Commentary & Analysis

Recovery Indicators Mixed, Strong ISM New Orders Data; A Different Look at Employment

The recovery indicators were mixed yet again,

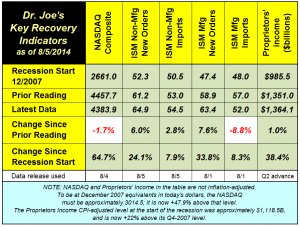

The recovery indicators were mixed yet again, but the ISM New Orders for manufacturing and non-manufacturing were very strong. This implies a strong start to Q3. (click chart to enlarge)

The NASDAQ had a tough month with markets adjusting to the suspicion that the Federal Reserve will take away the low interest rate punch bowl sometime in 2015. This created a reallocation of investment portfolios that is still underway.

In the revision to the GDP data series last week, Q1-2014 proprietors income was revised down from $1,360 billion to $1,351 billion. In Q2 proprietors income was up only 1% compared to Q1, even though GDP was up an estimated 4%.

Unemployment Report

There was some shock that the unemployment rate worsened last month, moving from 6.1% to 6.2%, but that's within statistical error ranges, and as the Bureau of Labor Statistics likes to say "essentially unchanged" or some similar phrase. The July report looks bad because the June report may have been misleadingly good. When you compare the May and July data you get a better picture of the economy.

From May to July, the number of employed workers in the household survey increased by 538,000, the number of unemployed workers fell by 128,000. The number of workers not in the labor force actually fell by 8,000. The May unemployment rate was 6.3% and the July's was 6.2%. July 2013 unemployment was 7.3%.

The problems with the labor market can be seen in the year-to-year comparisons. The labor participation rate is worse than 2013, falling from 63.4% to 62.9%. It seems to have stabilized in recent reports. The employment-population ratio has been bad, but has had some slight improvement, from 2013's 58.7% to the current 59%. Two million more people are employed now than in 2013, but more than 1.9 million have left the labor force for a multitude of reasons, many of which were long-term unemployed.

There are some analysts that attribute a portion of the rise in workers no longer in the workforce to retiring baby boomers, but the workers at retirement age who are still in the workforce has been rising throughout the recession and the recovery. Employment remains below the levels at the start of the recession when adjusted for population changes.

The unemployment rate is likely to be below 6% by the fourth quarter of 2014, mainly due to further labor force exits combined with continued mild monthly gains in employment.

# # #

The NASDAQ had a tough month with markets adjusting to the suspicion that the Federal Reserve will take away the low interest rate punch bowl sometime in 2015. This created a reallocation of investment portfolios that is still underway.

In the revision to the GDP data series last week, Q1-2014 proprietors income was revised down from $1,360 billion to $1,351 billion. In Q2 proprietors income was up only 1% compared to Q1, even though GDP was up an estimated 4%.

Unemployment Report

There was some shock that the unemployment rate worsened last month, moving from 6.1% to 6.2%, but that's within statistical error ranges, and as the Bureau of Labor Statistics likes to say "essentially unchanged" or some similar phrase. The July report looks bad because the June report may have been misleadingly good. When you compare the May and July data you get a better picture of the economy.

From May to July, the number of employed workers in the household survey increased by 538,000, the number of unemployed workers fell by 128,000. The number of workers not in the labor force actually fell by 8,000. The May unemployment rate was 6.3% and the July's was 6.2%. July 2013 unemployment was 7.3%.

The problems with the labor market can be seen in the year-to-year comparisons. The labor participation rate is worse than 2013, falling from 63.4% to 62.9%. It seems to have stabilized in recent reports. The employment-population ratio has been bad, but has had some slight improvement, from 2013's 58.7% to the current 59%. Two million more people are employed now than in 2013, but more than 1.9 million have left the labor force for a multitude of reasons, many of which were long-term unemployed.

There are some analysts that attribute a portion of the rise in workers no longer in the workforce to retiring baby boomers, but the workers at retirement age who are still in the workforce has been rising throughout the recession and the recovery. Employment remains below the levels at the start of the recession when adjusted for population changes.

The unemployment rate is likely to be below 6% by the fourth quarter of 2014, mainly due to further labor force exits combined with continued mild monthly gains in employment.

# # #

About Dr. Joe Webb

Dr. Joe Webb is one of the graphic arts industry's best-known consultants, forecasters, and commentators. He is the director of WhatTheyThink's Economics and Research Center.

Video Center

- Questions to ask about inkjet for corrugated packaging

- Can Chinese OEMs challenge Western manufacturers?

- The #1 Question When Selling Inkjet

- Integrator perspective on Konica Minolta printheads

- Surfing the Waves of Inkjet

- Kyocera Nixka talks inkjet integration trends

- B2B Customer Tours

- Keeping Inkjet Tickled Pink

© 2024 WhatTheyThink. All Rights Reserved.