For example, if your business had sales of $1,000,000 in 2009 and $1,000,000 in 2013, you would think that sales were flat in comparison. But a dollar was worth more (had more purchasing power) in 2009. Multiplying the 2009 sales by 1.094 shows that the purchasing power value was actually $1,094,000 in 2009, and that your 2013 sales were actually a decrease.

Over time, even supposedly "tame" inflation takes its toll. It's essential to take inflation into account not just in business decisions, but also in the way you manage personal savings. A 2% annual inflation rate compounds into a 22% decline in purchasing power over a ten year period.

There are many issues involved in inflation adjustment, so if you want to dig into the dirty details, my December 2011 slide presentation is still available online.

For example, if your business had sales of $1,000,000 in 2009 and $1,000,000 in 2013, you would think that sales were flat in comparison. But a dollar was worth more (had more purchasing power) in 2009. Multiplying the 2009 sales by 1.094 shows that the purchasing power value was actually $1,094,000 in 2009, and that your 2013 sales were actually a decrease.

Over time, even supposedly "tame" inflation takes its toll. It's essential to take inflation into account not just in business decisions, but also in the way you manage personal savings. A 2% annual inflation rate compounds into a 22% decline in purchasing power over a ten year period.

There are many issues involved in inflation adjustment, so if you want to dig into the dirty details, my December 2011 slide presentation is still available online.

Commentary & Analysis

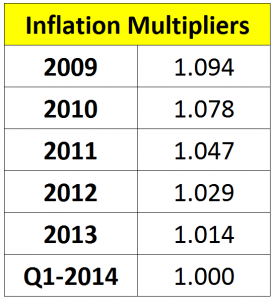

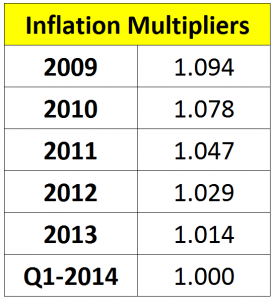

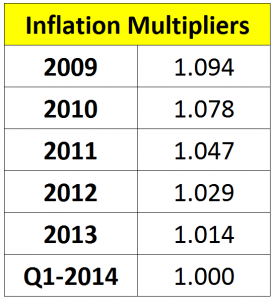

Latest Inflation Multipliers Q1-2014

The Federal Reserve is convinced that there'

The Federal Reserve is convinced that there's not enough inflation around. They have their reasons for believing so and acting accordingly, but businesspeople need to be aware of how inflation distorts the evaluation of historical trends in their business.

Most businesses use historical data in their budgeting and their strategic planning. If historical data are not adjusted for the actual purchasing power of at the time of their creation, businesses can misinterpret increased revenues as financial success when the trendline may actually be flat or down.

Below is the latest set of multipliers based on the Consumer Price Index. Multiply your historical financial statements by the figures below to adjust data to the CPI for the first quarter of this year.

For example, if your business had sales of $1,000,000 in 2009 and $1,000,000 in 2013, you would think that sales were flat in comparison. But a dollar was worth more (had more purchasing power) in 2009. Multiplying the 2009 sales by 1.094 shows that the purchasing power value was actually $1,094,000 in 2009, and that your 2013 sales were actually a decrease.

Over time, even supposedly "tame" inflation takes its toll. It's essential to take inflation into account not just in business decisions, but also in the way you manage personal savings. A 2% annual inflation rate compounds into a 22% decline in purchasing power over a ten year period.

There are many issues involved in inflation adjustment, so if you want to dig into the dirty details, my December 2011 slide presentation is still available online.

For example, if your business had sales of $1,000,000 in 2009 and $1,000,000 in 2013, you would think that sales were flat in comparison. But a dollar was worth more (had more purchasing power) in 2009. Multiplying the 2009 sales by 1.094 shows that the purchasing power value was actually $1,094,000 in 2009, and that your 2013 sales were actually a decrease.

Over time, even supposedly "tame" inflation takes its toll. It's essential to take inflation into account not just in business decisions, but also in the way you manage personal savings. A 2% annual inflation rate compounds into a 22% decline in purchasing power over a ten year period.

There are many issues involved in inflation adjustment, so if you want to dig into the dirty details, my December 2011 slide presentation is still available online.

For example, if your business had sales of $1,000,000 in 2009 and $1,000,000 in 2013, you would think that sales were flat in comparison. But a dollar was worth more (had more purchasing power) in 2009. Multiplying the 2009 sales by 1.094 shows that the purchasing power value was actually $1,094,000 in 2009, and that your 2013 sales were actually a decrease.

Over time, even supposedly "tame" inflation takes its toll. It's essential to take inflation into account not just in business decisions, but also in the way you manage personal savings. A 2% annual inflation rate compounds into a 22% decline in purchasing power over a ten year period.

There are many issues involved in inflation adjustment, so if you want to dig into the dirty details, my December 2011 slide presentation is still available online.

For example, if your business had sales of $1,000,000 in 2009 and $1,000,000 in 2013, you would think that sales were flat in comparison. But a dollar was worth more (had more purchasing power) in 2009. Multiplying the 2009 sales by 1.094 shows that the purchasing power value was actually $1,094,000 in 2009, and that your 2013 sales were actually a decrease.

Over time, even supposedly "tame" inflation takes its toll. It's essential to take inflation into account not just in business decisions, but also in the way you manage personal savings. A 2% annual inflation rate compounds into a 22% decline in purchasing power over a ten year period.

There are many issues involved in inflation adjustment, so if you want to dig into the dirty details, my December 2011 slide presentation is still available online.

About Dr. Joe Webb

Dr. Joe Webb is one of the graphic arts industry's best-known consultants, forecasters, and commentators. He is the director of WhatTheyThink's Economics and Research Center.

Video Center

- Questions to ask about inkjet for corrugated packaging

- Can Chinese OEMs challenge Western manufacturers?

- The #1 Question When Selling Inkjet

- Integrator perspective on Konica Minolta printheads

- Surfing the Waves of Inkjet

- Kyocera Nixka talks inkjet integration trends

- B2B Customer Tours

- Keeping Inkjet Tickled Pink

© 2024 WhatTheyThink. All Rights Reserved.