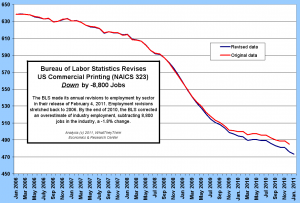

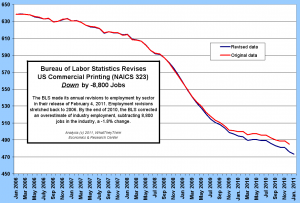

Last Friday (2/4/11), the Bureau of Labor Statistics made significant revisions to their employment data by industry. For US commercial printing (NAICS 323), they reduced employment by -8,800 workers. That's nearly a 2% miss. This is part of the annual revision they make, and the national revision was -500,000. It's not like the -8,800 were really there, it was just that the BLS wasn't accurately counting the actual number of employees.

The revision is rather telling. We know our industry has been downsizing at a rate faster than inflation-adjusted shipments have been declining. Last year, shipments were up +0.9%, but were down on an inflation-adjusted basis by -0.7%. Since 2006, these inflation-adjusted shipments are down -19.6%; employment is down -23.5%. We know the reasons: weak companies are gone, volume has consolidated to healthier shops, and printers have been cutting back on production expenses in light of flat market prices and rising materials and other costs. The chart below shows the employment trend, and the BLS revisions (click chart to enlarge).

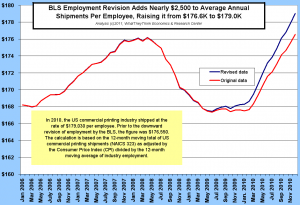

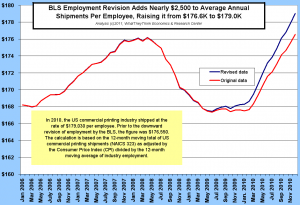

If employment is dropping faster than shipments, one of the key measures of the industry, shipments per employee, will rise. This had been increasing on an inflation-adjusted basis, and took a jump higher with the BLS revisions (click to enlarge):

In fact it added about $2500 to each employee's output. Some of this reached the bottom line, we know, because profits have been rising. They're still not good, but they are rising. Note the decline in the shipments per employee in 2009 when the industry took a sharp downturn, and how they have rebounded since. In fact, this is the highest output per employee in the forty or so years of data that we can find. It also helps that the exit of unprofitable businesses is not dragging down this particular statistic. (It is important to note that 2010 industry shipments data will be revised in mid-May and that revision may change this entire analysis).

As we know, revenues are not the whole story. Productivity is really about value added. So if market prices go down, and costs go up, and shipments per employee go up, it does not necessarily mean that the industry is more productive. There are companies who are still stuck in the habits of producing unprofitable things with great efficiency. Value added has to go up. The pressure to reduce headcount in companies is very strong. The way our headcount is being reduced is by the exit of unprofitable companies and by the choice of many businesses to merge or be acquired by "tuck-in." That often keeps the headcount of a company stable, but adds volume to that company so they can cope with numerous other market factors.

As I have cautioned, this is breathing room for restructuring our industry, and not an opportunity to do the same old things in a cheaper way. Cutting costs is not the answer. Right products, right costs, right investment, is.

If employment is dropping faster than shipments, one of the key measures of the industry, shipments per employee, will rise. This had been increasing on an inflation-adjusted basis, and took a jump higher with the BLS revisions (click to enlarge):

If employment is dropping faster than shipments, one of the key measures of the industry, shipments per employee, will rise. This had been increasing on an inflation-adjusted basis, and took a jump higher with the BLS revisions (click to enlarge):

In fact it added about $2500 to each employee's output. Some of this reached the bottom line, we know, because profits have been rising. They're still not good, but they are rising. Note the decline in the shipments per employee in 2009 when the industry took a sharp downturn, and how they have rebounded since. In fact, this is the highest output per employee in the forty or so years of data that we can find. It also helps that the exit of unprofitable businesses is not dragging down this particular statistic. (It is important to note that 2010 industry shipments data will be revised in mid-May and that revision may change this entire analysis).

As we know, revenues are not the whole story. Productivity is really about value added. So if market prices go down, and costs go up, and shipments per employee go up, it does not necessarily mean that the industry is more productive. There are companies who are still stuck in the habits of producing unprofitable things with great efficiency. Value added has to go up. The pressure to reduce headcount in companies is very strong. The way our headcount is being reduced is by the exit of unprofitable companies and by the choice of many businesses to merge or be acquired by "tuck-in." That often keeps the headcount of a company stable, but adds volume to that company so they can cope with numerous other market factors.

As I have cautioned, this is breathing room for restructuring our industry, and not an opportunity to do the same old things in a cheaper way. Cutting costs is not the answer. Right products, right costs, right investment, is.

In fact it added about $2500 to each employee's output. Some of this reached the bottom line, we know, because profits have been rising. They're still not good, but they are rising. Note the decline in the shipments per employee in 2009 when the industry took a sharp downturn, and how they have rebounded since. In fact, this is the highest output per employee in the forty or so years of data that we can find. It also helps that the exit of unprofitable businesses is not dragging down this particular statistic. (It is important to note that 2010 industry shipments data will be revised in mid-May and that revision may change this entire analysis).

As we know, revenues are not the whole story. Productivity is really about value added. So if market prices go down, and costs go up, and shipments per employee go up, it does not necessarily mean that the industry is more productive. There are companies who are still stuck in the habits of producing unprofitable things with great efficiency. Value added has to go up. The pressure to reduce headcount in companies is very strong. The way our headcount is being reduced is by the exit of unprofitable companies and by the choice of many businesses to merge or be acquired by "tuck-in." That often keeps the headcount of a company stable, but adds volume to that company so they can cope with numerous other market factors.

As I have cautioned, this is breathing room for restructuring our industry, and not an opportunity to do the same old things in a cheaper way. Cutting costs is not the answer. Right products, right costs, right investment, is.