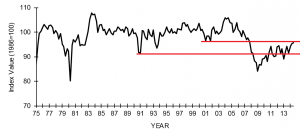

The chart above is from their report. From issue to issue, they change the number of years that they display, and this one is interesting because it goes back almost 40 years. I've drawn two red lines in the chart that show the bottom of the early 1990s recession and the bottom of the very mild early 2000s recession. Our current recovery has barely budged from this range, but is on a mild upswing.

It is notable that the late 1970s/early 1980s recession bottom was not approached in the most recent downturn. From the timing of the high points, it looks like the NFIB index peaks in advance of a general economic upturn as overall GDP figures increased after those points. That could be that large businesses turn to small businesses for services until they believe the upturn is certain and entrenched. From that perspective, we are still waiting for that big rise up.

# # #

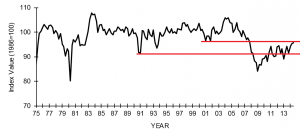

The chart above is from their report. From issue to issue, they change the number of years that they display, and this one is interesting because it goes back almost 40 years. I've drawn two red lines in the chart that show the bottom of the early 1990s recession and the bottom of the very mild early 2000s recession. Our current recovery has barely budged from this range, but is on a mild upswing.

It is notable that the late 1970s/early 1980s recession bottom was not approached in the most recent downturn. From the timing of the high points, it looks like the NFIB index peaks in advance of a general economic upturn as overall GDP figures increased after those points. That could be that large businesses turn to small businesses for services until they believe the upturn is certain and entrenched. From that perspective, we are still waiting for that big rise up.

# # #

Commentary & Analysis

NFIB Small Business Index Up Slightly

The National Federation of Independent Business (

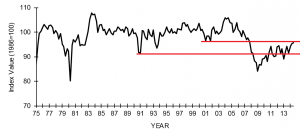

The National Federation of Independent Business (NFIB) has a monthly survey of members that is watched by economists interested in judging the health of small business. The press release for the most recent report can be downloaded from their site. The report is available for download as a PDF.

Their economist noted that "capital spending reports continue to remain mediocre, spending plans are weak, and inventories are too large, with more owners reporting sales trends deteriorating than improving." (click chart to enlarge)

The chart above is from their report. From issue to issue, they change the number of years that they display, and this one is interesting because it goes back almost 40 years. I've drawn two red lines in the chart that show the bottom of the early 1990s recession and the bottom of the very mild early 2000s recession. Our current recovery has barely budged from this range, but is on a mild upswing.

It is notable that the late 1970s/early 1980s recession bottom was not approached in the most recent downturn. From the timing of the high points, it looks like the NFIB index peaks in advance of a general economic upturn as overall GDP figures increased after those points. That could be that large businesses turn to small businesses for services until they believe the upturn is certain and entrenched. From that perspective, we are still waiting for that big rise up.

# # #

The chart above is from their report. From issue to issue, they change the number of years that they display, and this one is interesting because it goes back almost 40 years. I've drawn two red lines in the chart that show the bottom of the early 1990s recession and the bottom of the very mild early 2000s recession. Our current recovery has barely budged from this range, but is on a mild upswing.

It is notable that the late 1970s/early 1980s recession bottom was not approached in the most recent downturn. From the timing of the high points, it looks like the NFIB index peaks in advance of a general economic upturn as overall GDP figures increased after those points. That could be that large businesses turn to small businesses for services until they believe the upturn is certain and entrenched. From that perspective, we are still waiting for that big rise up.

# # #

The chart above is from their report. From issue to issue, they change the number of years that they display, and this one is interesting because it goes back almost 40 years. I've drawn two red lines in the chart that show the bottom of the early 1990s recession and the bottom of the very mild early 2000s recession. Our current recovery has barely budged from this range, but is on a mild upswing.

It is notable that the late 1970s/early 1980s recession bottom was not approached in the most recent downturn. From the timing of the high points, it looks like the NFIB index peaks in advance of a general economic upturn as overall GDP figures increased after those points. That could be that large businesses turn to small businesses for services until they believe the upturn is certain and entrenched. From that perspective, we are still waiting for that big rise up.

# # #

The chart above is from their report. From issue to issue, they change the number of years that they display, and this one is interesting because it goes back almost 40 years. I've drawn two red lines in the chart that show the bottom of the early 1990s recession and the bottom of the very mild early 2000s recession. Our current recovery has barely budged from this range, but is on a mild upswing.

It is notable that the late 1970s/early 1980s recession bottom was not approached in the most recent downturn. From the timing of the high points, it looks like the NFIB index peaks in advance of a general economic upturn as overall GDP figures increased after those points. That could be that large businesses turn to small businesses for services until they believe the upturn is certain and entrenched. From that perspective, we are still waiting for that big rise up.

# # #

About Dr. Joe Webb

Dr. Joe Webb is one of the graphic arts industry's best-known consultants, forecasters, and commentators. He is the director of WhatTheyThink's Economics and Research Center.

Video Center

- Questions to ask about inkjet for corrugated packaging

- Can Chinese OEMs challenge Western manufacturers?

- The #1 Question When Selling Inkjet

- Integrator perspective on Konica Minolta printheads

- Surfing the Waves of Inkjet

- Kyocera Nixka talks inkjet integration trends

- B2B Customer Tours

- Keeping Inkjet Tickled Pink

© 2024 WhatTheyThink. All Rights Reserved.