- Electrophotographic printing was first invented in the 1930s by Chester Carlson. By the late 1950s, it had become the most popular form of office copying.

- As print ordering continues to shift from brick-and-mortar shops to online, small EP printers are expected to experience a significant decline.

- There will always be a requirement for EP printing because not every print service provider will have the print volumes to justify an inkjet investment.

By German Sacristan

Introduction

For the most part, the direction and purpose of inkjet is clear. What isn’t so clear is where electrophotography (EP) will land—what is its role in the industry, which types of printers will sustain it, and will the technology have any room for future growth? The quality of inkjet printing has improved over the years, so more and more print volumes have shifted toward inkjet for productivity and cost reasons. With a consistent trend toward inkjet adoption, where does this leave EP?

The Stages of Electrophotographic Printing

According to DP3, electrophotographic printing was first invented in the 1930s by Chester Carlson. By the late 1950s, it had become the most popular form of office copying. In the mid-1970s, the process was adapted for use as a hardcopy output method for computers. Instead of using light reflected from an original document like old-fashioned photocopiers, a laser (or LED) was used to translate computer data into light pulses that would expose a light sensitive, photo-conducting drum or belt. By the 1980s, laser printing had been downscaled enough to be manufactured within a desktop-sized printer.

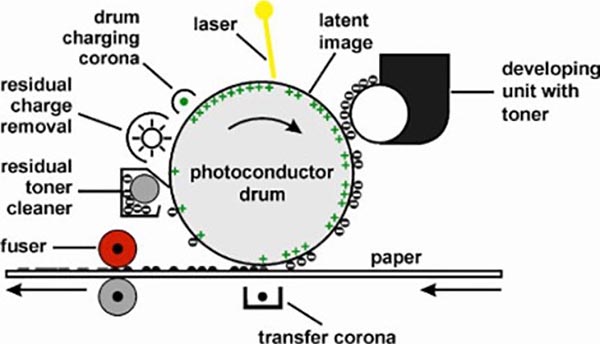

The six basic stages for this form of printing are as follows:

- Charging of the Photoconductor: A photo-conducting drum or belt is charged by a corona (electrical discharge).

- Exposure: When light exposes the charged drum or belt, the charge becomes neutralized. In a laser printer, the laser is turned on and off by the digital data from the computer. The laser is “on” for the white areas of the document or image, and it neutralizes the charge on those areas of the drum. The black areas of the document or image are not exposed by the laser, so those areas of the drum remain charged.

- Development: During this step, the toner is applied to the surface of the exposed drum. The toner carries an opposite charge from the drum, so toner only adheres to the still charged, unexposed areas.

- Transfer: The toner is transferred from the drum to the paper. A second corona is positioned behind the paper, and it creates a charge greater than that of the photoconductor. This pulls the toner from the drum to the paper.

- Fusing: At this point the toner is only resting on the surface of the paper and can easily be smeared. A variety of techniques may be employed to fix the image. For dry-toner systems, the fixing process is a combination of heat and pressure. For liquid-toner systems, evaporation of the solvent dries the image.

- Cleaning: For the photo-conducting drum or belt to be reused for the next print, it must be cleaned of residual toner and charge. The toner is scraped off mechanically. The drum is then cleaned by a light that neutralizes any remaining charge.

The Basic Stages of EP Printing

Source: DP3: Digital Print Preservation Portal | Electrophotographic (dp3project.org)

For an electrophotographic printer to create color images, four separate “impressions” (one each for cyan, magenta, yellow, and black toners) must be made.

An Uncertain Future

As print ordering continues to shift from brick-and-mortar shops to online, small EP printers are expected to experience a significant decline. Although some orders will continue to be placed face-to-face in physical print shops, some of these jobs will be redirected to centralized production centers that have larger production equipment and the ability to produce at a lower cost. At the same time, however, there will still be a need for small multifunctional peripherals (MFPs) that serve walk-up customers. These customers will typically demand quick-turn jobs on the spot, but these types of orders will be less common than they were in the past.

Another unclear—and even less predictable—aspect of the industry is what will happen to mid- and high-production range EP devices that are priced between $25,000 and $140,000. Those printers offer the expected differences in running costs (e.g., a larger capital investment will generally deliver a lower click charge). The high EP production segment—which includes devices such as Canon’s imagePRESS C9010VP/C10010VP, Ricoh’s Pro C9200, Konica Minolta’s AccurioPress C12000/C14000, Xerox’s Iridesse, and FujiFilm’s Revoria—is doing well. In fact, this range of printers has almost fully returned to its pre-pandemic sales numbers. This is largely because devices like HP Indigo’s 7 series and Xerox’s iGen series feature low average monthly print volumes (AMPVs) and have also benefitted from print volume consolidations.

Although the high-volume EP segments are doing reasonably well, mid-range EP production devices like Canon’s imagePRESS C810/910, Ricoh’s Pro C7200, Konica Minolta’s AccurioPress C4070/C4080/C7100, and Xerox’s Versant machines have struggled. These devices are typically priced below $70,000, but their sales are still quite short of pre-pandemic numbers. Of course, this situation can and might change in the future based on the most frequently required AMPVs within the EP production market. Demand will need to stabilize before we can determine which printers will succeed and bring a profitable business to their vendors.

The EP mid+ production market is estimated at about 126 billion A4 pages globally. Vendors have a clear goal to keep and grow their print volume market shares, even in a declining (albeit large) EP market. Even so, any future growth will come at a cost—either mid+ EP print volumes will shift to the larger production inkjet printers with lower running costs, or EP click charges will be reduced to make these devices more competitive. Lower click charges have been a growing trend in the EP market of late.

While cost is an important factor for any buyer during the decision-making process, it is not the only consideration. This is why the lowest-cost printers are not always the most successful. In addition to a good pricing strategy, today’s vendors must cover as much ground as possible during these unpredictable times. Parts of the mid+ EP market are struggling at this time, but this might change based on the devices that best fulfill market demand now and in the future.

How Are Vendors Responding?

With the introduction of its new imagePRESS V1000, Canon has made the strategic decision to develop a solution for every customer’s need in the mid+ EP market. Over time, this segment will likely be consolidated into fewer printers. Konica Minolta (with its AccurioPress C4070/80, 7100, and 12000/14000) and Xerox (with its Versant 280/4100 and Iridesse presses) are covering similar grounds.

The Bottom Line

At this time, it remains to be seen which EP printers will be the most successful and sustainable in the coming years. Long-term industry success will likely depend on buyer preferences and changing market dynamics. One thing is certain, though—there will always be a requirement for EP printing because not every print service provider will have the print volumes to justify an inkjet investment. Keypoint Intelligence also acknowledges that there are currently far too many options for a market that is declining, so future consolidation is inevitable. For the time being, EP vendors would be well-advised to serve as much of the market as possible so they can establish leadership and maintain a strong position when this consolidation in fact occurs. This should help drive more profitability to vendors when the EP market eventually stabilizes.

German Sacristan is the Director of Keypoint Intelligence’s Production Print & Media group. In this role, he supports customers with strategic go-to-market advice related to production printing in graphic arts and similar industry segments. German’s responsibilities include conducting market research, industry and technology forecasts, custom consulting and development of analyses, editorial content on technology, as well as support to clients in the areas of production digital printing.

Discussion

Join the discussion Sign In or Become a Member, doing so is simple and free