* * *

PS: A day after this report was posted, Gallup and Wells Fargo reported another strong report for small business optimism.

# # #

* * *

PS: A day after this report was posted, Gallup and Wells Fargo reported another strong report for small business optimism.

# # #

Commentary & Analysis

Manufacturing Indicators Retreat; Small Business Moves Forward

Recovery indicators in manufacturing continued to retreat in the ISM manufacturing report,

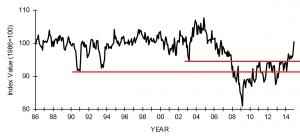

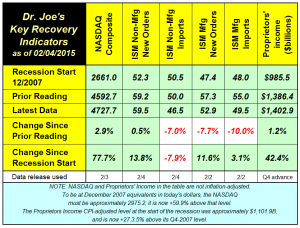

Recovery indicators in manufacturing continued to retreat in the ISM manufacturing report, in concert with news earlier this week from the Commerce Department that showed five months consecutive decline for factory orders. Non-manufacturing orders rose slightly, but imports continued to pull back. (click chart to enlarge)

The ISM new orders for manufacturing and non-manufacturing are still above 50, which indicates future growth, but at a slower rate. The NASDAQ index was up in the last month, but is still lower than it was two months ago. Trading has been choppy, which sometimes is indicative of a developing turning point.

With last week's advance report of GDP for the fourth quarter, a slower economy seems to be playing out. That report showed increasing inventories, which combined with the poor report of factory orders suggests a slow first quarter for those resources to be rebalanced.

The one bright spot in the report is a measure of small business, proprietors income,

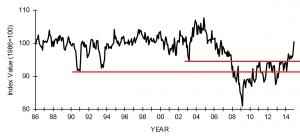

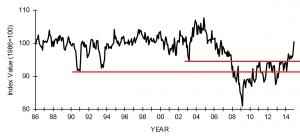

The one bright spot in the report is a measure of small business, proprietors income, upbeat news in an otherwise tough month. Recent reports from the Sam's Club/Gallup microbusiness survey and the NFIB were positive. The latter report has broken through the levels of two prior recessions with positive conviction (click chart to enlarge).

The ISM new orders for manufacturing and non-manufacturing are still above 50, which indicates future growth, but at a slower rate. The NASDAQ index was up in the last month, but is still lower than it was two months ago. Trading has been choppy, which sometimes is indicative of a developing turning point.

With last week's advance report of GDP for the fourth quarter, a slower economy seems to be playing out. That report showed increasing inventories, which combined with the poor report of factory orders suggests a slow first quarter for those resources to be rebalanced.

The one bright spot in the report is a measure of small business, proprietors income,

The one bright spot in the report is a measure of small business, proprietors income, upbeat news in an otherwise tough month. Recent reports from the Sam's Club/Gallup microbusiness survey and the NFIB were positive. The latter report has broken through the levels of two prior recessions with positive conviction (click chart to enlarge).

* * *

PS: A day after this report was posted, Gallup and Wells Fargo reported another strong report for small business optimism.

# # #

* * *

PS: A day after this report was posted, Gallup and Wells Fargo reported another strong report for small business optimism.

# # #

* * *

PS: A day after this report was posted, Gallup and Wells Fargo reported another strong report for small business optimism.

# # #

* * *

PS: A day after this report was posted, Gallup and Wells Fargo reported another strong report for small business optimism.

# # #

About Dr. Joe Webb

Dr. Joe Webb is one of the graphic arts industry's best-known consultants, forecasters, and commentators. He is the director of WhatTheyThink's Economics and Research Center.

Video Center

- Questions to ask about inkjet for corrugated packaging

- Can Chinese OEMs challenge Western manufacturers?

- The #1 Question When Selling Inkjet

- Integrator perspective on Konica Minolta printheads

- Surfing the Waves of Inkjet

- Kyocera Nixka talks inkjet integration trends

- B2B Customer Tours

- Keeping Inkjet Tickled Pink

© 2024 WhatTheyThink. All Rights Reserved.