The Bureau of Economic Analysis released the second revision of Q1-2014 US Gross Domestic Product (GDP), indicating a contraction of the US economy in the quarter. As reported in prior (“laughable and embarassing”) analysis, an inventory buildup in the last two quarters of 2013 distorted the underlying condition of the economy.

That conjecture about businesses making the wrong but reasonable assumptions of significantly higher 2014 total labor costs because of the implementation of the Affordable Care Act and the certainty of rising interest rates led them to increase inventories seems to have worked their way through the data. Those assumptions that 2013 would have lower unit labor costs and that financing inventories would never be cheaper proved wrong as the most costly provisions of the ACA were delayed and interest rates have not significantly changed.

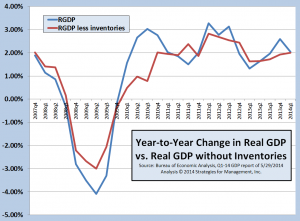

This created an inventory bubble that seems to have been worked off in the weak Q1. The chart below (click to enlarge) shows that the trendlines of real GDP with and without inventories are now together.

Theoretically, net inventories should be zero, with perfect information about future demand, flawless production, and on-time deliveries. But managers make inventories based on assumptions about future demand, costs, and prices. Their assumptions and actions are never perfect but usually in ranges that are non-disruptive. In this case, changes in the regulatory and financial environments gave clear signals that were withdrawn, but the inventory was already produced.

The underlying economy still seems to be growing in the 2% range. While a recession does not appear imminent, low rates of growth always mean that the risks of downturn are near but may not be realized. Sluggish growth is still the likely outlook.

# # #