Theoretically, the long run effect of inventories on the change in GDP should be zero. Because inventory management is not perfect, and that forecasting future demand is always challenging, buildups and drawdowns are affected by unexpected events or business planning assumptions that turn out to be bad, no matter how wise they may have seemed at the time. While the ACA implementation should be a one-off adjustment, the timing of changes creates problems. Those problems are minor compared to the maintenance of interest rates that are below inflation. Those can cause greater problems in the long run if business executives use those funds to purchase goods that are not demanded by the market. It appears that is still working its way through the system. It should be expected that Q2-2014 GDP should be better, and will at least be in the high 2% range.

The economy is still slow and sluggish, with strong incentives for investments in efficiency and few incentives for forward-looking projects with distant returns. Until that combination of investment calculus and philosophy changes, expect more of the same.

# # #

http://blogs.whattheythink.com/economics/2014/02/q4-2013-gdp-revised-down-from-3-2-to-2-4-consistent-with-last-months-analysis/

Theoretically, the long run effect of inventories on the change in GDP should be zero. Because inventory management is not perfect, and that forecasting future demand is always challenging, buildups and drawdowns are affected by unexpected events or business planning assumptions that turn out to be bad, no matter how wise they may have seemed at the time. While the ACA implementation should be a one-off adjustment, the timing of changes creates problems. Those problems are minor compared to the maintenance of interest rates that are below inflation. Those can cause greater problems in the long run if business executives use those funds to purchase goods that are not demanded by the market. It appears that is still working its way through the system. It should be expected that Q2-2014 GDP should be better, and will at least be in the high 2% range.

The economy is still slow and sluggish, with strong incentives for investments in efficiency and few incentives for forward-looking projects with distant returns. Until that combination of investment calculus and philosophy changes, expect more of the same.

# # #

http://blogs.whattheythink.com/economics/2014/02/q4-2013-gdp-revised-down-from-3-2-to-2-4-consistent-with-last-months-analysis/

Commentary & Analysis

Recovery Indicators Rebound; Q1-2014 GDP Below 1% but Corrects for Business Inventory Misjudgments

The recovery indicators rebounded since last month.

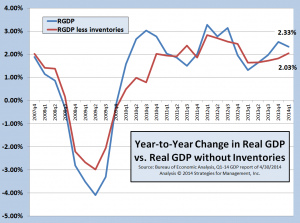

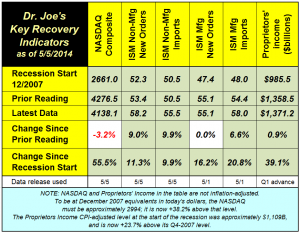

The recovery indicators rebounded since last month. New orders for manufacturers remained at the same level that indicates growth. The new orders for non-manufacturers was up strongly. There was a very small rise in proprietors' income, our indicator for small business. The NASDAQ index took a hard turn since the prior report. Five of the six indicators were flat or up, which is a sign of the economy firming after a very bad GDP report for the Q1-2014. That GDP report was +0.9%, and followed a Q4-2013 report of +2.4% and a Q3-2013 report of +4.1%. (click chart to enlarge)

In a "laughable and embarrassing" blogpost about the initial Q4 report, I stated that there were significant inventory buildups in Q3 and Q4. There were two reasons why businesses did this. The first was that interest rates were bound to rise in a few months, and the increase in total labor costs caused by the implementation of the ACA meant that those quarters would have the cheapest financing and the lowest relative labor costs that businesses would have in a long time. Both assumptions by executives and owners were reasonable, and both assumptions turned out to be wrong.

Janet Yellen, who replaced Ben Bernanke as chairman of the Federal Reserve, has implied that the Fed will end its Quantitative Easing program gradually but that interest rates would be kept low. Significant portions of the ACA were since delayed, meaning that a cost surge was not as imminent as thought. The Q1-2014 inventories were lower, higher than average, but enough to imply some absorption of the excess.

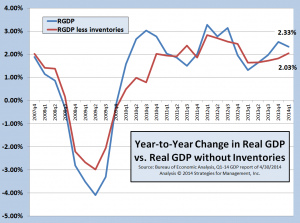

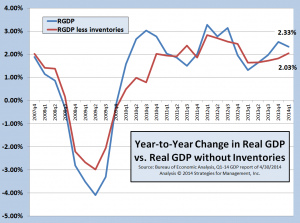

GDP is reported to the public as an annualized figure in comparison to the prior quarter. The chart below shows GDP on a year-to-year basis, my strongly preferred comparison, and it can be seen that the economy is still running at a +2% rate, whether inventories are included or not. This is well below the post-WW2 average of about +3.4%, but not as bad as the Q1-2014 report stated. (click chart to enlarge)

In a "laughable and embarrassing" blogpost about the initial Q4 report, I stated that there were significant inventory buildups in Q3 and Q4. There were two reasons why businesses did this. The first was that interest rates were bound to rise in a few months, and the increase in total labor costs caused by the implementation of the ACA meant that those quarters would have the cheapest financing and the lowest relative labor costs that businesses would have in a long time. Both assumptions by executives and owners were reasonable, and both assumptions turned out to be wrong.

Janet Yellen, who replaced Ben Bernanke as chairman of the Federal Reserve, has implied that the Fed will end its Quantitative Easing program gradually but that interest rates would be kept low. Significant portions of the ACA were since delayed, meaning that a cost surge was not as imminent as thought. The Q1-2014 inventories were lower, higher than average, but enough to imply some absorption of the excess.

GDP is reported to the public as an annualized figure in comparison to the prior quarter. The chart below shows GDP on a year-to-year basis, my strongly preferred comparison, and it can be seen that the economy is still running at a +2% rate, whether inventories are included or not. This is well below the post-WW2 average of about +3.4%, but not as bad as the Q1-2014 report stated. (click chart to enlarge)

Theoretically, the long run effect of inventories on the change in GDP should be zero. Because inventory management is not perfect, and that forecasting future demand is always challenging, buildups and drawdowns are affected by unexpected events or business planning assumptions that turn out to be bad, no matter how wise they may have seemed at the time. While the ACA implementation should be a one-off adjustment, the timing of changes creates problems. Those problems are minor compared to the maintenance of interest rates that are below inflation. Those can cause greater problems in the long run if business executives use those funds to purchase goods that are not demanded by the market. It appears that is still working its way through the system. It should be expected that Q2-2014 GDP should be better, and will at least be in the high 2% range.

The economy is still slow and sluggish, with strong incentives for investments in efficiency and few incentives for forward-looking projects with distant returns. Until that combination of investment calculus and philosophy changes, expect more of the same.

# # #

http://blogs.whattheythink.com/economics/2014/02/q4-2013-gdp-revised-down-from-3-2-to-2-4-consistent-with-last-months-analysis/

Theoretically, the long run effect of inventories on the change in GDP should be zero. Because inventory management is not perfect, and that forecasting future demand is always challenging, buildups and drawdowns are affected by unexpected events or business planning assumptions that turn out to be bad, no matter how wise they may have seemed at the time. While the ACA implementation should be a one-off adjustment, the timing of changes creates problems. Those problems are minor compared to the maintenance of interest rates that are below inflation. Those can cause greater problems in the long run if business executives use those funds to purchase goods that are not demanded by the market. It appears that is still working its way through the system. It should be expected that Q2-2014 GDP should be better, and will at least be in the high 2% range.

The economy is still slow and sluggish, with strong incentives for investments in efficiency and few incentives for forward-looking projects with distant returns. Until that combination of investment calculus and philosophy changes, expect more of the same.

# # #

http://blogs.whattheythink.com/economics/2014/02/q4-2013-gdp-revised-down-from-3-2-to-2-4-consistent-with-last-months-analysis/

Theoretically, the long run effect of inventories on the change in GDP should be zero. Because inventory management is not perfect, and that forecasting future demand is always challenging, buildups and drawdowns are affected by unexpected events or business planning assumptions that turn out to be bad, no matter how wise they may have seemed at the time. While the ACA implementation should be a one-off adjustment, the timing of changes creates problems. Those problems are minor compared to the maintenance of interest rates that are below inflation. Those can cause greater problems in the long run if business executives use those funds to purchase goods that are not demanded by the market. It appears that is still working its way through the system. It should be expected that Q2-2014 GDP should be better, and will at least be in the high 2% range.

The economy is still slow and sluggish, with strong incentives for investments in efficiency and few incentives for forward-looking projects with distant returns. Until that combination of investment calculus and philosophy changes, expect more of the same.

# # #

http://blogs.whattheythink.com/economics/2014/02/q4-2013-gdp-revised-down-from-3-2-to-2-4-consistent-with-last-months-analysis/

Theoretically, the long run effect of inventories on the change in GDP should be zero. Because inventory management is not perfect, and that forecasting future demand is always challenging, buildups and drawdowns are affected by unexpected events or business planning assumptions that turn out to be bad, no matter how wise they may have seemed at the time. While the ACA implementation should be a one-off adjustment, the timing of changes creates problems. Those problems are minor compared to the maintenance of interest rates that are below inflation. Those can cause greater problems in the long run if business executives use those funds to purchase goods that are not demanded by the market. It appears that is still working its way through the system. It should be expected that Q2-2014 GDP should be better, and will at least be in the high 2% range.

The economy is still slow and sluggish, with strong incentives for investments in efficiency and few incentives for forward-looking projects with distant returns. Until that combination of investment calculus and philosophy changes, expect more of the same.

# # #

http://blogs.whattheythink.com/economics/2014/02/q4-2013-gdp-revised-down-from-3-2-to-2-4-consistent-with-last-months-analysis/

About Dr. Joe Webb

Dr. Joe Webb is one of the graphic arts industry's best-known consultants, forecasters, and commentators. He is the director of WhatTheyThink's Economics and Research Center.

Video Center

- Questions to ask about inkjet for corrugated packaging

- Can Chinese OEMs challenge Western manufacturers?

- The #1 Question When Selling Inkjet

- Integrator perspective on Konica Minolta printheads

- Surfing the Waves of Inkjet

- Kyocera Nixka talks inkjet integration trends

- B2B Customer Tours

- Keeping Inkjet Tickled Pink

© 2024 WhatTheyThink. All Rights Reserved.