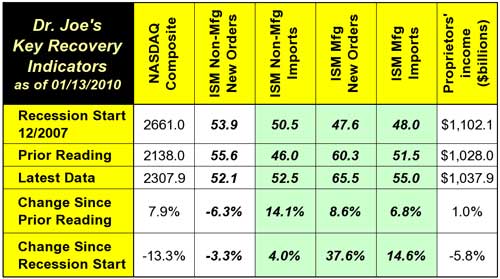

While we were all away on our holiday break, numerous economic data were published. Some were good, and some were bad. We'll have a complete roundup in Monday's column. In this note, we'll focus on our recovery indicators, which changed a bit, but are basically the same as last month.

Now, three of the indicators that we track from the Institute of Supply Management are still in areas that are higher than at the start of the recession. Unfortunately, we had the ISM non-manufacturing new orders index take a step back and the non-manufacturing imports take a step forward, leaving us in the same net position as we were last month. An old boss of mine used to call this “dynamic inertia.”

Because the non-manufacturing new orders index is above 50, it still implies growth in that sector, just not at a slower level than when it was going into the recession. The ISM manufacturing continued its strong performance, especially for new orders.

Despite the recent positive performance of the stock market, our NASDAQ index (preferred to the S&P 500 because of its lower emphasis on financial stocks) is still down -13% since the recovery start. This means we need a 15% increase from here to get to that level. That could very well happen over these next months.

Proprietors income is still down -5.8% since the recession start, and this will be stubborn to rise. Neither the NASDAQ or proprietors income are inflation adjusted, so even when they equal the recession start figures, they will still be behind. We'll discuss that at an appropriate time.

* * *

There were lots of economic data over the past weeks, and here are my very brief comments about some of the major ones:

- GDP for the third quarter was revised down, again, to +1.8%. As more and more estimated data were replaced by real data, it was clear that the economy was in worse shape than originally thought with the first estimate of +3.5%.

- Last Friday's unemployment report was a near-disaster, more of a disaster than the cable TV talking heads first realized in their chatter. Even though the unemployment rate was still 10%, nearly 700,000 people left the workforce. Had they stayed in, the unemployment rate would have been 10.4%. The rate that includes discouraged workers went up to 17.3%.

- The ISM manufacturing and non-manufacturing reports were generally better, but the indicators that would imply a needed positive change in employment were weak.

- Printing employment in December went down, but it was a very small downward change. January's data, released next month, should be quite revealing as to the outlook for the year.

- Printing shipments in November were down, but at a much lower rate than prior months. Don't take too much heart in that; it only means it went down -8% compared to last year.

- The National Federation of Independent Business started its latest commentary with “For small business owners, 2009 ended with a thud.” There is good reason to believe that the economy is stalling, again, especially for small business owners. They still lack visibility for long-term corporate and personal tax rates, inflation, the cost of money, employment regulations, benefits costs, and the direction of the general economy. Other than that, everything is just fine.

- Speaking of tax rates, unless Congress acts soon, a wage earner with an income of $75,000 will get caught in the Alternative Minimum Tax. This is the most punishing tax to the economy, especially to the Northeast, upper Midwest, and the West Coast, where state taxes are high and the AMT basically excludes them as deductions. If there is one reason for the long-term exodus of population and businesses from these areas, this tax is it. Keep an eye out for action, or inaction, on this critical element of tax policy. Inaction will delay the recovery, and hurt small business considerably.

- The trade deficit went up (a contrarian sign that the economy is growing), and everyone's panicking. Interesting, huh? The weak dollar was supposed to create a boom in U.S. exports, right? It doesn't and it won't.

Details in Monday's column, especially a look at Friday's inflation report... as I start my eighth year associated with WhatTheyThink. See you then!