I'm still asked if we're at the bottom of the recession; we're now at the point where almost all of the economic data conflict, and that's sometimes a sign that the bottom has been reached. Keep in mind that a portion of economic data will always conflict with others, because even in an upturn there are always sectors that are not experiencing a rise, and in a downturn there is always the opposite.

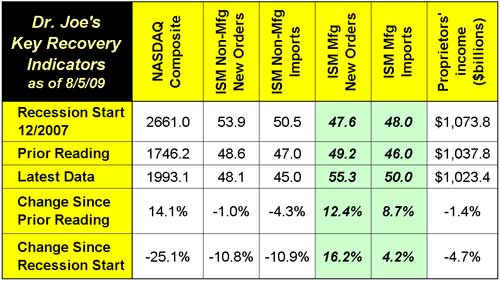

This week, the ISM manufacturing index was encouraging, and the non-manufacturing index was deeply discouraging. Proprietor's income, part of the GDP report, shows we still have quite a ways to go. The NASDAQ is up, significantly, in a short time, but is still quite a ways from its value at the recession start. These mixed signals feel like a bottom, but don't really feel like an upward inflection yet. We're more likely to get a “breakout” quarter sometime and then a slow, bumpy rise up from there. Here's the latest chart of the recovery indicators:

Two of our recovery indicators are now higher than at the recession start, but the others are still a problem. The NASDAQ has to rise another 33%; it had a big month, but it might not have legs to move further upward for a while. The two ISM non-manufacturing components have to rise a little more than 12%. Proprietors income must rise another 5%.

Printing shipments for June were bad, almost down $1 billion compared to June 2008. We won't know for a while if some big mail customers shifted work to July or August in an attempt to qualify for the USPS “summer sale.” If so, it looks like it would have been around $200 million, which would have added up to a bad comparison to June '08 nonetheless. We won't know for certain for a while. The biggest problem with the “summer sale” is that it does nothing to create new, long-term USPS customers.

I'll discuss these and other matters in the latest Monthly Shipments Report which we sell on the e-store. Of course, I'll go into some detail in Monday's column.

In other news, many economists are raising their GDP forecasts for the third and fourth quarter and for 2010. Let me understand this: We're asking the economists who did not see the bubble, the bursting of the bubble, and the length and depth of the recession for their forecasts for 90, 180, and 450 days from now. Okay, I'll play along... but only if I can bring my own dartboard and blindfold, too. All businesspeople need to know is that it will be slow, and any upturn will be mild, and that there is real risk of inflation. Treat your customers well, look for ways to lower their costs, open new opportunities, and select suppliers who help you do the same. Worrying about a half point change in GDP takes your eye off your customer's needs.