There is one important part of this latest report that has not been reported. The recession started in Q4-2007 when real GDP was $13.363 trillion. This report of Q4-2010 is the first time that the economy is larger than that level, coming in $13.382 trillion. This means, as funny as it may sound, that the recovery is over. We're on new ground, but we're not likely to sprout any wings soon. For all practical purposes, it's still an L-shaped recovery.

There is one important part of this latest report that has not been reported. The recession started in Q4-2007 when real GDP was $13.363 trillion. This report of Q4-2010 is the first time that the economy is larger than that level, coming in $13.382 trillion. This means, as funny as it may sound, that the recovery is over. We're on new ground, but we're not likely to sprout any wings soon. For all practical purposes, it's still an L-shaped recovery.

Commentary & Analysis

Q4-2010 GDP Report Has Something for Optimists & Pessimists Alike, But We're Still Moving Sideways

Today'

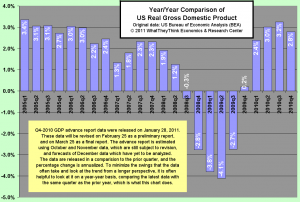

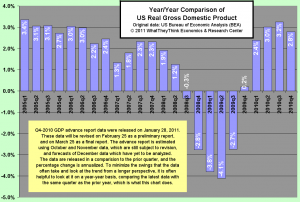

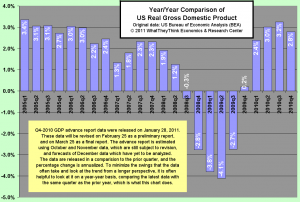

Today's GDP report was expected to hit +3.5%, and missed it, coming in at +3.2%. Yet again, inventories are the culprit, but this time the optimists can grab that explanation. In prior months, the pessimists were pointing at GDP growth being caused by inventory buildups, but this time, those inventories dropped. Adjusting for inventories, GDP grew at +7.1%. The most important figure that shows the domestic economy, without the distortion of imports and exports is real gross domestic purchases, and that was down -0.3%.

What was particularly interesting was the slowdown in some business investment, perhaps in expectation of the 2011 depreciation rules. The law was not passed until the quarter was underway, so it could not affect the entire quarter, but shifting purchases from December to January is rather easy. That shift may make Q1-2011 look better that it would have been.

The chart below shows real GDP on a year-year basis rather than a quarter-quarter basis. This reduces the variability of the data and makes it easier to see the underlying trend, and that is sideways. (click on the chart to enlarge)

There is one important part of this latest report that has not been reported. The recession started in Q4-2007 when real GDP was $13.363 trillion. This report of Q4-2010 is the first time that the economy is larger than that level, coming in $13.382 trillion. This means, as funny as it may sound, that the recovery is over. We're on new ground, but we're not likely to sprout any wings soon. For all practical purposes, it's still an L-shaped recovery.

There is one important part of this latest report that has not been reported. The recession started in Q4-2007 when real GDP was $13.363 trillion. This report of Q4-2010 is the first time that the economy is larger than that level, coming in $13.382 trillion. This means, as funny as it may sound, that the recovery is over. We're on new ground, but we're not likely to sprout any wings soon. For all practical purposes, it's still an L-shaped recovery.

There is one important part of this latest report that has not been reported. The recession started in Q4-2007 when real GDP was $13.363 trillion. This report of Q4-2010 is the first time that the economy is larger than that level, coming in $13.382 trillion. This means, as funny as it may sound, that the recovery is over. We're on new ground, but we're not likely to sprout any wings soon. For all practical purposes, it's still an L-shaped recovery.

There is one important part of this latest report that has not been reported. The recession started in Q4-2007 when real GDP was $13.363 trillion. This report of Q4-2010 is the first time that the economy is larger than that level, coming in $13.382 trillion. This means, as funny as it may sound, that the recovery is over. We're on new ground, but we're not likely to sprout any wings soon. For all practical purposes, it's still an L-shaped recovery.

About Dr. Joe Webb

Dr. Joe Webb is one of the graphic arts industry's best-known consultants, forecasters, and commentators. He is the director of WhatTheyThink's Economics and Research Center.

Video Center

- Questions to ask about inkjet for corrugated packaging

- Can Chinese OEMs challenge Western manufacturers?

- The #1 Question When Selling Inkjet

- Integrator perspective on Konica Minolta printheads

- Surfing the Waves of Inkjet

- Kyocera Nixka talks inkjet integration trends

- B2B Customer Tours

- Keeping Inkjet Tickled Pink

© 2024 WhatTheyThink. All Rights Reserved.