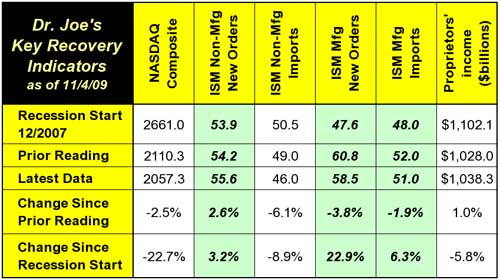

The recovery indicators remain mixed since last month. This Monday's ISM Manufacturing report continued to be above the levels at the recession start in December 2007. New orders are growing, but at a slower rate, already! Imports are growing, but also at a slower rate. Some might consider this as a sign that manufacturing will slow down enough and head back to recessionary levels. It's too soon to tell, but I don't think that's the case. The real bright spot in the report is the rise in hiring. Manufacturing employment has been negative for 22 of the last 23 months in this ISM report. Of great concern is that prices paid for goods used in manufacturing was up, which I believe will be a continuing theme ahead.

Today (Wednesday), the ISM non-manufacturing report was released, and shocked the experts by going down. While new orders were up, an encouraging sign, imports were down significantly. The worst part of the report was that employment contracted, the opposite direction found in the manufacturing report.

The NASDAQ is down since last month, but the change is minor. It still has to rise about 30% from these levels to return to the levels of December 2007. I think we will get there, but for a disappointing reason. Corporations are continuing to cut their staffs, and will not be hiring replacements. They will remain austere in their budgeting. This means that increases in revenues will have high margins associated with them, and profits should return to pre-recession levels long before hiring does. Considering that most of the publicly traded companies have international revenues, it is likely most of the revenue increases will come from those sources. Because stock prices are essentially based on the expectations of future profits, once profits start beating expectations with conviction, the index will begin to rise sharply. The NASDAQ will not rise 30% all at once, but perhaps by the middle of next year.

Proprietors income is also a disappointment, and its return to pre-recession levels is still six or nine months away at best. This measure of small business activity is critical to having a well-rounded and sustainable recovery. During the shallow recession in the general range of 2001 and 2002, that measure was among the first signs that a recovery was on its way.

The bottom lines are that we have three indicators still above their levels at the start of the recession. Two of those three, however, retreated. Overall, four of the six indicators are below levels of last month. It seems like we lost some ground last month, even though the mainstream business news seemed more positive; or at least it was written that way.

The big report this week is Friday's unemployment, and the ADP report today went down more than expected. Again, the key number on Friday is not the unemployment rate, it's whether or not the total workforce increases. We'll have it all digested in Monday's column, including comments about September's disappointing printing shipments and what the October employment report indicates for shipments last month.