While the change in the recovery indicators should raise some concern, it must be noted that most of the ISM indicators remain well above their 50 breakeven level, and remain at levels that indicate future growth. There are still indicators that imply that the economy has not recovered. We had one of them in a recent newsletter, the inflation-adjusted revenues of all of the companies in the S&P 500. This data series should be biased to the upside as companies engage in mergers and acquisitions. This creates openings for S&P to add additional companies, therefore adding more revenue to the calculation. But it's not happening; the data are flat. Also, real median household income remains below pre-recession levels. Finally, the relationship between employment and population is still at low levels not seen in about 35 years.

We will get another reading of the economy with the release of December employment data when it is released this Friday (1/9/2015).

# # #

While the change in the recovery indicators should raise some concern, it must be noted that most of the ISM indicators remain well above their 50 breakeven level, and remain at levels that indicate future growth. There are still indicators that imply that the economy has not recovered. We had one of them in a recent newsletter, the inflation-adjusted revenues of all of the companies in the S&P 500. This data series should be biased to the upside as companies engage in mergers and acquisitions. This creates openings for S&P to add additional companies, therefore adding more revenue to the calculation. But it's not happening; the data are flat. Also, real median household income remains below pre-recession levels. Finally, the relationship between employment and population is still at low levels not seen in about 35 years.

We will get another reading of the economy with the release of December employment data when it is released this Friday (1/9/2015).

# # #

Commentary & Analysis

Recovery Indicators Slammed After Upbeat Q3 GDP Revision

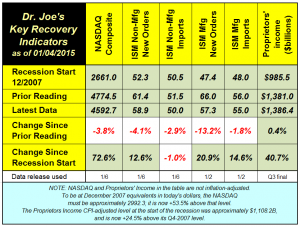

The recovery indicators took a hard body blow last month as the NASDAQ and the ISM indicators all retreated.

The recovery indicators took a hard body blow last month as the NASDAQ and the ISM indicators all retreated. One of the ISM measures, imports by non-manufacturing businesses, fell below the level it was when the recession started in December 2007. Proprietors' income was reduced slightly in the Q3 GDP revision. (click chart to enlarge)

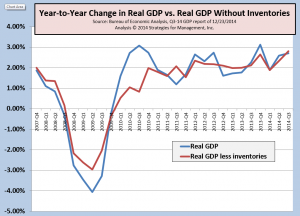

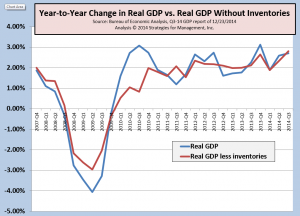

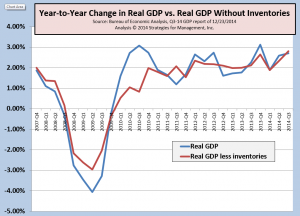

It's hard to believe that it was seven years ago, and we've been waiting for a strong and resounding upswing that typifies a recovery. It's only in the last GDP report, a revision to the third quarter's data, that we got anything close, a +5% revision. That 3Q-2014 GDP report started at +3.5%, then it was revised to +3.9%, and then +5.0%, getting stronger as real data replaced estimated data. But economic data are always seem to be viewed as a "what have you done for me lately" proposition rather than on a longer term perspective. The chart below shows the GDP report on a year-to-year basis rather than quarterly changes. Since the change in inventories has played a role in growth rates in recent quarters, GDP is displayed with and without those data. The trends still remain nearly a percentage point below post-WW2 average real GDP growth. (click chart to enlarge)

It's hard to believe that it was seven years ago, and we've been waiting for a strong and resounding upswing that typifies a recovery. It's only in the last GDP report, a revision to the third quarter's data, that we got anything close, a +5% revision. That 3Q-2014 GDP report started at +3.5%, then it was revised to +3.9%, and then +5.0%, getting stronger as real data replaced estimated data. But economic data are always seem to be viewed as a "what have you done for me lately" proposition rather than on a longer term perspective. The chart below shows the GDP report on a year-to-year basis rather than quarterly changes. Since the change in inventories has played a role in growth rates in recent quarters, GDP is displayed with and without those data. The trends still remain nearly a percentage point below post-WW2 average real GDP growth. (click chart to enlarge)

While the change in the recovery indicators should raise some concern, it must be noted that most of the ISM indicators remain well above their 50 breakeven level, and remain at levels that indicate future growth. There are still indicators that imply that the economy has not recovered. We had one of them in a recent newsletter, the inflation-adjusted revenues of all of the companies in the S&P 500. This data series should be biased to the upside as companies engage in mergers and acquisitions. This creates openings for S&P to add additional companies, therefore adding more revenue to the calculation. But it's not happening; the data are flat. Also, real median household income remains below pre-recession levels. Finally, the relationship between employment and population is still at low levels not seen in about 35 years.

We will get another reading of the economy with the release of December employment data when it is released this Friday (1/9/2015).

# # #

While the change in the recovery indicators should raise some concern, it must be noted that most of the ISM indicators remain well above their 50 breakeven level, and remain at levels that indicate future growth. There are still indicators that imply that the economy has not recovered. We had one of them in a recent newsletter, the inflation-adjusted revenues of all of the companies in the S&P 500. This data series should be biased to the upside as companies engage in mergers and acquisitions. This creates openings for S&P to add additional companies, therefore adding more revenue to the calculation. But it's not happening; the data are flat. Also, real median household income remains below pre-recession levels. Finally, the relationship between employment and population is still at low levels not seen in about 35 years.

We will get another reading of the economy with the release of December employment data when it is released this Friday (1/9/2015).

# # #

While the change in the recovery indicators should raise some concern, it must be noted that most of the ISM indicators remain well above their 50 breakeven level, and remain at levels that indicate future growth. There are still indicators that imply that the economy has not recovered. We had one of them in a recent newsletter, the inflation-adjusted revenues of all of the companies in the S&P 500. This data series should be biased to the upside as companies engage in mergers and acquisitions. This creates openings for S&P to add additional companies, therefore adding more revenue to the calculation. But it's not happening; the data are flat. Also, real median household income remains below pre-recession levels. Finally, the relationship between employment and population is still at low levels not seen in about 35 years.

We will get another reading of the economy with the release of December employment data when it is released this Friday (1/9/2015).

# # #

While the change in the recovery indicators should raise some concern, it must be noted that most of the ISM indicators remain well above their 50 breakeven level, and remain at levels that indicate future growth. There are still indicators that imply that the economy has not recovered. We had one of them in a recent newsletter, the inflation-adjusted revenues of all of the companies in the S&P 500. This data series should be biased to the upside as companies engage in mergers and acquisitions. This creates openings for S&P to add additional companies, therefore adding more revenue to the calculation. But it's not happening; the data are flat. Also, real median household income remains below pre-recession levels. Finally, the relationship between employment and population is still at low levels not seen in about 35 years.

We will get another reading of the economy with the release of December employment data when it is released this Friday (1/9/2015).

# # #

About Dr. Joe Webb

Dr. Joe Webb is one of the graphic arts industry's best-known consultants, forecasters, and commentators. He is the director of WhatTheyThink's Economics and Research Center.

Video Center

- Questions to ask about inkjet for corrugated packaging

- Can Chinese OEMs challenge Western manufacturers?

- The #1 Question When Selling Inkjet

- Integrator perspective on Konica Minolta printheads

- Surfing the Waves of Inkjet

- Kyocera Nixka talks inkjet integration trends

- B2B Customer Tours

- Keeping Inkjet Tickled Pink

© 2024 WhatTheyThink. All Rights Reserved.