- When in-plants were asked about the key challenges they faced in growing their operations and expanding capabilities, budgetary concerns topped the list at 54%. Even so, 90% of respondents expected their budgets to remain the same or increase over the next two years.

- Like budgets, the majority of in-plants (80%) expect their print volumes to increase over the next 3 years. In-plants can prepare for this growth in two ways—they can improve their existing offerings or add new services.

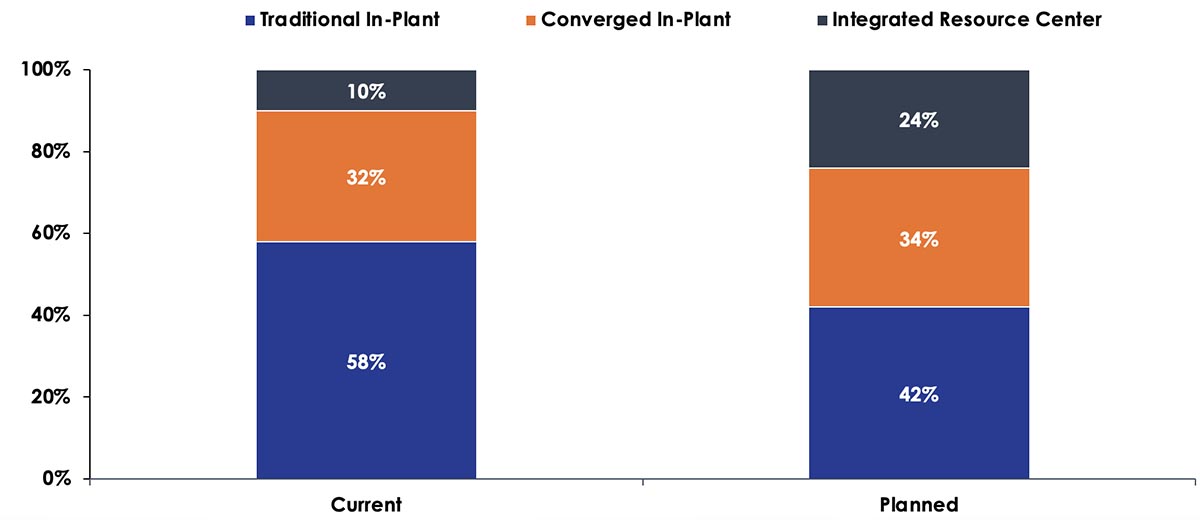

- Keypoint Intelligence’s research shows that in-plants are slowly transitioning themselves into integrated resource centers (IRCs), but there is still much work to be done.

By Greg Cholmondeley and Eve Padula

Introduction

The COVID-19 pandemic that hit hard in early 2020 is fortunately in our rear-view mirrors at this point, but its aftereffects still impact us all. In-plant operations are no exception to this rule, as they have been forced to reassess their overall purpose within their organizations. Today’s in-plants must continue to demonstrate value to their parent companies as they implement new ways to thrive in an evolving business environment.

In early 2023, Keypoint Intelligence partnered with Ricoh Corporation to conduct an in-depth survey of 50 in-plant respondents and a series of one-on-one interviews. This article provides a brief overview of our research findings to shed some light on the challenges that today’s in-plants are facing and strategies for future growth.

In-Plant Challenges

Like their commercial counterparts, today’s in-plants face a great many challenges, including rising costs, supply chain issues, pandemic-related disruptions, an aging workforce, and the ongoing shift from print work to digital. Here are some specific challenges uncovered in our quantitative research:

- Outsourcing to a third party may help alleviate some issues, but it is not a priority for in-plants. Only 16% of respondents expected outsourcing to a third party to increase over the next 3 years.

- Although 62% of respondents agreed that their leadership had a long-term vision for the future success of their in-plant, it is somewhat concerning that this share was not higher.

- Today’s in-plants must become more efficient by delivering more value or producing greater quantities with a lower budget, but this is easier said than done. When in-plants were asked about the key challenges they faced in growing their operations and expanding capabilities, budgetary concerns topped the list at 54%.

- Lack of space was another barrier to growth, cited by over a third of respondents (36%). Much like budget, a lack of space can impact productivity.

- Today’s in-plants must expand their services so they can attract additional business. To do this, they must leverage technology to meet their existing needs while also coming up with new ways to offer their services. Given that 32% of in-plants cite IT challenges as a barrier to growth, this should be another area of focus.

Although in-plants acknowledge a number of issues that may hamper growth, the good news is that most (62%) expect their budgets to increase over the next 2 years. Meanwhile, only 10% expected their budgets to decline.

Strategies for Growth

Like budgets, the majority of in-plants (80%) expect their print volumes to increase over the next 3 years. In-plants can prepare for this growth in two ways—they can improve their existing offerings or add new services.

Strategy 1: Improving Existing Offerings

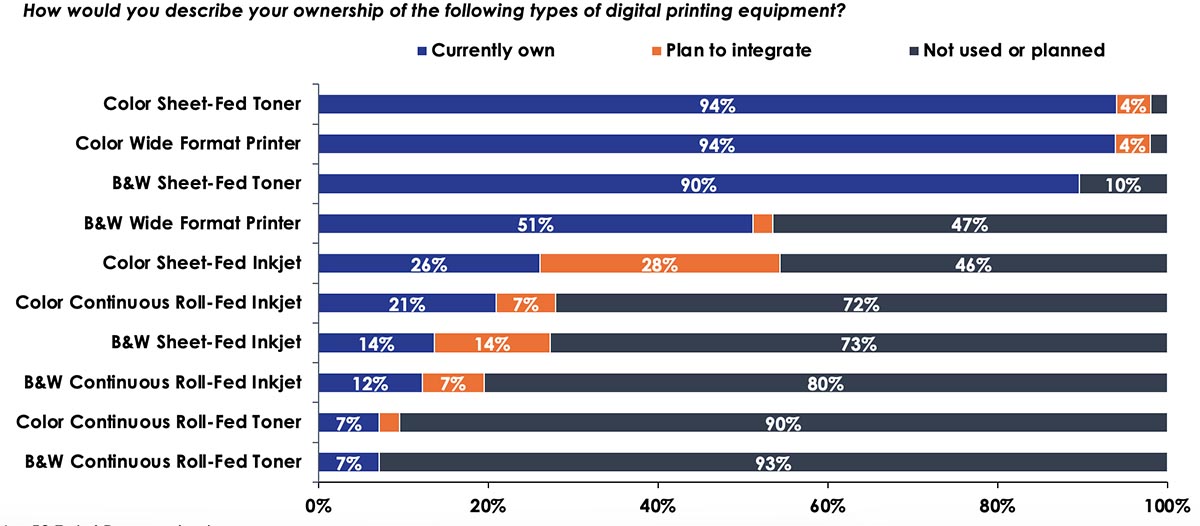

The vast majority of in-plants already own color sheet-fed toner devices, color wide format printers, and black & white sheet-fed toner devices. Meanwhile, color sheet-fed inkjet is a key area of investment that must be supported; 28% of in-plants have plans to integrate devices of this type in the near future.

Figure 1: Current/Planned Ownership of Digital Printing Equipment

N = 50 Total Respondents

Source: Ricoh In-Plant Study; Keypoint Intelligence 2023

Over 70% of in-plants already receive jobs via a web-to-print (job ticketing/preview) application, and another 15% plan to implement one soon. e-Commerce ordering (payment/job management) systems were also widespread, with 40% already using and 19% planning to implement. Among in-plants that were using an e-commerce or web-to-print ordering system, the greatest percentage were using them to manage jobs and production (92%) or to handle file production and preflighting (89%). This means that the jobs coming in through other methods are not being prepared and managed by the same system, which can impact productivity.

Over three-quarters of in-plants were currently using pre-press/pre-flight workflow software and/or job management & scheduling software. Meanwhile, production workflow automation, data collection/analytics dashboards, and job management/scheduling tools were key areas for planned investments. Automation and workflow are key to adding value, but in-plants must prioritize these initiatives. In-plants must seek new alternatives to generate growth.

Strategy 2: Adding New Services

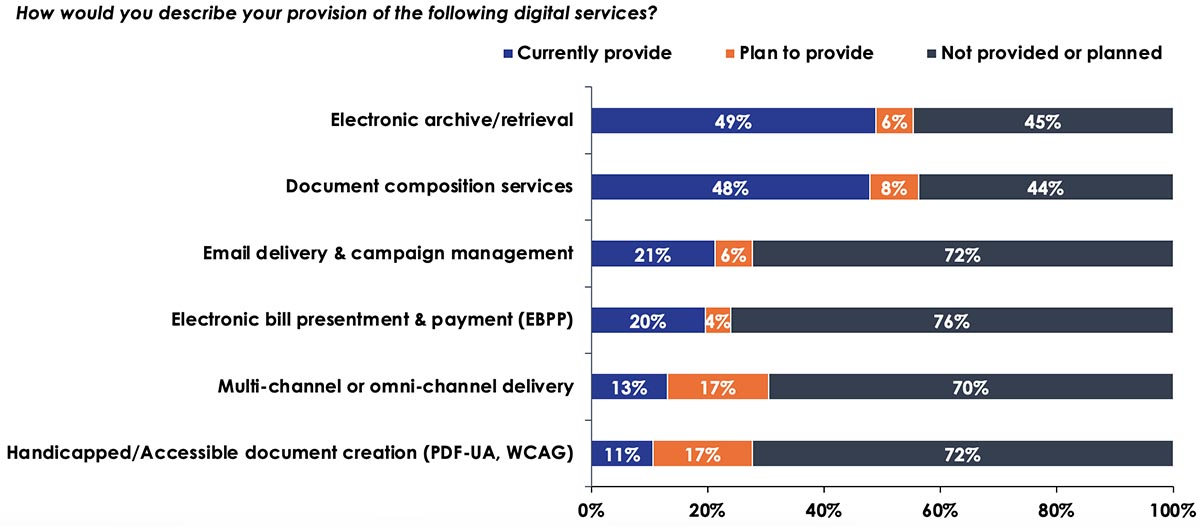

Encouragingly, 68% of respondents expect their digital output volumes to increase. None expected their digital output to decrease. The transition to digital is unquestionable, but this does not mean print is no longer important. As noted earlier, 80% of in-plants expected their print volumes to increase over the next 3 years. Nearly 60% also expected their mailpiece volumes to increase. Today’s in-plants understand and acknowledge the shift to digital, but they need direction to help them get started.

Multi-channel/omni-channel delivery is a key area of focus for in-plants. Only 13% of respondents are currently offering these services, but 17% plan to implement them soon.

Figure 2: Digital Services

N = 50 Total Respondents

Source: Ricoh In-Plant Study; Keypoint Intelligence 2023

Transitioning to an IRC

Keypoint Intelligence’s research shows that in-plants are slowly transitioning themselves into integrated resource centers (IRCs), but there is still much work to be done. Those in-plants that have become true IRCs tend to be on the lower end of the implementation spectrum, but in-plants are moving in the right direction. Only 42% of respondents are converged in-plants or IRCs at this time, but if stated plans are implemented, that should grow to 60% in the next few years.

Figure 3: Transitioning to an IRC

N = 50 Total Respondents

Source: Ricoh In-Plant Study; Keypoint Intelligence 2023

The Bottom Line

Today's in-plants are turning to professional services to help sustain and grow their operations because they recognize that simply investing in new equipment and software is not enough to guarantee success. Success requires a strategic approach that includes identifying organizational gaps and implementing improvements to increase efficiency and reduce costs. Professional services can provide in-plants with the necessary expertise, resources, and assessments to identify and implement these improvements. This can ultimately lead to increased profitability and the ability to expand into new markets. Moreover, professional services provide a valuable benchmark for measuring progress and evaluating the success of workflow improvements.

This article is a shortened version of an analysis document that was written by Keypoint Intelligence via a research partnership with RICOH-USA. To access the full report with more detailed findings, click here.

Greg Cholmondeley is a recognized expert on workflow automation, strategic planning, software solutions, and the printing industry. Before joining Keypoint Intelligence, he was President of PRINTelligence Consulting, where he analyzed and assessed production enhancement software solutions for vendor development and consumer understanding. He is a frequent speaker and panelist at industry events and a published author.

Eve Padula is a Senior Consulting Editor for Keypoint Intelligence’s Production services with a focus on Business Development Strategies and Customer Communications. She is responsible for creating and distributing many types of content, including forecasts, industry analyses, and research reports/multiclient studies. She also handles the editing and formatting cycles for many types of deliverables.

Discussion

Join the discussion Sign In or Become a Member, doing so is simple and free