Welcome to coverage of day three of our fourth annual Technology Outlook Week. Over the course of the week, WTT presenters looked at latest trends, technologies, and products in a wide array of categories from software and workflow to production inkjet printing to wide format. Today, we recap the session on labels and packaging with David Zwang. This session was sponsored by Screen. (You can watch the entire webinar here.)

Zwang opened the session noting that labels and packaging are getting a lot of attention for the tremendous opportunities they bring. However, while everybody loves opportunities, those opportunities don't come for free. Among the challenges to entering the packaging market:

- Transition to digital workflows, including production workflow.

- Labor challenges, leading to greater investments in automation.

- Push toward sustainability (“Not just the packaging itself, but the processes as well”).

- International challenges, such as Russia’s war in Ukraine and the impact on energy costs.

Labor Market Challenges

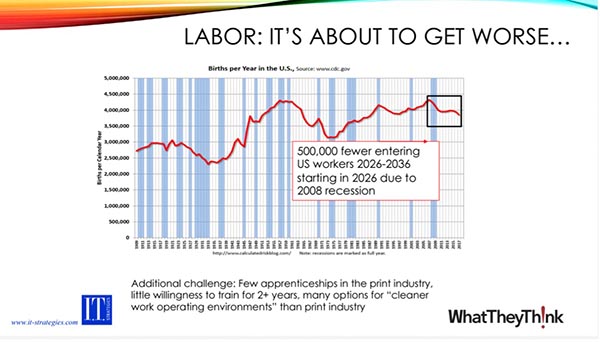

Zwang notes that, while the industry is well aware of the ongoing challenges in finding skilled labor, one aspect of that challenge not always discussed is the dip in birth rate between 2008-2009. As a result of this dip, fewer people will be entering the workforce starting in the 2026. Specifically, about a half a million fewer workers between 2026 and 2036.

Additional challenges include lack of apprenticeships in the industry and “the great resignation” that occurred as a result of the pandemic.

“So if you're thinking things are going to get better with time, they aren’t,” he says.

Furthermore, as the labor force shrinks, our industry is increasingly competing with other employers like Amazon, which is now paying up to $30 an hour and offering predictable work hours. “All of a sudden, you need to increase the wages that you're paying to draw people in,” says Zwang. “When you do, you need to increase the wages of your existing workforce, too, or they're going to leave.” (Zwang refers to this as “the wage war.”)

What about temp labor? They don’t have the skills of trained labor, and this is not a sustainable way to build a business. But if you do go this route, you’re still looking about $17 an hour or more. “Plus, you still have the same issues of wage matching,” he says.

Emphasis on Sustainability

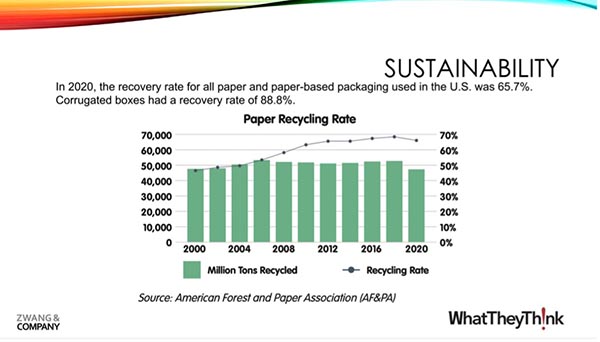

Turning to the issue of sustainability, Zwang notes that the industry’s efforts in terms of recycling are paying off. The recovery rate for paper and paper-based packaging in the United States is about 65.7%. For corrugated boxes, it’s 88%.

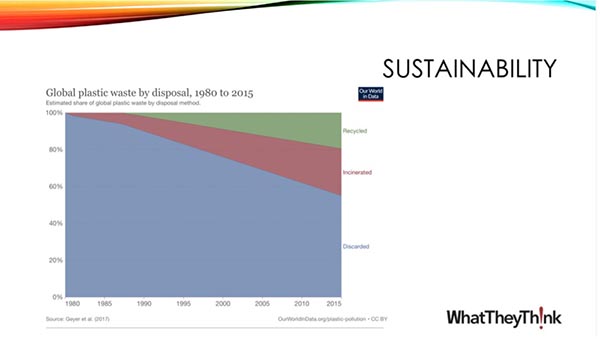

Even the management of plastic waste is improving, with the percentage of recycled or incinerated material growing as a percentage of the overall whole. “That, by the way, that's because the places we used to discard it (primarily Asia) didn't want it anymore,” Zwang observes. “They said, ‘No thanks. We have our own garbage.’

As these issues grow in the public consciousness, they are issues that our industry will increasingly need to deal with.

A Look at Labels

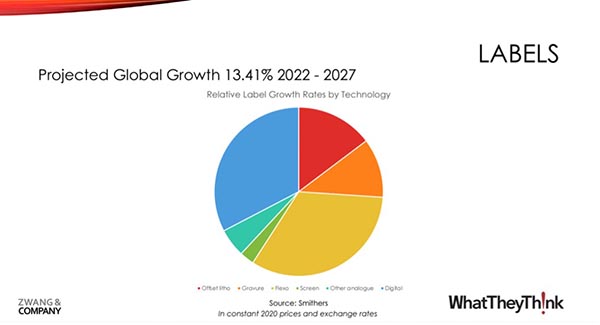

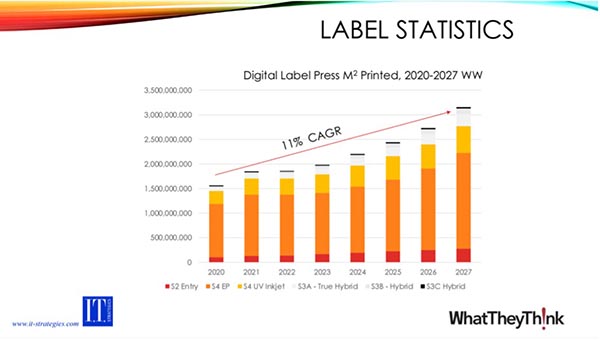

Next, Zwang broke down the trends in the labels market. Projected global growth for labels between 2022 and 2027 is about 13.41%. (“With consumer prices rising, this is a plus for converters in terms of their own pricing,” he says.)

Digital, while still a small percentage of the overall market, is showing rapid growth—11% between now and 2027. This varies by production type (S2 entry, S4 EP, S4 UV inkjet, S3A , SB hybrid, and S3C hybrid), but in almost all cases, these categories are seeing growth.

Which Press to Buy?

Those looking to get into packaging may be looking at purchasing a press (digital or analog) for this purpose. Which press to choose will depend on the application.

“Flexo still has the lion’s share of the market,” says Zwang, showing a slide with a variety of machines designed for flexo label production. “Flexo press manufacturers are trying very hard to digitalize their equipment both for efficiency and to address the labor shortage. While digital is fast growing in the label market, both flexo and digital will co-exist for a while.”

Brands of flexo presses to investigate include (but are not limited to):

- Omet

- Uteco

- Mark Andy

- Edale

- Soma

Zwang encourages anyone considering entry into this market to attend trade shows like the upcoming Label Expo in Brussels.

For those looking to go the inkjet route, Zwang pointed to the increasing number of vendors getting into this market. These include:

- Screen

- Durst

- Epson

- Fujifilm

- Domino

One of the key technology trends in the digital label press market is the move from inkjet to hybrid, which Zwang describes as “inkjet and flexo rolled into one.” Two of the bigger flexo manufacturers, Bobst and Gallus, have both released such devices. “They're modular, so you can put them together as you want,” Zwang explains. “Depending on your application and how much converting you need in line, any one of these devices could potentially fit your needs.”

In terms of pure growth, however, EP is where the volume is. For this, Zwang credits the fact that HP and Xeikon have been in this market since the early nineties. “Since then, Mark Andy has jumped in, and, of course, Konica-Minolta, and those are also very good solutions,” he says.

Growth in Flexible Packaging

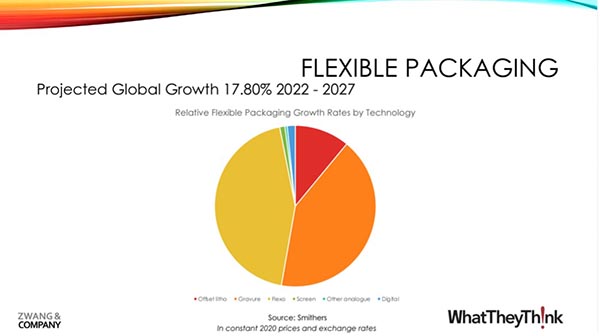

Next, Zwang turned to flexible packaging. Despite the fact the labels is getting most of the love right now, Zwang notes that the fastest growth is actually in this category (not the largest volume, but the fastest growing). According to Smithers, the flex pack market will see growth of 18% between now and 2027. “That’s a lot of growth,” says Zwang. The majority of this volume will be done on flexo and offset presses, although digital is starting to pick up.

Although offset maintains a decent market share, Zwang expects this share to be taken, over time, by digital technologies and more efficient (digitalized) flexo and hybrid technologies.

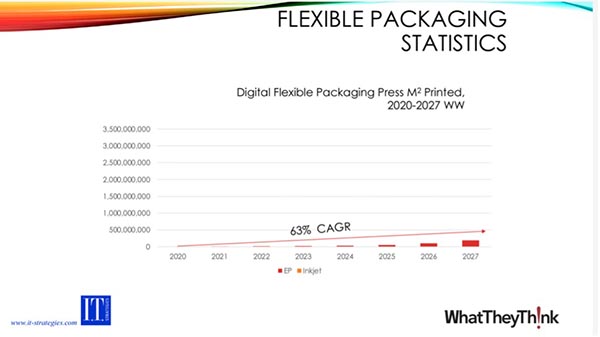

On the digital side of the market (data is shown in square meters printed ), the growth in digital flexible packaging is in EP rather than inkjet. “In flexible packaging, the vast majority is printed on some kind of polymer, and printing on these substrates inkjet is not easy,” says Zwang. “Now—and this is very important—we're starting to see a lot of alternatives, paper-based substrates for flexible packaging. They have minimal coatings, and these coatings don’t need to be recycled. They can go right through your normal garbage stream. (They can be composted, as well.)”

This, Zwang says, will drive growth on the inkjet side of the market over time.

Zwang pointed to a company, Sirane, the largest flexible packaging producer in the U.K. (running the HP Indigo 200K) , that has largely built its business on using sustainable materials for packaging, and noted that machines from Miyakoshi, Screen, and Kodak print on certain plastics, as well. “These machines are also water-based,” he points out. “This is very important as we start thinking about sustainability and everything that goes with that.”

In the meantime, EP remains the focus for digital flex pack work. Vendors playing in this market include Miyakoshi, Kodak, HP, and Xeikon.

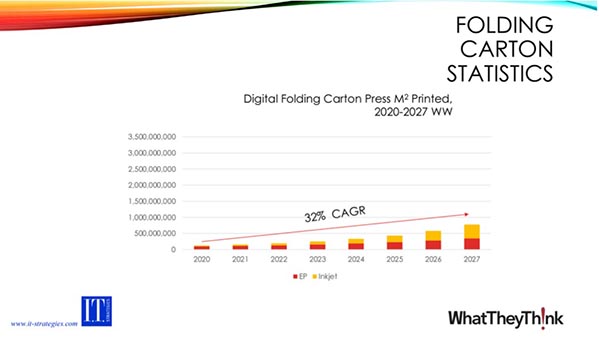

Folding Carton Volumes

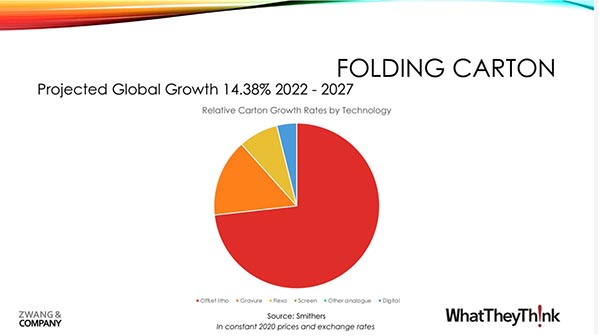

Next, Zwang turned his attention to folding cartons, which Smithers forecasts at 14.38% growth between 2022 – 2027. This growth, he says, is being driven by concerns for sustainability as more and more packaging shifts to paper-based substrates.

While production of folding cartons has historically been dominated by offset, these products are produced on flexo and, to some extent, digital and gravure, as well.

Taking a look at the growth rate of digital folding cartons, specifically, Zwang notes that both EP and inkjet are growing. Inkjet, in particular, is growing at an even faster rate based on its speed and lower cost per unit. “Not surprisingly, we're starting to see more inkjet presses better suited for folding cartons,” he says.

Among the analog press vendors:

- Heidelberg

- Komori

- KBA

All three of these vendors have also digitalized their presses. Zwang described the Heidelberg 106, as an example, as “frighteningly easy and quick.” The changeover, he says, is three to four minutes. “All the vendors are all doing that,” he says.

Among the vendors offering inkjet solutions:

- Agfa/Inca

- Landa

- KBA Durst (now available)

- Konica Minolta KM1

- Kodak Prosper

- Fujifilm JPress

Zwang notes that more printers are using the Landa as a folding carton press. “They are starting to ship a lot more presses now,” he says. “So you can expect to see folding carton growth in inkjet pick up.”

All of these presses are B2 with the exception of the Landa and the Durst, which are B1.

Cut Sheet “Coming Out” Party

Zwang also expects drupa to be a “coming out party” for many new cut sheet inkjet devices. Among the vendors offering EP solutions:

- Canon

- HP Indigo

- MGI AlphaJet (now starting to ship)

- Ricoh Z75 (Dragon)

“The Ricoh is the Z75 has been in a very successful beta,” says Zwang. “All indications are that they'll probably start shipping out of beta by the end of this year.”

Zwang also took the time to touch on the HP T700 I corrugated press, which people associate as a mid-size for corrugated preprint. However, he sees this as great for litho-lam for folding cartons, as well, and it's just the right size. “This was just introduced this year, so we’ll probably see some headway on this,” he says. “I got a chance to see it in in Germany in February. It is an amazing technology.”

Zwang used the press as an illustration of the move to “digitalization” of analog equipment. “This is basically an autonomous flexo press,” he explains. “Each of these units has an A and a B side. While the A side is running, you can be changing the B side. Either through pre-programming or a splice or whatever, it can switch from one to the other. Minimal waste—minimal. I think they said it's something like 10 meters of waste. You don't have to worry about setup, color change, or any of that. It’s all automated. Operators don't have to tweak things. They don't have to change the inks or do the wash up. It does it by itself. That is significant. This machine is also very modular, so you can get it based on what your needs are. It's designed to handle anything from under 10,000 sheets to well over one million. That's also a significant development. We're going to start to see more and more of these highly digitalized presses. Bobst is digitalizing everything in their lineup, as well.”

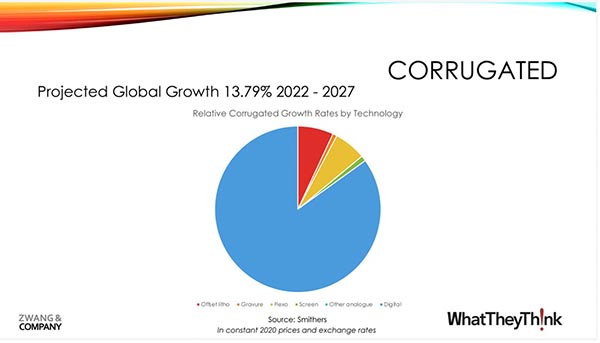

Corrugated Volumes

Finally, Zwang turned to corrugated. “If we talk about the largest volume of packaging produced, hands down, it's corrugated,” he says. “Especially with e-commerce, corrugated is just growing at a crazy pace (and it’s already crazy big), with nearly 14% growth forecast between now and 2027.”

Corrugated remains largely an analog production process, primarily flexo, and to some extent offset and gravure. “There's a lot of corrugated post print, where we're actually taking the corrugated sheets and printing directly on them,” says Zwang.

Among the vendors playing in this market are Xeikon, Domino, HP, EFI, and Koenig & Bauer. “You are going to see more of those because there's a good market for corrugated,” says Zwang. “Whether you're using it for boxes or shelf displays, there's a tremendous need for it.”

Opportunities are occurring in preprint, as well. The major players being HP, Bobst, and Koenig & Bauer. “This is where the vast majority of what you see — the pretty pictures on corrugated — are coming from,” Zwang says.

One of the most important things about packaging, Zwang adds, however, is that it’s about finishing: “If you don’t finish it, you don’t have a package.” He pointed to the most recent print edition of What They Think (“coming to a mailbox near you”) and its article on the importance of embellishment in packaging. “You should probably go and check that out,” he says.

While there wasn’t enough time or space to cover the wide variety corrugated finishing machines (such as those from Sei, Highcon, Scodix, Actega, and GM) available, Zwang encouraged participants to do their homework. “There are tens of machines in each field. You will start seeing more features like laser finishing, rotary dye cutting, folders and gluers, other things that that are going to be relatively easy and fast to be able to deal with. The runs are starting to get faster, and they're moving to full digitalization, as well.”

Tying It All Together

Then it's a matter of tying it all together. “Especially with the growing labor issues, converters increasingly need to start connecting these devices, so they talk to each other,” Zwang says. “This goes all the way through inventory so that if someone buys a product off a retail shelf, it will send a signal all the way back through the chain and create an order for a new one. That's really where we're going. We're not that far away. In some cases, it's already happening in other industries.”

If you are a converter, or if you want to get into that market, he emphasizes, it’s not just about the press. “It’s about the finishing. It’s about the embellishment unit. It’s about how everything connects to your customer and throughout the entire value and supply chain. Very important.”

Drupa Watch

Wrapping things up, Zwang offered the audience a “drupa watch.” These include:

- Cut sheet inkjet – B1 and B2

- Digitalization of analog (flexo/offset/hybrid)

- Next generation converting and finishing equipment

- Automation, automation, automation

- Integration, integration, integration

“You're going to see a lot more digitalization of the analog equipment and more inkjet that can be used for flexible packaging,” Zwang concludes. “You're also going to see a lot of next generation converting and finishing equipment. Automation, automation, automation integration, integration, integration. That's the mantra, guys. That's what you're going to have to understand and be aware of as you look at where you need to think about going in the future.”

The audience sent in a wide variety of questions, including the advantages and disadvantages of bespoke packaging workflow, whether digital package printing technologies will move from short volumes towards mid-size volumes in some applications (and when), and challenges in production, workflow, pre-imposed press, imposition, and coatings.

Discussion

By Valentin Vachkov on Jun 07, 2023

Valuable, thanks!

Discussion

Join the discussion Sign In or Become a Member, doing so is simple and free