Our concern remains with productivity. Because it is greater than GDP growth, there is little reason on a macroeconomic basis to expect that employment trends will change. While they are getting better, it is mainly because workers are exiting the labor market, reducing the unemployment rate. Generally, when economies start to grow again, the unemployment rate worsens because workers flood the market and it takes time for them to be absorbed. The signal for that is when GDP is greater than productivity, meaning that more workers are needed rather than squeezing more output out of those employed at the time. That does not seem to be playing out here. This is why watching total employment and statistics like the labor participation rate are more important than the unemployment rate to get an idea of what's going on closer to "real time."

Of greater concern is what is happening with real earnings, which is wages after inflation. Productivity is rising, and one of the fruits of that productivity should be increases in wages as workers share in the returns for their more efficient work. This has been a longer-term trend. Since the start of the recession in December 2007, however, productivity is flat, and real earnings are up +1.2%. The surge in productivity is more recent, and those extra dollars were used to pay for increased materials (reflected in the PPI which was higher than the CPI for many quarters) and other costs outside of wages. This allowed businesses to keep prices low for consumers who had fewer dollars to spend and were price-resistant.

That trend appears to have broken. Now, CPI and PPI are essentially the same. Since the start of the recession, there is a +14.1% vs. +9.2% change in the PPI compared to the CPI. But for the last year, and the annualized 6-month and 3-month trends, these measures are essentially the same.

On the political front, every unemployment report prior to the election will be scrutinized and judged as a window to the presidential election result. The numbers will be spun in numerous directions. There are always conspiracy theories that economic data are being manipulated to support incumbents, so a warning is appropriate.

Unless you are trading bonds or commodities or other financial instruments, short term changes in economic data are strategically meaningless. Most government economic data are based on estimates that have wide ranges of variability, and final data do not appear until years later. While we look to these data to get our bearings amidst the noise of daily business, they do not have the precision that they often appear to have. What might appear to be manipulation is usually well within the range of statistical variability. If you were the president, and could secretly order the data to be manipulated, why would you pick unemployment over 8%, GDP under 3%, inflation running at an annualized 6%, and weekly initial claims for unemployment at almost 400,000? There are bigger problems with the data series in their very methodologies than in possible malfeasance.

Look for the long-term trends, especially in demographics and technology, that have a far greater impact on strategic decisions. As far as the economy goes, the recovery began in mid-2009, and it has been one of the slowest recoveries ever. The increases in productivity we see are mainly from technology implementation, especially in communications. The slow growth in GDP masks the constant revolution in these technologies. Because the prices of these technologies are in constant decline, the breadth of their adoption cannot always be seen in dollar-based economic data.

While we believe that the economy will continue its muddle for months and months ahead, we are increasingly concerned with the prospects for print volume at the end of 2012 as the cumulative effect of 4 million iPads per month and 12 million iPhones per month, and their competitors, radically change the content marketplace. Stay vigilant and act decisively to take advantage of these trends and transition your business accordingly.

ADDENDUM, 4/19 9:00am EDT

Sure, just after I mention conspiracy theorists and economic data, Bloomberg publishes a story about it. It's called "CPI Conspiracy Theories Persist Even With Broad Checks" and can be found at http://www.bloomberg.com/news/2012-04-19/cpi-conspiracy-theories-persist-even-with-broad-checks.html

# # #

Our concern remains with productivity. Because it is greater than GDP growth, there is little reason on a macroeconomic basis to expect that employment trends will change. While they are getting better, it is mainly because workers are exiting the labor market, reducing the unemployment rate. Generally, when economies start to grow again, the unemployment rate worsens because workers flood the market and it takes time for them to be absorbed. The signal for that is when GDP is greater than productivity, meaning that more workers are needed rather than squeezing more output out of those employed at the time. That does not seem to be playing out here. This is why watching total employment and statistics like the labor participation rate are more important than the unemployment rate to get an idea of what's going on closer to "real time."

Of greater concern is what is happening with real earnings, which is wages after inflation. Productivity is rising, and one of the fruits of that productivity should be increases in wages as workers share in the returns for their more efficient work. This has been a longer-term trend. Since the start of the recession in December 2007, however, productivity is flat, and real earnings are up +1.2%. The surge in productivity is more recent, and those extra dollars were used to pay for increased materials (reflected in the PPI which was higher than the CPI for many quarters) and other costs outside of wages. This allowed businesses to keep prices low for consumers who had fewer dollars to spend and were price-resistant.

That trend appears to have broken. Now, CPI and PPI are essentially the same. Since the start of the recession, there is a +14.1% vs. +9.2% change in the PPI compared to the CPI. But for the last year, and the annualized 6-month and 3-month trends, these measures are essentially the same.

On the political front, every unemployment report prior to the election will be scrutinized and judged as a window to the presidential election result. The numbers will be spun in numerous directions. There are always conspiracy theories that economic data are being manipulated to support incumbents, so a warning is appropriate.

Unless you are trading bonds or commodities or other financial instruments, short term changes in economic data are strategically meaningless. Most government economic data are based on estimates that have wide ranges of variability, and final data do not appear until years later. While we look to these data to get our bearings amidst the noise of daily business, they do not have the precision that they often appear to have. What might appear to be manipulation is usually well within the range of statistical variability. If you were the president, and could secretly order the data to be manipulated, why would you pick unemployment over 8%, GDP under 3%, inflation running at an annualized 6%, and weekly initial claims for unemployment at almost 400,000? There are bigger problems with the data series in their very methodologies than in possible malfeasance.

Look for the long-term trends, especially in demographics and technology, that have a far greater impact on strategic decisions. As far as the economy goes, the recovery began in mid-2009, and it has been one of the slowest recoveries ever. The increases in productivity we see are mainly from technology implementation, especially in communications. The slow growth in GDP masks the constant revolution in these technologies. Because the prices of these technologies are in constant decline, the breadth of their adoption cannot always be seen in dollar-based economic data.

While we believe that the economy will continue its muddle for months and months ahead, we are increasingly concerned with the prospects for print volume at the end of 2012 as the cumulative effect of 4 million iPads per month and 12 million iPhones per month, and their competitors, radically change the content marketplace. Stay vigilant and act decisively to take advantage of these trends and transition your business accordingly.

ADDENDUM, 4/19 9:00am EDT

Sure, just after I mention conspiracy theorists and economic data, Bloomberg publishes a story about it. It's called "CPI Conspiracy Theories Persist Even With Broad Checks" and can be found at http://www.bloomberg.com/news/2012-04-19/cpi-conspiracy-theories-persist-even-with-broad-checks.html

# # #

Commentary & Analysis

Rising Inflation, Deteriorating Worker Earnings, and a Warning About Economic Data Conspiracy Theories

Increased inflation in both the Consumer Price Index and the Producer Price Index has been reported by the Bureau of Labor Statistcis,

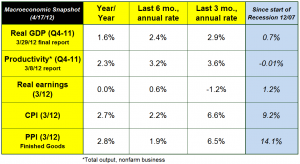

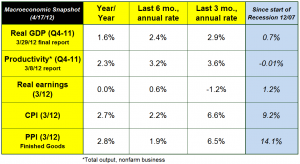

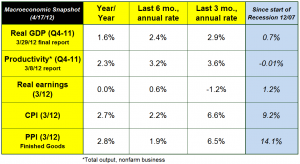

Increased inflation in both the Consumer Price Index and the Producer Price Index has been reported by the Bureau of Labor Statistcis, with both measures increasing at an annual rate of more than 6%. That rate is calculated by using the last three months of data, and is not one that you will see in the business press. It should be disturbing. The Federal Reserve, however, still believes that the increases in energy prices that are driving the CPI and PPI will either stop or retreat in coming months. Remember, in summer of 2008 oil hit $145 and just a few months later collapsed at $100 lower. This could happen again, but we believe it is unlikely, though the possibility is there. It is more likely that oil will keep trading in a range that averages about $100. (click table to enlarge to see the macroeconomic summary)

Our concern remains with productivity. Because it is greater than GDP growth, there is little reason on a macroeconomic basis to expect that employment trends will change. While they are getting better, it is mainly because workers are exiting the labor market, reducing the unemployment rate. Generally, when economies start to grow again, the unemployment rate worsens because workers flood the market and it takes time for them to be absorbed. The signal for that is when GDP is greater than productivity, meaning that more workers are needed rather than squeezing more output out of those employed at the time. That does not seem to be playing out here. This is why watching total employment and statistics like the labor participation rate are more important than the unemployment rate to get an idea of what's going on closer to "real time."

Of greater concern is what is happening with real earnings, which is wages after inflation. Productivity is rising, and one of the fruits of that productivity should be increases in wages as workers share in the returns for their more efficient work. This has been a longer-term trend. Since the start of the recession in December 2007, however, productivity is flat, and real earnings are up +1.2%. The surge in productivity is more recent, and those extra dollars were used to pay for increased materials (reflected in the PPI which was higher than the CPI for many quarters) and other costs outside of wages. This allowed businesses to keep prices low for consumers who had fewer dollars to spend and were price-resistant.

That trend appears to have broken. Now, CPI and PPI are essentially the same. Since the start of the recession, there is a +14.1% vs. +9.2% change in the PPI compared to the CPI. But for the last year, and the annualized 6-month and 3-month trends, these measures are essentially the same.

On the political front, every unemployment report prior to the election will be scrutinized and judged as a window to the presidential election result. The numbers will be spun in numerous directions. There are always conspiracy theories that economic data are being manipulated to support incumbents, so a warning is appropriate.

Unless you are trading bonds or commodities or other financial instruments, short term changes in economic data are strategically meaningless. Most government economic data are based on estimates that have wide ranges of variability, and final data do not appear until years later. While we look to these data to get our bearings amidst the noise of daily business, they do not have the precision that they often appear to have. What might appear to be manipulation is usually well within the range of statistical variability. If you were the president, and could secretly order the data to be manipulated, why would you pick unemployment over 8%, GDP under 3%, inflation running at an annualized 6%, and weekly initial claims for unemployment at almost 400,000? There are bigger problems with the data series in their very methodologies than in possible malfeasance.

Look for the long-term trends, especially in demographics and technology, that have a far greater impact on strategic decisions. As far as the economy goes, the recovery began in mid-2009, and it has been one of the slowest recoveries ever. The increases in productivity we see are mainly from technology implementation, especially in communications. The slow growth in GDP masks the constant revolution in these technologies. Because the prices of these technologies are in constant decline, the breadth of their adoption cannot always be seen in dollar-based economic data.

While we believe that the economy will continue its muddle for months and months ahead, we are increasingly concerned with the prospects for print volume at the end of 2012 as the cumulative effect of 4 million iPads per month and 12 million iPhones per month, and their competitors, radically change the content marketplace. Stay vigilant and act decisively to take advantage of these trends and transition your business accordingly.

ADDENDUM, 4/19 9:00am EDT

Sure, just after I mention conspiracy theorists and economic data, Bloomberg publishes a story about it. It's called "CPI Conspiracy Theories Persist Even With Broad Checks" and can be found at http://www.bloomberg.com/news/2012-04-19/cpi-conspiracy-theories-persist-even-with-broad-checks.html

# # #

Our concern remains with productivity. Because it is greater than GDP growth, there is little reason on a macroeconomic basis to expect that employment trends will change. While they are getting better, it is mainly because workers are exiting the labor market, reducing the unemployment rate. Generally, when economies start to grow again, the unemployment rate worsens because workers flood the market and it takes time for them to be absorbed. The signal for that is when GDP is greater than productivity, meaning that more workers are needed rather than squeezing more output out of those employed at the time. That does not seem to be playing out here. This is why watching total employment and statistics like the labor participation rate are more important than the unemployment rate to get an idea of what's going on closer to "real time."

Of greater concern is what is happening with real earnings, which is wages after inflation. Productivity is rising, and one of the fruits of that productivity should be increases in wages as workers share in the returns for their more efficient work. This has been a longer-term trend. Since the start of the recession in December 2007, however, productivity is flat, and real earnings are up +1.2%. The surge in productivity is more recent, and those extra dollars were used to pay for increased materials (reflected in the PPI which was higher than the CPI for many quarters) and other costs outside of wages. This allowed businesses to keep prices low for consumers who had fewer dollars to spend and were price-resistant.

That trend appears to have broken. Now, CPI and PPI are essentially the same. Since the start of the recession, there is a +14.1% vs. +9.2% change in the PPI compared to the CPI. But for the last year, and the annualized 6-month and 3-month trends, these measures are essentially the same.

On the political front, every unemployment report prior to the election will be scrutinized and judged as a window to the presidential election result. The numbers will be spun in numerous directions. There are always conspiracy theories that economic data are being manipulated to support incumbents, so a warning is appropriate.

Unless you are trading bonds or commodities or other financial instruments, short term changes in economic data are strategically meaningless. Most government economic data are based on estimates that have wide ranges of variability, and final data do not appear until years later. While we look to these data to get our bearings amidst the noise of daily business, they do not have the precision that they often appear to have. What might appear to be manipulation is usually well within the range of statistical variability. If you were the president, and could secretly order the data to be manipulated, why would you pick unemployment over 8%, GDP under 3%, inflation running at an annualized 6%, and weekly initial claims for unemployment at almost 400,000? There are bigger problems with the data series in their very methodologies than in possible malfeasance.

Look for the long-term trends, especially in demographics and technology, that have a far greater impact on strategic decisions. As far as the economy goes, the recovery began in mid-2009, and it has been one of the slowest recoveries ever. The increases in productivity we see are mainly from technology implementation, especially in communications. The slow growth in GDP masks the constant revolution in these technologies. Because the prices of these technologies are in constant decline, the breadth of their adoption cannot always be seen in dollar-based economic data.

While we believe that the economy will continue its muddle for months and months ahead, we are increasingly concerned with the prospects for print volume at the end of 2012 as the cumulative effect of 4 million iPads per month and 12 million iPhones per month, and their competitors, radically change the content marketplace. Stay vigilant and act decisively to take advantage of these trends and transition your business accordingly.

ADDENDUM, 4/19 9:00am EDT

Sure, just after I mention conspiracy theorists and economic data, Bloomberg publishes a story about it. It's called "CPI Conspiracy Theories Persist Even With Broad Checks" and can be found at http://www.bloomberg.com/news/2012-04-19/cpi-conspiracy-theories-persist-even-with-broad-checks.html

# # #

Our concern remains with productivity. Because it is greater than GDP growth, there is little reason on a macroeconomic basis to expect that employment trends will change. While they are getting better, it is mainly because workers are exiting the labor market, reducing the unemployment rate. Generally, when economies start to grow again, the unemployment rate worsens because workers flood the market and it takes time for them to be absorbed. The signal for that is when GDP is greater than productivity, meaning that more workers are needed rather than squeezing more output out of those employed at the time. That does not seem to be playing out here. This is why watching total employment and statistics like the labor participation rate are more important than the unemployment rate to get an idea of what's going on closer to "real time."

Of greater concern is what is happening with real earnings, which is wages after inflation. Productivity is rising, and one of the fruits of that productivity should be increases in wages as workers share in the returns for their more efficient work. This has been a longer-term trend. Since the start of the recession in December 2007, however, productivity is flat, and real earnings are up +1.2%. The surge in productivity is more recent, and those extra dollars were used to pay for increased materials (reflected in the PPI which was higher than the CPI for many quarters) and other costs outside of wages. This allowed businesses to keep prices low for consumers who had fewer dollars to spend and were price-resistant.

That trend appears to have broken. Now, CPI and PPI are essentially the same. Since the start of the recession, there is a +14.1% vs. +9.2% change in the PPI compared to the CPI. But for the last year, and the annualized 6-month and 3-month trends, these measures are essentially the same.

On the political front, every unemployment report prior to the election will be scrutinized and judged as a window to the presidential election result. The numbers will be spun in numerous directions. There are always conspiracy theories that economic data are being manipulated to support incumbents, so a warning is appropriate.

Unless you are trading bonds or commodities or other financial instruments, short term changes in economic data are strategically meaningless. Most government economic data are based on estimates that have wide ranges of variability, and final data do not appear until years later. While we look to these data to get our bearings amidst the noise of daily business, they do not have the precision that they often appear to have. What might appear to be manipulation is usually well within the range of statistical variability. If you were the president, and could secretly order the data to be manipulated, why would you pick unemployment over 8%, GDP under 3%, inflation running at an annualized 6%, and weekly initial claims for unemployment at almost 400,000? There are bigger problems with the data series in their very methodologies than in possible malfeasance.

Look for the long-term trends, especially in demographics and technology, that have a far greater impact on strategic decisions. As far as the economy goes, the recovery began in mid-2009, and it has been one of the slowest recoveries ever. The increases in productivity we see are mainly from technology implementation, especially in communications. The slow growth in GDP masks the constant revolution in these technologies. Because the prices of these technologies are in constant decline, the breadth of their adoption cannot always be seen in dollar-based economic data.

While we believe that the economy will continue its muddle for months and months ahead, we are increasingly concerned with the prospects for print volume at the end of 2012 as the cumulative effect of 4 million iPads per month and 12 million iPhones per month, and their competitors, radically change the content marketplace. Stay vigilant and act decisively to take advantage of these trends and transition your business accordingly.

ADDENDUM, 4/19 9:00am EDT

Sure, just after I mention conspiracy theorists and economic data, Bloomberg publishes a story about it. It's called "CPI Conspiracy Theories Persist Even With Broad Checks" and can be found at http://www.bloomberg.com/news/2012-04-19/cpi-conspiracy-theories-persist-even-with-broad-checks.html

# # #

Our concern remains with productivity. Because it is greater than GDP growth, there is little reason on a macroeconomic basis to expect that employment trends will change. While they are getting better, it is mainly because workers are exiting the labor market, reducing the unemployment rate. Generally, when economies start to grow again, the unemployment rate worsens because workers flood the market and it takes time for them to be absorbed. The signal for that is when GDP is greater than productivity, meaning that more workers are needed rather than squeezing more output out of those employed at the time. That does not seem to be playing out here. This is why watching total employment and statistics like the labor participation rate are more important than the unemployment rate to get an idea of what's going on closer to "real time."

Of greater concern is what is happening with real earnings, which is wages after inflation. Productivity is rising, and one of the fruits of that productivity should be increases in wages as workers share in the returns for their more efficient work. This has been a longer-term trend. Since the start of the recession in December 2007, however, productivity is flat, and real earnings are up +1.2%. The surge in productivity is more recent, and those extra dollars were used to pay for increased materials (reflected in the PPI which was higher than the CPI for many quarters) and other costs outside of wages. This allowed businesses to keep prices low for consumers who had fewer dollars to spend and were price-resistant.

That trend appears to have broken. Now, CPI and PPI are essentially the same. Since the start of the recession, there is a +14.1% vs. +9.2% change in the PPI compared to the CPI. But for the last year, and the annualized 6-month and 3-month trends, these measures are essentially the same.

On the political front, every unemployment report prior to the election will be scrutinized and judged as a window to the presidential election result. The numbers will be spun in numerous directions. There are always conspiracy theories that economic data are being manipulated to support incumbents, so a warning is appropriate.

Unless you are trading bonds or commodities or other financial instruments, short term changes in economic data are strategically meaningless. Most government economic data are based on estimates that have wide ranges of variability, and final data do not appear until years later. While we look to these data to get our bearings amidst the noise of daily business, they do not have the precision that they often appear to have. What might appear to be manipulation is usually well within the range of statistical variability. If you were the president, and could secretly order the data to be manipulated, why would you pick unemployment over 8%, GDP under 3%, inflation running at an annualized 6%, and weekly initial claims for unemployment at almost 400,000? There are bigger problems with the data series in their very methodologies than in possible malfeasance.

Look for the long-term trends, especially in demographics and technology, that have a far greater impact on strategic decisions. As far as the economy goes, the recovery began in mid-2009, and it has been one of the slowest recoveries ever. The increases in productivity we see are mainly from technology implementation, especially in communications. The slow growth in GDP masks the constant revolution in these technologies. Because the prices of these technologies are in constant decline, the breadth of their adoption cannot always be seen in dollar-based economic data.

While we believe that the economy will continue its muddle for months and months ahead, we are increasingly concerned with the prospects for print volume at the end of 2012 as the cumulative effect of 4 million iPads per month and 12 million iPhones per month, and their competitors, radically change the content marketplace. Stay vigilant and act decisively to take advantage of these trends and transition your business accordingly.

ADDENDUM, 4/19 9:00am EDT

Sure, just after I mention conspiracy theorists and economic data, Bloomberg publishes a story about it. It's called "CPI Conspiracy Theories Persist Even With Broad Checks" and can be found at http://www.bloomberg.com/news/2012-04-19/cpi-conspiracy-theories-persist-even-with-broad-checks.html

# # #

About Dr. Joe Webb

Dr. Joe Webb is one of the graphic arts industry's best-known consultants, forecasters, and commentators. He is the director of WhatTheyThink's Economics and Research Center.

Video Center

- Questions to ask about inkjet for corrugated packaging

- Can Chinese OEMs challenge Western manufacturers?

- The #1 Question When Selling Inkjet

- Integrator perspective on Konica Minolta printheads

- Surfing the Waves of Inkjet

- Kyocera Nixka talks inkjet integration trends

- B2B Customer Tours

- Keeping Inkjet Tickled Pink

© 2024 WhatTheyThink. All Rights Reserved.