- For the past few years, we’ve seen a war raging between consumers and enterprises—the communication channels that consumers might prefer are sometimes different than what enterprises might want to force (or perhaps nudge) the consumer toward.

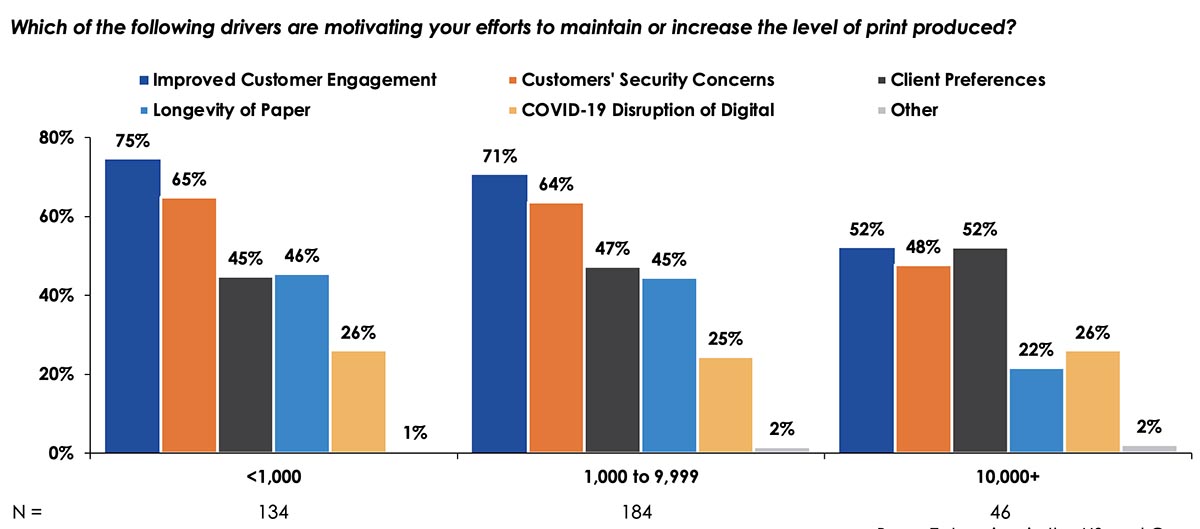

- Small and medium-sized enterprises seem to have a greater understanding that maintaining or increasing their level of print production can often improve customer engagement and loyalty while also alleviating consumers’ security concerns.

- Our newest Transactional Communications research tells us that customer communication preferences can vary greatly by vertical industry.

By Marc Mascara

Introduction

When it comes to consumers and enterprises, it’s a war out there. Everywhere you look, whether online or off, enterprises are sending customer communications that beg, plead, and sometimes even force consumers to go paperless. Will this movement toward paper suppression become that final nail in the coffin and represent the death of printed bills and statements? Although COVID-19 has accurately been dubbed “the great accelerator,” ongoing market shifts probably won’t prove to be the grim reaper for transactional mail.

The Data is In!

Each year, Keypoint Intelligence conducts primary research on transactional and marketing communications. The data from our most recent Annual State of Transactional Communications research brings some interesting findings to light on the business side. Up until three or four years ago, the paper suppression rate was in a steep increase. This suggested that mailed bills and statements would soon fall by the wayside while e-delivery soared, but dramatic changes to the trend line prevented this from happening. Instead, the trajectory for both curves—paper and electronic—began to flatten out. Even so, viewing the entire market as a whole is somewhat misleading. By taking a deeper dive into the individual vertical markets, we can see that different industries are on their own trajectories, but that the eventual trend projection is similar for all verticals.

Consumer Preferences Vary by Vertical

As consumers, we’ve basically come to expect three options for the delivery of our bills and statements—which is not to be confused with how you choose to pay your bill. Delivery deals with how you choose to receive your bill. These delivery options include:

- Printed communications only

- Both print and electronic communications (sometimes called “double dippers”)

- Electronic communications only

For the past few years, we’ve seen a war raging between consumers and enterprises—the communication channels that consumers might prefer are sometimes different than what enterprises might want to force (or perhaps nudge) the consumer toward.

As shown in the figure below, small and medium-sized enterprises seem to have a greater understanding that maintaining or increasing their level of print production can often improve customer engagement while also alleviating consumers’ security concerns—especially when it comes to addressing customers’ communication preferences. Meanwhile, some of the larger enterprises are still pursuing more aggressive paper suppression tactics. Ultimately, the smaller enterprises and brands are coming to realize that overenthusiastic paper suppression tactics might backfire and cause customers to migrate to competitors. These smaller players are placing a greater focus on improving customer engagement and alleviating security concerns, and it is likely only a matter of time before the larger enterprises follow suit.

Drivers Motivating Efforts to Maintain/Increase Paper

Base: Enterprises in the US and Canada

Source: Annual State of Transactional Communications Survey; Keypoint Intelligence 2021

The data by vertical paints a similar picture. Just three years ago during our 2018 study, enterprises within the banking/financial vertical expected their paper suppression rates to increase by 7% over the next two years. In our 2021 study, banking/financial respondents didn’t expect their paper suppression rates to increase at all in the coming two years. This suggests that the banking/financial vertical has already reached its optimal paper suppression rate, and other verticals will eventually follow suit. For example, healthcare respondents that participated in our 2021 research expected paper suppression rates to increase by 10% over the next two years.

Our newest Transactional Communications research tells us that customer communication preferences can vary greatly by vertical industry. The bottom line is that a whole host of factors can have a direct impact on the overall e-delivery adoption and paper suppression curve. Whereas the banking/financial industry seems to be approaching its ideal paper suppression rate, the healthcare vertical is on its own trajectory but will eventually arrive at a similar leveling-off point.

The Bottom Line

Our 2021 transactional communication survey data is indicative of consumers’ changing preferences, ongoing concerns about data security, and lingering concerns about the COVID-19 pandemic. At least for now, these factors have combined to hinder paperless adoption and the migration away from paper. Make no mistake, though—while the e-delivery and paper suppression curves have leveled off for the time being, the overall market trends remain the same for transactional communications across our five-year forecast period. Keypoint Intelligence still expects paper suppression rates to rise as enterprises address the security concerns associated with e-delivery and also implement less aggressive paper suppression tactics. For more information about the complete findings from this year’s Annual State of Transactional Communications research or our Value of Customer Communications Delivery Forecast, please contact your Keypoint Intelligence account representative or send an e-mail to [email protected].

Marc Mascara is the Director of Keypoint Intelligence’s Customer Communications Advisory Service. In this role, he supports customers with strategic go-to-market advice related to customer communications. His responsibilities include conducting market research and analysis, consulting engagements, forecasting market growth, client care, and providing coverage of industry events.

Discussion

By Pete Basiliere on Aug 12, 2021

The vertical market results is, as you write, more valuable than the overall market trend.

Can you explain how this conclusion was reached? “Keypoint Intelligence still expects paper suppression rates to rise as enterprises … implement less aggressive paper suppression tactics.”

Personally, I think paper suppression rates will rise as the generation raised on paper bills inevitably gives way to the mobile-first generation.

Discussion

Join the discussion Sign In or Become a Member, doing so is simple and free