Last week was WhatTheyThink’s fourth annual Technology Outlook Week (jeepers, has it been four years already?), our five-day series of webinars that look at the latest trends and technologies in a broad cross-section of the industry—digital printing, software and workflow, labels and packaging, and finishing.

On Thursday, in a session sponsored by EFI, Cary Sherburne and I tag-teamed a look at wide-format and signage (me) and textiles and apparel (Cary)—with a fair amount of overlap. In this article, I will recap the wide-format portion of the webinar and the textiles and apparel portion in a separate article. (You can watch the entire webinar here.)

What Kind of Day Has it Been?

In case you have been trapped in an underwater pyramid for the past four years, here’s the story so far:

By the end of the 2010s, the migration to wide-format on the part of general commercial printers had been largely slowing. But then—wham!—2020 happened, and wide-format printing was a saving grace during the pandemic, what with the infamous “pivot” to safety signage, distancing dots, and all the display graphics ephemera of the lockdown months. More importantly, there was also the shutdown of key vertical markets for display graphics producers, such as events, travel, etc.

Then, in 2021, things started to return to normal as we spent the year rebuilding the industry (and the economy). There were occasional virus variant-related snags, and macroeconomic indicators were all over the place, but overall things were getting better. In 2022, it was a case of “Virus? What virus?” and the infamous “supply chain challenges” dominated the headlines. For commercial printers, getting paper was the big issue, and for display graphics, certain types of vinyl, aluminum and other materials for signmaking, and other consumables were a bit of a challenge to get—and when you could, they were expensive.

Now, where are we in 2023? We are starting to see shops that specialize in display graphics start to look at diversification into new areas. After all, after the big migration into wide format in the 2010s, there’s more competition than ever. So where are they looking? Some are looking at label printing, some at packaging, and no small amount are looking at diversifying into textiles.

Smithers has a fairly bearish forecast of the display graphics and signage market. In their recent report The Future of Printed Signage in a Digital World to 2028, they see the global value for “posters, banners, flags, backdrops, point-of-sale (PoS) displays, billboards, decals & transfers, vehicle/fleet graphics, building wraps, corporate graphics, and trade show materials” in 2023 will reach $40.99 billion—down ~$5 billion from their pre-pandemic value. They add:

- Volume of printed signage has fallen from 10.81 billion meters square in 2019, to 8.92 billion meters square in 2020, although demand for printed signage did recover in 2021–2022.

- Output for all printed signage is projected to reach 10.08 billion meters square in 2023

- Upward trajectory is now levelling off thanks to inflation, energy costs, and geopolitical issues.

- Demand for printed signage will only grow marginally—value increasing at 0.2% CAGR to $25.15 billion in 2028.

- Volumes have a 0.7% CAGR to 2028; global output will reach 10.43 billion meters square in 2028.

Smithers is a bit more pessimistic than I would be, but their upshot is that there is an increased need to diversify into new application areas. (By the way, it’s worth mentioning that analysts also see the expansion of dynamic digital signage will also erode demand for printed and fabricated display graphics and signage, but I am not entirely convinced that the switchover is going to be as substantial as others claim.)

The Graying of Wide Format

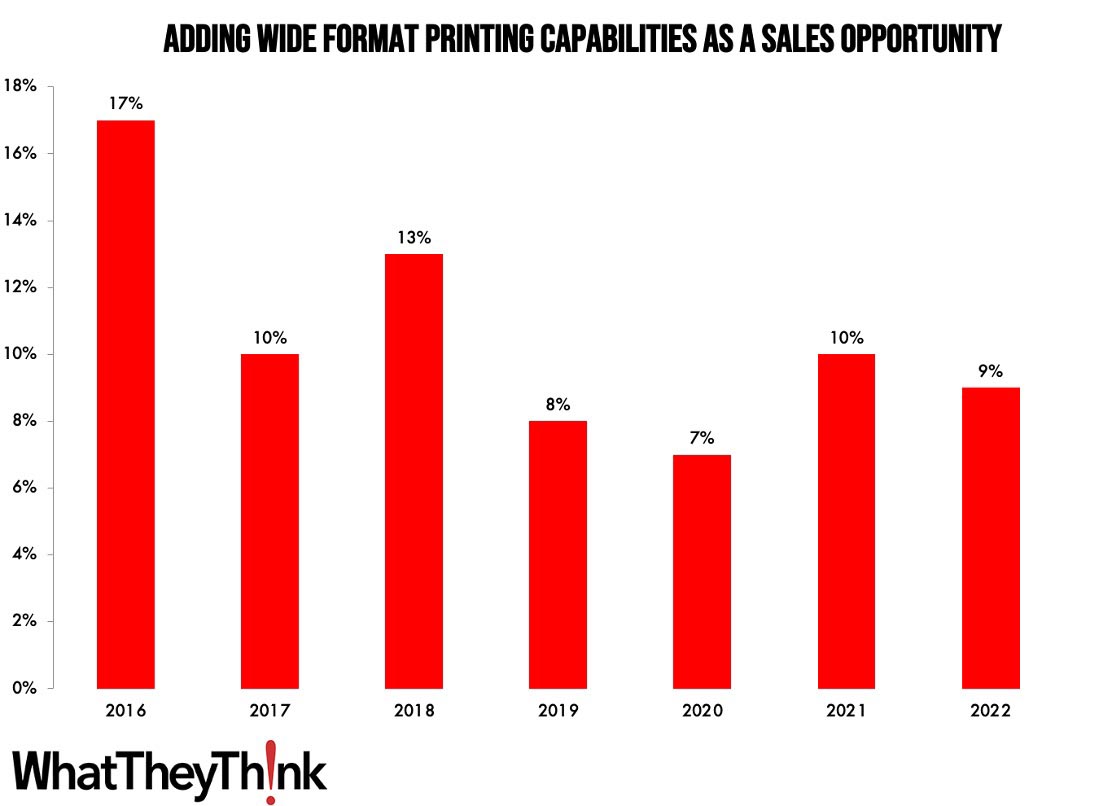

And it’s true that our annual Print Business Outlook surveys have found a cooling of interest in wide-format printing as a new business opportunity:

WhatTheyThink Business Outlook Surveys, 2016–2022

(Cary pointed out during the webinar that the print franchises—Sir Speedy, etc.—are still adding wide-format equipment and seeking new opportunities in display graphics.)

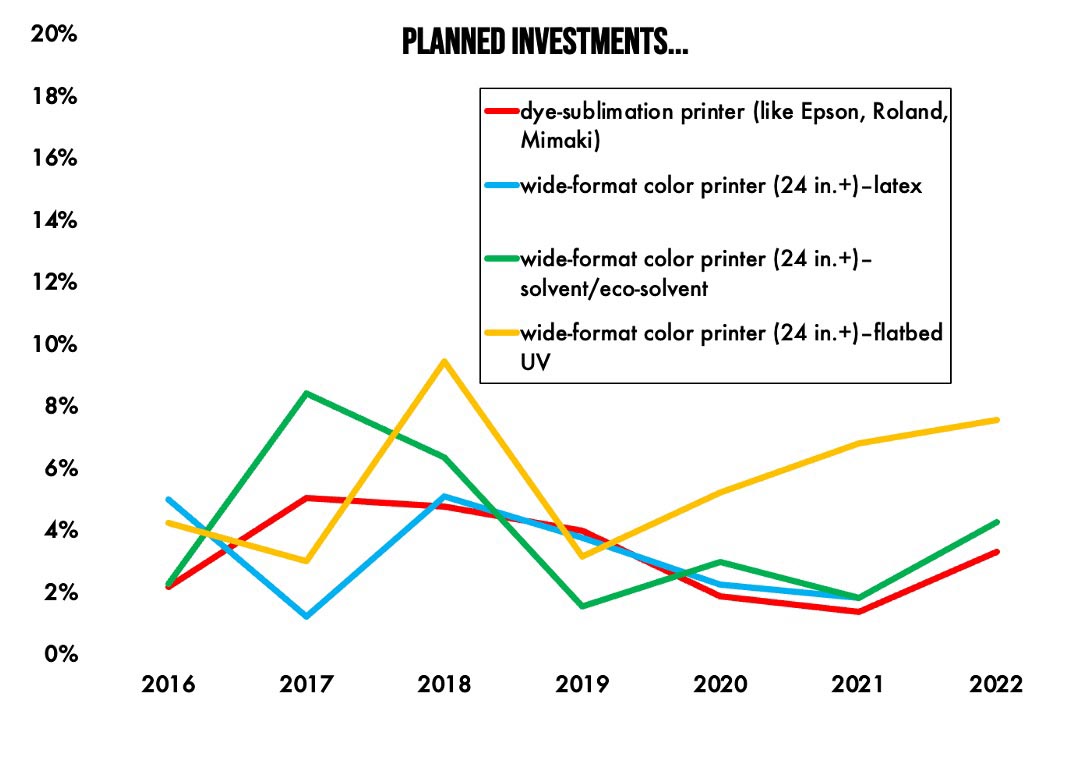

Investment in wide-format equipment continues apace, with especial interest in flatbed equipment:

WhatTheyThink Business Outlook Surveys, 2016–2022

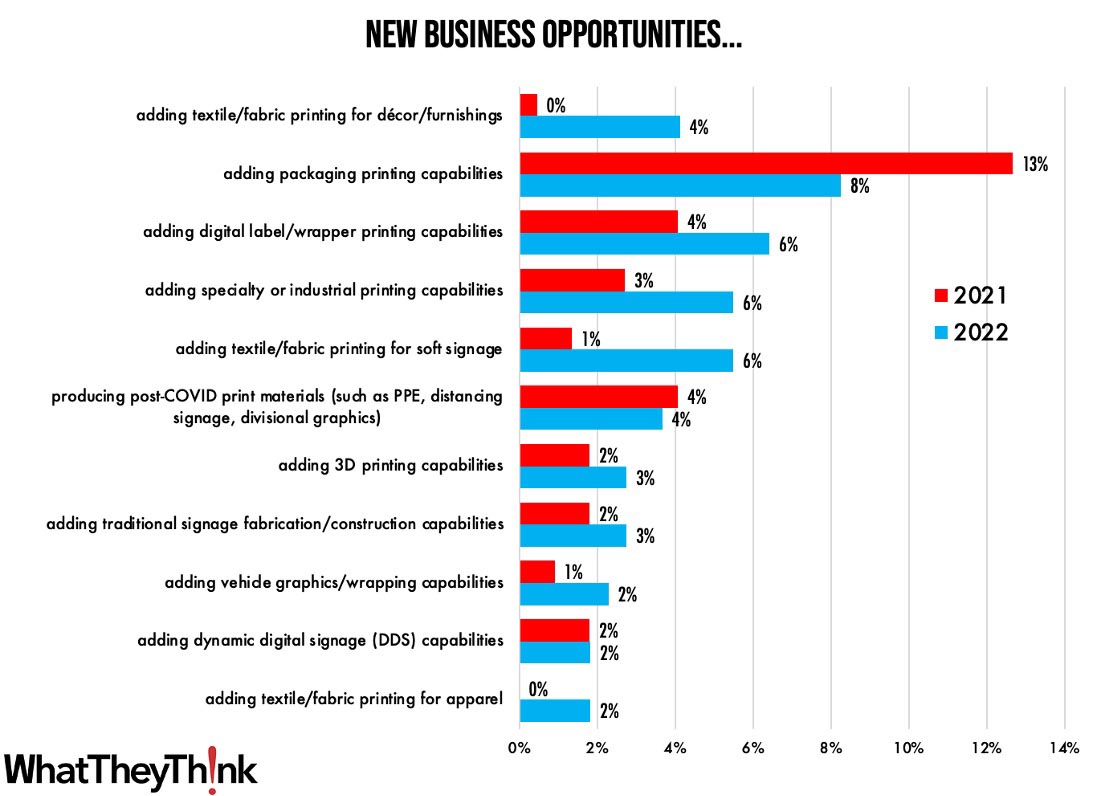

In our 2021 survey, we added some new items to our “new business opportunities” question, and we do see that there is some increased interest in print businesses getting into textile printing for décor (wallpaper is a huge new area), label printing, specialty or industrial printing (think of ad specialties and promotional items, water bottles, etc.), and soft signage.

WhatTheyThink Business Outlook Surveys, 2021–2022

Two data points do not a trend make, so we will be tracking these further in future surveys. Still, it does suggest that print businesses are looking beyond display graphics—and that many wide-format printing devices can also produce these applications makes it that much easier to get into.

Automation

The conversation around “automation” can mean different things depending upon which part of the printing industry you are talking about. In general commercial printing—as Pat McGrew and Ryan McAbee discussed in their Technology Outlook session—“automation” tends to refer to the up-front processes: estimating, pricing, etc., and linking those processes to production for purposes of inventory management, scheduling, etc. In wide-format printing, the automation conversation centers around production processes: “RIP and print”; imposition, nesting optimization, and job preparation; the ability to automatically apply premade settings to jobs; and the ability for one workflow to handle different types of applications (display graphics, textiles, etc.). And of course wide-format automation also increasingly includes robotics, such as robotic arms for board loading/offloading.

Outlook

As we charge through 2023, here is what the dominant trends are going to be:

- “Supply chain” problems easing—if not eased completely—although there is still moderate price inflation.

- Automation— software and hardware—will continue to evolve and be adopted. Here come the robots!

- Two sides of the employment issue: production staff shortages, will continue but more entrepreneurial business owners, especially in franchises.

- Indeed, since COVID, there have been more entrepreneurial workers overall. New business formation spiked in 2020 (The Great Resignation) and while down from its peak, is still at historic highs. Many of these new businesses are in traditional wide-format and signage verticals like retail. New businesses represent good opportunities for new customers as they often need a lot of the things that printers and sign shops produce.

- Experiential graphics headed for a rebound as offices continue to reopen. Many businesses/organizations may feel it’s a good time for a rebrand/refresh. At the same time, downsized offices/new locations also provide opportunities.

- Commercial construction has been slow but looks like it may be picking up. Said the American Institute of Architects (AIA) Chief Economist, Kermit Baker PhD: “The ongoing weakness in design activity at architecture firms reflects clients’ concerns regarding the economic outlook. High construction costs, extended project schedules, elevated interest rates, and growing difficulty in obtaining financing are all weighing on the construction market.” This impacts new signage projects as well as the AEC market.

- Shops are also slowly starting to diversify beyond print and traditional display graphics into textiles, labels, and other application areas.

- Of course, the print business is ultimately at the mercy of overall economic conditions, and the economy is doing pretty good at the moment: GDP is still rising and we have record low unemployment. The only glitch is that inflation is still persistent, but it’s down dramatically from last year. There is still no real sign of a recession…yet(?), although the debt ceiling showdown is worrying, as a default will blow everything up. (Update: The House passed the debt ceiling deal last night so that’s one less thing to worry about.)

- And of course sustainability continues to be a concern—not just materials but overall business practices, especially end-of-life issues: how do you sustainably discard/recycle old signage and display graphics. I like to reference the Vycom Recycling Program, which collects display graphics waste and disused signage and recycles into filler for Vycom’s decking material.

So the display graphics and signage market is a healthy one. Yes, it’s “gray,” but I can tell you firsthand that it is possible to be gray and healthy!

New Products

Here is a quick rundown of the major wide-format-related announcements that have come out in to last six months or so.

Agfa launched its Jeti Tauro H3300 UHS with Varnish. It’s a hybrid unit that prints up to 3.3m wide and up to up to 905 m2/hr.

Canon launched the Colorado M-series, “M” standing for “modular” as the machine is available in three configurations that allow users to scale up (or down, as the case may be) as their business and their needs change. The new Colorado is 64-in. wide and features the new UVgel 460 CMYK inkset—and now offers a white option. (You can read my write up of the new Colorado here.)

At FESPA last week, Durst introduced the P5 350 HS D4 hybrid printing system which notably features Durst P5 Robotics (remember what I said about “here come the robots”?), a feeder/stacker unit comprising two Kuka robots to handle unmanned production for a complete shift. The robots can pick up media from different pallets up to 180 cm height, feed them, and stack them separately. Printed media can also be turned 180° for reverse-side printing and fed into a second printing system. Durst also introduced the P5 350 HSR, a 3.5m LED roll-to-roll printer capable of print speeds of up to 670 sq. m. per hour. Durst also offers a complete suite of software for all aspects of the printing process including Analytics, Workflow, Smart Shop (Web-to-print), etc.

Last week at FESPA, EFI got a jump on what will be the next great leap for wide-format printing: single-pass printing. They previewed the Nozomi 14000 SD single-pass printer for sign and display graphics. It is a 1.4m CMYK + white, orange, and violet device and is said to be 10 times faster than current multi-pass printers. Look for this to hit the market later this year. We’ll certainly be keeping our eyes open for it.

Epson launched new units in the SureColor T-Series for AEC applications: the 36-inch SureColor T5770DM and 44-inch SureColor T7770DM, and the 4-color SureColor F6470 and 6-color 44-in. SureColor F6470H dye-sublimation printers are now shipping. This isn’t wide-format per se, but struck me as pretty cool when I saw it at the ISA Sign Expo: the SureLab D570 professional minilab photo printer for high-quality photo printing in compact and lightweight design—if you still print pictures, that is. By the way, along with Roland, Epson has one of the broadest portfolios in all of wide format, offering solvent/eco-solvent, resin (aka latex), UV flatbed, dye-sublimation, and direct-to-film.

At FESPA last week, Fujifilm launched the Acuity Prime Hybrid, a 2m unit that prints production quality starting at 92 sq. m/hr. They also launched the Uvijet HZ Thermoforming Ink for the Acuity Prime series.

You may also recall that for years Fujifilm had partnered with Inca Digital, for whom they sold the Onset series of high-end wide-format units. Inca Digital had also been working on single-pass technology, but after Agfa acquired Inca, Fujifilm had to seek another single-pass partner, and thus announced that they were working with Barberán to develop a single-pass printer for the display graphics and signage market. That is expected to appear later this year, and we’ll also definitely be keeping a look out for further announcements.

Late last year at PRINTING United, HP launched the Latex 2700, a 126-in (3.2m) printer that can print up to 1302 sq. ft./hr. (121 sq. m/hr.). It is available in four dual roll and/or white ink configurations.

This year, HP also launched SitePrint for the architecture and construction industry. SitePrint is a robotic printer like a Roomba that prints directly on the floor of a construction site to indicate where walls, doors, and other architectural features go. It is said to have 10 times the productivity of the manual process. Accuracy is currently within 3mm and they are continuing to improve on that. HP had announced SitePrint as an “early access program” and will be announcing general availability later this year.

Back at ISA in April, Konica Minolta had launched the latest in its AccurioWide series, the AccurioWide 250 hybrid, offering 2.5m width and speeds up to 1,238 sq. ft./hr. It can also print 4 x 8-ft. boards in landscape, and users can switch 4 x 8-ft. board production from long to short print tables and eliminate up to 12 feet in printer depth and up to 96 square feet of floor space.

Also at ISA, Mimaki had launched its first foray into direct-to-film (DTF) with the TFTxF150-75. (Direct-to-film is a transfer printing technology usually, but not always, used for garment printing. A powder is printed on a plastic transfer sheet which is then later applied, using a heat press, to a garment or other surface.) The TFTxF150-75 has a maximum printing width of 80cm for DTF transfer sheets. The PHT50 heat transfer pigment ink includes CMYK+W, and is said to produce up to 22 T-shirts/hr. or 210 “logo” shirts an hour, the latter referring to small coverage areas, such as a small logo.

Mutoh launched the latest in its XpertJet series, the XpertJet 1682SR Pro eco-solvent printer that prints up to 64-in. and comes with an 8-color option.

Roland has had a busy year, updating its True VIS line of UV printer/cutters—the LG Series UV printer/cutters, MG Series UV printer/cutters, and AP-640 Resin printer, the latter a challenge to latex for printing wall décor, indoor signs, retail displays, stickers and decals, banners and posters, vehicle wraps, and other applications on a wide range of substrates. One major new product that launched at ISA is the brand new VersaOBJECT CO line of hybrid UV flatbed printers. A replacement for the VersaUV LEC2 S-Series, the VersaOBJECT line is designed to print on a wide variety of flat substrates as well as 3D objects. It is currently available in two widths (30- and 64-in.) as well as three bed lengths. The printer is belt-driven which allows for faster loading/unloading, and the unit can print on rollfed media as well as rigid materials and objects up to 7.87-in. high. Complementary Rotary Rack accessories allow for printing on cylindrical objects like water bottles and YETI cups.

Roland also recently launched its own DTF printer, the VersaSTUDIO BN-20D Direct-to-Film System, allowing users to create custom T-shirts, tote bags, aprons, and other textile- and vinyl-based applications with no weeding or masking required.

By the way, along with Epson, Roland has one of the broadest portfolios in all of wide format, offering solvent/eco-solvent, resin (aka latex), UV flatbed, dye-sublimation, and direct-to-film.

SAi, makers of Flexi, the design application for the sign industry, announced EnRoute 23, upgraded CAD/CAM design software with a ton of new features for CNC routing and similar processes. SAi also expanded its Adendo.com platform. Flexi users can access online and in-person education, training, and support. Online “ecourses” provide extended, pre-recorded, and self-paced training modules—some being currently offered include “Designing Vehicle Wraps in Flexi,” “Learn Flexi in 3-Hours,” and “Full Flexi Training with Mark Rugen.” New courses will be added over time. Adendo’s “Virtual Training” allows sign companies to book live online training sessions that can last from 30 minutes up to several hours to address specific needs. There is also an on-site option, where Adendo experts will come out to a shop and conduct in-person training or problem solving. For more info, visit https://adendo.thinkific.com/collections.

Last week at FESPA, Vanguard Europe launched its VK3220T-HS Next-Generation UV Flatbed, a 3.2m wide machine that can print up to 360 sq. m/hr. Look for it to head across the pond before too long. (Am I the only one envisioning a flatbed printer doubling as a rowboat? Yeah, I thought so.)

And Zünd launched the BHS180 board handling system that comprises board feeder, cutter, and off-load unit for high levels of automation. (Zünd cutting tables have had robotic arm options for many years.)

Discussion

Join the discussion Sign In or Become a Member, doing so is simple and free