The US Bureau of Labor Statistics released the Consumer Price Index (CPI) for December, and it ended the year at +0.8% compared to December 2013. The primary reason for the decline in prices is the sharp drop in oil prices. This is eerily similar to the decline of oil prices in 2008, but that discussion is for another time. Inflation as measured by the CPI is low, less that half the targeted inflation rate of the Fed. The Fed is comfortable with an inflation rate of 2%. What they will be figuring out over these next months is whether or not how temporary they should consider the oil price decline to be. If it will remain at these low levels for a relatively long time, the Fed will take their time before act to cause interest rates to rise. If they believe oil prices will spike back up, they will act sooner.

But the Fed's actions matter little to this discussion. Inflation distorts management perceptions about history, even recent history. As an example, look at the highest grossing movies of all time based on their box office revenues, courtesy of the website

BoxOfficeMojo (click chart to enlarge).

The three top movies are

Avatar at $761 million,

Titanic at $659 million, and

Marvel's The Avengers at $623 million. In the chart you can see some other columns. These are "rank" and "adjusted gross." These are the ranks of the movies after adjusting for inflation's effect on ticket prices. The "adjusted gross" column are the original dollar amounts before the adjustment. In the jargon of economists, these are called "current dollars" or "nominal dollars."

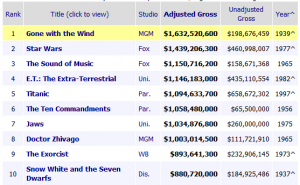

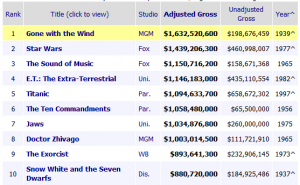

Below is the chart of the movies with the highest box office revenues of all time, adjusted for inflation (click chart to enlarge):

Avatar

Avatar doesn't hit the top ten. In the full list, it's currently ranked fourteenth.

Gone with the Wind remains at the top of the list with more than twice the revenues. Sure,

GWTW revenues benefit from its multiple theater releases over the years because there were no such things a cable movie channels or home video at that time, and for most of those releases home television was either non-existent or in limited availability, or in blurry black and white. But the US population was much smaller at that time; the

GWTW achievement is stunning in that regard. Other movies in the list are from the cable and video era and had multiple releases, notably

Star Wars,

E.T., and

Snow White. I seem to remember that

The Ten Commandments also had multiple theater releases.

I use this example to show how inflation distorts history, slowly, over time. That Fed objective of 2% inflation means that over a decade, with compounding, erodes savings by about 22%. If you have $50,000, after a year, that means its purchasing power is $1,000 less than it was.

This also means that in budgeting processes, the lack of inflation adjustment distorts the perception of history, even as recent as a year prior. Sure, it's less than 1% this past year, but in other years it was not.

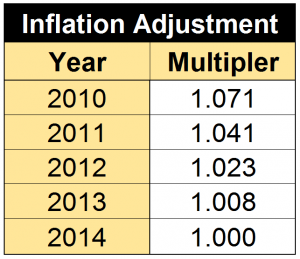

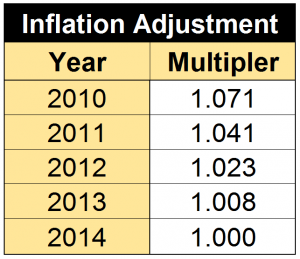

Here are the latest inflation multipliers (click chart to enlarge):

What this means is that when you compare your 2012 financials to 2014's, you should multiply those of 2012 by 1.023 to bring them up to current dollars. For 2011, multiply by 1.07.

The process is easy to do nowadays with Excel or other spreadsheet programs.

In recent years I have heard from more and more executives who are now adjusting their financial data for inflation.

There is also something else I have found: more companies are mentioning that they are finding ways to measure their businesses in ways other than money. Inflation may distort money, but it can't distort units. It's not always possible, but looking for ways to do so in conjunction with the other financial measures can be very helpful in assessing the true performance of a business.

* * *

The Consumer Price Index is the most important measurement of the effects of inflation, and is my preferred method, because those are the dollars in our pockets, the result of our labors. There are some who believe that the CPI (purposely) understates inflation, and an example of that can be

found here.

* * *

As workers and savers, it is important to be aware of the effects of inflation and also taxation. Sometimes they go hand-in-hand. I recently participated in the sale of a condominium owned by a family member that was not a primary residence. The capital gain on the property over about 22 years was $35,000, which meant that there was a capital gains tax to be paid. If the capital gain was adjusted for inflation, there would have been a

capital loss of more than $60,000. Inflation has been one of the most important reasons why the capital gains tax rate was lower than the marginal tax rate, as a means of partially compensating for illusory gains. This means that a tax was paid on gains that never actually occurred.

* * *

Back at the end of 2011, there was a comment about inflation made in a

PIA economic analysis, and they "kind of" mentioned me. This led to a presentation by me, which was posted online, about the nature of inflation's effect in our industry, as well as a discussion of the different measures of inflation. If you have insomnia, this is the cure you've been waiting for. The presentation was accessed more than 2500 times, about 1500 of those in the first three months after posting.

The slides are still available at

SlideShare. When they were originally posted, SlideShare allowed audio, synced with the slides, to be included. Last year, this audio feature was removed from the service.

You can hear the audio and all of its economic playfulness

at this link. It's an mp3 file and is just less than 10mb.

* * *

As a pre-teen, I, like many others in the US at that time, was a fan of

Mad Magazine. Their movie spoofs were exceptional. Therefore, it is only right that I link to a blogpost about their parody,

The Sound of Money. I've mentioned it in previous comments about this topic (such as last year) because it's such a vivid and happy memory, and because it is considered one of

Mad's best spoofs. Or is it because I was dragged to see the movie and forced to stand in line, outside, with my parents and hundreds of boring tall jabbering adults for over an hour, delaying my popcorn. I guess

Mad's version was my revenge, along with millions of other kids of that era.

# # #

The three top movies are Avatar at $761 million, Titanic at $659 million, and Marvel's The Avengers at $623 million. In the chart you can see some other columns. These are "rank" and "adjusted gross." These are the ranks of the movies after adjusting for inflation's effect on ticket prices. The "adjusted gross" column are the original dollar amounts before the adjustment. In the jargon of economists, these are called "current dollars" or "nominal dollars."

Below is the chart of the movies with the highest box office revenues of all time, adjusted for inflation (click chart to enlarge):

The three top movies are Avatar at $761 million, Titanic at $659 million, and Marvel's The Avengers at $623 million. In the chart you can see some other columns. These are "rank" and "adjusted gross." These are the ranks of the movies after adjusting for inflation's effect on ticket prices. The "adjusted gross" column are the original dollar amounts before the adjustment. In the jargon of economists, these are called "current dollars" or "nominal dollars."

Below is the chart of the movies with the highest box office revenues of all time, adjusted for inflation (click chart to enlarge):

Avatar doesn't hit the top ten. In the full list, it's currently ranked fourteenth. Gone with the Wind remains at the top of the list with more than twice the revenues. Sure, GWTW revenues benefit from its multiple theater releases over the years because there were no such things a cable movie channels or home video at that time, and for most of those releases home television was either non-existent or in limited availability, or in blurry black and white. But the US population was much smaller at that time; the GWTW achievement is stunning in that regard. Other movies in the list are from the cable and video era and had multiple releases, notably Star Wars, E.T., and Snow White. I seem to remember that The Ten Commandments also had multiple theater releases.

I use this example to show how inflation distorts history, slowly, over time. That Fed objective of 2% inflation means that over a decade, with compounding, erodes savings by about 22%. If you have $50,000, after a year, that means its purchasing power is $1,000 less than it was.

This also means that in budgeting processes, the lack of inflation adjustment distorts the perception of history, even as recent as a year prior. Sure, it's less than 1% this past year, but in other years it was not.

Here are the latest inflation multipliers (click chart to enlarge):

Avatar doesn't hit the top ten. In the full list, it's currently ranked fourteenth. Gone with the Wind remains at the top of the list with more than twice the revenues. Sure, GWTW revenues benefit from its multiple theater releases over the years because there were no such things a cable movie channels or home video at that time, and for most of those releases home television was either non-existent or in limited availability, or in blurry black and white. But the US population was much smaller at that time; the GWTW achievement is stunning in that regard. Other movies in the list are from the cable and video era and had multiple releases, notably Star Wars, E.T., and Snow White. I seem to remember that The Ten Commandments also had multiple theater releases.

I use this example to show how inflation distorts history, slowly, over time. That Fed objective of 2% inflation means that over a decade, with compounding, erodes savings by about 22%. If you have $50,000, after a year, that means its purchasing power is $1,000 less than it was.

This also means that in budgeting processes, the lack of inflation adjustment distorts the perception of history, even as recent as a year prior. Sure, it's less than 1% this past year, but in other years it was not.

Here are the latest inflation multipliers (click chart to enlarge):

What this means is that when you compare your 2012 financials to 2014's, you should multiply those of 2012 by 1.023 to bring them up to current dollars. For 2011, multiply by 1.07.

The process is easy to do nowadays with Excel or other spreadsheet programs.

In recent years I have heard from more and more executives who are now adjusting their financial data for inflation.

There is also something else I have found: more companies are mentioning that they are finding ways to measure their businesses in ways other than money. Inflation may distort money, but it can't distort units. It's not always possible, but looking for ways to do so in conjunction with the other financial measures can be very helpful in assessing the true performance of a business.

* * *

The Consumer Price Index is the most important measurement of the effects of inflation, and is my preferred method, because those are the dollars in our pockets, the result of our labors. There are some who believe that the CPI (purposely) understates inflation, and an example of that can be found here.

* * *

As workers and savers, it is important to be aware of the effects of inflation and also taxation. Sometimes they go hand-in-hand. I recently participated in the sale of a condominium owned by a family member that was not a primary residence. The capital gain on the property over about 22 years was $35,000, which meant that there was a capital gains tax to be paid. If the capital gain was adjusted for inflation, there would have been a capital loss of more than $60,000. Inflation has been one of the most important reasons why the capital gains tax rate was lower than the marginal tax rate, as a means of partially compensating for illusory gains. This means that a tax was paid on gains that never actually occurred.

* * *

Back at the end of 2011, there was a comment about inflation made in a PIA economic analysis, and they "kind of" mentioned me. This led to a presentation by me, which was posted online, about the nature of inflation's effect in our industry, as well as a discussion of the different measures of inflation. If you have insomnia, this is the cure you've been waiting for. The presentation was accessed more than 2500 times, about 1500 of those in the first three months after posting.

The slides are still available at SlideShare. When they were originally posted, SlideShare allowed audio, synced with the slides, to be included. Last year, this audio feature was removed from the service.

You can hear the audio and all of its economic playfulness at this link. It's an mp3 file and is just less than 10mb.

* * *

As a pre-teen, I, like many others in the US at that time, was a fan of Mad Magazine. Their movie spoofs were exceptional. Therefore, it is only right that I link to a blogpost about their parody, The Sound of Money. I've mentioned it in previous comments about this topic (such as last year) because it's such a vivid and happy memory, and because it is considered one of Mad's best spoofs. Or is it because I was dragged to see the movie and forced to stand in line, outside, with my parents and hundreds of boring tall jabbering adults for over an hour, delaying my popcorn. I guess Mad's version was my revenge, along with millions of other kids of that era.

# # #

What this means is that when you compare your 2012 financials to 2014's, you should multiply those of 2012 by 1.023 to bring them up to current dollars. For 2011, multiply by 1.07.

The process is easy to do nowadays with Excel or other spreadsheet programs.

In recent years I have heard from more and more executives who are now adjusting their financial data for inflation.

There is also something else I have found: more companies are mentioning that they are finding ways to measure their businesses in ways other than money. Inflation may distort money, but it can't distort units. It's not always possible, but looking for ways to do so in conjunction with the other financial measures can be very helpful in assessing the true performance of a business.

* * *

The Consumer Price Index is the most important measurement of the effects of inflation, and is my preferred method, because those are the dollars in our pockets, the result of our labors. There are some who believe that the CPI (purposely) understates inflation, and an example of that can be found here.

* * *

As workers and savers, it is important to be aware of the effects of inflation and also taxation. Sometimes they go hand-in-hand. I recently participated in the sale of a condominium owned by a family member that was not a primary residence. The capital gain on the property over about 22 years was $35,000, which meant that there was a capital gains tax to be paid. If the capital gain was adjusted for inflation, there would have been a capital loss of more than $60,000. Inflation has been one of the most important reasons why the capital gains tax rate was lower than the marginal tax rate, as a means of partially compensating for illusory gains. This means that a tax was paid on gains that never actually occurred.

* * *

Back at the end of 2011, there was a comment about inflation made in a PIA economic analysis, and they "kind of" mentioned me. This led to a presentation by me, which was posted online, about the nature of inflation's effect in our industry, as well as a discussion of the different measures of inflation. If you have insomnia, this is the cure you've been waiting for. The presentation was accessed more than 2500 times, about 1500 of those in the first three months after posting.

The slides are still available at SlideShare. When they were originally posted, SlideShare allowed audio, synced with the slides, to be included. Last year, this audio feature was removed from the service.

You can hear the audio and all of its economic playfulness at this link. It's an mp3 file and is just less than 10mb.

* * *

As a pre-teen, I, like many others in the US at that time, was a fan of Mad Magazine. Their movie spoofs were exceptional. Therefore, it is only right that I link to a blogpost about their parody, The Sound of Money. I've mentioned it in previous comments about this topic (such as last year) because it's such a vivid and happy memory, and because it is considered one of Mad's best spoofs. Or is it because I was dragged to see the movie and forced to stand in line, outside, with my parents and hundreds of boring tall jabbering adults for over an hour, delaying my popcorn. I guess Mad's version was my revenge, along with millions of other kids of that era.

# # #