(Read part one of Heidi’s coverage here.)

Three weeks ago, we kicked off our Fourth Annual Technology Outlook coverage with a look at the world of digital print. Ralph Schlözer, WhatTheyThink European section editor and Inkjet Insight contributor, opened the session with data on the installed base of inkjet and toner devices, followed by key hardware launches and inkjet print volumes. For space reasons, my write-up of the session was not able to include his discussion on print volumes, so that data is reported here.

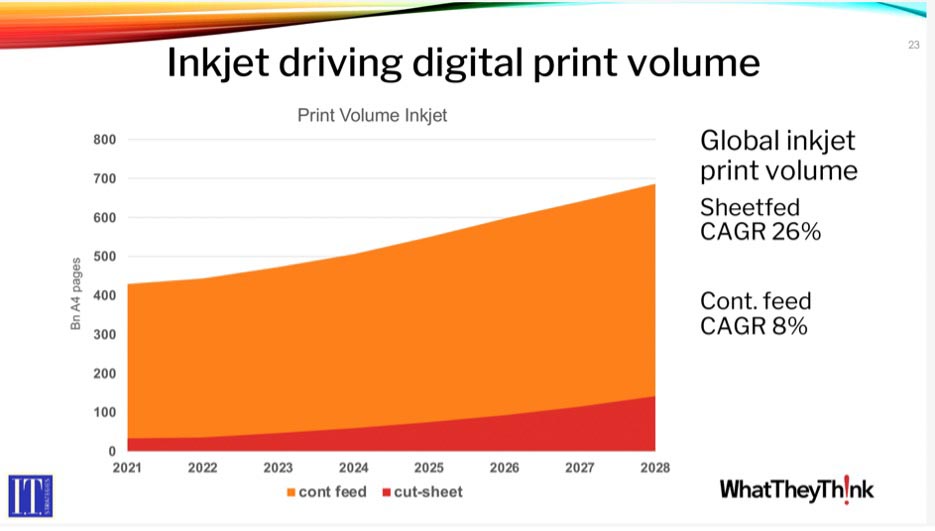

Citing data from IT Strategies, Schlözer outlined the dominance of the continuous feed market in terms of print volume. While volume on toner devices is growing more quickly than CF inkjet (at a rate of 8%), the speed and productivity of CF presses is driving volumes.

“Although CF engine sales are growing only modestly, the overall installed base of these presses continues to grow. Thus, the cumulative effect on the volumes is significant,” Schlözer says. “Growth of 8% per year is quite significant anyway, especially in a commercial printing market where volumes are otherwise going down.”

On the sheetfed side, the growth rate is quite a bit higher, at 26% per year. “But obviously, that is coming from a much lower base,” he says.

Inkjet Print Volume by Application

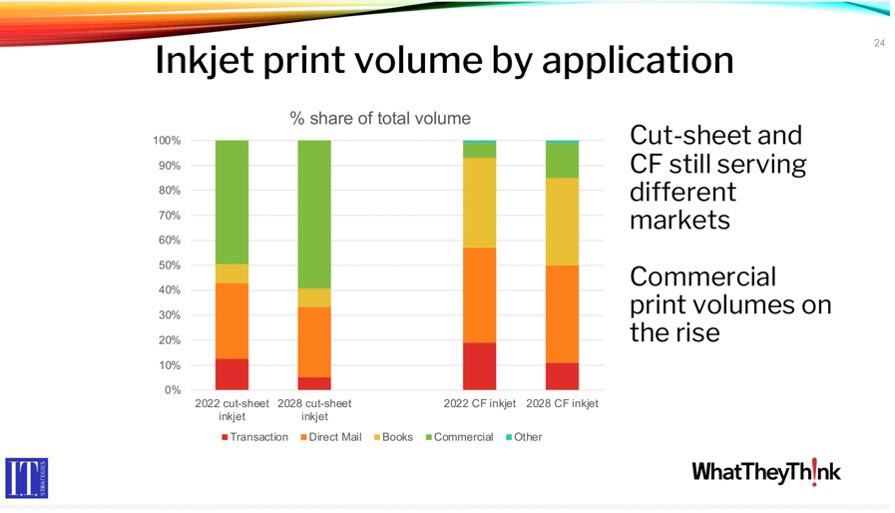

Next, Schlözer outlined the internal dynamics of the markets with the growth and decline in volumes by application.

- In 2022, 50% of cut sheet volume was commercial print. This is forecast to grow to 60% by 2028.

- Books and direct mail will hold fairly steady over this period, while transactional volumes will continue to decline.

- On the CF side, the percentage of overall volumes that is commercial print is expected to double by the end of the forecast period.

“Growth is mostly in commercial and, to some extent, books and direct mail,” he says. “Transactional printing is the only category expected to decline in the next couple of years.”

Schlözer credits growth in commercial printing to the ability of the latest generation of inkjet devices, both cut sheet and CF, to print at the highest quality on coated paper. But this transition isn’t always a direct transfer from offset to inkjet.

“More often, it is an offset run that is being split down or moved to another plant using inkjet, or print volumes resurfacing as brands find that, when they eliminate inserts and printed catalogs, they start missing opportunities in the market,” he says. “As that volume comes back, it’s not returning as mass produced offset or gravure. It is moving into short-run, more targeted volumes.”

Have We Passed the Tipping Point?

Responding to an audience question about the “tipping point” for color production inkjet being able to run on conventional coated offset papers, Schlözer responds that he wouldn’t use the word “tipping point” in that respect.

“I would describe it more as a constant chipping away,” he says. “It’s still the case that vendors prefer to talk about papers they have tested and approved, but that barrier is getting lower and lower. Rather than looking at it as a tipping point, it's probably more the case that we are seeing the lowering of that barrier.”

Schlözer notes that not every offset coated paper will run well on every inkjet device designed to run offset coated paper, but that number is getting smaller and smaller.

Where we see “on the ground” evidence of the shift in inkjet applications is in the large online printers, which are starting to scale up their investment in inkjet. “For many, many years, the big players really focused on offset presses and optimizing efficiency in their workflows around order entry through finishing,” says Schlözer. “Now they are starting to invest in inkjet, which is a huge paradigm shift.”

Another driver of growth in inkjet, Schlözer says, is the uptick in short-run, on-demand book production. He sees publishers—both self-publishers and commercial publishers—finally moving away from a focus on per unit cost and starting to take into consideration the full logistics around book ordering, processing, and warehousing. This is driving greater investment in full end-to-end automation.

“It is quite striking that optimized devices built by Hunkeler to make Amazon’s book production chains more efficient are now being brought to the general market,” Schlözer observes. “This is bringing down the cost of the hardware by making it more available. Other big vendors are also pressing the device manufacturers to become more efficient. Throughout the whole production chain, these technologies and workflows are becoming available to everybody.”

Rebirth of Direct Mail?

Among the big drivers of these market shifts, Schlözer continues, is optimization in direct mail. While direct mail didn’t see the surge during the pandemic that many forecasters expected, he sees it now starting to be taken more seriously as a channel for marketing alongside the electronic channels.

“While electronic channels are still very strong drivers of advertising dollars, there is a steady shift back into direct mail,” he says. “Strategies to minimize postage will be quite important.”

As applications for digital production continue to diversify beyond classic applications like newspapers, magazines, books, and general commercial, Schlözer encouraged the audience to look into niches such as photo merchandise, books, games, tags, and puzzles. “This is where technologies like laser cutting and scoring make sense,” he concludes. “Printers looking for new markets should consider growing niche applications like these, as well as door hangers and even short-run packaging.”

To read the original reporting on engine placements and key hardware launches, read our coverage here.

Discussion

By Elizabeth Gooding on Jul 14, 2023

This citation is not correct "Citing data from IT Strategies, .... While volume on toner devices is growing more quickly than CF inkjet (at a rate of 8%), the speed and productivity of CF presses is driving volumes."

This should say that volume on cut sheet inkjet is growing more quickly than CF presses, not Toner. Hope you can correct.

Discussion

Join the discussion Sign In or Become a Member, doing so is simple and free