- In the digital production printing space, we are seeing print volumes move to large inkjet devices that offer a lower cost per page compared to smaller toner-based products.

- As print volumes move to larger inkjet printing equipment, fewer color devices are being used and sold overall. Despite the anticipated fall in color equipment unit sales across the forecast period, we are expecting color print volumes to grow significantly during this time.

- To compete with their larger counterparts, smaller printers must concentrate on the value they can provide to customers.

By German Sacristan and Christine Dunne

Introduction

The COVID-19 pandemic created numerous challenges for the digital production printing market, including a decline in demand for print services and reduced investments in new production technology. These factors caused printer unit sales and print volumes to plunge—with the exception of color inkjet large production cut-sheet, which have actually grown since the onset of COVID. All the while, certain trends that were already in the works (including online purchasing/selling and a move toward inkjet technology) accelerated as a result of the pandemic.

Sales Are Declining, But Print Volumes Are Increasing

In the digital production printing space, we are seeing print volumes move to large inkjet devices that offer a lower cost per page compared to smaller toner-based products. Online printers, or print service providers (PSPs) that only sell online (e.g., Vistaprint and Shutterfly), are expected to contribute to this trend as many run an economy of scale business that strives to offer the lowest price. This trend will accelerate as copy centers’ and quick printers’ customers shift to online purchases and print volumes continue to transition from small multifunctional peripherals (MFPs) to larger production inkjet devices.

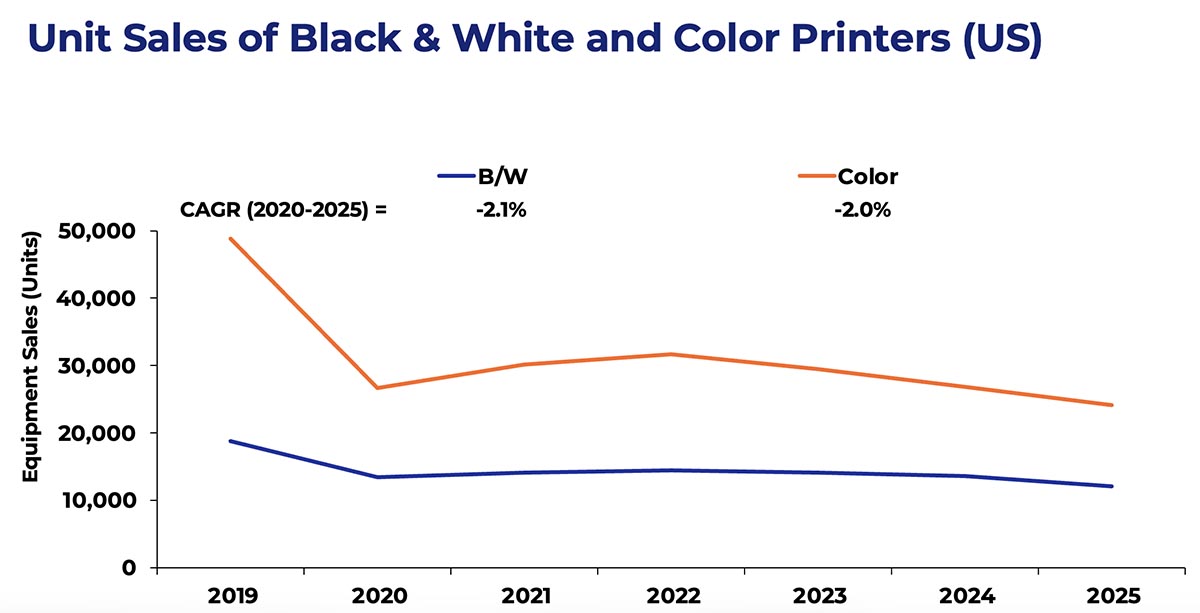

As print volumes move to larger inkjet printing equipment, fewer color devices are being used and sold overall—at least in the United States.[1] Indeed, one larger production inkjet device can now replace multiple toner-based products. We already knew that unit sales of monochrome devices were declining, but the newer decline in color unit sales is a tough reality for many printer manufacturers. The highlighted figures below show the extent to which the COVID-19 pandemic also put pressure on device unit sales, with double-digit percentage declines seen from 2019 to 2020 across product categories. While the situation has improved, declines are still predicted going forward; concerns around supply chain demand might actually impact sales even more than anticipated.

Figure 1. Unit Sales of Black & White and Color Printers (United States)

Source: US Digital Production Printing Application Forecast: 2020-2025; Keypoint Intelligence 2021

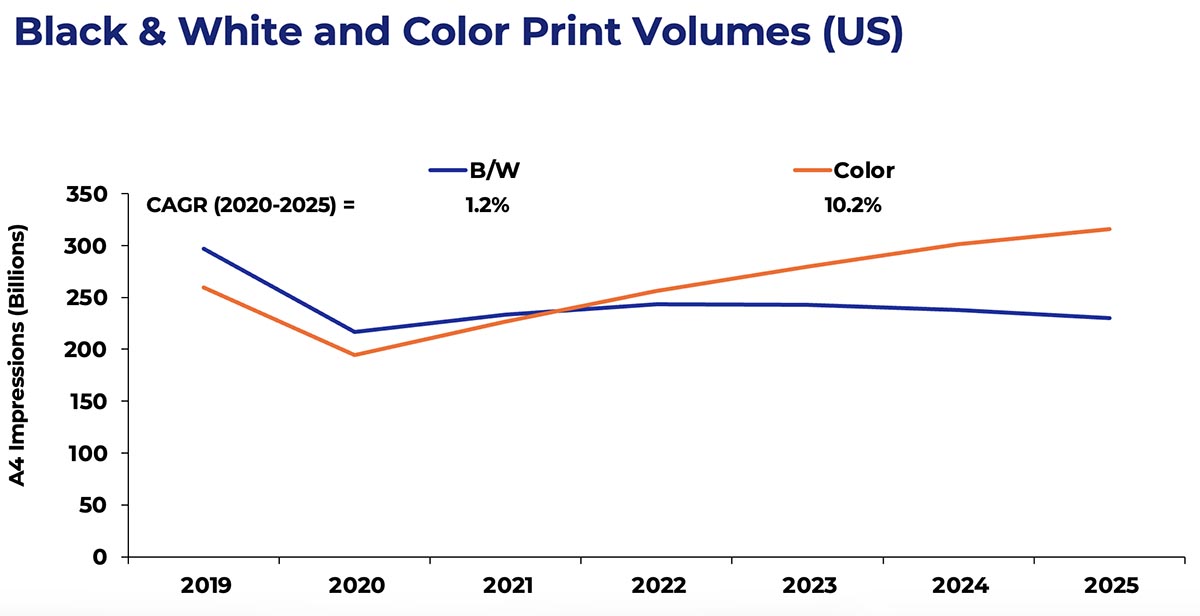

Despite the anticipated fall in color equipment unit sales across the forecast period, we are expecting color print volumes to grow significantly during this time. Indeed, we are forecasting a 10.2% compound annual growth rate (CAGR) in the United States between 2020 and 2025. Color volumes are also expected to grow on a global basis. That said, it’s important to understand that this growth is built upon a low-performance year associated with the pandemic. Another factor in the growth is the constant shift from offset to digital printing that is driven by inkjet’s lower running costs and increased interest in personalization. Also contributing to the predicted color print volume growth is increased use of specialty printing, including color embellishments, specialty substrates, and finishing, and the enablement of e-connectivity via QR codes, NFC tagging, and/or augmented reality (AR). Print is not the cheapest communication channel in the market, so PSPs must add differential value to remain competitive.

Figure 2. Black & White and Color Print Volumes (United States)

Source: US Digital Production Printing Application Forecast: 2020-2025; Keypoint Intelligence 2021

Overcoming Challenges with Value

Given the move to online and large printers using high-end inkjet technology, as well as offset and economy of scale models with low running costs, smaller printers are facing challenges retaining customers that are buying based on price. So how can these smaller printers differentiate themselves from their larger, more capital-heavy competitors? They will not be able to compete on price. Instead, they will need to compete based on the value they can provide to customers. This value might take the form of working with customers face-to-face, showing print samples and hardcopy proofs, or providing specialty print capabilities that online printers may not sell.

The Bottom Line

There is no question that the COVID-19 pandemic has put a tremendous amount of pressure on the digital production printing industry. While other communication channels are increasingly available in the market with a lower price than print, this does not mean they are less expensive overall. Digital printer manufacturers and their PSP customers must keep focusing on, promoting, and selling the ROI and value of print. Regardless of the technology (inkjet or electrophotography), differential value selling should be the main focus of any company that promotes and sells print.

To succeed in differential value selling, communicators must become more effective and strategic. They must consider the holistic value that digital printing offers, including customization, targeting, and reduced waste. Digital printing manufacturers are encouraged to not only provide PSPS with great technology at affordable prices, but also offer more support to PSPs in these various areas—helping them to improve the effectiveness of their sales and marketing.

German Sacristan is the Director of Keypoint Intelligence’s Production Print & Media group. In this role, he supports customers with strategic go-to-market advice related to production printing in graphic arts and similar industry segments. German’s responsibilities include conducting market research, industry and technology forecasts, custom consulting and development of analyses, editorial content on technology, as well as support to clients in the areas of production digital printing.

Christine Dunne is a Consulting Editor for Keypoint Intelligence’s Office Technology & Services Group. Her responsibilities include responding to client inquiries, conducting market research and analysis, and providing coverage of industry events. Ms. Dunne has written extensively about search engine optimization and pay-per-click advertising.

[1] Printer sales in Western Europe are showing a similar decline. Keypoint Intelligence has forecast data on this region too.

Discussion

Join the discussion Sign In or Become a Member, doing so is simple and free