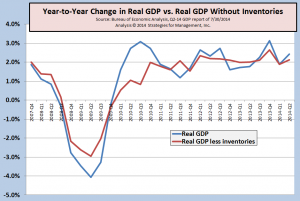

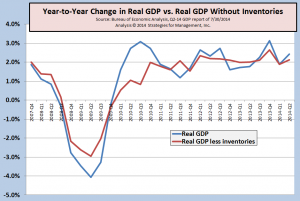

The first look at GDP for Q2 was very positive, +4%, reversing the negative Q1 report. Below is the chart of real GDP with and without inventories, which shows underlying GDP growth in the +2% range when considered on a year-to-year basis. (click to enlarge)

Inventories have been volatile in the last year, with Q1's contraction bringing them back in line. This first report of Q2 GDP showed an increase in inventories outside of the average of $55 billion since 2010. The $93.4 billion rise in inventories in Q2 was almost as large as Q3-2013's $95.6 billion. That was when inventories got out of control last year. It's important to remember that the advance report of GDP is packed with estimates and not much hard data reporting, so revisions can be large. These are the data we have now, so we have to run with them.

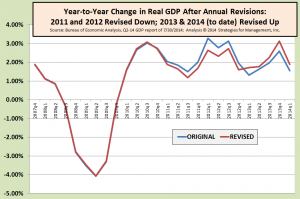

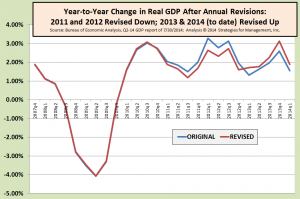

This release of GDP data was a benchmark revision that revised data back for decades, but mainly for the last three years. GDP for 2011 and 2012 were revised down slightly and revised up for 2013 and Q1-2014. The first quarter "final" estimate was a real GDP contraction of -2.8%, which has now been revised to -2.1%.

The chart below shows the changes since the start of the recession in Q4-2007 to Q1-2014. (click to enlarge)

One thing the strong GDP report did was reduce concerns about an impending recession. As we've stated many times, the economy is muddling along, and while low growth rates mean recession possibilities are greater, it is still likely that there will not be one. The low growth rates should be of concern, but seem to be shrugged off, as the "new normal" is not so new anymore and is accepted as normal. The economy is still well below the long run growth rate since WW2 of about +3.3%. We have not had one of those years since 2004 and 2005, and prior to those, 1995 to 2000 had above average growth.

This Federal Reserve announced that they will continue to reduce their bond purchases, as planned.

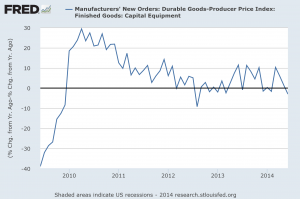

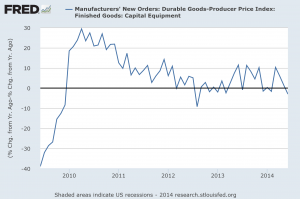

The durable goods orders report sounded better on the surface, but on a PPI-adjusted year-to-year basis was rather ho-hum, and indicates that this GDP report for Q2 is likely to be tweaked down in next month's revision. (click chart to enlarge)

# # #

Inventories have been volatile in the last year, with Q1's contraction bringing them back in line. This first report of Q2 GDP showed an increase in inventories outside of the average of $55 billion since 2010. The $93.4 billion rise in inventories in Q2 was almost as large as Q3-2013's $95.6 billion. That was when inventories got out of control last year. It's important to remember that the advance report of GDP is packed with estimates and not much hard data reporting, so revisions can be large. These are the data we have now, so we have to run with them.

This release of GDP data was a benchmark revision that revised data back for decades, but mainly for the last three years. GDP for 2011 and 2012 were revised down slightly and revised up for 2013 and Q1-2014. The first quarter "final" estimate was a real GDP contraction of -2.8%, which has now been revised to -2.1%.

The chart below shows the changes since the start of the recession in Q4-2007 to Q1-2014. (click to enlarge)

Inventories have been volatile in the last year, with Q1's contraction bringing them back in line. This first report of Q2 GDP showed an increase in inventories outside of the average of $55 billion since 2010. The $93.4 billion rise in inventories in Q2 was almost as large as Q3-2013's $95.6 billion. That was when inventories got out of control last year. It's important to remember that the advance report of GDP is packed with estimates and not much hard data reporting, so revisions can be large. These are the data we have now, so we have to run with them.

This release of GDP data was a benchmark revision that revised data back for decades, but mainly for the last three years. GDP for 2011 and 2012 were revised down slightly and revised up for 2013 and Q1-2014. The first quarter "final" estimate was a real GDP contraction of -2.8%, which has now been revised to -2.1%.

The chart below shows the changes since the start of the recession in Q4-2007 to Q1-2014. (click to enlarge)

One thing the strong GDP report did was reduce concerns about an impending recession. As we've stated many times, the economy is muddling along, and while low growth rates mean recession possibilities are greater, it is still likely that there will not be one. The low growth rates should be of concern, but seem to be shrugged off, as the "new normal" is not so new anymore and is accepted as normal. The economy is still well below the long run growth rate since WW2 of about +3.3%. We have not had one of those years since 2004 and 2005, and prior to those, 1995 to 2000 had above average growth.

This Federal Reserve announced that they will continue to reduce their bond purchases, as planned.

The durable goods orders report sounded better on the surface, but on a PPI-adjusted year-to-year basis was rather ho-hum, and indicates that this GDP report for Q2 is likely to be tweaked down in next month's revision. (click chart to enlarge)

One thing the strong GDP report did was reduce concerns about an impending recession. As we've stated many times, the economy is muddling along, and while low growth rates mean recession possibilities are greater, it is still likely that there will not be one. The low growth rates should be of concern, but seem to be shrugged off, as the "new normal" is not so new anymore and is accepted as normal. The economy is still well below the long run growth rate since WW2 of about +3.3%. We have not had one of those years since 2004 and 2005, and prior to those, 1995 to 2000 had above average growth.

This Federal Reserve announced that they will continue to reduce their bond purchases, as planned.

The durable goods orders report sounded better on the surface, but on a PPI-adjusted year-to-year basis was rather ho-hum, and indicates that this GDP report for Q2 is likely to be tweaked down in next month's revision. (click chart to enlarge)

# # #

# # #