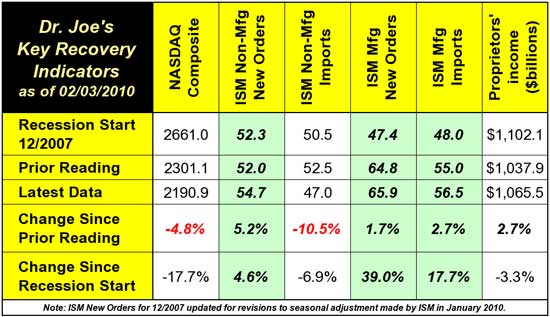

Our recovery indicators took a step sideways this month, and in some aspects were disappointing. We still have three of our six indicators at levels higher than the beginning of the recession in December 2007. It's been that way for a while.

On the upside, we had a nice change in proprietors' income, a good measure of the health of small business. These data are reported quarterly, but are revised most every month. In light of the strong GDP report, of which proprietors' income is a component, we should be concerned about a potential downward revision before the figure is pronounced as final. Despite the strong upturn of more than 10% when annualized, it's still behind its level at the recession start way back in December 2007. In Monday's column, I will discuss a tax issue that may cause small business income to rise at a higher than expected rate in 2010, and then shrink to lag the economy in 2011.

Also strong were Institute for Supply Management manufacturers new orders and imports by manufacturers. This sector has been stronger than others for some time. On the non-manufacturing side, new orders went back above the level at the recession start, a level that it's been flirting with for quite some time. Non-manufacturing imports, however, went down, and are contracting. Remember, many of the things that are imported into the U.S. are ingredients for other products, so the raw materials are important and the bulk of the value added is added here. This is the fallacy of the weak dollar supposedly making U.S. goods more attractive overseas. It also makes many of the materials used to create those goods more expensive to acquire.

Other aspects of the ISM reports showed inflation creeping into materials prices (especially for manufacturers) a pickup in employment in manufacturing, but continued contraction in non-manufacturing employment. Overall the ISM manufacturing report was very good, but the non-manufacturing report was disappointing.

After starting January well, the NASDAQ fell back almost -5% for the month. There is a lack of conviction about revenue growth among publicly traded stocks, but an expectation that cost-cutting has been the road to improved profits of these companies. There are numerous concerns about slowdown in emerging markets, rising prices of commodities (which is generally good for the stocks of commodities producers and bad for the stocks of commodities users). Over the month, there seems to have been a rush to buy bonds. I haven't seen much written that pulls this all together, but it does seem that while there may not be the deep pessimism that was seen in 2008 and lessened in 2009, but an extreme cautiousness that allows only short-term decisions to be made, and long-term decisions to be postponed.

This Friday is the unemployment report, and it will be the one that really gets picked apart by the talking heads. Every year, the Bureau of Labor Statistics makes revisions to their estimation models, and they have warned that their estimate of the number of people employed, especially in early 2009, will be revised down. The revision may be startling: they may take 2 million workers out of their estimate. Remember, all of these data start with an estimate, and then real data are folded in as the BLS receives them. The primary source of the actual data are the submissions of Social Security tax (on Form 941). Large companies submit these reports with every payroll. Smaller businesses may submit the reports every month. Smaller companies can submit them as little as every quarter.

The other factor is that the payroll report does not include self-employed workers. For that reason, I watch the household survey more closely. It is this survey from which the unemployment rate is actually calculated.

I'll pull it all together for Monday's column. Watch my posts on Twitter (wtterc) and I'll post the interesting findings as I uncover them.