Harry Truman is known for his request for a one-armed economist, someone who could explain what was happening without saying "but on the other hand" as they discussed the opposing forces that are always present in the marketplace.

Last Friday's GDP revision to negative was expected and shrugged off by most business economists as just another aspect of a slow recovery. When the economy can't muster strong rates of growth, there will be occasional dips into negative territory.

This was the second release of GDP data, and there is one more revision due at the end of June. There will be yet another when years of historical data are revised in July.

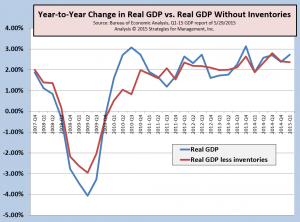

We have the strong preference to look at GDP data on a year-to-year basis rather than the quarter-to-quarter basis as is regularly reported. This shows the longer term trend and less prone to wide revisions. The chart shows this comparison with and without net inventories. The inventory data in the GDP report has been "flaky" in its pattern of revision and also in its underlying trend. The trend in the chart is for an economy that continues to muddle along in the +2.0 to +2.5% range. (click chart to enlarge)

A rise in inventories often shows a growing economy as businesses anticipate better future sales. Through most of the recovery, the inventories have usually been revised down in revisions, and quarters with high inventories have often been followed by slower growth rates. In the long run, net inventories should be zero, as businesses have the right inventories to satisfy consumers. In reality, inventory management is not that perfect, and recessions clear excess inventories out of the system. Net inventories are still running higher than average.

Declining GDP is not a good thing. When an economy is at this level, it is always easier to fall into recession. Be concerned but not obsessed with it. The economy is slow... is that news?

* * *

The Atlanta Fed's

GDPNow forecast of the second quarter GDP is running at +0.8% as of their June 1 update. This is well below the consensus forecasts of economists. Professional forecasters have been overly optimistic throughout the recovery.

* * *

There have been some "spin" applied to the analysis of GDP data as there is political concern about this negative report being a sign of recession which would be bad for politicians of all parties for any variety of reasons.

The discussion seems to have gotten to some of the folks in charge of the Bureau of Economic Analysis. They have reported that they are investigating changes to seasonal adjustments that are used in data.

There are seasonal patterns to all data. Seasonality does not always refer to weather. They can be related to any thing that causes a change in behavior, such as requiring taxes to be filed on April 15. This creates demand for accounting services at one time of year that are different than those of another.

All of the data in GDP are seasonally adjusted - and therefore the GDP itself does not need seasonal adjustment.

The most simple of seasonal adjustments is one period of the current year compared to the same period of a past one. The only problem with that is you can't get promoted in statistical agencies or get tenure in academic departments by proposing something simple.

Here are some links that are worthwhile in understanding GDP in general and some of the latest discussions:

# # #

UPDATE June 3: The release of import-export data for April raised the Atlanta Fed's GDPNow Q2 estimate to +1.1%

A rise in inventories often shows a growing economy as businesses anticipate better future sales. Through most of the recovery, the inventories have usually been revised down in revisions, and quarters with high inventories have often been followed by slower growth rates. In the long run, net inventories should be zero, as businesses have the right inventories to satisfy consumers. In reality, inventory management is not that perfect, and recessions clear excess inventories out of the system. Net inventories are still running higher than average.

Declining GDP is not a good thing. When an economy is at this level, it is always easier to fall into recession. Be concerned but not obsessed with it. The economy is slow... is that news?

* * *

The Atlanta Fed's GDPNow forecast of the second quarter GDP is running at +0.8% as of their June 1 update. This is well below the consensus forecasts of economists. Professional forecasters have been overly optimistic throughout the recovery.

* * *

There have been some "spin" applied to the analysis of GDP data as there is political concern about this negative report being a sign of recession which would be bad for politicians of all parties for any variety of reasons.

The discussion seems to have gotten to some of the folks in charge of the Bureau of Economic Analysis. They have reported that they are investigating changes to seasonal adjustments that are used in data.

There are seasonal patterns to all data. Seasonality does not always refer to weather. They can be related to any thing that causes a change in behavior, such as requiring taxes to be filed on April 15. This creates demand for accounting services at one time of year that are different than those of another.

All of the data in GDP are seasonally adjusted - and therefore the GDP itself does not need seasonal adjustment.

The most simple of seasonal adjustments is one period of the current year compared to the same period of a past one. The only problem with that is you can't get promoted in statistical agencies or get tenure in academic departments by proposing something simple.

Here are some links that are worthwhile in understanding GDP in general and some of the latest discussions:

A rise in inventories often shows a growing economy as businesses anticipate better future sales. Through most of the recovery, the inventories have usually been revised down in revisions, and quarters with high inventories have often been followed by slower growth rates. In the long run, net inventories should be zero, as businesses have the right inventories to satisfy consumers. In reality, inventory management is not that perfect, and recessions clear excess inventories out of the system. Net inventories are still running higher than average.

Declining GDP is not a good thing. When an economy is at this level, it is always easier to fall into recession. Be concerned but not obsessed with it. The economy is slow... is that news?

* * *

The Atlanta Fed's GDPNow forecast of the second quarter GDP is running at +0.8% as of their June 1 update. This is well below the consensus forecasts of economists. Professional forecasters have been overly optimistic throughout the recovery.

* * *

There have been some "spin" applied to the analysis of GDP data as there is political concern about this negative report being a sign of recession which would be bad for politicians of all parties for any variety of reasons.

The discussion seems to have gotten to some of the folks in charge of the Bureau of Economic Analysis. They have reported that they are investigating changes to seasonal adjustments that are used in data.

There are seasonal patterns to all data. Seasonality does not always refer to weather. They can be related to any thing that causes a change in behavior, such as requiring taxes to be filed on April 15. This creates demand for accounting services at one time of year that are different than those of another.

All of the data in GDP are seasonally adjusted - and therefore the GDP itself does not need seasonal adjustment.

The most simple of seasonal adjustments is one period of the current year compared to the same period of a past one. The only problem with that is you can't get promoted in statistical agencies or get tenure in academic departments by proposing something simple.

Here are some links that are worthwhile in understanding GDP in general and some of the latest discussions: