Data Analysis

Advertising Agency Revenues Have Major Revision Down for 2013 & 2014, but Remain in Long-term Uptrend

Published: March 17, 2016

The US Department of Commerce released its latest Quarterly Service Survey last week, and it reduced shipments for the third quarter of 2013 by -$4 billion (whoops – a -15% statistical error). Full Analysis

Is the Positive Run for Commercial Printing Coming to a Close?

Published: March 10, 2016

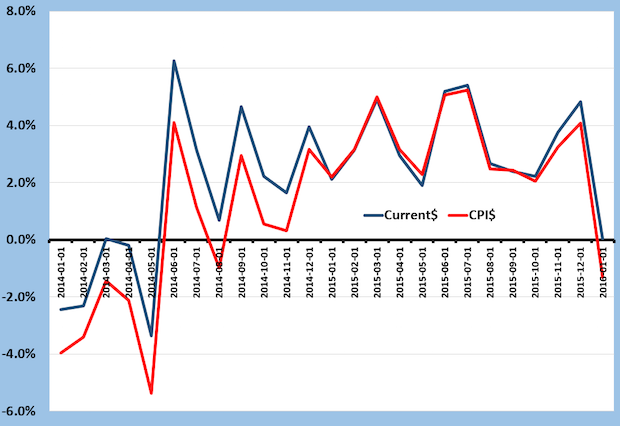

The latest printing shipments were discussed in the “Mondays with Dr. Joe” of March 7. The chart offers more details. Revenues turned around on a current dollar basis with June 2014 shipments (blue line) and the positive comparisons to the prior year kept going until the most recent report, January 2016. In current dollars, January’s shipments were barely above those of 2015, keeping the positive comparison streak intact. Full Analysis

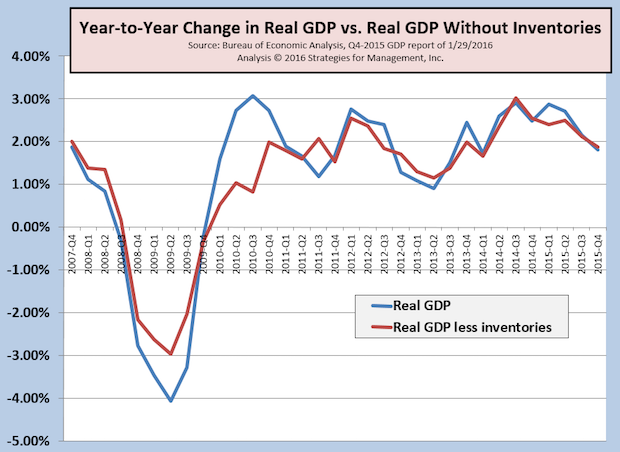

4Q-2015 GDP Revised Up from +0.7% to +1.0%, But Not as Good as It Seems

Published: March 1, 2016

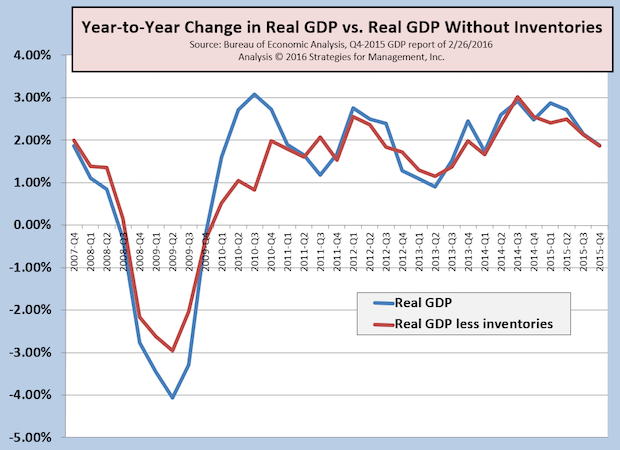

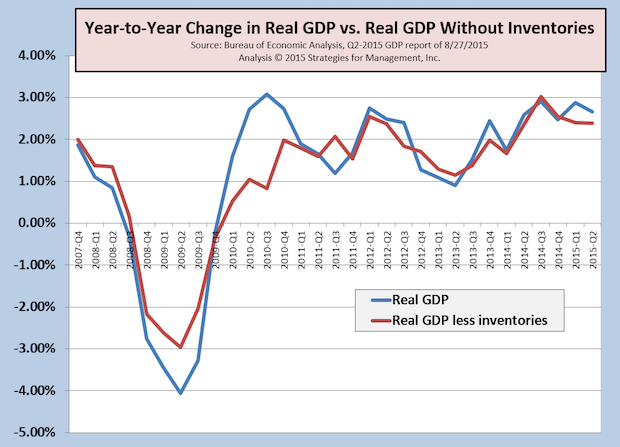

The second estimate of fourth quarter GDP was revised up from +0.7% to +1.0%, mainly from an increase in net inventories. This factor in the GDP calculation is volatile, so we track GDP with and without it to get a perspective of the underlying GDP rate from a long term perspective in a year-to-year comparison. Full Analysis

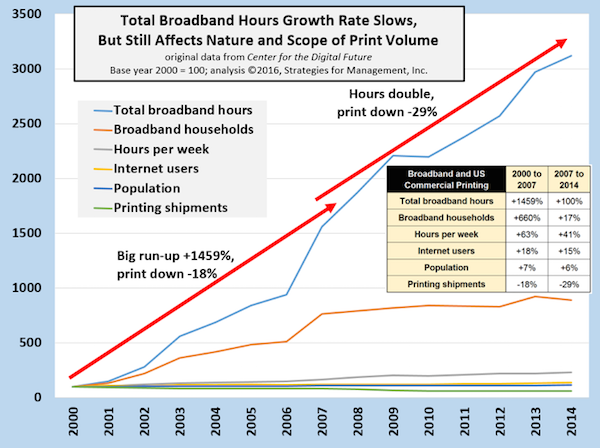

Broadband Hours and US Commercial Printing

Published: February 26, 2016

In 2014, US per capita hours using broadband is just over 900 per year (2.5 per day), and that's the entire population. The number of total hours has doubled since 2007. The population has grown in that period, but the average number of hours online per week has gone from 15.3 to 21.5 in 2014, and households with broadband connections grew from 76% to 89%. The cumulative effect has had most of its effect on mainstream commercial printing, especially information materials used for promotion and product support and advertising-funded products like magazines and catalogs. Printing's use is becoming more tactical, focused on specialty uses of printed images with higher expectations for impact, especially in concert with other media. Full Analysis

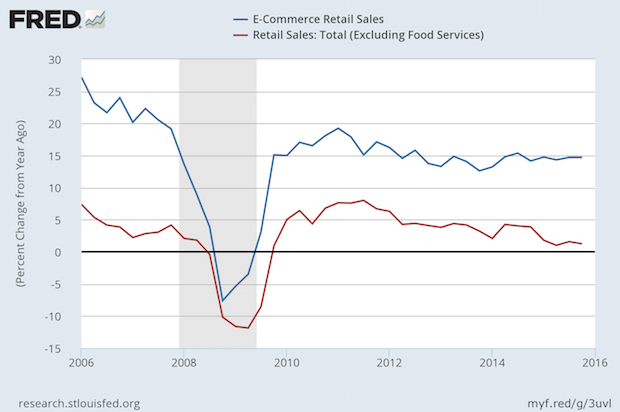

E-Commerce Retail Sales Still Growing at Nearly 15% Per Year

Published: February 18, 2016

E-commerce sales of all types, including industrial products, is still growing at a rate just under 15% per year. Full Analysis

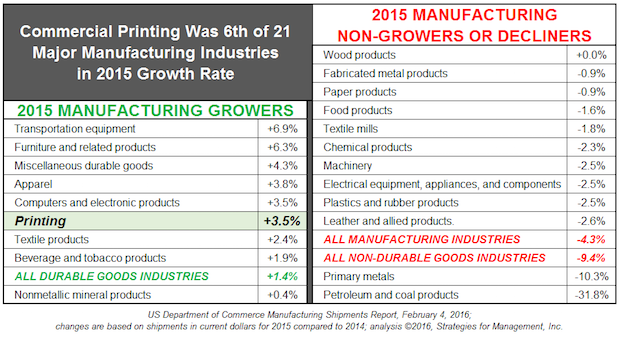

Printing Was 1 of 8 Major Manufacturing Industries with Positive Growth in 2015

Published: February 11, 2016

Part of print's good 2015 was how well it did compared to other industries. Of 21 major manufacturing industries, nine had positive years in current dollars, with commercial printing as sixth highest. Precipitous decreases in commodities prices caused manufacturing in metals and energy to have such a bad year that the entire manufacturing sector declined -4.3%. For the year, current dollar GDP growth was +2.9%. For the first time in twenty years, commercial printing growth exceeded GDP. Full Analysis

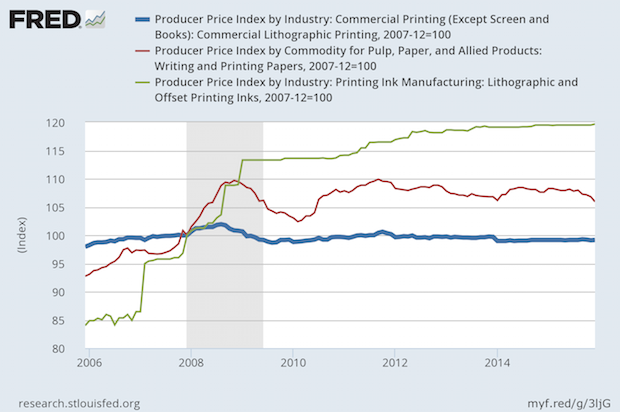

Commercial Printing Prices Less Than December 2007; Paper and Ink Higher

Published: February 4, 2016

Since December 2007, the CPI is up by +12.6%. How have the PPI for commercial printing, ink, and paper changed? Commercial printing prices are lower, -0.8%. This means that a commercial printing business has to increase its productivity and profitability to reward its owners and employees to make up for the loss of purchasing power they have in their paychecks. Full Analysis

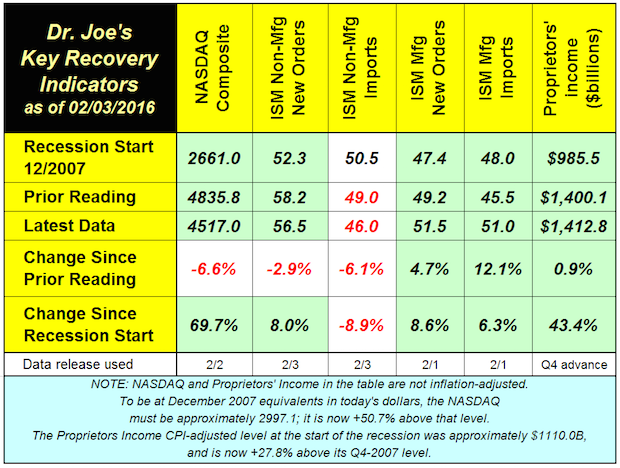

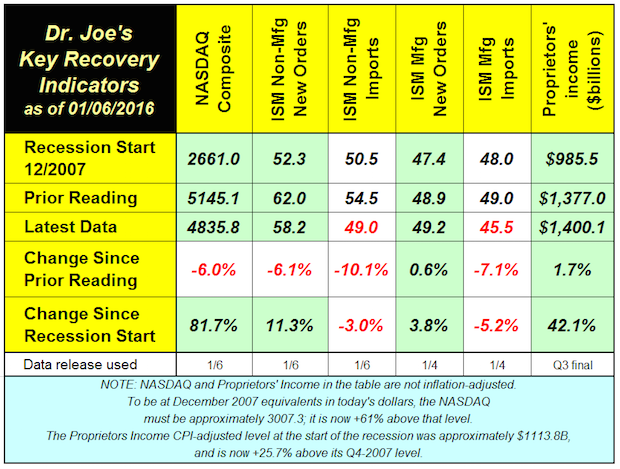

Recovery Indicators Show Economic Slowdown Underway

Published: February 4, 2016

The monthly recovery indicators were uneven again. The NASDAQ fell almost -7% in the last month, and ISM non-manufacturing new orders and imports also declined. Full Analysis

4Q-2015 GDP Disappoints at +0.7%; 2015 GDP +1.8%

Published: February 1, 2016

Real Gross Domestic Product (RGDP) for the US increased by an annual rate of +0.7% in the fourth quarter of 2015. On a year-to-year basis, RGDP was up +1.8%. Full Analysis

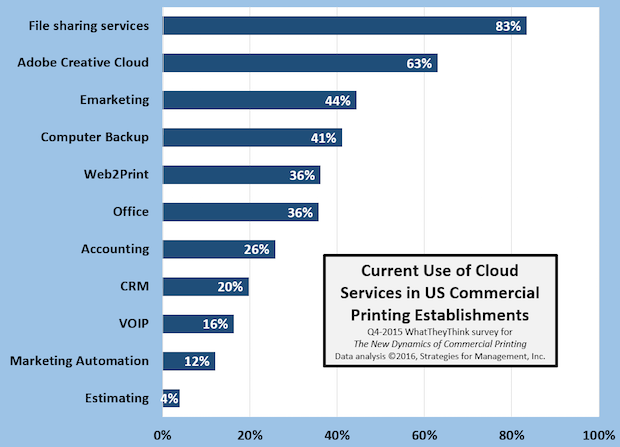

Cloud Product Usage in the Printing Industry

Published: January 28, 2016

The chart shows the percentage of US commercial printing establishments of all sizes and their responses to the question about the cloud-based services they use today. The question did not ask them their frequency or intensity of use, just whether or not they use it today. Some of the “non-users” may not even be aware that they are using cloud services, since some services run transparently in the background, such as backup services like Carbonite and others. Others may not be aware that they are using a VOIP phone system. Some cloud services such as Dropbox allow customers to brand their service so it looks like a company file sharing site. Generally, larger printers are using more cloud services than others, but the disparity is narrow. Full Analysis

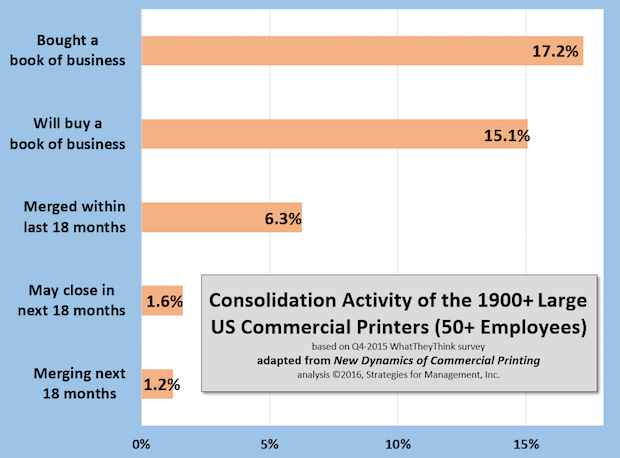

Consolidation is Somewhat Different Than Industry Common Wisdom

Published: January 21, 2016

Here are data from our survey at the end of 2015 where we asked respondents to identify the status of their companies in terms of consolidation. Generally, formal consolidations are executed by the largest print businesses, and small businesses close their respective shops and reopen a new business with new partners. Full Analysis

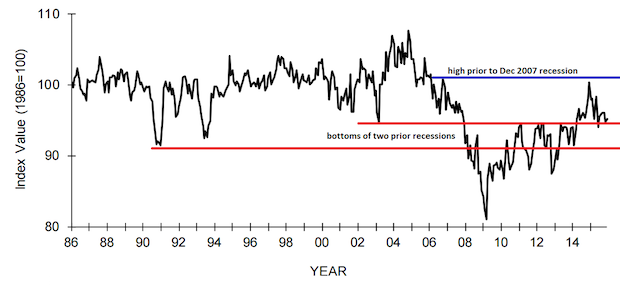

NFIB Small Business Index Still Shows Weak Small Business

Published: January 14, 2016

The latest survey of NFIB shows their index bouncing along the level of the early 2000s recession low, and down from the high prior to the December 2007 recession. Passing that level on the way up would have indicated a completed recovery of this sector but it just couldn't make it that far and break through. Using this indicator that means that small business did not emerge from the recession yet. Big business and the stock markets dominate the headlines, but small business remains the front line of the economy, and its difficulties are often hidden from view as being un-newsworthy. Its breakout above the bottom of the early 2000s recession took some time, and the recent trend in the chart looks like it's getting ready to fall below that again. It dipped below that level briefly a few months ago and climbed back out. Will it climb out again? It's worth watching. Full Analysis

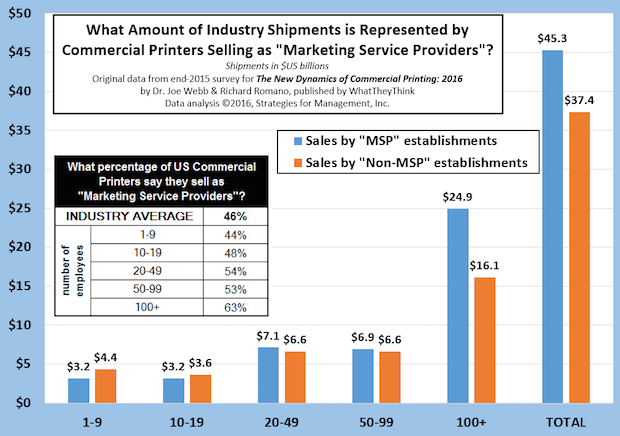

What Share of Shipments is Sold by “Marketing Service Providers”?

Published: January 7, 2016

For about a decade, many print businesses have marketed themselves as “marketing services providers” with varying degrees of success. Our recent survey showed less than half of print businesses market themselves in this or a similar manner. Full Analysis

Recovery Indicators Look More Like Recession Indicators – Are They?

Published: January 6, 2016

Are the recovery indicators becoming recession indicators There's enough negative news of late to be wary about the state of the economy, and a lengthening list of geopolitical issues, for sure. Full Analysis

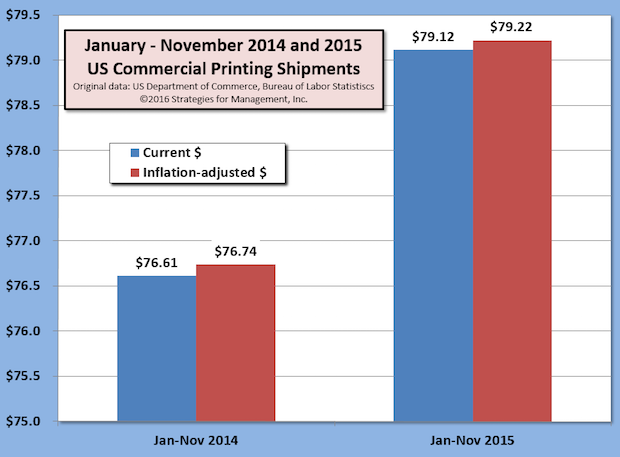

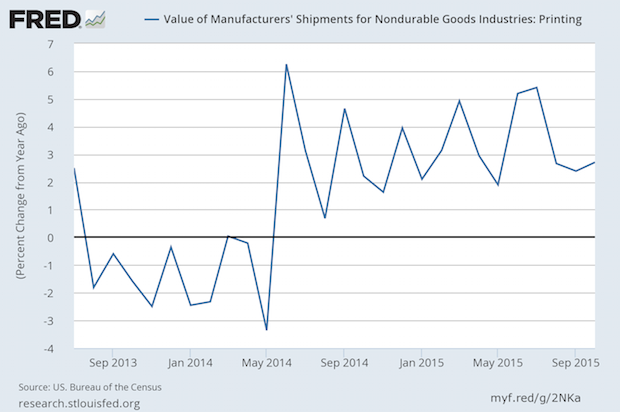

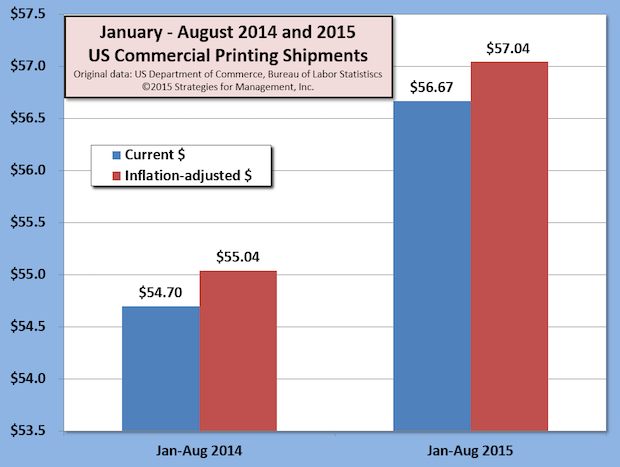

Eighteen Months of Industry Growth, Beating the Economy, Too

Published: January 6, 2016

US commercial printing industry shipments are up for 18 consecutive months in current dollars compared to the corresponding month of the prior year. Full Analysis

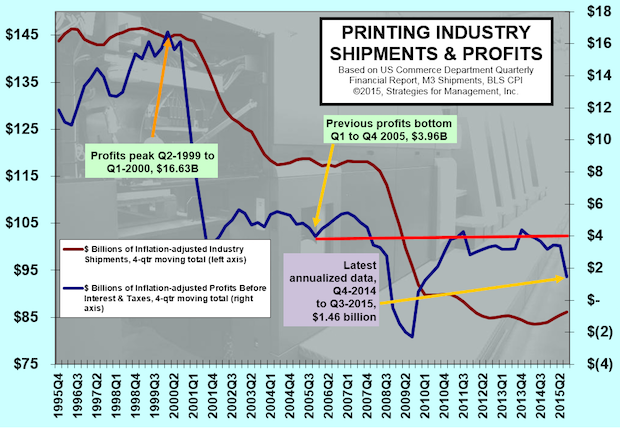

Printing Profits Dive as Large Printers Have Massive Writedowns

Published: December 22, 2015

The third quarter of 2015 marked a huge divergence in the performance of the industry, according to the Department of Commerce Quarterly Financial Report. Printers with more than $25 million in assets wrote down assets amounting to nearly -15% of revenues. This sent the quarterly moving total of inflation-adjusted profits before taxes to +$1.46 billion. Full Analysis

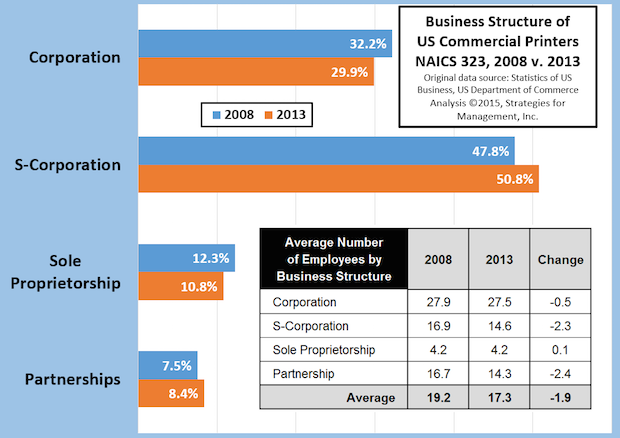

How the Business Structure of Commercial Printers Changed from 2008 to 2013

Published: December 17, 2015

The recession started just before 2008 was beginning and the latest data from the County Business Patterns report shows how the business formats of the industry changed by 2013. Full Analysis

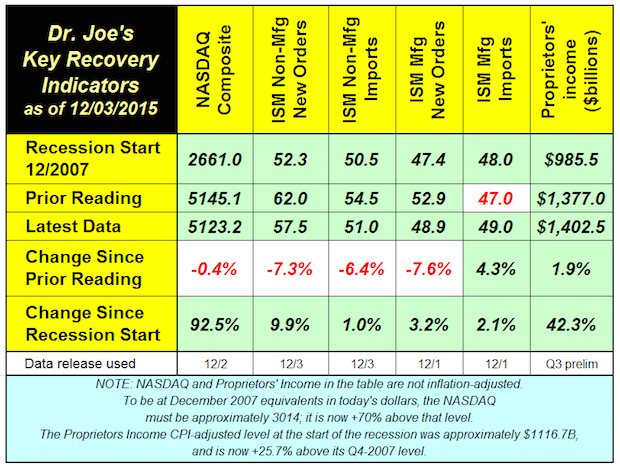

Recovery Indicators Cause Concern

Published: December 3, 2015

The recovery indicators turned in a mixed performance that warrants some caution, concern but not worry, yet. Some outside economic analysts starting to raise concerns about the economy in 2016. Citibank analysts peg the chances of recession in 2016 at 65%, the first such prognostication of a major investment firm that we have seen. Full Analysis

US Commercial Printing Shipments Have a Strong October, +$204 Million

Published: December 3, 2015

For 17 consecutive months the US commercial printing industry has scored increased shipments compared to the same month of the prior year. In current dollars, the Commerce Department reported that shipments were $7.729 billion. That meant that October 2016's shipments were +$204 million compared to 2015, a +2.7% performance. For the year through October, shipments are +3.3% on a current dollar basis. Full Analysis

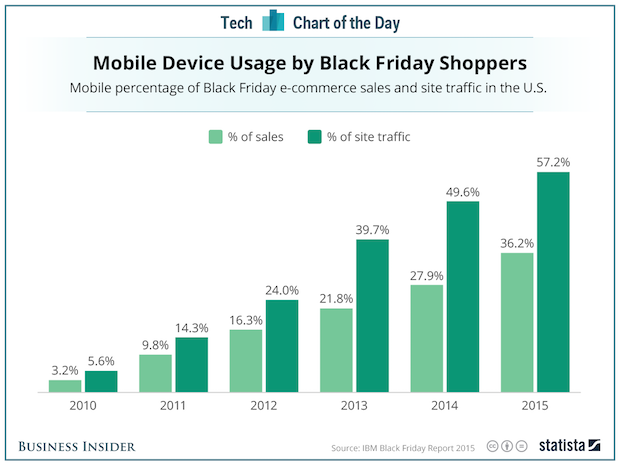

Mobile Plays Big Role in Black Friday

Published: December 3, 2015

The rise of mobile marketing has been long expected, and it looks like Black Friday 2015 is key milestone: mobile was more than half of web site traffic for e-commerce sites. Black Friday “brick-and-mortar” traffic was disappointing, but retailers were aggressively pushing sales online because it reduces the risks of riot-like runs for bargains as stores open. Target Stores had so much online traffic for CyberMonday its servers could not handle the volume. It wasn't the first time that Target misforecast demand for online sales. Some of Black Friday shopping may have been “window shopping” for mobile ordering. IBM, which still has a big business in systems for retailers issued a free download report about what was learned on Black Friday. In that report is the chart we highlight this week. If you sell to retailers or to businesses that sell to retailers, the report is worth reading. Full Analysis

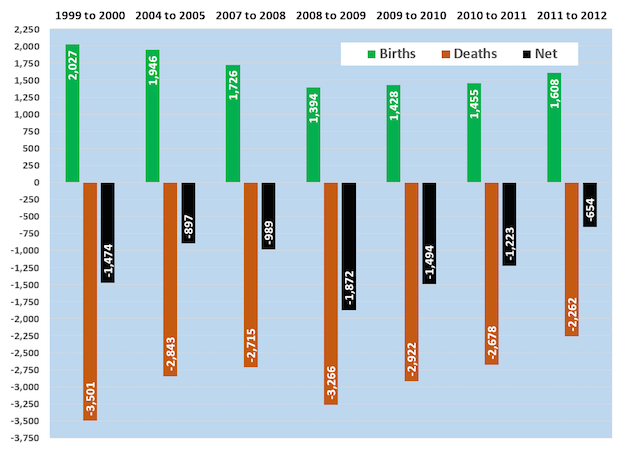

Printing's Birth-Death Data Show Improving Industry Health

Published: November 19, 2015

Even the usual industry dynamics are dynamic. The latest commercial printing industry birth-death data comparing 2012 to 2011 show a rising birth rate and a declining death rate. The +1608 births and -2262 deaths in 2012 were recent lows, as was the net change of only -654 establishments. Full Analysis

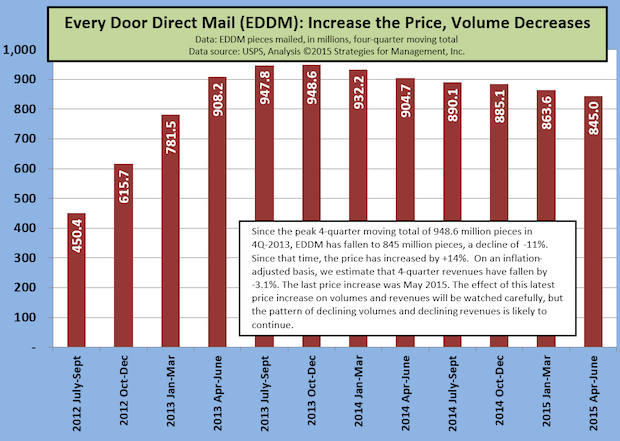

USPS EDDM Volume Decline Continues

Published: November 13, 2015

What could be an important product for local retailers to make their baby steps into direct mail, keeps declining as the USPS raises prices on the Every Door Direct Mail (EDDM) service. Full Analysis

Recovery Indicators Bounce Back

Published: November 9, 2015

The recovery indicators had a better month than last. Five of the six indicators increased and one fell below the level of the start of the recession. New orders for manufacturing and non-manufacturing were impressive in their increases, in stark contrast to government reports about September's durable goods and factory orders. Full Analysis

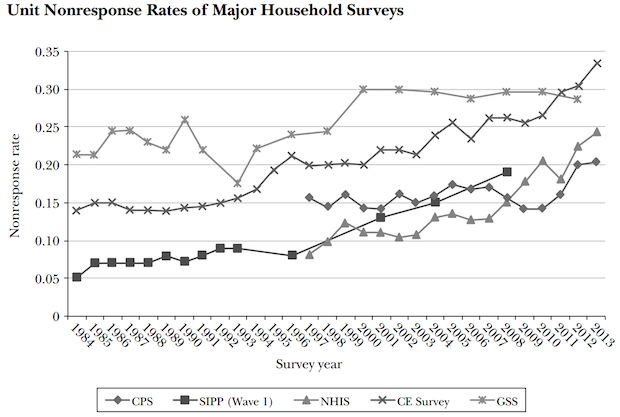

Can We Trust Government Data?

Published: November 5, 2015

A recent academic paper published in the Journal of Economic Perspectives (Volume 29, Number 4, Fall 2015), “Household Surveys in Crisis,” illustrates the problems of government surveys that are used to make multibillion dollar and multiyear decisions of government and business. Full Analysis

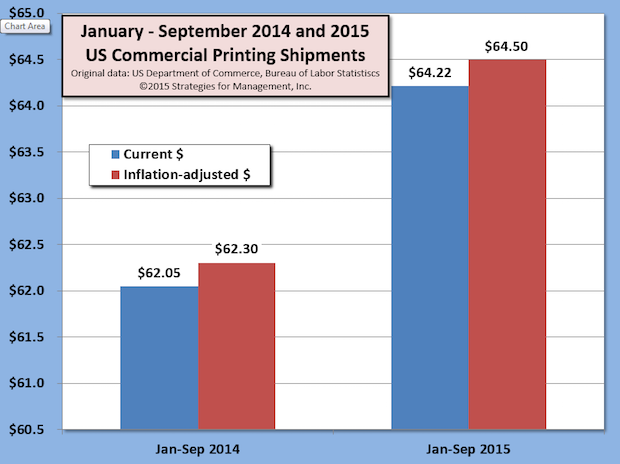

Third Quarter US Commercial Printing Shipments Have Highest Growth Rate Since 1996

Published: November 4, 2015

The US Commerce Department reported that commercial printing industry shipments are up for 16 consecutive months in current dollars compared to the same month of 2014. Full Analysis

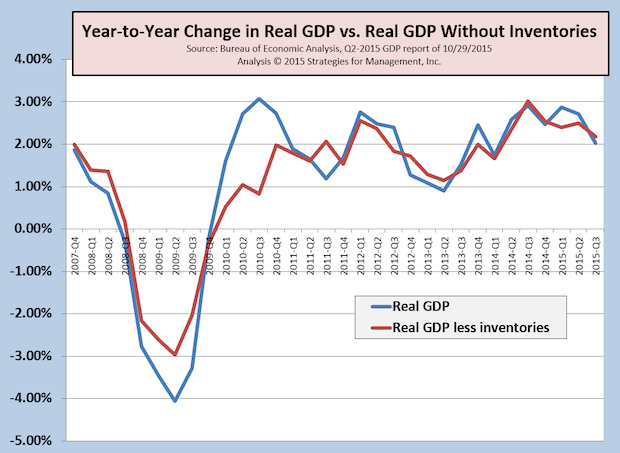

Third Quarter GDP Not Good, but Better Under the Surface

Published: October 29, 2015

The advance estimate of third quarter 2015 real GDP is +1.5%. We much prefer the year-to-year comparison, and also without the fluctuations of inventories. Those figures, also indicated in the chart, are +2.03% and +2.18% respectively. Net inventories have been running very high, but in the third quarter were $56.8 billion. This figure was cut in half from Q2, and is close to the 2010 to 2014 average. Full Analysis

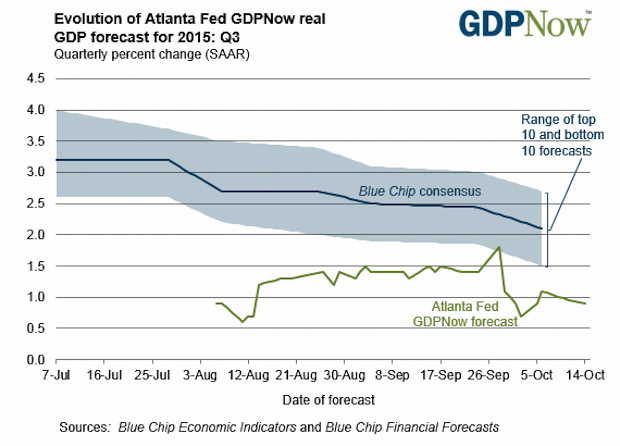

Recession Coming? Third Quarter GDP Looks Weaker than Experts Forecasted

Published: October 22, 2015

The latest estimate (October 20) by the Atlanta Fed's GDPNow model indicates that third quarter GDP will be +0.9%. That is, until the next data for their model comes in.

Full Analysis

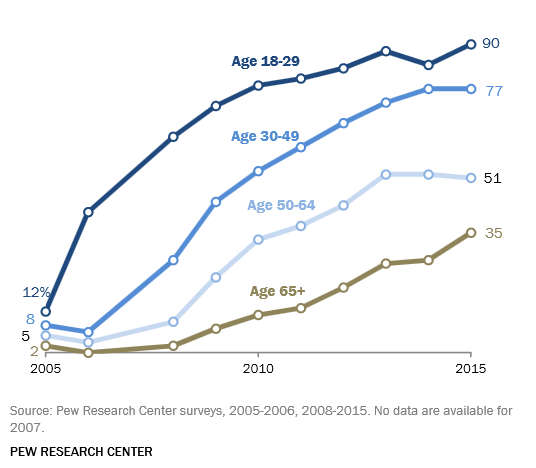

Pew Internet Survey Shows Social Media Use Up, Way Up, in Last Ten Years

Published: October 15, 2015

The Pew Internet Survey has released their latest survey (free download) of social media use and the long term trends are striking. The organization started tracking use in 2005 when social media use was by just 7% of the US population. Now, 65% of adults use social networking sites. Our chart shows the increases by age group.

Ninety percent of those between 18 and 29 use social media, which is not a surprise. Those social media users who are 65+ has more than tripled from 11% in 2010 to 35% in 2015. The report includes data about social media use by various demographics including income, race, gender, community, and education.

Full Analysis

Commercial Printing Shipments in Uptrend: 15 Consecutive Months of Growth, Best Growth Rate Since 1996

Published: October 14, 2015

US commercial printing industry shipments are up for 15 consecutive months compared to the same month of the prior year. Full Analysis

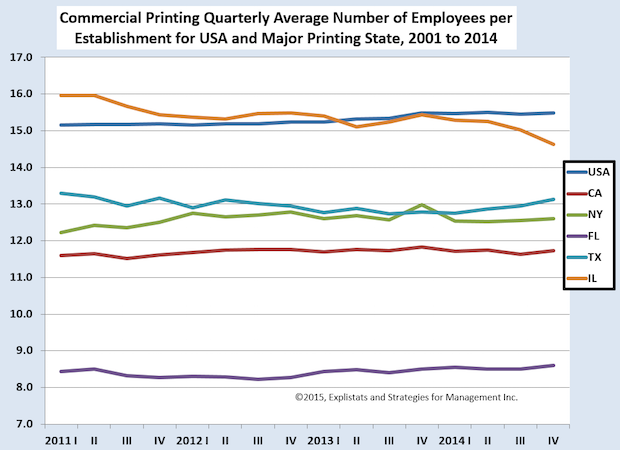

Changes in Commercial Printing Employment by State

Published: October 8, 2015

The chart shows the changes in the average number of employees per establishment in the US and large printing states. The average size of printing businesses in an area offers clues to the kinds of printing produced there and the history of the industry in that area. Full Analysis

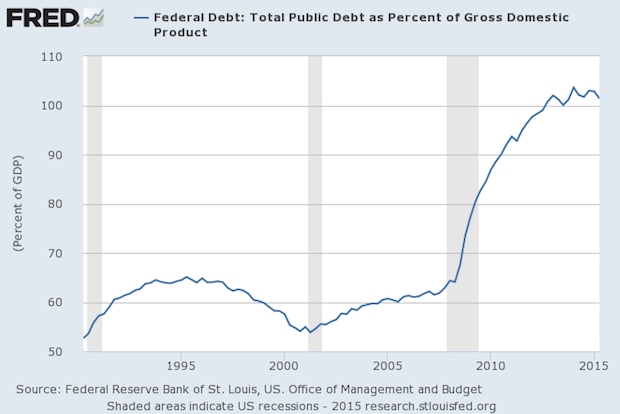

Debt as a Percentage of GDP

Published: October 2, 2015

Many people confuse debt and deficit when they see it as part of the Federal government's annual budget. Deficit is the annual shortfall between a government's spending and its revenues. Debt is the accumulation of all of the deficits and surpluses of the prior years in that government's history. Full Analysis

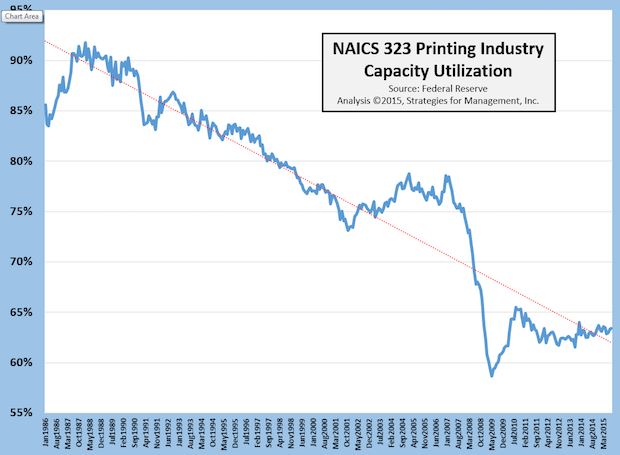

Updated Printing Industry Capacity Utilization Data – Not What Everyone Thinks It Is

Published: October 1, 2015

Even in the industry's most profitable and growing years, the mantra “there's too much capacity in the industry” was always heard. It's been a misplaced and inaccurate portrayal of the business, yet it persists. Full Analysis

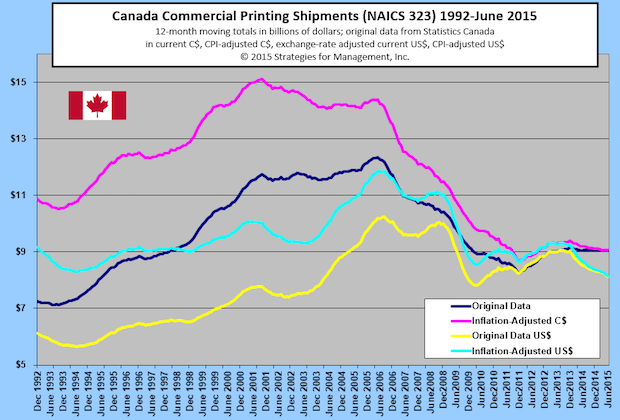

Canada's Commercial Printing Shipments

Published: September 17, 2015

Canada's commercial printing industry had a small rebound more than three years ago, before that of the US, and has been on a somewhat steady course since. In US dollars, however, Canada's gains market have been erased recently with the stronger dollar. Full Analysis

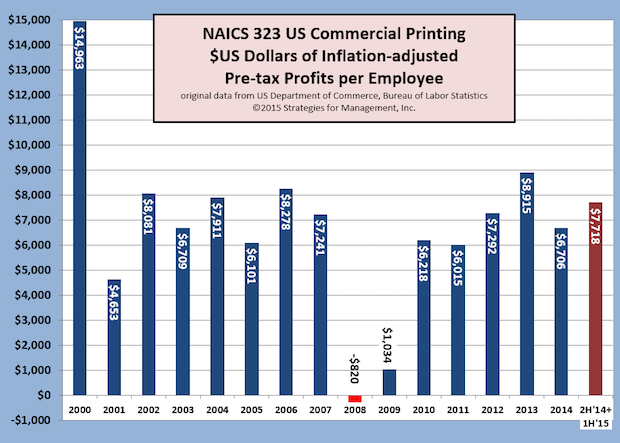

Profits Per Employee Increase

Published: September 10, 2015

The nearly $15,000 profit per employee of 2000 may not be in the cards for the US commercial printing business any time soon, but it looks like this measure is headed to its second best performance since the end of the recession. Using the latest data for the second quarter of 2015, and adding the previous three quarters to create a full year, profits per employee seem to be headed to $7,700, a thousand dollars more than the level of 2014. Full Analysis

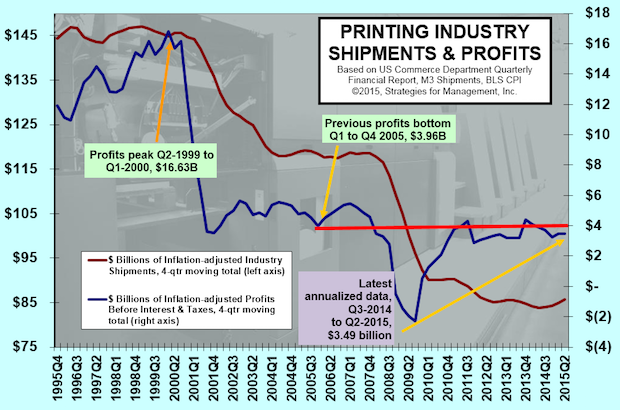

Improvement in Industry Shipments, Profits Improvement Elusive

Published: September 9, 2015

The 4-quarter moving total of inflation-adjusted US commercial printing shipments have been increasing, but unfortunately profits have not. Q2-2015 four-quarter shipments are up +2.3%, but profits are unfortunately down for the last four quarters -10.8%. Full Analysis

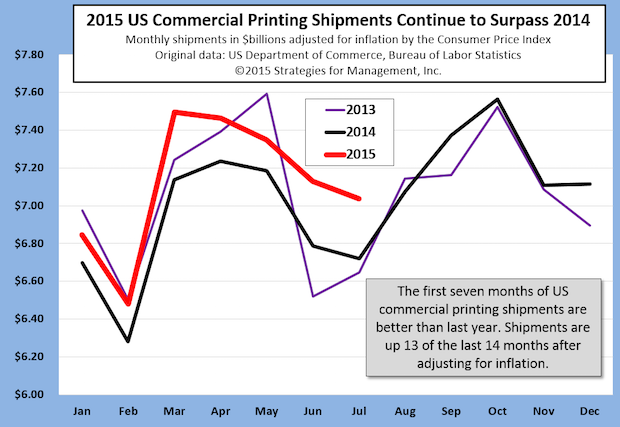

Latest Printing Shipments Reflect Rebound

Published: September 3, 2015

July's inflation-adjusted US commercial printing shipments continued to outshine prior year shipment levels. This was the best July since 2008 on a current dollar basis and since 2010 on an inflation-adjusted basis. On average, monthly industry shipments have been about $200 million higher than the year before. They are also tracking closer to GDP growth rates, a feat the industry has not done for almost two decades. Full Analysis

Recovery Indicators Mixed with Slight Downward Bias; Sluggish Economy Remains

Published: September 2, 2015

Four of the six recovery indicators fell last month, but the non-manufacturing new orders indicator remained very strong. World markets had a rocky month, and the NASDAQ fell -7% since the last indicators. Full Analysis

US Commercial Printing Shipments Up for 14 Consecutive Months

Published: September 2, 2015

US commercial printing shipments were nearly $7.04 billion in July, a $392 million increase (+4.9%) on a current dollar basis compared to 2014. This was the strongest July since 2008. Full Analysis

Q2 GDP Revised Up, Bigger Rebound from Q1... But What's Ahead?

Published: August 27, 2015

The first report of Q2-2015 real GDP was +2.3%, and now it's been raised to +3.7%, well ahead of forecaster expectations. On a longer-term year-to-year basis, the growth rate is +2.5%, still almost a full percentage point below post-WW2 average.

Longer term rate +2.5%. The effects of inventory increases is still a major factor in the growth, but there were other positives in the report implying that Q2 was broadly better than originally thought. There are concerns among professional forecasters that the inventory buildup will result in slower growth as those stockpiles are reduced. Considering that two thirds of the third quarter is almost complete, we know that international trade is being disrupted by currency and solvency issues in China and other countries. The Federal Reserve Bank of Atlanta GDPNow estimates that third quarter GDP will be at +1.4%. Please also note a recent chart where we showed important key indicators that have yet to surpass their recession levels from Q4-2007.

Full Analysis

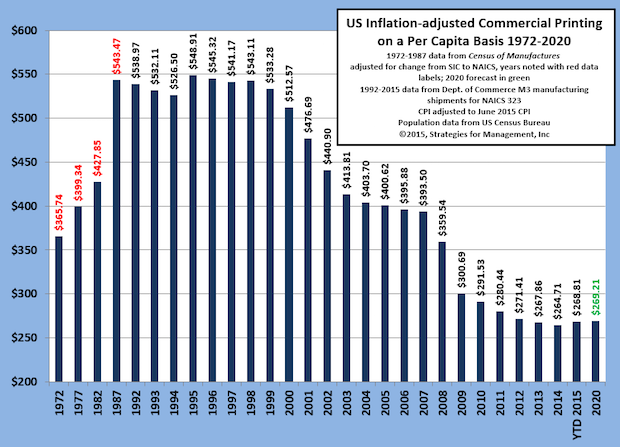

Per Capita Commercial Printing Shipments Stabilize; Forecast Models Project Levels to Continue

Published: August 20, 2015

The per capita value of US commercial printing shipments has stabilized at nearly $270, and the recent change in the direction of shipments in the last year or so has changed the forecasts. Forecast models place heavy weight on recent history, and that fact has changed the forecast for 2020 to remain at current levels. It was not long ago that the models forecast 2020 consumption at near zero, an unlikely outcome, but one worth pondering. Will shipments stay at these levels? That's unlikely, too, as media formats and loyalties are still changing.

Full Analysis

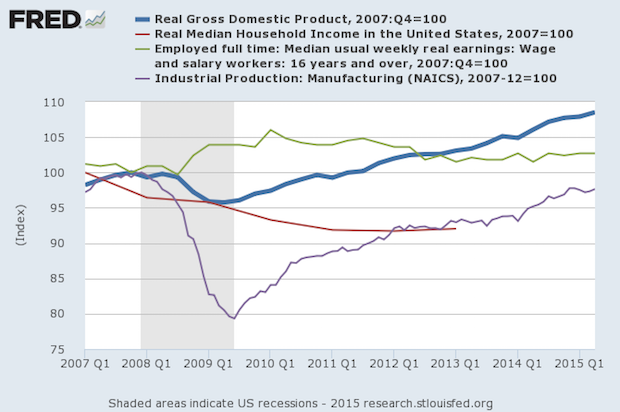

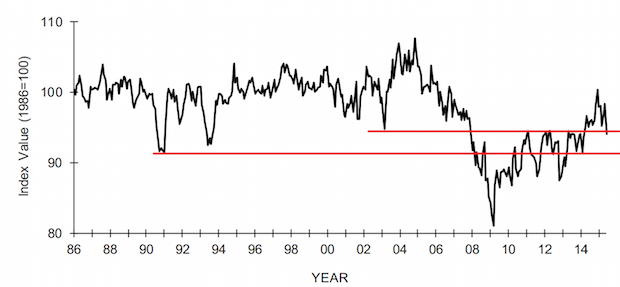

Key Indicators that Have Not Improved Since the Recession and Recovery

Published: August 14, 2015

There are numerous data series that explain that the economy has never recovered from the recession. These are not obscure data series, but mainstream ones. Gross Domestic Product should be the standard for determining the status of an economy (thick blue line). Movements in GDP should be confirmed by other measures. This week's chart uses the start of the recession, December 2007, as the base, which is 100. Full Analysis

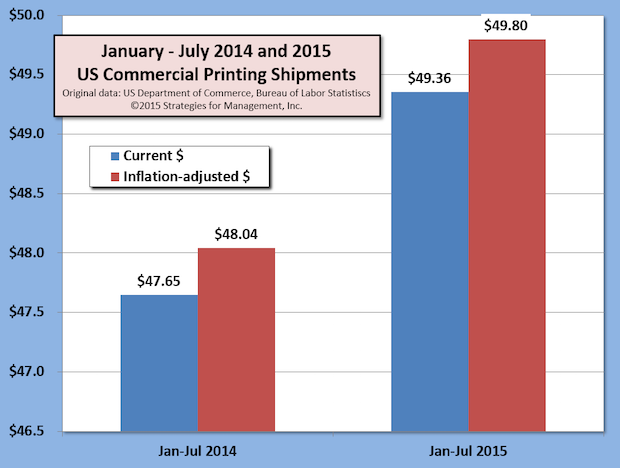

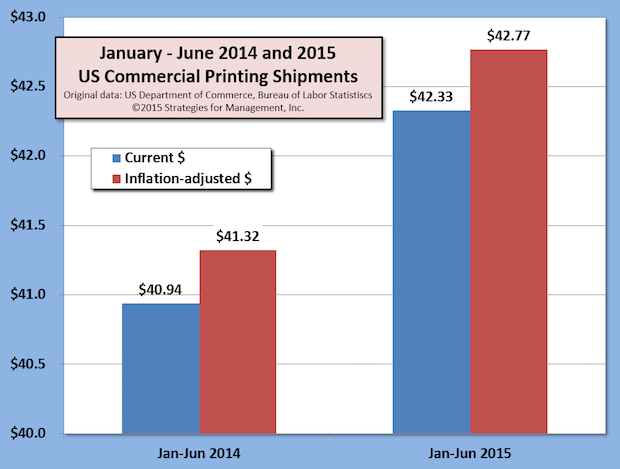

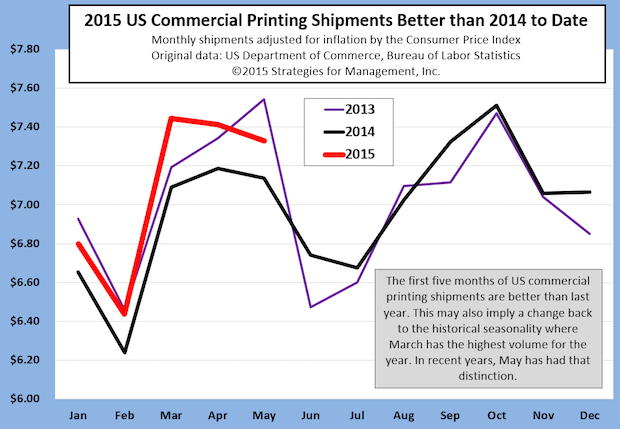

US Commercial Printing Shipments +3.5% for First Half of 2015, Exceeding Real GDP Growth

Published: August 6, 2015

US commercial printing shipments are up about +3.5% for January to June compared to the same period in 2014. The industry has been restructuring, as employment continues to decline. Usually employment and shipment levels move together in a tight range if not almost in lockstep. Full Analysis

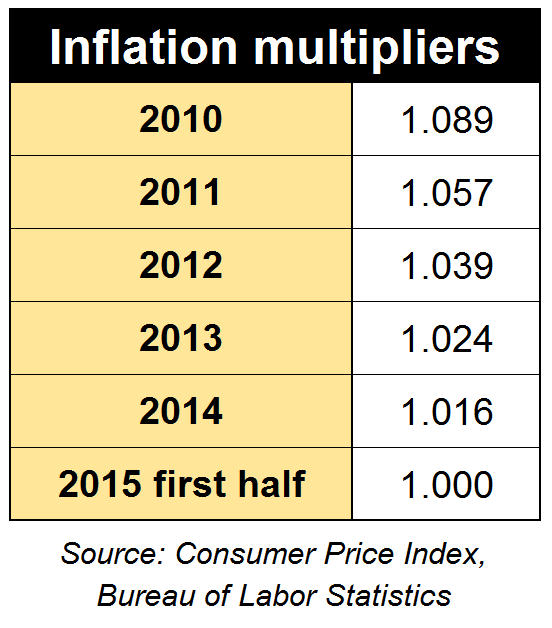

Inflation Multipliers Updated

Published: July 30, 2015

Inflation is supposedly tame, but if you're making comparisons of current year financial data to prior years, you still need to adjust for the years when inflation was not. The chart was created from Consumer Price Index data for each of the years specified. When looking at your company history, multiply your data for each year by the multiplier specified. This will give you an approximation for the effects of inflation on your business, and make your historical analysis, especially in the process of budgeting, to be more realistic. Adjusting your data, even in periods of claimed low inflation, creates a sense of more urgent action. Inflation means that to stay at the same level you actually need more dollars. Staying the same is actually a cut. Full Analysis

Year-to-Year Real Retail Sales Peaked in January, and Are Weaker Since

Published: July 23, 2015

June retail sales adjusted for inflation fell -0.6% compared to May. Month-to-month changes are somewhat volatile, so it's better to look at the comparisons to the prior year. The chart shows that June retail sales were +1.2% compared to last year, the worst comparison since March 2014. There are signs that the economy is slowing again. In the first quarter, real retail sales were +2.6% compared to the prior year, but this second quarter is only +1.6%. The economy always has conflicting positive and negative data, but this downturn in a key sector of the economy is likely to raise some eyebrows among economists and policymakers. Full Analysis

Is Small Business Slowing Down Again?

Published: July 22, 2015

The NFIB Small Business Index was released this week, “The weakness was substantial across the board, showing no signs of a growth spurt in the near future,” according to Bill Dunkelberg, NFIB Chief Economist. “Declines in spending plans accounted for 30 percent of the Index decline, and weaker expectations for real sales and business conditions another 20 percent. The deterioration in earnings trends accounted for about a quarter of the decline.” Full Analysis

Inflation-adjusted US Commercial Printing Shipments Better than 2014

Published: July 10, 2015

Commercial printing shipments have been much higher than they are in today's market, but the bounce off the lows of 2014 this year have been notable. The comparisons toward the end of 2015 will be harder to top since the industry started to show this bounceback at the end of 2014. The transformation of commercial printing businesses has been an arduous one, with volume declines of many mainstream products, but a rise in specialty applications. Those new applications are often based in digital printing, such as wide format specialties. There's also a new generation of print business managers who are not burdened by the myopia of history, where print was paramount. These executives and owners have grown up with computers and gadgets and have a better sense of print's new role in media communications Full Analysis

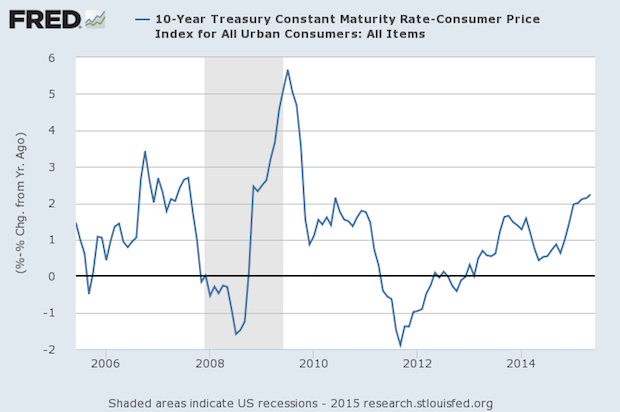

Interest Rates Have Rising Since the End of 2011

Published: June 25, 2015

We all know how the markets seem to panic when the Fed hints that rates will be rising soon, but they already have. That is, the markets have been pushing up the inflation-adjusted 10-year US Treasury since September 2011 by 420 basis points (4.2 percentage points). The rate is now the highest since June 2010, at 2.33%. This measure can be volatile because of the inflation adjustment. We used the year-to-year inflation rate as measured by the Consumer Price Index for that reason. There are Fed governors who believe that they have great latitude to be patient with a rise in inflation since their target of +2% annual inflation has not been met. This means that they believe they have a cushion of “banked” uncreated inflation that they can use up before they move aggressively. Whatever the case, a 25 basis point rise in short term rates is not much, as they might actually be catching up to the marketplace that has already moved and the Fed is already lagging well behind it. They miss an important point. The CPI does not measure inflation in a practical way. If wages are stagnant (though a little better lately), a “mild” 2% rise can be a burden. Median household income is still 4% lower than its peak just after the recession started. A 2% rise in inflation plus the 4% lower income is a 6% difference. That's something that's rarely mentioned in the business press. Full Analysis

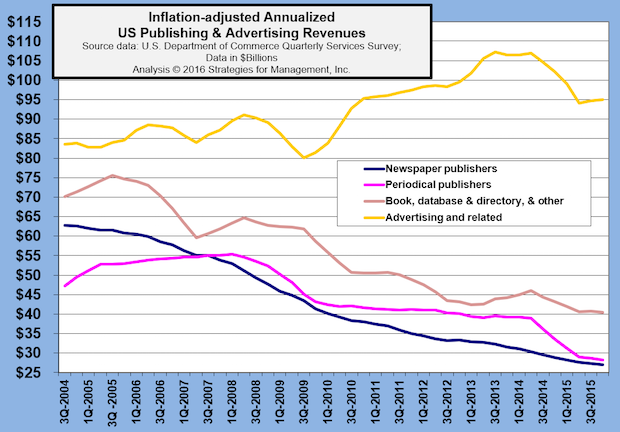

Ad Agency Revenues Still on the Rise, Up 40% Since Start of Recovery

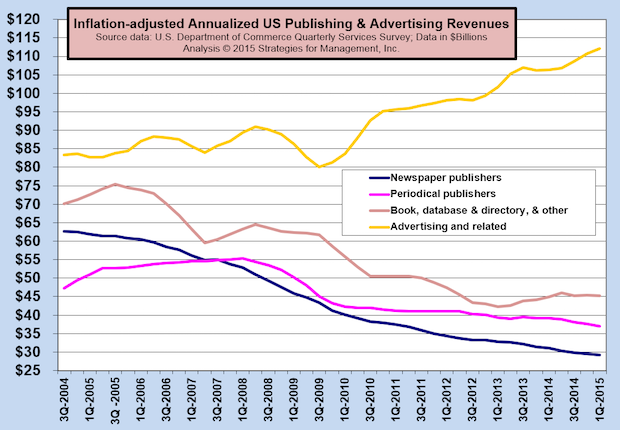

Published: June 18, 2015

Since the start of the recovery all the way back in mid-2009, advertising agency revenues have increased by +$32 billion, +40% since that time. There are many economic indicators that have never recovered (such as full time jobs) but ad agency revenues have blown through the pre-recession high of $91 billion and is now running at the rate of $112 billion annually. The agencies have had this performance because they are immersed in the media upheaval, riding and stoking the changes in communications formats on behalf of their clients. Wages have followed this shift in media, and has been documented by us before. The average public relations pay is about $10,000 more than the averaged of all agency wages. Book publishing industry revenues have stabilized, and trends of newspaper and periodical publishing revenues are still down, but at a lesser rate. Full Analysis

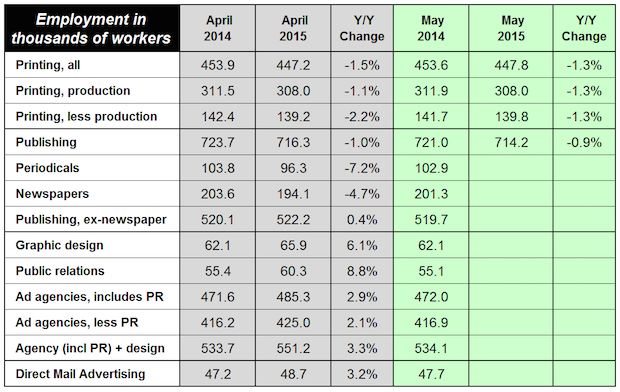

Latest Employment Data in Printing and Content Creation Markets

Published: June 11, 2015

In spite of recent strength in US commercial printing industry shipments, employment is still on a downward path. The industry seems to becoming more efficient, somewhat from better management, and somewhat from consolidation as weak establishments are aborbed or exit the market. Compared to April, however, the Bureau of Labor statistics estimates that employment increased by about 600, which is common compared for May in recent years. The April public relations employment was very strong compared to the prior year and is up +8.8%. When PR employment is excluded from ad agency employment, the number of employees in agencies is still up +2.1%. The employment data have always reflected the changes in the media market as well as the strength in the economy. Though the economy is slow, advertising agencies have reinvented themselves and are very active in social media and digital media production. Full Analysis

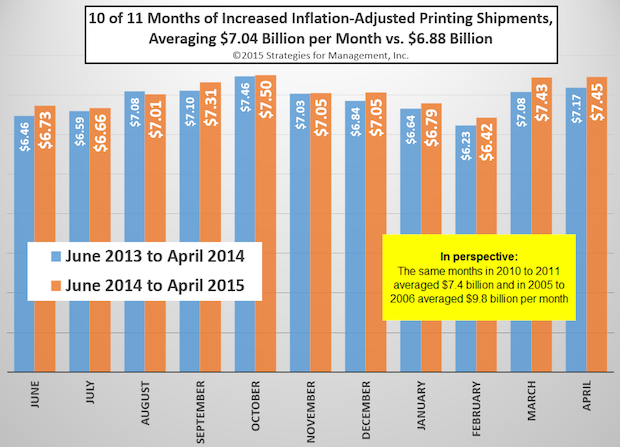

10 of 11 Months of Increased Inflation-Adjusted US Commercial Printing Shipments

Published: June 4, 2015

This chart shows how the US commercial printing shipments have been better compared to the prior year for the last 11 months of reporting by the Commerce Department. What's it mean? We're still averaging $400 million per month less than a similar period in 2010-2011, and we're well below the levels of ten years ago by about -$2.8 billion per month. The recent stability may be the result of several factors. First, weak companies are gone as a result of closures and consoPrinting Shipments Rising, Best April Since 2010lidations, leaving companies that know what modern print users need. Second, there has been a generational change in management to owners and executives who are more comfortable with digital technology because they have always used it, growing up with cell phones, video games, and computers everywhere. Third, the big targets for displacement by digital media have been pulverized, and what remains are specialties and applications more appropriate to a multichannel integrated media marketplace. Fourth, there a more companies using business development techniques (tell us about your target audience and how we can make your digital initiatives more effective) rather than old sales techniques (would you like to see my equipment list?). Then again, it could be the calm before another storm. New data networks are on their way, such as 5G, where two hour movies can be downloaded in six seconds rather than six minutes. Print has a good story to tell, but please, don't make it an old story. Print needs to be fresh and new. The market may be stable now, so use this time well to get ready for the market ahead. Full Analysis

- Questions to ask about inkjet for corrugated packaging

- Can Chinese OEMs challenge Western manufacturers?

- The #1 Question When Selling Inkjet

- Integrator perspective on Konica Minolta printheads

- Surfing the Waves of Inkjet

- Kyocera Nixka talks inkjet integration trends

- B2B Customer Tours

- Keeping Inkjet Tickled Pink

© 2024 WhatTheyThink. All Rights Reserved.