Have you ever wondered how the big CPGs determine which packaging designs work and which don’t? For many, it’s as much science as it is creative. To get insight into just how much science can go into it, take a peek at Quad Graphics’ Package Insight division.

Packaging Insight helps companies understand how people shop and how they react to packaging. The process starts with a setup that resembles retail shops. Participants wear special head gear that tracks their eye movements to determine the following:

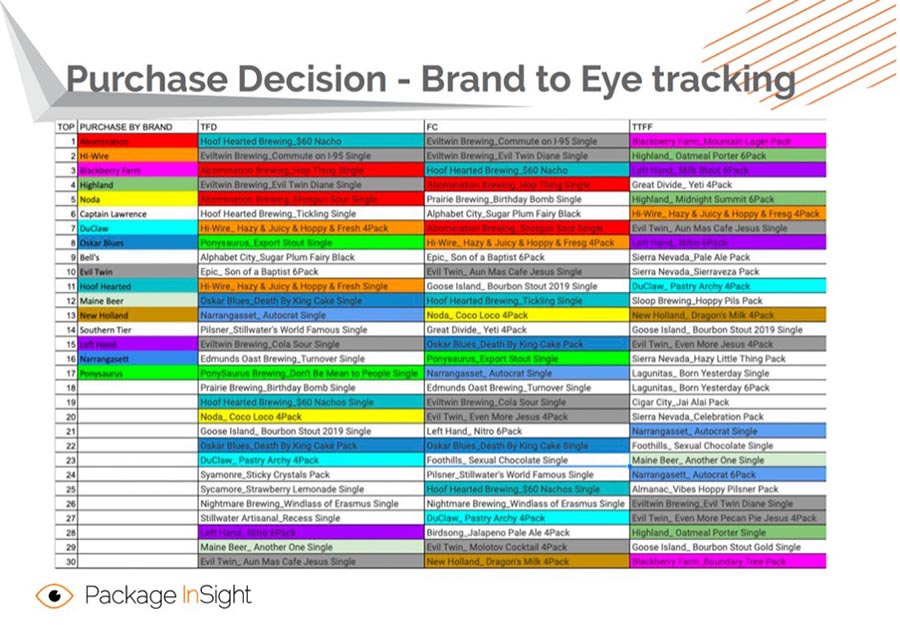

Total Fixation Duration (TFD): This is the time, in seconds, spent on average by participants fixating on this item. The higher the number, the better the package performs.

Time to First Fixation (TTFF): This is the time, in seconds, from when a product first enters a participant’s field of view until they fixate on it. The lower the number, the better the package performs.

Fixation Count (FC): This is the total number of times a product crosses into the participant’s line of vision.

Purchase Decision (PD): How many participants chose to buy the item. The higher the number, the better the package performs.

One of the overall takeaways from this research? Regardless of whether it’s a craft beer, soda, or toothpaste, the average shopper looks at a package for less than a second. Here is the value of eye-tracking studies. Even if it’s only a fraction of a second, brands want to maximize every fraction they can.

Craft Beer Study

As just one example of what this looks like, take the company’s study on craft beer. The goal was to capture data on consumer attention for different types of beer cans and bottles. Nearly 100 shoppers participated in the study.

Participants were qualified as follows:

- Over 21 years of age.

- Purchased beer in the last two months.

- Regularly purchased beer to consume at home at least once a month.

- Purchased craft beer brands.

- Open to trying new styles and/or brands of craft beer.

- Regularly shops at locally owned bottle shops.

Participants were checked in at the test location and were fitted and calibrated with Tobii 2 eye tracking glasses. They were instructed to shop the “main” portion of the store only (U.S. craft brewery selection) and choose two single beers that they would be purchasing to take home. Once they completed their shopping, the participants completed an online post-shopping survey to capture qualitative feedback and demographics.

Who Gets the Longest Looks?

Out of 30 craft beers studies, Hoof Hearted Brewing $60 Nacho got the highest Total Fixation Duration (TFD) and Eviltwin Commute on I-95 came in second, with nearly two seconds duration. This was followed by Abomination Brewing—Hop Thing Single.

How about Total Time to Fixation (TTF), or how long it took for recipients to focus on the beer? The top three were all multi-packs—Blackberry Mountain Farm Lager Pack, Highland Porter Oatmeal six-pack, and Lefthand Milk Stout six-pack. In fact, the top 12 of 13 beers with the lowest “time of fixation” were all multipacks.

How about Fixation Count, or the number of times participants went back to look at the can? Eviltwin Brewing Commute on I-95, Eviltwin Brewing—Eviltwin Diane, and Hoof Hearted Brewing $60 Nacho take the top three spots.

Here’s the most important question: To what extent do TFD, TTF, and FC translate into higher purchases? While two of the “top attention” craft beers in the study had zero purchases, there is a correlation between the total fixation duration (TFD) and sales. After all, you tend to spend the most time looking at the product you intend to buy.

Impact of Brand Story

One of the packaging factors not included in the study is the impact of storytelling. In the written portion of the study, participants were asked, “What information do you expect to obtain from a craft beer package to help you decide which beer to purchase?” “Ingredients/taste” came in first, followed by “brand story.”

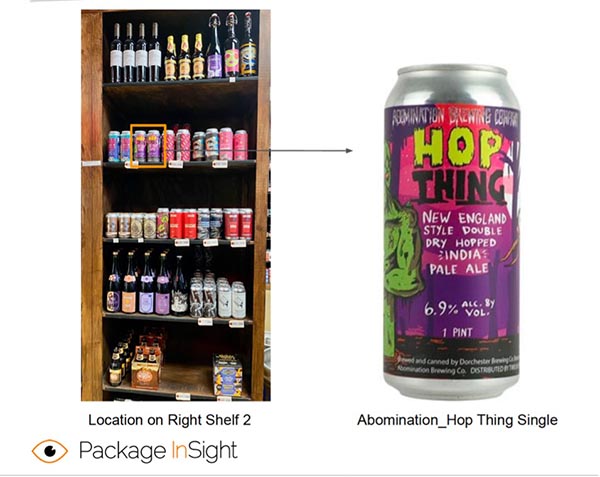

While the study described packaging in terms of things such as “heavily illustrated,” “minimal branding,” and “pressure sensitive,” it did not include brand story as one of those factors. Yet, it is notable that many of the cans with the highest eye tracking did just that. Consider Hop Thing, which has an eye-catching design, to be sure, but the can also tells the brand story right on the front—“New England Style Double Dry Hopped India Pale Ale.”

Many of the craft beers did, in fact, tell brand stories right on the bottle or can itself. It would be interesting if the study designers were to include that as a factor next time.

What’s the Value of Eye Tracking?

Although how much attention a package gets does have a loose correlation to purchases, it is not always a direct correlation. Shoppers could be looking for lots of reasons. They could be looking because they are interested in buying. They could be looking simply because they find the can interesting. Or the brand might be unfamiliar and they are trying to process information about it. Or it might be that the can is simply at eye level in the case.

The latter is notable since, when looking at heat maps (hot spots where there was the most attention paid), the “hot spots” were at eye level. So how much does location in the cooler impact TFD, TTF, and FC? It would be worth asking.

Sample Heat Maps from Craft Beer Study

Packaging Type Matters

Although there are many factors that impact sales, participants in the study did indicate that the packaging design plays an important role in their purchases. To this question, survey respondents overwhelmingly said that the packaging was, “important” or “very important.” Nearly 75% also indicated that the packaging design had a positive influence on their purchase decision (the design made them want the beer more).

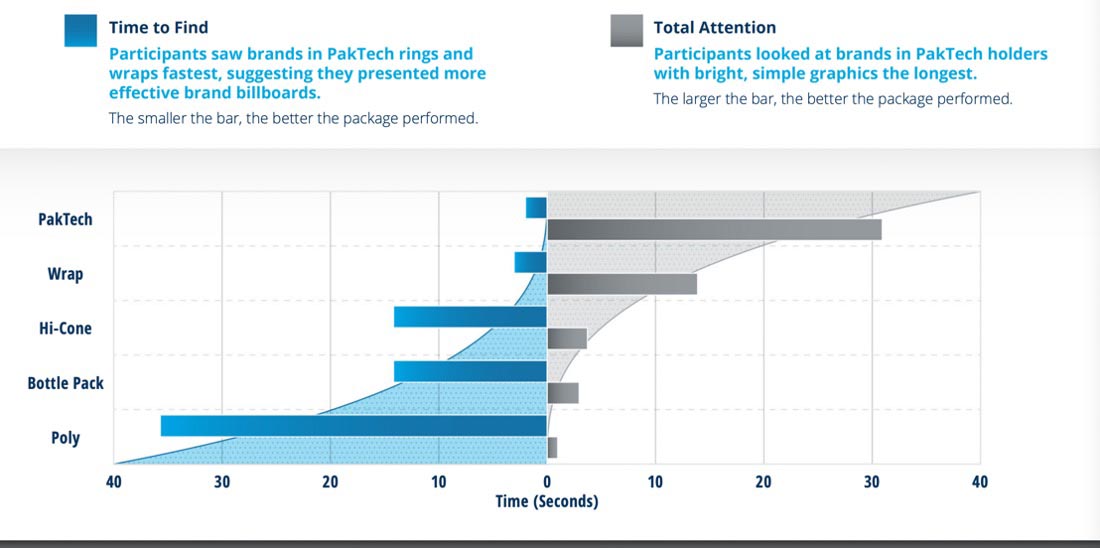

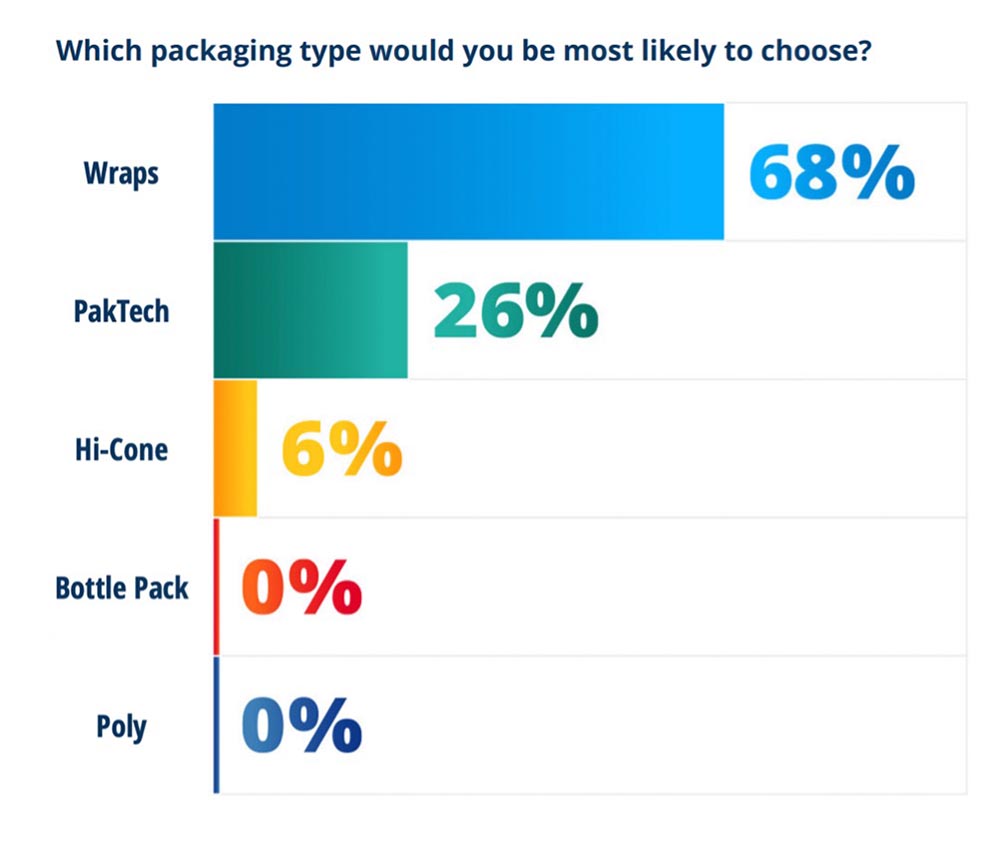

In a subsequent study, it was found that the type of packaging played a huge role, as well. Cardboard wraps were overwhelmingly preferred (68% of participants saying they are most likely to purchase craft beer in this type of packaging). Hi-Cone packaging (plastic rings) came in at a dismal 6%.

What It Tells You…And What It Doesn’t

Eye tracking is a powerful tool that gives insight into what consumers won’t (and often can’t) tell you—what happens in their subconscious mind. At the same time, it only tells you what they see, not what they are thinking.

For example, Quad’s Packaging Insight division also did a study on soda cans. The total fixation duration for Coca-Cola was 1/10 of a second—and Coke was at the bottom of the list in terms of total fixation duration, fixation count, and time to first fixation (as in, second to last). Yet, Coke was the second most sold product in the test. In this case, none of the eye-tracking scores correlated to purchase intent at all. Could this be because, when it comes to well-known brands, the shopper’s brain subconsciously says, “I know what that is,” so I don’t need to look as hard?

That’s why it’s important to understand what eye tracking does and doesn’t tell you. It tells you where, how long, and how many times people look. It doesn’t tell you why they are looking (or not).

Packaging brands use eye tracking for a variety of purposes. If they are evaluating a single package, it helps them see the which areas of the package get the most attention. If they are evaluating their packaging in a retail setting, it gives them competitive insights, either proactively or defensively (responding to a competitor’s move).

If you help customers with packaging design, consider an eye-tracking study. It’s another—important—tool in the toolbox.

Discussion

By Eddy Hagen on Jan 18, 2023

Thanks for picking this up Heidi!

But there is an important consequence that I emphasized in my article (https://www.insights4print.ceo/2023/01/how-our-brain-perceives-evaluates-color-system-1-vs-system-2-dual-process-theory/), which you don't really touch: how this short Total Fixation Duration links to how our brain works. It has a fast but very inaccurate part (System 1) and a slow but accurate part (System 2).

During shopping it's System 1 that is active, but when doing a press check, we activate System 2 and become much more critical about color...

Discussion

Join the discussion Sign In or Become a Member, doing so is simple and free