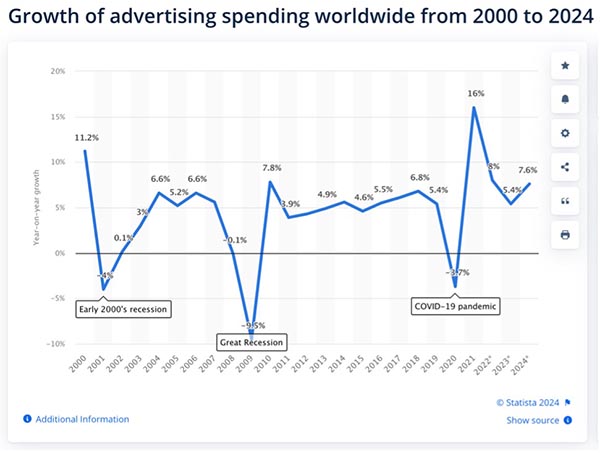

After experiencing a steady decline in the global advertising market over the past several years, we are finally getting some good news. Final numbers on global ad spending are projected to show growth for 2023, and not just growth, but significant growth. Following several years of gloom, advertisers are starting to feel more confident again.

According to research by GroupM, global ad revenues are projected to climb 5.8% at the end of 2023 to $889 billion (excluding the effects of U.S. political advertising). GroupM expects this momentum to decelerate slightly to 5.3% growth in 2024, but we’re still in very positive territory.

The forecast from Magna is similar, with an even more positive outlook for 2024. The research firm forecast global ad revenues to tick up 5.5% at the end of 2023 to $853 billion and then jump 7.2% to $914 billion in 2024.

Yet there is caution, too. With heightened tensions around the world (the Israel-Hamas conflict, Russia’s continued war in Ukraine, and inflamed political tensions in the United States), we’re still riding a wave of uncertainty.

Pure-Play Digital…For Now

Where is ad growth the highest? Pure-play digital! Pure-play digital (defined as publicly traded company that focuses its efforts and resources on only one line of business or industry) is a breakout that encompasses everything from social apps like TikTok to retail media networks. Magna expected this category to increase ad sales by 10.5% to $587 billion by the end of 2023, accounting for 69% of all ad sales.

The WPP group is more conservative. It sees the digital pure play category finishing 2023 with 9.2% growth before slowing to 7.3% growth in 2024. be up 9.4% in 2024.

While the category overall is experiencing strong growth, individual companies within the category are vulnerable, since these are single-product companies for which things can go south very quickly. So take the advertising money while you can!

U.S. Spending on the Rise, Too

For the U.S. advertising market, we turn to the Winterberry Group. According to its 18th annual forecast, U.S. spending on marketing and advertising will grow 10.7% in 2024 to reach $570 billion. But that spending may not look like it has in the past.

This growth—nearly double that in 2023—is being driven, in part, Winterberry says, by the election year. (Winterberry expects political ad spending to reach $17 billion in 2024, or roughly 30% of total growth.) But connected TV (CTV) and connected commerce, an umbrella term that includes retail media, will boost the industry in 2024, as well.

“CTV spending is expected to grow over 30% YoY in 2024 to hit $33.1 billion as advertisers chase emerging opportunities and a proliferation of ad-supported options,” Marketing Dive reports.

Another area of expected growth? In-person events. Look for growth in both consumer and B2B events driving growth in wide-format graphics of all types. Bizaboo, for example, finds that 80.4% of event organizers identify in-person events as their organization’s most impactful marketing channel.

Marketers Do More of the Heavy Lifting

Even as advertising budgets are growing, the workload is growing along with them. This is because, with the death of the cookie, marketers will need to do more of the tracking and personalizing themselves.

This can be fruitful, but also daunting. There is a lot of data out there! As marketers look to find alternative ways to get the right ads in front of the right people, Winterberry is pointing to growth in generative artificial intelligence (AI) and machine learning (ML). The company predicts that spending on data, data services and data infrastructure will top $36 billion, up 13.9% from last year.

The takeaway? When it comes to ad budgets, advertisers (and the printers who serve them) can breathe a sigh of relief…for now. But for industry players, even as these budgets represent juicy carrots, it means rolling up your sleeves, as well. The work is there for those who are willing to muscle up!

Discussion

Join the discussion Sign In or Become a Member, doing so is simple and free