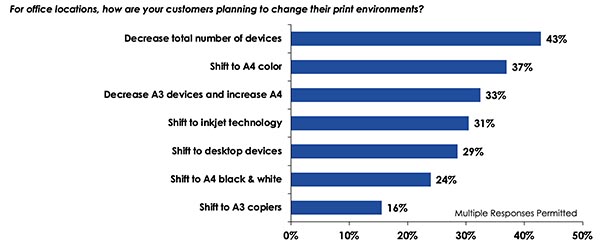

- 1 in 2 workplaces are planning to change their printing environments, and the most commonly anticipated changes included a decrease in the total number of devices, a shift to A4 color, and a general shift from A3 to A4 devices.

- A 2020 Keypoint Intelligence survey of US IT decision-makers revealed that 24% of companies had already downsized their staff as a result of the pandemic or were planning to do so in the future.

- A3 devices are great for high printing volumes, but the lower acquisiton costs of A4 devices may make them more financially sensible for lower volumes.

By Christine Dunne

Introduction

The printing industry is evolving rapidly as consumers’ preferences change and businesses realign their communication methods. According to a Keypoint Intelligence study of 300+ office equipment dealers and IT resellers that sell A3 print technology and provide servicing, 50% of respondents said their customers are actively planning to change their print environments after the pandemic. Another 33% are currently unsure, so some might decide to do so in the future. Ulltimately, though, it is quite compelling that one in two workplaces are making plans to change their printing environments.

Among those respondents who are expecting to make changes, the most commonly anticipated changes included a decrease in the total number of devices, a shift to A4 color, and a general shift from A3 to A4 devices.

Figure 1. Expected Changes to Print Environments

N = 154 Respondents in the US whose customers are actively discussing making changes to their printing environments

Source: The State of the Office Equipment and IT Reseller Channel; Keypoint Intelligence 2021

What’s Behind these Results?

A Decrease in the Total Number of Print Devices

There are many reasons that customers may be planning to reduce the number of print devices within their offices. For one thing, the COVID-19 pandemic resulted in many layoffs across numerous sectors. In fact, a 2020 Keypoint Intelligence survey of US IT decision-makers revealed that 24% of companies had already downsized their staff as a result of the pandemic or were planning to do so in the future. Fewer employees means a reduced need for print and the possibility to complete work with fewer devices.

We are also seeing a continuation of work-from-home arrangements that are of course reducing the need for printing in office locations. Many offices have opened back up for business, especially with vaccines becoming widely available in the United States. Even so, this doesn’t mean all employees have returned to the office on a full- or even part-time basis. There are a few reasons for this:

- Many employers are understanding of ongoing employee concerns surrounding virus exposure (for example, those who are unable get vaccinated for health reasons or have unvaccinated children at home) as well as continued needs to supervise children who are still learning remotely.

- Some employees have discovered that working remotely doesn’t necessarily equate to a decline in productivity. The ability to work from home at least occasionally can also serve as a perk that contributes to improved employee morale and job satisfaction. In response, some businesses are crafting new work-from-home policies for the longer term that may enable staff in certain roles to work from home on a full- or part-time basis. With more people working from home than ever before, the need for office printers will decline as a result.

- Beyond fewer people being in the office at a given time, many workers have developed new workflows and habits that no longer include printing, scanning, copying, or faxing practices that might have been forced at the beginning of the COVID-19 lockdown and shift toward remote working. This might also prompt employers to do away with some office printers and multifinctional periperhals (MFPs).

A Shift from A4 to A3 Print Technology

There are also a number of factors that are contributing to the planned move from A3 to A4 devices within office locations. First, if fewer people are in the office at a given time and those that are on-site are printing less, daily print volume needs are significantly lower. A3 devices are great for heavy printing, offering much lower costs per page (CPP) and total costs of ownership (TCO). When volumes become lower, however, A4 models might make more sense financially when devices are replaced due to their low acquisition costs.

A4 products also take up less space, often requiring a zero footprint on the office floor as they can be placed on desktops in cubicles or common departmental areas. Businesses that have laid off workers and/or extended remote and hybrid working may find themselves moving to smaller offices or reducing the amount of space they rent. When this transition occurs, A4 desktop models can be more practical.

Another reason for the shift away from A3 devices is their shared nature. Social distancing is still being practiced in various workplaces, and it’s quite likely that many businesses and employees will pay closer attention to personal hygiene and exposure to contagious illnesses even when COVID-19 becomes a part of history. A4 printers are more personal and typically used by a smaller circle of employees, so businesses may decide to make the switch when their A3 devices need to be replaced.

The Bottom Line

Office equipment dealers and IT resellers have front-row seats to the needs and preferences of their customers, even if this front row seat has taken a digital form over the past 15 months (thanks to platforms like Zoom, Microsoft Teams, and Cisco Webex). This gives us good reason to believe that the observations reflected in our latest channel survey are very much reflective of where the print market of the future is heading.

While some of the anticipated changes might not necessarily be great for vendors’ finances, they do offer an opportunity for these vendors to demonstrate that they are attuned to customers’ evolving needs. The COVID-19 pandemic accelerated many of the changes that were already occuring within our industry, including a different mix of product and service offerings as well as new business models, and the industry must continue to pivot in response to these shifts.

Christine Dunne is a Consulting Editor for Keypoint Intelligence’s Office Technology & Services Group. Her responsibilities include responding to client inquiries, conducting market research and analysis, and providing coverage of industry events. Ms. Dunne has written extensively about search engine optimization and pay-per-click advertising.

Discussion

Join the discussion Sign In or Become a Member, doing so is simple and free