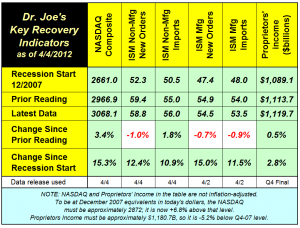

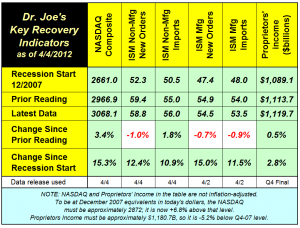

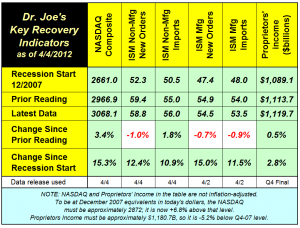

The ISM non-manufacturing index fell back from 57.3 to 56.0. The new orders index slipped from 59.4 to 58.8, but the latter is still a very strong reading, indicating continued service sector growth. The imports index for non-manufacturing rose, a good sign. The ISM manufacturing index retreated slightly since last month, but is still firmly indicating continued growth in this sector.

Proprietors income was revised upward again, but remains -5.2% below the inflation-adjusted level at the start of the recession. Small business continues to lag the overall economy. Overall, the last month was a sideways move for the recovery indicators.

The ISM non-manufacturing index fell back from 57.3 to 56.0. The new orders index slipped from 59.4 to 58.8, but the latter is still a very strong reading, indicating continued service sector growth. The imports index for non-manufacturing rose, a good sign. The ISM manufacturing index retreated slightly since last month, but is still firmly indicating continued growth in this sector.

Proprietors income was revised upward again, but remains -5.2% below the inflation-adjusted level at the start of the recession. Small business continues to lag the overall economy. Overall, the last month was a sideways move for the recovery indicators.

Commentary & Analysis

Recovery Indicators Make a Sideways Move

The NASDAQ Composite index rose over the past month with the general rally in stocks,

The NASDAQ Composite index rose over the past month with the general rally in stocks, and is now almost 7% above the level of December 2007 on an inflation-adjusted basis. Despite setbacks over the past few days, the index is up +3.4% since about this time last month. (click to enlarge chart)

The ISM non-manufacturing index fell back from 57.3 to 56.0. The new orders index slipped from 59.4 to 58.8, but the latter is still a very strong reading, indicating continued service sector growth. The imports index for non-manufacturing rose, a good sign. The ISM manufacturing index retreated slightly since last month, but is still firmly indicating continued growth in this sector.

Proprietors income was revised upward again, but remains -5.2% below the inflation-adjusted level at the start of the recession. Small business continues to lag the overall economy. Overall, the last month was a sideways move for the recovery indicators.

The ISM non-manufacturing index fell back from 57.3 to 56.0. The new orders index slipped from 59.4 to 58.8, but the latter is still a very strong reading, indicating continued service sector growth. The imports index for non-manufacturing rose, a good sign. The ISM manufacturing index retreated slightly since last month, but is still firmly indicating continued growth in this sector.

Proprietors income was revised upward again, but remains -5.2% below the inflation-adjusted level at the start of the recession. Small business continues to lag the overall economy. Overall, the last month was a sideways move for the recovery indicators.

The ISM non-manufacturing index fell back from 57.3 to 56.0. The new orders index slipped from 59.4 to 58.8, but the latter is still a very strong reading, indicating continued service sector growth. The imports index for non-manufacturing rose, a good sign. The ISM manufacturing index retreated slightly since last month, but is still firmly indicating continued growth in this sector.

Proprietors income was revised upward again, but remains -5.2% below the inflation-adjusted level at the start of the recession. Small business continues to lag the overall economy. Overall, the last month was a sideways move for the recovery indicators.

The ISM non-manufacturing index fell back from 57.3 to 56.0. The new orders index slipped from 59.4 to 58.8, but the latter is still a very strong reading, indicating continued service sector growth. The imports index for non-manufacturing rose, a good sign. The ISM manufacturing index retreated slightly since last month, but is still firmly indicating continued growth in this sector.

Proprietors income was revised upward again, but remains -5.2% below the inflation-adjusted level at the start of the recession. Small business continues to lag the overall economy. Overall, the last month was a sideways move for the recovery indicators.

About Dr. Joe Webb

Dr. Joe Webb is one of the graphic arts industry's best-known consultants, forecasters, and commentators. He is the director of WhatTheyThink's Economics and Research Center.

Video Center

- Questions to ask about inkjet for corrugated packaging

- Can Chinese OEMs challenge Western manufacturers?

- The #1 Question When Selling Inkjet

- Integrator perspective on Konica Minolta printheads

- Surfing the Waves of Inkjet

- Kyocera Nixka talks inkjet integration trends

- B2B Customer Tours

- Keeping Inkjet Tickled Pink

© 2024 WhatTheyThink. All Rights Reserved.