about raising rates, and in the process, rates for the 10-year US Treasury actually were negative in February. No, that’s not market rates, that’s the 10-year rate less the year-to-year Consumer Price Index. Since that time, the rate calculated in this manner has moved up 80 basis points. The rate peaked in September 2015 and it’s been down since then. The Fed is having problems making the decision to raise rates, and often announced more rates in a future period but increasing rates at a slower pace. They have a target inflation rate of 2% (which means you lose about 25% of your savings over 10 years on a compounded basis). If you believe that the inflation rate is calculated in a manner that makes it seem lower than it actually is, then the Fed’s desire to see inflation at the 2% rate before they start pushing interest rates higher may be be difficult to reach or sustain. That means long term rates will stay artificially low (on purpose) for a longer period of time than most experts expect. Full Analysis

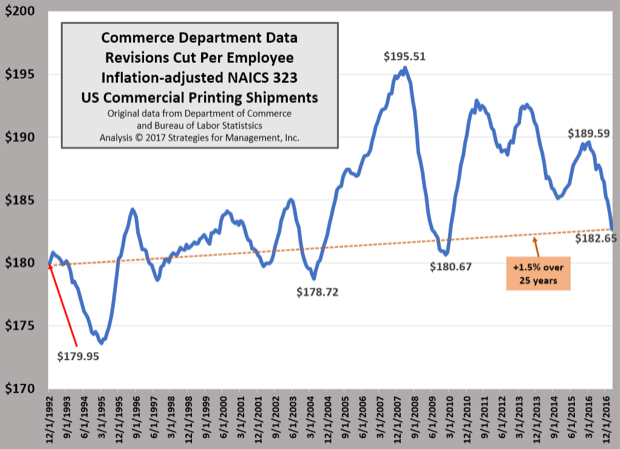

Inflation-adjusted Shipments per Employee

Published: May 25, 2017

The Commerce Department’s revisions to industry shipments show a much different picture of a key metric for the industry, sales per employee. The chart was created using 12-month moving totals of inflation-adjusted shipments and the 12 month moving average of total industry employment. The latest reading through March 2017 is $182.65 per employee, a meager +1.5% higher than it was at the end of 1992. It fell from a peak of $195.51 which was just before the burst of the housing bubble, the rise of social media platforms, tablets, and smartphones. The fall in this calculation has some interesting characteristics. Historically, large printing businesses focused on magazines, catalogs, and newspaper inserts, had sales per employee that were significantly higher than the industry averages, anywhere from 30% to 50% higher. Full Analysis

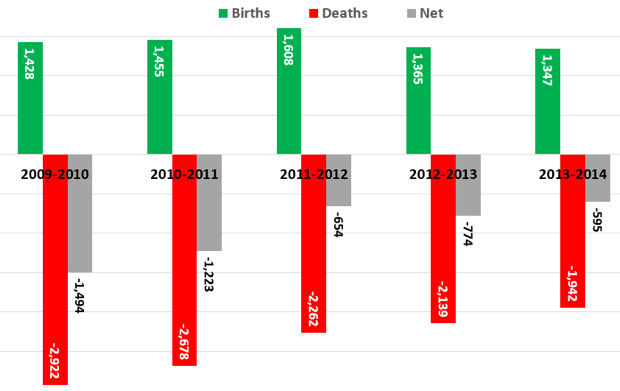

Births and Deaths of Commercial Printing Establishments, 2010 to 2014

Published: May 11, 2017

The Commerce Department tracks the number of business establishments by industry, and among he more interesting reports is the calculation of new and closed businesses. The data take a while to be released, and these new data about 2014 were recently made available. There’s a word of caution here. If someone was a corporation and decides to become a partnership or a proprietorship, that counts as one business closed and one business opened. And then there’s “poor man’s mergers” where two business owners decide to close their two businesses and open one new one. Same people, same equipment, no real change except to the tax authorities and government statisticians. The most important number is the net change of births less deaths. In the worst of the recession, the net number was 6% of establishments. For 2014, that had fallen to a little more than 2%. Full Analysis

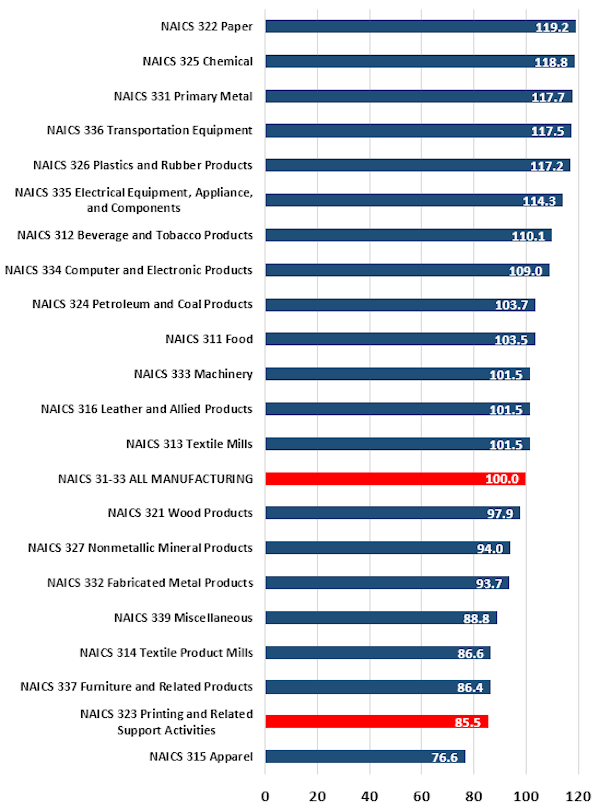

Printing Industry Lags Other Manufacturers in Defined Management Processes

Published: April 27, 2017

In what is not a surprise to many, the job shop operational structure of many printing businesses put the industry near the bottom of all manufacturing industries in terms of its management processes. Full Analysis

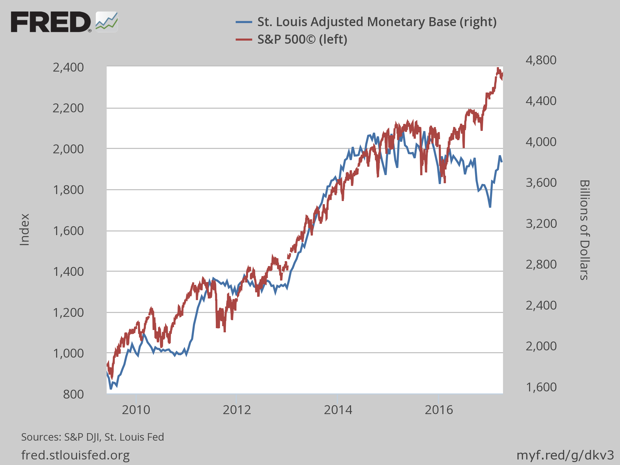

The Fed’s Balance Sheet and the S&P 500

Published: April 13, 2017

The financial markets were rattled a little bit by the recent minutes of the Fed meeting where they discussed the unwinding of their interventions and the ballooning of their balance sheet. The data are reflected in the St. Louis Fed Adjusted Monetary Base. The chart shows how the run-up in the S&P 500 stock index relates to the Fed’s quantitative easings Full Analysis

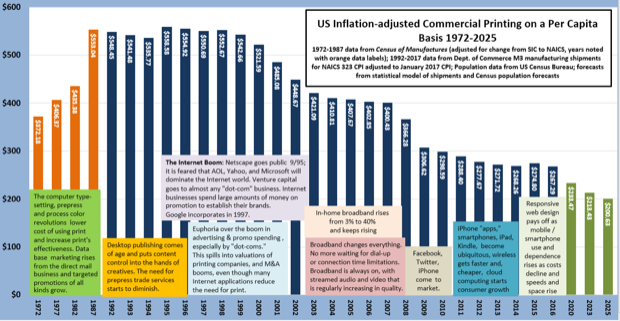

US Commercial Printing Shipments on a Per Capita Basis

Published: March 30, 2017

Yes, that sounds boring, but the data have been made interesting by including details about the last forty years or so of industry history and technological change. We added some statistical forecasts from our models that take the data out to 2025. When we started this chart almost ten years ago, those outlying years were near zero. They’re not any more (whew!). The data are inflation adjusted and based on the population data and forecasts of the US Census Bureau. It’s interesting how there are periods of relative stability, a change, followed by another period of stability. Technological change has been a much bigger factor affecting consumption than general economic conditions. Full Analysis

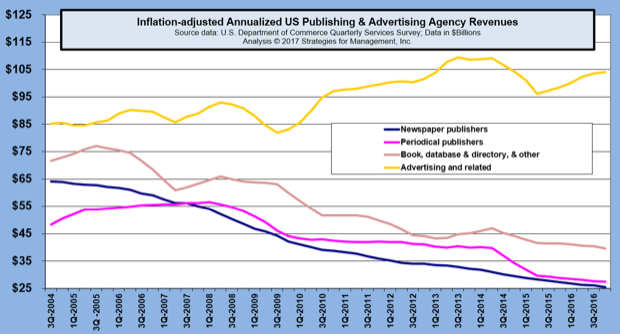

Ad Agency and Publisher Revenues

Published: March 23, 2017

Advertising agency revenues are having a slow rebound from their pullback in 2015. Publisher revenues are still having problems as ad pages and circulation are contracting. Clearly, agencies are finding other areas to garner revenues, especially in managing digital initiatives. Mobile communications are where their latest opportunities are, especially with website redesigns, creating the look and feel of content marketing for their clients, and assisting clients as they sort through the analytics that marketing automation offers. Full Analysis

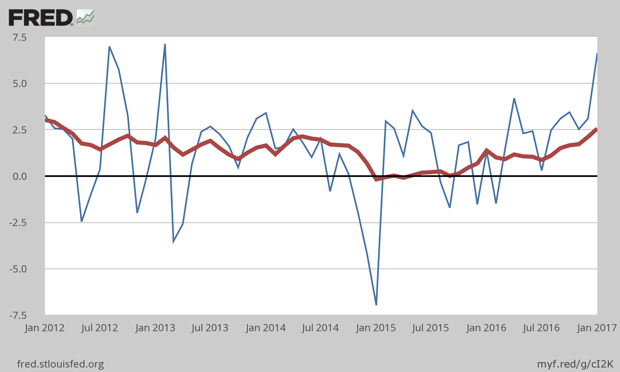

Consumer Inflation for 2016 at +2.5%, Giving Fed Reason to Increase Rates

Published: February 23, 2017

Consumer inflation for 2016 was increasing, with December’s reading +2.5% higher than 2015. December’s rate alone was at a +6.6% annualized rate. The chart shows the monthly comparisons as the blue line and the year-to-year comparisons as the heavier red line. Full Analysis

Employment Stalls; Printing Shipments Fall Sharply in December

Published: February 6, 2017

The national employment data may have had a headline of +227,000 payroll jobs, but the household survey did not indicate the same. Every year, the report released in February includes revisions to the prior year. The press release from the Bureau of Labor Statistics said that employment was “little changed.” Full Analysis

4Q-2016 GDP Slows to +1.9%, +0.9% Less Inventory Build-Up

Published: January 30, 2017

The fourth quarter of 2016 ended quiently, with a growth rate of +1.9% compared to the third quarter. That brought 2016 to an overall growth rate of +1.6%. Full Analysis

- Questions to ask about inkjet for corrugated packaging

- Can Chinese OEMs challenge Western manufacturers?

- The #1 Question When Selling Inkjet

- Integrator perspective on Konica Minolta printheads

- Surfing the Waves of Inkjet

- Kyocera Nixka talks inkjet integration trends

- B2B Customer Tours

- Keeping Inkjet Tickled Pink

© 2024 WhatTheyThink. All Rights Reserved.