Businesses have been coping with the stagnant situation by having more of an inward focus to their operations, and not an outward one. That is, they are focused on efficiency far more than they are expansion. While businesses always have efficiency as a management objective, the recession and the recovery period have been dominated by this thinking. Expansion? Risk avoidance is all around. While business is always risky, all expansionary initiatives, such as new plants, adding to the workforce, do not currently have the expectation that the payback will be adequate.

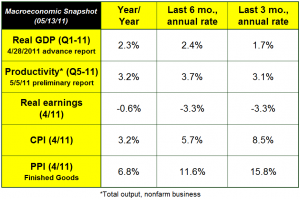

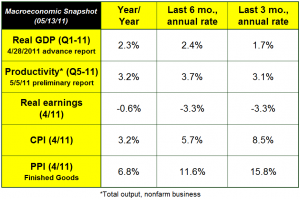

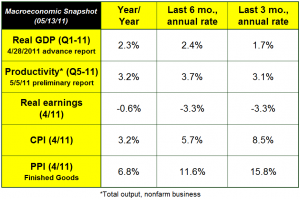

For this reason, it has been described that there is great uncertainty in the marketplace. That is untrue. Any time business people decide not to act, they have made a decision based on what is known at the time. When they see demand that is flat and is not likely to grow, they will adjust their plans accordingly. When their costs are rising (as noted in the PPI) they change other costs in their business process (reduce staffing), and when they cannot pass increasing costs to the marketplace (PPI is greater than CPI), they constrain wages paid to workers (real earnings decline). Therefore they make investments for efficiency such as in computing and communications but do not make investments for expansion (capital equipment). In consideration of the tax environment as it lies ahead, the prospects for higher inflation, and concerns related to the indebtedness of governments, the slow economy is not a paralysis of uncertainty. It is the result of thoughtful consideration of where businesspeople believe the economy and their markets are likely to be three to five years from now. Until that calculus changes and makes expansionary risks worth taking for a broader number of businesses and industries, expect more economic muddle ahead.

Businesses have been coping with the stagnant situation by having more of an inward focus to their operations, and not an outward one. That is, they are focused on efficiency far more than they are expansion. While businesses always have efficiency as a management objective, the recession and the recovery period have been dominated by this thinking. Expansion? Risk avoidance is all around. While business is always risky, all expansionary initiatives, such as new plants, adding to the workforce, do not currently have the expectation that the payback will be adequate.

For this reason, it has been described that there is great uncertainty in the marketplace. That is untrue. Any time business people decide not to act, they have made a decision based on what is known at the time. When they see demand that is flat and is not likely to grow, they will adjust their plans accordingly. When their costs are rising (as noted in the PPI) they change other costs in their business process (reduce staffing), and when they cannot pass increasing costs to the marketplace (PPI is greater than CPI), they constrain wages paid to workers (real earnings decline). Therefore they make investments for efficiency such as in computing and communications but do not make investments for expansion (capital equipment). In consideration of the tax environment as it lies ahead, the prospects for higher inflation, and concerns related to the indebtedness of governments, the slow economy is not a paralysis of uncertainty. It is the result of thoughtful consideration of where businesspeople believe the economy and their markets are likely to be three to five years from now. Until that calculus changes and makes expansionary risks worth taking for a broader number of businesses and industries, expect more economic muddle ahead.

Commentary & Analysis

Inflation and Worker Earnings Moving in the Wrong Directions

At the end of last week,

At the end of last week, the Bureau of Labor Statistics released their latest Producer Price Index and Consumer Price Index data. Things are not good.

We are still concerned about the size of the gap between producer prices (prices at the manufacturer level) and consumer prices (prices on store shelves). Last time they were wider than usual to this degree was in mid-2008. We know what happened then: prices crashed as the economy plummeted into recession. This time is a little different as the credit crisis was just forming. Though we're still dealing with that aftermath, we can still have further economic slowdown, which appears to be underway. As for inflation, the recent pullbacks in gold, silver, and some other commodities are more likely temporary than permanent.

Businesses have been coping with the stagnant situation by having more of an inward focus to their operations, and not an outward one. That is, they are focused on efficiency far more than they are expansion. While businesses always have efficiency as a management objective, the recession and the recovery period have been dominated by this thinking. Expansion? Risk avoidance is all around. While business is always risky, all expansionary initiatives, such as new plants, adding to the workforce, do not currently have the expectation that the payback will be adequate.

For this reason, it has been described that there is great uncertainty in the marketplace. That is untrue. Any time business people decide not to act, they have made a decision based on what is known at the time. When they see demand that is flat and is not likely to grow, they will adjust their plans accordingly. When their costs are rising (as noted in the PPI) they change other costs in their business process (reduce staffing), and when they cannot pass increasing costs to the marketplace (PPI is greater than CPI), they constrain wages paid to workers (real earnings decline). Therefore they make investments for efficiency such as in computing and communications but do not make investments for expansion (capital equipment). In consideration of the tax environment as it lies ahead, the prospects for higher inflation, and concerns related to the indebtedness of governments, the slow economy is not a paralysis of uncertainty. It is the result of thoughtful consideration of where businesspeople believe the economy and their markets are likely to be three to five years from now. Until that calculus changes and makes expansionary risks worth taking for a broader number of businesses and industries, expect more economic muddle ahead.

Businesses have been coping with the stagnant situation by having more of an inward focus to their operations, and not an outward one. That is, they are focused on efficiency far more than they are expansion. While businesses always have efficiency as a management objective, the recession and the recovery period have been dominated by this thinking. Expansion? Risk avoidance is all around. While business is always risky, all expansionary initiatives, such as new plants, adding to the workforce, do not currently have the expectation that the payback will be adequate.

For this reason, it has been described that there is great uncertainty in the marketplace. That is untrue. Any time business people decide not to act, they have made a decision based on what is known at the time. When they see demand that is flat and is not likely to grow, they will adjust their plans accordingly. When their costs are rising (as noted in the PPI) they change other costs in their business process (reduce staffing), and when they cannot pass increasing costs to the marketplace (PPI is greater than CPI), they constrain wages paid to workers (real earnings decline). Therefore they make investments for efficiency such as in computing and communications but do not make investments for expansion (capital equipment). In consideration of the tax environment as it lies ahead, the prospects for higher inflation, and concerns related to the indebtedness of governments, the slow economy is not a paralysis of uncertainty. It is the result of thoughtful consideration of where businesspeople believe the economy and their markets are likely to be three to five years from now. Until that calculus changes and makes expansionary risks worth taking for a broader number of businesses and industries, expect more economic muddle ahead.

Businesses have been coping with the stagnant situation by having more of an inward focus to their operations, and not an outward one. That is, they are focused on efficiency far more than they are expansion. While businesses always have efficiency as a management objective, the recession and the recovery period have been dominated by this thinking. Expansion? Risk avoidance is all around. While business is always risky, all expansionary initiatives, such as new plants, adding to the workforce, do not currently have the expectation that the payback will be adequate.

For this reason, it has been described that there is great uncertainty in the marketplace. That is untrue. Any time business people decide not to act, they have made a decision based on what is known at the time. When they see demand that is flat and is not likely to grow, they will adjust their plans accordingly. When their costs are rising (as noted in the PPI) they change other costs in their business process (reduce staffing), and when they cannot pass increasing costs to the marketplace (PPI is greater than CPI), they constrain wages paid to workers (real earnings decline). Therefore they make investments for efficiency such as in computing and communications but do not make investments for expansion (capital equipment). In consideration of the tax environment as it lies ahead, the prospects for higher inflation, and concerns related to the indebtedness of governments, the slow economy is not a paralysis of uncertainty. It is the result of thoughtful consideration of where businesspeople believe the economy and their markets are likely to be three to five years from now. Until that calculus changes and makes expansionary risks worth taking for a broader number of businesses and industries, expect more economic muddle ahead.

Businesses have been coping with the stagnant situation by having more of an inward focus to their operations, and not an outward one. That is, they are focused on efficiency far more than they are expansion. While businesses always have efficiency as a management objective, the recession and the recovery period have been dominated by this thinking. Expansion? Risk avoidance is all around. While business is always risky, all expansionary initiatives, such as new plants, adding to the workforce, do not currently have the expectation that the payback will be adequate.

For this reason, it has been described that there is great uncertainty in the marketplace. That is untrue. Any time business people decide not to act, they have made a decision based on what is known at the time. When they see demand that is flat and is not likely to grow, they will adjust their plans accordingly. When their costs are rising (as noted in the PPI) they change other costs in their business process (reduce staffing), and when they cannot pass increasing costs to the marketplace (PPI is greater than CPI), they constrain wages paid to workers (real earnings decline). Therefore they make investments for efficiency such as in computing and communications but do not make investments for expansion (capital equipment). In consideration of the tax environment as it lies ahead, the prospects for higher inflation, and concerns related to the indebtedness of governments, the slow economy is not a paralysis of uncertainty. It is the result of thoughtful consideration of where businesspeople believe the economy and their markets are likely to be three to five years from now. Until that calculus changes and makes expansionary risks worth taking for a broader number of businesses and industries, expect more economic muddle ahead.

About Dr. Joe Webb

Dr. Joe Webb is one of the graphic arts industry's best-known consultants, forecasters, and commentators. He is the director of WhatTheyThink's Economics and Research Center.

Video Center

- Questions to ask about inkjet for corrugated packaging

- Can Chinese OEMs challenge Western manufacturers?

- The #1 Question When Selling Inkjet

- Integrator perspective on Konica Minolta printheads

- Surfing the Waves of Inkjet

- Kyocera Nixka talks inkjet integration trends

- B2B Customer Tours

- Keeping Inkjet Tickled Pink

© 2024 WhatTheyThink. All Rights Reserved.