Q1 GDP was revised slightly from +1.8% to +1.9%. Last week's unemployment report was rather gruesome from a trend perspective, with the household survey (which includes self-employment) dropping by -445,000, and the employment participation rate dropping to 64.1%. The clearest picture of that is what has happened to the economy is proprietor's income, a good indicator of the state of small business. When you consider that the recession started just over three years ago, small business has grown less than one percent per year. It still has yet to reach the inflation-adjusted level of that time, which would be $1,163.5 billion in today's dollars. As for the NASDAQ, it's almost 6% higher than December 2007, but it lags the inflation-adjusted level of 2883. The recovery actually began in June 2009 and was completed in terms of GDP in Q4-2010; but these data show that the economy is slowing and the risks of a second recession are rising. That's a risk level, not a definite outcome. It's more likely that there will be more economic muddling without a downturn, but even that is not a desirable situation.

This will be a very busy week for economic indicators, with inflation reports on Thursday (PPI) and Friday (PPI). Initial jobless claims on Thursday will get increased scrutiny in light of last Friday's 9.2% unemployment report. Friday's Fed report of industrial production and the Empire State Manufacturing Survey will be searched for clues about the direction of manufacturing industries.

Later this month, five years of revised GDP data will be released, a reminder that no data are final. It is likely that the data will show that the recession will be shown as deeper than originally reported. All the more reason for small business executives to keep economic data in the background in their decisions and not as their primary focus.

###

Q1 GDP was revised slightly from +1.8% to +1.9%. Last week's unemployment report was rather gruesome from a trend perspective, with the household survey (which includes self-employment) dropping by -445,000, and the employment participation rate dropping to 64.1%. The clearest picture of that is what has happened to the economy is proprietor's income, a good indicator of the state of small business. When you consider that the recession started just over three years ago, small business has grown less than one percent per year. It still has yet to reach the inflation-adjusted level of that time, which would be $1,163.5 billion in today's dollars. As for the NASDAQ, it's almost 6% higher than December 2007, but it lags the inflation-adjusted level of 2883. The recovery actually began in June 2009 and was completed in terms of GDP in Q4-2010; but these data show that the economy is slowing and the risks of a second recession are rising. That's a risk level, not a definite outcome. It's more likely that there will be more economic muddling without a downturn, but even that is not a desirable situation.

This will be a very busy week for economic indicators, with inflation reports on Thursday (PPI) and Friday (PPI). Initial jobless claims on Thursday will get increased scrutiny in light of last Friday's 9.2% unemployment report. Friday's Fed report of industrial production and the Empire State Manufacturing Survey will be searched for clues about the direction of manufacturing industries.

Later this month, five years of revised GDP data will be released, a reminder that no data are final. It is likely that the data will show that the recession will be shown as deeper than originally reported. All the more reason for small business executives to keep economic data in the background in their decisions and not as their primary focus.

###

Commentary & Analysis

Economic Indicators Still Muddling Through; Slowdown Risks Rising

The economy is slowing again,

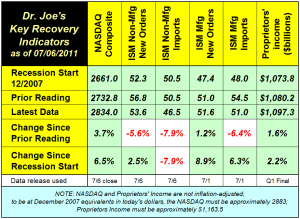

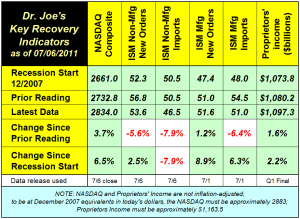

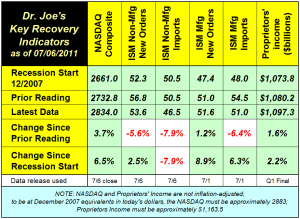

The economy is slowing again, the recovery indicators are starting to weaken compared to the start of the recession in December 2007 and recent reports. The latest Institute for Supply Management manufacturing and non-manufacturing new order indices took a tumble. The manufacturing imports went down, and the non-manufacturing imports dropped below recession start levels. (click table to enlarge)

Q1 GDP was revised slightly from +1.8% to +1.9%. Last week's unemployment report was rather gruesome from a trend perspective, with the household survey (which includes self-employment) dropping by -445,000, and the employment participation rate dropping to 64.1%. The clearest picture of that is what has happened to the economy is proprietor's income, a good indicator of the state of small business. When you consider that the recession started just over three years ago, small business has grown less than one percent per year. It still has yet to reach the inflation-adjusted level of that time, which would be $1,163.5 billion in today's dollars. As for the NASDAQ, it's almost 6% higher than December 2007, but it lags the inflation-adjusted level of 2883. The recovery actually began in June 2009 and was completed in terms of GDP in Q4-2010; but these data show that the economy is slowing and the risks of a second recession are rising. That's a risk level, not a definite outcome. It's more likely that there will be more economic muddling without a downturn, but even that is not a desirable situation.

This will be a very busy week for economic indicators, with inflation reports on Thursday (PPI) and Friday (PPI). Initial jobless claims on Thursday will get increased scrutiny in light of last Friday's 9.2% unemployment report. Friday's Fed report of industrial production and the Empire State Manufacturing Survey will be searched for clues about the direction of manufacturing industries.

Later this month, five years of revised GDP data will be released, a reminder that no data are final. It is likely that the data will show that the recession will be shown as deeper than originally reported. All the more reason for small business executives to keep economic data in the background in their decisions and not as their primary focus.

###

Q1 GDP was revised slightly from +1.8% to +1.9%. Last week's unemployment report was rather gruesome from a trend perspective, with the household survey (which includes self-employment) dropping by -445,000, and the employment participation rate dropping to 64.1%. The clearest picture of that is what has happened to the economy is proprietor's income, a good indicator of the state of small business. When you consider that the recession started just over three years ago, small business has grown less than one percent per year. It still has yet to reach the inflation-adjusted level of that time, which would be $1,163.5 billion in today's dollars. As for the NASDAQ, it's almost 6% higher than December 2007, but it lags the inflation-adjusted level of 2883. The recovery actually began in June 2009 and was completed in terms of GDP in Q4-2010; but these data show that the economy is slowing and the risks of a second recession are rising. That's a risk level, not a definite outcome. It's more likely that there will be more economic muddling without a downturn, but even that is not a desirable situation.

This will be a very busy week for economic indicators, with inflation reports on Thursday (PPI) and Friday (PPI). Initial jobless claims on Thursday will get increased scrutiny in light of last Friday's 9.2% unemployment report. Friday's Fed report of industrial production and the Empire State Manufacturing Survey will be searched for clues about the direction of manufacturing industries.

Later this month, five years of revised GDP data will be released, a reminder that no data are final. It is likely that the data will show that the recession will be shown as deeper than originally reported. All the more reason for small business executives to keep economic data in the background in their decisions and not as their primary focus.

###

Q1 GDP was revised slightly from +1.8% to +1.9%. Last week's unemployment report was rather gruesome from a trend perspective, with the household survey (which includes self-employment) dropping by -445,000, and the employment participation rate dropping to 64.1%. The clearest picture of that is what has happened to the economy is proprietor's income, a good indicator of the state of small business. When you consider that the recession started just over three years ago, small business has grown less than one percent per year. It still has yet to reach the inflation-adjusted level of that time, which would be $1,163.5 billion in today's dollars. As for the NASDAQ, it's almost 6% higher than December 2007, but it lags the inflation-adjusted level of 2883. The recovery actually began in June 2009 and was completed in terms of GDP in Q4-2010; but these data show that the economy is slowing and the risks of a second recession are rising. That's a risk level, not a definite outcome. It's more likely that there will be more economic muddling without a downturn, but even that is not a desirable situation.

This will be a very busy week for economic indicators, with inflation reports on Thursday (PPI) and Friday (PPI). Initial jobless claims on Thursday will get increased scrutiny in light of last Friday's 9.2% unemployment report. Friday's Fed report of industrial production and the Empire State Manufacturing Survey will be searched for clues about the direction of manufacturing industries.

Later this month, five years of revised GDP data will be released, a reminder that no data are final. It is likely that the data will show that the recession will be shown as deeper than originally reported. All the more reason for small business executives to keep economic data in the background in their decisions and not as their primary focus.

###

Q1 GDP was revised slightly from +1.8% to +1.9%. Last week's unemployment report was rather gruesome from a trend perspective, with the household survey (which includes self-employment) dropping by -445,000, and the employment participation rate dropping to 64.1%. The clearest picture of that is what has happened to the economy is proprietor's income, a good indicator of the state of small business. When you consider that the recession started just over three years ago, small business has grown less than one percent per year. It still has yet to reach the inflation-adjusted level of that time, which would be $1,163.5 billion in today's dollars. As for the NASDAQ, it's almost 6% higher than December 2007, but it lags the inflation-adjusted level of 2883. The recovery actually began in June 2009 and was completed in terms of GDP in Q4-2010; but these data show that the economy is slowing and the risks of a second recession are rising. That's a risk level, not a definite outcome. It's more likely that there will be more economic muddling without a downturn, but even that is not a desirable situation.

This will be a very busy week for economic indicators, with inflation reports on Thursday (PPI) and Friday (PPI). Initial jobless claims on Thursday will get increased scrutiny in light of last Friday's 9.2% unemployment report. Friday's Fed report of industrial production and the Empire State Manufacturing Survey will be searched for clues about the direction of manufacturing industries.

Later this month, five years of revised GDP data will be released, a reminder that no data are final. It is likely that the data will show that the recession will be shown as deeper than originally reported. All the more reason for small business executives to keep economic data in the background in their decisions and not as their primary focus.

###

About Dr. Joe Webb

Dr. Joe Webb is one of the graphic arts industry's best-known consultants, forecasters, and commentators. He is the director of WhatTheyThink's Economics and Research Center.

Video Center

- Questions to ask about inkjet for corrugated packaging

- Can Chinese OEMs challenge Western manufacturers?

- The #1 Question When Selling Inkjet

- Integrator perspective on Konica Minolta printheads

- Surfing the Waves of Inkjet

- Kyocera Nixka talks inkjet integration trends

- B2B Customer Tours

- Keeping Inkjet Tickled Pink

© 2024 WhatTheyThink. All Rights Reserved.