I'm not qualified to head the Federal Reserve, that's for sure. Nor am I a professional economist, something that our industry's economists can certainly agree about without saying “on the other hand.”

But I do have a job to explain economic trends from a businessperson's perspective. That often gets lost in the shuffle of financial reporting, much of which is directed to investors, traders, and big company CFOs.

Over the past weeks, Dr. Yellen has been commenting on the state of the economy and the actions of the Fed. From various news reports, here are her words. Below them are my comments, in italics, in the same format of Dr. Yellen.

Enjoy!

* * *

“Economic activity is rebounding in the current quarter and will continue to expand at a moderate pace”

“Economic activity is disappointing, and will continue to be so. If you were born after 1982, you’ve never held a job in a boom and you think this kind of economy is ‘normal’.” We're stuck in a +1.75-2.25% GDP growth range. The last eight quarters have been +1.4%, two percentage points lower than the post-WW2 average.

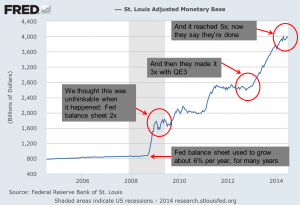

Fed will “reduce the pace of asset purchases in further measured steps.”

Fed will “reduce purchases to replace matured holdings, but can reverse positions after a consensus emerges that a downturn has begun. Finally, QE3 is over as the Fed's balance sheet is now 5x what it was when their aggressive actions began.” (click chart to enlarge)

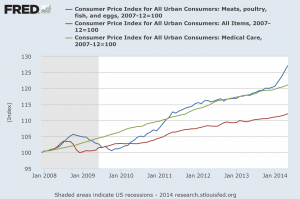

Inflation “has continued to run below the committee’s 2% objective.”

Inflation “is underestimated and a surge can catch the Fed by surprise; inflation psychology is slowly becoming embedded in consumers psyche. The Consumer Price Index is running at a 2.1% rate. Food and medical costs are increasing at 2x the general inflation rate. Yesterday's Producer Price Index came in at a 4.8% annual rate. Remember, a 2% inflation rate, compounded, guarantees you lose 22% of your purchasing power over 10 years.” (click chart to enlarge)

Low inflation “could pose risks to economic performance.”

Low inflation “would be a boon to savers and investors interested in real returns; high inflation distorts the risk assessment and size of future returns. What the Fed is really worried about is a drop in housing prices. The last thing they need is to have more underwater mortgages and more troubled banks than they have now. If home prices reverse course, they'll be back with more bond purchases.”

“The committee is confident it has the tools it needs to raise short-term interest rates”

“The committee will find that raising rates as quickly as they desire, or should, will be political Kryptonite, especially when the annual costs of financing the deficit of the U.S. budget are taken into account. For this reason, the Fed will go slow. Bond holders, like pension funds, would not be very pleased, either, if their long term bonds took a big hit in valuations.”

The Fed “will continue to have a very large balance sheet for some time.”

The Fed “is likely to keep its large balance sheet for decades, and will unwind by letting its holdings mature… and then buying more. It was an unprecedented action to increase their holdings, with little understanding of what that meant. They know less about what will happen when they start unwinding those positions, so they'll unwind as slowly as practical and hope for the best. Their best scenario is if the economy goes into a strong sustainable boom, which would make it easier to retreat from their actions. That's not likely any time soon.”

# # #