Open a spreadsheet with your data since 2005 (or any year since then) and multiply each year's data by the multiplier above.

Please note that countries calculate consumer prices differently; I am concerned with the validity of the data from China (where reporting is new, and we know there has been significant food price inflation). Every country's inflation has a different story behind it, but those stories will not be covered in this blogpost.

Using inflation factors will adjust the data for the change in consumer prices so the real underlying trends can be seen. What often happens is that sales increases disappear and sometimes can look like declines. This is an especially critical time to be dealing with inflation adjustments because it is unfortunately reasonable to assume that print demand will be contracting, print prices will be flat or slightly declining, and other costs are likely to increase by 5% per year. It's not pleasant, but if these assumptions are pessimistic, then your company will benefit greatly from being on the right side of some bad expectations.

Most importantly, this process is likely to impart a greater sense of urgency, especially in terms of the need for productivity, in company management.

* * *

My next column is not scheduled until Monday, February 7, but we'll have a busy few days ahead. Friday is the advance report for Q4-2010. Next week we'll have updated recovery indicators and printing shipments. Next week ends with a very important unemployment report as the BLS will be adjusting their employment data, with some revisions going back 5 years! We'll crunch all the numbers and Tweet and blog accordingly.

Open a spreadsheet with your data since 2005 (or any year since then) and multiply each year's data by the multiplier above.

Please note that countries calculate consumer prices differently; I am concerned with the validity of the data from China (where reporting is new, and we know there has been significant food price inflation). Every country's inflation has a different story behind it, but those stories will not be covered in this blogpost.

Using inflation factors will adjust the data for the change in consumer prices so the real underlying trends can be seen. What often happens is that sales increases disappear and sometimes can look like declines. This is an especially critical time to be dealing with inflation adjustments because it is unfortunately reasonable to assume that print demand will be contracting, print prices will be flat or slightly declining, and other costs are likely to increase by 5% per year. It's not pleasant, but if these assumptions are pessimistic, then your company will benefit greatly from being on the right side of some bad expectations.

Most importantly, this process is likely to impart a greater sense of urgency, especially in terms of the need for productivity, in company management.

* * *

My next column is not scheduled until Monday, February 7, but we'll have a busy few days ahead. Friday is the advance report for Q4-2010. Next week we'll have updated recovery indicators and printing shipments. Next week ends with a very important unemployment report as the BLS will be adjusting their employment data, with some revisions going back 5 years! We'll crunch all the numbers and Tweet and blog accordingly.

Commentary & Analysis

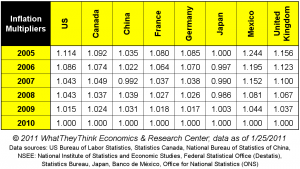

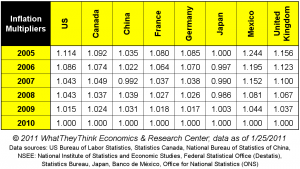

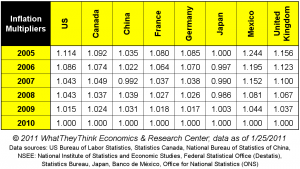

Analyze Your Business Trends with Our Updated Inflation Multipliers

Inflation distorts they way we look at our historical financial data,

Inflation distorts they way we look at our historical financial data, a topic that I have written about often. The last time was in July 2010. WhatTheyThink has been blessed with a rather sizeable worldwide audience, so this time we've added some other countries to our table. (Just click on the image for a larger version)

Open a spreadsheet with your data since 2005 (or any year since then) and multiply each year's data by the multiplier above.

Please note that countries calculate consumer prices differently; I am concerned with the validity of the data from China (where reporting is new, and we know there has been significant food price inflation). Every country's inflation has a different story behind it, but those stories will not be covered in this blogpost.

Using inflation factors will adjust the data for the change in consumer prices so the real underlying trends can be seen. What often happens is that sales increases disappear and sometimes can look like declines. This is an especially critical time to be dealing with inflation adjustments because it is unfortunately reasonable to assume that print demand will be contracting, print prices will be flat or slightly declining, and other costs are likely to increase by 5% per year. It's not pleasant, but if these assumptions are pessimistic, then your company will benefit greatly from being on the right side of some bad expectations.

Most importantly, this process is likely to impart a greater sense of urgency, especially in terms of the need for productivity, in company management.

* * *

My next column is not scheduled until Monday, February 7, but we'll have a busy few days ahead. Friday is the advance report for Q4-2010. Next week we'll have updated recovery indicators and printing shipments. Next week ends with a very important unemployment report as the BLS will be adjusting their employment data, with some revisions going back 5 years! We'll crunch all the numbers and Tweet and blog accordingly.

Open a spreadsheet with your data since 2005 (or any year since then) and multiply each year's data by the multiplier above.

Please note that countries calculate consumer prices differently; I am concerned with the validity of the data from China (where reporting is new, and we know there has been significant food price inflation). Every country's inflation has a different story behind it, but those stories will not be covered in this blogpost.

Using inflation factors will adjust the data for the change in consumer prices so the real underlying trends can be seen. What often happens is that sales increases disappear and sometimes can look like declines. This is an especially critical time to be dealing with inflation adjustments because it is unfortunately reasonable to assume that print demand will be contracting, print prices will be flat or slightly declining, and other costs are likely to increase by 5% per year. It's not pleasant, but if these assumptions are pessimistic, then your company will benefit greatly from being on the right side of some bad expectations.

Most importantly, this process is likely to impart a greater sense of urgency, especially in terms of the need for productivity, in company management.

* * *

My next column is not scheduled until Monday, February 7, but we'll have a busy few days ahead. Friday is the advance report for Q4-2010. Next week we'll have updated recovery indicators and printing shipments. Next week ends with a very important unemployment report as the BLS will be adjusting their employment data, with some revisions going back 5 years! We'll crunch all the numbers and Tweet and blog accordingly.

Open a spreadsheet with your data since 2005 (or any year since then) and multiply each year's data by the multiplier above.

Please note that countries calculate consumer prices differently; I am concerned with the validity of the data from China (where reporting is new, and we know there has been significant food price inflation). Every country's inflation has a different story behind it, but those stories will not be covered in this blogpost.

Using inflation factors will adjust the data for the change in consumer prices so the real underlying trends can be seen. What often happens is that sales increases disappear and sometimes can look like declines. This is an especially critical time to be dealing with inflation adjustments because it is unfortunately reasonable to assume that print demand will be contracting, print prices will be flat or slightly declining, and other costs are likely to increase by 5% per year. It's not pleasant, but if these assumptions are pessimistic, then your company will benefit greatly from being on the right side of some bad expectations.

Most importantly, this process is likely to impart a greater sense of urgency, especially in terms of the need for productivity, in company management.

* * *

My next column is not scheduled until Monday, February 7, but we'll have a busy few days ahead. Friday is the advance report for Q4-2010. Next week we'll have updated recovery indicators and printing shipments. Next week ends with a very important unemployment report as the BLS will be adjusting their employment data, with some revisions going back 5 years! We'll crunch all the numbers and Tweet and blog accordingly.

Open a spreadsheet with your data since 2005 (or any year since then) and multiply each year's data by the multiplier above.

Please note that countries calculate consumer prices differently; I am concerned with the validity of the data from China (where reporting is new, and we know there has been significant food price inflation). Every country's inflation has a different story behind it, but those stories will not be covered in this blogpost.

Using inflation factors will adjust the data for the change in consumer prices so the real underlying trends can be seen. What often happens is that sales increases disappear and sometimes can look like declines. This is an especially critical time to be dealing with inflation adjustments because it is unfortunately reasonable to assume that print demand will be contracting, print prices will be flat or slightly declining, and other costs are likely to increase by 5% per year. It's not pleasant, but if these assumptions are pessimistic, then your company will benefit greatly from being on the right side of some bad expectations.

Most importantly, this process is likely to impart a greater sense of urgency, especially in terms of the need for productivity, in company management.

* * *

My next column is not scheduled until Monday, February 7, but we'll have a busy few days ahead. Friday is the advance report for Q4-2010. Next week we'll have updated recovery indicators and printing shipments. Next week ends with a very important unemployment report as the BLS will be adjusting their employment data, with some revisions going back 5 years! We'll crunch all the numbers and Tweet and blog accordingly.

About Dr. Joe Webb

Dr. Joe Webb is one of the graphic arts industry's best-known consultants, forecasters, and commentators. He is the director of WhatTheyThink's Economics and Research Center.

Video Center

- KYOCERA NIXKA INKJET SYSTEMS (KNIS) INTRODUCES BELHARRA, THE NEW WAVE OF PHOTO PRINTERS

- New RISO Printing Unit Offers Easy Integration for Package Printing

- March 2024 Inkjet Installation Roundup

- Inkjet Integrator Profiles: Integrity Industrial Inkjet

- Revisiting the Samba printhead

- 2024 Inkjet Shopping Guide for Folding Carton Presses

- The Future of AI In Packaging

- Inkjet Integrator Profiles: DJM

WhatTheyThink is the official show daily media partner of drupa 2024. More info about drupa programs

© 2024 WhatTheyThink. All Rights Reserved.