I recently saw and heard reference to print volume increasing or decreasing because of the timing of Federal Reserve quantitative easings (

I recently saw and heard reference to print volume increasing or decreasing because of the

timing of Federal Reserve quantitative easings (QE1 and QE2) and also print volume being affected by stock prices.

I decided to take a closer look, since prior work on various data series did not show such relationships, but I had not examined the issue of quantitative easings. According to

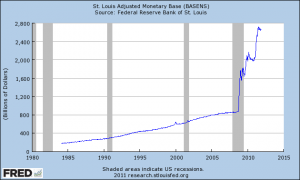

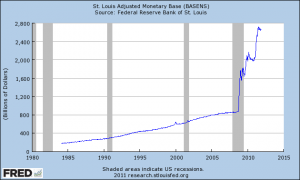

Bank Rate Monitor, QE1 was from November 25, 2008 to March 31, 2010. QE2 was from November 3, 2010 to June 30, 2011. The rise in the Fed's balance sheet can be tracked by using the

St. Louis Federal Reserve Monetary Base. This is the latest chart at the writing of this post (click chart to enlarge):

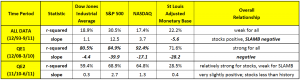

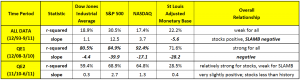

The stock market indices are better known, the Dow Jones Industrials, Standard & Poor's 500, and the NASDAQ. Because all of the data are in current dollars, and inflation-adjustment might distort the analysis, I used current dollars throughout. These are the results (click table to enlarge):

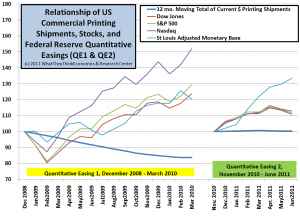

The current series of printing shipments data goes back to the beginning of 1993. Because of the monthly fluctuations that can occur, it was decided to use the 12 month moving total of the data series. Because the stock indices have multiple stocks of multiple seasonality characteristics, this was considered to be a better match. Having the full range of data and the relationship to the stock indices and the St. Louis Adjusted Monetary Base (we'll call it SLAMB for the rest of this post) would provide a good comparison. We identified the closest full month of shipments data to the quantitative easing dates and started the analysis.

Historically, the value of printing shipments has had a weak relationship with the stock markets. The r-squared measure should be above 70% in most business forecasting situations, and none of them are close. When we get to QE1, however, the r-squared data jump considerably. This would normally be quite encouraging, but the slope of the forecasting line is negative. That means that as the stock markets and SLAMB rose, printing shipments would actually decrease.

For the period of QE2, the statistical relationships remained much stronger than the full range of data, but less than QE1. The negative slopes disappeared, and were for the most part, only slightly positive.

Overall, neither stocks nor monetary action had any positive effect on printing shipments.

What is it then, that printers whose business increased during those periods in defiance of the aggregate move of the marketplace were seeing? We know the commercial printing business was contracting during this period from reports of the commerce department, and also in the decline of employees during these periods.

It is a case of incorrect attribution on the total market level. But it's very important to remember that the experiences of individual print businesses can be quite different. There are several reasons.

Survivors: Those print businesses that have outlasted their dearly departed brethren inherit the print sales that the brethren left behind. I have written about this quite a few times. This survivor bias in market research survey work is usually not important when markets are growing, but the statistical “whoops” factor can be a real problem when things are contracting. To make an extreme example, if the number of printing establishments contracts at a faster rate than market volume does, all of the surviving businesses can show sales increases. Why? Because the closed businesses no longer have sales to report. This actually occurs gradually, and has been more clearly evident in industry profits data than in the shipments data.

Some Print Clients Did Benefit from QE: Saving the banks and the financial institutions did affect the promotional budgets of those institutions. Once the draconian austerity period passed, spending on advertising and promotion did rise for many of the affected businesses, and if they were the client of a particular printer, that printer would reasonably attribute their good fortune to the QE process.

QE1 Continued through the End of the Recession: QE1 started about six or so months before the bottom (and therefore, the end) of the recession in June 2009. Because it continued, and increased the optimism of that time in businesses when they started to see stock prices rise, businesses loosened their budgets a bit. Seeing the economy rise, especially if you are a surviving printer benefiting from fewer print businesses for clients to choose from, a rise in business would seem to be caused by QE or rising corporate optimism from rising stock prices.

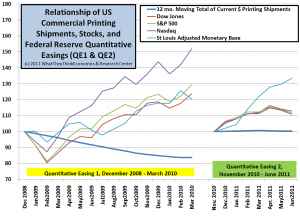

In the end, the issue is co-incidence and causation. The pressures of technology are still weighing heavy on shipments, and that digital substitution continues to prevent printing shipments from rising. The chart below summarizes the lack of effect on print during QE1 and QE2. All data are on a rate of change, and start at 100. So if something goes from 100 to 125, that's a 25% increase; if something goes from 100 to 75, that's a 25% decrease from the initial value. Stocks and SLAMB rose, but during QE1, current dollar shipments declined, and during QE2, they were flat. (Click on chart to enlarge).

The stock market indices are better known, the Dow Jones Industrials, Standard & Poor's 500, and the NASDAQ. Because all of the data are in current dollars, and inflation-adjustment might distort the analysis, I used current dollars throughout. These are the results (click table to enlarge):

The stock market indices are better known, the Dow Jones Industrials, Standard & Poor's 500, and the NASDAQ. Because all of the data are in current dollars, and inflation-adjustment might distort the analysis, I used current dollars throughout. These are the results (click table to enlarge):

The current series of printing shipments data goes back to the beginning of 1993. Because of the monthly fluctuations that can occur, it was decided to use the 12 month moving total of the data series. Because the stock indices have multiple stocks of multiple seasonality characteristics, this was considered to be a better match. Having the full range of data and the relationship to the stock indices and the St. Louis Adjusted Monetary Base (we'll call it SLAMB for the rest of this post) would provide a good comparison. We identified the closest full month of shipments data to the quantitative easing dates and started the analysis.

Historically, the value of printing shipments has had a weak relationship with the stock markets. The r-squared measure should be above 70% in most business forecasting situations, and none of them are close. When we get to QE1, however, the r-squared data jump considerably. This would normally be quite encouraging, but the slope of the forecasting line is negative. That means that as the stock markets and SLAMB rose, printing shipments would actually decrease.

For the period of QE2, the statistical relationships remained much stronger than the full range of data, but less than QE1. The negative slopes disappeared, and were for the most part, only slightly positive.

Overall, neither stocks nor monetary action had any positive effect on printing shipments.

What is it then, that printers whose business increased during those periods in defiance of the aggregate move of the marketplace were seeing? We know the commercial printing business was contracting during this period from reports of the commerce department, and also in the decline of employees during these periods.

It is a case of incorrect attribution on the total market level. But it's very important to remember that the experiences of individual print businesses can be quite different. There are several reasons.

Survivors: Those print businesses that have outlasted their dearly departed brethren inherit the print sales that the brethren left behind. I have written about this quite a few times. This survivor bias in market research survey work is usually not important when markets are growing, but the statistical “whoops” factor can be a real problem when things are contracting. To make an extreme example, if the number of printing establishments contracts at a faster rate than market volume does, all of the surviving businesses can show sales increases. Why? Because the closed businesses no longer have sales to report. This actually occurs gradually, and has been more clearly evident in industry profits data than in the shipments data.

Some Print Clients Did Benefit from QE: Saving the banks and the financial institutions did affect the promotional budgets of those institutions. Once the draconian austerity period passed, spending on advertising and promotion did rise for many of the affected businesses, and if they were the client of a particular printer, that printer would reasonably attribute their good fortune to the QE process.

QE1 Continued through the End of the Recession: QE1 started about six or so months before the bottom (and therefore, the end) of the recession in June 2009. Because it continued, and increased the optimism of that time in businesses when they started to see stock prices rise, businesses loosened their budgets a bit. Seeing the economy rise, especially if you are a surviving printer benefiting from fewer print businesses for clients to choose from, a rise in business would seem to be caused by QE or rising corporate optimism from rising stock prices.

In the end, the issue is co-incidence and causation. The pressures of technology are still weighing heavy on shipments, and that digital substitution continues to prevent printing shipments from rising. The chart below summarizes the lack of effect on print during QE1 and QE2. All data are on a rate of change, and start at 100. So if something goes from 100 to 125, that's a 25% increase; if something goes from 100 to 75, that's a 25% decrease from the initial value. Stocks and SLAMB rose, but during QE1, current dollar shipments declined, and during QE2, they were flat. (Click on chart to enlarge).

The current series of printing shipments data goes back to the beginning of 1993. Because of the monthly fluctuations that can occur, it was decided to use the 12 month moving total of the data series. Because the stock indices have multiple stocks of multiple seasonality characteristics, this was considered to be a better match. Having the full range of data and the relationship to the stock indices and the St. Louis Adjusted Monetary Base (we'll call it SLAMB for the rest of this post) would provide a good comparison. We identified the closest full month of shipments data to the quantitative easing dates and started the analysis.

Historically, the value of printing shipments has had a weak relationship with the stock markets. The r-squared measure should be above 70% in most business forecasting situations, and none of them are close. When we get to QE1, however, the r-squared data jump considerably. This would normally be quite encouraging, but the slope of the forecasting line is negative. That means that as the stock markets and SLAMB rose, printing shipments would actually decrease.

For the period of QE2, the statistical relationships remained much stronger than the full range of data, but less than QE1. The negative slopes disappeared, and were for the most part, only slightly positive.

Overall, neither stocks nor monetary action had any positive effect on printing shipments.

What is it then, that printers whose business increased during those periods in defiance of the aggregate move of the marketplace were seeing? We know the commercial printing business was contracting during this period from reports of the commerce department, and also in the decline of employees during these periods.

It is a case of incorrect attribution on the total market level. But it's very important to remember that the experiences of individual print businesses can be quite different. There are several reasons.

Survivors: Those print businesses that have outlasted their dearly departed brethren inherit the print sales that the brethren left behind. I have written about this quite a few times. This survivor bias in market research survey work is usually not important when markets are growing, but the statistical “whoops” factor can be a real problem when things are contracting. To make an extreme example, if the number of printing establishments contracts at a faster rate than market volume does, all of the surviving businesses can show sales increases. Why? Because the closed businesses no longer have sales to report. This actually occurs gradually, and has been more clearly evident in industry profits data than in the shipments data.

Some Print Clients Did Benefit from QE: Saving the banks and the financial institutions did affect the promotional budgets of those institutions. Once the draconian austerity period passed, spending on advertising and promotion did rise for many of the affected businesses, and if they were the client of a particular printer, that printer would reasonably attribute their good fortune to the QE process.

QE1 Continued through the End of the Recession: QE1 started about six or so months before the bottom (and therefore, the end) of the recession in June 2009. Because it continued, and increased the optimism of that time in businesses when they started to see stock prices rise, businesses loosened their budgets a bit. Seeing the economy rise, especially if you are a surviving printer benefiting from fewer print businesses for clients to choose from, a rise in business would seem to be caused by QE or rising corporate optimism from rising stock prices.

In the end, the issue is co-incidence and causation. The pressures of technology are still weighing heavy on shipments, and that digital substitution continues to prevent printing shipments from rising. The chart below summarizes the lack of effect on print during QE1 and QE2. All data are on a rate of change, and start at 100. So if something goes from 100 to 125, that's a 25% increase; if something goes from 100 to 75, that's a 25% decrease from the initial value. Stocks and SLAMB rose, but during QE1, current dollar shipments declined, and during QE2, they were flat. (Click on chart to enlarge).