Commentary & Analysis

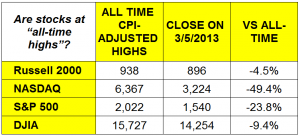

All Recovery Indicators Positive for Second Month; Stocks are NOT at All-Time Highs

For the second month,

For the second month, all of the indicators were positive, with all of them showing increases. Both ISM reports, manufacturing and non-manufacturing, came in stronger than expected.

There are two areas of concern about both reports in categories that are not part of the recovery indicators table. Inflation in materials increased, and the employment indicator showed a slowdown in growth.

Proprietors income, an indicator of the health of small business, was revised down for Q4-2012 to $1225.1 billion. The decrease was -$2.3 million.

There were news reports that personal income after taxes dropped by 4% in January compared to December. That amount is probably the approximate amount shifted by tax planning to adjust for the higher rates of 2013. It will take a few months for that data series to settle down after a spike upward for December's data for us to see the real trend.

As far as the NASDAQ goes, it was up 1.7% compared to the prior month. They went crazy on Wall Street and the business cable channels again. The Dow Jones Industrial Average set a new nominal high. But it's still about 9% off its inflation-adjusted high, and other stock market benchmarks are still having problems getting to their true highs. As a reminder, the Japanese stock market hit 30,000 in 1990, and is now above 11,000. That NASDAQ all-time high might be a number you tell your kids about one day. Or is that grandkids?

About Dr. Joe Webb

Dr. Joe Webb is one of the graphic arts industry's best-known consultants, forecasters, and commentators. He is the director of WhatTheyThink's Economics and Research Center.

Video Center

- KYOCERA NIXKA INKJET SYSTEMS (KNIS) INTRODUCES BELHARRA, THE NEW WAVE OF PHOTO PRINTERS

- New RISO Printing Unit Offers Easy Integration for Package Printing

- March 2024 Inkjet Installation Roundup

- Inkjet Integrator Profiles: Integrity Industrial Inkjet

- Revisiting the Samba printhead

- 2024 Inkjet Shopping Guide for Folding Carton Presses

- The Future of AI In Packaging

- Inkjet Integrator Profiles: DJM

WhatTheyThink is the official show daily media partner of drupa 2024. More info about drupa programs

© 2024 WhatTheyThink. All Rights Reserved.