Commentary & Analysis

Latest Recovery Indicators Still Moving Sideways

It'

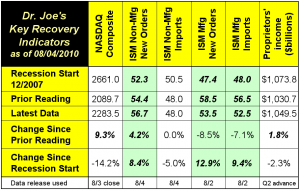

It's almost impossible to tell what the economy is doing by watching the news: it seems the pundits are changing their opinion every few minutes. The recovery indicators, which we look at once a month, are still mired in their sideways movement, and with very slight deterioration from a few months ago. What's it mean? More of the same, with no burst to the upside.

Even though the stock market, which we watch with our NASDAQ indicator, has had a very good month (+9.3%), it only erased the prior month's losses, and is still -14.2% off the December 2007 close. The ISM Manufacturing new orders and imports indices were down for the month, and the overall ISM manufacturing report was not as good as the business press made it out to be. They were looking at the employment indicator in that report, which did show improvement. They're doing the same for the ISM Non-manufacturing report, which also showed an improvement in employment. That index, which is not part of our recovery indicators, is showing growth. It showed growth in May. It showed contraction in June. It's showing growth in July. Sounds like a move sideways, huh?

The ISM Non-manufacturing new orders index was up +4.2% since the prior month, but imports are still showing decline, as it was flat with the prior month.

Proprietors' Income was revised with the two years of GDP revisions last week. It now shows that the income of small business was less than originally estimated at the start of the recession by more than 2%. They also overestimated its value of in the first quarter by more than 3%. Now that they have their statistical story straight, until the next revisions next year, it was up +1.8% since Q1, and is still -2.3% below the start of the recession, without factoring in inflation. All of this means that the National Federation of Independent Business surveys of small business have been right concerning the level of business in this sector. Small businesses are still bearing much of the recession and are not participating in the recovery at a time when past patterns would have indicated that they should.

Friday is the release of the latest unemployment data, and I believe the interest in the ISM employment indices are to get a preview of what that report will show, and also some journalistic cheerleading in hopes for a good report. I have no clue what it will be, but I still believe that the tax differences between 2010 and 2011 are still causing businesses to shift revenues into 2010 while delaying expenses to 2011. The issue is not a cloud of uncertainty before businesspeople. They're certain that higher taxes and new regulatory initiatives are part of their 2011 challenges. Getting more business into 2010 is essential to preparing for the increased costs and risks of 2011. That certainty will confound the employment issue for quite some time.

Overall, three of our six indicators are above the start of the recession, and it's been that way for quite a while, and I suspect it will continue to do so. Keep plugging away with customers, bringing them new ideas, and finding innovative ways to cut their long-term costs with new services and more efficiency... and that's good advice no matter what the economic situation might be.

Even though the stock market, which we watch with our NASDAQ indicator, has had a very good month (+9.3%), it only erased the prior month's losses, and is still -14.2% off the December 2007 close. The ISM Manufacturing new orders and imports indices were down for the month, and the overall ISM manufacturing report was not as good as the business press made it out to be. They were looking at the employment indicator in that report, which did show improvement. They're doing the same for the ISM Non-manufacturing report, which also showed an improvement in employment. That index, which is not part of our recovery indicators, is showing growth. It showed growth in May. It showed contraction in June. It's showing growth in July. Sounds like a move sideways, huh?

The ISM Non-manufacturing new orders index was up +4.2% since the prior month, but imports are still showing decline, as it was flat with the prior month.

Proprietors' Income was revised with the two years of GDP revisions last week. It now shows that the income of small business was less than originally estimated at the start of the recession by more than 2%. They also overestimated its value of in the first quarter by more than 3%. Now that they have their statistical story straight, until the next revisions next year, it was up +1.8% since Q1, and is still -2.3% below the start of the recession, without factoring in inflation. All of this means that the National Federation of Independent Business surveys of small business have been right concerning the level of business in this sector. Small businesses are still bearing much of the recession and are not participating in the recovery at a time when past patterns would have indicated that they should.

Friday is the release of the latest unemployment data, and I believe the interest in the ISM employment indices are to get a preview of what that report will show, and also some journalistic cheerleading in hopes for a good report. I have no clue what it will be, but I still believe that the tax differences between 2010 and 2011 are still causing businesses to shift revenues into 2010 while delaying expenses to 2011. The issue is not a cloud of uncertainty before businesspeople. They're certain that higher taxes and new regulatory initiatives are part of their 2011 challenges. Getting more business into 2010 is essential to preparing for the increased costs and risks of 2011. That certainty will confound the employment issue for quite some time.

Overall, three of our six indicators are above the start of the recession, and it's been that way for quite a while, and I suspect it will continue to do so. Keep plugging away with customers, bringing them new ideas, and finding innovative ways to cut their long-term costs with new services and more efficiency... and that's good advice no matter what the economic situation might be.

About Dr. Joe Webb

Dr. Joe Webb is one of the graphic arts industry's best-known consultants, forecasters, and commentators. He is the director of WhatTheyThink's Economics and Research Center.

Video Center

- KYOCERA NIXKA INKJET SYSTEMS (KNIS) INTRODUCES BELHARRA, THE NEW WAVE OF PHOTO PRINTERS

- New RISO Printing Unit Offers Easy Integration for Package Printing

- March 2024 Inkjet Installation Roundup

- Inkjet Integrator Profiles: Integrity Industrial Inkjet

- Revisiting the Samba printhead

- 2024 Inkjet Shopping Guide for Folding Carton Presses

- The Future of AI In Packaging

- Inkjet Integrator Profiles: DJM

WhatTheyThink is the official show daily media partner of drupa 2024. More info about drupa programs

© 2024 WhatTheyThink. All Rights Reserved.