- Although Gen Xers and Baby Boomers commonly hold accounts with large national banks, they are somewhat more likely to use small/regional banks or credit unions than Millennials and Gen Zers.

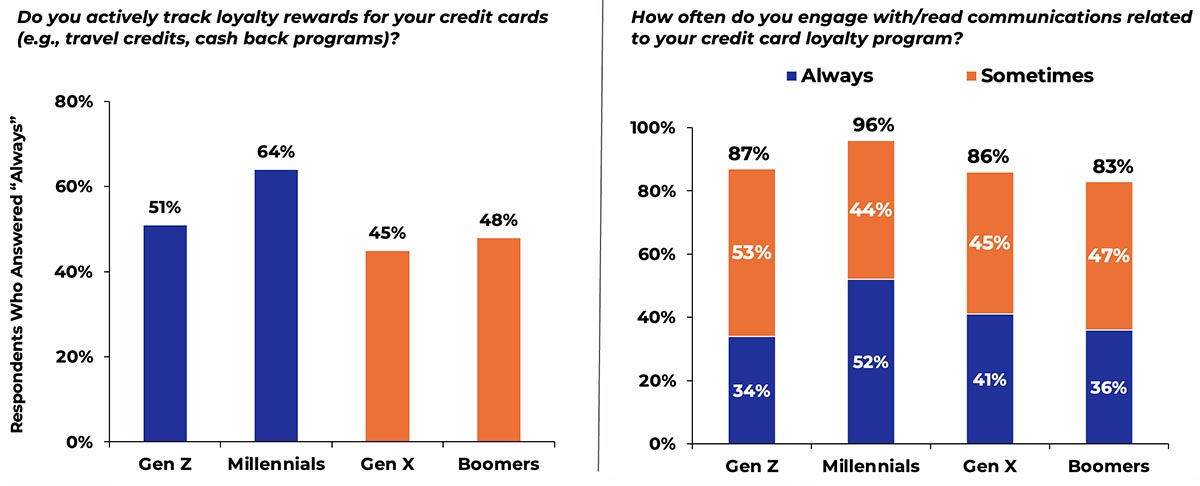

- Younger consumers—especially Millennials—are more likely to track credit card rewards such as cash back, travel points, and retail credits.

- 34% of Millennials and 28% of Gen Zers prefer using their providers’ mobile apps if they have a question about their investment, brokerage, or retirement accounts. This compares to 20% of Gen Xers and only 9% of Baby Boomers.

By Andy Young

Introduction

The US adult population consists of four major generations, including Generation Z (ages 18–25), Millennials (ages 26–41), Generation X (ages 42–57), and Baby Boomers (ages 58–74). Keypoint Intelligence’s most recent Annual State of Transactional Communications survey provides unique insight on how consumers of various ages interact with their bills and statements, including those from their banks and financial services providers. This article explores how today’s consumers—particularly younger ones—are managing their finances.

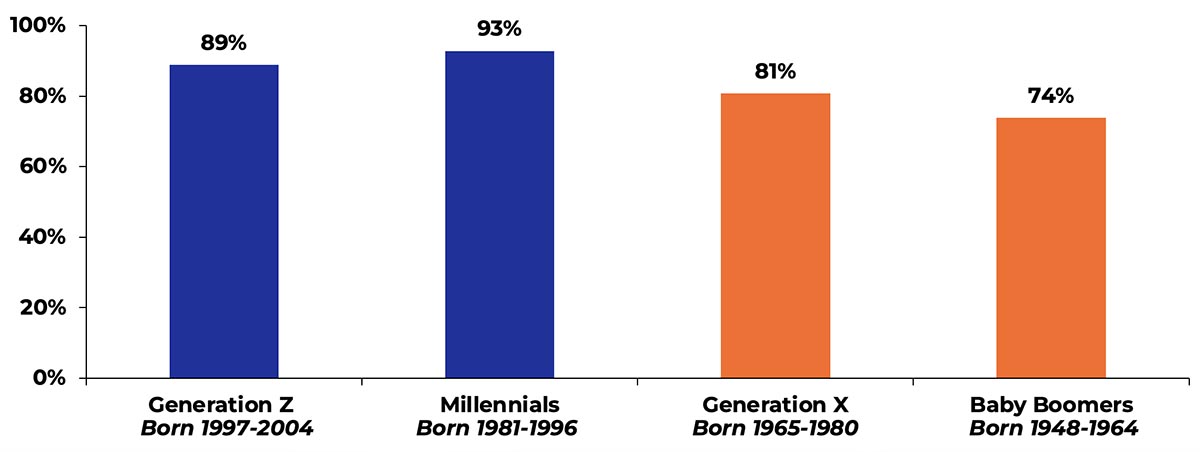

Younger Consumers Prefer Large National Banks

Even before recent economic challenges and well-publicized bank failures, consumers of all ages have been attracted to large national banks for their credit card loyalty programs and mobile capabilities. According to Keypoint Intelligence’s research, this was particularly true for the members of the two younger generations, Gen Z and Millennials. From the outset, it should be noted that “younger” is a relative term as the oldest Millennials are now in their early 40s. That said, these individuals are still of course younger than the members of Gen X and Baby Boomers. Whereas the older two generations also commonly hold accounts with large national banks, they are somewhat more likely to use small/regional banks or credit unions than their younger counterparts.

Figure 1: Share of Consumers with Checking/Savings Accounts at Large National Banks

N = 1,107 Consumer Respondents that receive transactional communications from banks

Source: Annual State of Transactional Communications Consumer Survey; Keypoint Intelligence 2022

When it comes to banking, some might assume that today’s tech-savvy and environmentally conscious Gen Zers and Millennials would prefer to work with online-only banks or local community banks. When asked to specify the banks they used, however, the younger two generations were more likely to hold accounts with large banks like Bank of America, Wells Fargo, JPMorgan Chase, or Citigroup. Only 5% of Millennials and 4% of Generation Z were members of a credit union, compared to 11% of Gen Xers and 21% of Boomers.

Loyalty Programs Drive Engagement

This same survey found that 64% of Millennials always track credit card rewards such as cash back, travel points, and retail credits. Although only about 51% of Generation Z always tracked these rewards, this share is still slightly higher than that for Generation X and Baby Boomers. A similar trend occurred when consumers were asked how often they engaged with or read credit card loyalty program messages—Millennials were especially likely to always read these communications. There is no denying that loyalty-based communications can be highly effective among younger consumers, and Millennials in particular.

Figure 2: Millennials Really Like Loyalty Programs!

N = 1,107 Consumer Respondents that receive transactional communications from banks

Source: Annual State of Transactional Communications Consumer Survey; Keypoint Intelligence 2022

Most of today’s most popular loyalty cards are issued by the largest US banks, and these loyalty programs might be part of the reason that younger consumers seem to prefer large national banks.

Mobile Technology Is Key to a Positive Experience

Younger consumers want a bank that offers the latest mobile capabilities so their entire banking experience (including accessing information and making payments) can be as seamless and efficient as possible. Large national banks have more resources to invest in digital technologies and other innovations.

According to our survey results, 34% of Millennials and 28% of Gen Zers prefer using their providers’ mobile apps if they have a question about their investment, brokerage, or retirement accounts. This compares to 20% of Gen Xers and only 9% of Baby Boomers. Additionally, when accessing more information about any product or service, 42% of Millennials and 29% of Gen Zers preferred to use the provider’s mobile app (compared to 25% of Gen Xers and 11% of Boomers).

The Bottom Line

Younger consumers—and Millennials in particular—prefer large national banks for several reasons, including brand recognition, rewards and perks offered through loyalty programs, and better access to mobile apps. Although regional banks and credit unions may offer personalized services and a sense of community, younger customers seem to be prioritizing the benefits that come with larger banks. The banking and financial services industry is constantly evolving, and it will be interesting to see how these trends continue to shape the customer communications industry in the future.

With a career spanning 25+ years in print and communications, Andy Young supplies insight and outlook for the industry as the Principal Analyst and Director of Customer Communications Solutions at Keypoint Intelligence. An entrepreneur at heart, Andy was raised in his family’s printing business and later started an electronic publishing services company specializing in early applications of Adobe Acrobat and PDF technology.

Discussion

Join the discussion Sign In or Become a Member, doing so is simple and free